Key Insights

The North America waste management market is poised for substantial growth, projected to reach USD 202.20 million by 2025. This expansion is fueled by a consistent Compound Annual Growth Rate (CAGR) of 4.01% through 2033, indicating a robust and expanding industry. Key drivers include the increasing volume of industrial and municipal solid waste, heightened environmental regulations mandating responsible waste disposal, and a growing public awareness regarding the detrimental impacts of improper waste handling. Furthermore, the burgeoning e-waste sector, driven by rapid technological advancements and shorter product lifecycles, presents a significant growth avenue, demanding specialized collection and processing solutions. The rising demand for sustainable practices is also propelling the recycling segment, as businesses and governments strive to reduce landfill dependency and conserve resources. Technological innovations in waste-to-energy solutions and advanced sorting technologies are further contributing to market dynamism, offering more efficient and environmentally friendly disposal alternatives.

North America Waste Management Market Market Size (In Million)

The market is segmented by waste type, with industrial waste and municipal solid waste forming the largest categories due to their sheer volume. However, the rapid growth of e-waste and plastic waste segments, coupled with increasing concerns over biomedical waste management, highlight evolving challenges and opportunities. Disposal methods such as landfilling, while still prevalent, are facing increasing scrutiny and regulatory pressure, leading to a greater emphasis on incineration and recycling. North America, encompassing the United States, Canada, and Mexico, is a dominant region in this market, characterized by well-established waste management infrastructure and stringent environmental policies. Leading companies like Waste Management Inc., Republic Services Inc., and Veolia North America are at the forefront, investing in advanced technologies and sustainable solutions to meet the escalating demands of this critical sector. The study period from 2019 to 2033 provides a comprehensive outlook, with the base year of 2025 setting the stage for projected growth and strategic investments.

North America Waste Management Market Company Market Share

This in-depth report provides a definitive analysis of the North America Waste Management Market, meticulously examining market dynamics, key trends, and growth opportunities from 2019 to 2033. With a base year of 2025, the report offers robust forecasts for the period 2025–2033, building upon historical data from 2019–2024. Explore critical insights into waste types, disposal methods, technological advancements, regulatory landscapes, and competitive strategies that are shaping this rapidly evolving sector. This analysis is essential for stakeholders seeking to navigate the complexities and capitalize on the significant growth potential within the North American waste management industry.

North America Waste Management Market Market Concentration & Innovation

The North America Waste Management Market exhibits a moderate to high degree of market concentration, with a few dominant players holding significant market share. Leading companies like Waste Management Inc., Republic Services Inc., and Waste Connections Inc. continually invest in innovation to drive efficiency and sustainability. Innovation is primarily driven by advancements in waste-to-energy technologies, sophisticated recycling processes, and digital solutions for optimizing collection routes and landfill management. Regulatory frameworks, such as stringent environmental protection laws and mandates for waste diversion, play a crucial role in shaping market strategies and fostering innovation. Product substitutes, including advanced material recovery facilities and on-site waste treatment solutions, are emerging but are yet to significantly disrupt the established waste disposal methods. End-user trends are leaning towards increased demand for sustainable waste solutions, circular economy initiatives, and corporate social responsibility reporting on waste management practices. Mergers and acquisitions (M&A) activity remains a significant aspect of market concentration, with strategic acquisitions aimed at expanding service portfolios, geographic reach, and technological capabilities. Recent M&A deal values underscore the consolidation trend, with numerous transactions in the multi-million dollar range supporting the growth of larger entities.

North America Waste Management Market Industry Trends & Insights

The North America Waste Management Market is experiencing robust growth, propelled by a confluence of increasing waste generation, stringent environmental regulations, and a growing emphasis on sustainable practices. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period. Technological disruptions are at the forefront of industry evolution, with investments in advanced sorting technologies, automated waste collection systems, and data analytics for optimizing operational efficiency. The rise of smart city initiatives and the increasing adoption of the Internet of Things (IoT) are further enhancing waste management infrastructure. Consumer preferences are shifting towards environmentally responsible waste disposal and a greater demand for recycling and waste diversion programs. This heightened awareness is influencing corporate waste management strategies and driving demand for circular economy solutions. Competitive dynamics are characterized by intense competition among established players and emerging niche providers. Companies are differentiating themselves through innovative service offerings, technological prowess, and a commitment to sustainability. Market penetration for advanced waste management solutions is steadily increasing as municipalities and corporations recognize the long-term economic and environmental benefits. The focus on reducing landfill dependency and maximizing resource recovery is a dominant trend, driving investments in incineration with energy recovery and advanced recycling facilities.

Dominant Markets & Segments in North America Waste Management Market

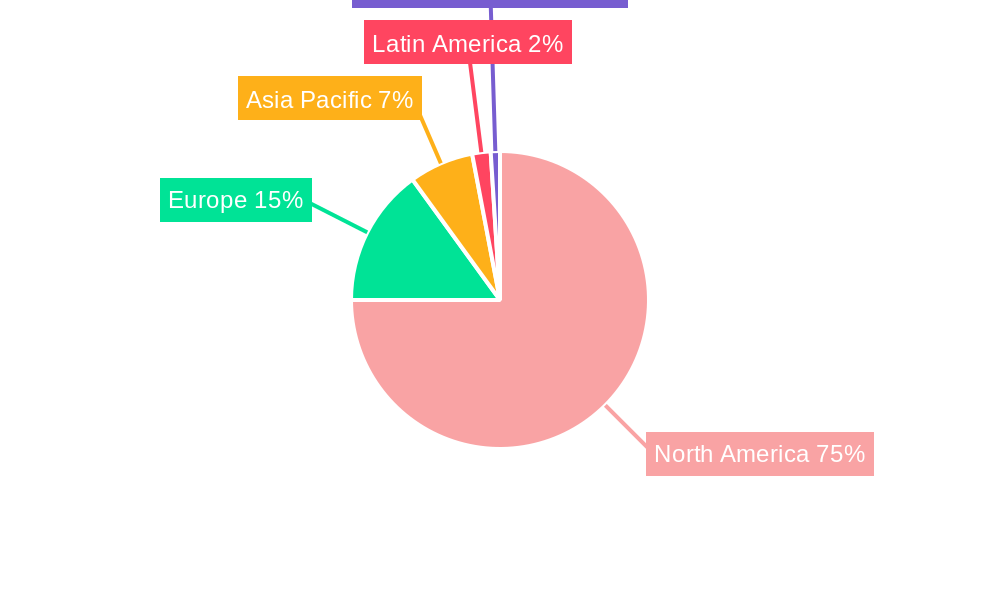

The North America Waste Management Market is predominantly influenced by the United States, which accounts for the largest market share due to its substantial industrial output and large urban populations generating significant waste volumes. Within the US, states with robust economic activity and stringent environmental regulations often lead in advanced waste management practices.

Waste Type Dominance:

- Municipal Solid Waste (MSW): This segment consistently represents the largest share of the market. Driven by increasing population density and evolving consumption patterns, the sheer volume of household and commercial waste necessitates sophisticated collection, processing, and disposal systems. Economic policies promoting waste reduction and recycling initiatives, coupled with growing public awareness, are key drivers.

- Industrial Waste: A significant segment, particularly in regions with strong manufacturing and resource extraction sectors. Economic policies supporting industrial development and the associated waste streams, along with the need for specialized handling of hazardous industrial materials, contribute to its dominance. The presence of robust infrastructure for treating and disposing of industrial by-products is crucial.

- Construction Waste: With ongoing infrastructure development and urbanization, construction and demolition (C&D) waste forms a substantial portion of the waste stream. Economic incentives for recycling C&D materials and regulations mandating waste diversion from landfills are key drivers for growth in this segment.

- Plastic Waste: Growing concerns over plastic pollution are leading to increased focus and investment in plastic waste management. Technological advancements in plastic recycling, coupled with consumer demand for sustainable alternatives, are driving this segment. Government regulations and Extended Producer Responsibility (EPR) schemes are also significant influencing factors.

- E-waste: The rapid pace of technological advancement results in a growing volume of electronic waste. Stringent regulations governing the disposal of hazardous components in e-waste and the increasing value of precious metals recoverable from these devices make this segment a focus area for specialized recycling efforts.

- Biomedical Waste: Driven by the healthcare sector's expansion, this segment requires specialized, stringent protocols for safe disposal to prevent the spread of infection. Healthcare infrastructure development and evolving public health concerns are key drivers.

Disposal Method Dominance:

- Landfill: While still a dominant disposal method, its share is gradually declining due to environmental concerns and regulatory pressures. However, modern engineered landfills with advanced leachate collection and gas capture systems remain essential for residual waste.

- Recycling: This segment is experiencing significant growth, fueled by economic incentives, consumer demand for recycled products, and government mandates. Investment in advanced Material Recovery Facilities (MRFs) and innovative recycling technologies is critical.

- Incineration (Waste-to-Energy): Increasingly favored as a method for waste reduction and energy generation, especially in densely populated areas where landfill space is limited. Policy support for renewable energy and the economic benefits of waste-to-energy plants are key drivers.

North America Waste Management Market Product Developments

Product developments in the North America Waste Management Market are largely focused on enhancing efficiency, sustainability, and cost-effectiveness. Innovations in automated sorting technologies, advanced anaerobic digestion for organic waste processing, and specialized containment solutions for hazardous materials are gaining traction. The development of digital platforms for waste tracking, route optimization, and customer engagement is also a key trend, offering competitive advantages through improved service delivery and data-driven decision-making.

North America Waste Management Market Report Scope & Segmentation Analysis

The scope of this report encompasses a detailed analysis of the North America Waste Management Market segmented by Waste Type and Disposal Methods. The waste types analyzed include Industrial Waste, Municipal Solid Waste (MSW), E-waste, Plastic Waste, and Biomedical + Others (including Construction Waste). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly examined. The report also segments the market by Disposal Methods, including Landfill, Incineration, and Recycling, providing insights into their respective market shares and future trends.

Industrial Waste: Expected to show steady growth, driven by industrial activity and regulations for hazardous waste management.

Municipal Solid Waste (MSW): Continues to be the largest segment, with ongoing demand for efficient collection and processing services.

E-waste: Forecasted to experience significant growth due to rapid technological obsolescence and increasing regulatory focus.

Plastic Waste: Growth driven by increasing recycling rates and the development of new recycling technologies.

Biomedical + Others (Including Construction Waste): These segments are expected to grow, with biomedical waste driven by healthcare expansion and construction waste by infrastructure development.

Landfill: While declining in relative importance, it remains a critical disposal method for residual waste, with ongoing investments in modern facilities.

Incineration: Projected for robust growth as waste-to-energy solutions become more attractive for energy recovery and waste volume reduction.

Recycling: Expected to see substantial expansion as circular economy principles gain prominence and advanced recycling technologies emerge.

Key Drivers of North America Waste Management Market Growth

The North America Waste Management Market's growth is propelled by several key drivers. Stringent environmental regulations, such as landfill diversion targets and emissions standards, are compelling businesses and municipalities to adopt more sustainable waste management practices. Growing public awareness and demand for eco-friendly solutions are fostering the adoption of recycling and waste-to-energy technologies. Technological advancements in sorting, processing, and data analytics are enhancing operational efficiency and reducing costs. Furthermore, the economic benefits derived from resource recovery and energy generation from waste streams are driving investments in advanced waste management infrastructure.

Challenges in the North America Waste Management Market Sector

Despite significant growth, the North America Waste Management Market faces several challenges. The high initial capital investment required for advanced recycling facilities and waste-to-energy plants can be a barrier. Fluctuations in commodity prices for recycled materials can impact the economic viability of recycling operations. Obtaining permits and navigating complex regulatory frameworks can be time-consuming and costly. Furthermore, the NIMBY (Not In My Backyard) phenomenon can hinder the development of new waste management infrastructure, particularly landfills and incineration facilities. Supply chain disruptions for critical components and the need for a skilled workforce to operate advanced technologies also pose challenges.

Emerging Opportunities in North America Waste Management Market

Emerging opportunities in the North America Waste Management Market lie in the development of advanced recycling technologies for hard-to-recycle materials like composite plastics and textiles. The growing demand for circular economy solutions presents opportunities for businesses focused on product design for recyclability and closed-loop systems. The expansion of waste-to-energy projects, particularly those incorporating carbon capture technologies, is another significant growth avenue. Furthermore, the development of digital platforms leveraging AI and IoT for smart waste management offers opportunities for improved efficiency and service delivery. The increasing focus on the management of specialized waste streams, such as batteries and critical minerals from e-waste, also presents lucrative opportunities.

Leading Players in the North America Waste Management Market Market

- Waste Management Inc.

- Republic Services Inc.

- Waste Connections Inc.

- Clean Harbors Inc.

- Covanta Holding Corporation

- Veolia North America

- Rumpke Waste & Recycling

- Heritage Environmental Services

- Waste Pro USA

- EnviroServe

- 7 3 Other Companies

Key Developments in North America Waste Management Market Industry

- March 2024: The Oak Ridge Office of Environmental Management and contractor UCOR have finished the first construction phase for the Environmental Management Disposal Facility (EMDF). This facility will offer the necessary waste disposal capacity for the Y-12 National Security Complex and Oak Ridge National Laboratory cleanup efforts. Early site preparations began in August, following a groundbreaking ceremony attended by congressional leaders and officials from the US Department of Energy, US Environmental Protection Agency, and Tennessee Department of Environment and Conservation.

- January 2024: In collaboration with Varme Energy Inc., its local subsidiary of Norway's Varme Energy, Edmonton, has finalized plans to construct a waste-to-energy plant in Alberta's capital region. This facility, set to commence operations as early as 2027, is a private initiative focused on producing eco-friendly electricity and industrial heat. It is designed to divert around 150,000 tons of household waste from landfills annually.

Strategic Outlook for North America Waste Management Market Market

The strategic outlook for the North America Waste Management Market is highly positive, characterized by sustained growth and increasing innovation. The market is poised to benefit from the continued push towards a circular economy, with a growing emphasis on waste reduction, reuse, and recycling. Investments in advanced technologies, particularly in waste-to-energy and sophisticated recycling processes, will be crucial for capturing market share. Government policies promoting sustainable waste management and the increasing corporate commitment to environmental, social, and governance (ESG) principles will further fuel market expansion. Opportunities for M&A and strategic partnerships will remain prevalent as companies seek to consolidate their market positions and expand their service offerings to meet the evolving demands of a more environmentally conscious society.

North America Waste Management Market Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. E-waste

- 1.4. Plastic waste

- 1.5. Biomedical + Others (Including Construction Waste)

-

2. Disposal methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Recycling

North America Waste Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Waste Management Market Regional Market Share

Geographic Coverage of North America Waste Management Market

North America Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Environmental Awareness; Innovations In Waste Management Technologies

- 3.3. Market Restrains

- 3.3.1. Growing Environmental Awareness; Innovations In Waste Management Technologies

- 3.4. Market Trends

- 3.4.1. Waste Management Market Surges in Response to Escalating Plastic Waste Concerns

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. E-waste

- 5.1.4. Plastic waste

- 5.1.5. Biomedical + Others (Including Construction Waste)

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Waste Management Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Republic Services Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Waste Connections Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Clean Harbors Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Covanta Holding Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Veolia North America

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rumpke Waste & Recycling

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Heritage Environmental Services

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Waste Pro USA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 EnviroServe**List Not Exhaustive 7 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Waste Management Inc

List of Figures

- Figure 1: North America Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: North America Waste Management Market Revenue Million Forecast, by Waste type 2020 & 2033

- Table 2: North America Waste Management Market Volume Billion Forecast, by Waste type 2020 & 2033

- Table 3: North America Waste Management Market Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 4: North America Waste Management Market Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 5: North America Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: North America Waste Management Market Revenue Million Forecast, by Waste type 2020 & 2033

- Table 8: North America Waste Management Market Volume Billion Forecast, by Waste type 2020 & 2033

- Table 9: North America Waste Management Market Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 10: North America Waste Management Market Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 11: North America Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States North America Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Waste Management Market?

The projected CAGR is approximately 4.01%.

2. Which companies are prominent players in the North America Waste Management Market?

Key companies in the market include Waste Management Inc, Republic Services Inc, Waste Connections Inc, Clean Harbors Inc, Covanta Holding Corporation, Veolia North America, Rumpke Waste & Recycling, Heritage Environmental Services, Waste Pro USA, EnviroServe**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the North America Waste Management Market?

The market segments include Waste type, Disposal methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 202.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Environmental Awareness; Innovations In Waste Management Technologies.

6. What are the notable trends driving market growth?

Waste Management Market Surges in Response to Escalating Plastic Waste Concerns.

7. Are there any restraints impacting market growth?

Growing Environmental Awareness; Innovations In Waste Management Technologies.

8. Can you provide examples of recent developments in the market?

March 2024: The Oak Ridge Office of Environmental Management and contractor UCOR have finished the first construction phase for the Environmental Management Disposal Facility (EMDF). This facility will offer the necessary waste disposal capacity for the Y-12 National Security Complex and Oak Ridge National Laboratory cleanup efforts. Early site preparations began in August, following a groundbreaking ceremony attended by congressional leaders and officials from the US Department of Energy, US Environmental Protection Agency, and Tennessee Department of Environment and Conservation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Waste Management Market?

To stay informed about further developments, trends, and reports in the North America Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence