Key Insights

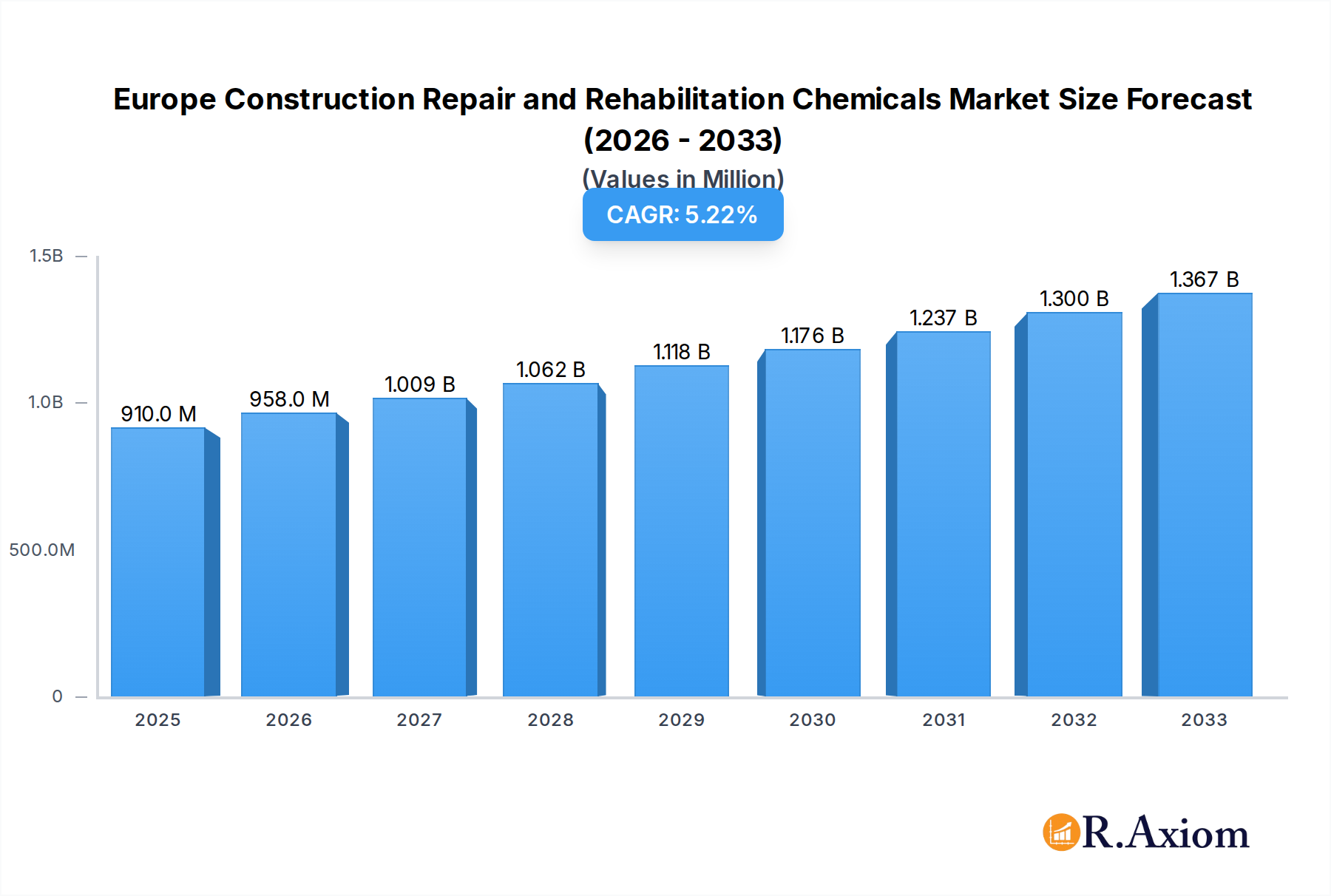

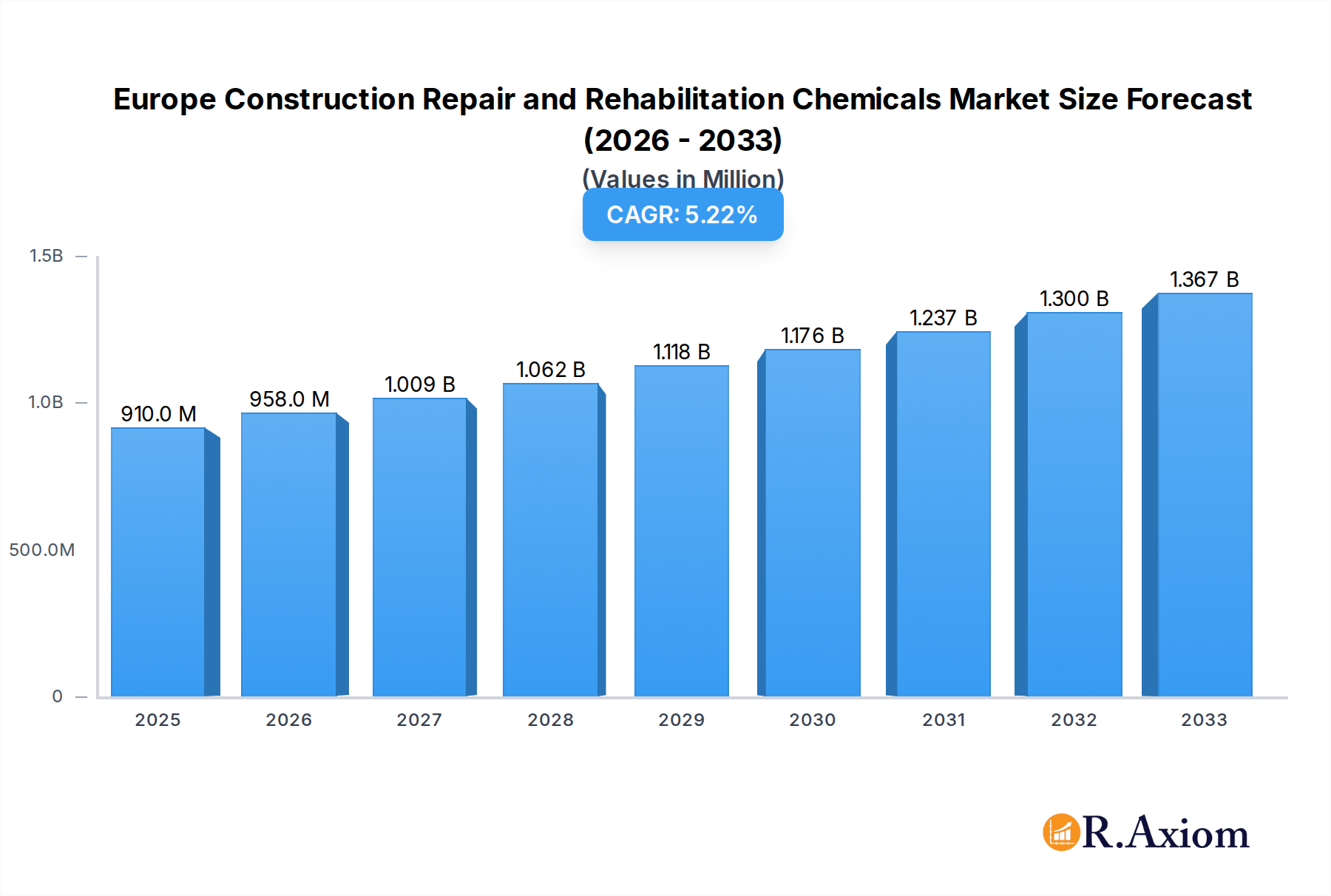

The Europe Construction Repair and Rehabilitation Chemicals Market is poised for robust growth, demonstrating a significant upward trajectory driven by increasing investments in infrastructure development and the growing emphasis on extending the lifespan of existing structures. With a current market size of $0.91 billion in 2025, the market is projected to expand at a Compound Annual Growth Rate (CAGR) of 5.29% through 2033. This expansion is underpinned by a confluence of factors, including the urgent need to address the aging built environment across key European nations and the rising adoption of advanced repair and rehabilitation techniques. The demand for specialized chemicals, such as fiber wrapping systems, injection grouting materials, micro-concrete mortars, modified mortars, and rebar protectors, is expected to surge as construction stakeholders prioritize durability, sustainability, and cost-effectiveness in their maintenance and upgrade strategies.

Europe Construction Repair and Rehabilitation Chemicals Market Market Size (In Million)

The market's momentum is further propelled by government initiatives aimed at modernizing existing infrastructure and a growing awareness among end-users in the commercial, industrial, institutional, and residential sectors to invest in long-term structural integrity. While challenges such as fluctuating raw material costs and the availability of skilled labor may present some headwinds, the inherent benefits of these chemical solutions—including enhanced performance, reduced downtime, and environmental advantages—are expected to outweigh these concerns. Leading companies are actively innovating and expanding their product portfolios to cater to the evolving needs of the European market, further solidifying the positive outlook for construction repair and rehabilitation chemicals.

Europe Construction Repair and Rehabilitation Chemicals Market Company Market Share

This detailed report provides an in-depth analysis of the Europe Construction Repair and Rehabilitation Chemicals Market, covering the historical period from 2019–2024, the base year of 2025, and a robust forecast period spanning from 2025–2033. With an estimated market size of $XX billion in 2025, the market is projected to witness significant growth driven by increasing infrastructure development, aging building stock, and a growing emphasis on sustainable construction practices. The report delves into key market segments, including end-use sectors like Commercial, Industrial and Institutional, Infrastructure, and Residential, as well as sub-products such as Fiber Wrapping Systems, Injection Grouting Materials, Micro-concrete Mortars, Modified Mortars, and Rebar Protectors. High-traffic keywords such as "construction chemicals Europe," "concrete repair solutions," "structural rehabilitation," "building maintenance chemicals," and "infrastructure repair materials" are integral to this analysis.

Europe Construction Repair and Rehabilitation Chemicals Market Market Concentration & Innovation

The Europe Construction Repair and Rehabilitation Chemicals Market exhibits a moderate to high degree of concentration, with several key global and regional players dominating the landscape. Innovation is a critical driver, fueled by the demand for more durable, sustainable, and efficient repair solutions. Companies are investing heavily in research and development to create advanced formulations that offer enhanced performance, reduced environmental impact, and faster application times. Regulatory frameworks, such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and various national building codes, play a significant role in shaping product development and market access. These regulations often necessitate rigorous testing and certification, pushing manufacturers towards compliant and high-quality products. Product substitutes, while present, are increasingly challenged by the specialized nature and superior performance of dedicated repair and rehabilitation chemicals. End-user trends are shifting towards lifecycle cost analysis, prioritizing long-term asset protection over initial material costs. Mergers and acquisitions (M&A) are a notable feature of the market, with significant deal values indicating strategic consolidation and expansion of product portfolios. For instance, the $XX billion acquisition of MBCC Group by Sika in May 2023 significantly reshaped the market landscape. Other key players like Saint-Gobain and RPM International Inc. are also actively involved in strategic growth initiatives.

Europe Construction Repair and Rehabilitation Chemicals Market Industry Trends & Insights

The Europe Construction Repair and Rehabilitation Chemicals Market is poised for substantial growth, driven by a confluence of macroeconomic factors and evolving industry dynamics. The estimated Compound Annual Growth Rate (CAGR) for the forecast period is XX%, translating to a market expansion to $XX billion by 2033. This growth is underpinned by an aging European infrastructure, necessitating extensive repair and rehabilitation to ensure safety, functionality, and longevity. Governments across Europe are increasingly investing in infrastructure upgrades, including bridges, roads, tunnels, and public buildings, creating a robust demand for specialized repair materials. Furthermore, the growing emphasis on sustainability and the circular economy is propelling the adoption of repair and rehabilitation solutions as an alternative to new construction, thereby extending the lifespan of existing assets and reducing material waste. Technological advancements are revolutionizing the sector, with the development of advanced materials like fiber-reinforced polymers (FRP) for structural strengthening, innovative injection grouts for crack repair, and high-performance micro-concrete mortars for concrete restoration. These innovations offer superior mechanical properties, faster curing times, and enhanced durability, meeting the stringent demands of modern construction projects. Consumer preferences are also evolving, with a greater appreciation for the long-term economic benefits of robust repair strategies, including reduced maintenance costs and extended asset value. The competitive landscape is characterized by intense rivalry, with companies focusing on product differentiation, technical expertise, and customer support to gain market share. Market penetration is expected to deepen as awareness of the benefits of construction repair and rehabilitation chemicals grows across all end-use sectors.

Dominant Markets & Segments in Europe Construction Repair and Rehabilitation Chemicals Market

The Infrastructure end-use sector stands out as a dominant force within the Europe Construction Repair and Rehabilitation Chemicals Market. This dominance is fueled by substantial government investments in maintaining and upgrading critical public infrastructure, including transportation networks (roads, bridges, railways, tunnels), utilities, and public facilities. The sheer scale and complexity of these projects necessitate a wide array of specialized repair and rehabilitation chemicals to address issues like concrete degradation, structural weakening, and water ingress.

- Key Drivers for Infrastructure Dominance:

- Aging Infrastructure: A significant portion of Europe's infrastructure is decades old and requires continuous maintenance and modernization to meet current safety and performance standards.

- Government Investment: Numerous European nations have implemented ambitious infrastructure development and renewal programs, injecting billions into the sector.

- Economic Impact: Well-maintained infrastructure is vital for economic growth, facilitating trade, transportation, and connectivity, thus prioritizing its upkeep.

- Technological Adoption: The infrastructure sector is often an early adopter of advanced repair technologies due to the high stakes involved in structural integrity and public safety.

Within the sub-product categories, Micro-concrete Mortars and Modified Mortars are particularly significant contributors to the Infrastructure segment. Micro-concrete mortars are essential for repairing damaged concrete structures, providing high strength and durability. Modified mortars, often enhanced with polymers or other additives, offer improved adhesion, flexibility, and resistance to environmental factors, making them ideal for a wide range of infrastructure repair applications.

- Dominance Analysis:

- The Infrastructure segment is expected to account for an estimated XX% of the total market revenue in 2025, with a projected CAGR of XX% through 2033.

- Countries like Germany, France, the United Kingdom, and the Netherlands are leading the charge in infrastructure repair and rehabilitation due to their extensive transportation networks and proactive governmental policies.

- The demand for Micro-concrete Mortars within the infrastructure sector is projected to reach $XX billion by 2033, driven by extensive bridge rehabilitation projects and repairs to utility networks.

- Modified Mortars are also experiencing robust growth, particularly in applications requiring enhanced chemical resistance and flexibility for bridges and tunnels exposed to de-icing salts and harsh weather conditions.

While Infrastructure leads, the Commercial and Industrial and Institutional sectors also represent substantial markets, driven by the need to maintain aging commercial buildings, factories, and institutional facilities, ensuring their operational efficiency and structural integrity. The Residential sector, though smaller in individual project scale, contributes significantly due to the vast number of housing units requiring ongoing maintenance and renovation.

Europe Construction Repair and Rehabilitation Chemicals Market Product Developments

Product developments in the Europe Construction Repair and Rehabilitation Chemicals Market are highly focused on enhancing performance, sustainability, and ease of application. Innovations include advanced, rapid-curing repair mortars that minimize downtime for critical infrastructure, and eco-friendly formulations with reduced VOC (Volatile Organic Compound) content. Fiber wrapping systems, utilizing advanced composite materials, are gaining traction for their ability to significantly increase the load-bearing capacity of structures with minimal intervention. Furthermore, smart materials that can self-diagnose and self-repair are on the horizon, promising a new era of proactive building maintenance. These developments cater to the increasing demand for solutions that offer superior durability, longevity, and a reduced environmental footprint.

Report Scope & Segmentation Analysis

This report segments the Europe Construction Repair and Rehabilitation Chemicals Market by End Use Sector and Sub Product. The End Use Sectors include Commercial, Industrial and Institutional, Infrastructure, and Residential. The Commercial sector encompasses offices, retail spaces, and hospitality venues, requiring maintenance for aesthetic appeal and structural integrity. The Industrial and Institutional sector covers manufacturing plants, power stations, and healthcare facilities, where operational continuity and safety are paramount. Infrastructure includes transportation networks, utilities, and public works, demanding robust and long-lasting solutions. Residential covers housing units, necessitating cost-effective and durable repair materials.

The Sub Product segmentation includes Fiber Wrapping Systems, offering high tensile strength for structural reinforcement; Injection Grouting Materials, used for filling cracks and voids; Micro-concrete Mortars, ideal for repairing damaged concrete surfaces; Modified Mortars, offering enhanced properties like flexibility and chemical resistance; and Rebar Protectors, preventing corrosion of steel reinforcement. Each segment is analyzed for its market size, growth projections, and competitive dynamics within the broader European market.

Key Drivers of Europe Construction Repair and Rehabilitation Chemicals Market Growth

The growth of the Europe Construction Repair and Rehabilitation Chemicals Market is propelled by several key drivers. Firstly, the substantial volume of aging infrastructure across Europe necessitates continuous repair and rehabilitation to ensure safety and functionality. Secondly, increasing government investments in infrastructure modernization and urban regeneration projects create sustained demand for these specialized chemicals. Thirdly, a growing emphasis on sustainable construction practices and the circular economy encourages the repair and rehabilitation of existing structures over new builds, extending their lifespan and reducing environmental impact. Finally, technological advancements leading to more efficient, durable, and eco-friendly repair solutions are further stimulating market expansion.

Challenges in the Europe Construction Repair and Rehabilitation Chemicals Market Sector

Despite the positive growth trajectory, the Europe Construction Repair and Rehabilitation Chemicals Market faces several challenges. Stringent and often fragmented regulatory landscapes across different European countries can create complexities in product certification and market access. Volatility in raw material prices can impact manufacturing costs and profitability. Furthermore, a shortage of skilled labor capable of applying these specialized materials can hinder project execution and adoption. Competition from alternative repair methods and the initial cost perception of specialized chemicals can also act as barriers.

Emerging Opportunities in Europe Construction Repair and Rehabilitation Chemicals Market

Emerging opportunities within the Europe Construction Repair and Rehabilitation Chemicals Market lie in the increasing demand for sustainable and high-performance solutions. The push for net-zero buildings and circular economy principles is driving innovation in eco-friendly formulations and materials that enhance the longevity of existing structures. The development and adoption of smart materials and digital technologies for condition monitoring and predictive maintenance present significant future growth avenues. Furthermore, exploring untapped potential in specific niche applications and expanding into emerging European markets with developing infrastructure can offer substantial opportunities for growth and market penetration.

Leading Players in the Europe Construction Repair and Rehabilitation Chemicals Market Market

- Remmers Gruppe AG

- Saint-Gobain

- RPM International Inc

- MBCC Group

- Simpson Strong-Tie Company Inc

- Fosroc Inc

- Ardex Group

- MAPEI S p A

- Sika AG

- MC-Bauchemie

Key Developments in Europe Construction Repair and Rehabilitation Chemicals Market Industry

- May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand. This strategic move has significantly consolidated market share and expanded product offerings.

- November 2021: Remmers Gruppe AG extended its sales organization in Wels, Austria, to boost its construction repair and rehabilitation chemicals popularity in the country, indicating a focus on expanding regional presence and market penetration.

- March 2021: MBCC Group acquired TPH Bausysteme GmbH to expand its offering of acrylates and polyurethanes for ground consolidation and waterproofing solutions in its underground construction sector, showcasing strategic acquisitions to enhance specialized product portfolios.

Strategic Outlook for Europe Construction Repair and Rehabilitation Chemicals Market Market

The strategic outlook for the Europe Construction Repair and Rehabilitation Chemicals Market is one of robust and sustained growth. The fundamental drivers of aging infrastructure and government investment in repairs will continue to provide a strong foundation. The increasing emphasis on sustainability and the circular economy will act as a significant catalyst, pushing innovation towards greener and more durable solutions. Companies that can effectively leverage technological advancements, focus on specialized product development, and navigate regulatory complexities will be well-positioned for success. Strategic collaborations, targeted acquisitions, and a keen understanding of evolving end-user needs will be crucial for maintaining a competitive edge and capitalizing on the ample opportunities within this vital market segment.

Europe Construction Repair and Rehabilitation Chemicals Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

- 2.1. Fiber Wrapping Systems

- 2.2. Injection Grouting Materials

- 2.3. Micro-concrete Mortars

- 2.4. Modified Mortars

- 2.5. Rebar Protectors

Europe Construction Repair and Rehabilitation Chemicals Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Construction Repair and Rehabilitation Chemicals Market Regional Market Share

Geographic Coverage of Europe Construction Repair and Rehabilitation Chemicals Market

Europe Construction Repair and Rehabilitation Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Banning/ Limiting Use of Plastics used in packaging applications

- 3.3. Market Restrains

- 3.3.1. ; Harmful Amines in Dyes; Paperless Green Initiatives

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Construction Repair and Rehabilitation Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Fiber Wrapping Systems

- 5.2.2. Injection Grouting Materials

- 5.2.3. Micro-concrete Mortars

- 5.2.4. Modified Mortars

- 5.2.5. Rebar Protectors

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Remmers Gruppe AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saint-Gobain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RPM International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MBCC Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Simpson Strong-Tie Company Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fosroc Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ardex Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MAPEI S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sika AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MC-Bauchemie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Remmers Gruppe AG

List of Figures

- Figure 1: Europe Construction Repair and Rehabilitation Chemicals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Construction Repair and Rehabilitation Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Construction Repair and Rehabilitation Chemicals Market Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 2: Europe Construction Repair and Rehabilitation Chemicals Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 3: Europe Construction Repair and Rehabilitation Chemicals Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 4: Europe Construction Repair and Rehabilitation Chemicals Market Volume K Tons Forecast, by Sub Product 2020 & 2033

- Table 5: Europe Construction Repair and Rehabilitation Chemicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Construction Repair and Rehabilitation Chemicals Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Europe Construction Repair and Rehabilitation Chemicals Market Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 8: Europe Construction Repair and Rehabilitation Chemicals Market Volume K Tons Forecast, by End Use Sector 2020 & 2033

- Table 9: Europe Construction Repair and Rehabilitation Chemicals Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 10: Europe Construction Repair and Rehabilitation Chemicals Market Volume K Tons Forecast, by Sub Product 2020 & 2033

- Table 11: Europe Construction Repair and Rehabilitation Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Construction Repair and Rehabilitation Chemicals Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Construction Repair and Rehabilitation Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Construction Repair and Rehabilitation Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Construction Repair and Rehabilitation Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Construction Repair and Rehabilitation Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: France Europe Construction Repair and Rehabilitation Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Europe Construction Repair and Rehabilitation Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Construction Repair and Rehabilitation Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Construction Repair and Rehabilitation Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Construction Repair and Rehabilitation Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Construction Repair and Rehabilitation Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Construction Repair and Rehabilitation Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Construction Repair and Rehabilitation Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Construction Repair and Rehabilitation Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Construction Repair and Rehabilitation Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Construction Repair and Rehabilitation Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Construction Repair and Rehabilitation Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Construction Repair and Rehabilitation Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Construction Repair and Rehabilitation Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Construction Repair and Rehabilitation Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Construction Repair and Rehabilitation Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Construction Repair and Rehabilitation Chemicals Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Construction Repair and Rehabilitation Chemicals Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Construction Repair and Rehabilitation Chemicals Market?

The projected CAGR is approximately 5.29%.

2. Which companies are prominent players in the Europe Construction Repair and Rehabilitation Chemicals Market?

Key companies in the market include Remmers Gruppe AG, Saint-Gobain, RPM International Inc, MBCC Group, Simpson Strong-Tie Company Inc, Fosroc Inc, Ardex Group, MAPEI S p A, Sika AG, MC-Bauchemie.

3. What are the main segments of the Europe Construction Repair and Rehabilitation Chemicals Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.91 billion as of 2022.

5. What are some drivers contributing to market growth?

; Banning/ Limiting Use of Plastics used in packaging applications.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Harmful Amines in Dyes; Paperless Green Initiatives.

8. Can you provide examples of recent developments in the market?

May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.November 2021: Remmers Gruppe AG extended its sales organization in Wels, Austria, to boost its construction repair and rehabilitation chemicals popularity in the country.March 2021: MBCC Group acquired TPH Bausysteme GmbH to expand its offering of acrylates and polyurethanes for ground consolidation and waterproofing solutions in its underground construction sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Construction Repair and Rehabilitation Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Construction Repair and Rehabilitation Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Construction Repair and Rehabilitation Chemicals Market?

To stay informed about further developments, trends, and reports in the Europe Construction Repair and Rehabilitation Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence