Key Insights

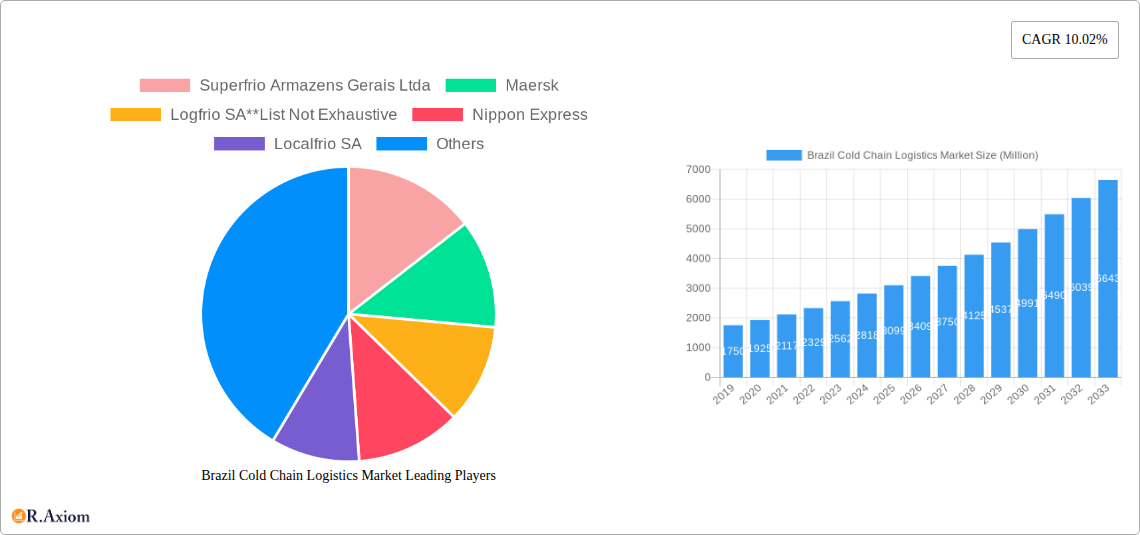

The Brazil Cold Chain Logistics market is poised for significant expansion, projected to reach an estimated market size of approximately USD 2.67 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 10.02%. This dynamic growth is primarily fueled by the increasing demand for temperature-sensitive goods, particularly within the horticulture, meat, fish, and poultry, and processed food sectors. The expanding middle class in Brazil and evolving consumer preferences for fresh and high-quality products are major drivers. Furthermore, the burgeoning pharmaceutical and life sciences industries, with their stringent requirements for maintaining product integrity throughout the supply chain, are also contributing substantially to market momentum. Investments in advanced cold storage facilities and efficient transportation networks are crucial for meeting this escalating demand and ensuring product safety and quality from origin to consumption.

Brazil Cold Chain Logistics Market Market Size (In Billion)

Key trends shaping the Brazil Cold Chain Logistics market include the growing adoption of technology for enhanced visibility and control, such as IoT sensors for real-time temperature monitoring and blockchain for traceability. The expansion of specialized cold chain services, including value-added services like kitting and cross-docking, is also gaining traction. However, the market faces certain restraints, including the high capital investment required for developing and maintaining cold chain infrastructure, potential logistical challenges in remote regions, and the need for skilled labor to manage sophisticated cold chain operations. Despite these challenges, the favorable regulatory environment and increasing focus on reducing food waste are expected to propel the market forward. Major players like Superfrio Armazens Gerais Ltda, Maersk, and Nippon Express are actively investing and expanding their presence, further solidifying the market's growth trajectory.

Brazil Cold Chain Logistics Market Company Market Share

This in-depth market research report provides a detailed analysis of the Brazil Cold Chain Logistics Market, encompassing historical data from 2019 to 2024, a base year of 2025, and a robust forecast period extending to 2033. We explore the intricate dynamics of the Brazilian cold chain, offering insights into market concentration, innovation, industry trends, dominant segments, product developments, and key players. This report is an indispensable resource for stakeholders seeking to understand and capitalize on the growth potential within Brazil's evolving cold chain logistics landscape, including vital sectors such as frozen food logistics, pharmaceutical cold chain, temperature-controlled warehousing Brazil, and cold chain transport Brazil.

Brazil Cold Chain Logistics Market Market Concentration & Innovation

The Brazil Cold Chain Logistics Market exhibits a moderate to high level of concentration, with several key players holding significant market share. While not dominated by a single entity, the market sees intense competition among established logistics providers and specialized cold chain operators. Innovation in this sector is primarily driven by the increasing demand for advanced temperature control technologies, real-time tracking solutions, and sustainable logistics practices. For instance, investments in smart warehousing technologies, such as IoT-enabled sensors for temperature monitoring and automated sorting systems, are becoming crucial for maintaining product integrity and operational efficiency.

- Market Share Insights: While precise current market share data fluctuates, leading companies are estimated to collectively hold over 60% of the organized cold chain logistics market.

- Innovation Drivers:

- Technological Advancements: Adoption of AI for route optimization, IoT for real-time monitoring, and advanced refrigeration technologies.

- Sustainability Initiatives: Focus on reducing carbon footprints through energy-efficient facilities and eco-friendly transportation.

- Regulatory Compliance: Stringent regulations for pharmaceuticals and food safety are compelling innovation in quality control and tracking.

- M&A Activities: The past few years have witnessed strategic mergers and acquisitions aimed at expanding geographical reach and service portfolios. For example, the acquisition of smaller regional players by larger logistics giants has been a notable trend, with deal values in the tens of millions.

- Regulatory Frameworks: Brazil's regulatory landscape, particularly concerning food safety standards (e.g., ANVISA regulations) and pharmaceutical logistics, plays a pivotal role in shaping market practices and driving compliance-related innovations.

- Product Substitutes: While direct substitutes for cold chain logistics are limited in many applications, inefficiencies in traditional warehousing or non-specialized transport can be considered indirect substitutes, highlighting the critical need for dedicated cold chain solutions.

- End-User Trends: Growing consumer demand for fresh, frozen, and temperature-sensitive products, coupled with the expansion of the e-commerce sector for groceries and pharmaceuticals, is a significant end-user trend influencing market dynamics.

Brazil Cold Chain Logistics Market Industry Trends & Insights

The Brazil Cold Chain Logistics Market is experiencing robust growth, propelled by a confluence of factors including expanding domestic consumption, increasing exports of perishable goods, and evolving regulatory standards. The CAGR for the Brazil Cold Chain Logistics Market is estimated to be around 7.5% during the forecast period (2025-2033). This upward trajectory is largely fueled by the nation's significant agricultural output and its growing importance as a global supplier of fruits, vegetables, meats, and poultry. The increasing sophistication of the retail sector, with more supermarkets and hypermarkets demanding consistent supply of chilled and frozen products, further solidifies this trend.

Technological disruptions are fundamentally reshaping how cold chain logistics are managed. The integration of the Internet of Things (IoT) for real-time temperature monitoring across the supply chain, from warehousing to final delivery, is becoming standard practice. Advanced analytics and artificial intelligence are being employed to optimize routes, predict demand, and minimize spoilage. Blockchain technology is also emerging as a tool to enhance traceability and transparency, particularly critical for high-value goods like pharmaceuticals and premium food products.

Consumer preferences are shifting towards convenience and quality. This translates to a higher demand for readily available chilled and frozen ready-to-eat meals, as well as a greater emphasis on the freshness and origin of produce. The burgeoning e-commerce sector in Brazil has amplified the need for efficient and reliable last-mile delivery solutions for temperature-sensitive items, creating new avenues for growth in specialized delivery services.

Competitive dynamics within the market are characterized by a blend of global logistics giants and specialized domestic players. Companies are investing heavily in expanding their cold storage capacity, modernizing their fleets with temperature-controlled vehicles, and developing value-added services such as kitting, labeling, and specialized packaging. Strategic partnerships and collaborations are becoming more common as companies seek to enhance their service offerings and geographical coverage. For instance, partnerships between logistics providers and large food producers are crucial for ensuring seamless supply chains. The market penetration of organized cold chain logistics is steadily increasing, particularly in urban centers and key export hubs, as businesses recognize the significant cost savings and risk mitigation associated with professional cold chain management. The demand for pharmaceutical cold chain logistics Brazil is a particularly high-growth segment due to stringent regulatory requirements and the increasing prevalence of temperature-sensitive medications.

Dominant Markets & Segments in Brazil Cold Chain Logistics Market

The Brazil Cold Chain Logistics Market is characterized by the dominance of specific segments and regions, driven by economic activity, infrastructure development, and consumer demand.

- Leading Region: São Paulo stands out as the most dominant region in Brazil's cold chain logistics market. Its status as the economic powerhouse of Brazil, coupled with its dense population, sophisticated retail infrastructure, and major transportation hubs, makes it a critical node for both domestic distribution and international trade. The presence of major food processing industries, pharmaceutical manufacturers, and large retail chains concentrated in and around São Paulo fuels an unparalleled demand for cold storage and transportation services.

- Dominant Services:

- Storage: Cold storage services are foundational to the market, driven by the need for effective inventory management and preservation of perishable goods. Facilities equipped with advanced temperature control systems for both chilled and frozen products are in high demand. The expansion of temperature-controlled warehousing in Brazil is a key indicator of market maturity.

- Transportation: The transportation segment is crucial for the movement of goods across Brazil's vast geography. This includes refrigerated trucks, reefer containers, and air cargo services, all tailored to maintain specific temperature ranges. Efficient cold chain transport Brazil is vital for reaching diverse consumer markets and export destinations.

- Dominant Temperature Types:

- Frozen: The frozen segment, encompassing products like meats, poultry, fish, and processed foods, holds a significant share due to consumer preferences for convenience and longer shelf life. The export of frozen meats and poultry further bolsters this segment.

- Chilled: The chilled segment, particularly for fresh fruits and vegetables, dairy products, and ready-to-eat meals, is also substantial, driven by evolving consumer lifestyles and dietary habits.

- Dominant Applications:

- Meats, Fish, and Poultry: This segment is a cornerstone of Brazil's agricultural economy and its export market, necessitating extensive cold chain infrastructure for its preservation and distribution.

- Horticulture (Fresh Fruits and Vegetables): Brazil's abundant production of diverse fruits and vegetables makes this a high-volume segment for cold chain logistics, requiring careful temperature management from farm to table.

- Processed Food Products: The growing demand for convenience foods, including frozen meals, dairy products, and baked goods, significantly contributes to the cold chain logistics market.

- Pharmaceuticals, Life Sciences, and Chemicals: This is a rapidly growing, high-value segment demanding stringent temperature and humidity controls, often involving specialized logistics providers with expertise in handling sensitive biologicals, vaccines, and chemical compounds.

- Key Cities:

- São Paulo: As mentioned, São Paulo is the undisputed leader, housing numerous distribution centers, processing plants, and serving as a gateway for imports and exports.

- Rio de Janeiro: A major commercial and consumption hub, Rio de Janeiro's demand for cold chain services is significant, particularly for food and pharmaceutical products.

- Salvador: As a key port city and regional economic center in the Northeast, Salvador plays a vital role in the distribution of perishable goods and agricultural products within its region and for export.

Key drivers for the dominance of these segments include favorable economic policies supporting agriculture and exports, continuous investment in logistics infrastructure, and the demographic and economic concentration in major urban centers. The demand for specialized handling and storage, particularly for pharmaceuticals, also drives innovation and growth in those specific niches.

Brazil Cold Chain Logistics Market Product Developments

Product developments in the Brazil Cold Chain Logistics Market are focused on enhancing efficiency, reliability, and sustainability. Innovations include advanced insulation materials for reefer containers and warehouses, smart sensors for real-time temperature and humidity monitoring, and AI-powered route optimization software to minimize transit times and energy consumption. The development of specialized packaging solutions that extend product shelf life and maintain precise temperature control during last-mile delivery is also gaining traction. These advancements are crucial for maintaining product integrity, reducing waste, and meeting the stringent requirements of sectors like pharmaceuticals and high-value food products, thereby providing a competitive edge in the market.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Brazil Cold Chain Logistics Market, segmented across critical dimensions to offer granular insights. The market is analyzed by Service, encompassing Storage, Transportation, and Value-added services, each exhibiting distinct growth patterns and demands. Temperature Type segmentation includes Chilled and Frozen, reflecting the diverse needs of perishable goods. The Application segment is thoroughly dissected, covering Horticulture (Fresh Fruits and Vegetables), Meats, Fish, and Poultry, Processed Food Products, Pharmaceuticals, Life Sciences, and Chemicals, and Other Applications, highlighting the unique logistical requirements of each. Furthermore, the analysis extends to Key Cities such as São Paulo, Rio de Janeiro, and Salvador, identifying regional market dynamics and growth projections for each.

Key Drivers of Brazil Cold Chain Logistics Market Growth

The growth of the Brazil Cold Chain Logistics Market is propelled by several key drivers. Firstly, the expansion of Brazil's agricultural exports, particularly in the meat, poultry, and horticulture sectors, necessitates robust cold chain infrastructure to maintain product quality and meet international standards. Secondly, evolving consumer lifestyles and increasing demand for convenient, chilled, and frozen food products are driving domestic consumption and, consequently, the need for efficient cold chain solutions. Thirdly, the stringent regulatory requirements for pharmaceutical and life sciences products, mandating precise temperature control and traceability, are creating significant demand for specialized cold chain services. Finally, ongoing technological advancements, including IoT, AI, and blockchain, are enhancing efficiency, reducing costs, and improving the reliability of cold chain operations, making them more accessible and attractive to businesses.

Challenges in the Brazil Cold Chain Logistics Market Sector

Despite its growth potential, the Brazil Cold Chain Logistics Market faces several challenges. High infrastructure costs, particularly for maintaining and upgrading specialized cold storage facilities and refrigerated fleets, remain a significant barrier. Inadequate transportation infrastructure in certain regions can lead to delays and increased operational expenses. Furthermore, navigating Brazil's complex tax system and varying regional regulations can add to compliance burdens and operational complexities for logistics providers. Intense competition also puts pressure on profit margins, requiring continuous innovation and efficiency improvements. Finally, the risk of product spoilage due to unforeseen disruptions or inadequate temperature control systems poses a constant challenge, necessitating stringent quality assurance protocols.

Emerging Opportunities in Brazil Cold Chain Logistics Market

Emerging opportunities in the Brazil Cold Chain Logistics Market are diverse and promising. The burgeoning e-commerce sector, with its increasing demand for last-mile delivery of perishable goods like groceries and pharmaceuticals, presents a significant growth avenue. The expanding middle class and changing dietary habits are also fueling demand for a wider variety of chilled and frozen processed foods. Furthermore, Brazil's growing role as a global supplier of pharmaceuticals and biologics is driving demand for highly specialized, temperature-controlled logistics services with advanced monitoring and tracking capabilities. Investments in technological advancements, such as AI-driven route optimization and blockchain for enhanced traceability, offer opportunities for companies to differentiate themselves and improve operational efficiency. There is also a growing opportunity for sustainable cold chain solutions, driven by increasing environmental consciousness among consumers and businesses.

Leading Players in the Brazil Cold Chain Logistics Market Market

- Superfrio Armazens Gerais Ltda

- Maersk

- Logfrio SA

- Nippon Express

- Localfrio SA

- Comfrio

- Martini Meat SA

- Arfrio Armazens Gerais Frigorificos

- Friozem Armazens Frigorificos Ltda

- Brado Logistica SA

- CAP Logistica Frigorificada Ltda

- Brasfrigo SA

Key Developments in Brazil Cold Chain Logistics Market Industry

- 2023: Expansion of temperature-controlled warehousing facilities by several key players to meet increasing demand from the food and pharmaceutical sectors.

- 2023: Increased adoption of IoT and AI-powered tracking solutions to enhance visibility and control over the cold chain.

- 2022: Strategic partnerships formed between logistics providers and e-commerce platforms to bolster last-mile delivery of frozen and chilled goods.

- 2022: Investments in upgrading reefer fleets with more energy-efficient and environmentally friendly technologies.

- 2021: Consolidation activities observed with acquisitions of smaller regional cold chain operators by larger entities to expand market reach.

- 2020: Increased focus on cold chain solutions for vaccine distribution in response to global health imperatives.

Strategic Outlook for Brazil Cold Chain Logistics Market Market

The strategic outlook for the Brazil Cold Chain Logistics Market is one of sustained growth and innovation. Key catalysts for future expansion include the continued rise in domestic consumption of perishable goods, driven by urbanization and evolving consumer preferences for convenience and quality. Brazil's expanding role in global food exports will continue to underpin demand for sophisticated cold chain infrastructure. The pharmaceutical and life sciences sector represents a significant high-value growth opportunity, demanding specialized and highly regulated logistics solutions. Companies that invest in cutting-edge technologies, such as AI for predictive analytics and IoT for real-time monitoring, coupled with a strong commitment to sustainability and regulatory compliance, will be best positioned to capitalize on the market's potential and navigate its challenges effectively. The ongoing development of logistics infrastructure and the increasing adoption of advanced cold chain practices will further solidify Brazil's position as a key player in the global perishable goods supply chain.

Brazil Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Meats, Fish, and Poultry

- 3.3. Processed Food Products

- 3.4. Pharmaceuticals, Life Sciences, and Chemicals

- 3.5. Other Applications

-

4. Key Cities

- 4.1. Sao Paulo

- 4.2. Rio de Janeiro

- 4.3. Salvador

Brazil Cold Chain Logistics Market Segmentation By Geography

- 1. Brazil

Brazil Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Brazil Cold Chain Logistics Market

Brazil Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Payments from Mobile

- 3.4. Market Trends

- 3.4.1. Increasing Meat Exports to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Meats, Fish, and Poultry

- 5.3.3. Processed Food Products

- 5.3.4. Pharmaceuticals, Life Sciences, and Chemicals

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Key Cities

- 5.4.1. Sao Paulo

- 5.4.2. Rio de Janeiro

- 5.4.3. Salvador

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Superfrio Armazens Gerais Ltda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maersk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Logfrio SA**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Localfrio SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Comfrio

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Martini Meat SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arfrio Armazens Gerais Frigorificos

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Friozem Armazens Frigorificos Ltda

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Brado Logistica SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CAP Logistica Frigorificada Ltda

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Brasfrigo SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Superfrio Armazens Gerais Ltda

List of Figures

- Figure 1: Brazil Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 5: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 8: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 10: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Cold Chain Logistics Market?

The projected CAGR is approximately 10.02%.

2. Which companies are prominent players in the Brazil Cold Chain Logistics Market?

Key companies in the market include Superfrio Armazens Gerais Ltda, Maersk, Logfrio SA**List Not Exhaustive, Nippon Express, Localfrio SA, Comfrio, Martini Meat SA, Arfrio Armazens Gerais Frigorificos, Friozem Armazens Frigorificos Ltda, Brado Logistica SA, CAP Logistica Frigorificada Ltda, Brasfrigo SA.

3. What are the main segments of the Brazil Cold Chain Logistics Market?

The market segments include Service, Temperature Type, Application, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.67 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used.

6. What are the notable trends driving market growth?

Increasing Meat Exports to Drive the Market.

7. Are there any restraints impacting market growth?

Increasing Usage of Payments from Mobile.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Brazil Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence