Key Insights

The Asia-Pacific (APAC) nuclear reactor construction market is projected for substantial growth, with an estimated market size of 7.73 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 2.47%. Despite facing global shifts towards renewable energy and lingering safety concerns from past incidents, the region's burgeoning economies, particularly China and India, demonstrate robust energy demands and a commitment to low-carbon power generation. This sustained need for baseload electricity positions nuclear power as a critical component of the APAC energy mix. The market is segmented, with Pressurized Water Reactors (PWRs) leveraging their established reliability and infrastructure. Emerging technologies like High-Temperature Gas-Cooled Reactors (HTGRs) are poised for gradual adoption, offering enhanced safety, though initial investment and technological maturity remain key considerations. The service sector, encompassing equipment and installation, is vital for both new builds and the ongoing maintenance and upgrades of existing facilities, demanding specialized expertise. Leading market participants are expected to prioritize cost-efficiency, technological advancements, and strong governmental partnerships to thrive in this evolving landscape.

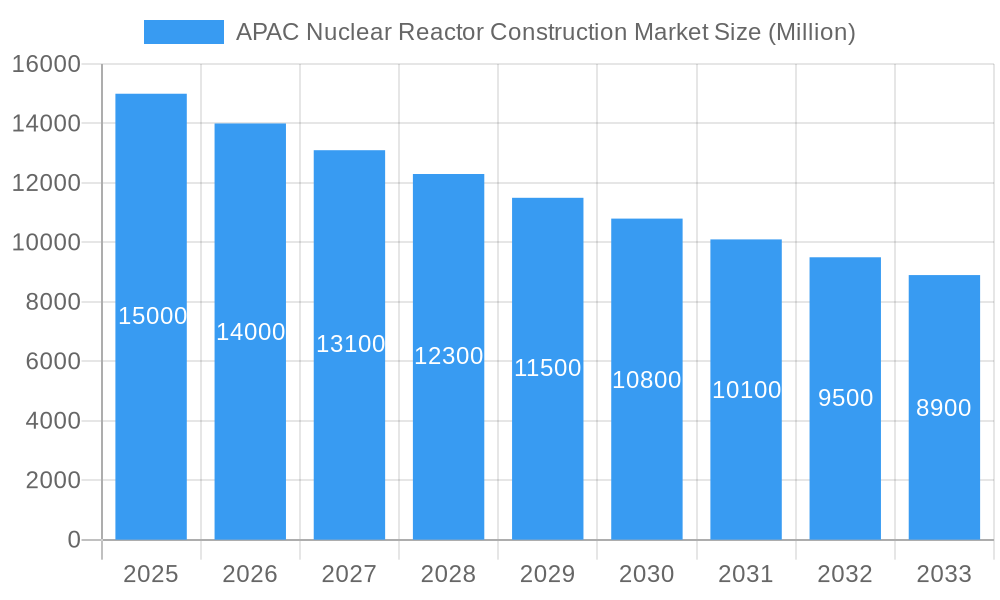

APAC Nuclear Reactor Construction Market Market Size (In Billion)

Key regional markets within APAC include China, India, South Korea, and Japan, driven by their advanced nuclear energy programs. While the overall market is expanding, specific sub-segments and locations may experience accelerated growth, particularly in regions with supportive government policies advocating for nuclear energy's role in ensuring a stable and low-emission power supply. The competitive environment features a mix of global and local enterprises, often collaborating through joint ventures. Success will be defined by technological prowess, sound financial strategies, and a nuanced understanding of regional regulatory frameworks. The long-term trajectory of the APAC nuclear reactor construction market hinges on effectively navigating industry challenges and adapting to evolving governmental energy strategies.

APAC Nuclear Reactor Construction Market Company Market Share

APAC Nuclear Reactor Construction Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific (APAC) nuclear reactor construction market, offering actionable insights for stakeholders across the industry value chain. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, growth drivers, challenges, and opportunities. The report features detailed segmentation by reactor type (Pressurized Water Reactor, Pressurized Heavy Water Reactor, Boiling Water Reactor, High-temperature Gas Cooled Reactor, Liquid Metal Fast Breeder Reactor) and service (Equipment, Installation), offering granular insights into market dynamics. Key players like Dongfang Electric Corporation Limited, Larsen & Toubro Limited, and others are profiled, providing a competitive landscape analysis. The report is crucial for investors, industry professionals, and researchers seeking a holistic understanding of this vital energy sector.

APAC Nuclear Reactor Construction Market Concentration & Innovation

The APAC nuclear reactor construction market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. Dongfang Electric Corporation Limited and Larsen & Toubro Limited are estimated to hold approximately xx% and xx% market share respectively in 2025, reflecting their extensive experience and established presence. However, the market is witnessing increased competition from emerging players and international companies, leading to a dynamic competitive environment. Innovation is primarily driven by advancements in reactor technology, such as the development of smaller modular reactors (SMRs) and improved safety features. Stringent regulatory frameworks and safety standards play a critical role in shaping innovation and market entry. Product substitutes, including renewable energy sources, are increasingly challenging the nuclear power sector; however, the need for reliable baseload power continues to fuel demand for nuclear energy in several APAC countries. End-user trends indicate a growing focus on sustainability and energy security, driving demand for efficient and safe nuclear reactor technologies. M&A activities have been moderate in recent years, with deal values totaling approximately xx Million in the past five years. These activities primarily involved strategic partnerships and acquisitions aimed at expanding geographical reach and technological capabilities.

- Market Concentration: High in certain segments, with a few major players dominating.

- Innovation Drivers: Advancements in reactor technology, safety regulations, and sustainability concerns.

- Regulatory Framework: Stringent safety standards and licensing processes influence market dynamics.

- Product Substitutes: Renewable energy sources pose competition but baseload power requirements remain.

- End-User Trends: Growing emphasis on energy security and environmental sustainability.

- M&A Activities: Moderate activity, with deals focused on strategic expansion and technological integration.

APAC Nuclear Reactor Construction Market Industry Trends & Insights

The APAC nuclear reactor construction market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including increasing energy demands across the region, a focus on energy independence, and government support for nuclear power projects. Technological disruptions, such as the development of SMRs and advanced reactor designs, are transforming the market. These technologies offer enhanced safety, reduced construction costs, and improved efficiency. Consumer preferences are shifting towards cleaner and more sustainable energy sources, creating demand for next-generation nuclear technologies that minimize environmental impact. Competitive dynamics are intense, with established players investing heavily in R&D and new technologies to maintain their market positions. Market penetration of advanced reactor types, such as SMRs, is expected to increase significantly during the forecast period, driven by their inherent advantages and government incentives. Challenges such as public perception, regulatory hurdles, and high capital costs remain potential headwinds to market growth.

Dominant Markets & Segments in APAC Nuclear Reactor Construction Market

China is expected to be the dominant market in APAC for nuclear reactor construction throughout the forecast period. This dominance is fueled by the country's aggressive expansion of its nuclear power capacity to meet its growing energy demand. Other significant markets include India, South Korea, and Japan.

Key Drivers for China's Dominance:

- Government Policies: Strong government support for nuclear energy expansion.

- Economic Growth: Rapid economic growth fuels high energy demand.

- Infrastructure Development: Extensive infrastructure investments facilitate nuclear power plant construction.

Dominant Segments:

- Reactor Type: Pressurized Water Reactors (PWRs) are projected to remain the dominant reactor type, due to their established technology and reliability. However, the share of other reactor types, such as SMRs, is expected to grow gradually.

- Service: The Equipment segment holds a larger market share compared to the Installation segment, driven by the large-scale procurement of equipment needed for reactor construction.

APAP Nuclear Reactor Construction Market Product Developments

Recent product innovations include advancements in reactor designs, focusing on enhanced safety features, modularity, and reduced construction timelines. These innovations aim to improve cost-effectiveness and public acceptance. Applications continue to be primarily focused on electricity generation, with increasing exploration of nuclear energy for desalination and hydrogen production. Competitive advantages stem from technology leadership, cost efficiency, regulatory compliance, and project execution capabilities. The market is witnessing a shift towards SMRs, which are expected to play a significant role in future market growth.

Report Scope & Segmentation Analysis

This report segments the APAC nuclear reactor construction market by reactor type (PWR, PHWR, BWR, HTGR, LMFR) and service (Equipment, Installation). Each segment’s market size, growth projections, and competitive landscape are thoroughly analyzed. For instance, the PWR segment is expected to maintain a significant market share owing to its maturity and widespread adoption. The Equipment segment is anticipated to exhibit higher growth than the Installation segment due to increasing demand for advanced reactor components.

Key Drivers of APAC Nuclear Reactor Construction Market Growth

The APAC nuclear reactor construction market is driven by several factors: increasing energy demand across the region, government support for nuclear power as a reliable and low-carbon energy source, and technological advancements leading to improved reactor designs and enhanced safety features. The need for baseload power and energy security further bolsters the growth.

Challenges in the APAP Nuclear Reactor Construction Market Sector

Significant challenges include stringent regulatory hurdles, high capital costs, public perception regarding nuclear safety, and potential supply chain disruptions. These factors influence project timelines and overall market growth. For example, delays in securing regulatory approvals can lead to project cost overruns and delays in commissioning of new nuclear power plants.

Emerging Opportunities in APAC Nuclear Reactor Construction Market

Emerging opportunities lie in the development and deployment of SMRs, advanced reactor designs with enhanced safety and efficiency features, and exploring the potential for using nuclear energy in other applications beyond electricity generation, such as hydrogen production and desalination.

Leading Players in the APAC Nuclear Reactor Construction Market Market

- Dongfang Electric Corporation Limited

- Larsen & Toubro Limited

- Doosan Heavy Industries & Construction Co Ltd

- Bilfinger SE

- China National Nuclear Corporation

- Electricite de France SA (EDF)

- KEPCO Engineering & Construction

- Westinghouse Electric Company LLC (Toshiba)

- Shanghai Electric Group Company Limited

- Rosatom State Nuclear Energy Corporation

- Mitsubishi Heavy Industries Ltd

- GE-Hitachi Nuclear Energy Inc

Key Developments in APAC Nuclear Reactor Construction Market Industry

- 2024-03: Dongfang Electric Corporation Limited announces a new contract for the construction of a PWR reactor in China.

- 2023-11: Larsen & Toubro Limited secures a significant order for nuclear power plant equipment in India.

- 2022-08: A joint venture between EDF and a local company is formed to develop SMR technology in APAC. (Further specific developments to be added based on actual data)

Strategic Outlook for APAC Nuclear Reactor Construction Market Market

The APAC nuclear reactor construction market holds immense potential for growth driven by consistent energy demand, government support, and technological advancements. The increasing focus on sustainable energy and energy security will continue to fuel the demand for nuclear power. The market is poised for robust expansion with the adoption of advanced reactor technologies.

APAC Nuclear Reactor Construction Market Segmentation

-

1. Service

- 1.1. Equipment

- 1.2. Installation

-

2. Reactor Type

- 2.1. Pressurized Water Reactor

- 2.2. Pressurized Heavy Water Reactor

- 2.3. Boiling Water Reactor

- 2.4. High-temperature Gas Cooled Reactor

- 2.5. Liquid Metal Fast Breeder Reactor

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Rest of Asia-Pacific

APAC Nuclear Reactor Construction Market Segmentation By Geography

- 1. China

- 2. India

- 3. Rest of Asia Pacific

APAC Nuclear Reactor Construction Market Regional Market Share

Geographic Coverage of APAC Nuclear Reactor Construction Market

APAC Nuclear Reactor Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Pressurized Water Reactor to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Equipment

- 5.1.2. Installation

- 5.2. Market Analysis, Insights and Forecast - by Reactor Type

- 5.2.1. Pressurized Water Reactor

- 5.2.2. Pressurized Heavy Water Reactor

- 5.2.3. Boiling Water Reactor

- 5.2.4. High-temperature Gas Cooled Reactor

- 5.2.5. Liquid Metal Fast Breeder Reactor

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. China APAC Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Equipment

- 6.1.2. Installation

- 6.2. Market Analysis, Insights and Forecast - by Reactor Type

- 6.2.1. Pressurized Water Reactor

- 6.2.2. Pressurized Heavy Water Reactor

- 6.2.3. Boiling Water Reactor

- 6.2.4. High-temperature Gas Cooled Reactor

- 6.2.5. Liquid Metal Fast Breeder Reactor

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. India APAC Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Equipment

- 7.1.2. Installation

- 7.2. Market Analysis, Insights and Forecast - by Reactor Type

- 7.2.1. Pressurized Water Reactor

- 7.2.2. Pressurized Heavy Water Reactor

- 7.2.3. Boiling Water Reactor

- 7.2.4. High-temperature Gas Cooled Reactor

- 7.2.5. Liquid Metal Fast Breeder Reactor

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Rest of Asia Pacific APAC Nuclear Reactor Construction Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Equipment

- 8.1.2. Installation

- 8.2. Market Analysis, Insights and Forecast - by Reactor Type

- 8.2.1. Pressurized Water Reactor

- 8.2.2. Pressurized Heavy Water Reactor

- 8.2.3. Boiling Water Reactor

- 8.2.4. High-temperature Gas Cooled Reactor

- 8.2.5. Liquid Metal Fast Breeder Reactor

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Dongfang Electric Corporation Limited

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Larsen & Toubro Limited

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Doosan Heavy Industries & Construction Co Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Bilfinger SE

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 China National Nuclear Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Electricite de France SA (EDF)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 KEPCO Engineering & Construction

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Westinghouse Electric Company LLC (Toshiba)

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Shanghai Electric Group Company Limited

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Rosatom State Nuclear Energy Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Mitsubishi Heavy Industries Ltd

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 GE-Hitachi Nuclear Energy Inc

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 Dongfang Electric Corporation Limited

List of Figures

- Figure 1: Global APAC Nuclear Reactor Construction Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China APAC Nuclear Reactor Construction Market Revenue (billion), by Service 2025 & 2033

- Figure 3: China APAC Nuclear Reactor Construction Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: China APAC Nuclear Reactor Construction Market Revenue (billion), by Reactor Type 2025 & 2033

- Figure 5: China APAC Nuclear Reactor Construction Market Revenue Share (%), by Reactor Type 2025 & 2033

- Figure 6: China APAC Nuclear Reactor Construction Market Revenue (billion), by Geography 2025 & 2033

- Figure 7: China APAC Nuclear Reactor Construction Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China APAC Nuclear Reactor Construction Market Revenue (billion), by Country 2025 & 2033

- Figure 9: China APAC Nuclear Reactor Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: India APAC Nuclear Reactor Construction Market Revenue (billion), by Service 2025 & 2033

- Figure 11: India APAC Nuclear Reactor Construction Market Revenue Share (%), by Service 2025 & 2033

- Figure 12: India APAC Nuclear Reactor Construction Market Revenue (billion), by Reactor Type 2025 & 2033

- Figure 13: India APAC Nuclear Reactor Construction Market Revenue Share (%), by Reactor Type 2025 & 2033

- Figure 14: India APAC Nuclear Reactor Construction Market Revenue (billion), by Geography 2025 & 2033

- Figure 15: India APAC Nuclear Reactor Construction Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: India APAC Nuclear Reactor Construction Market Revenue (billion), by Country 2025 & 2033

- Figure 17: India APAC Nuclear Reactor Construction Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue (billion), by Service 2025 & 2033

- Figure 19: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue Share (%), by Service 2025 & 2033

- Figure 20: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue (billion), by Reactor Type 2025 & 2033

- Figure 21: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue Share (%), by Reactor Type 2025 & 2033

- Figure 22: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of Asia Pacific APAC Nuclear Reactor Construction Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 3: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 7: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 10: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 11: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Reactor Type 2020 & 2033

- Table 15: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global APAC Nuclear Reactor Construction Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Nuclear Reactor Construction Market?

The projected CAGR is approximately 2.47%.

2. Which companies are prominent players in the APAC Nuclear Reactor Construction Market?

Key companies in the market include Dongfang Electric Corporation Limited, Larsen & Toubro Limited, Doosan Heavy Industries & Construction Co Ltd, Bilfinger SE, China National Nuclear Corporation, Electricite de France SA (EDF), KEPCO Engineering & Construction, Westinghouse Electric Company LLC (Toshiba), Shanghai Electric Group Company Limited, Rosatom State Nuclear Energy Corporation, Mitsubishi Heavy Industries Ltd, GE-Hitachi Nuclear Energy Inc.

3. What are the main segments of the APAC Nuclear Reactor Construction Market?

The market segments include Service, Reactor Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.73 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Pressurized Water Reactor to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Nuclear Reactor Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Nuclear Reactor Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Nuclear Reactor Construction Market?

To stay informed about further developments, trends, and reports in the APAC Nuclear Reactor Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence