Key Insights

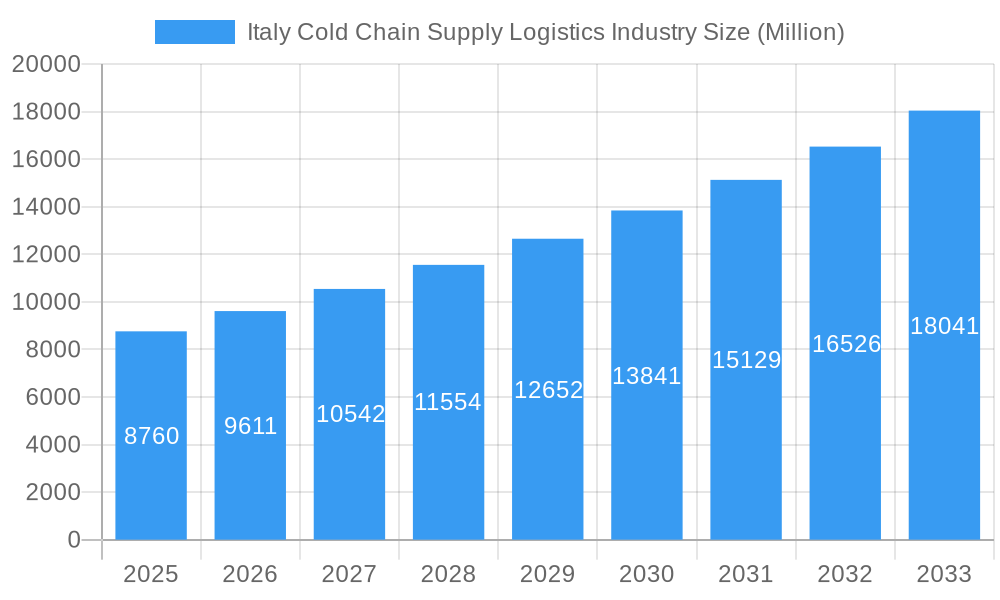

The Italy Cold Chain Supply Logistics Industry is poised for robust expansion, with a projected market size of approximately \$8.76 billion in 2025, driven by a significant Compound Annual Growth Rate (CAGR) of 9.73%. This impressive growth trajectory is fueled by increasing consumer demand for fresh and frozen food products, the expanding pharmaceutical sector requiring stringent temperature-controlled logistics, and the growing complexity of global supply chains. Key service segments contributing to this expansion include storage and transportation, with value-added services playing an increasingly vital role in optimizing efficiency and maintaining product integrity. The demand spans across ambient, chilled, and frozen temperature types, catering to diverse applications such as horticulture, dairy, meats and fish, processed foods, and critical life sciences and chemical sectors. Emerging trends like technological integration, automation, and a focus on sustainability within the cold chain are further shaping market dynamics, promising enhanced operational efficiency and reduced environmental impact.

Italy Cold Chain Supply Logistics Industry Market Size (In Billion)

The industry's growth is further supported by a burgeoning need for specialized cold storage facilities and a more sophisticated transportation network capable of handling temperature-sensitive goods across Italy. Key players like Frigoscandia SPA and Safim Logistics are instrumental in driving innovation and expanding service offerings to meet these evolving demands. Despite the optimistic outlook, potential restraints may include rising operational costs, stringent regulatory compliance, and the need for significant infrastructure investment to keep pace with technological advancements and sustainability goals. Nevertheless, the fundamental drivers of increased consumption of perishable goods and the critical role of the cold chain in public health and food safety solidify its position as a dynamic and expanding sector within the Italian logistics landscape.

Italy Cold Chain Supply Logistics Industry Company Market Share

Here is a detailed, SEO-optimized report description for the Italy Cold Chain Supply Logistics Industry, incorporating high-traffic keywords and actionable insights without placeholders.

Italy Cold Chain Supply Logistics Industry Market Concentration & Innovation

The Italian cold chain supply logistics market, valued at an estimated €45,000 Million in 2025, is characterized by moderate to high concentration, with a few dominant players and a growing number of specialized service providers. Innovation is a key differentiator, driven by the increasing demand for specialized temperature-controlled solutions across various sectors, notably pharmaceuticals and high-value food products. Regulatory frameworks, such as EU GMP guidelines and national food safety standards, play a crucial role in shaping operational practices and fostering a focus on quality and compliance. While direct product substitutes are limited for many cold chain applications, advancements in alternative packaging and short-term temperature management solutions present indirect competition. End-user trends highlight a growing preference for end-to-end logistics solutions, real-time tracking, and enhanced visibility. Mergers and acquisitions (M&A) activity is on the rise, with significant deal values anticipated as companies seek to expand their geographical reach and service portfolios. For instance, the investment of €15 Million by Bomi Group in a new healthcare logistics hub signifies substantial M&A and expansion strategies within the sector.

- Market Concentration: Dominated by key players, with increasing fragmentation in specialized niches.

- Innovation Drivers: Technological advancements (e.g., IoT, AI), demand for specialized temperature control, and sustainability initiatives.

- Regulatory Frameworks: Strict adherence to EU and national regulations impacting storage, transportation, and handling.

- Product Substitutes: Limited for core cold chain, but emerging solutions in packaging and short-term temperature management.

- End-User Trends: Demand for integrated solutions, transparency, and specialized services.

- M&A Activities: Strategic acquisitions and partnerships to gain market share and expand capabilities.

Italy Cold Chain Supply Logistics Industry Industry Trends & Insights

The Italian cold chain supply logistics industry is poised for significant growth, driven by an expanding e-commerce landscape, increasing consumer demand for fresh and frozen foods, and the critical need for secure pharmaceutical distribution. The market, projected to reach €80,000 Million by 2033, is experiencing a Compound Annual Growth Rate (CAGR) of approximately 7.5% from the base year 2025. Technological disruptions are at the forefront, with the adoption of Internet of Things (IoT) devices for real-time temperature monitoring and predictive analytics for route optimization transforming operational efficiency. Artificial intelligence (AI) is increasingly being integrated to enhance warehouse management and forecast demand. Consumer preferences are shifting towards convenient access to high-quality perishable goods, including ready-to-eat meals and organic produce, which necessitates robust cold chain infrastructure. This evolving demand is pushing logistics providers to offer more flexible and faster delivery options. Competitive dynamics are intensifying, with both established players and new entrants vying for market share. Companies are investing heavily in expanding their network of temperature-controlled warehouses and specialized transportation fleets to cater to diverse client needs, from chilled dairy products to ultra-frozen pharmaceuticals. The increasing sophistication of supply chain requirements for sensitive goods like vaccines and biologics is a major market penetration driver. The integration of automation in cold storage facilities, along with advancements in reefer container technology, is further optimizing operations and reducing costs. The growing emphasis on reducing food waste and ensuring product integrity throughout the supply chain also fuels investment and innovation in this sector.

Dominant Markets & Segments in Italy Cold Chain Supply Logistics Industry

The Italian cold chain supply logistics industry exhibits robust dominance across several key segments, reflecting the nation's strong agricultural base, sophisticated food processing industry, and a growing pharmaceutical sector.

Services Dominance:

- Storage: This segment is a cornerstone of the Italian cold chain, with a significant portion of the market share attributed to the warehousing of food products and pharmaceuticals. The demand for specialized temperature-controlled storage, particularly for frozen and ultra-low temperature applications, is exceptionally high. Major players like Frigocaserta SRL and Frigogel SRL are prominent in this area.

- Key Drivers: Increasing production of perishable goods, growing import/export volumes, and the need for buffer stock management.

- Transportation: The backbone of cold chain logistics, enabling the movement of temperature-sensitive goods from production to consumption. The demand for refrigerated transport, including specialized fleets for dairy, meat, fish, and pharmaceuticals, is substantial. Companies like Safim Logistics and Frigoscandia SPA are key contributors.

- Key Drivers: Expanding retail networks, e-commerce growth, and stringent delivery timelines for perishable and pharmaceutical items.

- Value-Added Services: This segment, encompassing activities like kitting, labeling, and customs clearance, is experiencing considerable growth. As businesses seek end-to-end solutions, providers offering integrated services are gaining traction.

- Key Drivers: Demand for supply chain simplification, enhanced product customization, and regulatory compliance support.

Temperature Type Dominance:

- Chilled: The largest segment within temperature types, driven by the widespread consumption of fresh produce, dairy products, and chilled ready-to-eat meals. The demand for maintaining temperatures between +2°C and +8°C is consistently high.

- Key Drivers: Consumer preference for fresh food, growth in the dairy and bakery industries.

- Frozen: A critical segment for the preservation of meats, fish, processed foods, and certain pharmaceuticals. The infrastructure for deep freezing and ultra-low temperature storage is expanding to meet specialized needs. DRS Depositi Regionali Surgelati SRL is a key player here.

- Key Drivers: Demand for long-shelf-life products, growth in the frozen food market, and advancements in cryogenic storage.

- Ambient: While less reliant on strict temperature control, ambient logistics still plays a role in the overall supply chain for certain food items and packaging materials.

Application Dominance:

- Horticulture (Fresh Fruits and Vegetables): Italy's significant agricultural output makes this a dominant application for cold chain logistics. Ensuring the freshness and quality of produce from farm to table is paramount.

- Key Drivers: Strong domestic production, export markets, and consumer demand for seasonal and organic produce.

- Dairy Products (Milk, Ice-cream, Butter, etc.): This sector is a consistent driver of cold chain demand due to the highly perishable nature of dairy items.

- Key Drivers: High consumption rates, diverse product range, and stringent hygiene regulations.

- Meats and Fish: Essential for maintaining food safety and quality, the chilled and frozen transport and storage of meats and fish represent a significant market.

- Key Drivers: Consumer demand for protein, food safety regulations, and the growth of the seafood industry.

- Processed Food Products: The growing market for pre-packaged meals, snacks, and frozen convenience foods contributes significantly to cold chain volumes.

- Key Drivers: Changing lifestyles, demand for convenience, and innovation in food product development.

- Pharma, Life Sciences, and Chemicals: This is a high-growth, high-value segment demanding extremely precise temperature control and rigorous compliance. The transportation of vaccines, biologics, and temperature-sensitive chemicals requires specialized infrastructure and expertise. Bomi Group's investments highlight the importance of this sector.

- Key Drivers: Increasing pharmaceutical production, demand for advanced therapies, and strict regulatory requirements.

Italy Cold Chain Supply Logistics Industry Product Developments

Product developments in the Italian cold chain supply logistics industry are primarily focused on enhancing efficiency, sustainability, and real-time visibility. Innovations include advanced reefer container technology with improved insulation and energy efficiency, smart warehousing solutions integrating robotics and AI for automated picking and packing, and sophisticated temperature monitoring systems utilizing IoT sensors. Furthermore, there's a growing emphasis on developing eco-friendly refrigerants and reusable packaging solutions to reduce environmental impact. These advancements provide a competitive advantage by ensuring product integrity, reducing operational costs, and meeting the evolving demands of industries like pharmaceuticals and high-value food.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Italy Cold Chain Supply Logistics Industry, segmented by Services, Temperature Type, and Application.

- Services: The report details the market dynamics for Storage, Transportation, and Value-added Services, including growth projections and market sizes for each, along with their competitive landscapes.

- Temperature Type: Analysis covers Ambient, Chilled, and Frozen temperature ranges, examining their respective market shares, growth drivers, and the technological advancements supporting each segment.

- Application: The report offers in-depth insights into Horticulture (Fresh Fruits and Vegetables), Dairy Products (Milk, Ice-cream, Butter, etc.), Meats and Fish, Processed Food Products, Pharma, Life Sciences, and Chemicals, and Other Applications. This includes detailed market size estimations, future growth projections, and the specific challenges and opportunities within each application sector.

Key Drivers of Italy Cold Chain Supply Logistics Industry Growth

The growth of the Italian cold chain supply logistics industry is propelled by several interconnected factors. A significant driver is the escalating consumer demand for fresh, high-quality food products, coupled with the expanding e-commerce penetration for groceries and ready-to-eat meals. The robust and growing pharmaceutical sector, with its stringent requirements for temperature-controlled distribution of sensitive medicines and vaccines, represents another critical growth engine. Government initiatives supporting agricultural modernization and food safety standards further stimulate investment in advanced cold chain infrastructure. Technological advancements, such as the adoption of IoT for real-time monitoring and AI for predictive analytics, are improving efficiency and reliability, making cold chain services more attractive and cost-effective.

Challenges in the Italy Cold Chain Supply Logistics Industry Sector

Despite its growth, the Italy cold chain supply logistics industry faces several challenges. The significant capital investment required for specialized infrastructure, including refrigerated warehouses and fleets, can be a barrier to entry for smaller players. Maintaining consistent temperature integrity across complex supply chains, especially during last-mile delivery and intermodal transfers, remains a critical operational challenge. Stringent and evolving regulatory requirements for food safety and pharmaceutical handling necessitate continuous compliance and investment in quality control systems. Furthermore, energy costs associated with maintaining low temperatures contribute to higher operational expenses. Intense competition and price pressures from both domestic and international logistics providers also pose a challenge.

Emerging Opportunities in Italy Cold Chain Supply Logistics Industry

Emerging opportunities in the Italian cold chain supply logistics industry are multifaceted. The burgeoning e-commerce sector for perishable goods presents a significant growth avenue, demanding more agile and faster delivery solutions. The increasing focus on health and wellness is driving demand for fresh, organic produce and specialized nutritional supplements, requiring tailored cold chain services. The growing pharmaceutical market, particularly for biologics and advanced therapies, offers substantial opportunities for providers with specialized cold chain capabilities. Furthermore, advancements in sustainable logistics, including the adoption of electric vehicles and renewable energy sources for cold storage, are creating new market niches and attracting environmentally conscious clients. The digitalization of supply chains, leveraging blockchain and AI, offers opportunities for enhanced transparency, traceability, and efficiency.

Leading Players in the Italy Cold Chain Supply Logistics Industry Market

- Frigocaserta SRL

- Frigogel SRL

- Fridocks General Warehouses and Frigoriferi SRL

- Eurofrigo Vernate SRL

- Soluzioni Logistiche Freddo SRL In Breve SL Freddo SRL

- DRS Depositi Regionali Surgelati SRL

- Sodele Magazzini Generali Frigoriferi SRL

- Safim Logistics

- Horigel SRL

- Frigoscandia SPA

Key Developments in Italy Cold Chain Supply Logistics Industry Industry

- May 2022: Bomi Group, through the Picking Farma brand, announces the forthcoming opening of the new logistics hub near Madrid dedicated to the Healthcare sector. The warehouse, whose work has already begun, will involve an investment of 15 million euros and the creation of 150 jobs. The new logistics platform will join the seven already present in Spain, including one near Madrid, four in Catalonia, and two in the Canary Islands. This new logistics center will have an area of 25,000 m² and a capacity of 60,000 pallet places, making it one of the essential reference warehouses for the pharmaceutical sector in Europe.

- April 2022: Bomi Group, a multinational leader in integrated logistics operating in the Healthcare sector, has announced the acquisition by its French branch of Tendron Pharma, the division of Tendron Transports - an independent company founded in 1963 dedicated to the transport of pharmaceutical products. Tendron Pharma has a fleet of 25 owned vehicles - made up of vans and trucks - all at a controlled temperature of +15+25° C, transports drugs and devices from the pharmaceutical plant to distributors in the Ile-de-France region, including pharmacies, hospitals, and clinics.

Strategic Outlook for Italy Cold Chain Supply Logistics Industry Market

The strategic outlook for the Italy Cold Chain Supply Logistics Industry is exceptionally positive, characterized by sustained growth and increasing sophistication. Key growth catalysts include the continued expansion of e-commerce for perishable goods, the vital role of cold chain in the burgeoning pharmaceutical and life sciences sectors, and a heightened consumer consciousness around food safety and quality. Investments in advanced technologies, such as automation and AI-driven analytics, will be crucial for optimizing operations and maintaining a competitive edge. Furthermore, the industry's focus on sustainability and the adoption of greener logistics practices will unlock new market opportunities and enhance brand reputation. Strategic partnerships and M&A activities are expected to continue, consolidating the market and expanding service offerings.

Italy Cold Chain Supply Logistics Industry Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Ambient

- 2.2. Chilled

- 2.3. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats and Fish

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other Applications

Italy Cold Chain Supply Logistics Industry Segmentation By Geography

- 1. Italy

Italy Cold Chain Supply Logistics Industry Regional Market Share

Geographic Coverage of Italy Cold Chain Supply Logistics Industry

Italy Cold Chain Supply Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for customizable delivery solutions4.; Growing need for operational effciency

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of efficient transportation infrastructure4.; High cost of white glove services

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Dairy Products in the Country is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Cold Chain Supply Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Ambient

- 5.2.2. Chilled

- 5.2.3. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats and Fish

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Frigocaserta SRL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Frigogel SRL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fridocks General Warehouses and Frigoriferi SRL**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eurofrigo Vernate SRL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Soluzioni Logistiche Freddo SRL In Breve SL Freddo SRL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DRS Depositi Regionali Surgelati SRL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sodele Magazzini Generali Frigoriferi SRL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safim Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Horigel SRL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Frigoscandia SPA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Frigocaserta SRL

List of Figures

- Figure 1: Italy Cold Chain Supply Logistics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Italy Cold Chain Supply Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Italy Cold Chain Supply Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Cold Chain Supply Logistics Industry?

The projected CAGR is approximately 9.73%.

2. Which companies are prominent players in the Italy Cold Chain Supply Logistics Industry?

Key companies in the market include Frigocaserta SRL, Frigogel SRL, Fridocks General Warehouses and Frigoriferi SRL**List Not Exhaustive, Eurofrigo Vernate SRL, Soluzioni Logistiche Freddo SRL In Breve SL Freddo SRL, DRS Depositi Regionali Surgelati SRL, Sodele Magazzini Generali Frigoriferi SRL, Safim Logistics, Horigel SRL, Frigoscandia SPA.

3. What are the main segments of the Italy Cold Chain Supply Logistics Industry?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.76 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for customizable delivery solutions4.; Growing need for operational effciency.

6. What are the notable trends driving market growth?

Increasing Usage of Dairy Products in the Country is Driving the Market.

7. Are there any restraints impacting market growth?

4.; Lack of efficient transportation infrastructure4.; High cost of white glove services.

8. Can you provide examples of recent developments in the market?

May 2022: Bomi Group, through the Picking Farma brand, announces the forthcoming opening of the new logistics hub near Madrid dedicated to the Healthcare sector. The warehouse, whose work has already begun, will involve an investment of 15 million euros and the creation of 150 jobs. The new logistics platform will join the seven already present in Spain, including one near Madrid, four in Catalonia, and two in the Canary Islands. This new logistics center will have an area of 25,000 m² and a capacity of 60,000 pallet places, making it one of the essential reference warehouses for the pharmaceutical sector in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Cold Chain Supply Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Cold Chain Supply Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Cold Chain Supply Logistics Industry?

To stay informed about further developments, trends, and reports in the Italy Cold Chain Supply Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence