Key Insights

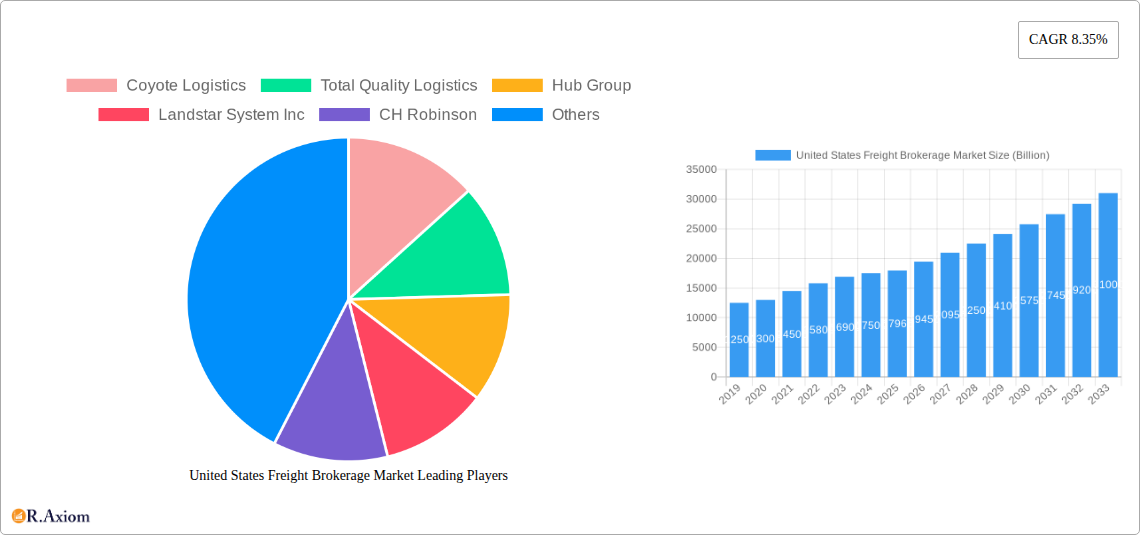

The United States freight brokerage market is poised for substantial growth, with an estimated market size of $17.96 billion in 2025, projected to expand at a robust Compound Annual Growth Rate (CAGR) of 8.35%. This upward trajectory is propelled by several key drivers, including the increasing demand for efficient supply chain solutions and the growing reliance on third-party logistics (3PL) providers to navigate complex transportation networks. The surge in e-commerce has significantly amplified shipping volumes, creating a continuous need for flexible and cost-effective freight brokerage services to manage the influx of goods. Furthermore, the ongoing digitalization of the logistics sector, with advancements in load matching platforms, real-time tracking, and data analytics, is enhancing operational efficiency and transparency, thereby stimulating market expansion. The market's segmentation reveals a strong emphasis on Less-Than-Truckload (LTL) and Full Truckload (FTL) services, catering to a diverse range of shipping needs. Key end-user industries such as Manufacturing and Automotive, along with Mining and Quarrying, are significant contributors, driven by their substantial freight volumes and the necessity for specialized logistics management.

United States Freight Brokerage Market Market Size (In Billion)

Despite the prevailing growth, the market is not without its challenges. Rising operational costs, including fuel price volatility and labor shortages within the trucking industry, present significant restraints. However, these challenges are being actively addressed through technological innovation and strategic partnerships. The market is characterized by a dynamic competitive landscape, featuring established players like CH Robinson, XPO Logistics Inc., and J.B. Hunt Transport Inc., alongside innovative newcomers such as Uber Freight, all vying for market share through service differentiation and technological advancements. The continued adoption of advanced brokerage solutions, coupled with a focus on optimizing capacity and enhancing customer experience, will be crucial for sustained success. The market's ability to adapt to evolving regulatory environments and economic shifts will further shape its future trajectory.

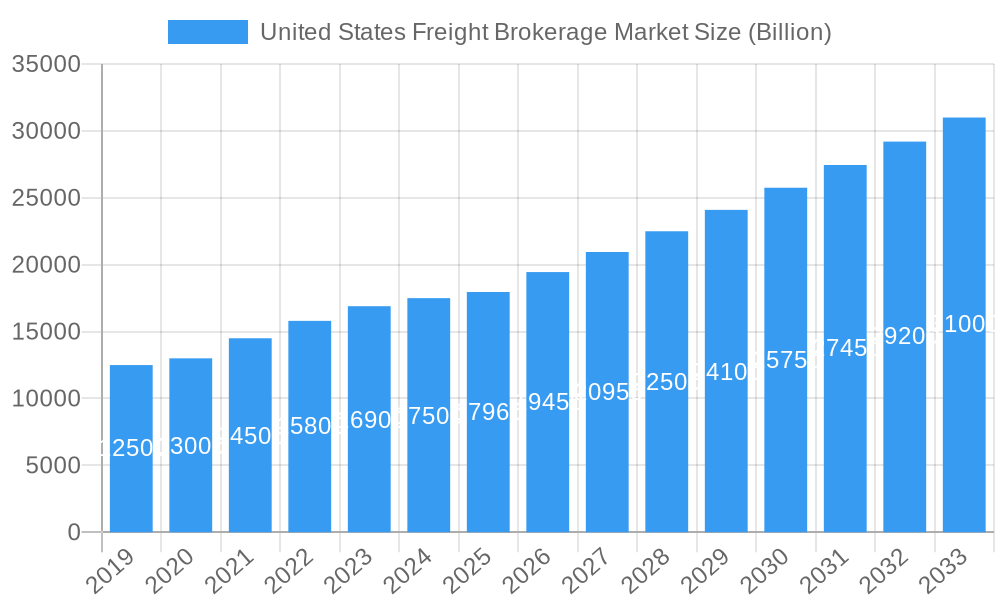

United States Freight Brokerage Market Company Market Share

This in-depth report provides a comprehensive analysis of the United States freight brokerage market, offering strategic insights for industry stakeholders. The study covers the historical period from 2019 to 2024, with the base and estimated year at 2025, and forecasts growth through 2033. This report is designed for immediate use without further modification, incorporating high-traffic keywords to maximize search visibility and engagement.

United States Freight Brokerage Market Market Concentration & Innovation

The United States freight brokerage market is characterized by a moderate level of concentration, with a few dominant players holding significant market share, estimated at over 60% of the total market value. This concentration is driven by economies of scale, established carrier networks, and advanced technological capabilities. Innovation plays a pivotal role in differentiating players, with investments in digital platforms, real-time tracking, and data analytics becoming crucial for operational efficiency and customer service. Regulatory frameworks, primarily governed by the Federal Motor Carrier Safety Administration (FMCSA) and the Department of Transportation (DOT), ensure safety and compliance, impacting operational costs and market entry barriers. Product substitutes, such as in-house logistics departments and direct carrier relationships, exist but are often less cost-effective for shippers requiring flexible capacity and specialized services. End-user trends are shifting towards demand for faster delivery times, greater transparency, and sustainable logistics solutions, influencing brokerage service offerings. Mergers and acquisitions (M&A) activities are frequent, with major deals valued in the hundreds of millions to billions of dollars, consolidating market power and expanding service portfolios. Notable M&A activities include acquisitions aimed at integrating technology solutions or expanding geographic reach.

- Market Share of Top Players: Estimated at over 60% of the total market value.

- M&A Deal Values: Ranging from hundreds of millions to billions of dollars.

- Key Innovation Drivers: Digital platforms, real-time tracking, data analytics, AI-powered load matching, and sustainability initiatives.

- Regulatory Bodies: FMCSA, DOT.

- End-User Demand Shifts: Faster delivery, increased transparency, sustainability.

United States Freight Brokerage Market Industry Trends & Insights

The United States freight brokerage market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period. This expansion is fueled by several key trends, including the relentless growth of e-commerce, which necessitates efficient and flexible last-mile delivery solutions. The increasing complexity of supply chains, driven by globalization and fluctuating consumer demand, further amplifies the need for expert freight brokerage services to manage intricate logistics networks. Technological advancements are revolutionizing the industry; digital freight matching platforms, artificial intelligence (AI) for route optimization and predictive analytics, and blockchain for enhanced transparency and security are becoming standard. The demand for intermodal transportation solutions is also rising as businesses seek cost-effective and environmentally friendly ways to move goods. Consumer preferences are evolving, with a strong emphasis on speed, reliability, and visibility throughout the shipping process. This has pushed freight brokers to invest heavily in technology that offers real-time tracking and proactive communication. Competitive dynamics are intensifying, with established players leveraging their scale and technology, while new entrants are disrupting the market with innovative digital-first approaches. The market penetration of digital brokerage services is expected to continue its upward trajectory, transforming traditional brokerage models. The growing emphasis on Environmental, Social, and Governance (ESG) principles is also influencing the market, with a greater focus on sustainable transportation options and ethical supply chain practices. The logistics sector's resilience, even amidst economic fluctuations, underpins the steady demand for freight brokerage services.

- Projected CAGR: Approximately 6.5% from 2025 to 2033.

- Key Growth Drivers: E-commerce boom, complex supply chains, technological adoption (AI, digital platforms), intermodal transportation, consumer demand for speed and visibility, and ESG focus.

- Market Penetration: Increasing adoption of digital brokerage services.

- Technological Disruptions: AI for optimization, real-time tracking, blockchain for transparency.

Dominant Markets & Segments in United States Freight Brokerage Market

The United States freight brokerage market exhibits significant dominance across various segments, driven by economic policies, infrastructure development, and sector-specific demands.

Service Segmentation:

- Full Truckload (FTL): This segment remains the largest and most dominant within the freight brokerage market, accounting for an estimated 55% of the total market value. The continued reliance on FTL for bulk shipments, long-haul transportation, and time-sensitive deliveries for industries like manufacturing, retail, and construction solidifies its leading position. The vast network of carriers and the efficiency in managing end-to-end FTL movements make it a cornerstone of brokerage operations. Key drivers include the expansive U.S. geography, the necessity for dedicated capacity for large volumes, and the demand from industries with significant raw material and finished goods transportation needs.

- Less Than Truckload (LTL): LTL services are a rapidly growing segment, projected to capture approximately 30% of the market by 2033. This growth is propelled by the increasing number of small and medium-sized businesses requiring cost-effective shipping solutions for smaller freight volumes. The rise of e-commerce, which often involves fragmented shipments, further boosts LTL demand. Technological advancements in LTL consolidation and route optimization are enhancing efficiency and reducing transit times. The ability to consolidate shipments from multiple customers into a single truckload makes LTL a more sustainable and economical option for many.

- Other Services: This segment, encompassing specialized freight like temperature-controlled, oversized, and hazardous materials, along with value-added services such as warehousing and cross-docking, constitutes the remaining 15% of the market. While smaller in proportion, these services often command higher margins due to their specialized nature and require expertise in handling unique logistical challenges.

End-User Segmentation:

- Manufacturing and Automotive: This sector is consistently the largest end-user of freight brokerage services, representing approximately 25% of the market. The continuous flow of raw materials, components, and finished vehicles across the country necessitates efficient and reliable transportation solutions. The industry's demand for just-in-time (JIT) delivery further amplifies the role of freight brokers in coordinating complex logistics.

- Distribution: The distribution sector, including wholesalers and retailers, is another major consumer of freight brokerage services, accounting for around 20% of the market. The efficient movement of goods from manufacturers to distribution centers and then to retail outlets is critical for supply chain management.

- Construction: The construction industry relies heavily on freight brokerage for the transportation of building materials, heavy machinery, and equipment. This segment represents approximately 15% of the market, with demand closely tied to infrastructure projects and housing development.

- Oil and Gas, Mining, and Quarrying: These industries, collectively accounting for about 10% of the market, require specialized transportation for heavy equipment, extracted resources, and supplies to remote locations. The logistical challenges associated with these sectors create a sustained demand for brokerage expertise.

- Agriculture, Fishing, and Forestry: This segment, contributing around 8% to the market, demands efficient transportation for perishable goods, harvested crops, timber, and seafood, often requiring temperature-controlled and expedited services.

- Other End Users: The remaining percentage is comprised of diverse industries such as healthcare, technology, and consumer goods, each with unique transportation requirements that freight brokers effectively address.

United States Freight Brokerage Market Product Developments

Recent product developments in the U.S. freight brokerage market are heavily influenced by technological innovation aimed at enhancing efficiency, transparency, and customer satisfaction. Digital platforms are continuously being refined to offer seamless booking, real-time tracking, and automated communication. Innovations like AI-powered load matching are optimizing carrier selection and route planning, reducing transit times and costs. Furthermore, the development of integrated supply chain management software provides shippers with end-to-end visibility and control. The focus on sustainability is also driving the development of services that promote less-than-truckload (LTL) consolidation and the use of alternative fuel vehicles. These advancements are crucial for brokers to maintain a competitive edge and meet the evolving demands of their clientele.

Report Scope & Segmentation Analysis

This report meticulously analyzes the United States freight brokerage market across various segments to provide granular insights. The market is segmented by Service into Less Than Truckload (LTL), Full Truckload (FTL), and Other Services. The End-User segmentation includes Manufacturing and Automotive, Oil and Gas, Mining, and Quarrying, Agriculture, Fishing, and Forestry, Construction, Distribution, and Other End Users. Each segment is examined for its current market size, projected growth rates, and the competitive dynamics shaping its landscape. Projections indicate continued strong growth for FTL due to its foundational role in U.S. logistics, while LTL is expected to see accelerated expansion driven by e-commerce. Other services, though niche, offer higher margins and cater to specialized needs. The manufacturing, automotive, and distribution sectors will continue to be dominant end-users, with emerging sectors showing potential for significant growth.

Key Drivers of United States Freight Brokerage Market Growth

Several key factors are driving the substantial growth of the United States freight brokerage market. The exponential rise of e-commerce continues to be a primary catalyst, increasing the demand for efficient and agile last-mile delivery and fulfillment solutions. Advancements in technology, particularly the adoption of digital freight matching platforms, AI for route optimization, and IoT for real-time tracking, are enhancing operational efficiency and transparency, thereby lowering costs and improving service quality. The increasing complexity and globalization of supply chains necessitate the expertise of freight brokers to navigate intricate logistics networks. Furthermore, a strong U.S. economy, characterized by consistent manufacturing output and consumer spending, underpins the demand for goods transportation. Regulatory support for supply chain efficiency and infrastructure development also contributes positively to market expansion.

Challenges in the United States Freight Brokerage Market Sector

Despite robust growth, the United States freight brokerage market faces several significant challenges. A persistent shortage of qualified truck drivers impacts carrier capacity and can lead to increased freight rates and delivery delays. Fluctuations in fuel prices introduce volatility into operational costs, directly affecting profitability. Intense competition among brokerage firms, including the rise of digital-native disruptors, puts pressure on margins and necessitates continuous investment in technology and service differentiation. Navigating evolving regulatory landscapes, such as emissions standards and driver hours-of-service regulations, requires constant adaptation and compliance efforts. Furthermore, the inherent economic cyclicality can lead to demand fluctuations, posing challenges for capacity planning and resource allocation. Cybersecurity threats to digital platforms also represent a growing concern, demanding robust data protection measures.

Emerging Opportunities in United States Freight Brokerage Market

The United States freight brokerage market is ripe with emerging opportunities. The rapid expansion of e-commerce continues to drive demand for specialized fulfillment and last-mile delivery solutions, creating niches for agile and tech-savvy brokers. The increasing focus on sustainability presents a significant opportunity for brokers who can offer greener logistics options, such as intermodal transportation, optimized routing for fuel efficiency, and partnerships with electric vehicle carriers. Technological advancements, including the broader adoption of AI and machine learning for predictive analytics, dynamic pricing, and autonomous trucking integration, will redefine operational efficiencies and service offerings. The growing demand for temperature-controlled and specialized freight for industries like pharmaceuticals and fresh produce also presents lucrative avenues. Furthermore, the consolidation of smaller brokerages by larger players creates opportunities for strategic partnerships and acquisitions, expanding market reach and service portfolios.

Leading Players in the United States Freight Brokerage Market Market

- Coyote Logistics

- Total Quality Logistics

- Hub Group

- Landstar System Inc

- CH Robinson

- KAG Logistics Inc

- SunteckTTS

- BNSF Logistics LLC

- XPO Logistics Inc

- Uber Freight

- Worldwide Express

- Schneider

- Echo Global Logistics

- GlobalTranz

- J B Hunt Transport Inc

- 6 3 Other Companies (List Not Exhaustive)

Key Developments in United States Freight Brokerage Market Industry

- August 2023: Digital logistics provider and freight brokerage Convoy unveiled an offering for just-in-time (JIT) trucking, with a pledge of delivery within 15 minutes of the set arrival time. Convoy spotted an opening for a more flexible service that gives shippers the ability to scale up and down in response to fast-changing conditions. Its new JIT service leverages a network of over 400,000 trucks and the IT infrastructure to find matching carriers to meet specific shipper requirements.

- February 2023: Echo Global Logistics Inc. (Echo), one of the leading providers of technology-enabled transportation and supply chain management services, launched EchoInsure+, a new and integrated, full-coverage cargo insurance product offered exclusively to Echo’s clients. By partnering with insurance group Falvey, EchoInsure+ offers an easy way for clients to access best-in-class protection for their LTL shipments through EchoShip, Echo's proprietary online shipping platform, and Echo’s representatives.

Strategic Outlook for United States Freight Brokerage Market Market

The strategic outlook for the United States freight brokerage market is exceptionally strong, driven by ongoing economic expansion and the indispensable role of logistics in modern commerce. Key growth catalysts include the continued surge in e-commerce, which mandates faster and more reliable delivery networks, and the persistent need for supply chain resilience in the face of global disruptions. Investments in advanced technologies, such as AI, IoT, and blockchain, will remain critical for enhancing operational efficiency, providing real-time visibility, and optimizing cost structures. The increasing demand for sustainable logistics solutions presents a significant opportunity for brokers to differentiate themselves by offering eco-friendly transportation options. Mergers and acquisitions are expected to continue, leading to market consolidation and the emergence of larger, more comprehensive service providers. Freight brokers who can effectively integrate technology, adapt to evolving customer demands for speed and transparency, and embrace sustainable practices are well-positioned to capitalize on the significant future market potential and emerging opportunities.

United States Freight Brokerage Market Segmentation

-

1. Service

- 1.1. LTL

- 1.2. FTL

- 1.3. Other Services

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distribu

- 2.6. Other En

United States Freight Brokerage Market Segmentation By Geography

- 1. United States

United States Freight Brokerage Market Regional Market Share

Geographic Coverage of United States Freight Brokerage Market

United States Freight Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Construction Across the Country4.; The Growing Number of Freight Brokers Across the Country

- 3.3. Market Restrains

- 3.3.1. 4.; Rerouting of Cargo and Other Factors4.; Reducing Freight Imports Across the Country

- 3.4. Market Trends

- 3.4.1. FTL Service Has Gained Momentum in the Country in Recent Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Freight Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. LTL

- 5.1.2. FTL

- 5.1.3. Other Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Coyote Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Total Quality Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hub Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Landstar System Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CH Robinson

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KAG Logistics Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SunteckTTS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BNSF Logistics LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 XPO Logistics Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Uber Freight**List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Worldwide Express

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Schneider

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Echo Global Logistics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 GlobalTranz

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 J B Hunt Transport Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Coyote Logistics

List of Figures

- Figure 1: United States Freight Brokerage Market Revenue Breakdown (Billion, %) by Product 2025 & 2033

- Figure 2: United States Freight Brokerage Market Share (%) by Company 2025

List of Tables

- Table 1: United States Freight Brokerage Market Revenue Billion Forecast, by Service 2020 & 2033

- Table 2: United States Freight Brokerage Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 3: United States Freight Brokerage Market Revenue Billion Forecast, by Region 2020 & 2033

- Table 4: United States Freight Brokerage Market Revenue Billion Forecast, by Service 2020 & 2033

- Table 5: United States Freight Brokerage Market Revenue Billion Forecast, by End User 2020 & 2033

- Table 6: United States Freight Brokerage Market Revenue Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Freight Brokerage Market?

The projected CAGR is approximately 8.35%.

2. Which companies are prominent players in the United States Freight Brokerage Market?

Key companies in the market include Coyote Logistics, Total Quality Logistics, Hub Group, Landstar System Inc, CH Robinson, KAG Logistics Inc, SunteckTTS, BNSF Logistics LLC, XPO Logistics Inc, Uber Freight**List Not Exhaustive 6 3 Other Companie, Worldwide Express, Schneider, Echo Global Logistics, GlobalTranz, J B Hunt Transport Inc.

3. What are the main segments of the United States Freight Brokerage Market?

The market segments include Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.96 Billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Construction Across the Country4.; The Growing Number of Freight Brokers Across the Country.

6. What are the notable trends driving market growth?

FTL Service Has Gained Momentum in the Country in Recent Years.

7. Are there any restraints impacting market growth?

4.; Rerouting of Cargo and Other Factors4.; Reducing Freight Imports Across the Country.

8. Can you provide examples of recent developments in the market?

August 2023: Digital logistics provider and freight brokerage Convoy unveiled an offering for just-in-time (JIT) trucking, with a pledge of delivery within 15 minutes of the set arrival time. Convoy spotted an opening for a more flexible service that gives shippers the ability to scale up and down in response to fast-changing conditions. Its new JIT service leverages a network of over 400,000 trucks and the IT infrastructure to find matching carriers to meet specific shipper requirements.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Freight Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Freight Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Freight Brokerage Market?

To stay informed about further developments, trends, and reports in the United States Freight Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence