Key Insights

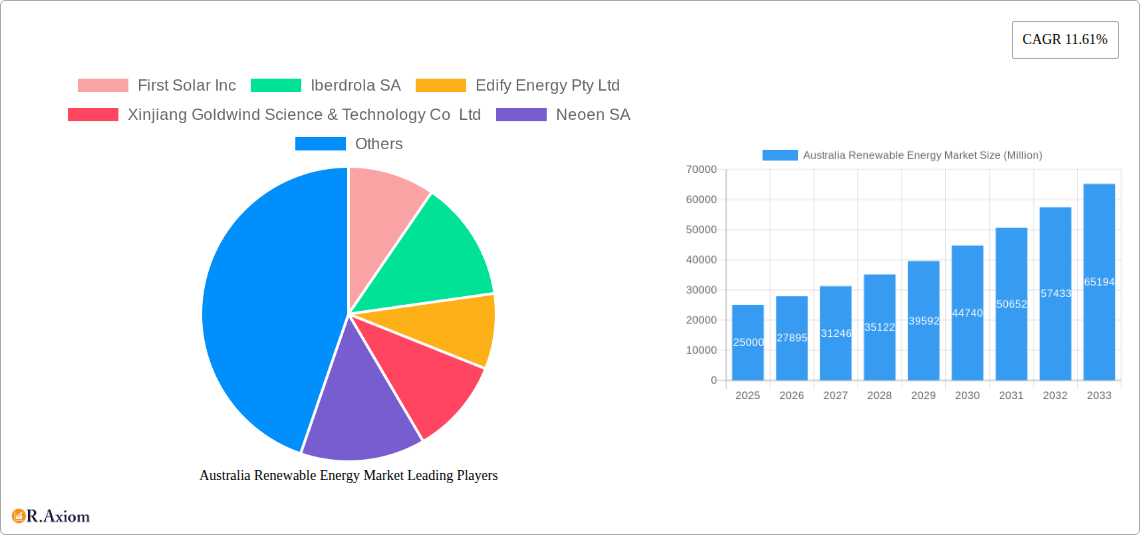

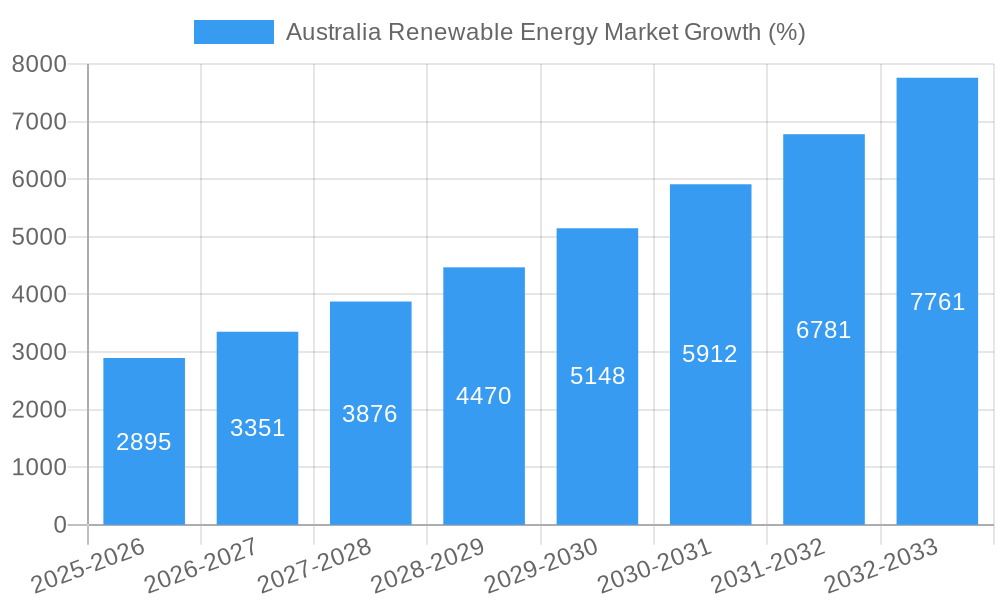

The Australian renewable energy market, currently experiencing robust growth, is projected to expand significantly over the next decade. Driven by supportive government policies aimed at reducing carbon emissions and increasing energy independence, coupled with decreasing technology costs, the market is witnessing a surge in investment across solar, wind, and hydropower sectors. The 11.61% CAGR (2019-2033) indicates a substantial market expansion, with solar and wind energy likely dominating due to their scalability and decreasing production costs. While hydropower contributes significantly, its growth may be somewhat constrained by geographical limitations and environmental concerns. Other renewable technologies, such as geothermal and biomass, are also gaining traction, although they currently hold a smaller market share. The market's success is further fueled by increasing consumer demand for clean energy, corporate sustainability initiatives, and the rising awareness of climate change.

Despite the positive outlook, challenges remain. Intermittency of solar and wind power requires substantial investment in energy storage solutions and smart grid infrastructure. Land use conflicts, particularly with agricultural activities, pose another hurdle for large-scale renewable energy projects. Regulatory complexities and permitting processes can also impede project development. However, ongoing technological advancements, improved grid integration strategies, and streamlined regulatory frameworks are expected to mitigate these challenges, contributing to the continued growth of the Australian renewable energy market. Key players, including First Solar, Iberdrola, and Vestas, are strategically positioning themselves to capitalize on this growth, driving innovation and competition within the sector. The Australian market’s unique geographic features and high solar irradiance offer considerable potential for continued expansion and leadership in the global renewable energy transition.

Australia Renewable Energy Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australian renewable energy market, covering the period from 2019 to 2033. It offers crucial insights into market trends, key players, technological advancements, and future growth prospects, equipping stakeholders with actionable intelligence to navigate this dynamic sector. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. All values are expressed in Millions.

Australia Renewable Energy Market: Market Concentration & Innovation

This section analyzes the competitive landscape, innovation drivers, regulatory frameworks, and market dynamics within the Australian renewable energy sector. The market shows increasing consolidation, with larger players acquiring smaller companies, leading to a more concentrated market structure.

Market Concentration:

- The market share of the top 5 players is estimated to be around 45% in 2025, increasing to xx% by 2033. This concentration is driven by significant M&A activities.

- The average deal value in M&A activities during 2019-2024 was approximately xx Million, with an expected increase to xx Million in the forecast period.

Innovation Drivers:

- Government policies promoting renewable energy adoption, including financial incentives and supportive regulations.

- Technological advancements in solar, wind, and other renewable technologies, leading to increased efficiency and cost reductions.

- Growing demand for cleaner energy sources, driven by environmental concerns and corporate sustainability goals.

Regulatory Frameworks:

- Australia's Renewable Energy Target (RET) and other supportive government initiatives shape the market dynamics.

- The regulatory environment is evolving to facilitate the integration of large-scale renewable energy projects.

Product Substitutes and End-User Trends:

- The primary substitutes for renewable energy sources are traditional fossil fuels (coal and gas). However, cost competitiveness and environmental concerns are driving shifts towards renewables.

- End-user trends show increasing preference for renewable energy solutions amongst businesses and households.

Australia Renewable Energy Market: Industry Trends & Insights

The Australian renewable energy market exhibits robust growth, driven by strong government support, technological advancements, and increasing consumer demand for sustainable energy solutions. The market is witnessing significant technological disruption, with innovations in solar, wind, and energy storage technologies continuously improving efficiency and reducing costs. The compound annual growth rate (CAGR) is projected at xx% from 2025 to 2033.

Market penetration of renewable energy sources continues to increase, reaching an estimated xx% of total electricity generation in 2025, with projections exceeding xx% by 2033. This increase reflects Australia's commitment to reducing its carbon footprint and transition to a low-carbon economy. The competitive dynamics are characterized by intense competition amongst various players, including established utilities, independent power producers (IPPs), and international players. This competition fosters innovation and drives down prices.

Dominant Markets & Segments in Australia Renewable Energy Market

The Australian renewable energy market is characterized by diverse technologies, with solar and wind energy dominating the landscape. However, hydropower and other technologies (e.g., geothermal, biomass) are also playing a significant role.

Solar:

- Key Drivers: Favorable solar irradiance across many regions, government incentives, decreasing solar panel costs.

- Dominance Analysis: Solar accounts for the largest share of renewable energy generation, demonstrating rapid growth due to cost-competitiveness and technological improvements.

Wind:

- Key Drivers: Abundant wind resources, particularly in offshore areas, coupled with advancements in wind turbine technology. Government support for offshore wind farms is a significant growth driver.

- Dominance Analysis: Wind energy holds a substantial share of the market, spurred by large-scale wind farm developments. Offshore wind projects are poised to significantly increase wind energy's contribution to the renewable energy mix.

Hydropower:

- Key Drivers: Existing hydropower infrastructure and potential for further development in specific regions. However, expansion is limited due to environmental considerations.

- Dominance Analysis: Hydropower accounts for a smaller, yet stable, share of the market.

Other Technologies:

- Key Drivers: Emerging technologies, such as geothermal and wave energy, offer further potential but are currently limited in scale. Technological advancements and government funding are vital for growth in this segment.

- Dominance Analysis: This segment's contribution remains relatively small, but it holds significant long-term potential.

Australia Renewable Energy Market: Product Developments

Recent product developments are focused on enhancing efficiency, lowering costs, and improving the reliability of renewable energy systems. This includes advancements in solar panel technology, larger and more efficient wind turbines, and improved energy storage solutions. The integration of smart grids and digital technologies is further enhancing the efficiency and management of renewable energy resources, allowing for improved grid stability and reduced waste. These developments are crucial for increased market penetration and wider adoption.

Report Scope & Segmentation Analysis

This report segments the Australian renewable energy market based on technology: Solar, Wind, Hydropower, and Other Technologies. Each segment is analyzed based on its market size, growth projections, and competitive landscape.

Solar: The solar segment is expected to witness significant growth due to declining costs and government incentives, creating a competitive landscape with numerous players.

Wind: Growth in this segment is driven by increased investment in large-scale wind farms, including offshore projects. Competitive dynamics are driven by technology advancements and economies of scale.

Hydropower: This segment experiences steady growth, largely based on existing infrastructure. However, limited expansion potential due to environmental concerns restricts the competitive landscape.

Other Technologies: This segment exhibits significant potential, though its contribution remains relatively small at present. This segment's competitive landscape is marked by emerging players and new technologies.

Key Drivers of Australia Renewable Energy Market Growth

The Australian renewable energy market's growth is fueled by several key factors. Firstly, the Australian government's commitment to reducing carbon emissions and increasing the share of renewable energy in the national energy mix through policies and incentives is a major driver. Secondly, the declining costs of renewable energy technologies, particularly solar and wind, are making them increasingly competitive with traditional fossil fuels. Thirdly, increasing awareness of climate change and the desire to adopt sustainable energy solutions among businesses and consumers is driving demand.

Challenges in the Australia Renewable Energy Market Sector

Several factors pose challenges to the growth of the Australian renewable energy market. These include: intermittency issues associated with solar and wind power requiring significant investment in energy storage solutions; the need for substantial investment in grid infrastructure to accommodate large-scale renewable energy integration; and regulatory hurdles and permitting processes that can delay project development and increase costs. These challenges create uncertainty and impact project timelines and economic viability.

Emerging Opportunities in Australia Renewable Energy Market

The Australian renewable energy market offers several emerging opportunities. The increasing focus on offshore wind projects presents significant potential for expansion. Further integration of energy storage technologies, particularly batteries, will address the intermittency of renewable energy sources. Furthermore, the growing demand for green hydrogen and its potential applications across various sectors opens new market opportunities for renewable energy producers. These opportunities need to be accompanied by policy support and strategic investments.

Leading Players in the Australia Renewable Energy Market Market

- First Solar Inc

- Iberdrola SA

- Edify Energy Pty Ltd

- Xinjiang Goldwind Science & Technology Co Ltd

- Neoen SA

- Tilt Renewables Ltd

- APA Group

- Vestas Wind Systems AS

- Acciona SA

- Ratch Group PLC

Key Developments in Australia Renewable Energy Market Industry

- June 2023: Octopus Investments Australia acquired a 175 MW solar project in Queensland with battery storage, creating a large multi-technology renewable energy hub.

- December 2022: Microsoft and FRV Australia partnered to add a 300 MW renewable energy source to the grid, supporting Microsoft's sustainability goals.

- November 2022: The Australian government announced the consideration of more offshore wind zones in Western Australia, aiming for 82% renewable energy by 2030.

- September 2022: Copenhagen Energy announced plans for 3 GW wind projects in Western Australia.

Strategic Outlook for Australia Renewable Energy Market Market

The Australian renewable energy market is poised for continued strong growth, driven by supportive government policies, technological advancements, and increasing consumer demand. The expansion of offshore wind, coupled with the integration of energy storage solutions and the emergence of new technologies such as green hydrogen, will further drive market expansion. This presents significant opportunities for both established players and new entrants, creating a dynamic and evolving market landscape.

Australia Renewable Energy Market Segmentation

-

1. Technology

- 1.1. Solar

- 1.2. Wind

- 1.3. Hydropower

- 1.4. Other Technologies

Australia Renewable Energy Market Segmentation By Geography

- 1. Australia

Australia Renewable Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Renewable Energy Generation 4.; Supportive Government Policies Towards Green Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Challenges In Installing Renewable Power in the Circulated Structure

- 3.4. Market Trends

- 3.4.1. Solar Technology is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Renewable Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Solar

- 5.1.2. Wind

- 5.1.3. Hydropower

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 First Solar Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Iberdrola SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Edify Energy Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xinjiang Goldwind Science & Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Neoen SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tilt Renewables Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 APA Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vestas Wind Systems AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Acciona SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ratch Group PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 First Solar Inc

List of Figures

- Figure 1: Australia Renewable Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Renewable Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Renewable Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Renewable Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Australia Renewable Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Australia Renewable Energy Market Volume gigawatt Forecast, by Technology 2019 & 2032

- Table 5: Australia Renewable Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Australia Renewable Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 7: Australia Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Australia Renewable Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 9: Australia Renewable Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 10: Australia Renewable Energy Market Volume gigawatt Forecast, by Technology 2019 & 2032

- Table 11: Australia Renewable Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Australia Renewable Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Renewable Energy Market?

The projected CAGR is approximately 11.61%.

2. Which companies are prominent players in the Australia Renewable Energy Market?

Key companies in the market include First Solar Inc, Iberdrola SA, Edify Energy Pty Ltd, Xinjiang Goldwind Science & Technology Co Ltd, Neoen SA, Tilt Renewables Ltd, APA Group, Vestas Wind Systems AS, Acciona SA, Ratch Group PLC.

3. What are the main segments of the Australia Renewable Energy Market?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Renewable Energy Generation 4.; Supportive Government Policies Towards Green Energy.

6. What are the notable trends driving market growth?

Solar Technology is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Challenges In Installing Renewable Power in the Circulated Structure.

8. Can you provide examples of recent developments in the market?

In June 2023, Octopus Investments Australia, a renewables manager, acquired a 175 MW solar project in Queensland with a battery storage component. This will add to the existing wind farm, paving the way for the state's largest multi-technology renewable energy hub.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Renewable Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Renewable Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Renewable Energy Market?

To stay informed about further developments, trends, and reports in the Australia Renewable Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence