Key Insights

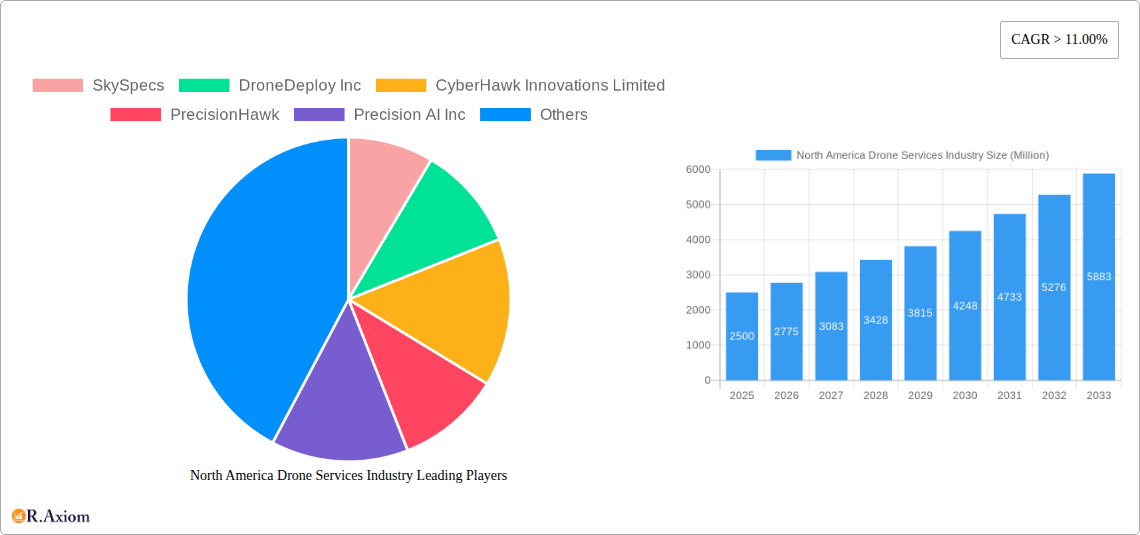

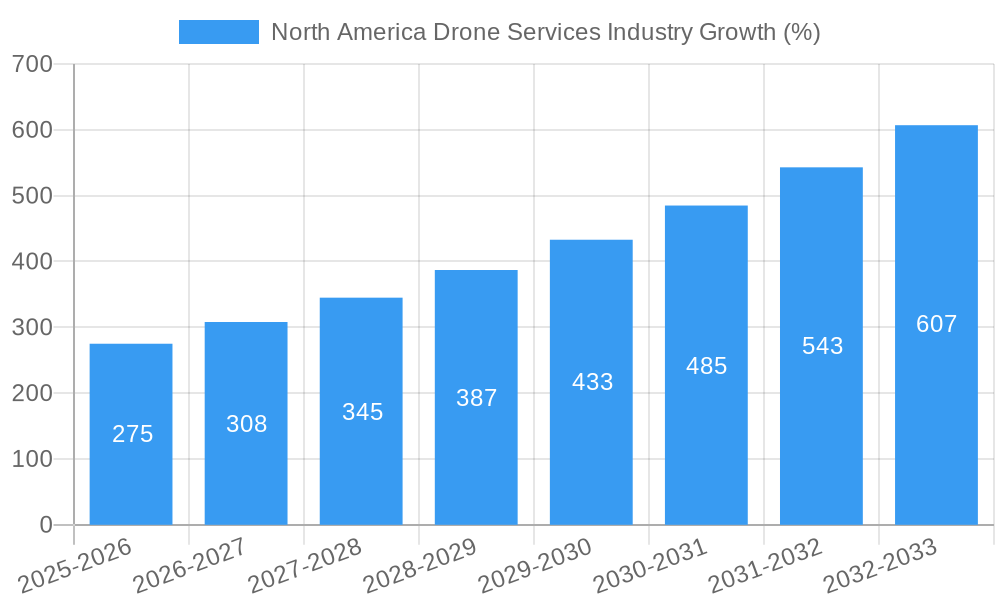

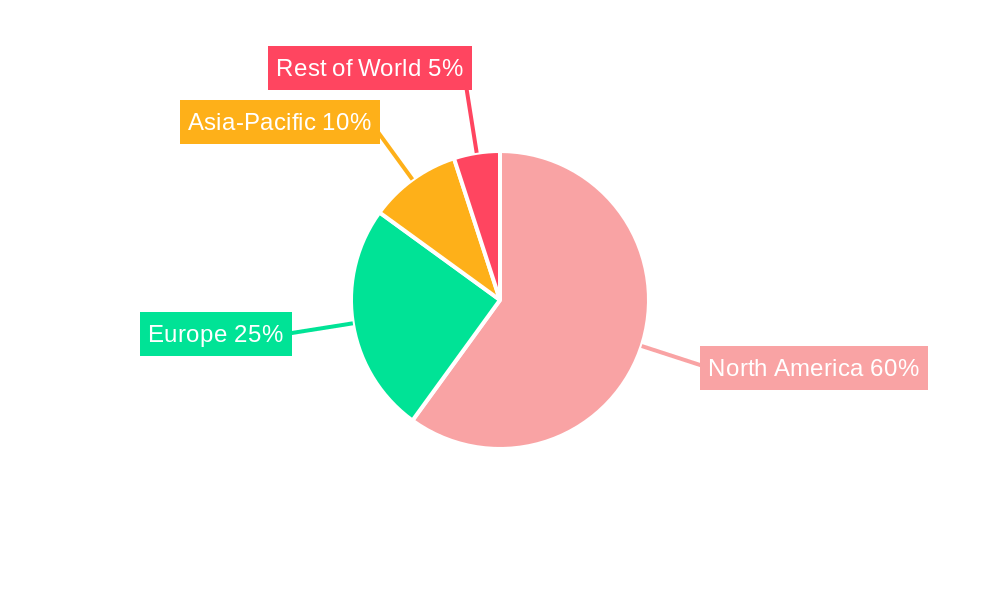

The North American drone services market is experiencing robust growth, driven by increasing adoption across diverse sectors. The market, valued at approximately $2.5 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 11% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, advancements in drone technology, including enhanced battery life, improved sensor capabilities, and greater autonomy, are making drones more versatile and reliable for a wider range of applications. Secondly, regulatory frameworks are evolving to support safe and responsible drone operations, fostering greater industry confidence and investment. Finally, the cost-effectiveness of drone services compared to traditional methods in sectors like agriculture (precision spraying, crop monitoring) and infrastructure inspection (bridge, pipeline inspections) is driving adoption. The construction, agriculture, and energy sectors are significant contributors to market growth, leveraging drones for surveying, monitoring, and maintenance. However, challenges remain, including concerns about data security, airspace management, and the need for skilled operators.

Despite these challenges, the long-term outlook for the North American drone services market remains positive. The increasing integration of artificial intelligence and machine learning into drone systems is poised to further enhance their capabilities, opening new opportunities in areas like autonomous delivery and advanced analytics. Furthermore, the growing demand for efficient and cost-effective solutions in diverse sectors, coupled with continuous technological innovation, will propel market expansion. The competitive landscape features both established players and emerging startups, with companies continually vying for market share through product innovation and strategic partnerships. The significant investment in research and development within the drone services industry reflects the considerable potential for future growth and market disruption. The focus will likely shift towards specialized applications and the development of integrated drone solutions to meet specific industry needs.

This comprehensive report provides a detailed analysis of the North America drone services industry, covering the period from 2019 to 2033. It offers in-depth insights into market size, segmentation, growth drivers, challenges, and key players, equipping stakeholders with actionable intelligence for strategic decision-making. The report utilizes data from the base year 2025 and provides forecasts until 2033, with a historical overview covering 2019-2024. The market is segmented by application, including Construction, Agriculture, Energy, Law Enforcement, Medical and Parcel Delivery, and Other Applications. Key players analyzed include SkySpecs, DroneDeploy Inc, CyberHawk Innovations Limited, PrecisionHawk, Precision AI Inc, Zipline, Arch Aerial LLC, Drone Delivery Canada, Volatus Aerospace Corp, AgEagle Aerial Systems Inc, Sky Source Aerial LLC, and Phoenix Drone Services LLC.

North America Drone Services Industry Market Concentration & Innovation

The North American drone services market is characterized by a moderately concentrated landscape, with a few major players commanding significant market share. However, the presence of numerous smaller, specialized firms fosters innovation and competition. In 2025, the top 5 companies are estimated to hold approximately xx% of the market share. M&A activity has been substantial, with several large deals exceeding $xx Million in the past five years driving consolidation and technological integration. Key innovation drivers include advancements in sensor technology, AI-powered data analytics, and improved drone autonomy. Regulatory frameworks, while evolving, remain a significant factor influencing market dynamics. The industry faces competition from traditional survey and inspection methods, but the superior efficiency and cost-effectiveness of drones are steadily increasing market penetration. End-user trends indicate a growing preference for integrated solutions offering data processing and analysis alongside drone services.

- Market Concentration: Top 5 players hold approximately xx% market share (2025).

- M&A Activity: Total deal value exceeding $xx Million over the past five years.

- Innovation Drivers: Advancements in sensor technology, AI, drone autonomy.

- Regulatory Landscape: Evolving regulations impacting market growth.

- End-User Trends: Preference for integrated data solutions.

North America Drone Services Industry Industry Trends & Insights

The North American drone services market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is fueled by several key factors. Technological advancements continue to enhance drone capabilities, leading to wider applications across diverse sectors. The increasing adoption of drones for data acquisition and analysis in industries like construction, agriculture, and energy is a major driver. Consumer preferences for faster, more efficient, and cost-effective solutions are contributing to the market’s expansion. However, competitive dynamics remain intense, with companies vying for market share through innovation, strategic partnerships, and expansion into new segments. Market penetration across various sectors is also rising, with significant growth expected in the agricultural and infrastructure monitoring segments. The market is also facing challenges from factors like regulatory hurdles and potential supply chain disruptions.

Dominant Markets & Segments in North America Drone Services Industry

The construction sector currently dominates the North American drone services market, driven by the increasing need for efficient site surveying, progress monitoring, and safety inspections. The agricultural sector is experiencing rapid growth, fueled by the adoption of precision agriculture techniques. The energy sector is another significant segment, with drones employed for pipeline inspections, wind turbine maintenance, and infrastructure monitoring.

- Construction: High demand for site surveying, progress monitoring, and safety inspections.

- Agriculture: Growing adoption of precision agriculture techniques for crop monitoring and yield optimization.

- Energy: Extensive use in pipeline inspections, wind turbine maintenance, and infrastructure monitoring.

- Law Enforcement: Increasing adoption for surveillance, search and rescue, and crime scene investigation.

- Medical and Parcel Delivery: Emerging segment with significant growth potential.

Dominance Analysis: The construction sector's dominance is attributed to its large scale, ongoing need for efficient data acquisition, and the clear return on investment offered by drone technology. While other segments show significant growth potential, construction's established need for drone services currently makes it the leading segment.

North America Drone Services Industry Product Developments

Recent product innovations focus on enhancing payload capacity, flight endurance, and data processing capabilities. The integration of advanced sensors, AI-powered analytics, and cloud-based platforms provides comprehensive data-driven solutions for various applications. Companies are emphasizing the development of user-friendly software and intuitive interfaces to broaden market accessibility. These advancements provide significant competitive advantages by offering improved efficiency, data accuracy, and operational safety.

Report Scope & Segmentation Analysis

This report segments the North American drone services market by application:

- Construction: The market size for construction drone services is projected to reach $xx Million by 2033, driven by increasing adoption across building projects.

- Agriculture: The agricultural segment is anticipated to reach $xx Million by 2033, fueled by demand for precise crop monitoring and yield optimization.

- Energy: The energy sector's drone services market is projected to reach $xx Million by 2033, primarily driven by pipeline inspections and renewable energy asset monitoring.

- Law Enforcement: This segment is showing a steady rise, reaching an estimated $xx Million by 2033.

- Medical and Parcel Delivery: A rapidly growing segment with anticipated growth to $xx Million by 2033.

- Other Applications: This category encompasses various applications and is expected to reach $xx Million by 2033.

Key Drivers of North America Drone Services Industry Growth

Technological advancements, particularly in drone autonomy, sensor technology, and data analytics, are major growth drivers. Favorable government regulations promoting drone adoption and increasing infrastructure investments further stimulate market expansion. The growing demand for efficient and cost-effective solutions across various industries also contributes significantly to market growth.

Challenges in the North America Drone Services Industry Sector

Regulatory hurdles related to airspace management and data privacy remain significant challenges. Supply chain disruptions and the availability of skilled labor also impact market growth. Intense competition among numerous providers can lead to price pressures, reducing profit margins for some companies. These factors together can impact overall market growth and profitability.

Emerging Opportunities in North America Drone Services Industry

The integration of advanced technologies like AI and machine learning offers substantial opportunities for improving data processing and analysis. Expansion into new application areas, such as environmental monitoring and disaster response, presents further growth potential. The increasing demand for drone-based delivery services also presents a significant market opportunity.

Leading Players in the North America Drone Services Industry Market

- SkySpecs

- DroneDeploy Inc

- CyberHawk Innovations Limited

- PrecisionHawk

- Precision AI Inc

- Zipline

- Arch Aerial LLC

- Drone Delivery Canada

- Volatus Aerospace Corp

- AgEagle Aerial Systems Inc

- Sky Source Aerial LLC

- Phoenix Drone Services LLC

Key Developments in North America Drone Services Industry Industry

- 2023-Q3: DroneDeploy Inc. launched a new AI-powered analytics platform.

- 2022-Q4: PrecisionHawk acquired a smaller drone services company, expanding its market reach.

- 2021-Q2: New regulations regarding drone operations were implemented in several states. (Further specific examples would need to be added here based on actual events).

Strategic Outlook for North America Drone Services Industry Market

The North American drone services market is poised for continued strong growth, driven by technological advancements, increased adoption across various sectors, and supportive regulatory frameworks. Companies focusing on innovation, strategic partnerships, and expansion into new application areas are well-positioned to capitalize on this market potential. The increasing adoption of drone-as-a-service (DaaS) models is expected to further drive market expansion.

North America Drone Services Industry Segmentation

-

1. Application

- 1.1. Construction

- 1.2. Agriculture

- 1.3. Energy

- 1.4. Law Enforcement

- 1.5. Medical and Parcel Delivery

- 1.6. Other Applications

-

2. Geography

-

2.1. North America

- 2.1.1. United States

- 2.1.2. Canada

-

2.1. North America

North America Drone Services Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

North America Drone Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 11.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Demand from the Agriculture Sector Expected to Increase in the Years to Come

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Drone Services Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Construction

- 5.1.2. Agriculture

- 5.1.3. Energy

- 5.1.4. Law Enforcement

- 5.1.5. Medical and Parcel Delivery

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. North America

- 5.2.1.1. United States

- 5.2.1.2. Canada

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United States North America Drone Services Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Drone Services Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Drone Services Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Drone Services Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 SkySpecs

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 DroneDeploy Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 CyberHawk Innovations Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PrecisionHawk

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Precision AI Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Zipline

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Arch Aerial LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Drone Delivery Canada

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Volatus Aerospace Corp

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AgEagle Aerial Systems Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Sky Source Aerial LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Phoenix Drone Services LLC

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 SkySpecs

List of Figures

- Figure 1: North America Drone Services Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Drone Services Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Drone Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Drone Services Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: North America Drone Services Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America Drone Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Drone Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Drone Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Drone Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Drone Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Drone Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Drone Services Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 11: North America Drone Services Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Drone Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Drone Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Drone Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Drone Services Industry?

The projected CAGR is approximately > 11.00%.

2. Which companies are prominent players in the North America Drone Services Industry?

Key companies in the market include SkySpecs, DroneDeploy Inc, CyberHawk Innovations Limited, PrecisionHawk, Precision AI Inc, Zipline, Arch Aerial LLC, Drone Delivery Canada, Volatus Aerospace Corp, AgEagle Aerial Systems Inc, Sky Source Aerial LLC, Phoenix Drone Services LLC.

3. What are the main segments of the North America Drone Services Industry?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Demand from the Agriculture Sector Expected to Increase in the Years to Come.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Drone Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Drone Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Drone Services Industry?

To stay informed about further developments, trends, and reports in the North America Drone Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence