Key Insights

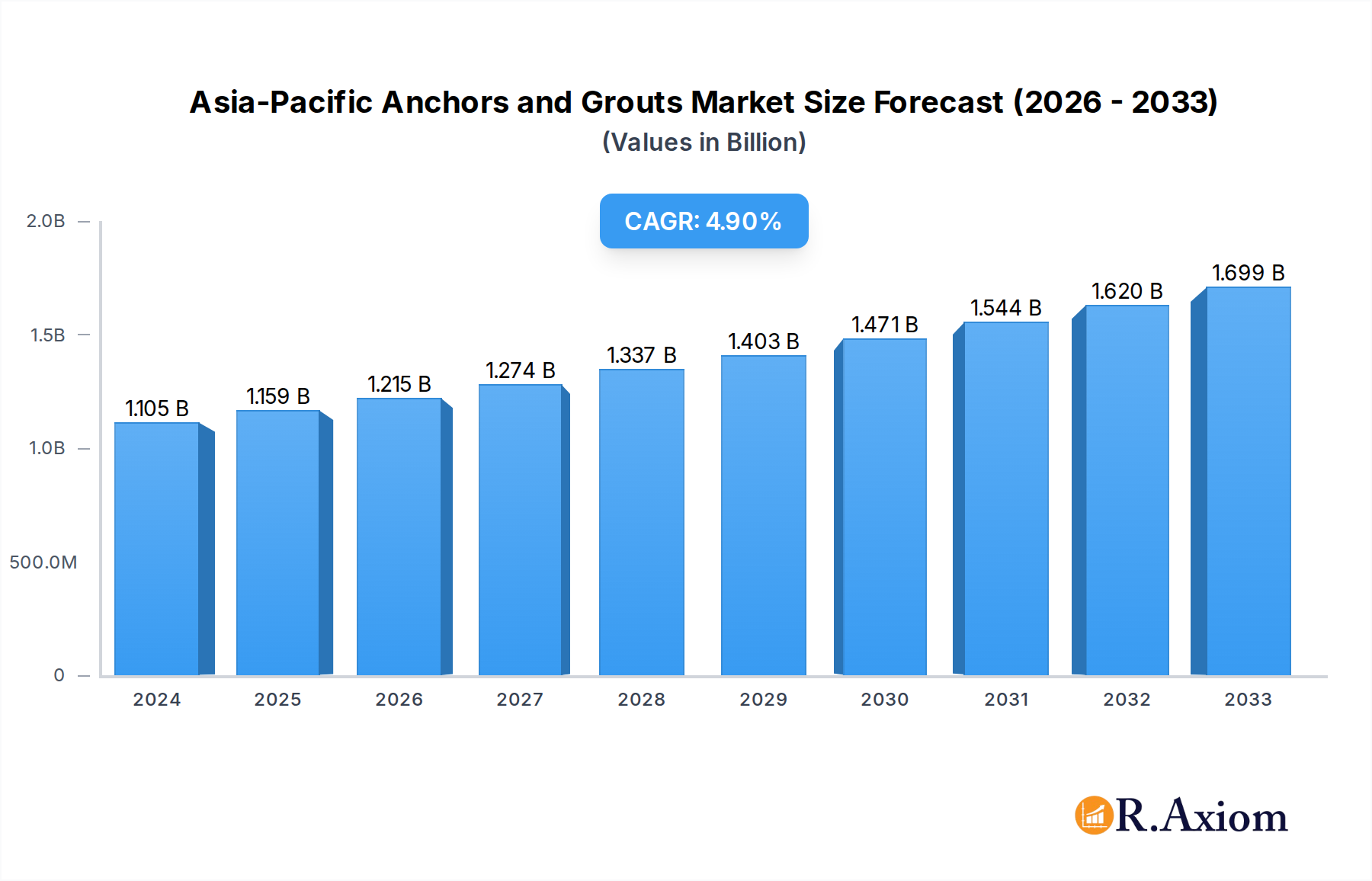

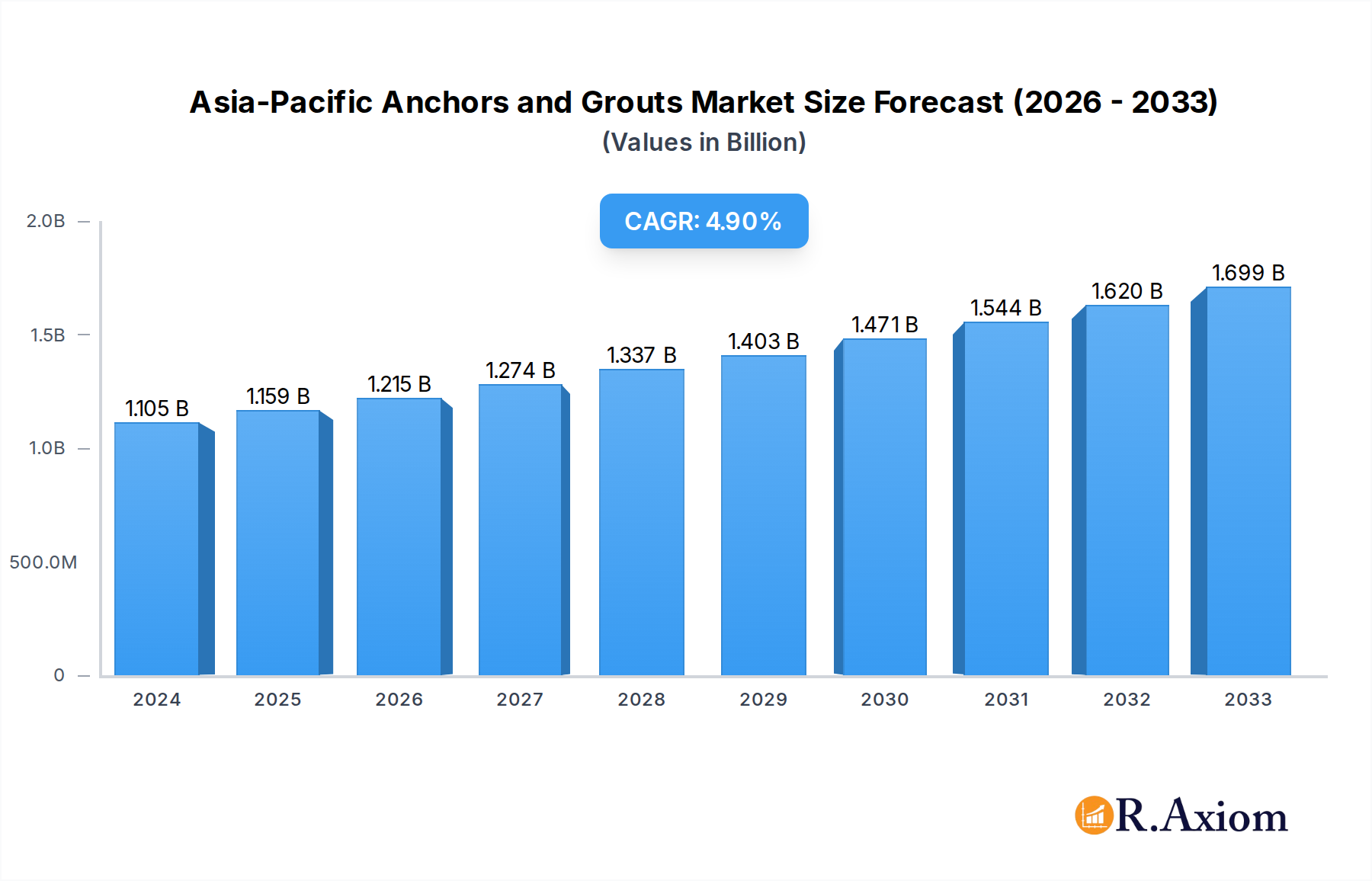

The Asia-Pacific anchors and grouts market is poised for robust growth, estimated to reach USD 1104.9 million in 2024 and expand at a Compound Annual Growth Rate (CAGR) of 4.9% through 2033. This upward trajectory is primarily fueled by a surge in infrastructure development across key economies like China and India, driven by significant government investments in transportation networks, urban renewal projects, and the expansion of industrial zones. The increasing demand for durable and reliable construction materials, coupled with the growing trend of prefabrication and modular construction techniques, further propels the adoption of advanced anchoring and grouting solutions. Furthermore, the residential sector's expansion, spurred by rising disposable incomes and urbanization, contributes significantly to market growth.

Asia-Pacific Anchors and Grouts Market Market Size (In Billion)

The market is characterized by a diverse range of applications spanning commercial, industrial, institutional, and residential end-use sectors. Within the product segment, cementitious fixing and epoxy grout are expected to dominate due to their proven performance and versatility in various construction applications. However, the growing emphasis on sustainability and enhanced performance is driving innovation in polyurethane (PU) grout and other specialized resin-based solutions. Key players like Arkema, Saint-Gobain, and Sika AG are actively investing in research and development to introduce high-performance, eco-friendly products, and expanding their geographical presence to capitalize on the burgeoning demand in the region. Restraints, such as fluctuating raw material prices and the presence of lower-cost alternatives in certain segments, are being navigated through product differentiation and value-added services.

Asia-Pacific Anchors and Grouts Market Company Market Share

Here's the SEO-optimized, detailed report description for the Asia-Pacific Anchors and Grouts Market:

Report Title: Asia-Pacific Anchors and Grouts Market: Growth Drivers, Trends, and Forecasts (2025-2033)

Report Description: Dive deep into the dynamic Asia-Pacific Anchors and Grouts Market with this comprehensive analysis. This report provides an in-depth understanding of market concentration, innovation drivers, regulatory landscapes, and end-user trends across the study period of 2019–2033, with a base year of 2025 and a forecast period extending from 2025–2033. Explore critical segments including Commercial, Industrial and Institutional, Infrastructure, and Residential end-use sectors, and sub-products like Cementitious Fixing, Resin Fixing, Epoxy Grout, Polyurethane (PU) Grout, and Other Types. Gain actionable insights into market dynamics, technological advancements, dominant regions, and strategic developments. Uncover the key players shaping the market, including Arkema, Saint-Gobain, RPM International Inc, MBCC Group, LATICRETE International Inc, Cemkrete Inter Co Ltd, Fosroc Inc, Ardex Group, Sika AG, and MAPEI S.p.A. This report is essential for stakeholders seeking to capitalize on the burgeoning opportunities within the Asia-Pacific construction chemical sector.

Asia-Pacific Anchors and Grouts Market Market Concentration & Innovation

The Asia-Pacific Anchors and Grouts Market exhibits a moderate to high level of concentration, with a few key global players holding significant market share. Innovation is a crucial differentiator, driven by the increasing demand for high-performance, sustainable, and technologically advanced anchoring and grouting solutions. Regulatory frameworks, while varying across countries, are increasingly focusing on environmental impact, safety standards, and performance requirements, influencing product development and material choices. Product substitutes, such as traditional mechanical anchoring methods or alternative chemical formulations, pose a competitive challenge, but advancements in epoxy and polyurethane grouts offer superior performance characteristics for demanding applications. End-user trends highlight a growing preference for durable, quick-setting, and eco-friendly products, particularly in the infrastructure and industrial sectors. Mergers and acquisitions (M&A) are actively shaping the market landscape, with substantial deal values signaling consolidation and strategic expansion. For instance, the acquisition of MBCC Group by Sika AG in May 2023, valued in the millions of dollars, significantly alters the competitive dynamics.

- Market Share Insights: Top players collectively hold approximately 60-70% of the market share, with ongoing shifts due to M&A activities.

- Innovation Drivers:

- Development of low-VOC and sustainable grout formulations.

- Enhanced adhesion and load-bearing capacity in anchoring systems.

- Faster curing times for rapid construction and repair projects.

- Digital integration for product selection and application guidance.

- M&A Activity: Significant M&A deals in the millions of dollars are reshaping the competitive landscape and expanding product portfolios.

- Regulatory Focus: Growing emphasis on fire resistance, seismic performance, and environmental certifications.

Asia-Pacific Anchors and Grouts Market Industry Trends & Insights

The Asia-Pacific Anchors and Grouts Market is experiencing robust growth, propelled by rapid urbanization, significant investments in infrastructure development, and a burgeoning construction industry across key economies. The compound annual growth rate (CAGR) is projected to be substantial, driven by the increasing adoption of advanced construction materials and techniques. Technological disruptions are fundamentally altering product offerings, with a shift towards high-performance resins, advanced cementitious formulations, and specialized epoxy and polyurethane grouts designed for extreme conditions and demanding applications. Consumer preferences are increasingly leaning towards solutions that offer enhanced durability, superior adhesion, faster installation times, and a reduced environmental footprint. This is evident in the growing demand for low-VOC and solvent-free products. Competitive dynamics are characterized by strategic partnerships, product innovation, and aggressive market penetration efforts by both global conglomerates and emerging regional players. The market penetration of specialized grouts like epoxy and polyurethane is steadily increasing, displacing traditional materials in high-value projects.

- Market Growth Drivers:

- Infrastructure Boom: Massive government spending on transportation networks, energy projects, and public facilities across countries like China, India, and Southeast Asian nations.

- Urbanization: Continuous migration to cities fuels residential and commercial construction, requiring reliable anchoring and grouting solutions.

- Industrial Expansion: Growth in manufacturing, logistics, and data centers necessitates robust structural integrity and equipment anchoring.

- Renovation and Retrofitting: Aging infrastructure and buildings require advanced repair and strengthening solutions.

- Technological Advancements:

- Development of self-leveling and non-shrink grouts for precision applications.

- Introduction of polymer-modified cementitious grouts offering enhanced flexibility and strength.

- Nanotechnology integration for improved material properties.

- Consumer Preferences:

- Demand for aesthetically pleasing and durable finishes in residential and commercial projects.

- Preference for quick-setting and high-strength solutions for time-sensitive projects.

- Growing awareness and adoption of sustainable and eco-friendly building materials.

- Market Penetration: Epoxy and polyurethane grout segments are witnessing higher market penetration due to their superior performance characteristics in critical applications.

- Competitive Landscape: Intense competition between established global brands and agile local manufacturers, leading to price sensitivity in certain segments and innovation-led differentiation in others.

Dominant Markets & Segments in Asia-Pacific Anchors and Grouts Market

The Infrastructure end-use sector is a dominant force within the Asia-Pacific Anchors and Grouts Market, driven by unprecedented government investments in transportation, energy, and utility projects across the region. Countries like China, India, and those in Southeast Asia are leading this charge, fueled by rapid economic development and a focus on improving connectivity and industrial capacity. Within this sector, sub-products like high-strength cementitious grouts and advanced resin-based anchoring systems are witnessing significant demand for applications such as bridge construction, tunnel lining, and power plant installations. The Commercial and Industrial and Institutional sectors also represent substantial market segments, propelled by the expansion of manufacturing facilities, the construction of large-scale commercial complexes, and the development of advanced institutional buildings. In these segments, epoxy and polyurethane grouts are increasingly favored for their chemical resistance, durability, and load-bearing capabilities, essential for heavy machinery installation and demanding industrial environments.

The Residential sector, while also significant, is characterized by a broader range of applications, from tiling and bathroom fittings to structural anchoring in housing developments. Here, a mix of cementitious and resin-based solutions are employed, with a growing emphasis on ease of application and cost-effectiveness.

- Dominant Regions/Countries:

- China: Largest market due to massive infrastructure projects and a robust manufacturing base.

- India: Rapid infrastructure development, urbanization, and growing construction activity.

- Southeast Asia (e.g., Vietnam, Indonesia, Thailand): Significant growth driven by foreign investment and infrastructure modernization.

- Key Drivers for Infrastructure Dominance:

- Massive government spending on railways, highways, airports, and ports.

- Renewable energy project development (e.g., wind turbines, solar farms) requiring specialized grouts.

- Urban rail expansion and metro system development.

- Dominant Sub-Products by Segment:

- Infrastructure: High-performance cementitious grouts, epoxy-based anchoring systems.

- Industrial & Commercial: Epoxy grouts, polyurethane grouts for chemical resistance and vibration dampening.

- Residential: Cementitious fixing, general-purpose epoxy and polyurethane grouts.

- Key Drivers for Commercial & Industrial Growth:

- Expansion of manufacturing and logistics hubs.

- Development of smart cities and data centers.

- Strict requirements for equipment stability and safety.

- Market Penetration Analysis:

- Cementitious Fixing: Widely used across all sectors, especially in infrastructure and residential.

- Resin Fixing: Growing in popularity for specialized applications requiring high strength and durability.

- Epoxy Grout: Dominant in industrial, commercial, and infrastructure due to superior chemical and mechanical properties.

- Polyurethane (PU) Grout: Increasing adoption for flexible and vibration-resistant applications.

Asia-Pacific Anchors and Grouts Market Product Developments

Product innovation in the Asia-Pacific Anchors and Grouts Market is focused on enhancing performance, sustainability, and ease of application. Developments include rapid-curing cementitious grouts for time-sensitive infrastructure projects, advanced epoxy resins offering superior adhesion and chemical resistance for industrial settings, and low-VOC polyurethane grouts addressing environmental concerns in commercial and residential applications. These innovations aim to provide increased durability, improved load-bearing capacity, and reduced installation times, offering significant competitive advantages in a rapidly evolving market.

Report Scope & Segmentation Analysis

This report provides an exhaustive analysis of the Asia-Pacific Anchors and Grouts Market, segmented by End Use Sector and Sub-Product. The End Use Sectors analyzed include Commercial, Industrial and Institutional, Infrastructure, and Residential. The Sub-Products covered are Cementitious Fixing, Resin Fixing, Epoxy Grout, Polyurethane (PU) Grout, and Other Types. Market sizes, growth projections, and competitive dynamics are detailed for each segment, offering granular insights into specific application areas and product categories.

- End Use Sector Analysis:

- Commercial: Growth driven by office buildings, retail spaces, and hospitality sector expansion.

- Industrial and Institutional: Fueled by manufacturing growth, data centers, and healthcare facilities.

- Infrastructure: Dominant segment with massive investments in transportation and energy.

- Residential: Steady growth supported by housing demand and urban development.

- Sub-Product Analysis:

- Cementitious Fixing: Broad application, expected steady growth.

- Resin Fixing: Niche but high-growth potential for specialized structural needs.

- Epoxy Grout: Strong growth anticipated due to superior performance.

- Polyurethane (PU) Grout: Rising demand for its flexibility and durability.

- Other Types: Includes specialized formulations and emerging technologies.

Key Drivers of Asia-Pacific Anchors and Grouts Market Growth

The Asia-Pacific Anchors and Grouts Market is primarily driven by sustained economic growth and significant government initiatives across the region. Robust investments in infrastructure development, including transportation networks, energy projects, and urban renewal, are creating substantial demand for anchoring and grouting solutions. Rapid urbanization and a growing middle class are fueling the construction of residential and commercial buildings, further boosting market expansion. Technological advancements leading to the development of high-performance, durable, and sustainable anchoring and grouting products also play a crucial role. Increasing awareness of the importance of structural integrity and longevity in construction projects is prompting the adoption of advanced materials.

- Economic Growth & Urbanization: Driving demand for new construction and renovation.

- Infrastructure Spending: Massive public and private investments in roads, bridges, railways, and power generation.

- Technological Advancements: Development of specialized and high-performance products.

- Increased Construction Activity: Surging demand from residential, commercial, and industrial sectors.

Challenges in the Asia-Pacific Anchors and Grouts Market Sector

Despite the positive growth trajectory, the Asia-Pacific Anchors and Grouts Market faces several challenges. Fluctuations in raw material prices, particularly for epoxy resins and cementitious components, can impact profitability and pricing strategies. Intense competition, especially from local manufacturers offering lower-cost alternatives, can create price pressures in certain market segments. Stringent and varying regulatory standards across different countries can also pose compliance challenges for manufacturers. Furthermore, supply chain disruptions, including logistics bottlenecks and the availability of skilled labor for specialized applications, can hinder market expansion. The adoption of new technologies can also be slow in less developed regions, creating market fragmentation.

- Raw Material Price Volatility: Impacting production costs and final product pricing.

- Intense Competition: From global players and low-cost regional alternatives.

- Regulatory Complexity: Diverse standards and approval processes across countries.

- Supply Chain Disruptions: Affecting logistics and material availability.

- Skilled Labor Shortages: For application of specialized anchoring and grouting systems.

Emerging Opportunities in Asia-Pacific Anchors and Grouts Market

Emerging opportunities in the Asia-Pacific Anchors and Grouts Market are centered on sustainable construction, smart infrastructure, and the growing demand for specialized, high-performance solutions. The increasing focus on green building initiatives presents an opportunity for manufacturers of eco-friendly, low-VOC, and recycled-content anchoring and grouting products. The development of smart cities and the retrofitting of existing infrastructure offer avenues for advanced, sensor-integrated anchoring systems. Furthermore, the expanding offshore wind energy sector in countries like Taiwan and Vietnam requires highly specialized, durable grouts capable of withstanding harsh marine environments. The growing adoption of precast construction techniques also creates demand for efficient and reliable grouting solutions.

- Sustainable Construction: Demand for eco-friendly and low-VOC products.

- Smart Infrastructure Development: Opportunities for integrated and intelligent anchoring systems.

- Renewable Energy Sector: Growth in offshore wind power projects.

- Precast Construction: Need for high-performance grouts for jointing and sealing.

- Growth in Developing Economies: Untapped potential in less developed but rapidly industrializing nations.

Leading Players in the Asia-Pacific Anchors and Grouts Market Market

- Arkema

- Saint-Gobain

- RPM International Inc

- MBCC Group

- LATICRETE International Inc

- Cemkrete Inter Co Ltd

- Fosroc Inc

- Ardex Group

- Sika AG

- MAPEI S.p.A

Key Developments in Asia-Pacific Anchors and Grouts Market Industry

- May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand. This major consolidation is expected to significantly reshape market share and competitive strategies.

- February 2023: Master Builders Solutions, an MBCC Group brand, inaugurated a new offshore grout production plant in Taichung, Taiwan, in order to meet the ongoing demand of the offshore wind turbine market, highlighting the growing importance of specialized solutions for the renewable energy sector.

- September 2022: Saint-Gobain acquired GCP Applied Technologies Inc. to strengthen its market presence through a global platform with extensive expertise in cement additives, concrete admixtures, infrastructure, and commercial and residential building materials, indicating a strategic move to expand product portfolios and market reach.

Strategic Outlook for Asia-Pacific Anchors and Grouts Market Market

The strategic outlook for the Asia-Pacific Anchors and Grouts Market remains highly optimistic, driven by a confluence of robust economic growth, substantial infrastructure development, and technological innovation. The increasing demand for durable, high-performance, and sustainable construction materials presents significant opportunities for market players. Strategic focus on expanding product portfolios to include advanced epoxy and polyurethane grouts, alongside eco-friendly cementitious solutions, will be crucial. Furthermore, strategic partnerships and potential acquisitions will likely continue to shape the competitive landscape, enabling companies to enhance their market presence and technological capabilities. The market is poised for sustained growth, particularly in emerging economies and in sectors like renewable energy and smart infrastructure, offering lucrative avenues for investment and expansion.

Asia-Pacific Anchors and Grouts Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

- 2.1. Cementitious Fixing

- 2.2. Resin Fixing

- 2.3. Epoxy Grout

- 2.4. Polyurethane (PU) Grout

- 2.5. Other Types

Asia-Pacific Anchors and Grouts Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. Southeast Asia

- 1.7. Rest of Asia Pacific

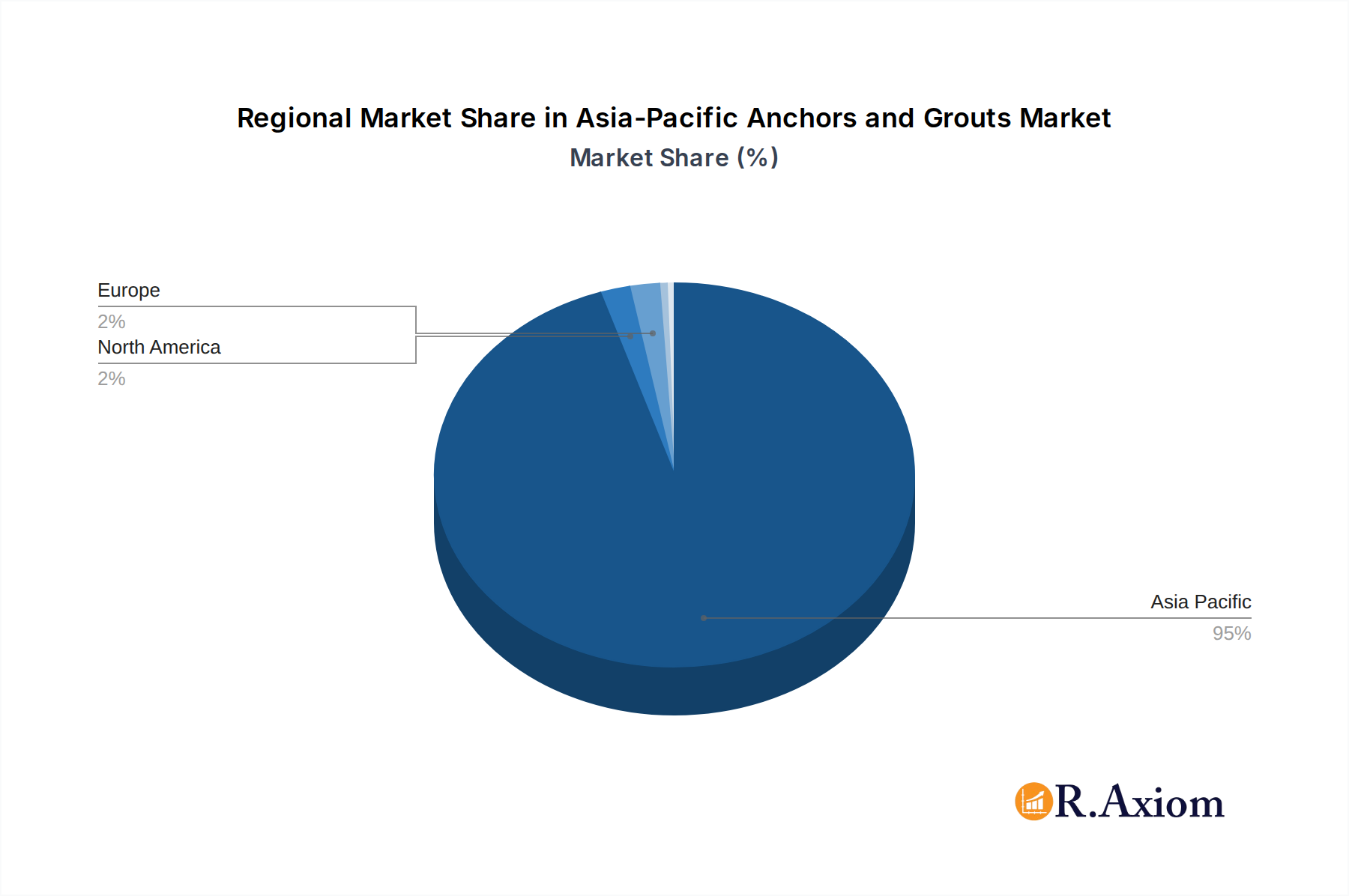

Asia-Pacific Anchors and Grouts Market Regional Market Share

Geographic Coverage of Asia-Pacific Anchors and Grouts Market

Asia-Pacific Anchors and Grouts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Construction Industry; Government Policies to Promote the Usage of Fly Ash

- 3.3. Market Restrains

- 3.3.1. Harmful Properties of Fly Ash; Non-suitability in Cold Weather Conditions

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Anchors and Grouts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Cementitious Fixing

- 5.2.2. Resin Fixing

- 5.2.3. Epoxy Grout

- 5.2.4. Polyurethane (PU) Grout

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arkema

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saint-Gobain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RPM International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MBCC Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LATICRETE International Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cemkrete Inter Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fosroc Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ardex Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sika A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MAPEI S p A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Arkema

List of Figures

- Figure 1: Asia-Pacific Anchors and Grouts Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Anchors and Grouts Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Anchors and Grouts Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 2: Asia-Pacific Anchors and Grouts Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 3: Asia-Pacific Anchors and Grouts Market Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 4: Asia-Pacific Anchors and Grouts Market Volume K Tons Forecast, by Sub Product 2020 & 2033

- Table 5: Asia-Pacific Anchors and Grouts Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Anchors and Grouts Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Anchors and Grouts Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 8: Asia-Pacific Anchors and Grouts Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 9: Asia-Pacific Anchors and Grouts Market Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 10: Asia-Pacific Anchors and Grouts Market Volume K Tons Forecast, by Sub Product 2020 & 2033

- Table 11: Asia-Pacific Anchors and Grouts Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Anchors and Grouts Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Anchors and Grouts Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: China Asia-Pacific Anchors and Grouts Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia-Pacific Anchors and Grouts Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia-Pacific Anchors and Grouts Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia-Pacific Anchors and Grouts Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia-Pacific Anchors and Grouts Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Asia-Pacific Anchors and Grouts Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: India Asia-Pacific Anchors and Grouts Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia-Pacific Anchors and Grouts Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia-Pacific Anchors and Grouts Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Southeast Asia Asia-Pacific Anchors and Grouts Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Southeast Asia Asia-Pacific Anchors and Grouts Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Asia-Pacific Anchors and Grouts Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Asia-Pacific Anchors and Grouts Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Anchors and Grouts Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Asia-Pacific Anchors and Grouts Market?

Key companies in the market include Arkema, Saint-Gobain, RPM International Inc, MBCC Group, LATICRETE International Inc, Cemkrete Inter Co Ltd, Fosroc Inc, Ardex Group, Sika A, MAPEI S p A.

3. What are the main segments of the Asia-Pacific Anchors and Grouts Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Construction Industry; Government Policies to Promote the Usage of Fly Ash.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Harmful Properties of Fly Ash; Non-suitability in Cold Weather Conditions.

8. Can you provide examples of recent developments in the market?

May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.February 2023: Master Builders Solutions, an MBCC Group brand, inaugurated a new offshore grout production plant in Taichung, Taiwan, in order to meet the ongoing demand of the offshore wind turbine market.September 2022: Saint-Gobain acquired GCP Applied Technologies Inc. to strengthen its market presence through a global platform with extensive expertise in cement additives, concrete admixtures, infrastructure, and commercial and residential building materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Anchors and Grouts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Anchors and Grouts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Anchors and Grouts Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Anchors and Grouts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence