Key Insights

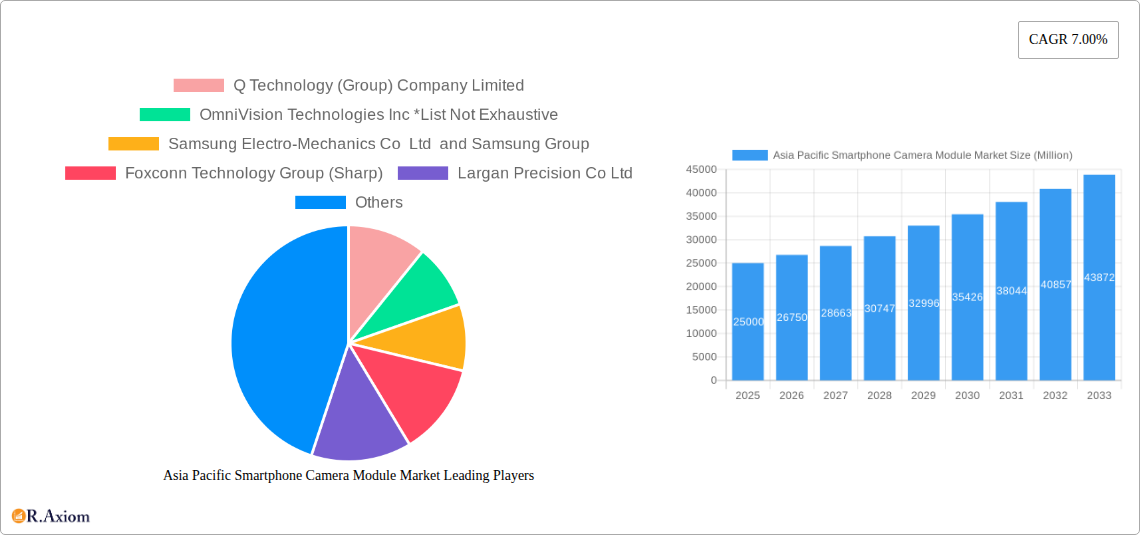

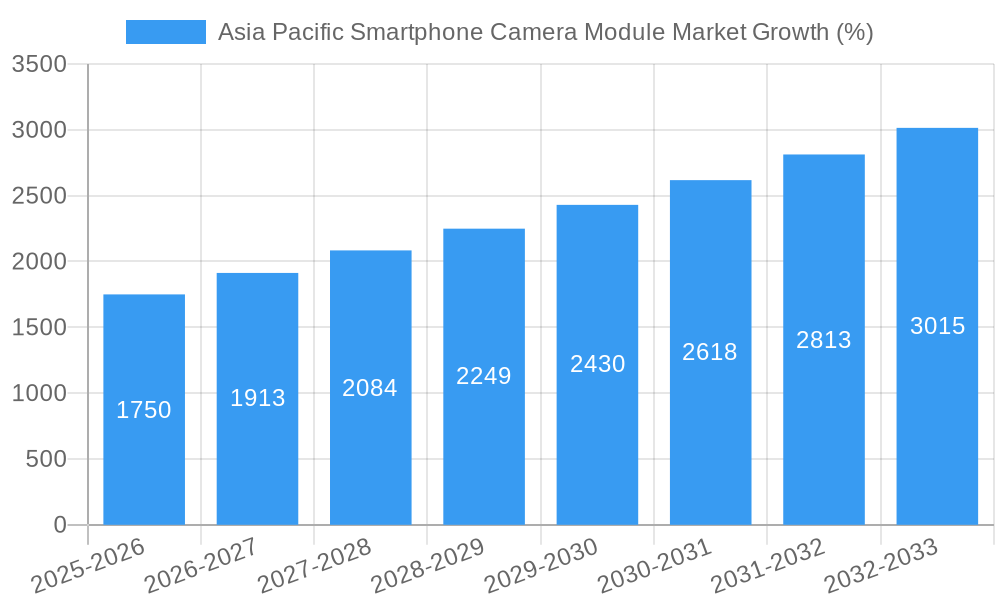

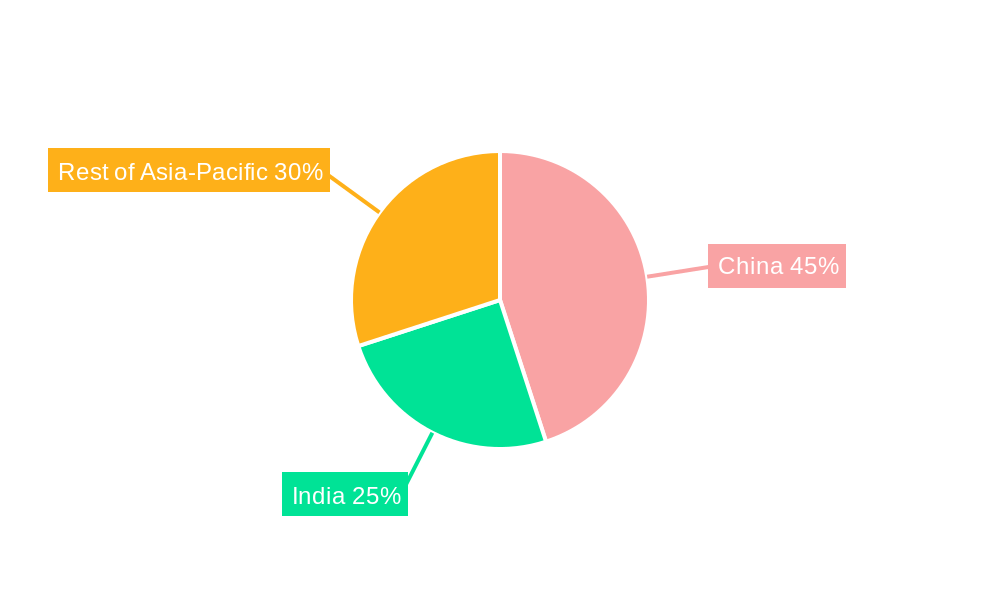

The Asia Pacific smartphone camera module market is experiencing robust growth, driven by increasing smartphone penetration, a rising preference for high-resolution cameras, and the burgeoning adoption of advanced camera features like multi-lens systems and improved image processing capabilities. The market's Compound Annual Growth Rate (CAGR) of 7% from 2019 to 2024 suggests a significant upward trajectory. China and India, as the region's largest smartphone markets, are key contributors to this growth, fueled by their large and expanding populations, and increasing disposable incomes leading to higher consumer spending on electronics. However, factors like fluctuating component costs and intense competition among module manufacturers can act as restraints. The market is segmented by country, with China and India dominating, followed by the Rest of Asia-Pacific. Leading players such as Sony, Samsung Electro-Mechanics, OmniVision, and Sunny Optical are vying for market share through innovation in camera technology and strategic partnerships. The forecast period of 2025-2033 anticipates continued growth, propelled by emerging trends such as the integration of Artificial Intelligence (AI) for enhanced image processing, the increasing demand for advanced features like night vision and improved low-light photography, and the growing popularity of foldable smartphones, which require sophisticated camera module designs. The market's future growth will depend on technological advancements, consumer demand, and the overall economic health of the region.

The diverse landscape of the Asia-Pacific smartphone camera module market is characterized by a dynamic interplay of established players and emerging companies. The continued rise of e-commerce and the growing influence of social media platforms fuel the demand for high-quality smartphone cameras. Furthermore, advancements in camera sensor technology, such as improved image stabilization and larger sensor sizes, are driving the adoption of more sophisticated modules. The competitive landscape is marked by continuous innovation in areas such as periscope lenses, multispectral imaging, and 3D sensing. Despite challenges, including supply chain disruptions and geopolitical uncertainties, the market exhibits strong resilience due to the fundamental demand for smartphones and the constant pursuit of enhanced camera capabilities by consumers. This consistent pursuit of improved visual experiences drives ongoing investment in research and development, further fueling the market's growth trajectory.

Asia Pacific Smartphone Camera Module Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific Smartphone Camera Module market, covering the period 2019-2033. It offers invaluable insights for industry stakeholders, investors, and strategic decision-makers seeking to navigate this dynamic and rapidly evolving market. The report leverages rigorous data analysis and expert insights to provide a clear understanding of market trends, opportunities, and challenges. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033. The historical period covered is 2019-2024.

Asia Pacific Smartphone Camera Module Market Concentration & Innovation

The Asia Pacific smartphone camera module market exhibits a moderately concentrated landscape, with several key players holding significant market share. The market share distribution amongst the top 5 players is estimated at xx% in 2025. Companies like Samsung Electro-Mechanics Co Ltd, Sony Corporation, and Sunny Optical Technology Company Limited have established strong positions through technological advancements and strategic partnerships. However, the market also accommodates several smaller, specialized players focusing on niche segments.

Innovation is a pivotal driver, with ongoing advancements in image sensor technology, lens design, and module integration. The increasing demand for high-resolution, multi-camera systems, and advanced features like optical zoom and 3D sensing fuels this innovation. Regulatory frameworks related to data privacy and component sourcing play a significant role, influencing market dynamics. The market sees continuous M&A activity, with deal values fluctuating based on market conditions and strategic priorities. Notable examples include partnerships like LG Innotek’s collaboration with Microsoft (March 2021), signifying the trend of strategic alliances to enhance capabilities and expand market reach. The average M&A deal value in the last five years was approximately xx Million. Product substitutes, such as software-based image enhancement solutions, pose a potential challenge, although the overall demand for hardware-based camera modules remains robust. End-user trends strongly favour enhanced camera capabilities, driving growth in premium smartphone segments.

Asia Pacific Smartphone Camera Module Market Industry Trends & Insights

The Asia Pacific smartphone camera module market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). Several factors drive this growth: the increasing penetration of smartphones across the region, particularly in developing economies like India; the escalating demand for high-quality camera features in smartphones, reflecting consumer preferences for superior image and video capture; technological advancements leading to improved image sensor technology, including higher resolution, enhanced low-light performance, and improved zoom capabilities; and the rising popularity of advanced camera features, such as multi-camera systems, optical image stabilization, and computational photography. The market penetration of high-resolution camera modules (above 48MP) is expected to reach xx% by 2033, driven by increasing consumer preference and technological innovation. However, the market also faces challenges, such as intensifying competition, fluctuating raw material prices, and potential supply chain disruptions. Competitive dynamics are characterized by continuous product innovation, strategic alliances, and aggressive pricing strategies.

Dominant Markets & Segments in Asia Pacific Smartphone Camera Module Market

China remains the dominant market for smartphone camera modules in the Asia Pacific region. This dominance is attributed to several key factors:

- Massive Smartphone Market: China boasts the world's largest smartphone market, creating immense demand for camera modules.

- Robust Domestic Manufacturing: A strong and well-established domestic manufacturing base supports the supply chain.

- Government Initiatives: Supportive government policies and initiatives aimed at boosting technological innovation further strengthen the market.

- Favorable Economic Conditions: Strong economic growth and increasing disposable incomes fuel consumer spending on smartphones and premium features.

India is another rapidly expanding market showing significant growth potential, driven by rising smartphone adoption rates among a young and tech-savvy population. The Rest of Asia-Pacific also presents opportunities, though at a slower pace compared to China and India, due to factors including varying levels of economic development and smartphone penetration across different countries.

Asia Pacific Smartphone Camera Module Market Product Developments

Recent years have witnessed significant advancements in smartphone camera module technology. The development of higher-resolution image sensors, enabling clearer and more detailed images, and the integration of multiple cameras with diverse functionalities, such as wide-angle, telephoto, and macro lenses, are prominent trends. Furthermore, innovations in optical image stabilization (OIS) and computational photography techniques have led to enhanced image quality and reduced camera shake. These developments cater to the growing consumer demand for superior image capture capabilities, creating a competitive landscape where companies strive to offer cutting-edge features and superior image quality.

Report Scope & Segmentation Analysis

This report segments the Asia Pacific smartphone camera module market by country: China, India, and Rest of Asia-Pacific. Each segment is analyzed based on its market size, growth projections, and competitive dynamics. The market size of the China segment is significantly larger compared to India and the Rest of Asia-Pacific. However, India demonstrates higher growth projections due to its burgeoning smartphone market. The Rest of Asia-Pacific encompasses diverse markets with varied growth trajectories depending on each country's unique economic conditions and technological advancements. Competitive landscapes also differ across segments, with varying degrees of market concentration and competitive intensity.

Key Drivers of Asia Pacific Smartphone Camera Module Market Growth

The Asia Pacific smartphone camera module market is fueled by several key drivers:

- Technological Advancements: Continuous innovation in image sensor technology, lens design, and module integration.

- Rising Smartphone Penetration: Growing smartphone adoption across the region, particularly in developing economies.

- Increasing Consumer Demand: Consumers increasingly seek high-quality camera features in smartphones.

- Favorable Economic Conditions: Economic growth and increased disposable incomes in many countries boost consumer spending.

Challenges in the Asia Pacific Smartphone Camera Module Market Sector

The Asia Pacific smartphone camera module market faces challenges including:

- Intense Competition: The market is highly competitive, with numerous players vying for market share.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact module production and availability.

- Fluctuating Raw Material Prices: Price volatility for key raw materials, such as rare earth elements, affects production costs.

Emerging Opportunities in Asia Pacific Smartphone Camera Module Market

Significant opportunities exist in the Asia Pacific smartphone camera module market, including:

- Growth in Emerging Markets: Expanding smartphone adoption in less penetrated markets creates substantial growth potential.

- Advancements in Camera Technology: Innovations in areas such as 3D sensing, computational photography, and high-zoom capabilities offer new opportunities.

- Development of Specialized Modules: Demand for camera modules tailored to specific smartphone features and applications is growing.

Leading Players in the Asia Pacific Smartphone Camera Module Market Market

- Q Technology (Group) Company Limited

- OmniVision Technologies Inc

- Samsung Electro-Mechanics Co Ltd and Samsung Group

- Foxconn Technology Group (Sharp)

- Largan Precision Co Ltd

- O-Film Tech Co Ltd

- LG Innotek Co Ltd

- Sunny Optical Technology Company Limited

- Luxvisions Innovation Limited

- JiangXi Holitech Technology Co Ltd

- Sony Corporation

Key Developments in Asia Pacific Smartphone Camera Module Market Industry

- March 2021: Samsung Electro-Mechanics announced the development and supply of an optical 10x zoom folding camera module to global smartphone manufacturers. This development significantly enhanced smartphone camera zoom capabilities.

- March 2021: LG Innotek partnered with Microsoft to develop cloud-connected 3D sensing smartphone camera modules, expanding the applications of 3D sensing technology in smartphones.

Strategic Outlook for Asia Pacific Smartphone Camera Module Market Market

The Asia Pacific smartphone camera module market holds substantial growth potential driven by continuous technological advancements, increasing smartphone adoption, and rising consumer demand for advanced camera features. Strategic partnerships and investments in R&D are crucial for companies to maintain a competitive edge. Companies focusing on innovation, efficient supply chains, and meeting evolving consumer preferences are poised for significant growth in this dynamic market.

Asia Pacific Smartphone Camera Module Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia Pacific Smartphone Camera Module Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Smartphone Camera Module Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of Multiple Camera Approaches and Introduction of Advanced Camera Technologies

- 3.3. Market Restrains

- 3.3.1. Slower Rate of Penetration of Telematics in Developing Regions; Delayed Regulatory Sanctions

- 3.4. Market Trends

- 3.4.1. Introduction of Advanced Camera Technologies is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Smartphone Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Q Technology (Group) Company Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 OmniVision Technologies Inc *List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Samsung Electro-Mechanics Co Ltd and Samsung Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Foxconn Technology Group (Sharp)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Largan Precision Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 O-Film Tech Co Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 LG Innotek Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Sunny Optical Technology Company Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Luxvisions Innovation Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 JiangXi Holitech Technology Co Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Sony Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Q Technology (Group) Company Limited

List of Figures

- Figure 1: Asia Pacific Smartphone Camera Module Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Smartphone Camera Module Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Taiwan Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Asia-Pacific Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Asia Pacific Smartphone Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: India Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: New Zealand Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Malaysia Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailand Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Vietnam Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Philippines Asia Pacific Smartphone Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Smartphone Camera Module Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Asia Pacific Smartphone Camera Module Market?

Key companies in the market include Q Technology (Group) Company Limited, OmniVision Technologies Inc *List Not Exhaustive, Samsung Electro-Mechanics Co Ltd and Samsung Group, Foxconn Technology Group (Sharp), Largan Precision Co Ltd, O-Film Tech Co Ltd, LG Innotek Co Ltd, Sunny Optical Technology Company Limited, Luxvisions Innovation Limited, JiangXi Holitech Technology Co Ltd, Sony Corporation.

3. What are the main segments of the Asia Pacific Smartphone Camera Module Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of Multiple Camera Approaches and Introduction of Advanced Camera Technologies.

6. What are the notable trends driving market growth?

Introduction of Advanced Camera Technologies is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Slower Rate of Penetration of Telematics in Developing Regions; Delayed Regulatory Sanctions.

8. Can you provide examples of recent developments in the market?

March 2021 - Samsung Electro-Mechanics announced that it has developed and is supplying an optical 10x zoom folding camera module to worldwide smartphone manufacturers. In smartphone cameras, it delivers a folding optical 10x zoom. Higher optical zoom is achieved when the focus point, or the distance between the image sensor and lens, is bigger.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Smartphone Camera Module Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Smartphone Camera Module Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Smartphone Camera Module Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Smartphone Camera Module Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence