Key Insights

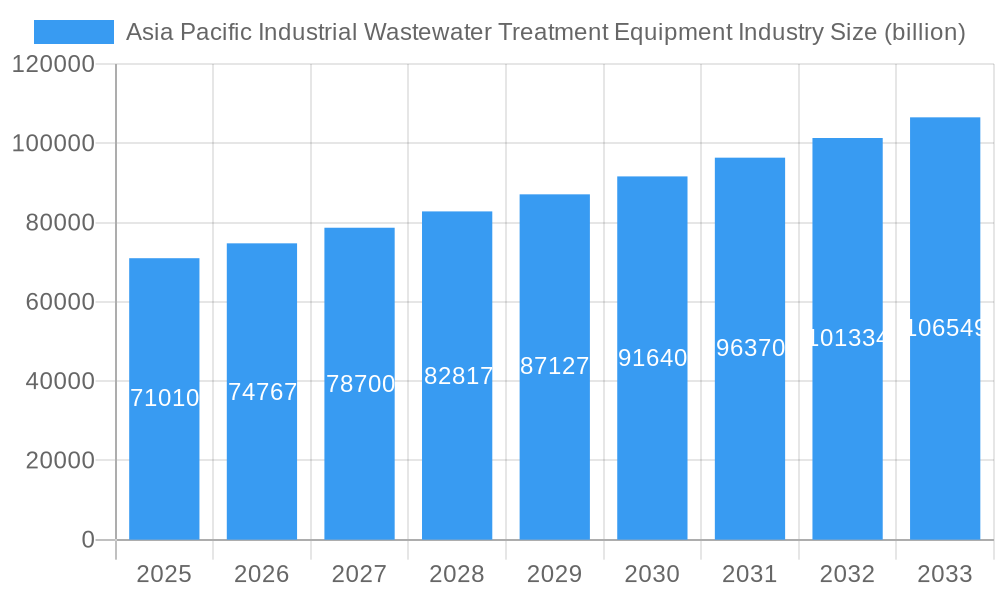

The Asia Pacific Industrial Wastewater Treatment Equipment market is poised for significant growth, projected to reach USD 71.01 billion in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 5.3% during the forecast period of 2025-2033. This robust expansion is primarily fueled by increasingly stringent environmental regulations across the region, coupled with a growing awareness of water scarcity and the need for sustainable industrial practices. Key industries such as Municipal, Pulp and Paper, Chemicals, Food and Beverage, Healthcare, and Power are substantial contributors to this market, as they generate considerable volumes of industrial wastewater requiring effective treatment solutions. The demand for advanced technologies like Microfiltration, Ultrafiltration, Nanofiltration, and Reverse Osmosis is escalating, driven by the need for higher treatment efficiency, water reuse, and compliance with evolving discharge standards. Technological advancements, including the development of more energy-efficient membranes and intelligent monitoring systems, are further stimulating market adoption.

Asia Pacific Industrial Wastewater Treatment Equipment Industry Market Size (In Billion)

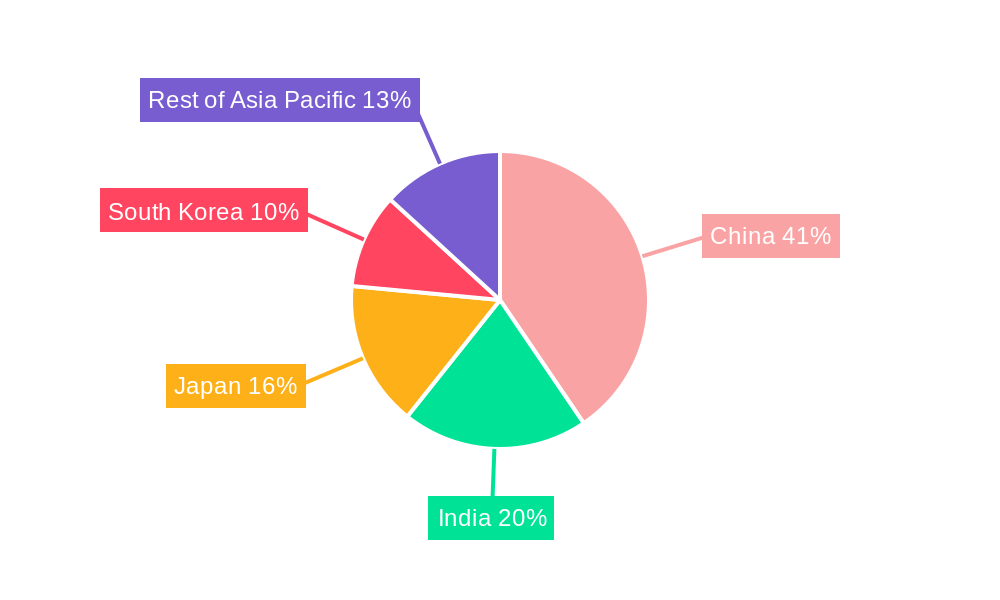

Geographically, China is expected to dominate the Asia Pacific industrial wastewater treatment equipment market, driven by its large industrial base and proactive environmental policies. India and South Korea are also significant markets, exhibiting strong growth trajectories due to rapid industrialization and government initiatives focused on water management. While the market is characterized by substantial growth opportunities, certain restraints, such as high initial investment costs for advanced treatment systems and the availability of less sophisticated, cheaper alternatives in some developing economies, need to be navigated. However, the persistent drive for cleaner production, circular economy principles, and the economic benefits derived from water recycling are expected to outweigh these challenges, ensuring a dynamic and expanding market for industrial wastewater treatment equipment across the Asia Pacific region. Leading players like Alfa Laval, Veolia Water Technologies, and TORAY INDUSTRIES INC are actively investing in research and development and expanding their presence to cater to this burgeoning demand.

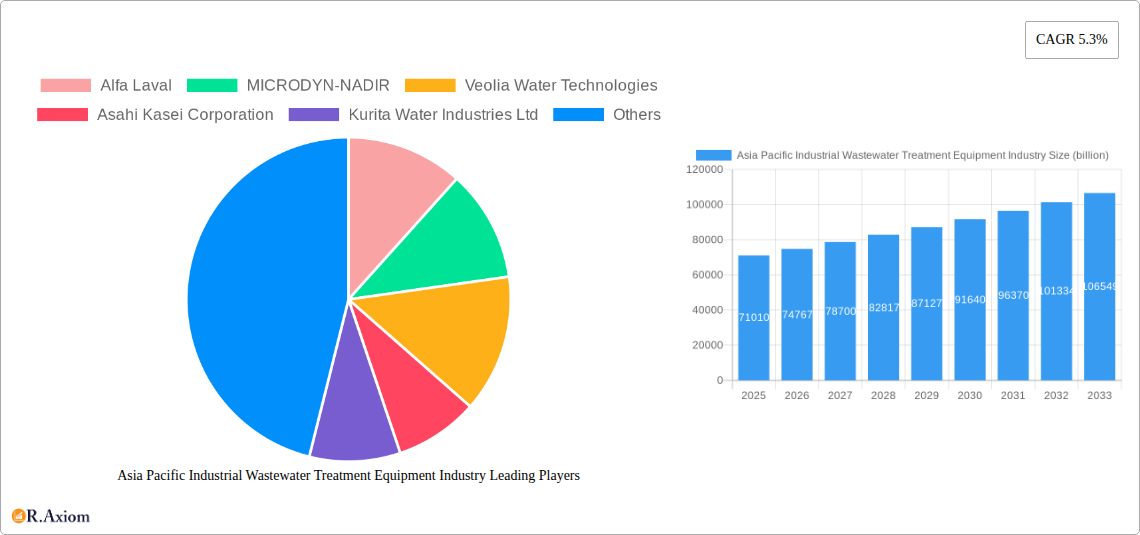

Asia Pacific Industrial Wastewater Treatment Equipment Industry Company Market Share

Here is an SEO-optimized, detailed report description for the Asia Pacific Industrial Wastewater Treatment Equipment Industry, incorporating your provided details and adhering to all specified formatting and content requirements.

Asia Pacific Industrial Wastewater Treatment Equipment Industry Market Concentration & Innovation

The Asia Pacific industrial wastewater treatment equipment market exhibits a moderate to high concentration, characterized by the presence of established global players and a growing number of regional specialists. Innovation is primarily driven by stringent environmental regulations, increasing water scarcity, and the demand for advanced, energy-efficient treatment solutions. Key innovation drivers include the development of membranes with enhanced flux rates and fouling resistance, smart monitoring systems for real-time process optimization, and integrated treatment systems addressing complex pollutant mixes. Regulatory frameworks are increasingly focused on stricter discharge limits and the promotion of water reuse, compelling industries to adopt more sophisticated treatment technologies. Product substitutes, such as improved in-process water conservation and advanced oxidation processes, are emerging but often complement rather than replace traditional equipment. End-user trends highlight a growing demand for customized solutions tailored to specific industrial needs and compliance requirements. Mergers and acquisitions (M&A) activities, valued in the billions, are strategic moves by major players to expand their technological portfolios, geographical reach, and service offerings. For instance, recent acquisitions have focused on companies with expertise in membrane technologies and digital water solutions, indicating a clear trend towards consolidation and capability enhancement within the industry.

Asia Pacific Industrial Wastewater Treatment Equipment Industry Industry Trends & Insights

The Asia Pacific industrial wastewater treatment equipment market is poised for robust growth, driven by a confluence of factors including rapid industrialization, escalating environmental concerns, and supportive government initiatives. The estimated market size is projected to reach USD 25.5 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This expansion is underpinned by a growing awareness of water sustainability and the critical need to manage industrial effluents effectively across the region. Technological disruptions are at the forefront, with significant advancements in membrane filtration technologies such as microfiltration, ultrafiltration, nanofiltration, and reverse osmosis, offering higher efficiency and reduced energy consumption. These technologies are becoming indispensable for industries grappling with complex wastewater streams and increasingly stringent discharge standards. Consumer preferences, particularly among industrial end-users, are shifting towards integrated, automated, and cost-effective wastewater treatment solutions that minimize operational expenditure and maximize water recovery. The competitive dynamics are intense, with leading global companies competing against an expanding base of domestic manufacturers. Strategic partnerships and technological collaborations are becoming common to leverage expertise and accelerate market penetration. The increasing adoption of Industry 4.0 principles, including IoT-enabled monitoring and AI-driven process optimization, is transforming the operational landscape, promising greater efficiency and reduced environmental impact. The robust economic growth in key Asia Pacific nations, coupled with substantial investments in infrastructure and manufacturing, further fuels the demand for advanced wastewater treatment equipment. This dynamic environment necessitates continuous innovation and strategic adaptation by market participants to capitalize on emerging opportunities and maintain a competitive edge.

Dominant Markets & Segments in Asia Pacific Industrial Wastewater Treatment Equipment Industry

The Asia Pacific industrial wastewater treatment equipment industry is characterized by significant dominance in specific geographies and end-user segments, driven by varying industrial landscapes and regulatory pressures.

Dominant Geography: China China stands as the most dominant market within the Asia Pacific region due to its vast manufacturing base, rapid industrial expansion, and increasingly stringent environmental enforcement. Government policies emphasizing pollution control and water resource management have spurred massive investments in wastewater treatment infrastructure across various industrial sectors. The sheer scale of industrial output in China necessitates advanced treatment solutions to comply with national discharge standards, making it a primary market for all types of wastewater treatment equipment.

Dominant Technology: Reverse Osmosis Reverse Osmosis (RO) technology holds a significant market share due to its effectiveness in removing dissolved salts, ions, and a wide range of organic contaminants from industrial wastewater. Its application is critical in industries requiring high-purity water for manufacturing processes or for achieving stringent effluent standards for discharge or reuse. The increasing demand for water recycling and desalination in water-scarce regions further propels RO’s dominance.

Dominant End-user Industry: Chemicals The chemical industry consistently ranks as a dominant end-user segment. The complex and often hazardous nature of wastewater generated by chemical manufacturing processes requires sophisticated and robust treatment solutions. Stringent regulations governing the discharge of chemical pollutants, coupled with the industry's drive for water reuse to reduce operational costs and environmental footprint, make it a consistent and significant market for advanced wastewater treatment equipment.

Key Drivers of Dominance:

- Economic Policies: Government incentives, subsidies for green technologies, and stricter environmental tax regimes in dominant regions like China push industries towards adopting advanced wastewater treatment.

- Infrastructure Development: Significant public and private investments in industrial parks, manufacturing facilities, and urban water infrastructure in key countries like China and India directly translate to increased demand for treatment equipment.

- Regulatory Frameworks: Aggressive enforcement of discharge standards, coupled with mandates for water recycling and reuse, are primary catalysts for the adoption of advanced technologies like RO and membrane-based solutions.

- Industrial Growth: The concentration of high-water-consuming and pollutant-generating industries, such as chemicals, pulp and paper, and food and beverage, in specific geographies drives segment dominance.

- Technological Adoption: The increasing recognition of the efficiency and cost-effectiveness of advanced technologies like Microfiltration, Ultrafiltration, Nanofiltration, and Reverse Osmosis in treating complex wastewater streams solidifies their dominance within the market.

Asia Pacific Industrial Wastewater Treatment Equipment Industry Product Developments

Product developments in the Asia Pacific industrial wastewater treatment equipment market are characterized by a focus on enhancing efficiency, reducing energy consumption, and enabling greater automation. Innovations in membrane technology, including improved pore structures and material compositions for microfiltration, ultrafiltration, nanofiltration, and reverse osmosis, are leading to higher flux rates and extended membrane life. Smart monitoring systems integrated with IoT sensors and AI algorithms are being developed to provide real-time performance data, predictive maintenance capabilities, and optimized operational control. Furthermore, there is a trend towards modular and skid-mounted systems, offering flexibility and faster deployment for various industrial applications, from pulp and paper to food and beverage and chemical manufacturing. These advancements aim to provide clients with cost-effective, sustainable, and compliant wastewater treatment solutions, enhancing their competitive advantage in the evolving market.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Asia Pacific Industrial Wastewater Treatment Equipment Industry, segmenting the market across key areas. The Technology segmentation includes Microfiltration, Ultrafiltration, Nanofiltration, and Reverse Osmosis, each offering distinct separation capabilities crucial for various industrial effluents. The End-user Industry segmentation covers Municipal, Pulp and Paper, Chemicals, Food and Beverage, Healthcare, Power, and Others, reflecting the diverse applications and demands across different sectors. Geographically, the market is analyzed across China, India, Japan, South Korea, and the Rest of Asia-Pacific, highlighting regional specificities in growth drivers and adoption rates. Growth projections for each segment are detailed, with estimated market sizes and competitive dynamics to provide a holistic view of the industry's landscape.

Key Drivers of Asia Pacific Industrial Wastewater Treatment Equipment Industry Growth

The growth of the Asia Pacific industrial wastewater treatment equipment industry is propelled by several key factors. Stringent environmental regulations and increasing government focus on water quality and pollution control are compelling industries to invest in advanced treatment solutions. Rapid industrialization and economic expansion across the region, particularly in manufacturing and chemical sectors, generate significant volumes of wastewater requiring effective treatment. Growing awareness of water scarcity and the economic benefits of water reuse are driving demand for technologies like reverse osmosis and ultrafiltration that enable recycling. Technological advancements, leading to more efficient, cost-effective, and energy-saving equipment, further stimulate market adoption. Finally, increased investments in water and wastewater infrastructure projects across developing nations in the region provide a substantial impetus for market growth.

Challenges in the Asia Pacific Industrial Wastewater Treatment Equipment Industry Sector

Despite robust growth prospects, the Asia Pacific industrial wastewater treatment equipment sector faces several challenges. High initial capital investment for advanced treatment systems can be a significant barrier, especially for small and medium-sized enterprises. The lack of skilled labor for the operation and maintenance of sophisticated equipment in some developing regions poses operational challenges. Evolving and sometimes inconsistent regulatory frameworks across different countries within Asia Pacific can create compliance uncertainties. Furthermore, competition from lower-cost, less advanced technologies can impact the adoption of premium, high-performance equipment. Supply chain disruptions, as experienced globally, can also affect the availability and cost of critical components, impacting project timelines and overall market dynamics.

Emerging Opportunities in Asia Pacific Industrial Wastewater Treatment Equipment Industry

Emerging opportunities in the Asia Pacific industrial wastewater treatment equipment industry are diverse and promising. The increasing trend towards a circular economy and water stewardship presents significant opportunities for companies offering comprehensive water reuse and zero liquid discharge (ZLD) solutions. The expansion of high-tech industries, such as electronics and semiconductors, which generate complex wastewater streams, creates demand for highly specialized treatment technologies. The growing adoption of Industry 4.0 principles, leading to the development of smart, IoT-enabled wastewater treatment plants with advanced analytics and AI-driven optimization, opens new avenues for service and technology providers. Furthermore, the increasing focus on treating emerging contaminants, like microplastics and pharmaceuticals, in industrial effluents presents a niche but growing market segment. Developing regions within Asia Pacific, with their expanding industrial bases and increasing environmental consciousness, represent significant untapped markets for advanced wastewater treatment solutions.

Leading Players in the Asia Pacific Industrial Wastewater Treatment Equipment Industry Market

- Alfa Laval

- MICRODYN-NADIR

- Veolia Water Technologies

- Asahi Kasei Corporation

- Kurita Water Industries Ltd

- Kemira

- Evoqua Water Technologies LLC

- Aquatech International LLC

- Koch Membrane Systems Inc

- TORAY INDUSTRIES INC

- Suez

Key Developments in Asia Pacific Industrial Wastewater Treatment Equipment Industry Industry

- June 2022: Evoqua Water Technologies LLC, a market leader in mission-critical water treatment systems, opened a new production plant in Singapore, marking the company's continued investment in Asia-Pacific, where there is a rising need for cutting-edge water treatment technologies.

- October 2022: The Municipal Corporation of Greater Mumbai (MCGM), the utility agency responsible for municipal drinking water and sewerage in the city of Mumbai, awarded Suez a EUR 700 million (USD 745.53 million) contract for the design, construction, and operation (BOD) of a 500 MLD capacity treatment plant in Worli, Mumbai to serve an equivalent population of 2.5 million. This will strengthen the company's position in the international markets.

Strategic Outlook for Asia Pacific Industrial Wastewater Treatment Equipment Industry Market

The strategic outlook for the Asia Pacific industrial wastewater treatment equipment market is highly positive, driven by persistent environmental concerns and a growing commitment to sustainable industrial practices. Key growth catalysts include continued investments in advanced membrane technologies like Reverse Osmosis and Ultrafiltration for water reuse, and the integration of digital solutions for optimized plant operations. The expansion of manufacturing hubs in emerging economies within Asia Pacific will fuel demand for compliant and efficient treatment systems. Companies that can offer integrated solutions, focusing on energy efficiency, automation, and customization for specific industry needs, will be best positioned for success. Strategic partnerships, M&A activities, and continuous innovation in product development will be crucial for maintaining market leadership and capitalizing on the substantial future potential of this dynamic sector.

Asia Pacific Industrial Wastewater Treatment Equipment Industry Segmentation

-

1. Technology

- 1.1. Microfiltration

- 1.2. Ultrafiltration

- 1.3. Nanofiltration

- 1.4. Reverse Osmosis

-

2. End-user Industry

- 2.1. Municipal

- 2.2. Pulp and Paper

- 2.3. Chemicals

- 2.4. Food and Beverage

- 2.5. Healthcare

- 2.6. Power

- 2.7. Others

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia-Pacific

Asia Pacific Industrial Wastewater Treatment Equipment Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia Pacific Industrial Wastewater Treatment Equipment Industry Regional Market Share

Geographic Coverage of Asia Pacific Industrial Wastewater Treatment Equipment Industry

Asia Pacific Industrial Wastewater Treatment Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Low-pressure Membrane Technologies; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Poor Fouling Resistance of Nano porous Membranes; Other Restraints

- 3.4. Market Trends

- 3.4.1. Municipal Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Industrial Wastewater Treatment Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Microfiltration

- 5.1.2. Ultrafiltration

- 5.1.3. Nanofiltration

- 5.1.4. Reverse Osmosis

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Municipal

- 5.2.2. Pulp and Paper

- 5.2.3. Chemicals

- 5.2.4. Food and Beverage

- 5.2.5. Healthcare

- 5.2.6. Power

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. China Asia Pacific Industrial Wastewater Treatment Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Microfiltration

- 6.1.2. Ultrafiltration

- 6.1.3. Nanofiltration

- 6.1.4. Reverse Osmosis

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Municipal

- 6.2.2. Pulp and Paper

- 6.2.3. Chemicals

- 6.2.4. Food and Beverage

- 6.2.5. Healthcare

- 6.2.6. Power

- 6.2.7. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. India Asia Pacific Industrial Wastewater Treatment Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Microfiltration

- 7.1.2. Ultrafiltration

- 7.1.3. Nanofiltration

- 7.1.4. Reverse Osmosis

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Municipal

- 7.2.2. Pulp and Paper

- 7.2.3. Chemicals

- 7.2.4. Food and Beverage

- 7.2.5. Healthcare

- 7.2.6. Power

- 7.2.7. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Japan Asia Pacific Industrial Wastewater Treatment Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Microfiltration

- 8.1.2. Ultrafiltration

- 8.1.3. Nanofiltration

- 8.1.4. Reverse Osmosis

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Municipal

- 8.2.2. Pulp and Paper

- 8.2.3. Chemicals

- 8.2.4. Food and Beverage

- 8.2.5. Healthcare

- 8.2.6. Power

- 8.2.7. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South Korea Asia Pacific Industrial Wastewater Treatment Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Microfiltration

- 9.1.2. Ultrafiltration

- 9.1.3. Nanofiltration

- 9.1.4. Reverse Osmosis

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Municipal

- 9.2.2. Pulp and Paper

- 9.2.3. Chemicals

- 9.2.4. Food and Beverage

- 9.2.5. Healthcare

- 9.2.6. Power

- 9.2.7. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Rest of Asia Pacific Asia Pacific Industrial Wastewater Treatment Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Microfiltration

- 10.1.2. Ultrafiltration

- 10.1.3. Nanofiltration

- 10.1.4. Reverse Osmosis

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Municipal

- 10.2.2. Pulp and Paper

- 10.2.3. Chemicals

- 10.2.4. Food and Beverage

- 10.2.5. Healthcare

- 10.2.6. Power

- 10.2.7. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Alfa Laval

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MICRODYN-NADIR

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Veolia Water Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Asahi Kasei Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kurita Water Industries Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kemira

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Evoqua Water Technologies LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aquatech International LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koch Membrane Systems Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TORAY INDUSTRIES INC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Suez

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Alfa Laval

List of Figures

- Figure 1: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Industrial Wastewater Treatment Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 3: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 5: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 10: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 11: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 13: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 18: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 19: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 21: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 26: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 27: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 29: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 34: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 35: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 36: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 37: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 42: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 43: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 44: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 45: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 46: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 47: Asia Pacific Industrial Wastewater Treatment Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Asia Pacific Industrial Wastewater Treatment Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Industrial Wastewater Treatment Equipment Industry?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Asia Pacific Industrial Wastewater Treatment Equipment Industry?

Key companies in the market include Alfa Laval, MICRODYN-NADIR, Veolia Water Technologies, Asahi Kasei Corporation, Kurita Water Industries Ltd, Kemira, Evoqua Water Technologies LLC, Aquatech International LLC, Koch Membrane Systems Inc, TORAY INDUSTRIES INC, Suez.

3. What are the main segments of the Asia Pacific Industrial Wastewater Treatment Equipment Industry?

The market segments include Technology, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 71.01 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Low-pressure Membrane Technologies; Other Drivers.

6. What are the notable trends driving market growth?

Municipal Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Poor Fouling Resistance of Nano porous Membranes; Other Restraints.

8. Can you provide examples of recent developments in the market?

In June 2022, Evoqua Water Technologies LLC a market leader in mission-critical water treatment systems, opened a new production plant in Singapore, marking the company's continued investment in Asia-Pacific, where there is a rising need for cutting-edge water treatment technologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Industrial Wastewater Treatment Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Industrial Wastewater Treatment Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Industrial Wastewater Treatment Equipment Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Industrial Wastewater Treatment Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence