Key Insights

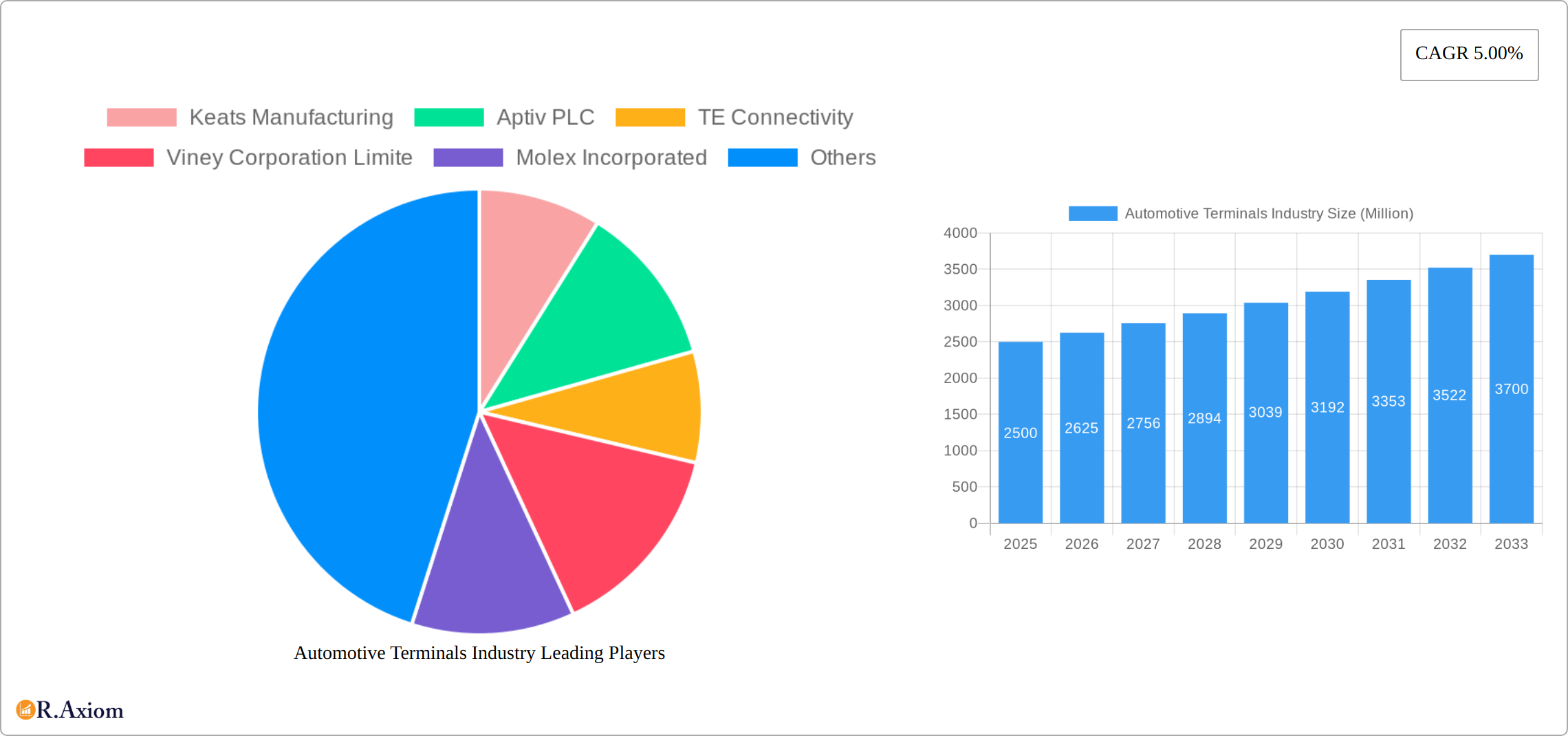

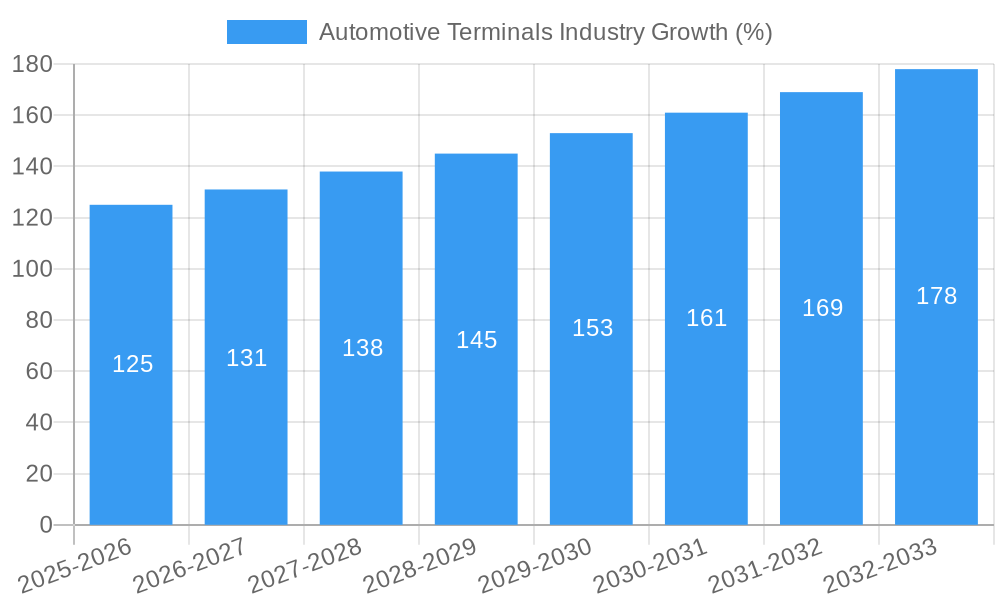

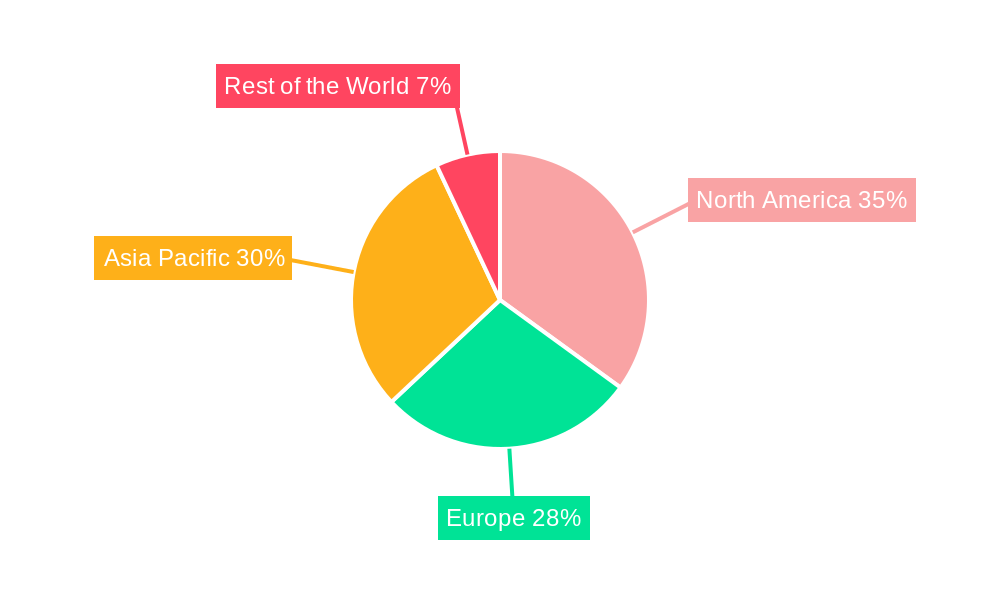

The automotive terminals market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5% from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of electric vehicles (EVs) significantly boosts demand for high-amperage terminals capable of handling the substantial power requirements of EV battery systems and propulsion components. Furthermore, advancements in automotive electronics, leading to sophisticated infotainment and safety systems, contribute to the rising demand for diverse terminal types. The trend towards lightweighting in vehicle design also plays a role, driving the adoption of terminals made from lighter, more durable materials. However, fluctuating raw material prices and potential supply chain disruptions pose challenges to market growth. Segmentation analysis reveals a strong preference for terminals in the 41-100 Ampere range, driven by the widespread use of these terminals in hybrid and conventional vehicles. The electric propulsion segment is experiencing particularly rapid growth, exceeding the growth rate of the internal combustion engine (ICE) segment, reflective of the global shift toward electrification in the automotive industry. Geographically, North America and Asia Pacific are currently leading the market, while Europe shows strong potential for future expansion. Leading players like Aptiv PLC, TE Connectivity, and Molex Incorporated are strategically investing in research and development to enhance terminal technology, further stimulating market growth.

The competitive landscape is characterized by both established players and emerging companies striving to innovate in terms of design, material, and manufacturing processes. The market is witnessing increasing adoption of advanced materials and designs to improve electrical conductivity, corrosion resistance, and thermal management capabilities. Miniaturization of terminals and the integration of smart sensors are other notable trends, enhancing overall vehicle performance and efficiency. Future growth will depend on successfully navigating challenges related to supply chain resilience, maintaining profitability in the face of fluctuating raw material costs, and meeting the increasingly stringent safety and regulatory requirements of the automotive sector. Continued investment in R&D, strategic partnerships, and geographically diverse manufacturing facilities are vital for sustained success in this dynamic market.

This in-depth report provides a comprehensive analysis of the automotive terminals industry, encompassing market size, growth drivers, challenges, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for industry stakeholders, investors, and businesses seeking to understand and navigate this dynamic market.

Automotive Terminals Industry Market Concentration & Innovation

This section analyzes the automotive terminals market concentration, assessing market share distribution among key players like Keats Manufacturing, Aptiv PLC, TE Connectivity, Viney Corporation Limited, Molex Incorporated, Lear Corporation, Furukawa Electric Co Ltd, Grote Industries Inc, Sumitomo Electric Industries Ltd, and PKC Group Ltd. We examine the role of innovation in driving market growth, including the impact of new product launches and technological advancements. Regulatory frameworks and their influence on industry practices are explored, alongside an analysis of product substitutes and their potential market impact. Furthermore, this section delves into end-user trends, highlighting shifts in demand patterns and their implications for market dynamics. Finally, we analyze mergers and acquisitions (M&A) activities, including deal values and their impact on market consolidation and competition. The global market concentration is estimated at xx%, with the top 5 players accounting for approximately xx Million in revenue in 2025. Significant M&A activities have resulted in an estimated xx Million in deal values during the historical period.

- Market Share Analysis: Detailed breakdown of market share held by leading companies.

- Innovation Drivers: Analysis of technological advancements driving market growth.

- Regulatory Landscape: Assessment of the impact of regulations on market dynamics.

- Product Substitutes: Evaluation of alternative technologies and their market impact.

- M&A Activity: Overview of major mergers and acquisitions and their consequences.

Automotive Terminals Industry Industry Trends & Insights

This section offers an in-depth examination of the automotive terminals market trends and insights, with a focus on market growth drivers, technological disruptions, evolving consumer preferences, and the intense competitive dynamics shaping the industry's trajectory. We analyze the compound annual growth rate (CAGR) and market penetration for different segments to provide a clear picture of the market's evolution. The global automotive terminals market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033. This growth is primarily driven by the rising demand for electric vehicles (EVs) and the increasing adoption of advanced driver-assistance systems (ADAS). The market penetration of high-amperage terminals is expected to increase significantly, driven by the growing demand for EVs and hybrid vehicles.

- Market Growth Drivers: Detailed analysis of factors propelling market growth.

- Technological Disruptions: Impact of new technologies on market dynamics.

- Consumer Preferences: Shifting consumer demands and their influence on the industry.

- Competitive Landscape: In-depth analysis of competitive dynamics and strategies.

Dominant Markets & Segments in Automotive Terminals Industry

This section identifies the leading regions, countries, and segments within the automotive terminals market based on current range (Below 40 Ampere, 41-100 Ampere, 100 Ampere+), propulsion type (IC Engine, Electric), and application (Infotainment System, Safety and Security System, Battery Systems, Others). We analyze the key drivers behind the dominance of specific regions and segments, including economic policies, infrastructure development, and technological advancements. The analysis will reveal which region holds the largest market share and the reasons behind its dominance.

- By Current Range: The 41-100 Ampere segment is expected to dominate the market due to its wide applicability across various automotive applications.

- By Propulsion Type: The Electric propulsion type segment is projected to witness the highest growth rate due to the increasing adoption of electric and hybrid vehicles.

- By Application: The Battery Systems segment is expected to be a major growth driver due to the increasing demand for electric vehicles.

- Geographic Dominance: The xx region is expected to dominate the market, driven by factors such as strong automotive manufacturing base and supportive government policies.

Automotive Terminals Industry Product Developments

This section summarizes recent product innovations, applications, and competitive advantages in the automotive terminals industry. Technological trends driving product development are highlighted, emphasizing the importance of miniaturization, improved performance, and enhanced reliability in meeting market demands. The focus is on how these developments translate into market fit and competitive advantages. For example, TE Connectivity's introduction of the PicoMQS connector system exemplifies the trend towards miniaturization in automotive electronics.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation analysis of the automotive terminals market, covering the following:

- Current Range: Below 40 Ampere, 41-100 Ampere, 100 Ampere and above. Each segment's growth projections, market sizes, and competitive dynamics are analyzed. The 41-100 Ampere segment is expected to experience significant growth.

- Propulsion Type: IC Engine, Electric. The Electric segment is anticipated to showcase rapid expansion.

- Application: Infotainment System, Safety and Security System, Battery Systems, Others. The Battery Systems segment is projected as a high-growth area.

Key Drivers of Automotive Terminals Industry Growth

The growth of the automotive terminals industry is fueled by several key factors:

- Technological advancements: The development of miniaturized and high-performance terminals is driving increased adoption in advanced automotive systems.

- Economic growth: Rising disposable incomes and increasing vehicle ownership are boosting demand.

- Government regulations: Stringent emission norms and safety standards are stimulating the adoption of advanced technologies and components.

Challenges in the Automotive Terminals Industry Sector

The automotive terminals industry faces several challenges:

- Supply chain disruptions: Global supply chain volatility can impact the availability and cost of raw materials and components.

- Intense competition: The industry is highly competitive, putting pressure on pricing and margins.

- Regulatory hurdles: Meeting evolving safety and environmental regulations presents significant challenges.

Emerging Opportunities in Automotive Terminals Industry

The automotive terminals industry presents numerous growth opportunities:

- Electric vehicle adoption: The rapid growth of the electric vehicle market is driving demand for high-capacity terminals.

- Autonomous driving technology: The development of autonomous driving technologies is creating new opportunities for advanced connectivity solutions.

- Emerging markets: Developing economies are presenting significant growth potential for automotive terminals.

Leading Players in the Automotive Terminals Industry Market

- Keats Manufacturing

- Aptiv PLC

- TE Connectivity

- Viney Corporation Limited

- Molex Incorporated

- Lear Corporation

- Furukawa Electric Co Ltd

- Grote Industries Inc

- Sumitomo Electric Industries Ltd

- PKC Group Ltd

Key Developments in Automotive Terminals Industry Industry

- September 2022: TE Connectivity introduced the PicoMQS connector system, the industry's smallest automotive-qualified crimping terminal, significantly advancing miniaturization capabilities.

- November 2021: Furukawa Electric Co., Ltd. announced the adoption of its corrosion-resistant Alpha Terminal series in Toyota Land Cruiser 300 series wire harnesses, highlighting advancements in corrosion resistance.

- September 2021: TE Connectivity acquired ERNI Group AG, expanding its product portfolio and enhancing its position in high-speed and fine-pitch terminals.

Strategic Outlook for Automotive Terminals Industry Market

The automotive terminals market is poised for robust growth driven by the accelerating adoption of electric vehicles, advanced driver-assistance systems, and the increasing complexity of automotive electronics. The focus on miniaturization, improved performance, and enhanced reliability will continue to shape product development. New opportunities will emerge in emerging markets and through technological advancements in areas like autonomous driving and connected cars. The market's future is bright, driven by innovation and technological advancements in the automotive sector.

Automotive Terminals Industry Segmentation

-

1. Current Range

- 1.1. Below 40 Ampere

- 1.2. 41-100 Ampere

-

2. Propulsion Type

- 2.1. IC Engine

- 2.2. Electric

-

3. Application

- 3.1. Infotainment System

- 3.2. Safety and Security System

- 3.3. Battery Systems

- 3.4. Others

Automotive Terminals Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Terminals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in sales of E-bike will fuel the market growth.

- 3.3. Market Restrains

- 3.3.1. Limited Performance in Some Applications such as Heavy-Duty Vehicles

- 3.4. Market Trends

- 3.4.1. Growing Sales of Electric Vehicles to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Terminals Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Current Range

- 5.1.1. Below 40 Ampere

- 5.1.2. 41-100 Ampere

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. IC Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Infotainment System

- 5.3.2. Safety and Security System

- 5.3.3. Battery Systems

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Current Range

- 6. North America Automotive Terminals Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Current Range

- 6.1.1. Below 40 Ampere

- 6.1.2. 41-100 Ampere

- 6.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.2.1. IC Engine

- 6.2.2. Electric

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Infotainment System

- 6.3.2. Safety and Security System

- 6.3.3. Battery Systems

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Current Range

- 7. Europe Automotive Terminals Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Current Range

- 7.1.1. Below 40 Ampere

- 7.1.2. 41-100 Ampere

- 7.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.2.1. IC Engine

- 7.2.2. Electric

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Infotainment System

- 7.3.2. Safety and Security System

- 7.3.3. Battery Systems

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Current Range

- 8. Asia Pacific Automotive Terminals Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Current Range

- 8.1.1. Below 40 Ampere

- 8.1.2. 41-100 Ampere

- 8.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.2.1. IC Engine

- 8.2.2. Electric

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Infotainment System

- 8.3.2. Safety and Security System

- 8.3.3. Battery Systems

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Current Range

- 9. Rest of the World Automotive Terminals Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Current Range

- 9.1.1. Below 40 Ampere

- 9.1.2. 41-100 Ampere

- 9.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.2.1. IC Engine

- 9.2.2. Electric

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Infotainment System

- 9.3.2. Safety and Security System

- 9.3.3. Battery Systems

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Current Range

- 10. North America Automotive Terminals Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Automotive Terminals Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Spain

- 11.1.6 Rest of Europe

- 12. Asia Pacific Automotive Terminals Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Automotive Terminals Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Keats Manufacturing

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Aptiv PLC

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 TE Connectivity

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Viney Corporation Limite

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Molex Incorporated

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Lear Corporation

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Furukawa Electric Co Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Grote Industries Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Sumitomo Electric Industries Ltd

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 PKC Group Ltd

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Keats Manufacturing

List of Figures

- Figure 1: Global Automotive Terminals Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Terminals Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Terminals Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Terminals Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Terminals Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive Terminals Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive Terminals Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Automotive Terminals Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Automotive Terminals Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive Terminals Industry Revenue (Million), by Current Range 2024 & 2032

- Figure 11: North America Automotive Terminals Industry Revenue Share (%), by Current Range 2024 & 2032

- Figure 12: North America Automotive Terminals Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 13: North America Automotive Terminals Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 14: North America Automotive Terminals Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Automotive Terminals Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Automotive Terminals Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Automotive Terminals Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Automotive Terminals Industry Revenue (Million), by Current Range 2024 & 2032

- Figure 19: Europe Automotive Terminals Industry Revenue Share (%), by Current Range 2024 & 2032

- Figure 20: Europe Automotive Terminals Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 21: Europe Automotive Terminals Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 22: Europe Automotive Terminals Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Automotive Terminals Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Automotive Terminals Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Automotive Terminals Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Terminals Industry Revenue (Million), by Current Range 2024 & 2032

- Figure 27: Asia Pacific Automotive Terminals Industry Revenue Share (%), by Current Range 2024 & 2032

- Figure 28: Asia Pacific Automotive Terminals Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 29: Asia Pacific Automotive Terminals Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 30: Asia Pacific Automotive Terminals Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific Automotive Terminals Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific Automotive Terminals Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Automotive Terminals Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Automotive Terminals Industry Revenue (Million), by Current Range 2024 & 2032

- Figure 35: Rest of the World Automotive Terminals Industry Revenue Share (%), by Current Range 2024 & 2032

- Figure 36: Rest of the World Automotive Terminals Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 37: Rest of the World Automotive Terminals Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 38: Rest of the World Automotive Terminals Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Rest of the World Automotive Terminals Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Rest of the World Automotive Terminals Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Automotive Terminals Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Terminals Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Terminals Industry Revenue Million Forecast, by Current Range 2019 & 2032

- Table 3: Global Automotive Terminals Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 4: Global Automotive Terminals Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Automotive Terminals Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Automotive Terminals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Automotive Terminals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Terminals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: China Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Automotive Terminals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: South America Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Middle East and Africa Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Automotive Terminals Industry Revenue Million Forecast, by Current Range 2019 & 2032

- Table 27: Global Automotive Terminals Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 28: Global Automotive Terminals Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Automotive Terminals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of North America Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Automotive Terminals Industry Revenue Million Forecast, by Current Range 2019 & 2032

- Table 34: Global Automotive Terminals Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 35: Global Automotive Terminals Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Automotive Terminals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Spain Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Automotive Terminals Industry Revenue Million Forecast, by Current Range 2019 & 2032

- Table 44: Global Automotive Terminals Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 45: Global Automotive Terminals Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 46: Global Automotive Terminals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: India Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: China Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Automotive Terminals Industry Revenue Million Forecast, by Current Range 2019 & 2032

- Table 53: Global Automotive Terminals Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 54: Global Automotive Terminals Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 55: Global Automotive Terminals Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: South America Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Middle East and Africa Automotive Terminals Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Terminals Industry?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Automotive Terminals Industry?

Key companies in the market include Keats Manufacturing, Aptiv PLC, TE Connectivity, Viney Corporation Limite, Molex Incorporated, Lear Corporation, Furukawa Electric Co Ltd, Grote Industries Inc, Sumitomo Electric Industries Ltd, PKC Group Ltd.

3. What are the main segments of the Automotive Terminals Industry?

The market segments include Current Range, Propulsion Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in sales of E-bike will fuel the market growth..

6. What are the notable trends driving market growth?

Growing Sales of Electric Vehicles to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

Limited Performance in Some Applications such as Heavy-Duty Vehicles.

8. Can you provide examples of recent developments in the market?

September 2022: TE Connectivity introduced the PicoMQS connector system, the industry's smallest automotive-qualified crimping terminal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Terminals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Terminals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Terminals Industry?

To stay informed about further developments, trends, and reports in the Automotive Terminals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence