Key Insights

The North American Fast-Moving Consumer Goods (FMCG) logistics market, valued at $322.97 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.84% from 2025 to 2033. This expansion is driven by several key factors. E-commerce continues its rapid ascent, demanding increasingly sophisticated and efficient logistics solutions to meet consumer expectations for faster delivery and greater convenience. Simultaneously, the rise of omnichannel retail strategies necessitates a flexible and adaptable supply chain capable of seamlessly integrating online and offline operations. Furthermore, growing consumer preference for healthier and more sustainable products influences logistics operations, prompting a need for specialized handling and temperature-controlled transportation, particularly within the food and beverage segment. The increasing focus on supply chain resilience and risk mitigation, following recent global disruptions, is also contributing to market growth as businesses invest in advanced technologies and diversified logistics partnerships. Competition is fierce, with major players like DB Schenker, DHL, FedEx, and Kuehne + Nagel vying for market share through technological innovation, service diversification, and strategic acquisitions.

North America Fast Moving Consumer Goods Industry Market Size (In Million)

Segmentation within the market reveals significant opportunities. The transportation segment, encompassing trucking, rail, and air freight, constitutes a considerable portion of the overall market, while warehousing and distribution are crucial supporting functions. Inventory management services are experiencing growing demand as businesses strive to optimize stock levels and reduce warehousing costs. The food and beverage sector holds the largest share within the product category segment, reflecting the high volume and specialized handling requirements of perishable goods. Within North America, the United States, owing to its large population and developed infrastructure, dominates the market, followed by Canada and Mexico. The "Other Consumables" category, encompassing personal care and household care goods, also shows potential for growth, reflecting increasing consumer demand. Continued investment in technology and infrastructure, coupled with adapting to the evolving needs of the e-commerce landscape, will determine the trajectory of this expanding market.

North America Fast Moving Consumer Goods Industry Company Market Share

This comprehensive report provides a detailed analysis of the North America Fast Moving Consumer Goods industry, covering market size, growth drivers, challenges, opportunities, and competitive landscape from 2019 to 2033. The study offers actionable insights for industry stakeholders, including manufacturers, logistics providers, and investors. The report uses 2025 as the base year and forecasts market trends until 2033, leveraging data from the historical period (2019-2024). Key players analyzed include DB Schenker, APL Logistics, Nippon Express, DHL Group, C.H. Robinson Worldwide Inc, XPO Logistics, FedEx, CEVA Logistics, Agility Logistics, Kuehne + Nagel, and Hellmann Worldwide Logistics (list not exhaustive).

North America Fast Moving Consumer Goods Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities within the North American FMCG industry. The market is characterized by a moderate level of concentration, with the top 5 players holding an estimated xx% market share in 2025. Innovation is driven by factors such as increasing consumer demand for sustainable and healthier products, technological advancements in supply chain management, and the rise of e-commerce. Regulatory frameworks, including food safety regulations and environmental protection laws, significantly influence industry operations. The prevalence of private label brands and the emergence of direct-to-consumer (DTC) models represent key product substitutes. End-user trends reveal a growing preference for convenience, personalization, and value. Significant M&A activities, with a total deal value of approximately $xx Million in 2024, reshape the competitive landscape.

- Market Share (2025): Top 5 players - xx%

- M&A Deal Value (2024): $xx Million

- Key Innovation Drivers: Sustainability, Technology, E-commerce

North America Fast Moving Consumer Goods Industry Industry Trends & Insights

The North American FMCG market exhibits robust growth, driven by several key factors. The industry's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Market penetration of new products and services is also increasing, particularly in online channels. Technological disruptions, such as automation and artificial intelligence (AI) in logistics and supply chain management, are significantly impacting efficiency and cost optimization. Evolving consumer preferences toward healthier, sustainable, and ethically sourced products are reshaping product development strategies. Intense competitive dynamics, fueled by both established players and emerging brands, necessitate continuous innovation and strategic adaptations.

Dominant Markets & Segments in North America Fast Moving Consumer Goods Industry

The North American FMCG market is geographically diverse, with significant variations in consumption patterns across different regions and countries. The Food and Beverage segment dominates the market by product category due to its large consumer base and essential nature. Within services, Transportation holds the largest share due to the volume of goods moved.

Leading Regions/Countries: (Analysis based on factors like population density, disposable income, and retail infrastructure) xx (Largest Market) and xx (Fastest Growing Market).

Dominant Segments:

- By Service:

- Transportation: High volume of goods requiring efficient movement.

- Warehousing: Demand for efficient storage solutions, particularly near major population centers.

- Distribution: Complex networks essential for timely delivery to various retail outlets.

- Inventory Management: Sophisticated systems essential for managing vast product portfolios.

- Other Value-added Services: Growing demand for customized services like packaging and labeling.

- By Product Category:

- Food and Beverage: Largest segment due to basic needs and diverse product offerings.

- Personal Care: Growing demand for premium and specialized products.

- Household Care: Steady growth driven by regular household consumption.

- Other Consumables: Includes various goods, with growth dependent on specific product trends.

Key Drivers of Segment Dominance:

- Economic Policies: Government regulations and incentives for infrastructure development.

- Infrastructure: Efficient transportation networks and warehousing facilities are crucial.

North America Fast Moving Consumer Goods Industry Product Developments

The FMCG industry showcases continuous product innovation, focusing on enhancing convenience, health, sustainability, and personalization. Technological advancements drive this, with smart packaging, personalized nutrition solutions, and sustainable materials becoming increasingly prevalent. These innovations improve shelf life, provide customized experiences, and reduce environmental impact, thus improving market fit and fostering competitive advantages.

Report Scope & Segmentation Analysis

This report segments the North American FMCG market by service (Transportation, Warehousing, Distribution, Inventory Management, Other Value-added Services) and by product category (Food and Beverage, Personal Care, Household Care, Other Consumables). Each segment's market size, growth projections, and competitive dynamics are analyzed, providing a comprehensive understanding of the market structure. Growth projections vary across segments based on factors like consumer demand and technological disruption. Competitive intensity also differs based on segment size and the presence of major players.

Key Drivers of North America Fast Moving Consumer Goods Industry Growth

Growth in the North American FMCG industry is driven by several factors. Increasing disposable incomes fuel consumer spending. E-commerce expansion provides new sales channels and access to wider markets. Technological advancements, such as AI-powered supply chain optimization, enhance efficiency. Favorable regulatory environments promoting competition and innovation contribute to growth.

Challenges in the North America Fast Moving Consumer Goods Industry Sector

Several challenges impact the North American FMCG industry. Fluctuating raw material prices affect profitability. Supply chain disruptions due to geopolitical instability or natural disasters create bottlenecks. Intense competition from both domestic and international players requires constant innovation and cost control. Stringent regulatory compliance adds to operational costs. Changing consumer preferences and demand for sustainability pose further challenges.

Emerging Opportunities in North America Fast Moving Consumer Goods Industry

The North American FMCG industry presents significant emerging opportunities. Growing demand for personalized and customized products creates new market segments. The rising adoption of e-commerce opens new distribution channels and enhances market reach. The increasing focus on sustainability and ethical sourcing provides opportunities for brands committed to environmentally responsible practices. Expansion into underserved markets and the utilization of advanced analytics for targeted marketing offer further growth potential.

Leading Players in the North America Fast Moving Consumer Goods Industry Market

- DB Schenker

- APL Logistics

- Nippon Express

- DHL Group

- C.H. Robinson Worldwide Inc

- XPO Logistics

- FedEx

- CEVA Logistics

- Agility Logistics

- Kuehne + Nagel

- Hellmann Worldwide Logistics

Key Developments in North America Fast Moving Consumer Goods Industry Industry

- 2023-Q4: XPO Logistics announces a major expansion of its warehousing capacity in the Midwest.

- 2024-Q1: DHL Group launches a new sustainable packaging initiative for FMCG products.

- 2024-Q3: Merger between two significant players in the personal care segment.

- (Add further developments with specific dates and impact)

Strategic Outlook for North America Fast Moving Consumer Goods Industry Market

The North American FMCG market is poised for continued growth, driven by robust consumer demand, technological advancements, and increasing e-commerce penetration. Opportunities exist for players who prioritize innovation, sustainability, and efficient supply chain management. Strategic partnerships and mergers & acquisitions will further shape the market landscape. Focus on adapting to evolving consumer preferences and leveraging technology will be crucial for success.

North America Fast Moving Consumer Goods Industry Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehous

- 1.3. Other Value-added Services

-

2. Product Category

- 2.1. Food and Beverage

- 2.2. Personal Care

- 2.3. Household Care

- 2.4. Other Consumables

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Fast Moving Consumer Goods Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

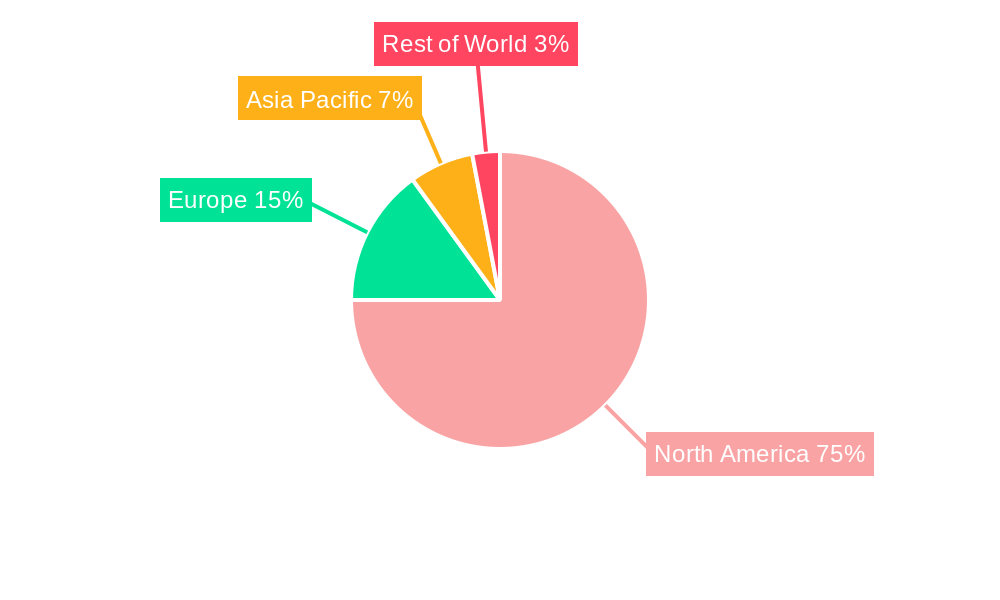

North America Fast Moving Consumer Goods Industry Regional Market Share

Geographic Coverage of North America Fast Moving Consumer Goods Industry

North America Fast Moving Consumer Goods Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strategic Location; Economic diversification

- 3.3. Market Restrains

- 3.3.1. Infrastructure challenges; Skilled workforce

- 3.4. Market Trends

- 3.4.1. Increasing Growth in Food and Beverages Products are Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fast Moving Consumer Goods Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehous

- 5.1.3. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Product Category

- 5.2.1. Food and Beverage

- 5.2.2. Personal Care

- 5.2.3. Household Care

- 5.2.4. Other Consumables

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. United States North America Fast Moving Consumer Goods Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehous

- 6.1.3. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by Product Category

- 6.2.1. Food and Beverage

- 6.2.2. Personal Care

- 6.2.3. Household Care

- 6.2.4. Other Consumables

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Canada North America Fast Moving Consumer Goods Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehous

- 7.1.3. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by Product Category

- 7.2.1. Food and Beverage

- 7.2.2. Personal Care

- 7.2.3. Household Care

- 7.2.4. Other Consumables

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Mexico North America Fast Moving Consumer Goods Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehous

- 8.1.3. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by Product Category

- 8.2.1. Food and Beverage

- 8.2.2. Personal Care

- 8.2.3. Household Care

- 8.2.4. Other Consumables

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 DB Schenker

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 APL Logistics**List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Nippon Express

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 DHL Group

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 C H Robinson Worldwide Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 XPO Logistics

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 FedEx

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 CEVA Logistics

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Agility Logistics

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Kuehne + Nagel

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Hellmann Worlwide Logistics

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 DB Schenker

List of Figures

- Figure 1: North America Fast Moving Consumer Goods Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Fast Moving Consumer Goods Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 3: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 6: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 7: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 10: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 11: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 14: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Product Category 2020 & 2033

- Table 15: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Fast Moving Consumer Goods Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fast Moving Consumer Goods Industry?

The projected CAGR is approximately 4.84%.

2. Which companies are prominent players in the North America Fast Moving Consumer Goods Industry?

Key companies in the market include DB Schenker, APL Logistics**List Not Exhaustive, Nippon Express, DHL Group, C H Robinson Worldwide Inc, XPO Logistics, FedEx, CEVA Logistics, Agility Logistics, Kuehne + Nagel, Hellmann Worlwide Logistics.

3. What are the main segments of the North America Fast Moving Consumer Goods Industry?

The market segments include Service, Product Category, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 322.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Strategic Location; Economic diversification.

6. What are the notable trends driving market growth?

Increasing Growth in Food and Beverages Products are Driving the Market Growth.

7. Are there any restraints impacting market growth?

Infrastructure challenges; Skilled workforce.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fast Moving Consumer Goods Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fast Moving Consumer Goods Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fast Moving Consumer Goods Industry?

To stay informed about further developments, trends, and reports in the North America Fast Moving Consumer Goods Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence