Key Insights

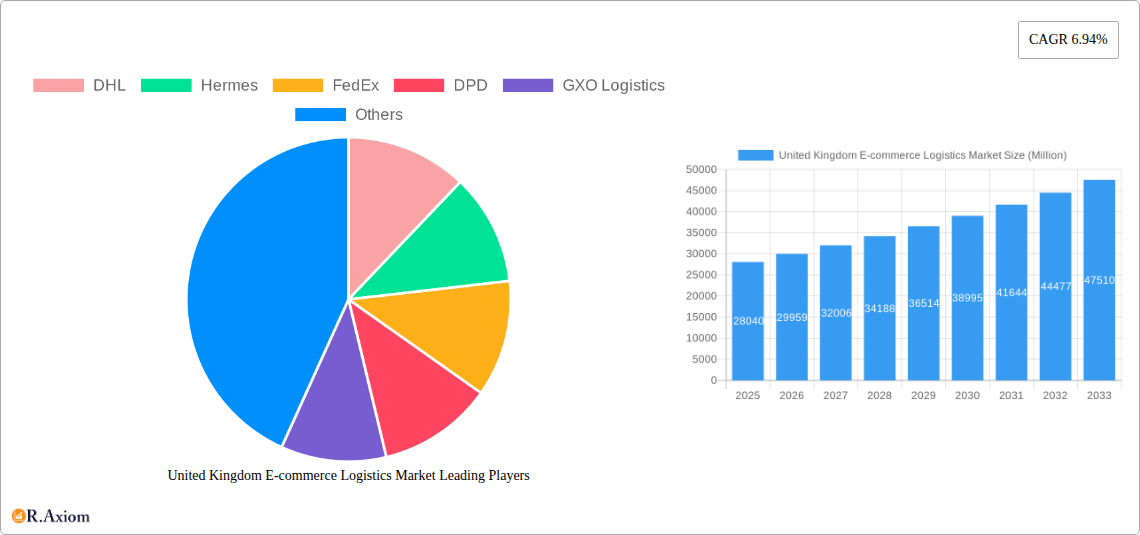

The United Kingdom's e-commerce logistics market is projected for robust expansion, with an estimated market size of $28.04 billion in 2025, growing at a Compound Annual Growth Rate (CAGR) of 6.94% through to 2033. This significant growth is propelled by several key drivers, including the sustained surge in online shopping across all consumer demographics, advancements in delivery technologies, and the increasing demand for faster and more reliable fulfillment services. The market is witnessing a strong push towards integrated logistics solutions, encompassing efficient transportation networks, sophisticated warehousing and inventory management, and a growing array of value-added services like specialized labeling and packaging. The Business-to-Business (B2B) segment continues to be a dominant force, but the Business-to-Consumer (B2C) sector is rapidly catching up, fueled by direct-to-consumer (DTC) brand proliferation and evolving consumer expectations for convenience and speed.

United Kingdom E-commerce Logistics Market Market Size (In Billion)

The competitive landscape is dynamic, featuring major global players like DHL, FedEx, and Amazon Logistics, alongside prominent regional providers such as Hermes and Royal Mail, all vying for market share. Emerging trends are heavily influenced by technological innovation, including the adoption of automation in warehouses, the use of AI for route optimization, and the exploration of drone and autonomous vehicle deliveries. These advancements are crucial in addressing market restraints such as rising operational costs, labor shortages, and the environmental impact of logistics operations, particularly for international or cross-border shipments which are seeing increased demand, especially for fashion, apparel, and consumer electronics. Companies are investing in sustainable logistics practices and innovative packaging solutions to mitigate these challenges and enhance customer satisfaction, particularly within the fast-moving fashion and apparel sector, as well as for high-value consumer electronics and home appliances.

United Kingdom E-commerce Logistics Market Company Market Share

This in-depth report provides a detailed analysis of the United Kingdom E-commerce Logistics Market, encompassing market size, growth trends, competitive landscape, and strategic insights for stakeholders. The study covers the historical period from 2019 to 2024, with the base year as 2025, and projects growth through to 2033. Leveraging high-traffic keywords such as "UK e-commerce logistics," "online retail fulfillment," "last-mile delivery UK," and "e-commerce warehousing solutions," this report is optimized for maximum search visibility and engagement within the industry.

United Kingdom E-commerce Logistics Market Market Concentration & Innovation

The United Kingdom e-commerce logistics market exhibits a moderate to high concentration, with dominant players like DHL, FedEx, and Royal Mail holding significant market share. However, the burgeoning e-commerce sector fuels continuous innovation, driven by the need for faster, more efficient, and sustainable logistics solutions. Key innovation drivers include the integration of artificial intelligence (AI) for route optimization and demand forecasting, the adoption of advanced robotics in warehousing, and the development of eco-friendly delivery options such as electric vehicles. Regulatory frameworks, including those concerning emissions, data privacy, and labor laws, play a crucial role in shaping operational strategies and investment decisions. The threat of product substitutes is minimal in the core logistics services themselves, but innovation in alternative delivery models and direct-to-consumer (DTC) strategies by brands can indirectly impact the demand for traditional e-commerce logistics. End-user trends are increasingly leaning towards same-day or next-day delivery, personalized returns, and transparent tracking, pushing logistics providers to enhance their service offerings. Mergers and acquisitions (M&A) activities are a notable aspect of market dynamics. For instance, the acquisition of Shopify Logistics assets by Flexport in May 2023, valued at an estimated XX Million, underscores the strategic importance of logistics capabilities in the online retail ecosystem. While specific M&A deal values for the UK segment are not readily available, the global trend indicates substantial investment in acquiring advanced technology and expanding network reach.

United Kingdom E-commerce Logistics Market Industry Trends & Insights

The United Kingdom e-commerce logistics market is experiencing robust growth, fueled by the sustained surge in online shopping and evolving consumer expectations. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.5% over the forecast period (2025-2033). This expansion is primarily driven by increasing internet penetration, the growing adoption of smartphones for online purchases, and the convenience offered by e-commerce platforms. Technological disruptions are at the forefront of this evolution. The integration of AI and machine learning is revolutionizing warehouse management, optimizing inventory levels, and predicting demand with greater accuracy. Automation, through robotics and automated guided vehicles (AGVs), is enhancing operational efficiency and reducing labor costs in fulfillment centers. The rise of drone delivery and autonomous vehicles for last-mile delivery, while still in nascent stages, represents a significant future trend.

Consumer preferences are rapidly shifting, with a strong demand for faster delivery times, often within 24-48 hours, and flexible delivery options, including click-and-collect services and precise delivery windows. Returns management has also become a critical differentiator, with consumers expecting hassle-free and convenient return processes. Competitive dynamics are intensifying, with established players investing heavily in infrastructure and technology to maintain their market share, while new entrants, often tech-focused, are disrupting traditional models with innovative solutions. The increasing importance of sustainability is also shaping the industry, with a growing emphasis on green logistics, including the use of electric delivery fleets and optimized route planning to reduce carbon emissions. The overall market penetration of e-commerce logistics services is expected to reach 85% by 2033, indicating its indispensable role in the UK's retail landscape. The market size for UK e-commerce logistics is estimated to reach XXX Million by 2025 and is projected to grow to YYY Million by 2033.

Dominant Markets & Segments in United Kingdom E-commerce Logistics Market

The Transportation segment is currently the largest and most dominant within the UK e-commerce logistics market, accounting for an estimated 45% of the total market value. This dominance is propelled by the sheer volume of goods being moved daily across the country. Key drivers for this segment's leadership include:

- Economic Policies: Government initiatives promoting trade and e-commerce growth, coupled with favorable import/export regulations, support robust transportation networks.

- Infrastructure: The UK possesses a well-developed road network and significant port infrastructure, facilitating efficient domestic and international freight movement.

- Consumer Demand: The insatiable demand for rapid delivery, especially for products like fashion and apparel and consumer electronics, directly fuels the need for extensive transportation services.

Within Transportation, Domestic delivery represents the largest sub-segment due to the high volume of intra-UK e-commerce transactions. However, International/Cross Border logistics is experiencing rapid growth, driven by the increasing popularity of global online marketplaces and the demand for a wider variety of products.

Warehousing and Inventory Management is the second-largest segment, comprising approximately 35% of the market. The exponential growth of online retail necessitates sophisticated warehousing solutions to store, manage, and fulfill orders efficiently.

- Urbanization: The concentration of consumers in urban areas requires strategically located fulfillment centers to facilitate last-mile delivery.

- Technology Adoption: The increasing use of Warehouse Management Systems (WMS) and automation technologies enhances efficiency and reduces operational costs.

- Product Diversity: The wide array of products, from fast-moving consumer goods to larger items like furniture, demands diverse warehousing capabilities, including temperature-controlled and specialized storage.

The B2C (Business-to-Consumer) business model significantly outweighs B2B in terms of volume and value within e-commerce logistics, reflecting the direct-to-consumer nature of online retail.

Value-added services (labeling, packaging, etc.) constitute the remaining 20% of the market. These services are crucial for ensuring product integrity and presentation during transit. The Fashion and Apparel product category is a major contributor to the e-commerce logistics market's demand, followed closely by Consumer electronics and Beauty and Personal Care. The increasing popularity of online purchasing for these items, coupled with high return rates in fashion, drives substantial logistics activity. The Home Appliances and Furniture segments, while smaller in volume, often require specialized handling and delivery, contributing significantly to the value of logistics services.

United Kingdom E-commerce Logistics Market Product Developments

Product developments in UK e-commerce logistics are heavily focused on enhancing speed, efficiency, and customer experience. Innovations include the deployment of AI-powered route optimization software to minimize delivery times and fuel consumption, and the introduction of smart packaging solutions that provide real-time temperature and shock monitoring for sensitive goods. Furthermore, the integration of advanced robotics in warehouses, such as autonomous mobile robots (AMRs) for picking and sorting, is drastically improving order fulfillment accuracy and speed. The development of user-friendly customer portals for seamless tracking and returns management, along with the expansion of dark stores and micro-fulfillment centers in urban areas, are key competitive advantages being leveraged by logistics providers to meet the ever-increasing demands of the online retail sector.

Report Scope & Segmentation Analysis

This report segments the United Kingdom E-commerce Logistics Market across several key dimensions. The Service segmentation includes Transportation, Warehousing and Inventory Management, and Value-added services. Transportation is projected to grow at a CAGR of 13% due to increasing online sales volumes. Warehousing and Inventory Management, with an estimated market size of XXX Million in 2025, is expected to grow at a CAGR of 11.5%, driven by the need for efficient storage and fulfillment. Value-added services, projected to reach YYY Million by 2033, will see a CAGR of 10.8% as businesses increasingly outsource complex customization and preparation tasks.

The Business segmentation divides the market into B2B and B2C. B2C, currently the dominant segment at ZZZ Million in 2025, is anticipated to grow at a CAGR of 13.2%, driven by direct consumer purchasing. B2B, valued at AAA Million in 2025, is expected to grow at a CAGR of 9.5%.

The Destination segmentation categorizes the market into Domestic and International/Cross Border. Domestic logistics, valued at BBB Million in 2025, is forecast to grow at a CAGR of 12.8%. International/Cross Border logistics, with a market size of CCC Million in 2025, is projected to expand at a CAGR of 14.1% owing to global e-commerce trends.

The Product segmentation includes Fashion and Apparel, Consumer electronics, Home Appliances, Furniture, Beauty and Personal care, and Other products. Fashion and Apparel, valued at DDD Million in 2025, is expected to grow at a CAGR of 13.5%. Consumer electronics, projected to reach EEE Million in 2033, will see a CAGR of 12.9%.

Key Drivers of United Kingdom E-commerce Logistics Market Growth

Several key drivers are propelling the growth of the UK e-commerce logistics market. The unwavering surge in online retail penetration, fueled by consumer convenience and a wider product selection, is the primary catalyst. Technological advancements, particularly in automation, AI, and data analytics, are enhancing operational efficiency and reducing costs. The increasing demand for faster delivery times and improved customer experience, including seamless returns, is compelling logistics providers to invest in their infrastructure and service offerings. Government support for e-commerce and infrastructure development, alongside a robust digital economy, further contributes to market expansion.

Challenges in the United Kingdom E-commerce Logistics Market Sector

Despite its strong growth, the UK e-commerce logistics market faces several challenges. The escalating cost of fuel and labor, coupled with driver shortages, poses a significant operational hurdle. Stringent environmental regulations and the increasing consumer demand for sustainable practices necessitate substantial investments in green logistics solutions. The complexity of last-mile delivery in densely populated urban areas, characterized by traffic congestion and limited delivery windows, adds to operational costs and delivery times. Furthermore, intense competition among logistics providers can lead to price wars and pressure on profit margins, while the need for continuous technological upgrades requires substantial capital investment.

Emerging Opportunities in United Kingdom E-commerce Logistics Market

Emerging opportunities within the UK e-commerce logistics market are abundant. The burgeoning demand for same-day and even same-hour delivery services presents a significant growth avenue, particularly in metropolitan areas. The continuous expansion of the B2C e-commerce sector, especially in niche markets like personalized goods and subscription boxes, opens new logistics demands. Advancements in drone and autonomous vehicle technology offer the potential for more efficient and cost-effective last-mile deliveries. Furthermore, the growing emphasis on reverse logistics and sustainable packaging solutions creates opportunities for specialized service providers. The increasing adoption of IoT devices for real-time tracking and inventory management also presents significant growth potential.

Leading Players in the United Kingdom E-commerce Logistics Market Market

- DHL

- Hermes

- FedEx

- DPD

- GXO Logistics

- Amazon Logistics

- Agility Logistics

- TNT Express

- DTDC

- Royal Mail

- Zendbox

- 7 3 Other Companie

Key Developments in United Kingdom E-commerce Logistics Market Industry

- January 2024: DHL Supply Chain announced a strategic alliance with robotics company Robust.ai to create and deploy a cutting-edge robotic warehouse fleet. This strategic alliance brought together DHL Supply Chain’s extensive knowledge of logistics issues, track record in implementing automated solutions, and Robust.ai’s experience in AI and advanced robotics.

- May 2023: Flexport, a leading technology-driven logistics platform, acquired Shopify Logistics assets, including Deliverr, Inc.

Strategic Outlook for United Kingdom E-commerce Logistics Market Market

The strategic outlook for the United Kingdom e-commerce logistics market remains exceptionally strong, driven by the persistent growth of online retail and evolving consumer expectations. Key growth catalysts include continued investment in automation and AI to enhance efficiency and reduce operational costs, and the expansion of last-mile delivery networks to meet the demand for faster fulfillment. The increasing focus on sustainability will drive innovation in green logistics, creating opportunities for companies that adopt environmentally friendly practices. Strategic partnerships and acquisitions will continue to shape the competitive landscape, enabling companies to expand their service offerings and geographical reach. The integration of advanced technologies for real-time visibility and data-driven decision-making will be paramount for success, ensuring that logistics providers can adapt to the dynamic demands of the UK e-commerce ecosystem. The market is poised for continued expansion, with an emphasis on agility, customer-centricity, and technological integration.

United Kingdom E-commerce Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory Management

- 1.3. Value-added services (labeling, packaging, etc.)

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International/Cross Border

-

4. product

- 4.1. Fashion and pparel

- 4.2. Consumer electronics

- 4.3. Home Appliances

- 4.4. Furniture

- 4.5. Beauty and Personal care

- 4.6. Other products (Toys, Food Products, etc.)

United Kingdom E-commerce Logistics Market Segmentation By Geography

- 1. United Kingdom

United Kingdom E-commerce Logistics Market Regional Market Share

Geographic Coverage of United Kingdom E-commerce Logistics Market

United Kingdom E-commerce Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing E-commerce Penetration; Surge in Cross-Border Trade Activities

- 3.3. Market Restrains

- 3.3.1. Infrastructure Challenges; Regulatory Complexities

- 3.4. Market Trends

- 3.4.1. Immense Growth Projection for the Domestic Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory Management

- 5.1.3. Value-added services (labeling, packaging, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/Cross Border

- 5.4. Market Analysis, Insights and Forecast - by product

- 5.4.1. Fashion and pparel

- 5.4.2. Consumer electronics

- 5.4.3. Home Appliances

- 5.4.4. Furniture

- 5.4.5. Beauty and Personal care

- 5.4.6. Other products (Toys, Food Products, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hermes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FedEx

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DPD

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GXO Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amazon Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Agility Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TNT Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DTDC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Royal Mail

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Zendbox**List Not Exhaustive 7 3 Other Companie

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: United Kingdom E-commerce Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom E-commerce Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by product 2020 & 2033

- Table 5: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by product 2020 & 2033

- Table 10: United Kingdom E-commerce Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom E-commerce Logistics Market?

The projected CAGR is approximately 6.94%.

2. Which companies are prominent players in the United Kingdom E-commerce Logistics Market?

Key companies in the market include DHL, Hermes, FedEx, DPD, GXO Logistics, Amazon Logistics, Agility Logistics, TNT Express, DTDC, Royal Mail, Zendbox**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the United Kingdom E-commerce Logistics Market?

The market segments include Service, Business, Destination, product.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing E-commerce Penetration; Surge in Cross-Border Trade Activities.

6. What are the notable trends driving market growth?

Immense Growth Projection for the Domestic Segment.

7. Are there any restraints impacting market growth?

Infrastructure Challenges; Regulatory Complexities.

8. Can you provide examples of recent developments in the market?

January 2024: DHL Supply chain announced a strategic alliance with robotics company Robust.ai to create and deploy a cutting-edge robotic warehouse fleet. This strategic alliance brought together the DHL Supply chain’s extensive knowledge of logistics issues, track record in implementing automated solutions, and Robust.ai’s experience in AI and advanced robotics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom E-commerce Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom E-commerce Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom E-commerce Logistics Market?

To stay informed about further developments, trends, and reports in the United Kingdom E-commerce Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence