Key Insights

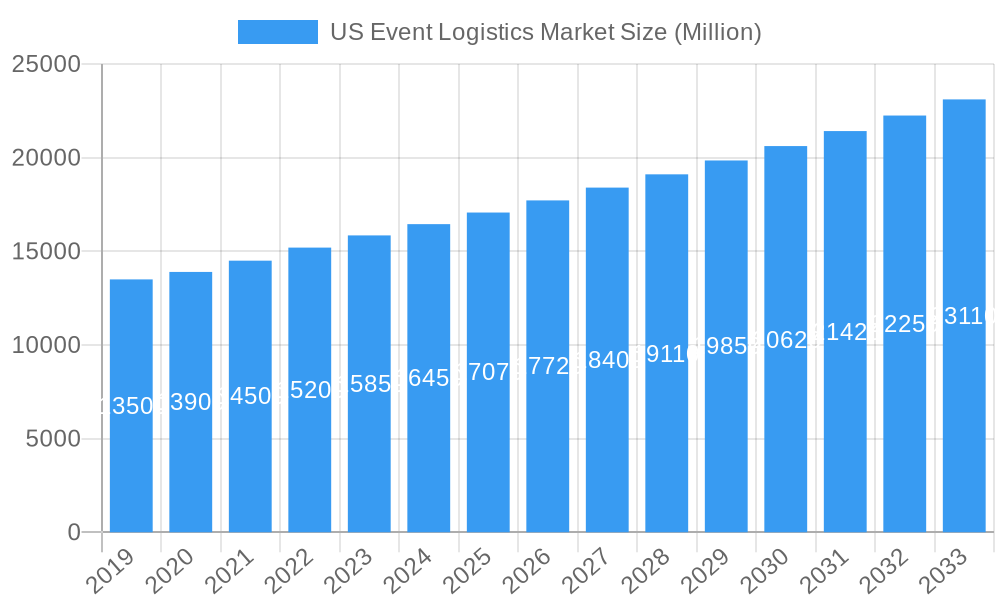

The US Event Logistics market is poised for robust growth, projected to reach a significant valuation and expand at a healthy Compound Annual Growth Rate (CAGR) of 4.23% from 2019 to 2033. This upward trajectory is driven by several key factors. The increasing frequency and scale of major entertainment events, global sporting championships, and large-scale trade fairs are creating a sustained demand for specialized logistics services. Businesses are increasingly recognizing the critical role of efficient event logistics in ensuring brand visibility, attendee satisfaction, and the overall success of their events. This necessitates sophisticated solutions for inventory control, seamless distribution of materials, and agile on-site logistics management. The market's growth is further fueled by technological advancements in tracking, real-time monitoring, and automation, enhancing operational efficiency and reducing potential disruptions.

US Event Logistics Market Market Size (In Billion)

The competitive landscape for US event logistics is dynamic, featuring established global players like DB Schenker, DHL International GmbH, FedEx Corporation, and UPS, alongside specialized providers. These companies are investing in advanced infrastructure, sustainable practices, and tailored service offerings to cater to the unique demands of the event industry. Key trends shaping the market include the growing demand for temperature-controlled logistics for high-value exhibits, the integration of digital solutions for end-to-end visibility, and a focus on environmentally conscious logistics to align with corporate sustainability goals. While the market presents significant opportunities, potential restraints such as escalating transportation costs, labor shortages, and the complexities of navigating diverse regulatory environments, particularly for international events, will require strategic mitigation by market participants. Addressing these challenges will be crucial for maintaining profitability and ensuring continued market expansion.

US Event Logistics Market Company Market Share

This in-depth report provides a definitive analysis of the US Event Logistics Market, a dynamic sector crucial for the successful execution of a wide range of events, from major sporting spectacles and global trade fairs to concerts and corporate gatherings. We delve into market dynamics, key players, emerging trends, and future growth trajectories, offering actionable insights for stakeholders. The study encompasses a comprehensive historical period (2019-2024), a base year of 2025, and an extensive forecast period (2025-2033), projecting a robust Compound Annual Growth Rate (CAGR) of XX%.

The US event logistics market is characterized by a high degree of complexity, demanding specialized expertise in inventory management, transportation, warehousing, and on-site delivery. This report meticulously examines the interplay of these factors across various event applications, including entertainment logistics, sports event logistics, trade fair logistics, and other specialized applications. With an estimated market size of over $XX Billion in the base year 2025, the sector is poised for significant expansion, driven by increasing consumer spending on experiences and a resurgence in large-scale events.

US Event Logistics Market Market Concentration & Innovation

The US Event Logistics Market exhibits a moderately concentrated landscape, with a few dominant players holding substantial market share, alongside a growing number of specialized niche providers. Key companies like DB Schenker, DHL International GmbH, FedEx Corporation, Ceva Logistics, GEFCO, Kuehne + Nagel International AG, Rhenus SE & Co KG, XPO Logistics Inc, GEODIS, and United Parcel Service of America Inc. are actively competing. Innovation is a critical differentiator, fueled by the need for enhanced efficiency, real-time tracking, and sustainable practices. Technology adoption, including AI-powered route optimization, IoT for asset tracking, and advanced warehouse management systems, is paramount. Regulatory frameworks, such as those governing hazardous materials transport and customs clearance for international events, play a significant role in shaping operational strategies. Product substitutes are limited, with the core offering being specialized logistics services, though technological advancements can offer different approaches to solving logistical challenges. End-user trends lean towards demanding seamless, end-to-end solutions with minimal disruption. Mergers and acquisitions (M&A) are ongoing, with a reported M&A deal value of approximately $XX Million in the historical period, indicating a consolidation trend and strategic expansion by leading firms to broaden service portfolios and geographic reach.

US Event Logistics Market Industry Trends & Insights

The US Event Logistics Market is experiencing robust growth, projected to expand at a CAGR of XX% from 2025 to 2033, reaching an estimated market size of over $XX Billion by the forecast year. This expansion is primarily driven by the increasing demand for seamless and efficient logistical support for a wide array of events, including the burgeoning sports event logistics sector, the consistent need for trade fair logistics, and the vibrant entertainment logistics industry. Technological advancements are profoundly reshaping the industry, with the integration of Artificial Intelligence (AI) for predictive analytics and route optimization, the Internet of Things (IoT) for real-time asset tracking and inventory visibility, and advanced Warehouse Management Systems (WMS) to enhance operational efficiency. Furthermore, there's a growing consumer preference for experiential events, leading to an increase in the frequency and scale of gatherings, thereby necessitating sophisticated logistics solutions. Competitive dynamics are intensifying, with established players investing heavily in technology and service innovation, while newer entrants focus on specialized niches and agile service delivery models. The trend towards sustainability in logistics is also gaining traction, with companies exploring eco-friendly transportation options and waste reduction strategies at event venues. The market penetration of specialized event logistics services is steadily increasing as event organizers recognize the value of expert handling of complex logistical challenges, from secure transportation of high-value equipment and exhibits to managing intricate on-site setup and dismantle operations.

Dominant Markets & Segments in US Event Logistics Market

The US Event Logistics Market is characterized by the dominance of specific segments and applications, driven by distinct economic and consumer trends.

Dominant Type Segments:

- Logistics Solutions: This segment holds the largest market share and is projected to grow significantly. It encompasses a broad spectrum of services including transportation, warehousing, customs brokerage, freight forwarding, and on-site management. The demand is driven by the need for comprehensive, integrated solutions that streamline the entire event supply chain.

- Key Drivers: Increasing complexity of event setups, globalization of events requiring international logistics, and the desire for a single point of contact for all logistical needs.

- Distribution Systems: This segment plays a critical role in ensuring timely and accurate delivery of event materials, equipment, and merchandise. Efficient distribution networks are essential for avoiding delays that could impact event schedules.

- Key Drivers: Need for specialized handling of delicate or high-value items, just-in-time delivery requirements, and the management of returns and inventory post-event.

- Inventory Control: While a supporting function, effective inventory control is paramount for managing event assets, from promotional materials to exhibitor booth components. Accurate tracking minimizes losses and ensures availability.

- Key Drivers: Minimizing shrinkage, optimizing resource allocation, and ensuring compliance with contractual obligations regarding asset management.

Dominant Application Segments:

- Entertainment: This sector, encompassing concerts, festivals, film shoots, and touring productions, represents a significant market for event logistics. The demanding nature of entertainment events, with tight schedules and specialized equipment, requires agile and reliable logistics partners.

- Key Drivers: Growing consumer spending on live entertainment, the increasing popularity of large-scale music festivals, and the continuous demand for touring theatrical and musical productions.

- Trade Fair: The trade fair segment is a perennial driver of event logistics demand. Exhibitors and organizers rely heavily on logistics providers for the transportation of booth structures, products, marketing materials, and audiovisual equipment to convention centers nationwide.

- Key Drivers: Robust corporate spending on marketing and brand promotion, the resurgence of in-person business interactions post-pandemic, and the continuous introduction of new products and services showcased at expos.

- Sports: The sports event logistics market is experiencing substantial growth, driven by major sporting events, league championships, and international competitions. This segment demands specialized handling of athletic equipment, fan merchandise, broadcasting equipment, and infrastructure components.

- Key Drivers: Hosting of major sporting tournaments (e.g., Olympics, World Cups), increased frequency of professional league events, and the growing global appeal of sports.

- Other Applications: This category includes corporate events, conferences, weddings, and other specialized gatherings that also require logistical support, contributing to the overall market volume.

- Key Drivers: Growth in the MICE (Meetings, Incentives, Conferences, and Exhibitions) sector, and the increasing trend of destination events and corporate retreats.

US Event Logistics Market Product Developments

Recent product developments in the US Event Logistics Market are centered on enhancing visibility, efficiency, and sustainability. Companies are rolling out advanced tracking solutions utilizing IoT sensors and GPS technology, providing real-time location data for high-value equipment and sensitive materials. The development of specialized, modular transportation units designed for easy loading and unloading of event assets is also a key trend. Furthermore, there is a growing focus on integrated digital platforms that consolidate booking, tracking, and communication, offering a seamless experience for event organizers. These innovations provide a competitive advantage by reducing transit times, minimizing the risk of damage or loss, and enabling more precise planning and execution of complex event logistics.

US Event Logistics Market Report Scope & Segmentation Analysis

This report meticulously analyzes the US Event Logistics Market across its key segments.

Type Segmentation:

- Inventory Control: This segment, projected to reach over $XX Million by 2033, focuses on managing and tracking event-related inventory, ensuring accurate stock levels and minimizing loss.

- Distribution Systems: Expected to grow to over $XX Million by 2033, this segment deals with the efficient movement and delivery of event materials and equipment.

- Logistics Solutions: This dominant segment, forecast to exceed $XX Billion by 2033, encompasses comprehensive end-to-end services, including transportation, warehousing, and on-site management, reflecting strong growth driven by integrated service demands.

Application Segmentation:

- Entertainment: This dynamic sector, projected to reach over $XX Billion by 2033, includes logistics for concerts, festivals, and tours, driven by high demand for experiential events.

- Sports: The sports event logistics market is anticipated to grow to over $XX Billion by 2033, fueled by major sporting events and leagues.

- Trade Fair: This established segment is projected to grow to over $XX Billion by 2033, driven by ongoing corporate participation in exhibitions.

- Other Applications: Encompassing corporate events and specialized gatherings, this segment is expected to reach over $XX Million by 2033, showing steady growth.

Key Drivers of US Event Logistics Market Growth

The US Event Logistics Market is propelled by several key drivers:

- Rising Consumer Demand for Experiences: A significant increase in consumer spending on live events, including concerts, festivals, and sporting competitions, directly translates into higher demand for event logistics services.

- Technological Advancements: The adoption of AI, IoT, and sophisticated tracking systems is enhancing efficiency, reducing costs, and improving the reliability of event logistics.

- Growth in the MICE Sector: The Meetings, Incentives, Conferences, and Exhibitions sector continues to expand, driving demand for logistical support for corporate events and trade shows.

- Resurgence of In-Person Events: Following a period of reduced physical gatherings, there is a strong resurgence of large-scale events, requiring comprehensive logistical planning and execution.

- Globalization of Events: As events become more international in scope, the need for cross-border logistics expertise, customs clearance, and specialized handling increases significantly.

Challenges in the US Event Logistics Market Sector

Despite robust growth, the US Event Logistics Market faces several challenges:

- Complex Regulatory Landscape: Navigating varied state and federal regulations, particularly concerning transportation of sensitive materials, permits, and customs, can be complex and time-consuming.

- Short Lead Times and Unpredictability: Event schedules can change rapidly, and last-minute demands are common, posing significant challenges for planning and resource allocation.

- Skilled Workforce Shortages: A persistent shortage of trained and experienced logistics professionals, especially drivers and warehouse staff, can impact operational efficiency.

- Infrastructure Congestion: Traffic congestion in major metropolitan areas can lead to delays in delivery and on-site setup, affecting tight event timelines.

- Cost Pressures: Event organizers often operate with tight budgets, putting pressure on logistics providers to offer competitive pricing while maintaining service quality.

Emerging Opportunities in US Event Logistics Market

The US Event Logistics Market presents significant emerging opportunities:

- Sustainable Logistics Solutions: Growing demand for eco-friendly event execution creates opportunities for providers offering green transportation options, waste management services, and carbon footprint reduction strategies.

- Expansion into Niche Event Verticals: The rise of specialized events, such as esports tournaments, wellness retreats, and immersive art installations, opens avenues for tailored logistics solutions.

- Leveraging Big Data and AI: The increased availability of data presents an opportunity for advanced analytics to optimize routes, predict demand, and enhance client communication.

- Development of Smart Warehousing: Implementing automated and technologically advanced warehousing facilities can improve efficiency and reduce handling times for event assets.

- Partnerships and Collaborations: Forming strategic alliances with event organizers, venue managers, and technology providers can lead to integrated service offerings and broader market reach.

Leading Players in the US Event Logistics Market Market

- DB Schenker

- DHL International GmbH

- FedEx Corporation

- Ceva Logistics

- GEFCO

- Kuehne + Nagel International AG

- Rhenus SE & Co KG

- XPO Logistics Inc

- Geodis

- United Parcel Service of America Inc

Key Developments in US Event Logistics Market Industry

- September 2023: SGS completed the acquisition of global supply chain and operations consulting firm Maine Pointe, enhancing its capabilities in supply chain optimization and consulting services relevant to event logistics.

- February 2023: XPDEL, a prominent hi-tech 3PL logistics company in India, announced significant expansion plans within India, including the opening of a fourth fulfillment center in Delhi equipped with cutting-edge technology, underscoring a broader trend of investment in advanced logistics infrastructure that could influence international event logistics.

Strategic Outlook for US Event Logistics Market Market

The strategic outlook for the US Event Logistics Market is overwhelmingly positive, driven by the enduring human desire for shared experiences and the increasing professionalism of event management. Key growth catalysts include the continued expansion of the sports event logistics sector, the robust demand from trade fair logistics, and the vibrant entertainment logistics industry. The ongoing integration of advanced technologies such as AI for predictive analytics and IoT for real-time tracking will empower logistics providers to offer unparalleled efficiency and transparency. Furthermore, the growing emphasis on sustainability presents a significant opportunity for companies to differentiate themselves by offering eco-friendly solutions. Strategic partnerships and the development of specialized service offerings tailored to the unique needs of various event types will be crucial for capturing market share and fostering long-term growth in this dynamic sector. The market is ripe for innovation, with companies poised to benefit from a strong resurgence in large-scale events and an increasing reliance on expert logistical support.

US Event Logistics Market Segmentation

-

1. Type

- 1.1. Inventory Control

- 1.2. Distribution Systems

- 1.3. Logistics Solutions

-

2. Application

- 2.1. Entertainment

- 2.2. Sports

- 2.3. Trade fair

- 2.4. Other Applications

US Event Logistics Market Segmentation By Geography

- 1. Germany

- 2. UK

- 3. Spain

- 4. Italy

- 5. France

- 6. Rest of Europe

US Event Logistics Market Regional Market Share

Geographic Coverage of US Event Logistics Market

US Event Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Events in E-commerce Sector; Increasing Demand for Qualified Event Logistics Services

- 3.3. Market Restrains

- 3.3.1. High Labour Cost; High Pricing

- 3.4. Market Trends

- 3.4.1. Increasing demand from media and entertainment segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. US Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inventory Control

- 5.1.2. Distribution Systems

- 5.1.3. Logistics Solutions

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Entertainment

- 5.2.2. Sports

- 5.2.3. Trade fair

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. UK

- 5.3.3. Spain

- 5.3.4. Italy

- 5.3.5. France

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany US Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Inventory Control

- 6.1.2. Distribution Systems

- 6.1.3. Logistics Solutions

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Entertainment

- 6.2.2. Sports

- 6.2.3. Trade fair

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. UK US Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Inventory Control

- 7.1.2. Distribution Systems

- 7.1.3. Logistics Solutions

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Entertainment

- 7.2.2. Sports

- 7.2.3. Trade fair

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Spain US Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Inventory Control

- 8.1.2. Distribution Systems

- 8.1.3. Logistics Solutions

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Entertainment

- 8.2.2. Sports

- 8.2.3. Trade fair

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy US Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Inventory Control

- 9.1.2. Distribution Systems

- 9.1.3. Logistics Solutions

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Entertainment

- 9.2.2. Sports

- 9.2.3. Trade fair

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. France US Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Inventory Control

- 10.1.2. Distribution Systems

- 10.1.3. Logistics Solutions

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Entertainment

- 10.2.2. Sports

- 10.2.3. Trade fair

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Europe US Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Inventory Control

- 11.1.2. Distribution Systems

- 11.1.3. Logistics Solutions

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Entertainment

- 11.2.2. Sports

- 11.2.3. Trade fair

- 11.2.4. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 DB Schenker

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 DHL International GmbH

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 FedEx Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Ceva logistics

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Gefco

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Kuehne + Nagel International AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 *List Not Exhaustive*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Rhenus SE & Co KG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 XPO Logistics Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Geodis

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 United Parcel Service of America Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 DB Schenker

List of Figures

- Figure 1: US Event Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: US Event Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: US Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: US Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: US Event Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: US Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: US Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: US Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: US Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: US Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: US Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: US Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: US Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: US Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: US Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: US Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: US Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: US Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: US Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: US Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: US Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: US Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: US Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Event Logistics Market?

The projected CAGR is approximately 4.23%.

2. Which companies are prominent players in the US Event Logistics Market?

Key companies in the market include DB Schenker, DHL International GmbH, FedEx Corporation, Ceva logistics, Gefco, Kuehne + Nagel International AG, *List Not Exhaustive*List Not Exhaustive, Rhenus SE & Co KG, XPO Logistics Inc, Geodis, United Parcel Service of America Inc.

3. What are the main segments of the US Event Logistics Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Events in E-commerce Sector; Increasing Demand for Qualified Event Logistics Services.

6. What are the notable trends driving market growth?

Increasing demand from media and entertainment segment.

7. Are there any restraints impacting market growth?

High Labour Cost; High Pricing.

8. Can you provide examples of recent developments in the market?

September 2023: SGS completed acquisition of global supply chain and operations consulting firm Maine Pointe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Event Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Event Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Event Logistics Market?

To stay informed about further developments, trends, and reports in the US Event Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence