Key Insights

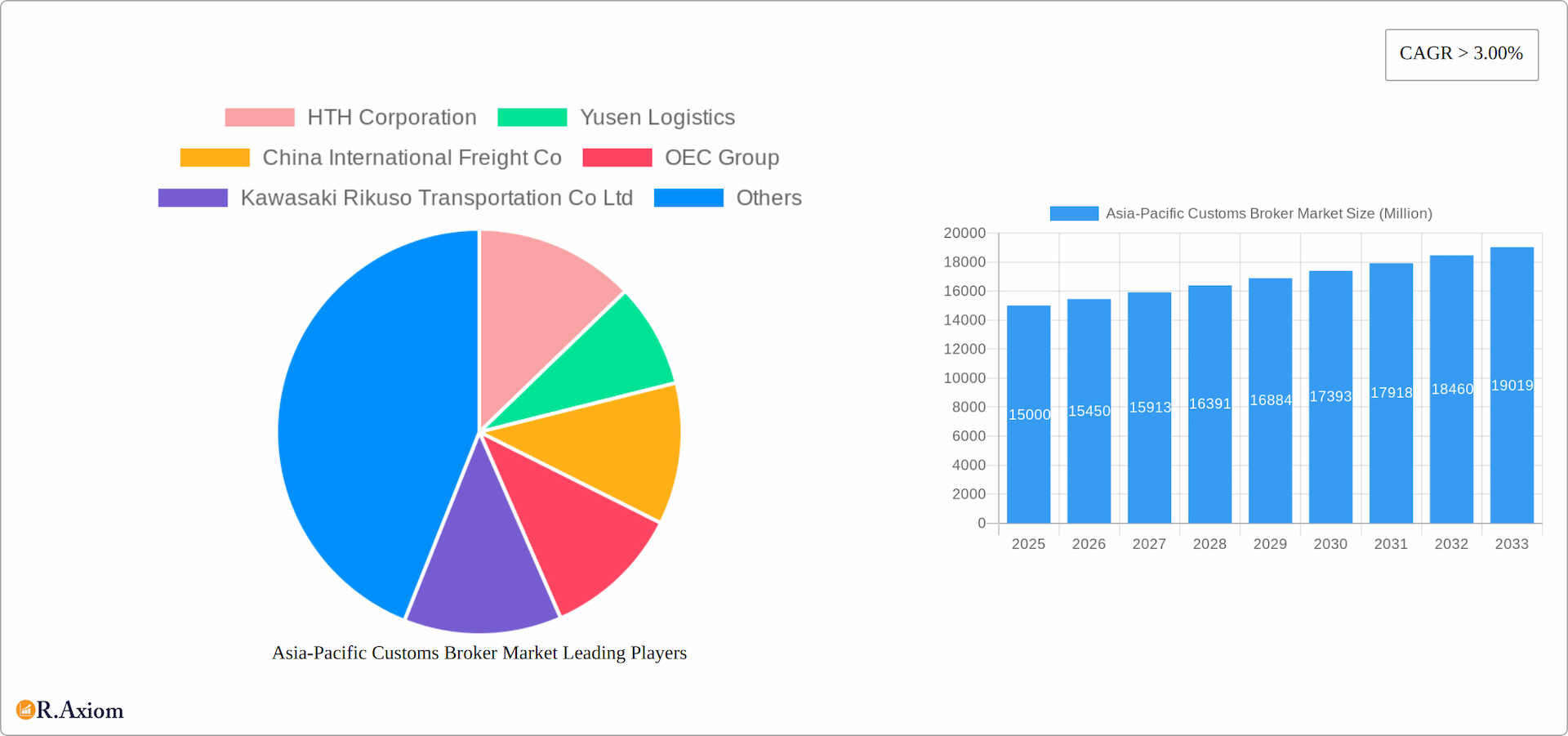

The Asia-Pacific customs brokerage market is poised for significant expansion, driven by escalating e-commerce, burgeoning cross-border trade, and evolving regulatory landscapes. With a current market size of $26.54 billion and a projected Compound Annual Growth Rate (CAGR) of 7.37%, the market is set to reach substantial valuations by 2025. Key growth catalysts include heightened global trade activity, particularly within the Asia-Pacific, necessitating expert customs brokerage solutions. The demand for optimized supply chain management and adherence to stringent customs protocols further fuels this growth. The market is segmented by transport mode, with sea freight anticipated to lead due to high cargo volumes across the region. Industry leaders are adopting technological innovations like automation and digital platforms to enhance customs clearance efficiency and service delivery. Despite potential headwinds from economic volatility, trade disputes, and supply chain disruptions, the market's growth is particularly robust in major economies like China, Japan, India, and South Korea, attributed to their extensive manufacturing and export operations. The sustained growth of e-commerce and deepening economic integration in Asia will continue to propel the market forward throughout the forecast period (2025-2033).

Asia-Pacific Customs Broker Market Market Size (In Billion)

Continued growth in the Asia-Pacific customs brokerage sector is anticipated, bolstered by increasing intra-regional commerce and the economic expansion of emerging markets. Opportunities exist for specialized service providers within specific transport mode segments. Intense competition necessitates ongoing innovation and strategic alliances among market players. Government policies promoting trade facilitation and streamlined customs procedures are expected to foster market expansion. The widespread adoption of digital technologies will significantly enhance operational efficiency and service quality. Regional trade agreements and initiatives aimed at promoting seamless cross-border commerce will further stimulate demand for customs brokerage services throughout the Asia-Pacific.

Asia-Pacific Customs Broker Market Company Market Share

Asia-Pacific Customs Broker Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific Customs Broker Market, offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The study covers the period 2019-2033, with a focus on the base year 2025 and a forecast period extending to 2033. The report utilizes a robust methodology and incorporates extensive primary and secondary research to deliver actionable intelligence. The market is segmented by mode of transport (Sea, Air, Cross-Border Land Transport), providing a granular understanding of growth patterns across different transportation channels. The total market size is projected to reach xx Million by 2033.

Asia-Pacific Customs Broker Market Market Concentration & Innovation

This section delves into the competitive dynamics of the Asia-Pacific Customs Broker market, analyzing market concentration, innovation drivers, regulatory influences, substitute solutions, evolving end-user demands, and merger and acquisition (M&A) activities. The market displays a moderately concentrated structure, with several key players commanding significant market share. However, a substantial number of smaller players contribute to a dynamic and competitive landscape.

Market Share & Competitive Landscape: In 2025, the top five players—HTH Corporation, Yusen Logistics, China International Freight Co., OEC Group, and Kawasaki Rikuso Transportation Co. Ltd.—held an estimated [Insert Specific Percentage]% of the market share. This leaves a significant portion distributed among numerous smaller, yet agile competitors, including One Global Logistics, JAS Worldwide Logistics, DHL Group Logistics, Geodis Logistics, and Kintetsu World Express. The competitive intensity is fueled by the varying strengths and specializations of these players, leading to strategic pricing, service differentiation, and a focus on niche markets.

Innovation Drivers: Technological advancements are reshaping the customs brokerage landscape. Blockchain technology, enabling enhanced supply chain transparency and automation of customs processes, is a primary driver. Artificial intelligence (AI) and machine learning (ML) are also gaining traction, optimizing customs declaration accuracy and reducing processing times. Furthermore, the growing demand for efficient and streamlined customs brokerage services fuels continuous innovation within the sector.

Regulatory Frameworks and Compliance: The diverse and evolving customs regulations across the Asia-Pacific region present both challenges and opportunities. Navigating this complex regulatory environment necessitates specialized expertise, continuous monitoring of regulatory changes, and robust compliance programs. Companies specializing in navigating these complexities gain a significant competitive edge.

M&A Activities and Strategic Growth: The past five years have witnessed a notable level of M&A activity, with deal values totaling approximately [Insert Specific Amount] Million. These transactions are primarily motivated by the pursuit of geographic expansion, broader service offerings, enhanced technological capabilities, and increased market share. Consolidation is expected to continue as larger players seek to strengthen their positions.

Product Substitutes and Competitive Pressures: While direct substitutes for traditional customs brokerage services are limited, alternative solutions are emerging. Self-service customs portals and technology-driven platforms are gaining popularity, particularly among smaller businesses. This evolving competitive landscape compels established players to embrace innovation and develop strategies to maintain their market positions.

End-User Trends and Service Demands: End-users increasingly prioritize faster and more reliable customs clearance processes. Demand for customized, integrated solutions tailored to specific industry needs is also on the rise. This necessitates a shift towards greater flexibility and responsiveness from customs brokers, with a focus on building strong client relationships and offering value-added services.

Asia-Pacific Customs Broker Market Industry Trends & Insights

The Asia-Pacific Customs Broker Market is experiencing significant growth, driven by several key factors. The region’s robust economic growth, coupled with the expansion of e-commerce and globalization, is fueling demand for efficient customs brokerage services. The market's CAGR during the forecast period (2025-2033) is estimated to be xx%. Market penetration for integrated logistics solutions offering customs brokerage services is growing steadily, reaching an estimated xx% in 2025. Technological disruptions, particularly the increasing adoption of automation and digitalization within the customs process, are streamlining operations and boosting efficiency. Consumer preferences are shifting towards seamless and transparent customs clearance processes, creating a demand for advanced technology-driven solutions. Competitive dynamics are characterized by both consolidation and innovation. Established players are focusing on expanding their service portfolios and geographic reach, while new entrants are introducing innovative solutions. The ongoing evolution of trade policies and regulations within the Asia-Pacific region presents both challenges and opportunities.

Dominant Markets & Segments in Asia-Pacific Customs Broker Market

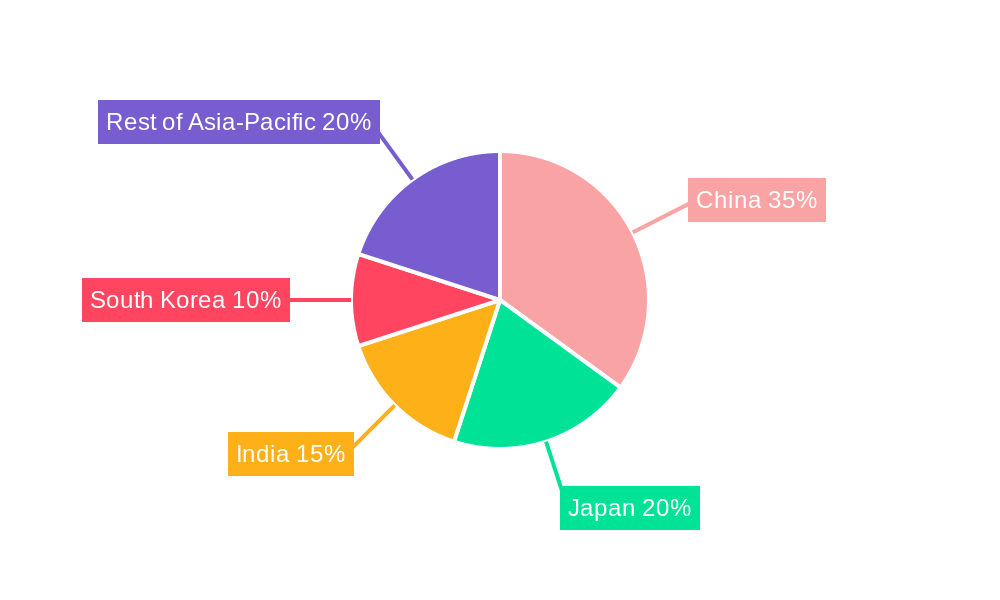

The Sea freight segment dominates the Asia-Pacific Customs Broker market, accounting for the largest share of revenue in 2025. This dominance is primarily attributable to the region's high dependence on seaborne trade. China and India emerge as the leading countries, driven by their substantial import-export activities and robust economic growth.

Key Drivers for the Sea Freight Segment:

Economic Policies: Government initiatives promoting international trade and infrastructure development are significant drivers.

Infrastructure: Extensive port infrastructure and well-established shipping networks facilitate efficient cargo handling.

Trade Volumes: The sheer volume of seaborne trade in the Asia-Pacific region significantly boosts demand for customs brokerage services.

Country-Specific Dominance Analysis:

China's robust manufacturing sector and extensive export-oriented businesses contribute substantially to the demand for customs brokerage services. India's rapidly growing economy and expanding trade relationships further propel the market. The continued expansion of both countries' economies is expected to consolidate their leadership positions throughout the forecast period.

Asia-Pacific Customs Broker Market Product Developments

Recent product innovations include the integration of AI and machine learning into customs brokerage software to enhance efficiency and reduce processing times. These advancements offer significant competitive advantages, enabling faster customs clearance and improved compliance. The market is increasingly focused on developing integrated, technology-driven solutions that cater to the evolving needs of businesses seeking streamlined and transparent customs processes. The market fit for these innovative products is strong, owing to the increasing demand for efficiency and transparency within supply chains.

Report Scope & Segmentation Analysis

The report segments the Asia-Pacific Customs Broker Market primarily by mode of transport:

Sea: This segment accounts for the largest market share, driven by the high volume of seaborne trade in the region. Growth is projected to remain robust due to continuous growth in international trade. Competition in this segment is intense, with numerous established players and new entrants vying for market share.

Air: This segment is experiencing significant growth, driven by the increasing demand for faster delivery times. The growth rate is expected to outpace that of the sea freight segment due to the growing e-commerce sector and the need for quicker delivery of goods. Competitive dynamics are similar to the sea freight segment, characterized by a mix of large established companies and emerging players.

Cross-Border Land Transport: This segment showcases moderate growth, primarily driven by increasing cross-border trade within the region. Competition is less intense compared to sea and air freight, offering opportunities for specialized players focused on this mode of transport.

Key Drivers of Asia-Pacific Customs Broker Market Growth

The Asia-Pacific Customs Broker Market is driven by a confluence of factors, including the region's expanding economies, increasing international trade, and advancements in technology. Strong economic growth in major economies such as China and India fuels demand for efficient customs brokerage services. The rise of e-commerce and globalization further amplifies this demand. Furthermore, technological innovations, such as the adoption of AI and blockchain, are streamlining processes and improving efficiency. Government initiatives promoting trade facilitation and modernization of customs procedures are also contributing significantly to market growth.

Challenges in the Asia-Pacific Customs Broker Market Sector

The Asia-Pacific Customs Broker Market faces challenges such as varying customs regulations across different countries, complex procedures, and supply chain disruptions. Inconsistencies in regulations across countries create complexity and add costs. The impact of these regulations is estimated to reduce market growth by approximately xx% annually. Supply chain disruptions due to geopolitical factors or natural disasters can significantly affect the industry. Furthermore, intense competition from established players and new entrants necessitates continuous innovation and adaptation to stay ahead.

Emerging Opportunities in Asia-Pacific Customs Broker Market

Emerging opportunities lie in the adoption of advanced technologies, such as AI and blockchain, to enhance efficiency and transparency. Expanding into new markets with less developed customs infrastructure presents significant potential. Increased focus on sustainability and environmentally friendly logistics solutions opens up new avenues for growth. Providing specialized services catering to specific industry segments like healthcare or technology offers further opportunities.

Leading Players in the Asia-Pacific Customs Broker Market Market

- HTH Corporation

- Yusen Logistics

- China International Freight Co (Note: This may link to a broader group site)

- OEC Group

- Kawasaki Rikuso Transportation Co Ltd (Note: This may be a Japanese-language site)

- One Global Logistics

- JAS Worldwide Logistics

- DHL Group Logistics

- Geodis Logistics

- Kintetsu World Express

Key Developments in Asia-Pacific Customs Broker Market Industry

- Jan 2023: DHL Group Logistics launched a new AI-powered customs clearance platform.

- Mar 2022: Yusen Logistics acquired a smaller customs brokerage firm in Singapore.

- Oct 2021: HTH Corporation invested in blockchain technology for improved supply chain transparency.

- Jun 2020: New regulations introduced in Vietnam impacted cross-border land transport.

Strategic Outlook for Asia-Pacific Customs Broker Market Market

The Asia-Pacific Customs Broker Market holds significant future potential, driven by sustained economic growth, increasing trade volumes, and technological advancements. The market is poised for continued expansion, with opportunities for players who can leverage technology, adapt to changing regulations, and offer efficient and customer-centric solutions. The continued integration of technology within the customs process is expected to be a major driver of growth, creating opportunities for players with strong technological capabilities. The strategic focus should be on innovation, strategic partnerships, and expansion into high-growth markets within the region.

Asia-Pacific Customs Broker Market Segmentation

-

1. Mode Of Transport

- 1.1. Sea

- 1.2. Air

- 1.3. Cross-Border Land Transport

-

2. Geography

- 2.1. China

- 2.2. Japan

- 2.3. India

- 2.4. Australia

- 2.5. Malaysia

- 2.6. South Korea

- 2.7. Rest of Asia-Pacific

Asia-Pacific Customs Broker Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Malaysia

- 6. South Korea

- 7. Rest of Asia Pacific

Asia-Pacific Customs Broker Market Regional Market Share

Geographic Coverage of Asia-Pacific Customs Broker Market

Asia-Pacific Customs Broker Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing international trade; Complex custom regulations

- 3.3. Market Restrains

- 3.3.1. Regulatory Challenges; Geopolitical Uncertainity

- 3.4. Market Trends

- 3.4.1. Increasing Chinese Imports Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Customs Broker Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.1.1. Sea

- 5.1.2. Air

- 5.1.3. Cross-Border Land Transport

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. Japan

- 5.2.3. India

- 5.2.4. Australia

- 5.2.5. Malaysia

- 5.2.6. South Korea

- 5.2.7. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Malaysia

- 5.3.6. South Korea

- 5.3.7. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6. China Asia-Pacific Customs Broker Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6.1.1. Sea

- 6.1.2. Air

- 6.1.3. Cross-Border Land Transport

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. Japan

- 6.2.3. India

- 6.2.4. Australia

- 6.2.5. Malaysia

- 6.2.6. South Korea

- 6.2.7. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 7. Japan Asia-Pacific Customs Broker Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 7.1.1. Sea

- 7.1.2. Air

- 7.1.3. Cross-Border Land Transport

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. Japan

- 7.2.3. India

- 7.2.4. Australia

- 7.2.5. Malaysia

- 7.2.6. South Korea

- 7.2.7. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 8. India Asia-Pacific Customs Broker Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 8.1.1. Sea

- 8.1.2. Air

- 8.1.3. Cross-Border Land Transport

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. Japan

- 8.2.3. India

- 8.2.4. Australia

- 8.2.5. Malaysia

- 8.2.6. South Korea

- 8.2.7. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 9. Australia Asia-Pacific Customs Broker Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 9.1.1. Sea

- 9.1.2. Air

- 9.1.3. Cross-Border Land Transport

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. Japan

- 9.2.3. India

- 9.2.4. Australia

- 9.2.5. Malaysia

- 9.2.6. South Korea

- 9.2.7. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 10. Malaysia Asia-Pacific Customs Broker Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 10.1.1. Sea

- 10.1.2. Air

- 10.1.3. Cross-Border Land Transport

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. Japan

- 10.2.3. India

- 10.2.4. Australia

- 10.2.5. Malaysia

- 10.2.6. South Korea

- 10.2.7. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 11. South Korea Asia-Pacific Customs Broker Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 11.1.1. Sea

- 11.1.2. Air

- 11.1.3. Cross-Border Land Transport

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. Japan

- 11.2.3. India

- 11.2.4. Australia

- 11.2.5. Malaysia

- 11.2.6. South Korea

- 11.2.7. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 12. Rest of Asia Pacific Asia-Pacific Customs Broker Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 12.1.1. Sea

- 12.1.2. Air

- 12.1.3. Cross-Border Land Transport

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. China

- 12.2.2. Japan

- 12.2.3. India

- 12.2.4. Australia

- 12.2.5. Malaysia

- 12.2.6. South Korea

- 12.2.7. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 HTH Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Yusen Logistics

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 China International Freight Co

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 OEC Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Kawasaki Rikuso Transportation Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 One Global Logistics**List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 JAS Worldwide Logistics

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 DHL Group Logistics

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Geodis Logistics

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Kintetsu World Express

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 HTH Corporation

List of Figures

- Figure 1: Asia-Pacific Customs Broker Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Customs Broker Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 2: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 5: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 8: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 11: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 14: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 17: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 20: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 21: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 23: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Customs Broker Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Customs Broker Market?

The projected CAGR is approximately 7.37%.

2. Which companies are prominent players in the Asia-Pacific Customs Broker Market?

Key companies in the market include HTH Corporation, Yusen Logistics, China International Freight Co, OEC Group, Kawasaki Rikuso Transportation Co Ltd, One Global Logistics**List Not Exhaustive, JAS Worldwide Logistics, DHL Group Logistics, Geodis Logistics, Kintetsu World Express.

3. What are the main segments of the Asia-Pacific Customs Broker Market?

The market segments include Mode Of Transport, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.54 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing international trade; Complex custom regulations.

6. What are the notable trends driving market growth?

Increasing Chinese Imports Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

Regulatory Challenges; Geopolitical Uncertainity.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Customs Broker Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Customs Broker Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Customs Broker Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Customs Broker Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence