Key Insights

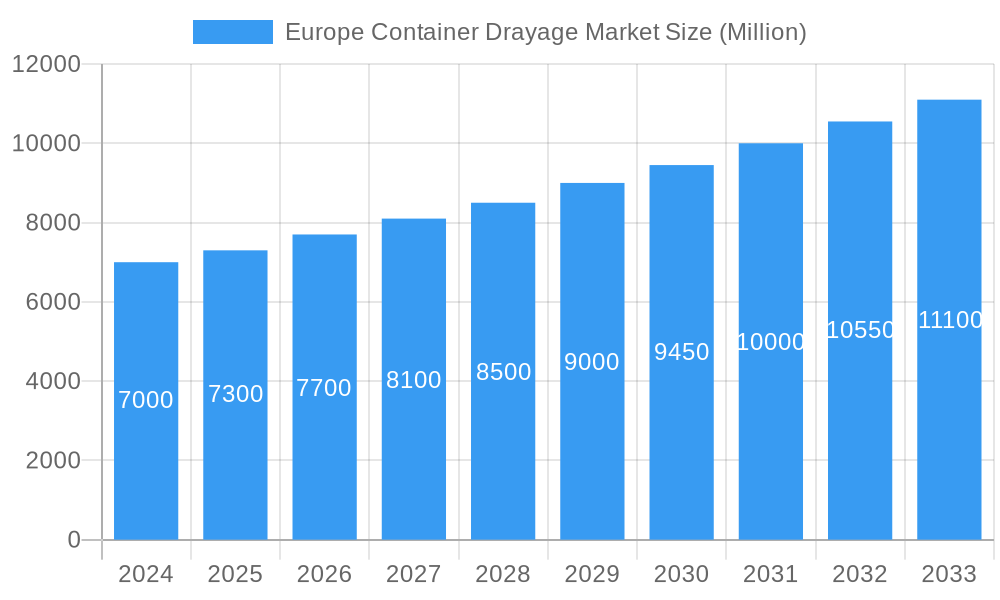

The European container drayage market is poised for robust expansion, projected to reach a substantial market size of approximately €7.30 billion by 2025. This growth is driven by a healthy Compound Annual Growth Rate (CAGR) of 5.50%, indicating sustained momentum throughout the forecast period ending in 2033. The primary catalysts for this expansion include the increasing volume of international trade, the burgeoning e-commerce sector, and the growing reliance on efficient intermodal transportation networks across the continent. Key trends shaping the market are the adoption of advanced tracking and logistics technologies, a growing preference for sustainable and eco-friendly drayage solutions, and the continuous optimization of drayage operations to reduce transit times and costs. The market is witnessing a significant shift towards digitization, with real-time visibility and predictive analytics becoming crucial for operational efficiency. Furthermore, the demand for specialized drayage services, such as temperature-controlled or hazardous material transport, is also on the rise, contributing to market diversification.

Europe Container Drayage Market Market Size (In Billion)

Despite the positive outlook, certain factors present challenges. The significant infrastructure limitations in some European regions, coupled with fluctuating fuel prices and the ongoing shortage of skilled truck drivers, pose potential restraints to the market's full potential. However, proactive investments in infrastructure development, the implementation of driver training and retention programs, and the exploration of alternative fuel sources are expected to mitigate these challenges. The market is segmented by modes of transport, with Rail and Road drayage holding dominant positions due to their established networks and cost-effectiveness. Other modes of transport are also gaining traction as businesses seek integrated and flexible supply chain solutions. Prominent players like DHL, DB Schenker, and Kuehne + Nagel are actively competing, leveraging their extensive networks and technological advancements to capture market share. Geographically, Europe, particularly countries like Germany, the United Kingdom, and the Netherlands, is a focal point for container drayage activities, benefiting from extensive port facilities and well-developed logistics corridors.

Europe Container Drayage Market Company Market Share

This comprehensive report delivers an in-depth analysis of the Europe Container Drayage Market, providing critical insights into market dynamics, growth drivers, challenges, and future opportunities. With a study period spanning from 2019 to 2033, and a base year of 2025, this report offers a robust forecast period from 2025 to 2033, built upon meticulously analyzed historical data from 2019 to 2024. The Europe container drayage market is a vital component of the global supply chain, facilitating the movement of goods between ports, inland terminals, and final destinations. This report leverages high-traffic keywords such as "Europe container logistics," "intermodal transport Europe," "port drayage services," "European rail freight," "road freight Europe," and "container trucking Europe" to ensure maximum search visibility and engagement with industry stakeholders, including logistics providers, shipping lines, freight forwarders, and supply chain managers.

Europe Container Drayage Market Market Concentration & Innovation

The Europe Container Drayage Market is characterized by a moderate to high degree of market concentration, with several global giants holding significant market share. Key players like DHL, DB Schenker, and Kuehne + Nagel dominate the landscape, leveraging extensive networks and integrated logistics solutions. Innovation is a critical differentiator, driven by the adoption of advanced technologies such as IoT for real-time tracking, AI for route optimization, and the development of intermodal solutions that seamlessly integrate rail and road transport. Regulatory frameworks, while sometimes posing compliance challenges, also foster standardization and efficiency, particularly concerning emissions and driver hours. Product substitutes, such as direct FTL (Full Truckload) or LTL (Less Than Truckload) services for shorter hauls, exist but often lack the cost-effectiveness and scale offered by drayage for port-related movements. End-user trends are increasingly focused on speed, reliability, and cost optimization, pushing for more integrated and technologically advanced drayage solutions. Mergers and Acquisitions (M&A) activities are prevalent, with deal values in the range of hundreds of millions to billions of Euros, as companies seek to expand their geographic reach, service offerings, and technological capabilities. For instance, the acquisition of ContainerWorld Forwarding Services Inc. by Mullen Group Ltd. signifies a strategic move to consolidate market presence and enhance service offerings within specific niches.

Europe Container Drayage Market Industry Trends & Insights

The Europe Container Drayage Market is experiencing robust growth, fueled by increasing international trade volumes and the expansion of e-commerce. The market size is estimated to reach XX Billion Euros by 2033, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Technological disruptions are at the forefront, with digitalization transforming operations. Advanced fleet management systems, real-time visibility platforms, and predictive analytics are enhancing efficiency and reducing turnaround times. The increasing adoption of automation in ports and terminals further streamlines drayage processes. Consumer preferences are shifting towards sustainable logistics solutions, driving demand for greener transportation options, including electric trucks and optimized rail intermodalism. Competitive dynamics are intensifying, with established players investing heavily in infrastructure, technology, and strategic partnerships to maintain their market positions. The rise of niche drayage providers specializing in specific cargo types or regions also adds to the competitive landscape. Market penetration for intermodal drayage solutions is steadily increasing, driven by the economic and environmental benefits associated with shifting freight from road to rail. The overall market penetration of container drayage services is estimated to be XX% of total containerized freight movements.

Dominant Markets & Segments in Europe Container Drayage Market

The Road segment currently holds the dominant position within the Europe Container Drayage Market, driven by its flexibility, last-mile connectivity, and the extensive road infrastructure across the continent. Countries like Germany, the Netherlands, and France, with their high port throughput and well-developed logistics networks, represent leading regional markets. Key drivers for the dominance of road drayage include:

- Infrastructure Accessibility: The widespread availability of roads and efficient terminal connections ensures rapid delivery and pickup.

- Economic Policies: Government support for road freight and investment in logistics infrastructure continue to bolster this segment.

- Flexibility and Speed: Road transport offers unparalleled flexibility for time-sensitive deliveries and door-to-door service.

However, the Rail segment is poised for significant growth, driven by sustainability initiatives and efforts to alleviate road congestion. Major European rail corridors and intermodal hubs are witnessing increased investment, enhancing their capacity and efficiency for container transport. Strategic partnerships, such as the one announced between PKP Cargo and COSCO, are crucial for expanding intermodal flows across Europe, connecting key ports and inland destinations. The dominance of rail is expected to increase as environmental regulations tighten and the need for cost-effective long-haul freight solutions becomes more pronounced. "Other Modes of Transport," encompassing inland waterways and short-sea shipping, play a crucial role in specific regions, particularly in countries with extensive canal networks like the Netherlands and Belgium, and along coastal routes, offering a sustainable alternative for bulk movements and connecting to major port hubs.

Europe Container Drayage Market Product Developments

Recent product developments in the Europe Container Drayage Market focus on enhancing efficiency, sustainability, and real-time visibility. Companies are investing in advanced fleet management software that integrates GPS tracking, driver behavior monitoring, and predictive maintenance to optimize routes and reduce operational costs. The development of eco-friendlier drayage solutions, including the deployment of electric and hydrogen-powered trucks, is gaining traction, offering competitive advantages in markets with stringent environmental regulations. Furthermore, the integration of blockchain technology for enhanced security and transparency in container tracking and documentation is an emerging trend. These innovations aim to provide customers with seamless, reliable, and environmentally responsible drayage services, fostering stronger customer relationships and market differentiation.

Report Scope & Segmentation Analysis

The Europe Container Drayage Market is segmented based on the Mode of Transport, encompassing Rail, Road, and Other Modes of Transport.

- Road: This segment is characterized by its extensive reach and flexibility, providing last-mile delivery services. Growth projections for this segment remain steady, with an estimated market size of XX Billion Euros by 2033. Competitive dynamics are intense, with a focus on optimizing delivery times and fleet utilization.

- Rail: This segment is experiencing a significant upward trajectory, driven by its cost-effectiveness for long-haul transport and environmental benefits. Growth projections are robust, with an estimated market size of XX Billion Euros by 2033. Competitive advantages lie in the development of intermodal solutions and expanded network reach.

- Other Modes of Transport: This segment includes inland waterways and short-sea shipping. It offers a sustainable and cost-effective alternative for specific routes. Growth projections are moderate, with an estimated market size of XX Billion Euros by 2033. Competitive dynamics focus on intermodal integration and regional connectivity.

Key Drivers of Europe Container Drayage Market Growth

Several key drivers are propelling the Europe Container Drayage Market forward. Increasing international trade volumes and a surge in e-commerce activities necessitate efficient and rapid movement of goods from ports to inland destinations. Technological advancements, such as IoT, AI, and automation, are enhancing operational efficiency, reducing transit times, and improving visibility across the supply chain. Government initiatives and infrastructure investments aimed at improving port connectivity, expanding rail networks, and promoting sustainable logistics practices also play a crucial role. Furthermore, a growing emphasis on supply chain resilience and cost optimization is driving demand for integrated and reliable drayage services. The development of intermodal transport solutions that seamlessly combine different modes of transport is also a significant growth catalyst.

Challenges in the Europe Container Drayage Market Sector

The Europe Container Drayage Market faces several challenges that can impact its growth trajectory. Labor shortages, particularly of qualified truck drivers, continue to be a persistent issue, leading to increased operational costs and delivery delays. Stringent environmental regulations and the push towards decarbonization require significant investment in new technologies and greener fleets, posing a financial burden for some operators. Infrastructure bottlenecks at ports and inland terminals, coupled with increasing container volumes, can lead to congestion and extended turnaround times. Fluctuations in fuel prices directly impact operational costs for road drayage, affecting profitability. Furthermore, complex customs procedures and border delays can add to transit times and introduce inefficiencies into the supply chain. The market also faces intense price competition, which can pressure margins for drayage providers.

Emerging Opportunities in Europe Container Drayage Market

Emerging opportunities in the Europe Container Drayage Market are centered around innovation and sustainability. The growing demand for green logistics solutions presents a significant opportunity for companies investing in electric and hydrogen-powered drayage fleets. Digitalization and the adoption of smart logistics platforms offer opportunities to enhance efficiency, improve customer service, and create new data-driven revenue streams. The development of advanced intermodal hubs and integrated logistics networks that seamlessly connect ports, rail, and road will create new markets and streamline freight flows. There is also a growing opportunity in providing specialized drayage services for specific industries, such as pharmaceuticals or temperature-controlled goods, requiring tailored solutions. The expansion of e-commerce fulfillment centers in strategic inland locations will further drive demand for efficient drayage services to support last-mile delivery networks.

Leading Players in the Europe Container Drayage Market Market

- DHL

- DB Schenker

- Kuehne + Nagel

- CMA CGM

- Maersk Line

- Hapag-Lloyd

- MSC (Mediterranean Shipping Company)

- COSCO Shipping

- Evergreen Marine

- Yang Ming

- 6 3 Other Companies

Key Developments in Europe Container Drayage Market Industry

- June 2024: PKP Cargo and COSCO announced a strategic partnership to enhance intermodal flows throughout Europe, focusing on robust development in transport and logistics. This collaboration aims to extend intermodal services across Western, Central, and Eastern Europe, significantly strengthening COSCO's rail freight presence in the region.

- May 2024: Mullen Group Ltd. finalized the acquisition of ContainerWorld Forwarding Services Inc. ContainerWorld, a key logistics player since 1993 specializing in tailored supply chain solutions for Canada's alcoholic beverage and hospitality industries, will operate as a standalone subsidiary under Mullen Group's ownership, signaling consolidation and strategic expansion within the broader logistics sector.

Strategic Outlook for Europe Container Drayage Market Market

The strategic outlook for the Europe Container Drayage Market is highly positive, driven by an ongoing commitment to technological innovation and sustainability. Growth catalysts include the continued expansion of global trade and the robust performance of the e-commerce sector, both of which inherently rely on efficient container drayage for timely goods movement. Investments in digitalization, such as advanced tracking systems and AI-powered route optimization, will continue to enhance operational efficiency and reduce costs. The increasing emphasis on environmental responsibility is paving the way for broader adoption of green drayage solutions, including electric and alternative fuel vehicles, presenting a significant market differentiation opportunity. Strategic collaborations and the development of integrated intermodal networks are expected to further streamline supply chains, offering enhanced connectivity and reliability. The market is poised for sustained growth, with a focus on creating resilient, cost-effective, and environmentally conscious logistics solutions that cater to the evolving needs of global businesses.

Europe Container Drayage Market Segmentation

-

1. Mode of Transport

- 1.1. Rail

- 1.2. Road

- 1.3. Other Modes of Transport

Europe Container Drayage Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Container Drayage Market Regional Market Share

Geographic Coverage of Europe Container Drayage Market

Europe Container Drayage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing International Trade Driving the Market4.; Increasing Importance of Environmental Sustainability Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing International Trade Driving the Market4.; Increasing Importance of Environmental Sustainability Driving the Market

- 3.4. Market Trends

- 3.4.1. Demand for Containers Driven by Cross-border E-commerce

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Container Drayage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Rail

- 5.1.2. Road

- 5.1.3. Other Modes of Transport

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kuehne + Nagel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CMA CGM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Maersk Line

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hapag-Lloyd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MSC (Mediterranean Shipping Company)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 COSCO Shipping

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evergreen Marine

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yang Ming**List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: Europe Container Drayage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Container Drayage Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 2: Europe Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 3: Europe Container Drayage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Container Drayage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: Europe Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 6: Europe Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 7: Europe Container Drayage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Europe Container Drayage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 11: Germany Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 13: France Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Italy Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Netherlands Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Belgium Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Belgium Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Sweden Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Sweden Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Norway Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Norway Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Poland Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Poland Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Denmark Europe Container Drayage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Denmark Europe Container Drayage Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Container Drayage Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Europe Container Drayage Market?

Key companies in the market include DHL, DB Schenker, Kuehne + Nagel, CMA CGM, Maersk Line, Hapag-Lloyd, MSC (Mediterranean Shipping Company), COSCO Shipping, Evergreen Marine, Yang Ming**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Europe Container Drayage Market?

The market segments include Mode of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.30 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing International Trade Driving the Market4.; Increasing Importance of Environmental Sustainability Driving the Market.

6. What are the notable trends driving market growth?

Demand for Containers Driven by Cross-border E-commerce.

7. Are there any restraints impacting market growth?

4.; Increasing International Trade Driving the Market4.; Increasing Importance of Environmental Sustainability Driving the Market.

8. Can you provide examples of recent developments in the market?

June 2024: PKP Cargo and COSCO announced that they are poised to enhance intermodal flows throughout Europe. Focusing on transport and logistics, their partnership is strategically geared toward robust development. Together, they plan to extend intermodal services, spanning Western, Central, and Eastern Europe. PKP Cargo also plays a pivotal role in strengthening COSCO's rail freight presence in Europe.May 2024: Mullen Group Ltd finalized its acquisition of ContainerWorld Forwarding Services Inc. ContainerWorld, headquartered in Richmond, British Columbia, has been a key player in the logistics scene since its establishment in 1993. Specializing in tailored supply chain solutions, ContainerWorld primarily caters to Canada's alcoholic beverage and hospitality industries. Going forward, ContainerWorld will function as a standalone subsidiary under Mullen Group's ownership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Container Drayage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Container Drayage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Container Drayage Market?

To stay informed about further developments, trends, and reports in the Europe Container Drayage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence