Key Insights

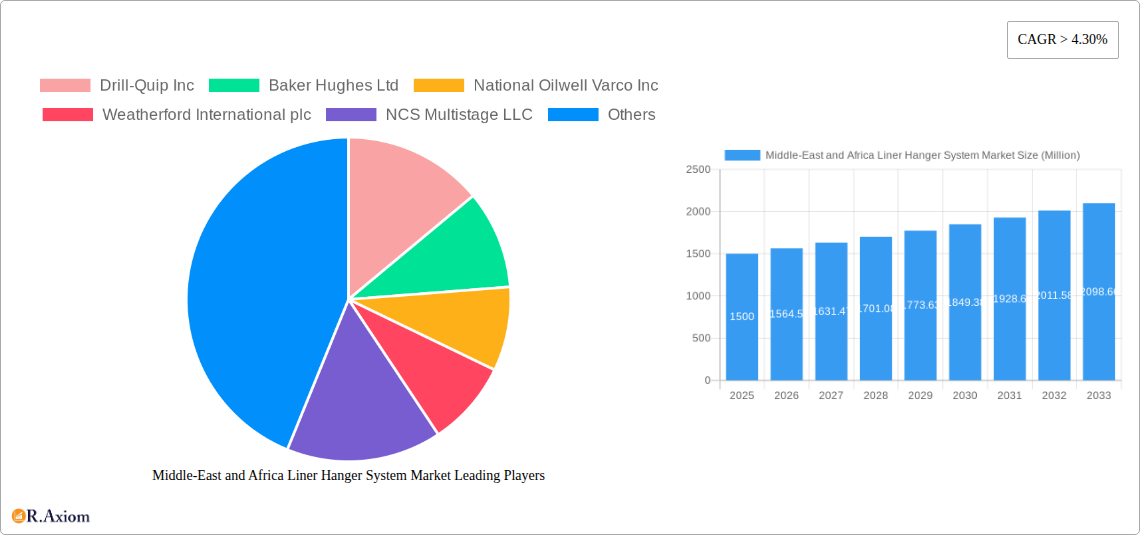

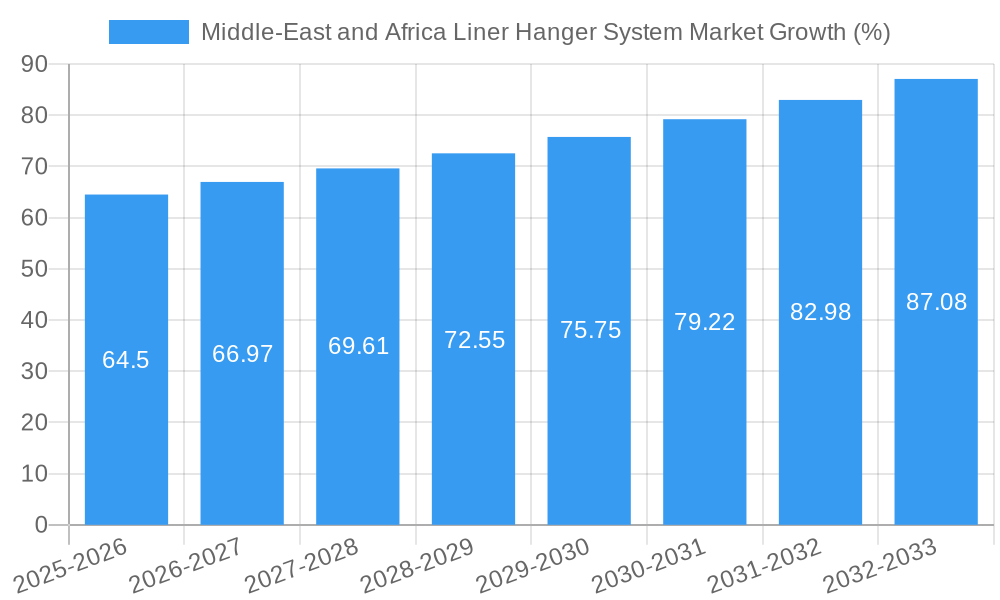

The Middle East and Africa Liner Hanger System market is experiencing robust growth, projected to expand significantly between 2025 and 2033. A Compound Annual Growth Rate (CAGR) exceeding 4.30% indicates a steadily increasing demand driven by several key factors. The surge in oil and gas exploration and production activities across the region, particularly in countries like the United Arab Emirates, Saudi Arabia, and Nigeria, is a primary driver. Furthermore, the ongoing investments in offshore and onshore oil and gas infrastructure development are fueling market expansion. Technological advancements in liner hanger systems, such as the adoption of expandable and advanced conventional designs, are enhancing efficiency and operational capabilities, contributing to market growth. While challenges exist, such as fluctuations in oil prices and geopolitical uncertainties, the overall outlook remains positive due to the long-term growth prospects of the energy sector in the region. Increased focus on improved well completion techniques and enhanced oil recovery methods further bolsters market demand. The market segmentation, encompassing different geographical areas, system types (conventional and expandable), and deployment locations (onshore and offshore), offers diverse opportunities for industry players. The presence of prominent companies like Schlumberger, Baker Hughes, and Halliburton underscores the market's competitiveness and technological sophistication.

The competitive landscape features a mix of established multinational corporations and specialized service providers. This leads to a dynamic environment marked by continuous innovation and strategic partnerships. Growth is expected to be uneven across different segments, with offshore deployment potentially witnessing faster growth due to rising deepwater exploration activities. The market is also experiencing increased demand for more sophisticated liner hanger systems capable of handling high-pressure and high-temperature conditions encountered in challenging geological formations. The strategic focus on enhancing operational efficiency and reducing well intervention costs further influences the selection of liner hanger systems, with advanced technologies gaining traction. Government initiatives promoting energy independence and sustainable energy practices also indirectly contribute to the market's growth trajectory by driving investment in upstream oil and gas exploration. Overall, the Middle East and Africa Liner Hanger System market presents substantial opportunities for companies that can effectively address the region's unique technical and operational requirements.

Middle-East and Africa Liner Hanger System Market: A Comprehensive Report (2019-2033)

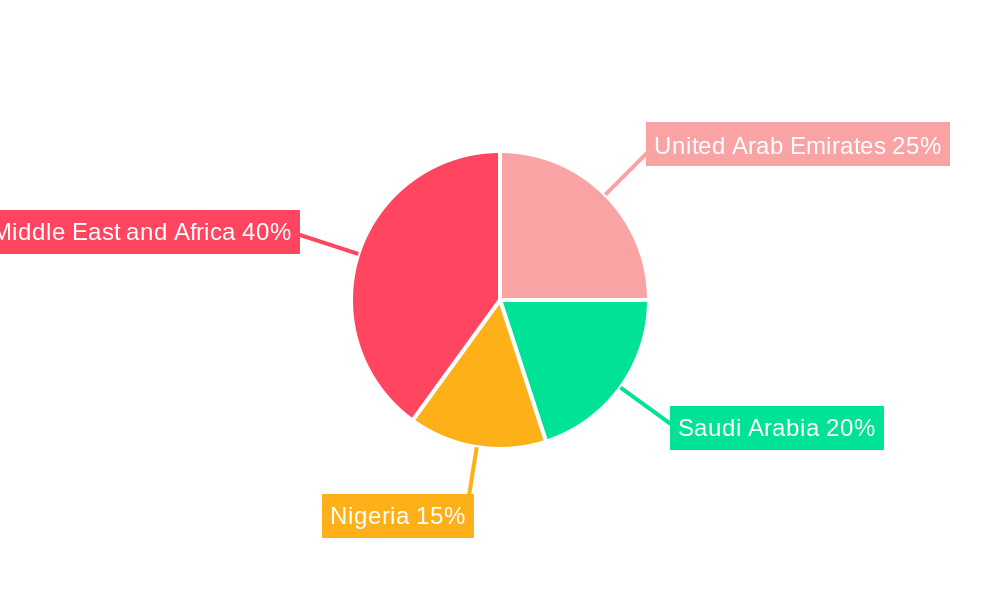

This detailed report provides a comprehensive analysis of the Middle East and Africa Liner Hanger System market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with 2025 as the base year and a forecast period spanning 2025-2033. We delve into market dynamics, competitive landscapes, technological advancements, and growth opportunities within this crucial sector of the oil and gas industry. The report leverages rigorous research methodologies and incorporates real-world examples to offer actionable recommendations. Expect a deep dive into market segmentation by geography (The United Arab Emirates, Saudi Arabia, Nigeria, Rest of Middle East and Africa), type (Conventional, Expandable), and location of deployment (Offshore, Onshore).

Middle-East and Africa Liner Hanger System Market Concentration & Innovation

The Middle East and Africa Liner Hanger System market exhibits a moderately concentrated landscape, dominated by a few multinational players and supported by a range of regional providers. Key players, including Schlumberger Limited, Halliburton Company, Baker Hughes Ltd, National Oilwell Varco Inc, and Weatherford International plc, hold significant market share, estimated at approximately xx% collectively in 2025. Their dominance stems from extensive technological expertise, global reach, and established client relationships within the oil and gas sector. However, smaller, specialized companies are emerging, focusing on niche technologies and regional markets. Market share fluctuations are influenced by technological advancements, M&A activities, and the cyclical nature of the oil and gas industry.

Innovation is a critical driver, with ongoing efforts focused on enhancing liner hanger system efficiency, reliability, and safety. Expandable liner hanger systems are gaining traction due to their adaptability to challenging well conditions. Stringent regulatory frameworks, particularly concerning environmental protection and safety standards, significantly impact market dynamics. The market also faces pressures from substitute technologies and evolving end-user demands for cost-effective and sustainable solutions. Several recent M&A activities valued at approximately USD xx Million have further reshaped the competitive landscape, emphasizing the consolidation trend within the industry.

Middle-East and Africa Liner Hanger System Market Industry Trends & Insights

The Middle East and Africa Liner Hanger System market is experiencing robust growth, driven by increasing oil and gas exploration and production activities across the region. The CAGR is projected to be xx% during the forecast period (2025-2033). This growth is fueled by substantial investments in upstream oil and gas projects, particularly in the Middle East, and the expanding need for advanced well completion technologies. Technological advancements such as improved materials, automated processes, and enhanced data analytics are reshaping the market. The industry is moving towards digitalization and data-driven decision-making, resulting in higher efficiency and reduced operational costs. Market penetration of expandable liner hanger systems is steadily increasing as operators seek more cost-effective and adaptable solutions for complex well designs. Competitive dynamics are characterized by intense rivalry, with major players investing heavily in R&D to maintain a competitive edge. The market is also witnessing increasing adoption of integrated well services, leading to greater collaboration among service providers and oil and gas companies.

Dominant Markets & Segments in Middle-East and Africa Liner Hanger System Market

- Leading Region: The Middle East, specifically Saudi Arabia and the UAE, constitutes the dominant market owing to their substantial oil and gas reserves and extensive investments in upstream activities.

- Leading Country: Saudi Arabia, driven by the massive scale of its oil and gas operations, holds the largest market share, surpassing the UAE and Nigeria.

- Leading Segment (Type): Conventional liner hanger systems currently hold a larger market share compared to expandable systems, primarily due to established infrastructure and existing operational workflows. However, expandable systems are witnessing faster growth due to their increased adaptability and efficiency.

- Leading Segment (Location): Offshore deployment currently dominates, reflecting the substantial offshore oil and gas exploration and production activities in the region. However, onshore operations are also exhibiting healthy growth.

Key Drivers for Dominant Markets:

- Significant Oil and Gas Reserves: The abundance of hydrocarbons in the Middle East makes this region a primary focus for exploration and production activities.

- Government Investments: Governments in the Middle East and Africa are investing heavily in oil and gas infrastructure development, which directly boosts demand for liner hanger systems.

- Technological Advancements: The adoption of innovative technologies and streamlined processes in this sector facilitates a higher rate of operation.

Middle-East and Africa Liner Hanger System Market Product Developments

Recent product developments focus on improving the reliability, efficiency, and safety of liner hanger systems. Manufacturers are concentrating on lightweight, high-strength materials, advanced sealing technologies, and automated deployment systems. These innovations enhance operational efficiency, reduce installation time, and improve well integrity, leading to substantial cost savings for operators. The market is seeing growing demand for expandable liner hanger systems, designed for complex wellbores and harsh environments. These systems offer enhanced flexibility and adaptability, catering to the increasing complexity of drilling operations.

Report Scope & Segmentation Analysis

Geography: The report segments the market by geography into The United Arab Emirates, Saudi Arabia, Nigeria, and the Rest of Middle East and Africa. Saudi Arabia and the UAE are projected to experience the highest growth rates due to their extensive oil and gas activities. Nigeria presents a significant market with growth potential, while the Rest of Middle East and Africa shows steady, moderate expansion.

Type: The market is categorized into conventional and expandable liner hanger systems. Conventional systems currently dominate, yet expandable systems exhibit higher growth potential due to advancements in technology.

Location of Deployment: The market is further divided into onshore and offshore deployments. Offshore operations currently dominate due to the substantial offshore oil and gas activities in the region.

Growth projections and competitive dynamics vary across each segment, with onshore showing steady growth potential. Market sizes are estimated for each segment based on historical data, current market trends, and future forecasts.

Key Drivers of Middle-East and Africa Liner Hanger System Market Growth

The Middle East and Africa Liner Hanger System market is propelled by several key factors. Firstly, the region's significant oil and gas reserves necessitate continuous investment in exploration and production activities, directly driving demand. Secondly, technological advancements, particularly in expandable liner hanger systems, enhance well completion efficiency and reduce operational costs. Finally, increasing government initiatives to support energy infrastructure development within the region further stimulates market growth.

Challenges in the Middle-East and Africa Liner Hanger System Market Sector

The market faces challenges such as fluctuating oil prices, which can impact investment decisions. Supply chain disruptions and the availability of skilled labor can impact project timelines and costs. Intense competition among major players necessitates continuous innovation and adaptation to maintain market share. Furthermore, stringent regulatory requirements related to safety and environmental protection pose operational constraints, and ensuring consistent adherence can be demanding.

Emerging Opportunities in Middle-East and Africa Liner Hanger System Market

Significant opportunities exist for innovative liner hanger technologies, particularly those addressing the needs of unconventional oil and gas resources. The growth of offshore exploration and production activities opens avenues for specialized liner hanger systems suited to harsh environments. Furthermore, the increasing focus on environmental sustainability creates demand for eco-friendly materials and technologies within the sector.

Leading Players in the Middle-East and Africa Liner Hanger System Market Market

- Drill-Quip Inc

- Baker Hughes Ltd

- National Oilwell Varco Inc

- Weatherford International plc

- NCS Multistage LLC

- Halliburton Company

- National-Oilwell Varco Inc

- Schlumberger Limited

- Well Innovation AS

Key Developments in Middle-East and Africa Liner Hanger System Market Industry

September 2022: Weatherford International plc secured a five-year, USD 400 Million+ framework agreement with Abu Dhabi National Oil Company (ADNOC) for directional drilling and logging-while-drilling services, including conventional line hangers. This signifies significant market share gains for Weatherford and highlights the increasing demand for high-quality well completion services in the UAE.

March 2022: Saudi Aramco awarded a major contract to Schlumberger for integrated drilling and well construction services, encompassing liner hanger systems, in a gas drilling project. This deal underscores the trend towards integrated service offerings and the growing demand for advanced technologies in Saudi Arabia's gas sector.

Strategic Outlook for Middle-East and Africa Liner Hanger System Market Market

The Middle East and Africa Liner Hanger System market is poised for sustained growth, driven by continuous investments in oil and gas exploration and production, technological innovation, and increasing government support. The expansion of unconventional resource development, coupled with the growing adoption of integrated well services, will present significant opportunities for market players. Companies focusing on R&D, offering customized solutions, and adopting sustainable practices will be well-positioned to capitalize on this lucrative market's future potential.

Middle-East and Africa Liner Hanger System Market Segmentation

-

1. Type

- 1.1. Conventional

- 1.2. Expandable

-

2. Location of Deployment

- 2.1. Offshore

- 2.2. Onshore

-

3. Geogrpahy

- 3.1. The United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. Nigeria

- 3.4. Rest of Middle-East and Africa

Middle-East and Africa Liner Hanger System Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle-East and Africa Liner Hanger System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Production from Unconventional Sources4.; Growing Energy Demand in the Region

- 3.3. Market Restrains

- 3.3.1. 4.; Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Onshore Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Liner Hanger System Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Conventional

- 5.1.2. Expandable

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Offshore

- 5.2.2. Onshore

- 5.3. Market Analysis, Insights and Forecast - by Geogrpahy

- 5.3.1. The United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Nigeria

- 5.3.4. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Middle-East and Africa Liner Hanger System Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle-East and Africa Liner Hanger System Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle-East and Africa Liner Hanger System Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle-East and Africa Liner Hanger System Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle-East and Africa Liner Hanger System Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle-East and Africa Liner Hanger System Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Drill-Quip Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Baker Hughes Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 National Oilwell Varco Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Weatherford International plc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 NCS Multistage LLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Halliburton Company

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 National-Oilwell Varco Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Schlumberger Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Well Innovation AS

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Drill-Quip Inc

List of Figures

- Figure 1: Middle-East and Africa Liner Hanger System Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle-East and Africa Liner Hanger System Market Share (%) by Company 2024

List of Tables

- Table 1: Middle-East and Africa Liner Hanger System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Middle-East and Africa Liner Hanger System Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Middle-East and Africa Liner Hanger System Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 6: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Location of Deployment 2019 & 2032

- Table 7: Middle-East and Africa Liner Hanger System Market Revenue Million Forecast, by Geogrpahy 2019 & 2032

- Table 8: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Geogrpahy 2019 & 2032

- Table 9: Middle-East and Africa Liner Hanger System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Middle-East and Africa Liner Hanger System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: South Africa Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Sudan Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Sudan Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Uganda Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Uganda Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Tanzania Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tanzania Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Kenya Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kenya Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of Africa Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Africa Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Middle-East and Africa Liner Hanger System Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 27: Middle-East and Africa Liner Hanger System Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 28: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Location of Deployment 2019 & 2032

- Table 29: Middle-East and Africa Liner Hanger System Market Revenue Million Forecast, by Geogrpahy 2019 & 2032

- Table 30: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Geogrpahy 2019 & 2032

- Table 31: Middle-East and Africa Liner Hanger System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Middle-East and Africa Liner Hanger System Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: Saudi Arabia Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Saudi Arabia Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: United Arab Emirates Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Arab Emirates Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Israel Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Qatar Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Qatar Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Kuwait Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Kuwait Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Oman Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Oman Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Bahrain Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Bahrain Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Jordan Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Jordan Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Lebanon Middle-East and Africa Liner Hanger System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Lebanon Middle-East and Africa Liner Hanger System Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Liner Hanger System Market?

The projected CAGR is approximately > 4.30%.

2. Which companies are prominent players in the Middle-East and Africa Liner Hanger System Market?

Key companies in the market include Drill-Quip Inc, Baker Hughes Ltd, National Oilwell Varco Inc, Weatherford International plc, NCS Multistage LLC, Halliburton Company, National-Oilwell Varco Inc, Schlumberger Limited, Well Innovation AS.

3. What are the main segments of the Middle-East and Africa Liner Hanger System Market?

The market segments include Type, Location of Deployment, Geogrpahy.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Production from Unconventional Sources4.; Growing Energy Demand in the Region.

6. What are the notable trends driving market growth?

Onshore Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Environmental Concerns.

8. Can you provide examples of recent developments in the market?

September 2022: Weatherford International plc received a five-year framework agreement from Abu Dhabi National Oil Company to provide directional drilling and logging-while-drilling services. The drilling process includes the deployment of conventional line hangers, drill bits, drill pipes, centrifuges, etc. The contract is valued at over USD 400 million, and ADNOC has the option to extend the contract for an additional two years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Liner Hanger System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Liner Hanger System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Liner Hanger System Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Liner Hanger System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence