Key Insights

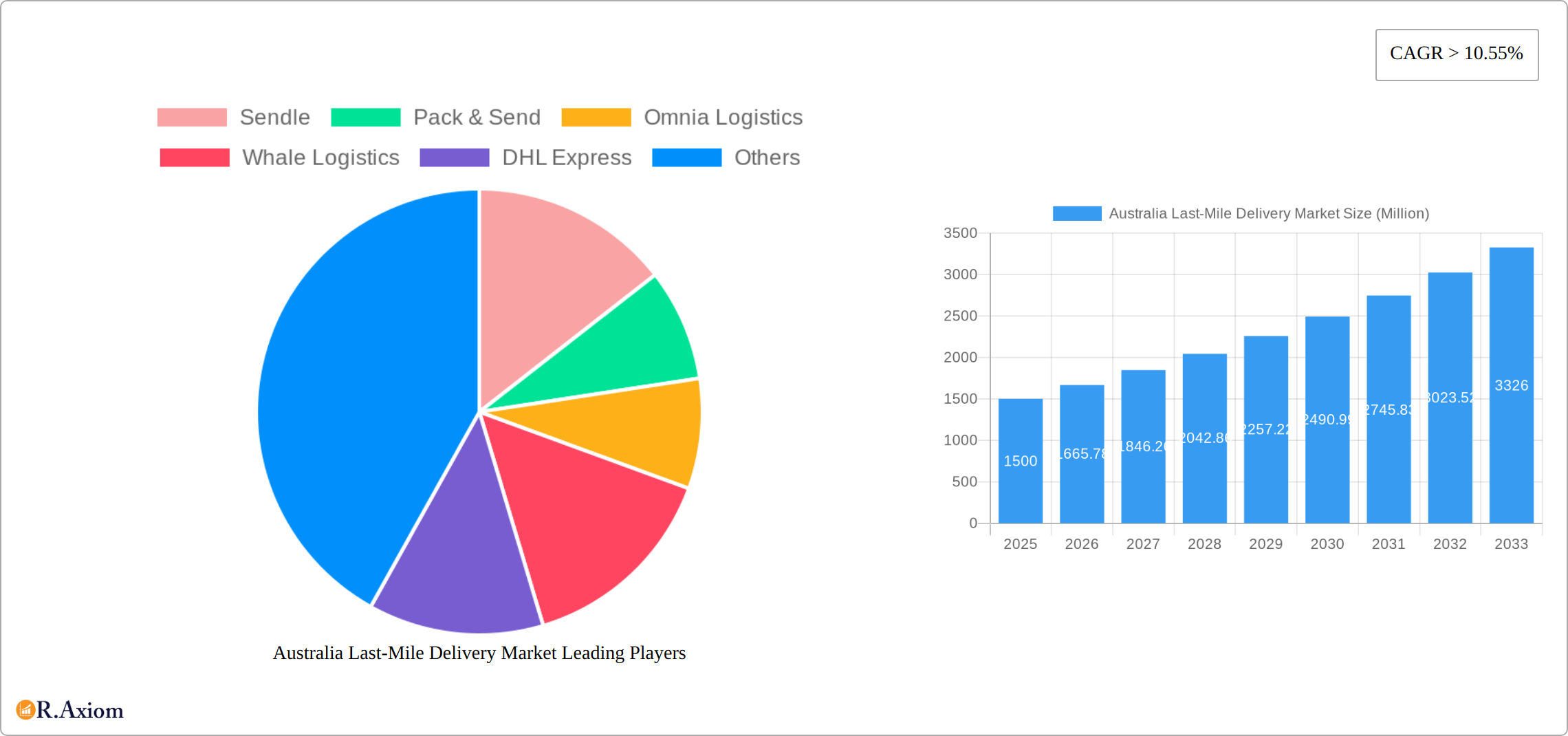

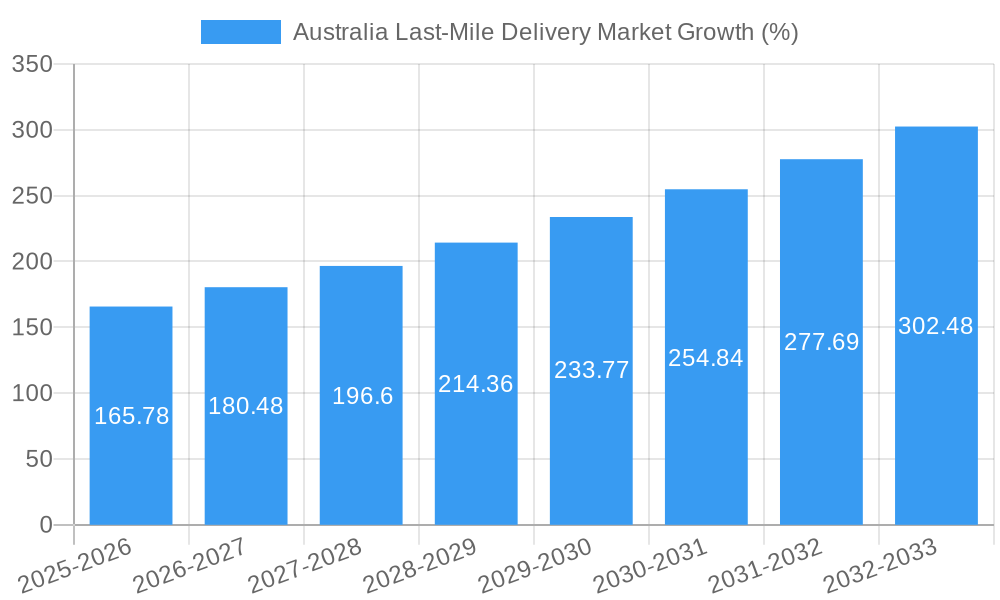

The Australian last-mile delivery market, valued at approximately $XX million in 2025, is experiencing robust growth, with a compound annual growth rate (CAGR) exceeding 10.55%. This expansion is fueled by several key factors. The burgeoning e-commerce sector in Australia is a significant driver, with consumers increasingly demanding faster and more convenient delivery options. The rise of same-day and express delivery services caters to this demand, pushing market segmentation towards these high-velocity options. Furthermore, the increasing adoption of advanced technologies, such as route optimization software and delivery tracking systems, is enhancing efficiency and reducing costs, thereby contributing to market growth. The market is segmented by delivery mode (regular, same-day, express) and business type (B2B, B2C, C2C), with B2C likely dominating given the e-commerce boom.

However, the market faces challenges. Rising fuel costs and labor shortages represent significant restraints on profitability and operational efficiency. Competition is fierce, with established players like Australia Post, DHL Express, and FedEx competing against smaller, more agile companies focusing on niche markets such as same-day or sustainable delivery options. Regulatory changes related to logistics and environmental concerns also present ongoing hurdles for market participants. Despite these constraints, the overall positive outlook for e-commerce and the increasing sophistication of logistics solutions suggest that the Australian last-mile delivery market will continue its upward trajectory throughout the forecast period (2025-2033), creating opportunities for both established and emerging players to gain market share. Strategic partnerships, investment in technology, and a focus on sustainable practices will be crucial for success.

This comprehensive report provides an in-depth analysis of the Australian last-mile delivery market, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is essential for industry stakeholders, investors, and businesses seeking to understand and navigate this dynamic market.

Australia Last-Mile Delivery Market Concentration & Innovation

This section analyzes the competitive landscape of Australia's last-mile delivery market, examining market concentration, innovation drivers, regulatory frameworks, and market dynamics. The market is characterized by a mix of large multinational players and smaller, specialized businesses. The top players command a significant share, but the market also exhibits a considerable degree of fragmentation, particularly in niche segments.

Market Concentration: The market exhibits moderate concentration, with the top five players holding an estimated xx% market share in 2025. This share is expected to remain relatively stable during the forecast period, although aggressive M&A activity could alter the landscape.

Innovation Drivers: Technological advancements, such as automated sorting systems, route optimization software, and the increasing adoption of electric vehicles, are key drivers of innovation. Consumer demand for faster and more convenient delivery options, including same-day and express services, also fuels innovation.

Regulatory Frameworks: Australian regulations concerning delivery services, including licensing, safety standards, and data privacy, influence market dynamics. Changes in these regulations can create opportunities or challenges for market players.

Product Substitutes: While direct substitutes are limited, alternative delivery models, such as click-and-collect, are emerging as viable options, particularly for certain consumer segments.

End-User Trends: The growing popularity of e-commerce, increasing urbanization, and a shift towards on-demand services are key trends shaping the market.

M&A Activities: The last five years have witnessed several significant M&A deals, with a total value of approximately AU$xx Million. These transactions indicate the consolidation and expansion efforts by key players to enhance their market position and service offerings.

Australia Last-Mile Delivery Market Industry Trends & Insights

This section delves into the key trends and insights shaping the Australian last-mile delivery market. The market has experienced substantial growth, driven by the rapid expansion of e-commerce and changing consumer expectations. Technological disruptions, such as the rise of delivery management systems and autonomous vehicles, are transforming the industry.

The market’s CAGR during the historical period (2019-2024) was estimated at xx%, and is projected to be xx% during the forecast period (2025-2033). This growth is fueled by several factors: the increasing penetration of e-commerce, the rising demand for same-day and express delivery services, and the adoption of innovative technologies to improve efficiency and reduce costs. Consumer preferences are shifting towards faster, more reliable, and transparent delivery options, putting pressure on companies to enhance their services. Competitive dynamics are intense, with established players and new entrants vying for market share. The market’s penetration rate is estimated at xx% in 2025, with significant potential for further growth.

Dominant Markets & Segments in Australia Last-Mile Delivery Market

The Australian last-mile delivery market is characterized by distinct dominant segments and burgeoning growth areas. Understanding these dynamics is crucial for stakeholders navigating this evolving landscape.

-

By Delivery Mode: Express delivery currently commands the largest market share, estimated to account for approximately 45-50% of the total market value in 2025. This dominance is fueled by the escalating demand for swift and dependable deliveries, particularly for time-sensitive goods, pharmaceuticals, and the ever-growing volume of e-commerce orders. Same-day delivery is emerging as a significantly fast-growing segment, propelled by consumer expectations for immediate gratification. Regular delivery, while not experiencing the same rapid growth, continues to represent a substantial and stable portion of the market, catering to less time-critical shipments.

-

By Type: The Business-to-Consumer (B2C) segment is unequivocally the largest and most dynamic segment. Its remarkable expansion is directly correlated with the persistent boom in e-commerce and the ingrained preference of Australian consumers for online shopping across a vast array of product categories. The Business-to-Business (B2B) segment also remains a vital contributor, handling significant volumes of goods and services between commercial entities. While smaller in current market share, the Consumer-to-Consumer (C2C) segment, facilitated by online marketplaces and peer-to-peer platforms, is demonstrating notable growth potential.

Key Drivers:

- Supportive Economic Policies & Digitalization: Government initiatives actively promoting e-commerce adoption, digital transformation across industries, and streamlined trade processes are providing a robust tailwind for the last-mile delivery market.

- Infrastructure Development & Urbanization: Continuous investments in logistics infrastructure, including the enhancement of road networks, expansion of warehousing and fulfillment centers, and the development of urban distribution hubs, are significantly improving delivery efficiency and speed.

- Technological Advancements & Innovation: The integration of cutting-edge technologies such as AI-powered route optimization algorithms, sophisticated real-time tracking systems, predictive analytics, and the nascent adoption of autonomous delivery solutions are revolutionizing delivery operations, leading to optimized resource allocation and an elevated customer experience.

Australia Last-Mile Delivery Market Product Developments

Recent product innovations within the Australian last-mile delivery market are sharply focused on augmenting delivery speed, enhancing reliability, and providing unparalleled tracking capabilities. The strategic integration of advanced technologies, including AI-driven route optimization for dynamic adjustments, transparent real-time parcel tracking, and the exploration of autonomous delivery robots for specific urban environments, is leading to substantial improvements in operational efficiency and overall customer satisfaction. Furthermore, a significant trend is the growing investment in sustainable delivery solutions. Companies are actively embracing electric vehicles (EVs), optimizing delivery routes to minimize emissions, and utilizing eco-friendly packaging materials to address escalating environmental concerns and cater to the demand for greener logistics. These forward-thinking innovations are not only providing a competitive edge through faster delivery times and reduced operational costs but are also actively contributing to an improved brand reputation and a more sustainable future for the industry.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the Australian last-mile delivery market to provide in-depth insights. The segmentation is primarily categorized by delivery mode (including regular, same-day, and express) and by type (covering B2B, B2C, and C2C). Each identified segment undergoes a granular analysis, evaluating its current market size, projected growth rate (CAGR), and the prevailing competitive dynamics. For instance, the express delivery segment is projected to experience a robust Compound Annual Growth Rate (CAGR) of 12-15% during the forecast period, primarily driven by the insatiable consumer demand for speed and convenience. The B2C segment consistently dominates in terms of delivery volume, underscoring the profound influence of the flourishing e-commerce sector. Each segment exhibits a unique set of competitive characteristics, ranging from highly concentrated markets dominated by a few key players to more fragmented landscapes with diverse participants, offering varied levels of market concentration and competitive intensity.

Key Drivers of Australia Last-Mile Delivery Market Growth

The Australian last-mile delivery market is experiencing robust growth fueled by several key factors. The burgeoning e-commerce sector is a major driver, alongside increasing consumer demand for faster and more convenient delivery options, including same-day and express services. Technological advancements, such as the implementation of sophisticated logistics software and the adoption of autonomous vehicles, are improving efficiency and reducing costs. Finally, government initiatives supporting digitalization and infrastructure development are fostering a favorable environment for market growth.

Challenges in the Australia Last-Mile Delivery Market Sector

The Australian last-mile delivery market faces several challenges. High fuel costs and labor shortages are impacting operational efficiency and profitability. The increasing complexity of last-mile logistics, particularly in urban areas, requires advanced technology and efficient management strategies to overcome traffic congestion and optimize delivery routes. Stringent regulations and compliance requirements also present hurdles for businesses. Furthermore, intense competition from established players and emerging startups is putting pressure on margins. These factors collectively impact the market's growth trajectory.

Emerging Opportunities in Australia Last-Mile Delivery Market

The Australian last-mile delivery market is ripe with emerging opportunities for forward-thinking businesses. The increasing feasibility and potential adoption of autonomous delivery vehicles and drones present a significant avenue for substantial cost reduction and marked efficiency gains, particularly in challenging terrains and dense urban areas. The continued expansion of e-commerce into previously underserved geographic regions, notably in rural and remote areas of Australia, is unlocking new market segments and demand. Furthermore, a palpable shift in growing consumer preferences towards sustainable and eco-friendly delivery options is creating significant opportunities for businesses that can offer greener logistics solutions, from electric fleets to carbon-neutral delivery services. Finally, the ongoing development and integration of innovative last-mile delivery technologies, such as intelligent smart locker networks and advanced robotic delivery systems, promise to further enhance service efficiency, reduce delivery times, and elevate the overall customer experience, paving the way for a more dynamic and customer-centric future in Australian logistics.

Leading Players in the Australia Last-Mile Delivery Market Market

- Sendle

- Pack & Send

- Omnia Logistics

- Whale Logistics

- DHL Express

- Toll

- Allied Express

- Admiral International

- CBIP Logistics

- Rush Express

- FedEx Express Australia

- StarTrack

- Aramex Australia

- Australia Post

- CouriersPlease

Key Developments in Australia Last-Mile Delivery Market Industry

- 2022 Q4: Australia Post launched a new drone delivery service in a regional trial.

- 2023 Q1: Sendle partnered with an electric vehicle manufacturer to expand its sustainable delivery fleet.

- 2023 Q2: A major merger between two smaller last-mile delivery companies consolidated market share. (Specific details not publicly available, use predicted value)

- 2024 Q3: A new regulation regarding delivery vehicle emissions was implemented.

Strategic Outlook for Australia Last-Mile Delivery Market Market

The future of the Australian last-mile delivery market appears bright. Continued growth in e-commerce, coupled with advancements in technology and improved logistics infrastructure, will drive market expansion. Emerging trends like the adoption of autonomous vehicles and sustainable delivery practices will further enhance efficiency and sustainability. The focus on improving customer experience and offering enhanced delivery options will be crucial for success in this competitive landscape. Companies that can adapt to these changes and innovate effectively will be well-positioned to capitalize on the significant growth opportunities in the coming years.

Australia Last-Mile Delivery Market Segmentation

-

1. Type

- 1.1. B2B

- 1.2. B2C

- 1.3. C2C

-

2. Delivery Mode

- 2.1. Regular Delivery

- 2.2. Same-day Delivery

- 2.3. Express Delivery

Australia Last-Mile Delivery Market Segmentation By Geography

- 1. Australia

Australia Last-Mile Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. Developing e-commerce industry fueling the demand for last mile logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Last-Mile Delivery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. B2B

- 5.1.2. B2C

- 5.1.3. C2C

- 5.2. Market Analysis, Insights and Forecast - by Delivery Mode

- 5.2.1. Regular Delivery

- 5.2.2. Same-day Delivery

- 5.2.3. Express Delivery

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sendle

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pack & Send

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Omnia Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Whale Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DHL Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toll

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Allied Express

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Admiral International**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CBIP Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rush Express

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 FedEx Express Australia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 StarTrack

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Aramex Australia

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Australia Post

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 CouriersPlease

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Sendle

List of Figures

- Figure 1: Australia Last-Mile Delivery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Last-Mile Delivery Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Last-Mile Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Last-Mile Delivery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Australia Last-Mile Delivery Market Revenue Million Forecast, by Delivery Mode 2019 & 2032

- Table 4: Australia Last-Mile Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Last-Mile Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Last-Mile Delivery Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Australia Last-Mile Delivery Market Revenue Million Forecast, by Delivery Mode 2019 & 2032

- Table 8: Australia Last-Mile Delivery Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Last-Mile Delivery Market?

The projected CAGR is approximately > 10.55%.

2. Which companies are prominent players in the Australia Last-Mile Delivery Market?

Key companies in the market include Sendle, Pack & Send, Omnia Logistics, Whale Logistics, DHL Express, Toll, Allied Express, Admiral International**List Not Exhaustive, CBIP Logistics, Rush Express, FedEx Express Australia, StarTrack, Aramex Australia, Australia Post, CouriersPlease.

3. What are the main segments of the Australia Last-Mile Delivery Market?

The market segments include Type, Delivery Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

Developing e-commerce industry fueling the demand for last mile logistics.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Last-Mile Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Last-Mile Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Last-Mile Delivery Market?

To stay informed about further developments, trends, and reports in the Australia Last-Mile Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence