Key Insights

The Asia-Pacific (APAC) veterinary vaccine market is poised for substantial expansion, driven by burgeoning livestock populations, escalating pet ownership, and heightened awareness of animal health across the region. While mature markets such as Japan, South Korea, and Australia demonstrate robust per capita expenditure on animal health, emerging economies like China and India present considerable untapped potential, fueled by their extensive livestock sectors and increasing disposable incomes. Government initiatives supporting animal disease control and the adoption of advanced vaccination technologies, including recombinant and inactivated vaccines, are key growth accelerators, promising enhanced efficacy and safety. Nevertheless, market penetration is challenged by the presence of counterfeit products, constrained access to veterinary services in rural areas, and disparate regulatory landscapes, necessitating strategic market entry and expansion for vaccine manufacturers within APAC.

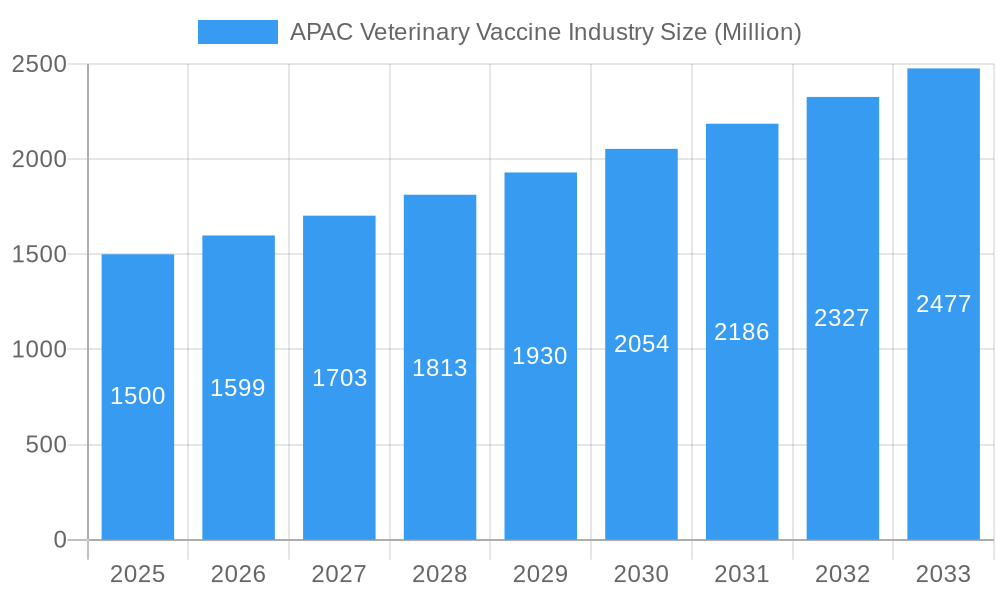

APAC Veterinary Vaccine Industry Market Size (In Million)

Market segmentation within APAC highlights strong demand for both livestock and companion animal vaccines. The livestock segment commands a significant market share, primarily due to the extensive agricultural base and the prevalent threat of infectious diseases. Growing consumer demand for meat and dairy products, coupled with governmental efforts to boost livestock productivity, are pivotal drivers for this segment's growth. Concurrently, the companion animal vaccine segment is experiencing accelerated expansion, propelled by the increasing humanization of pets and rising pet adoption rates throughout APAC. This trend underscores a greater emphasis on pet well-being and proactive healthcare, thereby spurring vaccine demand for prevalent diseases. The integration of cutting-edge vaccine technologies is also reshaping market dynamics, particularly in developed APAC economies where the preference for highly effective and safer vaccines is pronounced. This trajectory is anticipated to continue shaping market trends throughout the forecast period. The global Asia-Pacific veterinary vaccine market is projected to reach 13.17 million by 2025, growing at a Compound Annual Growth Rate (CAGR) of 6.94% from a base year of 2025.

APAC Veterinary Vaccine Industry Company Market Share

APAC Veterinary Vaccine Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the APAC veterinary vaccine industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's dynamics, growth drivers, challenges, and future prospects. The report leverages extensive data analysis and expert insights to provide actionable intelligence across various segments, including vaccine types and technologies. With a focus on key players like Elanco, Zoetis Inc, Boehringer Ingelheim International GmbH, and others, the report paints a complete picture of this dynamic market.

APAC Veterinary Vaccine Industry Market Concentration & Innovation

The APAC veterinary vaccine market exhibits a moderately concentrated landscape, with several multinational corporations and regional players vying for market share. Major players like Zoetis Inc and Elanco hold significant positions, but smaller, specialized companies also contribute considerably. Market concentration is further analyzed using metrics such as the Herfindahl-Hirschman Index (HHI), which assesses the degree of market dominance. The report includes an analysis of the market share held by the top 5 players, estimated to be xx%. Innovation within the sector is driven by a need for enhanced efficacy, safety, and ease of administration. This is reflected in the rising adoption of advanced technologies such as recombinant vaccines and the ongoing research and development of novel vaccines tailored to specific regional diseases.

- Regulatory Frameworks: Stringent regulatory approvals and compliance requirements significantly influence market dynamics. The report analyzes the impact of varying regulatory landscapes across different APAC countries.

- Product Substitutes: The availability of alternative disease control methods, such as antibiotics and biosecurity measures, poses a competitive challenge to vaccine manufacturers.

- End-User Trends: Shifting animal husbandry practices and increasing pet ownership influence vaccine demand. The report analyzes emerging trends in livestock management and pet care within the region.

- M&A Activities: The report examines past and present mergers and acquisitions, including deal values and their impact on market consolidation. For example, the xx Million deal between [Company A] and [Company B] in [Year] demonstrated a trend toward consolidation.

APAC Veterinary Vaccine Industry Industry Trends & Insights

The APAC veterinary vaccine market is experiencing robust growth, driven by several key factors. The rising prevalence of animal diseases, particularly in high-density livestock farming, necessitates increased vaccination programs. Additionally, improving veterinary infrastructure and increasing awareness of animal health are boosting demand. The report predicts a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, resulting in a market size of xx Million by 2033. Technological advancements, such as the development of more effective and safer vaccines, are further accelerating market growth. The increasing adoption of advanced diagnostic tools and improved disease surveillance contributes to enhanced vaccination strategies. Competitive dynamics are shaped by pricing strategies, product differentiation, and the introduction of innovative vaccines. Market penetration of advanced technologies like recombinant vaccines is steadily increasing, driven by their higher efficacy and safety profiles compared to traditional approaches. Consumer preferences, influenced by rising incomes and an increasing emphasis on animal welfare, drive demand for high-quality, safe, and effective vaccines.

Dominant Markets & Segments in APAC Veterinary Vaccine Industry

The report identifies China and India as the leading markets within the APAC region, largely due to their extensive livestock populations and growing pet ownership. The livestock vaccine segment holds the largest market share, driven by high disease prevalence in livestock populations and proactive governmental support for vaccination campaigns.

Key Drivers of Dominance:

- China: Strong government support for agricultural development, expanding livestock farming, and large-scale vaccination programs.

- India: High livestock population, increasing focus on animal health, and government initiatives promoting vaccination.

By Vaccine Type:

- Livestock Vaccines: This segment is characterized by high volume sales due to large-scale animal farming and the prevalence of animal diseases.

- Companion Animal Vaccines: Growing pet ownership and increased awareness of pet health contribute to the growth of this segment.

By Technology:

- Live Attenuated Vaccines: While cost-effective, concerns regarding potential reversion to virulence and limited shelf life constrain this technology's market share.

- Inactivated Vaccines: Their safety profile makes them a preferred choice, contributing to substantial market share.

- Recombinant Vaccines: Increasingly favored for their higher efficacy and better safety, this technology presents a strong growth opportunity.

APAC Veterinary Vaccine Industry Product Developments

Recent innovations include the development of multivalent vaccines offering protection against multiple diseases, improving vaccination efficiency and cost-effectiveness. Furthermore, advancements in vaccine technology, such as the use of novel adjuvants, enhance vaccine efficacy and durability. Companies are also focusing on developing vaccines specifically targeted at emerging animal diseases, addressing market needs and ensuring animal health. These advancements align with the ongoing trend toward personalized medicine in veterinary care, increasing market fit.

Report Scope & Segmentation Analysis

This report segments the APAC veterinary vaccine market by vaccine type (Livestock Vaccines, Companion Animal Vaccines, and Other Livestock Vaccines) and technology (Live Attenuated Vaccines, Inactivated Vaccines, Toxoid Vaccines, Recombinant Vaccines, and Other Technologies). Each segment’s growth projections, market size, and competitive dynamics are thoroughly analyzed. For example, the Livestock Vaccines segment is projected to witness significant growth, driven by the expanding livestock population and increasing prevalence of animal diseases. The Recombinant Vaccines segment demonstrates high growth potential due to its superior efficacy and safety.

Key Drivers of APAC Veterinary Vaccine Industry Growth

Several factors fuel the growth of the APAC veterinary vaccine industry. Rising disposable incomes and increasing pet ownership, particularly in urban areas, have increased demand for companion animal vaccines. Government initiatives promoting animal health and welfare, along with stringent regulatory frameworks ensuring vaccine safety and efficacy, also contribute to the expansion of this sector. Moreover, advancements in vaccine technology, leading to safer and more effective vaccines, are driving significant market growth.

Challenges in the APAP Veterinary Vaccine Industry Sector

The industry faces challenges such as stringent regulatory approvals, which can lead to delays in product launches. The complex and fragmented supply chain increases production costs and creates logistical hurdles. Intense competition among established and emerging players further puts pressure on pricing and profitability. These factors can limit market expansion and growth potential. The estimated impact of these factors on overall market growth is estimated to be a xx% reduction in potential annual growth.

Emerging Opportunities in APAP Veterinary Vaccine Industry

Several opportunities exist within the APAC veterinary vaccine market. The growing adoption of precision livestock farming techniques and improved disease surveillance enhance opportunities for targeted vaccination programs. The development and application of novel vaccine platforms, such as mRNA and viral vector vaccines, present promising future prospects. Furthermore, the expansion into underserved markets and unmet medical needs creates significant growth opportunities.

Leading Players in the APAC Veterinary Vaccine Industry Market

- Elanco

- Zoetis Inc

- Boehringer Ingelheim International GmbH

- Hester Biosciences Ltd

- Jinyu Biotechnology Co Ltd

- HIPRA

- China Animal Husbandry Industry Co Ltd

- Phibro Animal Health Corp

- Tianjin Ringpu Bio-Technology Co Ltd

- Ceva Sante Animale

- Merck & Co

- Virbac SA

Key Developments in APAC Veterinary Vaccine Industry Industry

- June 2022: Launch of Animal Vaccines and Diagnostic Kits by ICAR-National Research Centre on Equines, India. This development enhances the availability of affordable and effective vaccines in India, significantly impacting market dynamics.

- June 2022: APVMA approval of an emergency permit for a rabbit hemorrhagic disease vaccine in Australia. This underscores the importance of rapid response to emerging animal diseases and the regulatory framework supporting timely vaccine availability.

Strategic Outlook for APAC Veterinary Vaccine Industry Market

The APAC veterinary vaccine market is poised for continued expansion, driven by several factors, including rising pet ownership, advancements in vaccine technology, and increasing government support for animal health initiatives. The market's future potential is substantial, especially considering the growing demand for innovative and effective vaccines tailored to specific regional needs and the increasing focus on animal welfare and disease prevention. The market presents lucrative opportunities for both established players and emerging companies to expand their product portfolios and enhance their market presence.

APAC Veterinary Vaccine Industry Segmentation

-

1. Vaccine Type

-

1.1. Livestock Vaccines

- 1.1.1. Bovine Vaccines

- 1.1.2. Poultry Vaccines

- 1.1.3. Porcine Vaccines

- 1.1.4. Other Livestock Vaccines

-

1.2. Companion Animal Vaccines

- 1.2.1. Canine Vaccines

- 1.2.2. Feline Vaccines

- 1.2.3. Equine Vaccines

-

1.1. Livestock Vaccines

-

2. Technology

- 2.1. Live Attenuated Vaccines

- 2.2. Inactivated Vaccines

- 2.3. Toxoid Vaccines

- 2.4. Recombinant Vaccines

- 2.5. Other Technologies

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia-Pacific

APAC Veterinary Vaccine Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

- 5. Australia

- 6. Rest of Asia Pacific

APAC Veterinary Vaccine Industry Regional Market Share

Geographic Coverage of APAC Veterinary Vaccine Industry

APAC Veterinary Vaccine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Burden of Diseases in Animals; Initiatives by Various Government Agencies

- 3.2.2 Animal Associations

- 3.2.3 and Leading Players

- 3.3. Market Restrains

- 3.3.1. High Storage Costs for Vaccines

- 3.4. Market Trends

- 3.4.1. The Live Attenuated Vaccines Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Veterinary Vaccine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 5.1.1. Livestock Vaccines

- 5.1.1.1. Bovine Vaccines

- 5.1.1.2. Poultry Vaccines

- 5.1.1.3. Porcine Vaccines

- 5.1.1.4. Other Livestock Vaccines

- 5.1.2. Companion Animal Vaccines

- 5.1.2.1. Canine Vaccines

- 5.1.2.2. Feline Vaccines

- 5.1.2.3. Equine Vaccines

- 5.1.1. Livestock Vaccines

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Live Attenuated Vaccines

- 5.2.2. Inactivated Vaccines

- 5.2.3. Toxoid Vaccines

- 5.2.4. Recombinant Vaccines

- 5.2.5. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. South Korea

- 5.3.5. Australia

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. South Korea

- 5.4.5. Australia

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 6. China APAC Veterinary Vaccine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 6.1.1. Livestock Vaccines

- 6.1.1.1. Bovine Vaccines

- 6.1.1.2. Poultry Vaccines

- 6.1.1.3. Porcine Vaccines

- 6.1.1.4. Other Livestock Vaccines

- 6.1.2. Companion Animal Vaccines

- 6.1.2.1. Canine Vaccines

- 6.1.2.2. Feline Vaccines

- 6.1.2.3. Equine Vaccines

- 6.1.1. Livestock Vaccines

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Live Attenuated Vaccines

- 6.2.2. Inactivated Vaccines

- 6.2.3. Toxoid Vaccines

- 6.2.4. Recombinant Vaccines

- 6.2.5. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. South Korea

- 6.3.5. Australia

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 7. Japan APAC Veterinary Vaccine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 7.1.1. Livestock Vaccines

- 7.1.1.1. Bovine Vaccines

- 7.1.1.2. Poultry Vaccines

- 7.1.1.3. Porcine Vaccines

- 7.1.1.4. Other Livestock Vaccines

- 7.1.2. Companion Animal Vaccines

- 7.1.2.1. Canine Vaccines

- 7.1.2.2. Feline Vaccines

- 7.1.2.3. Equine Vaccines

- 7.1.1. Livestock Vaccines

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Live Attenuated Vaccines

- 7.2.2. Inactivated Vaccines

- 7.2.3. Toxoid Vaccines

- 7.2.4. Recombinant Vaccines

- 7.2.5. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. South Korea

- 7.3.5. Australia

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 8. India APAC Veterinary Vaccine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 8.1.1. Livestock Vaccines

- 8.1.1.1. Bovine Vaccines

- 8.1.1.2. Poultry Vaccines

- 8.1.1.3. Porcine Vaccines

- 8.1.1.4. Other Livestock Vaccines

- 8.1.2. Companion Animal Vaccines

- 8.1.2.1. Canine Vaccines

- 8.1.2.2. Feline Vaccines

- 8.1.2.3. Equine Vaccines

- 8.1.1. Livestock Vaccines

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Live Attenuated Vaccines

- 8.2.2. Inactivated Vaccines

- 8.2.3. Toxoid Vaccines

- 8.2.4. Recombinant Vaccines

- 8.2.5. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. South Korea

- 8.3.5. Australia

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 9. South Korea APAC Veterinary Vaccine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 9.1.1. Livestock Vaccines

- 9.1.1.1. Bovine Vaccines

- 9.1.1.2. Poultry Vaccines

- 9.1.1.3. Porcine Vaccines

- 9.1.1.4. Other Livestock Vaccines

- 9.1.2. Companion Animal Vaccines

- 9.1.2.1. Canine Vaccines

- 9.1.2.2. Feline Vaccines

- 9.1.2.3. Equine Vaccines

- 9.1.1. Livestock Vaccines

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Live Attenuated Vaccines

- 9.2.2. Inactivated Vaccines

- 9.2.3. Toxoid Vaccines

- 9.2.4. Recombinant Vaccines

- 9.2.5. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. South Korea

- 9.3.5. Australia

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 10. Australia APAC Veterinary Vaccine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 10.1.1. Livestock Vaccines

- 10.1.1.1. Bovine Vaccines

- 10.1.1.2. Poultry Vaccines

- 10.1.1.3. Porcine Vaccines

- 10.1.1.4. Other Livestock Vaccines

- 10.1.2. Companion Animal Vaccines

- 10.1.2.1. Canine Vaccines

- 10.1.2.2. Feline Vaccines

- 10.1.2.3. Equine Vaccines

- 10.1.1. Livestock Vaccines

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Live Attenuated Vaccines

- 10.2.2. Inactivated Vaccines

- 10.2.3. Toxoid Vaccines

- 10.2.4. Recombinant Vaccines

- 10.2.5. Other Technologies

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. South Korea

- 10.3.5. Australia

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 11. Rest of Asia Pacific APAC Veterinary Vaccine Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 11.1.1. Livestock Vaccines

- 11.1.1.1. Bovine Vaccines

- 11.1.1.2. Poultry Vaccines

- 11.1.1.3. Porcine Vaccines

- 11.1.1.4. Other Livestock Vaccines

- 11.1.2. Companion Animal Vaccines

- 11.1.2.1. Canine Vaccines

- 11.1.2.2. Feline Vaccines

- 11.1.2.3. Equine Vaccines

- 11.1.1. Livestock Vaccines

- 11.2. Market Analysis, Insights and Forecast - by Technology

- 11.2.1. Live Attenuated Vaccines

- 11.2.2. Inactivated Vaccines

- 11.2.3. Toxoid Vaccines

- 11.2.4. Recombinant Vaccines

- 11.2.5. Other Technologies

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. Japan

- 11.3.3. India

- 11.3.4. South Korea

- 11.3.5. Australia

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Vaccine Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Elanco

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Zoetis Inc *List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Boehringer Ingelheim International GmbH

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Hester Biosciences Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Jinyu Biotechnology Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 HIPRA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 China Animal Husbandry Industry Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Phibro Animal Health Corp

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Tianjin Ringpu Bio-Technology Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Ceva Sante Animale

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Merck & Co

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Virbac SA

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Elanco

List of Figures

- Figure 1: Global APAC Veterinary Vaccine Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: China APAC Veterinary Vaccine Industry Revenue (million), by Vaccine Type 2025 & 2033

- Figure 3: China APAC Veterinary Vaccine Industry Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 4: China APAC Veterinary Vaccine Industry Revenue (million), by Technology 2025 & 2033

- Figure 5: China APAC Veterinary Vaccine Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: China APAC Veterinary Vaccine Industry Revenue (million), by Geography 2025 & 2033

- Figure 7: China APAC Veterinary Vaccine Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China APAC Veterinary Vaccine Industry Revenue (million), by Country 2025 & 2033

- Figure 9: China APAC Veterinary Vaccine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Japan APAC Veterinary Vaccine Industry Revenue (million), by Vaccine Type 2025 & 2033

- Figure 11: Japan APAC Veterinary Vaccine Industry Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 12: Japan APAC Veterinary Vaccine Industry Revenue (million), by Technology 2025 & 2033

- Figure 13: Japan APAC Veterinary Vaccine Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Japan APAC Veterinary Vaccine Industry Revenue (million), by Geography 2025 & 2033

- Figure 15: Japan APAC Veterinary Vaccine Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Japan APAC Veterinary Vaccine Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Japan APAC Veterinary Vaccine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: India APAC Veterinary Vaccine Industry Revenue (million), by Vaccine Type 2025 & 2033

- Figure 19: India APAC Veterinary Vaccine Industry Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 20: India APAC Veterinary Vaccine Industry Revenue (million), by Technology 2025 & 2033

- Figure 21: India APAC Veterinary Vaccine Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: India APAC Veterinary Vaccine Industry Revenue (million), by Geography 2025 & 2033

- Figure 23: India APAC Veterinary Vaccine Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: India APAC Veterinary Vaccine Industry Revenue (million), by Country 2025 & 2033

- Figure 25: India APAC Veterinary Vaccine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South Korea APAC Veterinary Vaccine Industry Revenue (million), by Vaccine Type 2025 & 2033

- Figure 27: South Korea APAC Veterinary Vaccine Industry Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 28: South Korea APAC Veterinary Vaccine Industry Revenue (million), by Technology 2025 & 2033

- Figure 29: South Korea APAC Veterinary Vaccine Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: South Korea APAC Veterinary Vaccine Industry Revenue (million), by Geography 2025 & 2033

- Figure 31: South Korea APAC Veterinary Vaccine Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: South Korea APAC Veterinary Vaccine Industry Revenue (million), by Country 2025 & 2033

- Figure 33: South Korea APAC Veterinary Vaccine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Australia APAC Veterinary Vaccine Industry Revenue (million), by Vaccine Type 2025 & 2033

- Figure 35: Australia APAC Veterinary Vaccine Industry Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 36: Australia APAC Veterinary Vaccine Industry Revenue (million), by Technology 2025 & 2033

- Figure 37: Australia APAC Veterinary Vaccine Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Australia APAC Veterinary Vaccine Industry Revenue (million), by Geography 2025 & 2033

- Figure 39: Australia APAC Veterinary Vaccine Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Australia APAC Veterinary Vaccine Industry Revenue (million), by Country 2025 & 2033

- Figure 41: Australia APAC Veterinary Vaccine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific APAC Veterinary Vaccine Industry Revenue (million), by Vaccine Type 2025 & 2033

- Figure 43: Rest of Asia Pacific APAC Veterinary Vaccine Industry Revenue Share (%), by Vaccine Type 2025 & 2033

- Figure 44: Rest of Asia Pacific APAC Veterinary Vaccine Industry Revenue (million), by Technology 2025 & 2033

- Figure 45: Rest of Asia Pacific APAC Veterinary Vaccine Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 46: Rest of Asia Pacific APAC Veterinary Vaccine Industry Revenue (million), by Geography 2025 & 2033

- Figure 47: Rest of Asia Pacific APAC Veterinary Vaccine Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Asia Pacific APAC Veterinary Vaccine Industry Revenue (million), by Country 2025 & 2033

- Figure 49: Rest of Asia Pacific APAC Veterinary Vaccine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Vaccine Type 2020 & 2033

- Table 2: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 3: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 4: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Vaccine Type 2020 & 2033

- Table 6: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 7: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 8: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Vaccine Type 2020 & 2033

- Table 10: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 11: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Vaccine Type 2020 & 2033

- Table 14: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 15: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 16: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 17: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Vaccine Type 2020 & 2033

- Table 18: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 19: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 20: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 21: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Vaccine Type 2020 & 2033

- Table 22: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 23: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 24: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Country 2020 & 2033

- Table 25: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Vaccine Type 2020 & 2033

- Table 26: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Technology 2020 & 2033

- Table 27: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 28: Global APAC Veterinary Vaccine Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Veterinary Vaccine Industry?

The projected CAGR is approximately 6.94%.

2. Which companies are prominent players in the APAC Veterinary Vaccine Industry?

Key companies in the market include Elanco, Zoetis Inc *List Not Exhaustive, Boehringer Ingelheim International GmbH, Hester Biosciences Ltd, Jinyu Biotechnology Co Ltd, HIPRA, China Animal Husbandry Industry Co Ltd, Phibro Animal Health Corp, Tianjin Ringpu Bio-Technology Co Ltd, Ceva Sante Animale, Merck & Co, Virbac SA.

3. What are the main segments of the APAC Veterinary Vaccine Industry?

The market segments include Vaccine Type, Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.17 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Diseases in Animals; Initiatives by Various Government Agencies. Animal Associations. and Leading Players.

6. What are the notable trends driving market growth?

The Live Attenuated Vaccines Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Storage Costs for Vaccines.

8. Can you provide examples of recent developments in the market?

In June 2022, the Union Minister of Agriculture & Farmers' Welfare, Shri Narendra Singh Tomar, launched Animal Vaccine and other Diagnostic Kits developed by the ICAR-National Research Centre on Equines in Hisar, Haryana, India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Veterinary Vaccine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Veterinary Vaccine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Veterinary Vaccine Industry?

To stay informed about further developments, trends, and reports in the APAC Veterinary Vaccine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence