Key Insights

The United States apparel logistics market, a significant segment of the global apparel industry, is experiencing robust growth, driven by the increasing e-commerce penetration and the rising demand for faster and more efficient delivery solutions. The market's size in 2025 is estimated at $15 billion, reflecting a substantial portion of the global market considering the US's position as a major apparel consumer and producer. This robust market is further fueled by several key factors. The burgeoning popularity of fast fashion, demanding quick turnaround times in supply chains, necessitates streamlined logistics solutions. Simultaneously, the growth of omnichannel retail strategies, incorporating both online and offline sales, increases the complexity of logistics, creating demand for sophisticated inventory management and warehousing services. Furthermore, advancements in technology, such as warehouse automation and real-time tracking, enhance efficiency and transparency, making the entire logistics process more appealing to apparel companies. A key restraint is the increasing labor costs and the ongoing challenges associated with maintaining a consistent and skilled workforce. However, the ongoing investments in automation are expected to mitigate this challenge over the long term.

United States Apparel Logistics Market Market Size (In Billion)

The projected CAGR of over 4.57% indicates a consistently expanding market throughout the forecast period (2025-2033). This growth will be largely driven by ongoing e-commerce expansion and increased consumer expectations for convenient and timely delivery. Specific segments, such as transportation and warehousing, are expected to see disproportionately high growth due to the need for efficient movement and storage of apparel goods. The presence of major logistics players like DHL, DSV, and others, showcases the market's maturity and competitiveness, driving innovation and efficiency improvements. However, the market's expansion is not without challenges. Geopolitical factors, fluctuating fuel costs, and potential supply chain disruptions can impact growth trajectory, necessitating agility and resilience among logistics providers. The market's segmentation offers opportunities for specialized service providers focusing on specific niche areas within the apparel logistics industry.

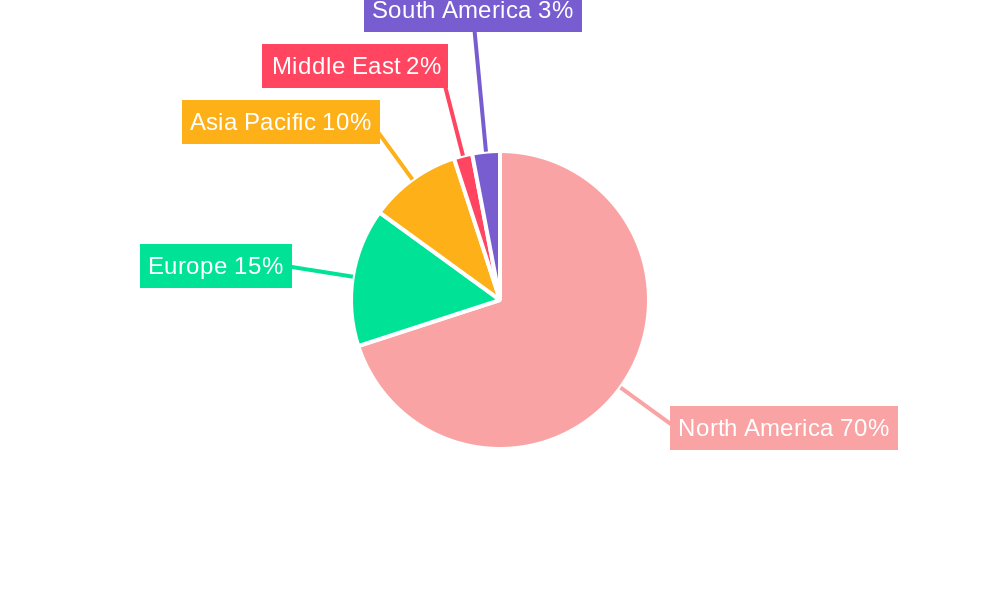

United States Apparel Logistics Market Company Market Share

United States Apparel Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States Apparel Logistics Market, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is crucial for stakeholders, investors, and industry professionals seeking actionable insights into this dynamic market. The total market size is estimated to be xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

United States Apparel Logistics Market Concentration & Innovation

The US Apparel Logistics market exhibits a moderately concentrated structure, with a handful of major players holding significant market share. However, the presence of numerous smaller, specialized firms contributes to a dynamic competitive landscape. Innovation is a key driver, with companies investing in advanced technologies like AI-powered warehouse management systems, blockchain for supply chain transparency, and automation to enhance efficiency and reduce costs. The regulatory framework, including customs regulations and transportation laws, significantly impacts market operations. Substitute products, such as direct-to-consumer shipping models, present competitive pressures. End-user trends, such as the increasing demand for faster delivery and sustainable practices, shape market demand. Mergers and acquisitions (M&A) are frequent, with recent deals focusing on expanding geographical reach, service offerings, and technological capabilities. For example, the Yusen Logistics acquisition of Taylored Services significantly boosted market consolidation. M&A deal values have shown an upward trend over recent years, averaging approximately xx Million per deal in the past three years. Market share data from 2024 indicates that the top five players collectively hold approximately xx% of the market.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Innovation Drivers: AI, automation, blockchain technology, sustainable logistics solutions.

- Regulatory Framework: Significant impact from customs, transportation, and environmental regulations.

- Product Substitutes: Direct-to-consumer shipping models, alternative transportation methods.

- End-User Trends: Growing demand for fast delivery, transparency, and sustainable practices.

- M&A Activity: Frequent mergers and acquisitions, focusing on expansion and technological integration. Average deal value: xx Million (2021-2023).

United States Apparel Logistics Market Industry Trends & Insights

The US Apparel Logistics market is experiencing robust growth driven by several key factors. The e-commerce boom continues to fuel demand for efficient and reliable logistics solutions, particularly in last-mile delivery. Technological advancements, including automation and data analytics, are increasing operational efficiency and reducing costs. Changing consumer preferences, including demand for faster delivery and personalized experiences, are driving innovation in logistics solutions. Intense competition among logistics providers is driving down prices and improving service quality. The market has shown a consistent growth trajectory during the historical period (2019-2024) and this growth is expected to continue throughout the forecast period. The compound annual growth rate (CAGR) for the market is projected to be xx% from 2025 to 2033. Market penetration of advanced technologies, such as automated guided vehicles (AGVs) and warehouse management systems (WMS), is steadily increasing, projected to reach xx% by 2033. This progress is being facilitated by the continuous influx of investments into the sector by both incumbent and emerging firms.

Dominant Markets & Segments in United States Apparel Logistics Market

The Northeastern region of the United States currently represents the largest segment of the apparel logistics market, driven by high population density, strong retail presence, and well-developed infrastructure. Within the service segments, Transportation dominates, accounting for approximately xx% of the market share in 2025, followed by Warehousing and Inventory Management at xx%. Other Value-added Services, encompassing specialized offerings like customized packaging and reverse logistics, are experiencing significant growth.

- Key Drivers of Northeastern Region Dominance:

- High population density and consumer spending.

- Extensive transportation infrastructure (ports, airports, highways).

- Strong presence of major apparel brands and retailers.

- Transportation Segment Dominance:

- High demand for efficient and timely delivery of apparel goods.

- Extensive network of trucking, rail, and air freight providers.

- Warehousing and Inventory Management Growth:

- Increased need for efficient storage and management of apparel inventory.

- Growing adoption of advanced warehouse management systems (WMS).

- Other Value-added Services Expansion:

- Growing demand for customized packaging and reverse logistics solutions.

- Increasing focus on sustainable and ethical practices.

United States Apparel Logistics Market Product Developments

Recent product innovations focus on enhancing efficiency and sustainability. This includes the implementation of automated sorting systems, the use of data analytics for optimized routing and delivery, and the introduction of sustainable packaging solutions. These innovations are aimed at meeting evolving consumer demands for faster delivery and environmentally responsible practices while simultaneously enhancing operational efficiency for logistics providers. These advancements provide competitive advantages by streamlining processes, reducing costs, and improving service quality, ultimately leading to increased market share and customer satisfaction.

Report Scope & Segmentation Analysis

The report segments the US Apparel Logistics Market by service type:

- Transportation: This segment includes trucking, rail, air, and ocean freight. Growth is projected at xx% CAGR from 2025-2033. The market is highly competitive with numerous players offering varied services.

- Warehousing and Inventory Management: This segment encompasses storage, order fulfillment, and inventory management solutions. It is predicted to grow at a CAGR of xx% from 2025 to 2033, driven by the rise of e-commerce and omnichannel retail. Competitive dynamics are shaped by technological advancements in warehouse automation.

- Other Value-added Services: This includes specialized services like customized packaging, labeling, and reverse logistics. This segment is expected to exhibit the fastest growth, with a projected CAGR of xx% from 2025-2033, driven by increasing consumer demands for specialized and personalized services. Competition is increasing with the emergence of niche service providers.

Key Drivers of United States Apparel Logistics Market Growth

Several factors are driving the growth of the US Apparel Logistics market. The rapid expansion of e-commerce necessitates efficient and reliable logistics solutions, fueling demand for faster delivery and optimized supply chains. Technological advancements, such as automation and AI-powered systems, are improving efficiency and reducing costs. Government regulations promoting sustainable logistics practices are creating opportunities for green solutions. The continued growth of the apparel industry itself, particularly in e-commerce and omnichannel retail, directly correlates with market expansion.

Challenges in the United States Apparel Logistics Market Sector

Several challenges hinder market growth. Stringent regulatory compliance requirements, including customs regulations and environmental standards, increase operational complexity and costs. Supply chain disruptions, such as port congestion and labor shortages, impact delivery times and costs. Intense competition among logistics providers puts pressure on pricing and profit margins. Fluctuations in fuel prices and fluctuating demand for seasonal apparel can negatively impact the financial performance of logistics companies.

Emerging Opportunities in United States Apparel Logistics Market

Several emerging opportunities exist. The growing adoption of advanced technologies, such as drones and autonomous vehicles, presents potential for improved efficiency and cost reduction. The increasing demand for sustainable and ethical logistics practices creates opportunities for green logistics solutions. Expansion into underserved markets and the growing integration of technology into every facet of the supply chain provide additional avenues for development and innovation.

Leading Players in the United States Apparel Logistics Market Market

- BGROUP SRL

- DB Schenker

- Hellmann Worldwide Logistics

- Genex Logistics

- Logwin AG

- Ceva Logistics

- Yusen Logistics

- Nippon Express

- Apparel Logistics Group Inc

- Deutsche Post DHL Group

- Bollore Logistics

- GAC Group

- DSV

- Expeditors International of Washington Inc

Key Developments in United States Apparel Logistics Market Industry

- August 2023: DHL Express announced a USD 192 Million investment in a new aircraft maintenance facility at CVG airport, significantly expanding its operational capacity.

- March 2023: Yusen Logistics acquired Taylored Services, expanding its US warehouse network and enhancing its omnichannel fulfillment capabilities.

Strategic Outlook for United States Apparel Logistics Market Market

The future of the US Apparel Logistics market appears bright, driven by continued e-commerce growth, technological advancements, and increasing demand for sustainable practices. Companies that embrace innovation, invest in technology, and prioritize customer satisfaction will be well-positioned for success. The market is expected to consolidate further through mergers and acquisitions, with larger players seeking to expand their service offerings and geographical reach. Focus on sustainability and ethical sourcing will also become increasingly important, driving innovation in areas such as green logistics solutions and supply chain transparency.

United States Apparel Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing, and Inventory Management

- 1.3. Other Value-added Services

United States Apparel Logistics Market Segmentation By Geography

- 1. United States

United States Apparel Logistics Market Regional Market Share

Geographic Coverage of United States Apparel Logistics Market

United States Apparel Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of online apparel sales; The demand for faster delivery and quicker time to market

- 3.3. Market Restrains

- 3.3.1. Highly perishable fashion trends; High cost of technology and infrastructure

- 3.4. Market Trends

- 3.4.1. Growth in the online apparel market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Apparel Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing, and Inventory Management

- 5.1.3. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BGROUP SRL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hellmann Worldwide Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Genex Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Logwin AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ceva Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yusen Logistics**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nippon Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Apparel Logistics Group Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Deutsche Post DHL Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bollore Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GAC Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 DSV

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Expeditors International of Washington Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 BGROUP SRL

List of Figures

- Figure 1: United States Apparel Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Apparel Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: United States Apparel Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: United States Apparel Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: United States Apparel Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: United States Apparel Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Apparel Logistics Market?

The projected CAGR is approximately > 4.57%.

2. Which companies are prominent players in the United States Apparel Logistics Market?

Key companies in the market include BGROUP SRL, DB Schenker, Hellmann Worldwide Logistics, Genex Logistics, Logwin AG, Ceva Logistics, Yusen Logistics**List Not Exhaustive, Nippon Express, Apparel Logistics Group Inc, Deutsche Post DHL Group, Bollore Logistics, GAC Group, DSV, Expeditors International of Washington Inc.

3. What are the main segments of the United States Apparel Logistics Market?

The market segments include Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of online apparel sales; The demand for faster delivery and quicker time to market.

6. What are the notable trends driving market growth?

Growth in the online apparel market.

7. Are there any restraints impacting market growth?

Highly perishable fashion trends; High cost of technology and infrastructure.

8. Can you provide examples of recent developments in the market?

August 2023: DHL Express has announced intentions to construct a state-of-the-art aircraft maintenance facility at its main US superhub located at Cincinnati/Northern Kentucky International Airport (CVG), with an investment totaling USD 192 million. Covering an area of 305,000 square feet, the facility will incorporate eight fresh aircraft gates, along with three maintenance parking gates. It will provide accommodation for two Boeing 777 widebody freighters and new office spaces and storage facilities for aircraft components. This development is situated adjacent to the company's current airport cargo operations, which marks a significant expansion of DHL's operational capabilities in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Apparel Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Apparel Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Apparel Logistics Market?

To stay informed about further developments, trends, and reports in the United States Apparel Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence