Key Insights

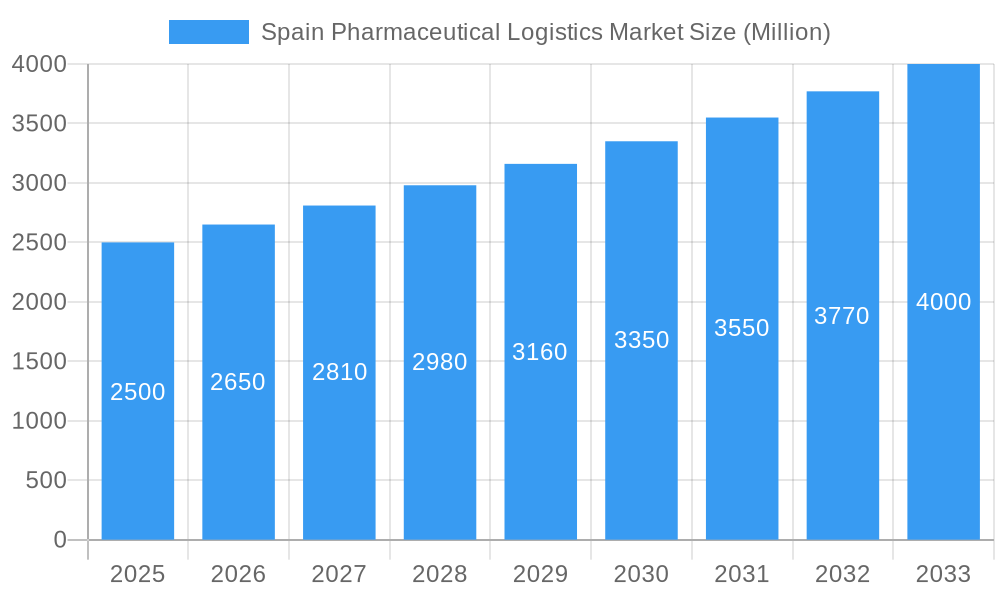

The Spain pharmaceutical logistics market, valued at approximately €[Estimate based on available market size data for similar regions and adjusting for Spain's specific pharmaceutical market size] million in 2025, exhibits robust growth potential, projected to expand at a CAGR exceeding 6% from 2025 to 2033. This expansion is driven by several key factors. Firstly, Spain's aging population and increasing prevalence of chronic diseases fuel demand for pharmaceuticals, necessitating efficient and reliable logistics solutions. Secondly, the rise of e-pharmacy and direct-to-patient deliveries are reshaping the landscape, demanding advanced cold-chain capabilities and sophisticated delivery networks. Further growth is spurred by government initiatives promoting pharmaceutical innovation and the increasing adoption of temperature-sensitive drug delivery systems, particularly within the biopharmaceutical segment. The market is segmented by mode of transport (air, rail, road, sea), product type (generic and branded drugs), operational mode (cold chain and non-cold chain), and application (biopharma and chemical pharma).

Spain Pharmaceutical Logistics Market Market Size (In Billion)

However, the market faces certain challenges. Stringent regulatory compliance and safety standards within the pharmaceutical industry necessitate significant investments in infrastructure and technology. Furthermore, economic fluctuations and potential supply chain disruptions can impact the market's growth trajectory. Despite these restraints, the long-term outlook remains positive. Major players like DB Schenker, DHL, UPS, FedEx, and Kuehne+Nagel are well-positioned to capitalize on this growth, leveraging their existing networks and technological expertise. The competitive landscape will likely witness further consolidation and innovation as companies strive to meet the evolving demands of the pharmaceutical industry. The increasing focus on sustainability and reducing carbon footprint will also shape future strategies within the market.

Spain Pharmaceutical Logistics Market Company Market Share

Spain Pharmaceutical Logistics Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Spain pharmaceutical logistics market, offering actionable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable data and forecasts to inform strategic decision-making. The report segments the market by mode of transport (air, rail, road, sea), product (generic and branded drugs), mode of operation (cold chain and non-cold chain logistics), and application (biopharma and chemical pharma). Key players analyzed include DB Schenker, DHL, United Parcel Service, CSP, Kuehne+Nagel International AG, FedEx, CEVA Logistics, Agility Logistics, C H Robinson, Movianto, and Eurotranspharma.

Spain Pharmaceutical Logistics Market Concentration & Innovation

The Spanish pharmaceutical logistics market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller, specialized logistics providers fosters competition and innovation. Market share data for 2024 reveals that the top 5 players collectively hold approximately xx% of the market, while the remaining xx% is distributed among numerous smaller players. This fragmentation offers opportunities for niche players to thrive.

Innovation is driven by several factors:

- Stringent Regulatory Framework: Compliance with stringent regulations regarding temperature-sensitive drug transportation and data security drives investment in advanced technologies.

- Product Substitutes: The emergence of innovative packaging and delivery solutions is constantly challenging the status quo.

- End-User Trends: Growing demand for personalized medicine and specialized delivery solutions for clinical trials fuels market dynamism.

- M&A Activities: Significant M&A activity, as evidenced by recent acquisitions (detailed in the "Key Developments" section), reflects consolidation and expansion efforts by leading players. The total value of M&A deals in the sector during 2019-2024 reached approximately xx Million.

Spain Pharmaceutical Logistics Market Industry Trends & Insights

The Spain pharmaceutical logistics market is experiencing robust growth, fueled by several factors. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was xx%, and is projected to reach xx% during the forecast period (2025-2033). This growth is driven by:

- Increasing Pharmaceutical Production & Consumption: Spain's growing pharmaceutical sector and rising healthcare expenditure significantly contribute to market expansion.

- Technological Disruptions: Advancements in cold chain technologies, automation, and real-time tracking systems are enhancing efficiency and supply chain visibility.

- Consumer Preferences: Patients' increasing demand for home delivery of pharmaceuticals boosts the demand for efficient and reliable logistics solutions.

- Competitive Dynamics: The market's competitive landscape encourages innovation and the adoption of best practices, pushing market expansion and efficiency. Market penetration of cold chain logistics is expected to increase from xx% in 2024 to xx% by 2033.

Dominant Markets & Segments in Spain Pharmaceutical Logistics Market

The Spanish pharmaceutical logistics market is geographically diverse, with major activity concentrated in regions with strong pharmaceutical manufacturing and distribution hubs. Specific regional performance data is limited to maintain confidentiality but varies slightly by segment.

By Mode of Transport: Road shipping currently dominates the market due to its cost-effectiveness and widespread infrastructure. However, air shipping is rapidly gaining traction for time-sensitive deliveries.

- Road Shipping: Key drivers include extensive road networks and cost-effectiveness.

- Air Shipping: Driven by the need for speed in transporting temperature-sensitive drugs and high-value pharmaceuticals.

- Rail Shipping: Limited due to comparatively less developed rail infrastructure for pharmaceutical shipments.

- Sea Shipping: A niche segment primarily used for importing and exporting large quantities of pharmaceuticals.

By Product: Branded drugs currently hold a larger market share due to higher pricing and associated logistics demands compared to generic drugs.

By Mode of Operation: Cold chain logistics is experiencing rapid growth due to the increasing proportion of temperature-sensitive pharmaceuticals.

By Application: Both biopharma and chemical pharma segments contribute significantly, with their growth trajectory largely dependent on the development of new drugs and therapies.

Spain Pharmaceutical Logistics Market Product Developments

Recent innovations include the adoption of smart packaging with integrated temperature sensors and GPS tracking, and the use of automated warehouse systems and drones for efficient delivery. These developments address market demands for improved supply chain visibility, enhanced security, and reduced operational costs. The integration of blockchain technology for secure data management is also gaining traction.

Report Scope & Segmentation Analysis

This report segments the Spain pharmaceutical logistics market comprehensively:

By Mode of Transport: Air, Rail, Road, Sea shipping segments are individually analyzed, providing market size projections, growth rates, and competitive dynamics.

By Product: Generic and Branded drugs segments are individually examined, providing insights into pricing trends, shipment volumes, and specialized logistics requirements.

By Mode of Operation: Cold chain and Non-cold chain logistics segments are assessed, factoring in respective growth rates, infrastructural needs, and technological developments.

By Application: Biopharma and Chemical pharma segments are dissected, presenting insights into volume-based logistics requirements for both segments.

Key Drivers of Spain Pharmaceutical Logistics Market Growth

Several factors contribute to the market's growth:

- Technological advancements: Improved cold chain technologies, automation, and real-time tracking systems.

- Government regulations: Stringent regulations promoting the efficient and safe handling of pharmaceuticals.

- Economic growth: Increasing healthcare spending and pharmaceutical production.

Challenges in the Spain Pharmaceutical Logistics Market Sector

The market faces challenges including:

- Regulatory complexities: Stringent regulations demanding high compliance costs.

- Supply chain disruptions: Global events can impact drug availability and delivery timelines.

- Intense competition: The presence of several established players creates intense competition.

Emerging Opportunities in Spain Pharmaceutical Logistics Market

Opportunities exist in:

- Specialized logistics for personalized medicine: Catering to tailored drug deliveries.

- Adoption of advanced technologies: Utilizing AI and machine learning for improved efficiency.

- Expansion into rural markets: Providing pharmaceutical access to underserved areas.

Leading Players in the Spain Pharmaceutical Logistics Market Market

- DB Schenker

- DHL

- United Parcel Service

- CSP

- Kuehne+Nagel International AG

- FedEx

- CEVA Logistics

- Agility Logistics

- C H Robinson

- Movianto

- Eurotranspharma

Key Developments in Spain Pharmaceutical Logistics Market Industry

- January 2022: MOVIANTO invested 41.88 Million USD in a new center in Numancia de la Sagra (Toledo), significantly expanding its cold storage capacity.

- August 2022: Lineage Logistics announced its intent to acquire Grupo Fuentes, expanding its cold storage capabilities in Murcia by 100,000 pallet positions.

Strategic Outlook for Spain Pharmaceutical Logistics Market Market

The Spanish pharmaceutical logistics market presents significant growth potential, driven by technological advancements, regulatory changes, and increasing healthcare expenditure. Focus on cold chain solutions, innovative delivery methods, and efficient supply chain management will be crucial for market success. The market is poised for continued expansion, with opportunities for both established players and new entrants to capitalize on emerging trends and unmet needs.

Spain Pharmaceutical Logistics Market Segmentation

-

1. Product

- 1.1. Generic Drugs

- 1.2. Branded Drugs

-

2. Mode of Operation

- 2.1. Cold Chain Logistics

- 2.2. Non-cold Chain Logistics

-

3. Application

- 3.1. Bio Pharma

- 3.2. Chemical Pharma

-

4. Mode Of Transport

- 4.1. Air Shipping

- 4.2. Rail Shipping

- 4.3. Road Shipping

- 4.4. Sea Shipping

Spain Pharmaceutical Logistics Market Segmentation By Geography

- 1. Spain

Spain Pharmaceutical Logistics Market Regional Market Share

Geographic Coverage of Spain Pharmaceutical Logistics Market

Spain Pharmaceutical Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Transportation Ordered

- 3.4. Market Trends

- 3.4.1. Increase in Pharmaceutical Sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Pharmaceutical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Generic Drugs

- 5.1.2. Branded Drugs

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.2.1. Cold Chain Logistics

- 5.2.2. Non-cold Chain Logistics

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bio Pharma

- 5.3.2. Chemical Pharma

- 5.4. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.4.1. Air Shipping

- 5.4.2. Rail Shipping

- 5.4.3. Road Shipping

- 5.4.4. Sea Shipping

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 United Parcel Service

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CSP**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuehne+Nagel International AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agility Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 C H Robinson

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Movianto

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Eurotranspharma

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Spain Pharmaceutical Logistics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Spain Pharmaceutical Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Mode of Operation 2020 & 2033

- Table 3: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Mode Of Transport 2020 & 2033

- Table 5: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 7: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Mode of Operation 2020 & 2033

- Table 8: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Mode Of Transport 2020 & 2033

- Table 10: Spain Pharmaceutical Logistics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Pharmaceutical Logistics Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Spain Pharmaceutical Logistics Market?

Key companies in the market include DB Schenker, DHL, United Parcel Service, CSP**List Not Exhaustive, Kuehne+Nagel International AG, FedEx, CEVA Logistics, Agility Logistics, C H Robinson, Movianto, Eurotranspharma.

3. What are the main segments of the Spain Pharmaceutical Logistics Market?

The market segments include Product, Mode of Operation, Application, Mode Of Transport .

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Over the Counter Drugs Across the European Region; Growing Manufacture Activity from Pharmaceutical Companies.

6. What are the notable trends driving market growth?

Increase in Pharmaceutical Sales.

7. Are there any restraints impacting market growth?

High Cost Associated with the Transportation Ordered.

8. Can you provide examples of recent developments in the market?

August 2022: Lineage Logistics, LLC ('Lineage' or the 'Company'), one of the world's leading temperature-controlled industrial REIT and logistics solutions providers, announced its intention to acquire Grupo Fuentes, a major operator of transport and cold storage facilities, headquartered in Murcia, Spain. Grupo Fuentes has a cold storage warehouse in Murcia with 60,000 pallet positions and plans to expand the site with an additional 40,000 pallet positions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Pharmaceutical Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Pharmaceutical Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Pharmaceutical Logistics Market?

To stay informed about further developments, trends, and reports in the Spain Pharmaceutical Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence