Key Insights

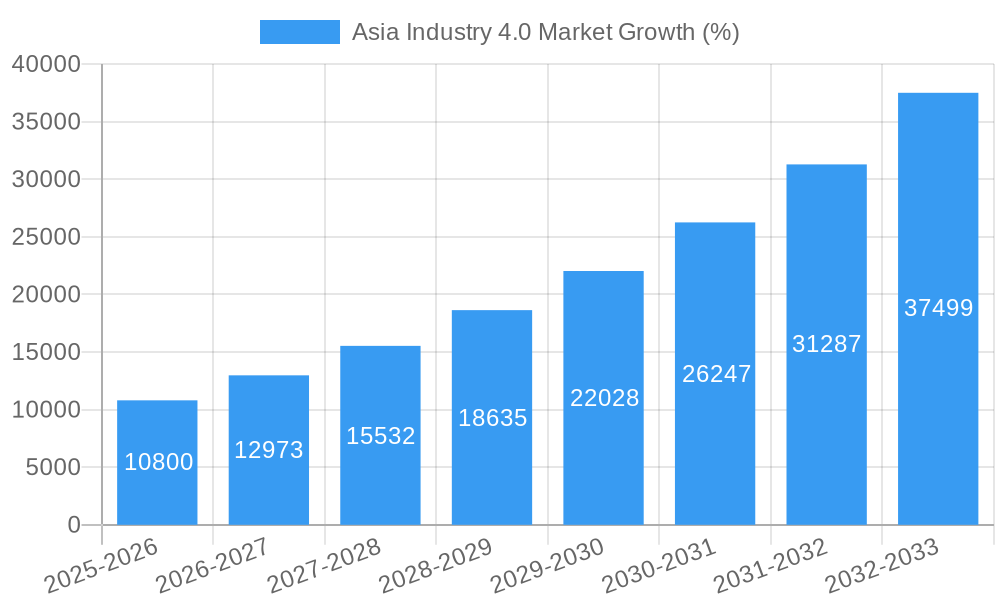

The Asia Industry 4.0 market is experiencing explosive growth, driven by increasing automation needs across diverse sectors and significant government investments in digital infrastructure. The region's large manufacturing base, particularly in countries like China, Japan, South Korea, and India, provides a fertile ground for Industry 4.0 technologies. A compound annual growth rate (CAGR) of 21.60% from 2019-2033 indicates a substantial expansion, with the market expected to reach considerable size by 2033. Key drivers include the rising adoption of industrial robotics for enhanced productivity and efficiency, the proliferation of IIoT (Industrial Internet of Things) devices for real-time data analytics and improved decision-making, and the increasing integration of AI and ML for process optimization and predictive maintenance. Furthermore, technologies like blockchain for supply chain transparency, extended reality for enhanced training and remote operation, digital twins for virtual prototyping and simulation, and 3D printing for customized production are contributing significantly to this growth trajectory. While data security concerns and the need for skilled workforce present challenges, the overall market outlook remains strongly positive, driven by continued technological advancements and supportive government policies.

The diverse segments within the Asia Industry 4.0 market present both opportunities and challenges. The manufacturing sector leads in adoption, followed by automotive, oil and gas, and electronics. Technological advancements are consistently pushing the boundaries, creating new application areas and business models. The high adoption in manufacturing is further fueled by the rising demand for improved product quality, reduced production costs, and increased efficiency. The automotive sector is heavily investing in automation to improve production speed and meet stringent quality requirements. The significant presence of key players like ABB, Fanuc, and Mitsubishi Electric, coupled with robust regional supply chains, strengthens the Asia Pacific region's position as a dominant force in the global Industry 4.0 market. Future growth will likely be shaped by the increasing convergence of technologies, the expansion of 5G networks, and the ongoing evolution of cybersecurity protocols.

Asia Industry 4.0 Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Industry 4.0 market, encompassing market size, segmentation, growth drivers, challenges, and key players. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on the burgeoning opportunities within the Asian Industry 4.0 landscape. The report analyzes market trends across key segments including Industrial Robotics, IIoT, AI and ML, and various end-user industries, offering actionable insights for strategic decision-making.

Asia Industry 4.0 Market Concentration & Innovation

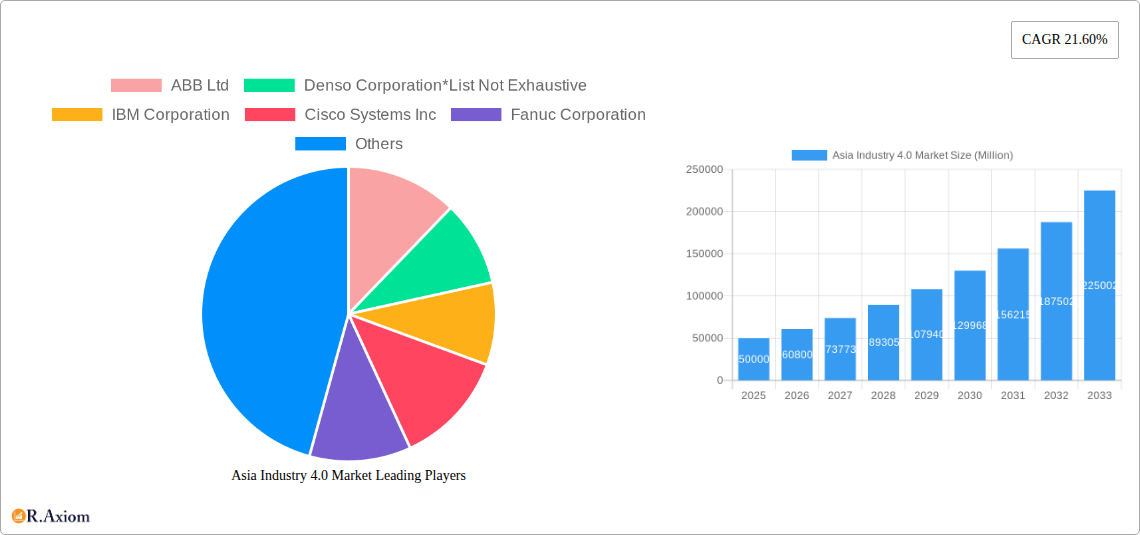

The Asia Industry 4.0 market exhibits a moderately concentrated landscape, with a few dominant players commanding significant market share. Companies like ABB Ltd, Denso Corporation, IBM Corporation, Cisco Systems Inc, Fanuc Corporation, Omron Corporation, Robert Bosch GmbH, Yokogawa Electric Corporation, Mitsubishi Electric, General Electric Company, Intel Corporation, and Yaskawa Electric Corporation are key players driving innovation. However, the market also features numerous smaller, specialized companies contributing to niche segments.

Market concentration is influenced by factors such as technological expertise, established supply chains, and brand recognition. Innovation is fueled by substantial R&D investments, strategic partnerships, and government initiatives promoting digital transformation. The regulatory environment varies across Asian countries, influencing market access and technological adoption. While there is a degree of product substitution among different Industry 4.0 technologies, the unique capabilities of each technology cater to distinct application needs. The M&A landscape is dynamic, with deal values varying based on target companies’ technologies and market position. Notable deals in recent years have involved (xx Million) in total value, though precise figures are often confidential. End-user trends heavily favour automation and data-driven decision-making, driving demand for advanced Industry 4.0 solutions.

- Market Share: Top 5 players hold approximately xx% of the market share (2024 estimate).

- M&A Activity: XX major M&A deals concluded in the period 2019-2024, with an estimated total value of xx Million.

- Innovation Drivers: Government policies, increased investment in R&D, and the drive for operational efficiency.

Asia Industry 4.0 Market Industry Trends & Insights

The Asia Industry 4.0 market is experiencing robust growth, driven by rapid industrialization, increasing digitalization, and government support for smart manufacturing initiatives across the region. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%. This growth is fueled by the increasing adoption of Industrial Internet of Things (IIoT) technologies, Artificial Intelligence (AI) and Machine Learning (ML) for automation and predictive maintenance, and the burgeoning demand for Industrial Robotics across various sectors. Market penetration of Industry 4.0 solutions remains relatively low in some countries, suggesting substantial untapped potential. Technological disruptions, such as the emergence of 5G and edge computing, are further accelerating market expansion. Consumer preferences are shifting towards personalized products and faster delivery times, spurring demand for efficient and agile manufacturing processes. Competitive dynamics are intense, with both established players and new entrants striving to innovate and capture market share. This competition is driving rapid technological advancements and price reductions, benefiting end-users. The increasing focus on data security and cyber resilience is shaping the development and adoption of Industry 4.0 solutions, alongside a growing preference for cloud-based solutions, enabling remote asset monitoring and improved operational visibility.

Dominant Markets & Segments in Asia Industry 4.0 Market

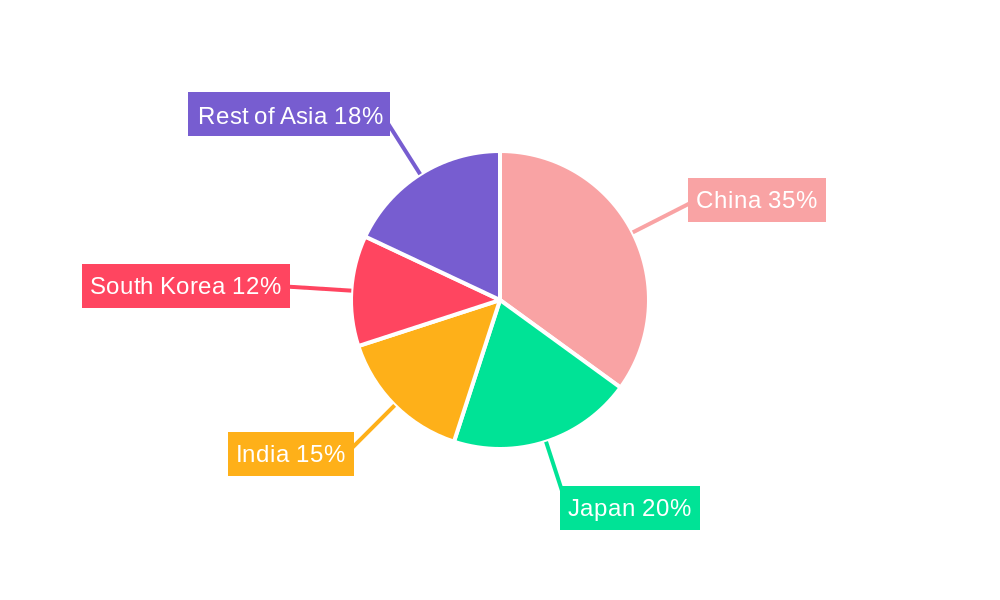

By Country: China dominates the Asia Industry 4.0 market due to its vast manufacturing base, significant government investment in digital infrastructure, and a large pool of skilled engineers. Japan and South Korea also hold strong positions, driven by technological prowess and advanced automation in their industries. India and Indonesia represent significant growth opportunities, albeit with challenges in infrastructure and digital literacy.

- China: Key drivers include substantial government funding for Industry 4.0 initiatives, a large manufacturing sector, and a robust technology ecosystem.

- Japan: Strong technological capabilities, a focus on automation, and a highly skilled workforce contribute to its leading role.

- South Korea: Similar to Japan, strong technological prowess and a concentrated manufacturing sector drives market growth.

- India: Rapid economic growth, a growing manufacturing sector, and government initiatives promoting digitalization offer considerable growth potential.

- Indonesia: Emerging as a key market with significant untapped potential driven by industrialization and government initiatives.

By Technology Type: Industrial Robotics and IIoT are currently the largest segments. However, AI and ML are experiencing the fastest growth, driven by their potential to optimize processes, enhance predictive maintenance, and improve decision-making.

By End-user Industry: The manufacturing sector accounts for the largest share, followed by the automotive and electronics industries. Growth across other industries like energy and utilities, food and beverage, and aerospace and defense is also significant.

Asia Industry 4.0 Market Product Developments

Recent product innovations have focused on enhancing the integration of different Industry 4.0 technologies, improving data analytics capabilities, and developing more user-friendly interfaces. The emphasis on cloud-based solutions and edge computing allows for real-time data processing and enhanced scalability. New applications are emerging in areas like predictive maintenance, supply chain optimization, and quality control, giving manufacturers considerable competitive advantages. The market is rapidly evolving, with constant improvements to accuracy, speed and efficiency of core Industry 4.0 technologies.

Report Scope & Segmentation Analysis

This report segments the Asia Industry 4.0 market across three key dimensions: Technology Type, End-user Industry, and Country.

By Technology Type: The report analyzes the market size and growth prospects for Industrial Robotics, IIoT, AI and ML, Blockchain, Extended Reality, Digital Twin, 3D Printing, and other technology types. Growth projections vary significantly across these segments, with AI and ML expected to exhibit the highest CAGR. Competitive dynamics are characterized by intense innovation and partnerships to integrate different technologies.

By End-user Industry: The report provides detailed analysis of the manufacturing, automotive, oil and gas, energy and utilities, electronics and foundry, food and beverage, aerospace and defense, and other end-user industries. Market size and growth projections vary substantially across these segments, with manufacturing remaining the largest. Competitive dynamics are influenced by industry-specific requirements and technological adoption rates.

By Country: The report examines the market in China, South Korea, Japan, India, Indonesia, and the Rest of Asia. Significant variations in market size, growth rates, and competitive intensity exist across these countries, influenced by economic development levels, government policies, and technological capabilities.

Key Drivers of Asia Industry 4.0 Market Growth

The Asia Industry 4.0 market is driven by several key factors: Firstly, government initiatives and supportive policies across many Asian nations actively encourage digital transformation and smart manufacturing. Secondly, the expanding manufacturing base in several Asian economies fuels significant demand for automation and efficiency-enhancing technologies. Thirdly, falling costs of Industry 4.0 technologies, particularly hardware, increase accessibility for businesses of all sizes. Finally, a growing skilled workforce and entrepreneurial ecosystem in the region enhances technological innovation and implementation.

Challenges in the Asia Industry 4.0 Market Sector

Challenges include the high initial investment costs for implementing Industry 4.0 technologies, a skills gap in certain areas hindering effective implementation, and concerns regarding data security and cyber resilience. Further, inconsistencies in digital infrastructure and connectivity across the region pose an obstacle to seamless technology adoption. Supply chain disruptions can also impact the timely availability of necessary components, potentially delaying projects. Finally, varying levels of regulatory frameworks and standards across Asian nations complicate standardization and cross-border collaboration.

Emerging Opportunities in Asia Industry 4.0 Market

Emerging opportunities lie in the expanding adoption of AI-powered solutions for predictive maintenance and quality control, the growing use of blockchain for secure supply chain management, and the potential of extended reality technologies for enhanced training and remote operations. The rising demand for sustainable and environmentally friendly manufacturing processes creates opportunities for developing green Industry 4.0 solutions. Furthermore, the increasing penetration of 5G and edge computing will drive further innovation and adoption of real-time applications.

Leading Players in the Asia Industry 4.0 Market Market

- ABB Ltd

- Denso Corporation

- IBM Corporation

- Cisco Systems Inc

- Fanuc Corporation

- Omron Corporation

- Robert Bosch GmbH

- Yokogawa Electric Corporation

- Mitsubishi Electric

- General Electric Company

- Intel Corporation

- Yaskawa Electric Corporation

Key Developments in Asia Industry 4.0 Market Industry

June 2022: Yokogawa Electric Corporation launched OpreX asset health insights, a cloud-based plant asset monitoring service leveraging ML and AI for enhanced operational efficiency. This highlights the growing trend towards cloud-based asset management solutions.

February 2022: Mitsubishi Electric Corporation received the SAP Japan Customer Award 2021 for its leadership in digital transformation, showcasing the increasing importance of IT/OT integration in Industry 4.0.

Strategic Outlook for Asia Industry 4.0 Market Market

The Asia Industry 4.0 market presents significant growth potential. Continued government support, increasing technological advancements, and the expanding manufacturing sector will drive market expansion. The focus on sustainability, data security, and the integration of emerging technologies like AI and blockchain will shape future market dynamics. Companies that invest in innovation, build robust partnerships, and adapt to evolving market trends will be well-positioned to capitalize on the opportunities in this dynamic market.

Asia Industry 4.0 Market Segmentation

-

1. Technology Type

- 1.1. Industrial Robotics

- 1.2. IIoT

- 1.3. AI and ML

- 1.4. Blockchain

- 1.5. Extended Reality

- 1.6. Digital Twin

- 1.7. 3D Printing

- 1.8. Other Technology Types

-

2. End-user Industry

- 2.1. Manufacturing

- 2.2. Automotive

- 2.3. Oil and Gas

- 2.4. Energy and Utilities

- 2.5. Electronics and Foundry

- 2.6. Food and Beverage

- 2.7. Aerospace and Defense

- 2.8. Other End-user Industries

Asia Industry 4.0 Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asia Industry 4.0 Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Governmental Initiatives and Collaborations Between Stakeholders in the Region; Growth in Demand for Industrial Robotics; Digital Transformation Initiatives Undertaken by SMEs

- 3.3. Market Restrains

- 3.3.1. Sluggish Adoption of New Technologies

- 3.4. Market Trends

- 3.4.1. Manufacturing Industry to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 5.1.1. Industrial Robotics

- 5.1.2. IIoT

- 5.1.3. AI and ML

- 5.1.4. Blockchain

- 5.1.5. Extended Reality

- 5.1.6. Digital Twin

- 5.1.7. 3D Printing

- 5.1.8. Other Technology Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Manufacturing

- 5.2.2. Automotive

- 5.2.3. Oil and Gas

- 5.2.4. Energy and Utilities

- 5.2.5. Electronics and Foundry

- 5.2.6. Food and Beverage

- 5.2.7. Aerospace and Defense

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 6. China Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ABB Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Denso Corporation*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 IBM Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Cisco Systems Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fanuc Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Omron Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Robert Bosch GmbH

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yokogawa Electric Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Mitsubishi Electric

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 General Electric Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Intel Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Yaskawa Electric Corporation

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 ABB Ltd

List of Figures

- Figure 1: Asia Industry 4.0 Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Industry 4.0 Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Industry 4.0 Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Industry 4.0 Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 3: Asia Industry 4.0 Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Asia Industry 4.0 Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Industry 4.0 Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Industry 4.0 Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 14: Asia Industry 4.0 Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Asia Industry 4.0 Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Bangladesh Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Pakistan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Industry 4.0 Market?

The projected CAGR is approximately 21.60%.

2. Which companies are prominent players in the Asia Industry 4.0 Market?

Key companies in the market include ABB Ltd, Denso Corporation*List Not Exhaustive, IBM Corporation, Cisco Systems Inc, Fanuc Corporation, Omron Corporation, Robert Bosch GmbH, Yokogawa Electric Corporation, Mitsubishi Electric, General Electric Company, Intel Corporation, Yaskawa Electric Corporation.

3. What are the main segments of the Asia Industry 4.0 Market?

The market segments include Technology Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Governmental Initiatives and Collaborations Between Stakeholders in the Region; Growth in Demand for Industrial Robotics; Digital Transformation Initiatives Undertaken by SMEs.

6. What are the notable trends driving market growth?

Manufacturing Industry to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Sluggish Adoption of New Technologies.

8. Can you provide examples of recent developments in the market?

June 2022: Yokogawa Electric Corporation released OpreX asset health insights. OpreX is a cloud-based plant asset monitoring service that refines, collects, and aggregates operational technology data from distributed assets. Asset Health Insights Oprex powered by Yokogawa Cloud is equipped with ML and AI analytics capability. As the adoption of Industry 4.0 technologies continues to pace in the region, companies are changing the way they do asset management by introducing cloud-based technologies that can monitor assets from anywhere in the world and optimize their performance in real-time. Driven by customers' focus on integrated, remote, and increasingly autonomous operations, Yokogawa Electric developed Asset Health Insights to make data more visible, integrated, and actionable.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Industry 4.0 Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Industry 4.0 Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Industry 4.0 Market?

To stay informed about further developments, trends, and reports in the Asia Industry 4.0 Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence