Key Insights

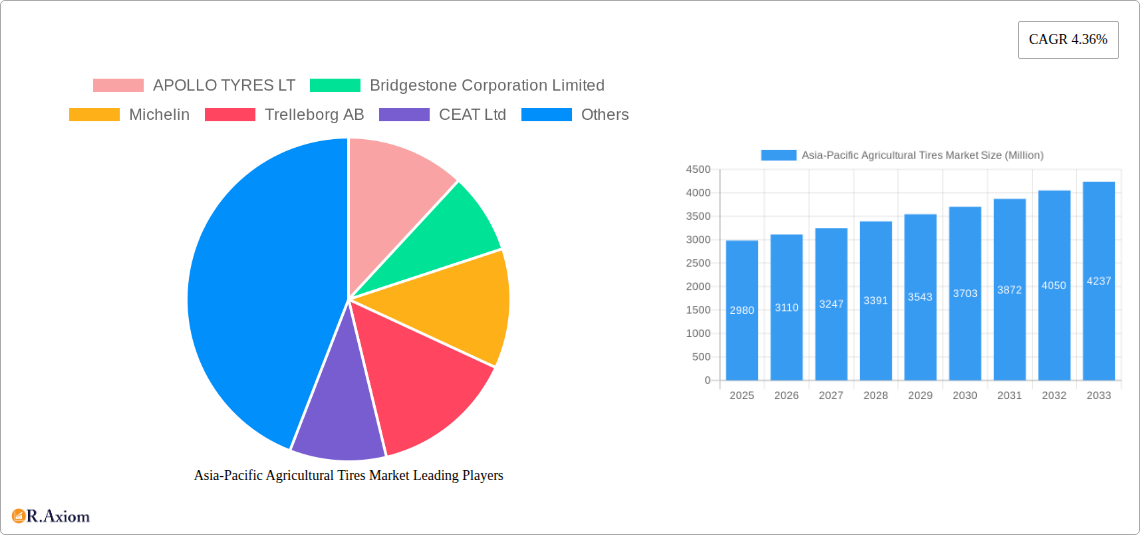

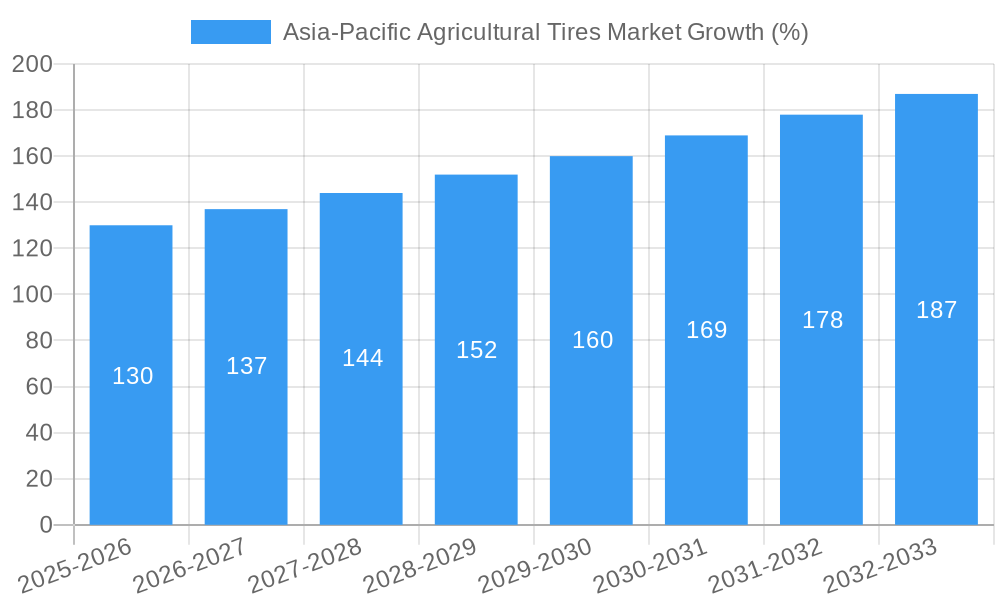

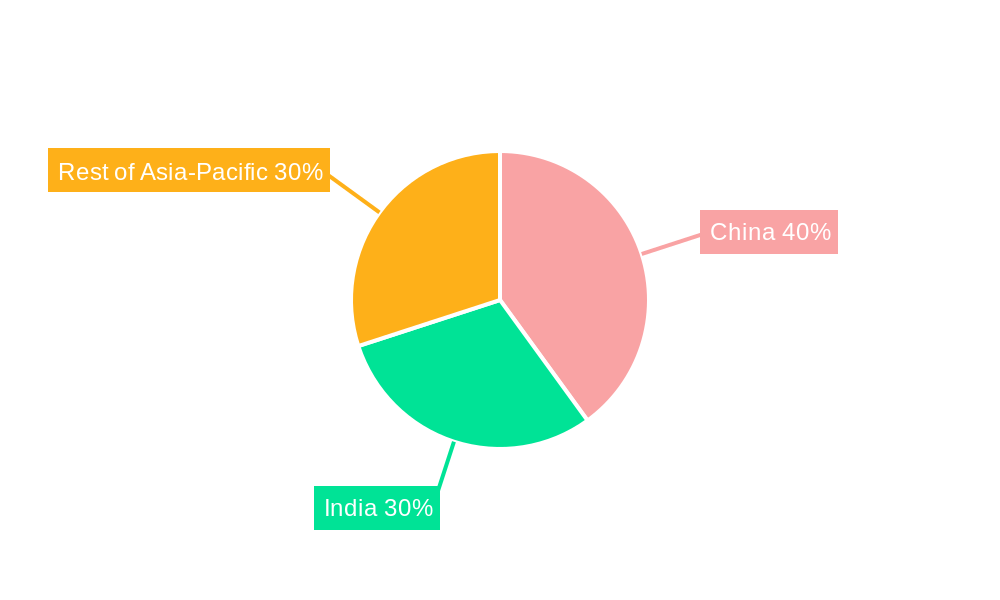

The Asia-Pacific agricultural tire market, valued at $2.98 billion in 2025, is projected to experience robust growth, driven by rising agricultural mechanization and increasing crop production across the region. A Compound Annual Growth Rate (CAGR) of 4.36% is anticipated from 2025 to 2033, indicating a significant expansion in market size. This growth is fueled by several key factors. Firstly, the increasing adoption of advanced farming techniques and high-yield crops necessitates efficient and durable tires for improved traction and operational efficiency. Secondly, government initiatives promoting agricultural modernization and infrastructure development in countries like India and China are significantly boosting demand. Furthermore, the rising disposable incomes and a growing middle class are leading to increased consumption of agricultural produce, further fueling the demand for efficient agricultural machinery and associated tires. However, fluctuating raw material prices and the potential for economic downturns pose challenges to the market's sustained growth. The market is segmented by application type (tractors, combine harvesters, sprayers, and others), construction type (bias and radial tires), and sales channel (OEM and replacement/aftermarket). Radial tires are expected to witness higher growth compared to bias tires due to their superior performance characteristics. The OEM segment currently holds a larger share, but the aftermarket segment is predicted to witness significant growth driven by increasing demand for tire replacements. China and India are the key drivers within the Asia-Pacific region, contributing significantly to the overall market value.

The competitive landscape is characterized by a mix of global and regional players, including Apollo Tyres, Bridgestone, Michelin, Trelleborg, and CEAT, among others. These companies are focusing on innovation and technological advancements to offer superior product quality and performance. Strategic partnerships, mergers, and acquisitions are also expected to shape the market dynamics in the coming years. Growth in the agricultural sector and continuous technological innovation in tire manufacturing will be crucial factors determining the market's trajectory over the forecast period. Focus on sustainable and eco-friendly tire manufacturing practices will also gain traction, influenced by growing environmental concerns. The market is poised for significant expansion, presenting lucrative opportunities for established players and new entrants alike.

Asia-Pacific Agricultural Tires Market: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Asia-Pacific agricultural tires market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report uses Million as the unit for all value mentions.

Asia-Pacific Agricultural Tires Market Market Concentration & Innovation

The Asia-Pacific agricultural tire market exhibits a moderately concentrated landscape, with key players like Bridgestone, Michelin, and Apollo Tires holding significant market share. However, the presence of several regional and local manufacturers contributes to competitive intensity. Market share data for 2024 indicates Bridgestone holds approximately xx%, Michelin xx%, and Apollo Tyres xx%, while other players collectively account for the remaining xx%. Innovation is driven by the need for enhanced tire performance, sustainability, and cost-effectiveness. This is reflected in the development of radial tires, which offer superior fuel efficiency and traction compared to bias tires. Furthermore, the increasing adoption of precision farming technologies necessitates tires capable of withstanding higher loads and operating pressures.

Regulatory frameworks, such as those related to tire safety and environmental standards, play a significant role in shaping market dynamics. The presence of substitute products, primarily retreaded tires, exerts some competitive pressure, though the performance and longevity advantages of new tires generally favor their adoption. End-user trends indicate a growing preference for high-performance, fuel-efficient tires that minimize soil compaction and maximize productivity. M&A activities in the sector have been moderate in recent years, with deal values ranging from xx Million to xx Million, primarily focused on strategic expansions and technology acquisitions. Examples include [Insert specific M&A examples if available, otherwise state "No significant M&A activity reported in the study period"].

Asia-Pacific Agricultural Tires Market Industry Trends & Insights

The Asia-Pacific agricultural tires market is experiencing robust growth, driven by factors such as increasing agricultural mechanization, rising crop production, and expanding farm sizes. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is further fueled by technological advancements in tire design and manufacturing, leading to improved durability, fuel efficiency, and traction. Consumer preferences are increasingly shifting towards radial tires, due to their superior performance characteristics and long lifespan.

Competitive dynamics are shaped by the presence of both global and regional players. Global manufacturers enjoy a larger market share due to their established brand reputation, advanced technologies, and extensive distribution networks. However, regional players are gaining traction by focusing on customized solutions tailored to the specific needs of local farmers and offering competitive pricing. Market penetration of radial tires is steadily increasing, driven by their benefits and government initiatives promoting efficient farming practices, exceeding xx% in 2024 and projected to reach xx% by 2033.

Dominant Markets & Segments in Asia-Pacific Agricultural Tires Market

Leading Region: India and China dominate the Asia-Pacific agricultural tires market due to their vast agricultural lands, large farming populations, and growing mechanization rates.

Dominant Application Type: Tractor tires hold the largest market share among application types, followed by combine harvesters, and sprayers. This dominance is primarily driven by the widespread adoption of tractors in agricultural operations across the region.

Leading Construction Type: Radial tires are gaining significant traction and are projected to surpass bias tires in market share by 2033. This is attributable to their enhanced performance characteristics and improved fuel efficiency.

Dominant Sales Channel Type: The replacement/aftermarket segment constitutes a larger portion of the overall sales compared to the OEM segment. This is largely due to the large installed base of agricultural machinery in the region.

Key Drivers for Dominant Segments:

- India and China: Strong government support for agricultural modernization, expanding agricultural land under cultivation, and a large farmer base fuel market growth.

- Tractor Tires: Widespread tractor adoption across diverse agricultural landscapes across the Asia-Pacific region.

- Radial Tires: Superior performance characteristics, improved fuel efficiency, and increased longevity compared to bias tires.

- Replacement/Aftermarket: Large installed base of agricultural machinery requiring periodic tire replacements.

Asia-Pacific Agricultural Tires Market Product Developments

Recent product innovations highlight a strong focus on enhanced durability, fuel efficiency, and sustainability. For example, Continental AG's VF TractorMaster boasts exceptional load capacity and diameter, while Apollo Tires' Virat range offers improved performance and longevity. Michelin's EVOBIB tire emphasizes reduced soil compaction and lower fuel consumption. These developments cater to the evolving needs of farmers seeking to optimize productivity and minimize environmental impact. The trend toward larger, higher-capacity tires reflects the growing use of larger machinery in agriculture.

Report Scope & Segmentation Analysis

Application Type: The report segments the market by application type, including tractors, combine harvesters, sprayers, and other application types. Each segment's growth is analyzed, considering factors like technological advancements, market size, and competitive intensity. Tractor tires are expected to maintain dominance throughout the forecast period.

Construction Type: The market is further segmented by tire construction type, encompassing bias and radial tires. Radial tires are projected to witness faster growth due to their performance advantages. Detailed market size projections are provided for each segment.

Sales Channel Type: The report analyzes the market by sales channel type, differentiating between OEM (Original Equipment Manufacturer) and replacement/aftermarket channels. The replacement market is expected to exhibit higher growth compared to OEM. Competitive analysis details each segment’s key players and their strategies.

Key Drivers of Asia-Pacific Agricultural Tires Market Growth

The Asia-Pacific agricultural tire market is driven by several key factors, including: (1) rising agricultural mechanization across the region, leading to increased demand for high-quality tires; (2) government initiatives promoting agricultural modernization and improved farming techniques; (3) growing awareness about the importance of sustainable agricultural practices, leading to increased adoption of fuel-efficient and environmentally friendly tires; and (4) robust economic growth in several countries, increasing farmers' purchasing power.

Challenges in the Asia-Pacific Agricultural Tires Market Sector

Several challenges hinder market growth. These include fluctuating raw material prices impacting production costs, the competitive landscape with both global and local players, stringent environmental regulations requiring manufacturers to meet specific emission standards, and the uneven distribution of agricultural machinery and technology across different regions of the Asia-Pacific region. Supply chain disruptions have also impacted availability and pricing in certain periods.

Emerging Opportunities in Asia-Pacific Agricultural Tires Market

Emerging opportunities lie in the increasing demand for smart agricultural technologies, which necessitates the development of specialized tires capable of integrating with precision farming systems. Growing demand for sustainable and eco-friendly tires also presents a significant opportunity. Furthermore, expansion into less-developed agricultural sectors presents a considerable potential for growth. The development of specialized tires for specific crops and terrains also holds significant promise.

Leading Players in the Asia-Pacific Agricultural Tires Market Market

- APOLLO TYRES LT

- Bridgestone Corporation Limited

- Michelin

- Trelleborg AB

- CEAT Ltd

- Tian Jin United Tire And Rubber International Co Ltd

- Balkrishna Industries Limited

- Continental AG

- Zhongce Rubber Group Co Ltd

- ATG Tires Private Ltd

- MRF Limited

Key Developments in Asia-Pacific Agricultural Tires Market Industry

- February 2023: Continental AG launched the VF TractorMaster, a large-diameter, high-load-capacity tractor tire, significantly impacting the high-end segment.

- May 2022: Apollo Tires introduced the Virat range of agricultural tires in India, signifying a strategic move to enhance its product portfolio and compete in the rapidly growing Indian market.

- February 2022: Michelin unveiled the New EVOBIB Agricultural Tire, emphasizing sustainability and improved operational efficiency, influencing market preferences towards eco-friendly options.

Strategic Outlook for Asia-Pacific Agricultural Tires Market Market

The Asia-Pacific agricultural tires market is poised for continued growth, driven by factors such as rising agricultural mechanization, increasing demand for high-performance tires, and a growing focus on sustainable agricultural practices. Opportunities exist in developing specialized tires tailored to specific crops and terrains, leveraging technological advancements in tire design and manufacturing. Companies that effectively address the challenges of raw material price fluctuations, stringent environmental regulations, and competitive pressures are likely to succeed in this dynamic market.

Asia-Pacific Agricultural Tires Market Segmentation

-

1. Sales Channel Type

- 1.1. OEM

- 1.2. Replacement/Aftermarket

-

2. Application Type

- 2.1. Tractors

- 2.2. Combine Harvesters

- 2.3. Sprayers

- 2.4. Other Application Type

-

3. Construction Type

- 3.1. Bias Tires

- 3.2. Radial Tires

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. South Korea

- 4.4. Japan

- 4.5. Rest of Asia-Pacific

Asia-Pacific Agricultural Tires Market Segmentation By Geography

- 1. China

- 2. India

- 3. South Korea

- 4. Japan

- 5. Rest of Asia Pacific

Asia-Pacific Agricultural Tires Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Farm Mechanization; Others

- 3.3. Market Restrains

- 3.3.1. Significant Demand for Retreaded Tires; Others

- 3.4. Market Trends

- 3.4.1. Replacement Tires To Exhibit The Highest Growth Rate During The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sales Channel Type

- 5.1.1. OEM

- 5.1.2. Replacement/Aftermarket

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Tractors

- 5.2.2. Combine Harvesters

- 5.2.3. Sprayers

- 5.2.4. Other Application Type

- 5.3. Market Analysis, Insights and Forecast - by Construction Type

- 5.3.1. Bias Tires

- 5.3.2. Radial Tires

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. South Korea

- 5.4.4. Japan

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. South Korea

- 5.5.4. Japan

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sales Channel Type

- 6. China Asia-Pacific Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sales Channel Type

- 6.1.1. OEM

- 6.1.2. Replacement/Aftermarket

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Tractors

- 6.2.2. Combine Harvesters

- 6.2.3. Sprayers

- 6.2.4. Other Application Type

- 6.3. Market Analysis, Insights and Forecast - by Construction Type

- 6.3.1. Bias Tires

- 6.3.2. Radial Tires

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. South Korea

- 6.4.4. Japan

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Sales Channel Type

- 7. India Asia-Pacific Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sales Channel Type

- 7.1.1. OEM

- 7.1.2. Replacement/Aftermarket

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Tractors

- 7.2.2. Combine Harvesters

- 7.2.3. Sprayers

- 7.2.4. Other Application Type

- 7.3. Market Analysis, Insights and Forecast - by Construction Type

- 7.3.1. Bias Tires

- 7.3.2. Radial Tires

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. South Korea

- 7.4.4. Japan

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Sales Channel Type

- 8. South Korea Asia-Pacific Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sales Channel Type

- 8.1.1. OEM

- 8.1.2. Replacement/Aftermarket

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Tractors

- 8.2.2. Combine Harvesters

- 8.2.3. Sprayers

- 8.2.4. Other Application Type

- 8.3. Market Analysis, Insights and Forecast - by Construction Type

- 8.3.1. Bias Tires

- 8.3.2. Radial Tires

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. South Korea

- 8.4.4. Japan

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Sales Channel Type

- 9. Japan Asia-Pacific Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sales Channel Type

- 9.1.1. OEM

- 9.1.2. Replacement/Aftermarket

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Tractors

- 9.2.2. Combine Harvesters

- 9.2.3. Sprayers

- 9.2.4. Other Application Type

- 9.3. Market Analysis, Insights and Forecast - by Construction Type

- 9.3.1. Bias Tires

- 9.3.2. Radial Tires

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. South Korea

- 9.4.4. Japan

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Sales Channel Type

- 10. Rest of Asia Pacific Asia-Pacific Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sales Channel Type

- 10.1.1. OEM

- 10.1.2. Replacement/Aftermarket

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Tractors

- 10.2.2. Combine Harvesters

- 10.2.3. Sprayers

- 10.2.4. Other Application Type

- 10.3. Market Analysis, Insights and Forecast - by Construction Type

- 10.3.1. Bias Tires

- 10.3.2. Radial Tires

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. South Korea

- 10.4.4. Japan

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Sales Channel Type

- 11. China Asia-Pacific Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asia-Pacific Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 13. India Asia-Pacific Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asia-Pacific Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asia-Pacific Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asia-Pacific Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asia-Pacific Agricultural Tires Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 APOLLO TYRES LT

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Bridgestone Corporation Limited

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Michelin

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Trelleborg AB

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 CEAT Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Tian Jin United Tire And Rubber International Co Ltd

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Balkrishna Industries Limited

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Continental AG

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Zhongce Rubber Group Co Ltd

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 ATG Tires Private Ltd

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 MRF Limited

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.1 APOLLO TYRES LT

List of Figures

- Figure 1: Asia-Pacific Agricultural Tires Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Agricultural Tires Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Sales Channel Type 2019 & 2032

- Table 3: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 4: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 5: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Asia-Pacific Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan Asia-Pacific Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Asia-Pacific Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea Asia-Pacific Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Taiwan Asia-Pacific Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia Asia-Pacific Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia-Pacific Asia-Pacific Agricultural Tires Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Sales Channel Type 2019 & 2032

- Table 16: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 17: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 18: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 19: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Sales Channel Type 2019 & 2032

- Table 21: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 22: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 23: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Sales Channel Type 2019 & 2032

- Table 26: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 27: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 28: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Sales Channel Type 2019 & 2032

- Table 31: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 32: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 33: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Sales Channel Type 2019 & 2032

- Table 36: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 37: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 38: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 39: Asia-Pacific Agricultural Tires Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Agricultural Tires Market?

The projected CAGR is approximately 4.36%.

2. Which companies are prominent players in the Asia-Pacific Agricultural Tires Market?

Key companies in the market include APOLLO TYRES LT, Bridgestone Corporation Limited, Michelin, Trelleborg AB, CEAT Ltd, Tian Jin United Tire And Rubber International Co Ltd, Balkrishna Industries Limited, Continental AG, Zhongce Rubber Group Co Ltd, ATG Tires Private Ltd, MRF Limited.

3. What are the main segments of the Asia-Pacific Agricultural Tires Market?

The market segments include Sales Channel Type, Application Type, Construction Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Farm Mechanization; Others.

6. What are the notable trends driving market growth?

Replacement Tires To Exhibit The Highest Growth Rate During The Forecast Period.

7. Are there any restraints impacting market growth?

Significant Demand for Retreaded Tires; Others.

8. Can you provide examples of recent developments in the market?

February 2023: Continental AG unveiled the VF TractorMaster, the largest tractor tire of its kind, boasting an impressive diameter of 2,147 millimeters. This heavyweight tire weighs 475 kg and has a remarkable load index of 10,300 kg.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Agricultural Tires Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Agricultural Tires Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Agricultural Tires Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Agricultural Tires Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence