Key Insights

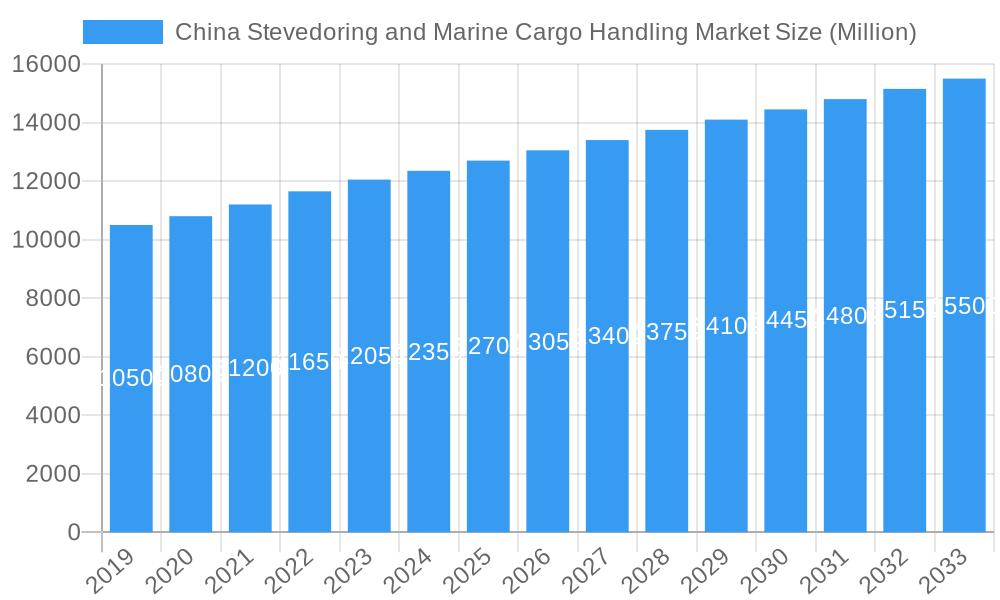

The China Stevedoring and Marine Cargo Handling Market is poised for robust expansion, projecting a market size of approximately USD 12,500 million in 2025, with a Compound Annual Growth Rate (CAGR) exceeding 3.50% through 2033. This growth is primarily propelled by China's sustained position as a global manufacturing hub, driving significant import and export volumes of goods. The increasing complexity and scale of international trade necessitate advanced stevedoring and cargo handling services, encompassing efficient loading, unloading, and transshipment operations. Key drivers include the continuous development and modernization of China's port infrastructure, investment in automated handling equipment, and the growing demand for specialized handling of diverse cargo types, from bulk commodities to high-value containerized goods. Furthermore, the expansion of Free Trade Zones and the Belt and Road Initiative are expected to stimulate increased maritime traffic, thereby bolstering demand for these essential logistics services.

China Stevedoring and Marine Cargo Handling Market Market Size (In Billion)

The market is segmented by type, with 'Stevedoring' and 'Cargo and handling transportation' holding dominant shares, reflecting the core activities of the industry. The 'Bulk Cargo' and 'Containerized Cargo' segments are expected to witness substantial growth, driven by their critical role in global supply chains. While the market benefits from these strong growth factors, it also faces certain restraints. These include the potential for rising operational costs, including labor and equipment maintenance, and stringent environmental regulations that may require significant investment in greener technologies. Moreover, geopolitical factors and global economic fluctuations can introduce volatility into trade volumes, impacting demand for stevedoring services. Despite these challenges, the ongoing technological advancements in port automation, digitalization of logistics processes, and the inherent resilience of China's export-oriented economy suggest a positive and dynamic outlook for the stevedoring and marine cargo handling sector.

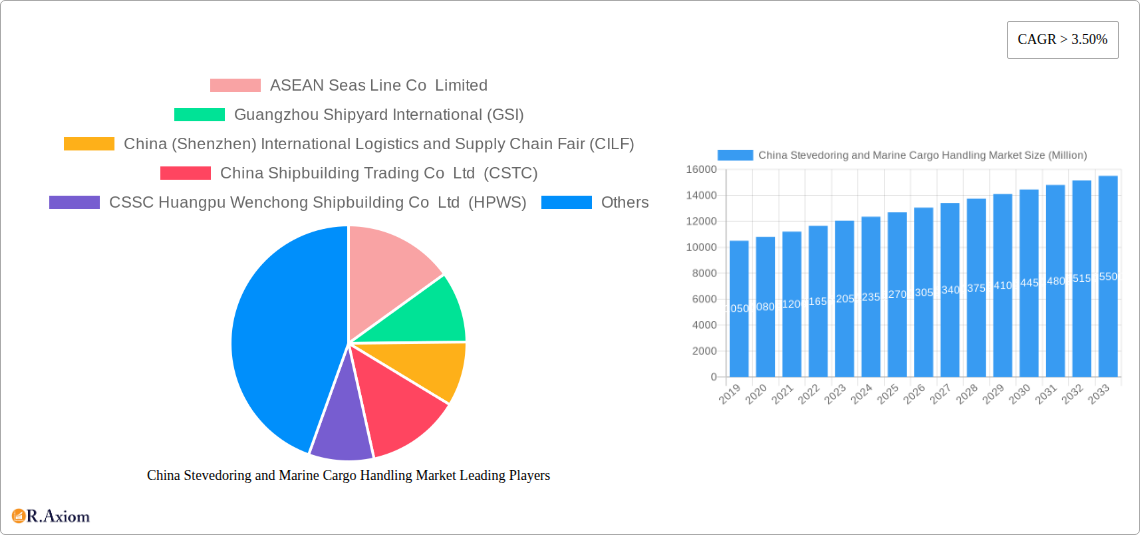

China Stevedoring and Marine Cargo Handling Market Company Market Share

This in-depth report provides a detailed analysis of the China Stevedoring and Marine Cargo Handling Market, offering critical insights into market dynamics, growth drivers, competitive landscape, and future trends. Covering the period from 2019 to 2033, with a base year of 2025, this research is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this vital sector of global trade. We delve into market concentration, technological innovations, regulatory environments, and consumer preferences, presenting a clear roadmap for strategic decision-making.

China Stevedoring and Marine Cargo Handling Market Market Concentration & Innovation

The China Stevedoring and Marine Cargo Handling Market exhibits a moderate to high level of market concentration, with a few dominant players controlling significant market share. However, the landscape is dynamic, driven by continuous innovation and strategic investments. Key innovation drivers include the adoption of advanced automation technologies, such as robotic cranes and automated guided vehicles (AGVs), aimed at increasing efficiency and reducing operational costs. Stringent regulatory frameworks by the Chinese government, focused on environmental protection and safety standards, also shape innovation. For instance, the push for greener port operations is leading to the development of electric-powered handling equipment and advanced waste management systems.

- Market Share: While specific granular market share data for all players is proprietary, leading entities in stevedoring and marine cargo handling command substantial percentages, especially in major port hubs like Shanghai, Ningbo-Zhoushan, and Shenzhen.

- Innovation Trends:

- Automation & Robotics: Increased deployment of automated quay cranes, yard cranes, and AGVs.

- Digitalization: Integration of IoT, AI, and blockchain for enhanced supply chain visibility and operational efficiency.

- Green Port Initiatives: Focus on reducing emissions, optimizing energy consumption, and sustainable waste management.

- M&A Activities: Mergers and acquisitions are a recurring theme as larger entities seek to expand their geographical footprint and service offerings. Recent M&A deal values are estimated to be in the hundreds of millions of USD as consolidation continues. Companies are actively acquiring smaller regional players or forging strategic alliances to enhance their competitive edge.

- Product Substitutes: While direct substitutes for core stevedoring and cargo handling services are limited, advancements in multimodal transportation and the development of inland logistics hubs can indirectly influence demand at port facilities.

China Stevedoring and Marine Cargo Handling Market Industry Trends & Insights

The China Stevedoring and Marine Cargo Handling Market is poised for robust growth, fueled by China's pivotal role in global trade and its continuous economic expansion. The market is characterized by a dynamic interplay of technological advancements, evolving consumer preferences, and intensified competitive pressures. The Compound Annual Growth Rate (CAGR) is projected to be between 6.5% and 8.0% over the forecast period (2025-2033). Market penetration of advanced technologies such as AI-powered logistics management systems and IoT sensors for real-time cargo tracking is steadily increasing, contributing to operational efficiency and reduced turnaround times.

The burgeoning e-commerce sector in China significantly influences the demand for containerized cargo handling, driving higher volumes and the need for specialized logistics solutions. Furthermore, the ongoing development of the Belt and Road Initiative (BRI) continues to boost international trade flows, directly benefiting China's port infrastructure and cargo handling services. The increasing emphasis on sustainability and environmental compliance is a major trend, pushing operators to invest in greener technologies and practices, such as the adoption of LNG-powered vessels and cleaner port operations. This shift is not only driven by regulatory mandates but also by a growing awareness of corporate social responsibility among industry players.

Technological disruptions, including the adoption of autonomous vehicles for yard operations and the use of big data analytics for predictive maintenance and resource optimization, are transforming the efficiency and competitiveness of the sector. Consumer preferences are leaning towards faster delivery times and more transparent supply chains, necessitating enhanced operational agility from cargo handlers. The competitive dynamics are intensifying, with both domestic and international players vying for market share through service diversification, technological superiority, and strategic partnerships. Companies are increasingly focusing on offering integrated logistics solutions beyond traditional stevedoring, encompassing warehousing, distribution, and customs clearance services. The sheer scale of China's manufacturing output and its position as a global export powerhouse underpins the sustained demand for efficient and cost-effective marine cargo handling services.

Dominant Markets & Segments in China Stevedoring and Marine Cargo Handling Market

The China Stevedoring and Marine Cargo Handling Market is overwhelmingly dominated by Containerized Cargo, driven by the nation's status as a global manufacturing hub and its extensive involvement in international trade. This segment consistently accounts for the largest share of cargo throughput, with major ports equipped with state-of-the-art container handling facilities. The Stevedoring segment, intrinsically linked to the movement of cargo, naturally holds a significant presence.

Dominant Cargo Type: Containerized Cargo

- Key Drivers:

- Global Trade Volume: China's immense export-oriented manufacturing sector generates a massive volume of containerized goods.

- E-commerce Boom: The rapid growth of online retail fuels demand for efficient container logistics.

- Standardization: The widespread adoption of standardized shipping containers facilitates streamlined handling and intermodal transfer.

- Economic Policies: Government support for manufacturing and trade, including free trade zones, boosts containerized trade.

- Dominance Analysis: Major ports like Shanghai, Ningbo-Zhoushan, and Shenzhen are world leaders in container throughput, equipped with advanced quay cranes, automated stacking systems, and efficient yard management technologies. The continuous expansion of these ports and investments in larger container vessels further solidify the dominance of this segment. The market size for containerized cargo handling is estimated to be in the tens of billions of USD.

- Key Drivers:

Dominant Segment by Type: Stevedoring

- Key Drivers:

- Trade Volumes: The fundamental act of loading and unloading vessels is directly proportional to trade activity.

- Port Infrastructure: Investment in advanced quay cranes, straddle carriers, and specialized equipment enhances stevedoring efficiency.

- Labor and Technology Integration: A balance of skilled labor and technological advancements in automation.

- Dominance Analysis: Stevedoring services are integral to all cargo types but are most intensely utilized in the containerized segment. The efficiency of stevedoring operations directly impacts vessel turnaround times and overall port efficiency, making it a critical area of focus for operators. The market size for stevedoring services alone is substantial, contributing significantly to the overall market value.

- Key Drivers:

Other Significant Segments:

- Bulk Cargo: While not as dominant as containerized cargo, bulk cargo handling remains crucial for commodities like coal, iron ore, and agricultural products. Ports specializing in bulk handling, such as those in northern China for coal exports, continue to be vital.

- Cargo and Handling Transportation: This broader category encompasses integrated logistics solutions, including inland transportation, warehousing, and distribution, which are becoming increasingly important as ports offer end-to-end services.

- Other Cargo: This includes specialized cargo such as project cargo, vehicles, and liquid bulk, which, while smaller in volume, often require specialized handling and expertise.

China Stevedoring and Marine Cargo Handling Market Product Developments

Product developments in the China Stevedoring and Marine Cargo Handling Market are increasingly focused on enhancing efficiency, safety, and sustainability. Innovations include the deployment of AI-powered automated guided vehicles (AGVs) for yard operations, smart quay cranes with predictive maintenance capabilities, and advanced cargo tracking systems utilizing IoT and blockchain technology. These developments aim to optimize vessel turnaround times, reduce operational costs, and improve supply chain visibility. The competitive advantage lies in the successful integration of these technologies to offer faster, more reliable, and environmentally friendly cargo handling solutions. The market is witnessing a surge in the development of eco-friendly equipment and processes to meet stringent environmental regulations and cater to the growing demand for green logistics.

Report Scope & Segmentation Analysis

This report meticulously analyzes the China Stevedoring and Marine Cargo Handling Market across its key segmentation. The primary segments include: Type: Stevedoring, Cargo and handling transportation, and Others. Under Cargo Type, the analysis focuses on Bulk Cargo, Containerized Cargo, and Other Cargo. Growth projections and market sizes for each segment are detailed within the report, considering factors like infrastructure development, trade policies, and technological adoption. Competitive dynamics within each segment are assessed, highlighting key players and their market positioning.

- Stevedoring: This segment encompasses the services related to the loading and unloading of vessels. It is expected to witness steady growth, driven by increasing trade volumes.

- Cargo and Handling Transportation: This broader category includes integrated logistics and supply chain management services associated with marine cargo. It is anticipated to experience significant expansion as companies offer end-to-end solutions.

- Others: This segment covers specialized handling services and niche market operations.

- Bulk Cargo: Handling of unpackaged goods such as grains, minerals, and coal. This segment's growth is linked to commodity prices and industrial demand.

- Containerized Cargo: Handling of goods transported in standardized containers. This segment is projected to remain the largest and fastest-growing due to global trade patterns and e-commerce.

- Other Cargo: Includes project cargo, vehicles, and liquid bulk, which require specialized handling and cater to specific industries.

Key Drivers of China Stevedoring and Marine Cargo Handling Market Growth

Several key factors are propelling the growth of the China Stevedoring and Marine Cargo Handling Market. Economically, China's position as a global manufacturing powerhouse and its continuous involvement in international trade are fundamental drivers. Technological advancements, such as automation and digitalization, are significantly boosting operational efficiency and reducing costs. Regulatory frameworks that promote port modernization and environmental sustainability are also crucial. For instance, government initiatives aimed at developing smart ports and reducing carbon emissions are spurring investment in advanced handling equipment and eco-friendly technologies. The expansion of the e-commerce sector further fuels the demand for efficient containerized cargo handling.

Challenges in the China Stevedoring and Marine Cargo Handling Market Sector

Despite the promising growth outlook, the China Stevedoring and Marine Cargo Handling Market faces several challenges. Regulatory hurdles, including evolving environmental compliance standards and complex customs procedures, can impact operational efficiency. Intense competition among domestic and international players leads to price pressures and the need for continuous innovation to maintain profitability. Supply chain disruptions, such as port congestion and geopolitical uncertainties, can lead to significant delays and increased operational costs. Furthermore, the substantial capital investment required for upgrading infrastructure and adopting new technologies presents a financial challenge for many operators. The workforce also needs continuous upskilling to adapt to automated systems.

Emerging Opportunities in China Stevedoring and Marine Cargo Handling Market

The China Stevedoring and Marine Cargo Handling Market presents numerous emerging opportunities. The ongoing development of smart ports and the integration of IoT and AI technologies offer significant potential for enhanced efficiency and data-driven decision-making. The global push towards green logistics creates opportunities for companies investing in sustainable practices and eco-friendly equipment. The expansion of inland port connectivity and multimodal transportation solutions provides avenues for integrated service offerings. Furthermore, the increasing demand for specialized cargo handling, such as project cargo and cold chain logistics, opens up niche market opportunities. The Belt and Road Initiative continues to foster new trade routes and cargo flows, creating expansion possibilities.

Leading Players in the China Stevedoring and Marine Cargo Handling Market Market

- ASEAN Seas Line Co Limited

- Guangzhou Shipyard International (GSI)

- China (Shenzhen) International Logistics and Supply Chain Fair (CILF)

- China Shipbuilding Trading Co Ltd (CSTC)

- CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS)

- Qingdao Port International Limited

- Taizhou Sanfu Ship Engineering Co Ltd

- China Merchants Jinling Shipyard (Weihai) Co Ltd

- Shenzhen Yihaitong Global Supply Chain Management Co Ltd

- China Ocean Shipping Company

Key Developments in China Stevedoring and Marine Cargo Handling Market Industry

- July 2022: China's first indigenously developed offshore oil and gas extraction facility, the subsea 'Xmas Tree' system, was put into operation in the Yingge Sea, south China's Hainan Province. This system is capable of producing approximately 200 million cubic meters of natural gas per year, as reported by China National Offshore Oil Corporation (CNOOC), highlighting advancements in energy resource handling.

- May 2022: The world's first LNG dual-fuel ultra-large crude oil tanker, YUAN RUI YANG, successfully completed its maiden voyage after unloading cargo in Vietnam. This achievement by COSCO SHIPPING Energy signifies a major step towards promoting LNG as the primary fuel for ultra-large crude oil tankers and underscores China's exploration of green, low-carbon, and sustainable maritime energy transportation.

Strategic Outlook for China Stevedoring and Marine Cargo Handling Market Market

The strategic outlook for the China Stevedoring and Marine Cargo Handling Market is highly positive, characterized by continuous growth and innovation. Key growth catalysts include the ongoing expansion of global trade, particularly through China's manufacturing prowess, and the increasing adoption of advanced technologies like automation and AI to enhance operational efficiency. The market is well-positioned to benefit from the global shift towards sustainable logistics, with significant opportunities arising from investments in green port infrastructure and cleaner energy solutions. Strategic partnerships, mergers, and acquisitions are expected to continue, consolidating the market and fostering larger, more integrated service providers. The government's continued support for port modernization and trade facilitation, coupled with the growing demand from sectors like e-commerce, will further fuel the market's expansion and solidify China's dominance in global maritime logistics.

China Stevedoring and Marine Cargo Handling Market Segmentation

-

1. Type

- 1.1. Stevedoring

- 1.2. Cargo and handling transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Bulk Cargo

- 2.2. Containerized Cargo

- 2.3. Other Cargo

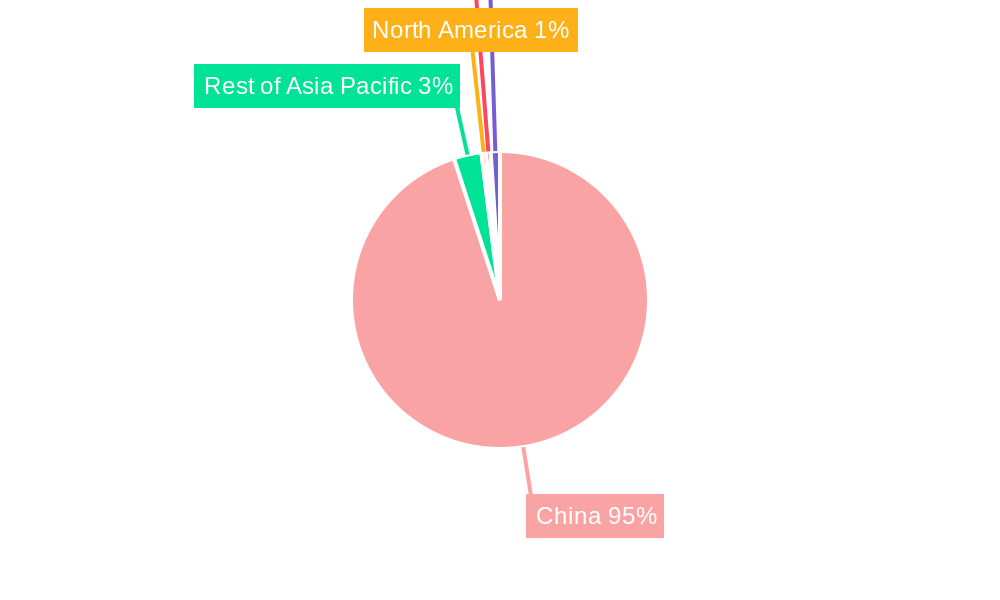

China Stevedoring and Marine Cargo Handling Market Segmentation By Geography

- 1. China

China Stevedoring and Marine Cargo Handling Market Regional Market Share

Geographic Coverage of China Stevedoring and Marine Cargo Handling Market

China Stevedoring and Marine Cargo Handling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. China’s increasing investments in the ocean freight shipping industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Stevedoring

- 5.1.2. Cargo and handling transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Bulk Cargo

- 5.2.2. Containerized Cargo

- 5.2.3. Other Cargo

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ASEAN Seas Line Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guangzhou Shipyard International (GSI)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China (Shenzhen) International Logistics and Supply Chain Fair (CILF)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Shipbuilding Trading Co Ltd (CSTC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qingdao Port International Limited**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Taizhou Sanfu Ship Engineering Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China Merchants Jinling Shipyard (Weihai) Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shenzhen Yihaitong Global Supply Chain Management Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Ocean Shipping Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ASEAN Seas Line Co Limited

List of Figures

- Figure 1: China Stevedoring and Marine Cargo Handling Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Stevedoring and Marine Cargo Handling Market Share (%) by Company 2025

List of Tables

- Table 1: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 3: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 6: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Stevedoring and Marine Cargo Handling Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the China Stevedoring and Marine Cargo Handling Market?

Key companies in the market include ASEAN Seas Line Co Limited, Guangzhou Shipyard International (GSI), China (Shenzhen) International Logistics and Supply Chain Fair (CILF), China Shipbuilding Trading Co Ltd (CSTC), CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS), Qingdao Port International Limited**List Not Exhaustive, Taizhou Sanfu Ship Engineering Co Ltd, China Merchants Jinling Shipyard (Weihai) Co Ltd, Shenzhen Yihaitong Global Supply Chain Management Co Ltd, China Ocean Shipping Company.

3. What are the main segments of the China Stevedoring and Marine Cargo Handling Market?

The market segments include Type, Cargo Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

China’s increasing investments in the ocean freight shipping industry.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

July 2022: China's first indigenously developed offshore oil and gas extraction facility, subsea 'Xmas Tree' system, was put into operation in the Yingge Sea, south China's Hainan Province. The system is able to produce about 200 million cubic meters of natural gas per year, according to China National Offshore Oil Corporation (CNOOC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Stevedoring and Marine Cargo Handling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Stevedoring and Marine Cargo Handling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Stevedoring and Marine Cargo Handling Market?

To stay informed about further developments, trends, and reports in the China Stevedoring and Marine Cargo Handling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence