Key Insights

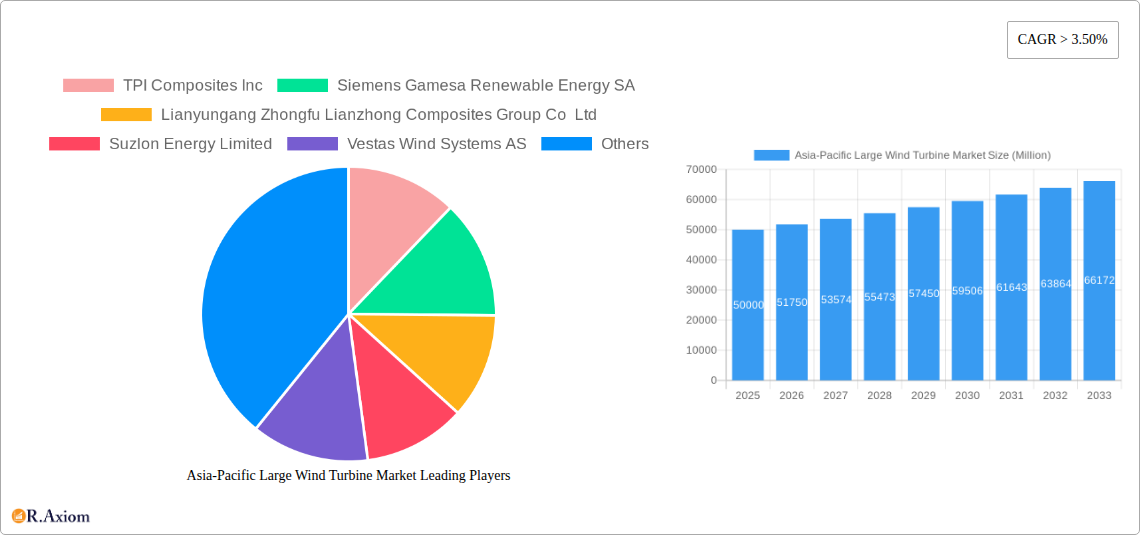

The Asia-Pacific large wind turbine market is experiencing robust growth, driven by increasing energy demands, supportive government policies promoting renewable energy adoption, and a significant push towards decarbonization across the region. China, India, Japan, and South Korea are key contributors to this expansion, fueled by substantial investments in onshore and offshore wind projects. The market's compound annual growth rate (CAGR) exceeding 3.50% from 2019-2033 indicates a sustained upward trajectory. While the initial market size in 2019 isn't explicitly provided, considering the CAGR and substantial market presence of major players like Siemens Gamesa, Vestas, and Goldwind, a reasonable estimation would place it in the billions. The market is segmented by location (onshore and offshore), with offshore wind experiencing faster growth due to higher capacity factors and increasing technological advancements enabling deeper water installations. However, the onshore segment maintains a larger market share due to established infrastructure and lower initial investment costs. Growth is also being spurred by technological innovations leading to improved turbine efficiency and reduced costs, as well as the development of larger-capacity turbines capable of generating more power. Challenges include grid integration complexities, land acquisition issues for onshore projects, and the high initial investment required for offshore wind farms. Nevertheless, the long-term outlook for the Asia-Pacific large wind turbine market remains positive, with considerable potential for expansion throughout the forecast period. The consistent presence of major international and domestic players underscores the market's competitive yet dynamic nature, reflecting the enduring appeal of large-scale wind energy solutions across the region.

Asia-Pacific Large Wind Turbine Market Market Size (In Billion)

The major players in this market, including TPI Composites, Siemens Gamesa, Lianyungang Zhongfu, Suzlon Energy, Vestas, General Electric, Enercon, and Nordex, are strategically investing in research and development, capacity expansion, and partnerships to capitalize on the growing opportunities. This competitive landscape further stimulates innovation and drives down costs, making large wind turbines an increasingly attractive and viable solution for meeting the region's escalating energy needs and environmental goals. The ongoing focus on sustainable energy sources within the Asia-Pacific region strengthens the overall positive outlook for this market segment, positioning it for continued, robust growth in the coming years.

Asia-Pacific Large Wind Turbine Market Company Market Share

Asia-Pacific Large Wind Turbine Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Asia-Pacific large wind turbine market, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, investors, and strategists seeking to navigate this rapidly evolving landscape. The report leverages extensive market research and data analysis to deliver actionable intelligence, focusing on market size, growth projections, key players, and emerging trends. With a base year of 2025 and a forecast period extending to 2033, this report is your essential guide to understanding the future of large wind turbine deployment in the Asia-Pacific region.

Asia-Pacific Large Wind Turbine Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Asia-Pacific large wind turbine market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of established global players and regional manufacturers. Market share data reveals a dynamic environment with shifting competitive positions. For instance, while Vestas and Siemens Gamesa hold significant market shares, the emergence of Chinese manufacturers like Lianyungang Zhongfu Lianzhong Composites Group Co Ltd is rapidly reshaping the competitive dynamics. The average M&A deal value in the sector has seen fluctuations, reflecting the varied strategic objectives of players. Innovation is primarily driven by the need for greater efficiency, reduced costs, and the development of larger capacity turbines, leading to substantial R&D investment across the industry. Stringent regulatory frameworks, particularly concerning environmental impact and grid integration, influence product development and deployment strategies. The increasing adoption of offshore wind projects drives innovation in turbine design and materials to withstand harsh maritime environments. Meanwhile, substitutes like solar power exert competitive pressure, necessitating continuous innovation to maintain market share.

- Key Metrics: Market share (xx%), Average M&A deal value (xx Million), R&D expenditure (xx Million).

- Innovation Drivers: Increased efficiency, cost reduction, larger capacity turbines, offshore wind development.

- Regulatory Impacts: Environmental regulations, grid integration standards, safety protocols.

- M&A Activity: Consolidation among manufacturers, strategic partnerships for technology sharing, expansion into new markets.

Asia-Pacific Large Wind Turbine Market Industry Trends & Insights

The Asia-Pacific large wind turbine market exhibits robust growth, driven by increasing energy demand, supportive government policies promoting renewable energy adoption, and falling turbine costs. The CAGR for the forecast period (2025-2033) is estimated at xx%. Market penetration is steadily increasing, particularly in countries with ambitious renewable energy targets. Technological disruptions, such as advancements in blade design and materials, are enabling the development of larger, more efficient turbines. Consumer preferences are shifting towards sustainable energy sources, fueling demand for wind power. However, the market's growth is not without its challenges, including grid infrastructure limitations and fluctuating electricity prices. The competitive landscape remains dynamic, with both established players and new entrants vying for market share. This necessitates continuous innovation and strategic partnerships to maintain competitiveness. The emergence of innovative financing models further influences market expansion. The sector's growth faces challenges from intermittency issues and competition from other renewable energy sources, though technological improvements in energy storage are gradually mitigating this.

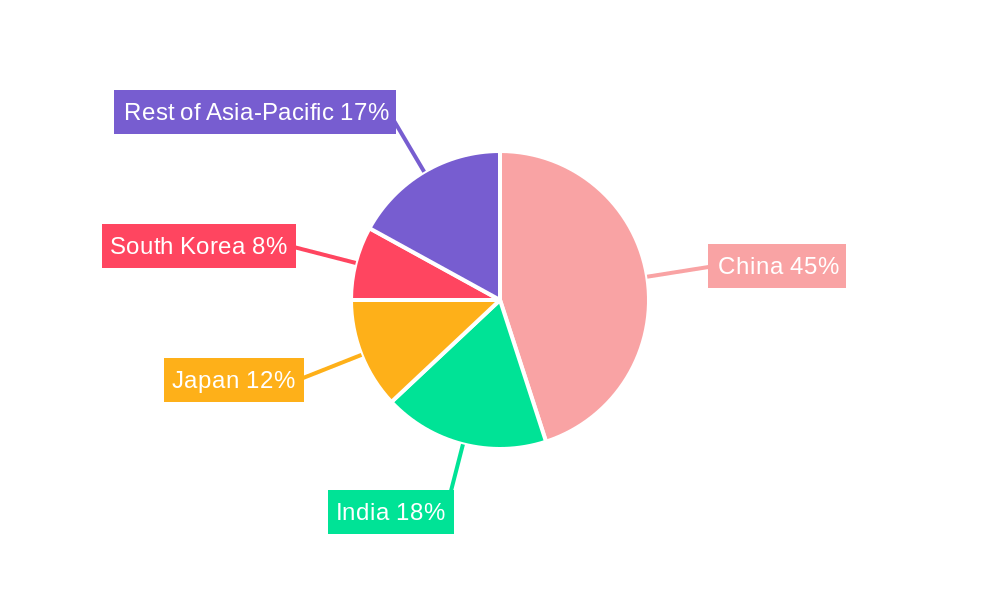

Dominant Markets & Segments in Asia-Pacific Large Wind Turbine Market

China and Taiwan currently dominate the Asia-Pacific large wind turbine market, particularly within the offshore segment. The substantial government investments in renewable energy infrastructure and supportive policies, especially China's commitment to carbon neutrality by 2060, have spurred significant growth. Taiwan's proactive approach to offshore wind development has also positioned it as a key market.

Key Drivers for Dominance:

- China: Massive government subsidies, large-scale renewable energy targets, robust manufacturing capabilities.

- Taiwan: Strong government support for offshore wind, successful auctions stimulating project development, favorable geographic conditions.

The onshore segment remains larger in terms of overall installed capacity, however, the offshore wind segment is growing at a faster rate fueled by ambitious governmental targets and decreasing costs of offshore installation. This shift is particularly evident in countries like China and Vietnam. Japan is poised for significant offshore growth, though the initial phase remains focused on near-shore projects.

Asia-Pacific Large Wind Turbine Market Product Developments

Recent advancements in large wind turbine technology emphasize larger capacities (14 MW to 20 MW and beyond), increased efficiency, improved blade design (for example, the 827-foot impeller diameter of the planned CSSC Haizhuang turbine), and lighter weight designs for easier transport and installation. These innovations address cost-effectiveness, enhanced performance in various weather conditions, and optimized grid integration. The trend towards modular designs simplifies maintenance and reduces downtime.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific large wind turbine market by location (Offshore and Onshore).

Onshore: This segment represents a significant portion of the market and is expected to maintain steady growth, driven by continued expansion into rural areas and decreasing turbine costs. Competition in this segment remains intense, with established players focusing on cost leadership and technological improvements.

Offshore: This segment exhibits strong growth potential due to the higher capacity factors compared to onshore. However, higher installation costs and logistical challenges pose limitations. The market is likely to experience more consolidation as companies with the required resources (both financial and technological) dominate project development. The market size for Onshore is projected to reach xx Million by 2033, while Offshore is estimated at xx Million.

Key Drivers of Asia-Pacific Large Wind Turbine Market Growth

The market is propelled by several factors, including supportive government policies and subsidies aimed at increasing renewable energy adoption, growing energy demand from a rapidly expanding population, decreasing turbine costs making wind power increasingly competitive, and technological advancements leading to larger and more efficient turbines. Furthermore, the increasing awareness of climate change and the need for sustainable energy sources are driving market growth.

Challenges in the Asia-Pacific Large Wind Turbine Market Sector

The Asia-Pacific large wind turbine market faces challenges such as grid infrastructure limitations impacting the integration of large-scale wind farms, intermittency of wind power requiring substantial energy storage solutions, the need for efficient and sustainable lifecycle management and responsible disposal of components, and regulatory uncertainties in some regions delaying project approvals. These factors create uncertainty for investors and can limit market expansion. Supply chain disruptions and the fluctuating price of raw materials can also significantly impact profitability.

Emerging Opportunities in Asia-Pacific Large Wind Turbine Market

The market presents significant opportunities in areas such as floating offshore wind technology enabling expansion into deeper waters, the development of innovative energy storage solutions to address intermittency issues, the increasing demand for hybrid renewable energy projects combining wind and solar power, and further optimization of turbine designs for specific regional weather patterns. Additionally, improvements in grid management and smart grid technologies will unlock higher penetration levels.

Leading Players in the Asia-Pacific Large Wind Turbine Market Market

- TPI Composites Inc

- Siemens Gamesa Renewable Energy SA

- Lianyungang Zhongfu Lianzhong Composites Group Co Ltd

- Suzlon Energy Limited

- Vestas Wind Systems AS

- General Electric Company

- Enercon GmbH

- Nordex SE

Key Developments in Asia-Pacific Large Wind Turbine Market Industry

- November 2022: Chinese CSSC Haizhuang plans to launch an 18 MW wind turbine with an impeller diameter of 827 feet (252 meters), impacting the market with its significant capacity and innovative design.

- September 2022: Vena Energy's plans to launch the Wei-Na and Wei-Long offshore wind projects (1.8 GW combined capacity) in Taiwan using 14-20 MW turbines signifies a major step in the offshore sector's expansion.

Strategic Outlook for Asia-Pacific Large Wind Turbine Market Market

The Asia-Pacific large wind turbine market is poised for sustained growth, driven by supportive government policies, increasing energy demand, and technological advancements. The focus will shift towards larger capacity turbines, improved efficiency, and greater grid integration capabilities. The offshore segment will experience particularly strong growth, while technological innovations will further reduce the cost of renewable energy and enhance its competitiveness. Strategic partnerships and mergers and acquisitions will likely shape the market structure, driving further consolidation among industry players.

Asia-Pacific Large Wind Turbine Market Segmentation

-

1. Location

- 1.1. Offshore

- 1.2. Onshore

-

2. Geography

- 2.1. India

- 2.2. China

- 2.3. Japan

- 2.4. Rest of Asia-Pacific

Asia-Pacific Large Wind Turbine Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Rest of Asia Pacific

Asia-Pacific Large Wind Turbine Market Regional Market Share

Geographic Coverage of Asia-Pacific Large Wind Turbine Market

Asia-Pacific Large Wind Turbine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Energy Demand4.; The Increasing Share of Renewables in the Power Generation Mix

- 3.3. Market Restrains

- 3.3.1. 4.; Adopting Clean Energy Sources Like Solar and Other Alternatives

- 3.4. Market Trends

- 3.4.1. Offshore Wind Turbine to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Large Wind Turbine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Offshore

- 5.1.2. Onshore

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. India

- 5.2.2. China

- 5.2.3. Japan

- 5.2.4. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Japan

- 5.3.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. India Asia-Pacific Large Wind Turbine Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location

- 6.1.1. Offshore

- 6.1.2. Onshore

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. India

- 6.2.2. China

- 6.2.3. Japan

- 6.2.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Location

- 7. China Asia-Pacific Large Wind Turbine Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location

- 7.1.1. Offshore

- 7.1.2. Onshore

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. India

- 7.2.2. China

- 7.2.3. Japan

- 7.2.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Location

- 8. Japan Asia-Pacific Large Wind Turbine Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location

- 8.1.1. Offshore

- 8.1.2. Onshore

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. India

- 8.2.2. China

- 8.2.3. Japan

- 8.2.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Location

- 9. Rest of Asia Pacific Asia-Pacific Large Wind Turbine Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location

- 9.1.1. Offshore

- 9.1.2. Onshore

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. India

- 9.2.2. China

- 9.2.3. Japan

- 9.2.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Location

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 TPI Composites Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Siemens Gamesa Renewable Energy SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Lianyungang Zhongfu Lianzhong Composites Group Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Suzlon Energy Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Vestas Wind Systems AS

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 General Electric Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Enercon GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nordex SE

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 TPI Composites Inc

List of Figures

- Figure 1: Asia-Pacific Large Wind Turbine Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Large Wind Turbine Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Location 2020 & 2033

- Table 2: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Location 2020 & 2033

- Table 3: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Location 2020 & 2033

- Table 8: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Location 2020 & 2033

- Table 9: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 11: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Location 2020 & 2033

- Table 14: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Location 2020 & 2033

- Table 15: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 17: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Location 2020 & 2033

- Table 20: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Location 2020 & 2033

- Table 21: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Location 2020 & 2033

- Table 26: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Location 2020 & 2033

- Table 27: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: Asia-Pacific Large Wind Turbine Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Asia-Pacific Large Wind Turbine Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Large Wind Turbine Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Asia-Pacific Large Wind Turbine Market?

Key companies in the market include TPI Composites Inc, Siemens Gamesa Renewable Energy SA, Lianyungang Zhongfu Lianzhong Composites Group Co Ltd, Suzlon Energy Limited, Vestas Wind Systems AS, General Electric Company, Enercon GmbH , Nordex SE.

3. What are the main segments of the Asia-Pacific Large Wind Turbine Market?

The market segments include Location, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Energy Demand4.; The Increasing Share of Renewables in the Power Generation Mix.

6. What are the notable trends driving market growth?

Offshore Wind Turbine to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; Adopting Clean Energy Sources Like Solar and Other Alternatives.

8. Can you provide examples of recent developments in the market?

In November 2022, Chinese CSSC Haizhuang plans to launch an 18 MW wind turbine with an impeller diameter of 827 feet (252 meters), the lightest per megawatt weight, and a 480-foot (146-meter) hub. According to the product's specifications, the turbine is equipped with a medium-speed gear transmission, easily disassembled and integrated features, and a permanent magnet generator.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Large Wind Turbine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Large Wind Turbine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Large Wind Turbine Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Large Wind Turbine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence