Key Insights

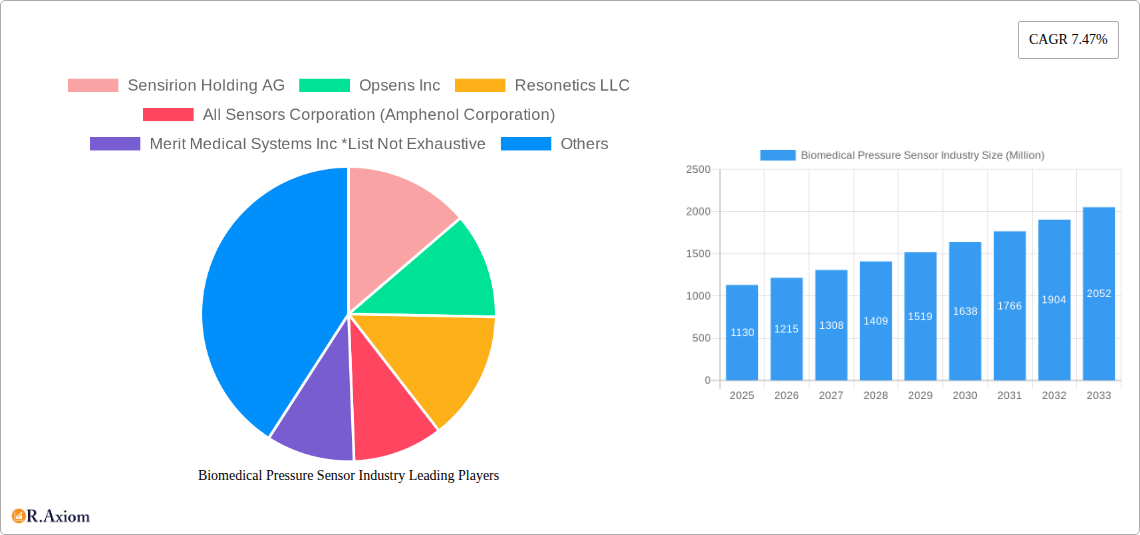

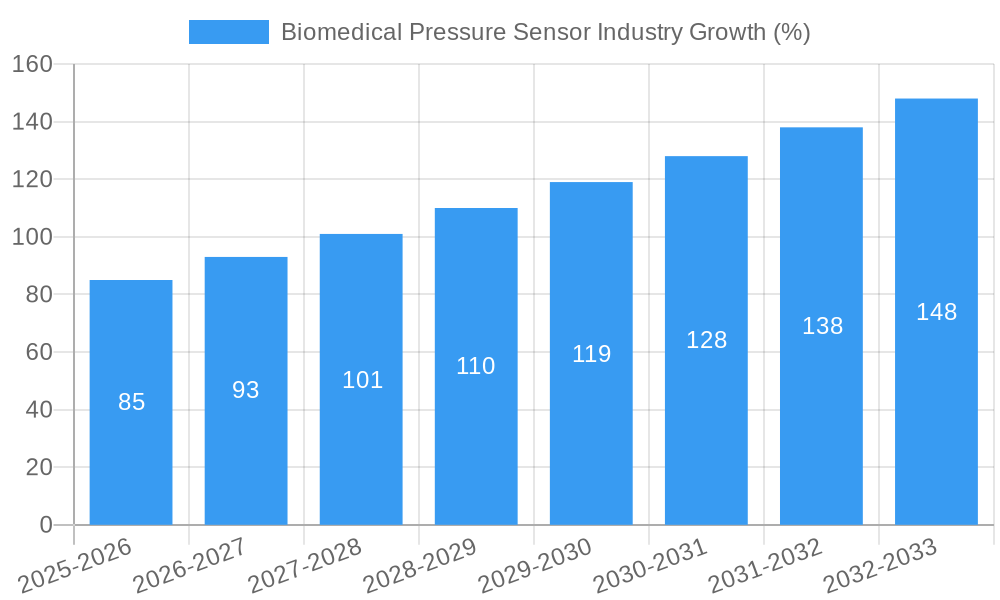

The biomedical pressure sensor market is experiencing robust growth, projected to reach $1.13 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.47% from 2025 to 2033. This expansion is driven by several key factors. The increasing prevalence of chronic diseases like hypertension and cardiovascular issues necessitates advanced monitoring technologies, fueling demand for accurate and reliable pressure sensors in diagnostic and therapeutic applications. Technological advancements, particularly in miniaturization, wireless capabilities, and improved accuracy of sensor types like fiber-optic and self-calibrating sensors, are significantly enhancing the market. The growing adoption of minimally invasive surgical procedures and remote patient monitoring systems further contributes to market growth. Furthermore, the rising focus on fitness and wellness, coupled with the increasing affordability of wearable health devices incorporating pressure sensors, is expanding the market's application scope.

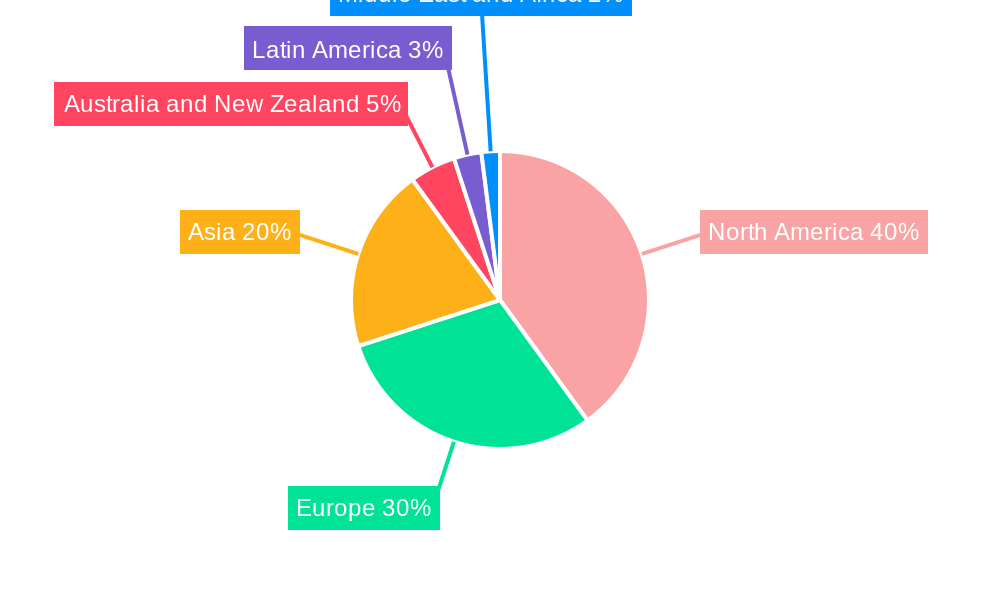

However, the market faces some challenges. High initial investment costs associated with advanced sensor technologies and the stringent regulatory approvals required for medical devices can act as restraints. The need for highly skilled professionals to operate and maintain these sophisticated devices also contributes to market limitations. Despite these constraints, the long-term growth outlook remains positive, driven primarily by the escalating demand for accurate and reliable pressure monitoring across various medical applications. The market segmentation reveals significant opportunities across different sensor technologies (fiber-optic, capacitive, piezoelectric, etc.) and applications (diagnostic, therapeutic, medical imaging, monitoring, etc.), indicating diverse avenues for market participants. The regional distribution likely reflects a higher concentration in developed markets initially (North America and Europe), with emerging economies in Asia experiencing rapid growth in the coming years.

This in-depth report provides a comprehensive analysis of the Biomedical Pressure Sensor industry, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers market size, segmentation, growth drivers, challenges, competitive landscape, and future outlook, using data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033). The global market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Biomedical Pressure Sensor Industry Market Concentration & Innovation

The Biomedical Pressure Sensor industry exhibits a moderately concentrated market structure, with several key players holding significant market share. Sensirion Holding AG, Opsens Inc, Resonetics LLC, All Sensors Corporation (Amphenol Corporation), and Merit Medical Systems Inc are some of the prominent companies, though the market also includes numerous smaller players and niche specialists like RJC Entreprises LLC. Market share data for 2024 indicates that the top five players collectively account for approximately xx% of the global market, suggesting the existence of both established players and a considerable fragmented segment.

Innovation is a key driver, fueled by advancements in sensor technology (e.g., miniaturization, improved accuracy, wireless capabilities), increasing demand for minimally invasive procedures, and the rising adoption of remote patient monitoring. Stringent regulatory frameworks, particularly concerning medical device approvals (e.g., FDA approval in the US), pose a significant barrier to entry and influence innovation trajectories. The industry is also characterized by ongoing mergers and acquisitions (M&A) activity, with deal values totaling approximately xx Million in the past five years. These M&A activities aim to expand product portfolios, enhance technological capabilities, and broaden market reach.

- Market Share (2024): Sensirion Holding AG (xx%), Opsens Inc (xx%), Resonetics LLC (xx%), All Sensors Corporation (xx%), Merit Medical Systems Inc (xx%), Others (xx%)

- M&A Deal Value (2019-2024): Approximately xx Million

Biomedical Pressure Sensor Industry Industry Trends & Insights

The biomedical pressure sensor market is experiencing robust growth, driven by several key factors. The increasing prevalence of chronic diseases such as hypertension and diabetes fuels the demand for continuous monitoring, fostering the adoption of pressure sensors in various medical devices. Technological advancements, including the development of smaller, more accurate, and wireless sensors, have significantly enhanced the capabilities and usability of these devices. Furthermore, the rising preference for minimally invasive procedures has created an impetus for smaller and more adaptable pressure sensor technologies. The market's competitive landscape is dynamic, with existing players focused on innovation and new product development while new entrants strive to carve a niche. The market penetration of wireless and miniaturized sensors is steadily increasing, driven by their enhanced patient comfort and mobility capabilities. The current market size is estimated at xx Million in 2025, projecting a strong growth trajectory with a CAGR of xx% from 2025 to 2033.

Dominant Markets & Segments in Biomedical Pressure Sensor Industry

The North American region currently dominates the biomedical pressure sensor market, driven by a combination of factors. The region boasts a robust healthcare infrastructure, high technological adoption rates, and a sizeable aging population requiring increased medical monitoring. Within North America, the United States is the leading market.

By Technology: The piezoresistive technology segment currently holds the largest market share due to its cost-effectiveness and mature technology. However, the fiber-optic and wireless passive technologies are experiencing the fastest growth rates due to their enhanced accuracy, reliability, and miniaturization potential.

By Application: The diagnostic and monitoring segments are the most significant revenue generators, driven by the wide adoption of pressure sensors in blood pressure monitoring, cardiovascular disease management, and other related applications. The therapeutic applications segment is also expected to demonstrate substantial growth driven by the increasing use of pressure sensors in drug delivery systems and minimally invasive surgeries.

Key Drivers for North American Dominance:

- Strong healthcare infrastructure and investment in medical technologies

- High prevalence of chronic diseases requiring continuous monitoring

- Early adoption of advanced medical technologies

- Favorable regulatory environment

Biomedical Pressure Sensor Industry Product Developments

Recent product developments have focused on miniaturization, improved accuracy, and enhanced wireless capabilities. The integration of advanced materials and manufacturing techniques has enabled the creation of smaller, more flexible, and biocompatible sensors. This addresses the growing need for minimally invasive procedures and improved patient comfort. The emergence of smart sensors with integrated data processing and communication capabilities is further transforming the market, leading to the development of advanced diagnostic and therapeutic tools. This shift towards more sophisticated devices aligns perfectly with the broader trend of increased precision medicine and personalized healthcare.

Report Scope & Segmentation Analysis

This report comprehensively segments the biomedical pressure sensor market by technology (self-calibrating, fiber-optic, telemetric, capacitive, wireless passive, piezoresistive) and application (diagnostic, therapeutic, medical imaging, monitoring, fitness and wellness, other applications). Each segment is analyzed in detail, considering growth projections, market size, and competitive dynamics. For example, the wireless passive technology segment is projected to exhibit significant growth due to its advantages in remote patient monitoring. Similarly, the monitoring application segment is expected to expand rapidly driven by the rising demand for continuous health monitoring solutions.

Key Drivers of Biomedical Pressure Sensor Growth

Several key factors drive the growth of the biomedical pressure sensor market. These include:

- Technological advancements: Miniaturization, improved accuracy, and wireless capabilities are making sensors more versatile and user-friendly.

- Rising prevalence of chronic diseases: The increasing incidence of conditions such as hypertension and diabetes fuels the demand for continuous monitoring.

- Demand for minimally invasive procedures: Smaller and more flexible sensors are vital for minimally invasive techniques.

- Government initiatives and funding: Investment in healthcare and medical technology research promotes innovation.

Challenges in the Biomedical Pressure Sensor Industry Sector

The industry faces several challenges:

- Stringent regulatory requirements: Obtaining approvals for medical devices is complex and time-consuming.

- High manufacturing costs: Advanced sensor technologies can be expensive to produce.

- Competition from established players: The market is competitive, with both large and small players vying for market share.

- Supply chain disruptions: Dependence on specialized components can make the industry vulnerable to disruptions.

Emerging Opportunities in Biomedical Pressure Sensor Industry

Emerging opportunities exist in:

- Wearable technology integration: Pressure sensors are becoming increasingly integrated into wearable health monitoring devices.

- Point-of-care diagnostics: The development of portable and affordable diagnostic tools is driving demand.

- Remote patient monitoring: Wireless sensors enable remote monitoring of patients' vital signs.

- New therapeutic applications: Pressure sensors are being explored in novel therapeutic approaches.

Leading Players in the Biomedical Pressure Sensor Industry Market

- Sensirion Holding AG

- Opsens Inc

- Resonetics LLC

- All Sensors Corporation (Amphenol Corporation)

- Merit Medical Systems Inc

- RJC Entreprises LLC

Key Developments in Biomedical Pressure Sensor Industry

- March 2023: Tekscan launched the High-Speed TireScan system, enabling precise measurement of dynamic contact patch pressure (DCPP) in tires at high speeds. This showcases the adaptability of pressure sensor technology beyond the biomedical field.

- April 2023: Welan Technologies highlighted Tekscan's pressure sensors' use in automotive testing, demonstrating the technology's diverse applications in areas such as fuel cell analysis, battery optimization, and crash impact assessment. These developments underscore the versatility and expanding applications of pressure sensor technology.

Strategic Outlook for Biomedical Pressure Sensor Market

The biomedical pressure sensor market is poised for significant growth, driven by technological innovation, increasing healthcare expenditure, and the rising prevalence of chronic diseases. The integration of advanced materials, improved manufacturing processes, and the growing adoption of wireless and miniaturized sensors are key growth catalysts. The expanding applications of pressure sensors in novel diagnostic and therapeutic tools present significant opportunities for market expansion. The forecast suggests a sustained period of growth, presenting attractive investment prospects for stakeholders.

Biomedical Pressure Sensor Industry Segmentation

-

1. Technology

- 1.1. Self-calibrating

- 1.2. Fiber-optic

- 1.3. Telemetric

- 1.4. Capacitive

- 1.5. Wireless Passive

- 1.6. Piezoresistive

-

2. Application

- 2.1. Diagnostic

- 2.2. Therapeutic

- 2.3. Medical Imaging

- 2.4. Monitoring

- 2.5. Fitness and Wellness

- 2.6. Other Applications

Biomedical Pressure Sensor Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Biomedical Pressure Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Demand for Low-cost

- 3.2.2 High Performance

- 3.2.3 and Reliable Sensors; Demand for Enhanced Patient Care

- 3.3. Market Restrains

- 3.3.1. Environmental Impact on Sensors; Lack of Product Differentiation

- 3.4. Market Trends

- 3.4.1. Therapeutic Applications to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biomedical Pressure Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Self-calibrating

- 5.1.2. Fiber-optic

- 5.1.3. Telemetric

- 5.1.4. Capacitive

- 5.1.5. Wireless Passive

- 5.1.6. Piezoresistive

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Diagnostic

- 5.2.2. Therapeutic

- 5.2.3. Medical Imaging

- 5.2.4. Monitoring

- 5.2.5. Fitness and Wellness

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Biomedical Pressure Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Self-calibrating

- 6.1.2. Fiber-optic

- 6.1.3. Telemetric

- 6.1.4. Capacitive

- 6.1.5. Wireless Passive

- 6.1.6. Piezoresistive

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Diagnostic

- 6.2.2. Therapeutic

- 6.2.3. Medical Imaging

- 6.2.4. Monitoring

- 6.2.5. Fitness and Wellness

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Biomedical Pressure Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Self-calibrating

- 7.1.2. Fiber-optic

- 7.1.3. Telemetric

- 7.1.4. Capacitive

- 7.1.5. Wireless Passive

- 7.1.6. Piezoresistive

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Diagnostic

- 7.2.2. Therapeutic

- 7.2.3. Medical Imaging

- 7.2.4. Monitoring

- 7.2.5. Fitness and Wellness

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Biomedical Pressure Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Self-calibrating

- 8.1.2. Fiber-optic

- 8.1.3. Telemetric

- 8.1.4. Capacitive

- 8.1.5. Wireless Passive

- 8.1.6. Piezoresistive

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Diagnostic

- 8.2.2. Therapeutic

- 8.2.3. Medical Imaging

- 8.2.4. Monitoring

- 8.2.5. Fitness and Wellness

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Biomedical Pressure Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Self-calibrating

- 9.1.2. Fiber-optic

- 9.1.3. Telemetric

- 9.1.4. Capacitive

- 9.1.5. Wireless Passive

- 9.1.6. Piezoresistive

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Diagnostic

- 9.2.2. Therapeutic

- 9.2.3. Medical Imaging

- 9.2.4. Monitoring

- 9.2.5. Fitness and Wellness

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Biomedical Pressure Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Self-calibrating

- 10.1.2. Fiber-optic

- 10.1.3. Telemetric

- 10.1.4. Capacitive

- 10.1.5. Wireless Passive

- 10.1.6. Piezoresistive

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Diagnostic

- 10.2.2. Therapeutic

- 10.2.3. Medical Imaging

- 10.2.4. Monitoring

- 10.2.5. Fitness and Wellness

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. North America Biomedical Pressure Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Biomedical Pressure Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Biomedical Pressure Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Australia and New Zealand Biomedical Pressure Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America Biomedical Pressure Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East and Africa Biomedical Pressure Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Sensirion Holding AG

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Opsens Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Resonetics LLC

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 All Sensors Corporation (Amphenol Corporation)

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Merit Medical Systems Inc *List Not Exhaustive

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 RJC Entreprises LLC

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.1 Sensirion Holding AG

List of Figures

- Figure 1: Global Biomedical Pressure Sensor Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Biomedical Pressure Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Biomedical Pressure Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Biomedical Pressure Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Biomedical Pressure Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Biomedical Pressure Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Biomedical Pressure Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Biomedical Pressure Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Biomedical Pressure Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Biomedical Pressure Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Biomedical Pressure Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Biomedical Pressure Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Biomedical Pressure Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Biomedical Pressure Sensor Industry Revenue (Million), by Technology 2024 & 2032

- Figure 15: North America Biomedical Pressure Sensor Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 16: North America Biomedical Pressure Sensor Industry Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Biomedical Pressure Sensor Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Biomedical Pressure Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Biomedical Pressure Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Biomedical Pressure Sensor Industry Revenue (Million), by Technology 2024 & 2032

- Figure 21: Europe Biomedical Pressure Sensor Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 22: Europe Biomedical Pressure Sensor Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Biomedical Pressure Sensor Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Biomedical Pressure Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Biomedical Pressure Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Biomedical Pressure Sensor Industry Revenue (Million), by Technology 2024 & 2032

- Figure 27: Asia Pacific Biomedical Pressure Sensor Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 28: Asia Pacific Biomedical Pressure Sensor Industry Revenue (Million), by Application 2024 & 2032

- Figure 29: Asia Pacific Biomedical Pressure Sensor Industry Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Pacific Biomedical Pressure Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Biomedical Pressure Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Latin America Biomedical Pressure Sensor Industry Revenue (Million), by Technology 2024 & 2032

- Figure 33: Latin America Biomedical Pressure Sensor Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 34: Latin America Biomedical Pressure Sensor Industry Revenue (Million), by Application 2024 & 2032

- Figure 35: Latin America Biomedical Pressure Sensor Industry Revenue Share (%), by Application 2024 & 2032

- Figure 36: Latin America Biomedical Pressure Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Latin America Biomedical Pressure Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East and Africa Biomedical Pressure Sensor Industry Revenue (Million), by Technology 2024 & 2032

- Figure 39: Middle East and Africa Biomedical Pressure Sensor Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 40: Middle East and Africa Biomedical Pressure Sensor Industry Revenue (Million), by Application 2024 & 2032

- Figure 41: Middle East and Africa Biomedical Pressure Sensor Industry Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East and Africa Biomedical Pressure Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Biomedical Pressure Sensor Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Biomedical Pressure Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Biomedical Pressure Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Biomedical Pressure Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Biomedical Pressure Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Biomedical Pressure Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Biomedical Pressure Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 18: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 21: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 24: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 27: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 30: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global Biomedical Pressure Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biomedical Pressure Sensor Industry?

The projected CAGR is approximately 7.47%.

2. Which companies are prominent players in the Biomedical Pressure Sensor Industry?

Key companies in the market include Sensirion Holding AG, Opsens Inc, Resonetics LLC, All Sensors Corporation (Amphenol Corporation), Merit Medical Systems Inc *List Not Exhaustive, RJC Entreprises LLC.

3. What are the main segments of the Biomedical Pressure Sensor Industry?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Low-cost. High Performance. and Reliable Sensors; Demand for Enhanced Patient Care.

6. What are the notable trends driving market growth?

Therapeutic Applications to Witness Major Growth.

7. Are there any restraints impacting market growth?

Environmental Impact on Sensors; Lack of Product Differentiation.

8. Can you provide examples of recent developments in the market?

April 2023: Welan Technologies showcased the myriad advantages of Tekscan's pressure sensors in the realm of automotive testing and measurement. These pressure mapping systems boast a broad spectrum of applications, encompassing the analysis of pressure distribution in fuel cell stacks, optimization of pressure within battery stacks, evaluation of seat comfort, assessment of grip force distribution, analysis of crash impact, examination of brake pad force distribution, scrutiny of tire footprint pressure distribution, assessment of door seals, wipers, tire bead seating pressure, and dynamic tire footprint analysis.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biomedical Pressure Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biomedical Pressure Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biomedical Pressure Sensor Industry?

To stay informed about further developments, trends, and reports in the Biomedical Pressure Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence