Key Insights

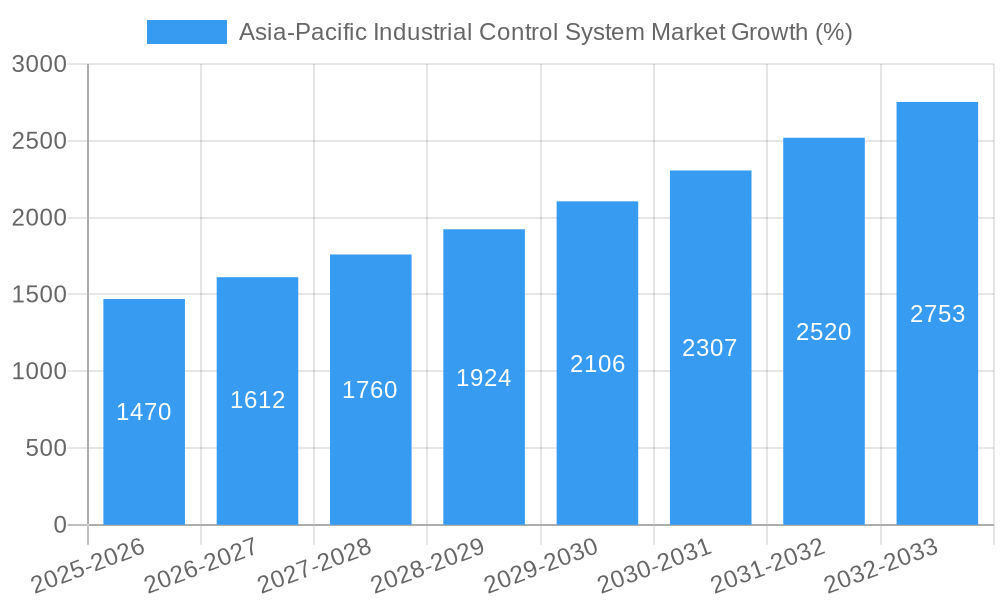

The Asia-Pacific Industrial Control System (ICS) market is experiencing robust growth, driven by the region's rapid industrialization, increasing automation across various sectors, and the burgeoning adoption of smart manufacturing technologies. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 9.83% and a base year of 2025), is projected to witness significant expansion through 2033. Key drivers include the substantial investments in infrastructure development, particularly in China and India, the rising demand for improved operational efficiency and productivity in industries like automotive, chemical, and power & utilities, and the growing emphasis on data-driven decision-making. The increasing integration of advanced technologies such as cloud computing, artificial intelligence (AI), and the Industrial Internet of Things (IIoT) is further propelling market growth. While challenges like cybersecurity concerns and the need for skilled workforce remain, the overall trajectory points towards a continuously expanding market.

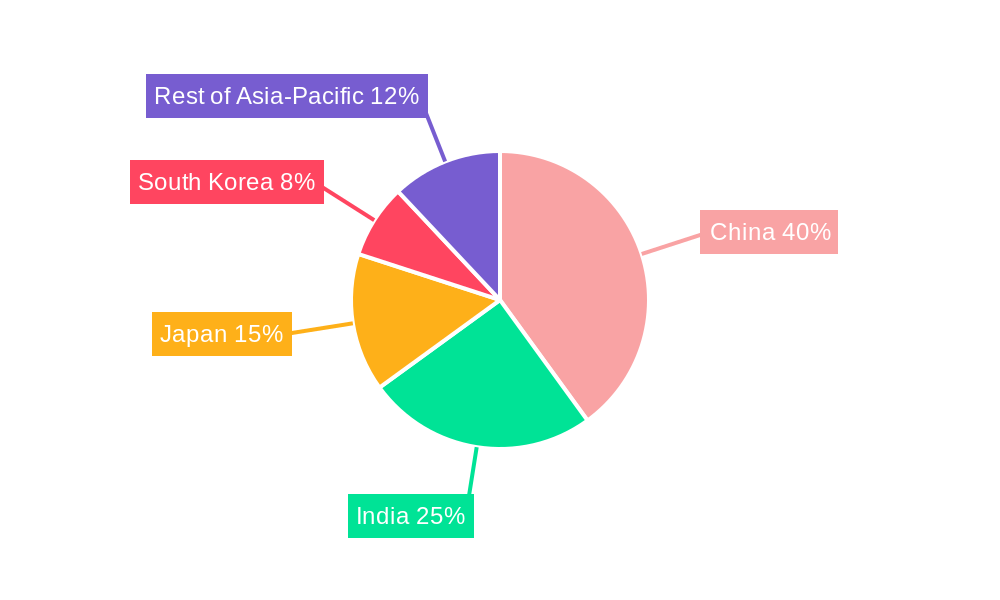

Significant growth is anticipated across various end-user segments. The automotive, chemical and petrochemical, and power and utilities sectors are expected to remain major contributors due to their high levels of automation and reliance on sophisticated control systems. The electronics and semiconductor industry is also projected to show strong growth, driven by the increasing complexity and automation in manufacturing processes. Geographical analysis reveals that China, India, and Japan will remain pivotal markets, fueled by ongoing industrial expansion and government initiatives promoting digital transformation. Companies like Honeywell, Siemens, and Schneider Electric are strategically positioned to capitalize on this growth, leveraging their established presence and advanced technological capabilities to secure market share. The continued investment in research and development of advanced ICS technologies will be crucial in maintaining the momentum of this expanding market.

Asia-Pacific Industrial Control System Market: A Comprehensive Report (2019-2033)

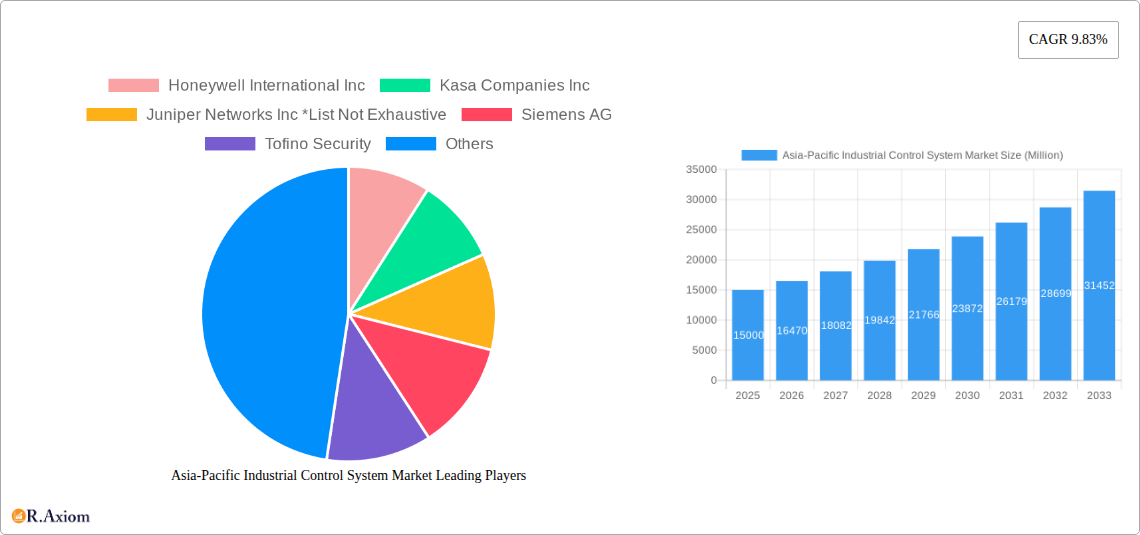

This comprehensive report provides a detailed analysis of the Asia-Pacific Industrial Control System (ICS) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils the market's dynamics, growth drivers, challenges, and future opportunities. The report utilizes rigorous research methodologies and incorporates data from credible sources to offer a robust and reliable forecast. Key players such as Honeywell International Inc, Kasa Companies Inc, Juniper Networks Inc, Siemens AG, Tofino Security, Schneider Electric, Sourcefire Inc, IBM, and ABB are analyzed, but the list is not exhaustive.

Asia-Pacific Industrial Control System Market Market Concentration & Innovation

The Asia-Pacific ICS market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. However, the market is witnessing increased competition from both established players and emerging startups. Innovation is a key driver, fueled by advancements in areas such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT). Stringent regulatory frameworks focusing on cybersecurity and data privacy are shaping market practices. The rise of product substitutes, such as cloud-based solutions, is also impacting market dynamics. End-user trends towards automation, digitization, and improved efficiency are driving demand. Mergers and acquisitions (M&A) activity is significant, reflecting consolidation and strategic expansion within the market.

- Market Share: The top 5 players collectively hold approximately xx% of the market share in 2025.

- M&A Activity: Total M&A deal value in the Asia-Pacific ICS market reached approximately $xx Million in 2024, with an expected increase to $xx Million by 2028.

- Innovation Drivers: AI-powered predictive maintenance, cybersecurity advancements, cloud-based ICS solutions.

- Regulatory Frameworks: Data privacy regulations (e.g., GDPR in certain regions) and cybersecurity standards are driving adoption of secure ICS solutions.

- Product Substitutes: Cloud-based solutions, software-defined networking.

Asia-Pacific Industrial Control System Market Industry Trends & Insights

The Asia-Pacific ICS market is experiencing robust growth, driven by increasing industrial automation across various sectors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, such as the proliferation of IoT devices and the adoption of AI-powered analytics, are transforming industry practices. Consumer preferences are shifting towards more efficient, secure, and sustainable ICS solutions. Competitive dynamics are intense, with established players focusing on innovation and expansion, while new entrants are disrupting the market with disruptive technologies and business models. Market penetration of advanced ICS solutions is steadily increasing, reaching an estimated xx% in 2025.

Dominant Markets & Segments in Asia-Pacific Industrial Control System Market

China and Japan are the dominant markets within the Asia-Pacific region, accounting for xx% and xx% of the total market value in 2025, respectively. The Oil and Gas and Power and Utilities sectors are major end-users, followed by the Chemical and Petrochemical and Automotive industries.

Key Drivers for Dominant Segments:

- Oil and Gas: Growing demand for energy, coupled with the need for enhanced operational efficiency and safety.

- Power and Utilities: Smart grid initiatives, renewable energy integration, and the need for improved grid reliability.

- Chemical and Petrochemical: Automation and optimization of complex chemical processes.

- Automotive: Increasing automation in automotive manufacturing and the rise of electric vehicles.

Dominance Analysis: China's rapid industrialization and substantial investments in infrastructure are major factors contributing to its market dominance. Japan’s technological advancements and strong industrial base also play a significant role.

Asia-Pacific Industrial Control System Market Product Developments

Recent product innovations focus on enhancing cybersecurity, improving operational efficiency, and integrating advanced analytics. New solutions leverage AI and ML for predictive maintenance and real-time anomaly detection. The integration of IoT technologies enables remote monitoring and control of industrial processes, improving efficiency and reducing downtime. These developments cater to the growing demand for secure, reliable, and cost-effective ICS solutions, aligning with the evolving needs of industries across the Asia-Pacific region.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific ICS market by end-user, including Automotive, Chemical and Petrochemical, Power and Utilities, Pharmaceuticals, Food and Beverage, Oil and Gas, Electronics and Semiconductor, and Other End Users. Each segment exhibits unique growth trajectories driven by specific industry dynamics and technological adoption rates. Growth projections vary across segments, with the Oil and Gas and Power and Utilities sectors experiencing comparatively faster growth due to large-scale infrastructure development and modernization projects. Competitive dynamics are segment-specific, with established players often holding dominant positions in some segments while new entrants pose challenges in others. Market sizes for each segment are projected to reach xx Million by 2033.

Key Drivers of Asia-Pacific Industrial Control System Market Growth

The Asia-Pacific ICS market's growth is primarily driven by:

- Technological advancements: AI, IoT, and cloud computing are enabling enhanced automation, efficiency, and data-driven decision-making.

- Economic growth: Rapid industrialization and urbanization across the region are fueling demand for advanced ICS solutions.

- Government initiatives: Policies promoting digital transformation and smart manufacturing are driving investment in ICS infrastructure.

Challenges in the Asia-Pacific Industrial Control System Market Sector

The Asia-Pacific ICS market faces challenges such as:

- Cybersecurity threats: Increased connectivity and data exchange heighten vulnerability to cyberattacks, requiring robust security measures.

- Supply chain disruptions: Global supply chain issues can affect the availability of ICS components and equipment, impacting project timelines and costs.

- Skilled labor shortage: The demand for skilled professionals to install, operate, and maintain ICS systems exceeds the current supply.

Emerging Opportunities in Asia-Pacific Industrial Control System Market

Emerging opportunities include:

- Smart manufacturing adoption: Increased adoption of smart manufacturing initiatives offers significant opportunities for ICS providers.

- Integration of renewable energy sources: The growing adoption of renewable energy necessitates advanced ICS solutions for efficient grid management.

- Growth in developing economies: Developing economies in the Asia-Pacific region offer substantial untapped potential for ICS market expansion.

Leading Players in the Asia-Pacific Industrial Control System Market Market

- Honeywell International Inc

- Kasa Companies Inc

- Juniper Networks Inc

- Siemens AG

- Tofino Security

- Schneider Electric

- Sourcefire Inc

- IBM

- ABB

Key Developments in Asia-Pacific Industrial Control System Market Industry

- July 2022: Siemens acquired Senseye, expanding its predictive maintenance portfolio.

- July 2022: Emerson extended its agreement with Dragos Inc., enhancing cybersecurity capabilities.

- June 2022: Rockwell Automation collaborated with Bravo Motor Company, focusing on EV manufacturing solutions.

- January 2022: Honeywell collaborated with FREYR Battery, developing smart energy storage solutions.

Strategic Outlook for Asia-Pacific Industrial Control System Market Market

The Asia-Pacific ICS market is poised for sustained growth, driven by strong economic growth, technological advancements, and government support for industrial automation. Opportunities abound in sectors such as renewable energy, smart manufacturing, and digital infrastructure development. Companies that focus on innovation, cybersecurity, and customer-centric solutions are well-positioned to capitalize on this market's potential. The market is expected to witness further consolidation through M&A activity and the emergence of new technologies and business models.

Asia-Pacific Industrial Control System Market Segmentation

-

1. End User

- 1.1. Automotive

- 1.2. Chemical and Petrochemical

- 1.3. Power and Utilities

- 1.4. Pharmaceuticals

- 1.5. Food and Beverage

- 1.6. Oil and Gas

- 1.7. Electronics and Semiconductor

- 1.8. Other End Users

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. Rest of Asia-Pacific

Asia-Pacific Industrial Control System Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of Asia Pacific

Asia-Pacific Industrial Control System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidence of Cyberattacks; Convergence of IT and OT Networks

- 3.3. Market Restrains

- 3.3.1. Complexity in Implementing the Security Systems

- 3.4. Market Trends

- 3.4.1. Automotive sector is likely to drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Industrial Control System Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Automotive

- 5.1.2. Chemical and Petrochemical

- 5.1.3. Power and Utilities

- 5.1.4. Pharmaceuticals

- 5.1.5. Food and Beverage

- 5.1.6. Oil and Gas

- 5.1.7. Electronics and Semiconductor

- 5.1.8. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. China Asia-Pacific Industrial Control System Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Automotive

- 6.1.2. Chemical and Petrochemical

- 6.1.3. Power and Utilities

- 6.1.4. Pharmaceuticals

- 6.1.5. Food and Beverage

- 6.1.6. Oil and Gas

- 6.1.7. Electronics and Semiconductor

- 6.1.8. Other End Users

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. India Asia-Pacific Industrial Control System Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Automotive

- 7.1.2. Chemical and Petrochemical

- 7.1.3. Power and Utilities

- 7.1.4. Pharmaceuticals

- 7.1.5. Food and Beverage

- 7.1.6. Oil and Gas

- 7.1.7. Electronics and Semiconductor

- 7.1.8. Other End Users

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Japan Asia-Pacific Industrial Control System Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Automotive

- 8.1.2. Chemical and Petrochemical

- 8.1.3. Power and Utilities

- 8.1.4. Pharmaceuticals

- 8.1.5. Food and Beverage

- 8.1.6. Oil and Gas

- 8.1.7. Electronics and Semiconductor

- 8.1.8. Other End Users

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Rest of Asia Pacific Asia-Pacific Industrial Control System Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Automotive

- 9.1.2. Chemical and Petrochemical

- 9.1.3. Power and Utilities

- 9.1.4. Pharmaceuticals

- 9.1.5. Food and Beverage

- 9.1.6. Oil and Gas

- 9.1.7. Electronics and Semiconductor

- 9.1.8. Other End Users

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. China Asia-Pacific Industrial Control System Market Analysis, Insights and Forecast, 2019-2031

- 11. Japan Asia-Pacific Industrial Control System Market Analysis, Insights and Forecast, 2019-2031

- 12. India Asia-Pacific Industrial Control System Market Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Asia-Pacific Industrial Control System Market Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Asia-Pacific Industrial Control System Market Analysis, Insights and Forecast, 2019-2031

- 15. Australia Asia-Pacific Industrial Control System Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Asia-Pacific Industrial Control System Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Honeywell International Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Kasa Companies Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Juniper Networks Inc *List Not Exhaustive

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Siemens AG

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Tofino Security

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Schneider Electric

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Sourcefire Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 IBM

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 ABB

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.1 Honeywell International Inc

List of Figures

- Figure 1: Asia-Pacific Industrial Control System Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Industrial Control System Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by End User 2019 & 2032

- Table 3: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Industrial Control System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Industrial Control System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Industrial Control System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Industrial Control System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Industrial Control System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Industrial Control System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Industrial Control System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by End User 2019 & 2032

- Table 23: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asia-Pacific Industrial Control System Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Industrial Control System Market?

The projected CAGR is approximately 9.83%.

2. Which companies are prominent players in the Asia-Pacific Industrial Control System Market?

Key companies in the market include Honeywell International Inc, Kasa Companies Inc, Juniper Networks Inc *List Not Exhaustive, Siemens AG, Tofino Security, Schneider Electric, Sourcefire Inc, IBM, ABB.

3. What are the main segments of the Asia-Pacific Industrial Control System Market?

The market segments include End User , Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidence of Cyberattacks; Convergence of IT and OT Networks.

6. What are the notable trends driving market growth?

Automotive sector is likely to drive the market.

7. Are there any restraints impacting market growth?

Complexity in Implementing the Security Systems.

8. Can you provide examples of recent developments in the market?

July 2022: Siemens acquired Senseye, a global leader in artificial intelligence-powered industrial machine performance and reliability solutions. Due to this acquisition, Siemens will be able to expand its predictive maintenance and asset intelligence portfolio. Atlas 3D Inc.'s acquisition aims to broaden the company's additive manufacturing/industrial 3D printing offerings in the industrial control & factory automation market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Industrial Control System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Industrial Control System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Industrial Control System Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Industrial Control System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence