Key Insights

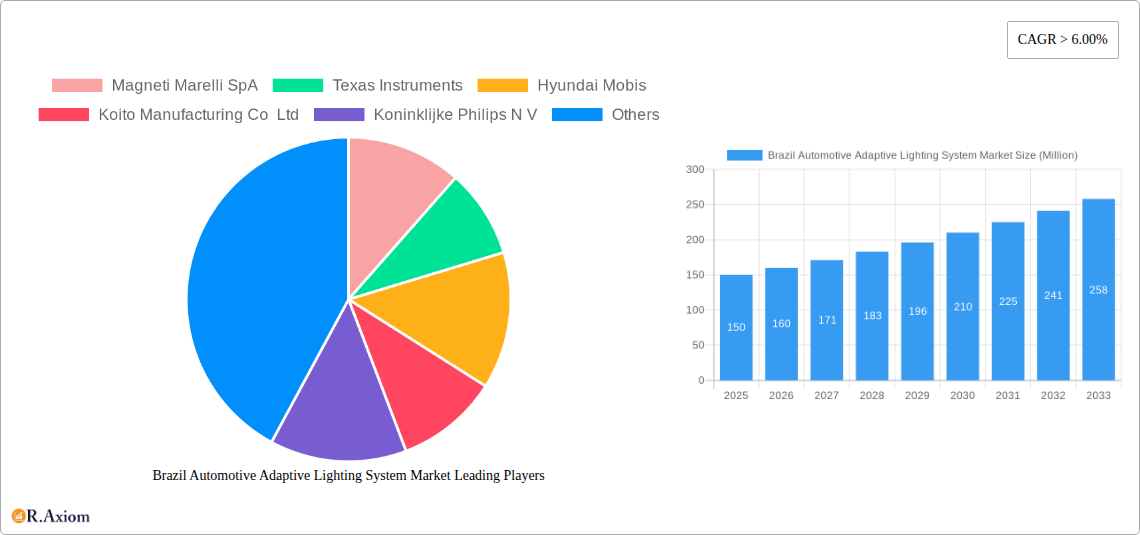

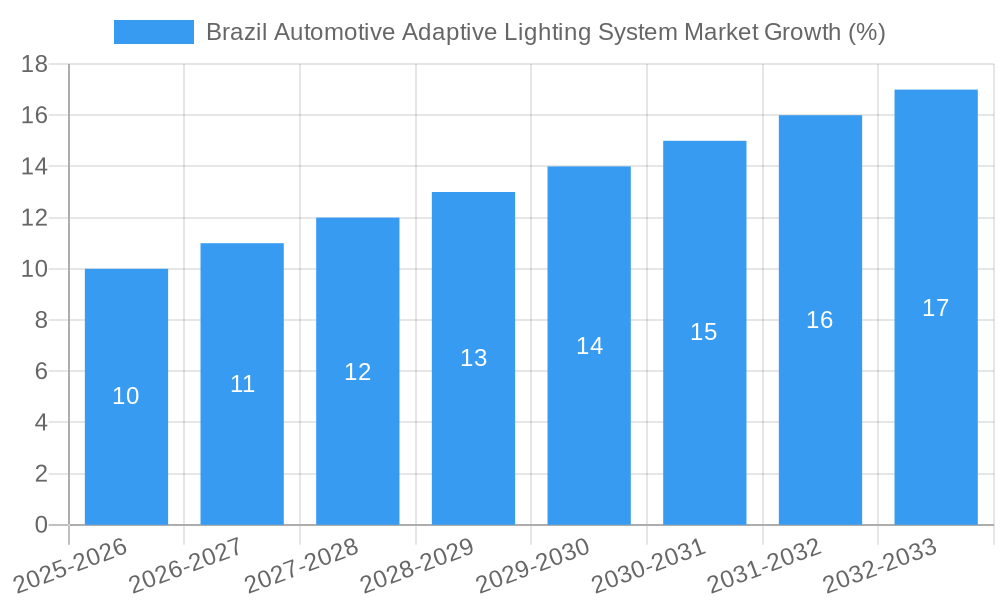

The Brazil automotive adaptive lighting system market is experiencing robust growth, driven by increasing vehicle production, rising consumer preference for enhanced safety features, and government regulations promoting advanced driver-assistance systems (ADAS). The market's Compound Annual Growth Rate (CAGR) exceeding 6% from 2019 to 2024 indicates a significant upward trajectory. Segmentation reveals a strong demand across various vehicle types, including mid-segment passenger vehicles, sports cars, and premium vehicles. Front and rear lighting systems are both significant contributors to the market, reflecting the comprehensive nature of adaptive lighting technology. The OEM (Original Equipment Manufacturer) sales channel currently holds a larger share, but the aftermarket segment is expected to grow significantly as consumer awareness of these systems increases and the need for replacements arises. Key players like Magneti Marelli, Texas Instruments, and Valeo are actively contributing to the market's expansion through technological innovation and strategic partnerships. The Brazilian government's focus on road safety and initiatives promoting vehicle safety standards further bolster market growth.

The forecast period from 2025 to 2033 projects sustained growth, primarily driven by technological advancements in LED and laser lighting technologies. These innovations offer improved energy efficiency, enhanced visibility, and increased safety features, attracting consumers and automakers alike. However, high initial investment costs associated with adopting adaptive lighting systems could pose a restraint, particularly in the lower-priced vehicle segments. Nevertheless, the long-term benefits in terms of safety and fuel efficiency are likely to outweigh the initial costs, driving continued market expansion. Further growth opportunities exist through the penetration of adaptive lighting systems in commercial vehicles, which is currently a less-exploited segment in Brazil. Overall, the Brazilian automotive adaptive lighting system market presents a promising investment opportunity for stakeholders in the automotive technology sector.

Brazil Automotive Adaptive Lighting System Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Brazil Automotive Adaptive Lighting System market, offering invaluable insights for stakeholders across the automotive industry value chain. Spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this study offers a granular view of market dynamics, segmentation, competitive landscape, and future growth potential. The report utilizes rigorous research methodologies and incorporates key market indicators to provide actionable intelligence for strategic decision-making.

Keywords: Brazil Automotive Adaptive Lighting System Market, Adaptive Lighting, Automotive Lighting, Brazil Automotive Market, LED Lighting, OEM, Aftermarket, Market Size, Market Share, CAGR, Market Forecast, Magneti Marelli, Texas Instruments, Hyundai Mobis, Koito Manufacturing, Philips, Osram, HELLA, Stanley Electric, Valeo, Market Growth, Industry Trends, Competitive Analysis, Technological Advancements, Market Segmentation, Regulatory Framework, Investment Opportunities.

Brazil Automotive Adaptive Lighting System Market Concentration & Innovation

The Brazil Automotive Adaptive Lighting System market exhibits a moderately concentrated landscape, with a few key players holding significant market share. Magneti Marelli SpA, Valeo Group, and HELLA KGaA Hueck & Co. are among the dominant players, collectively accounting for approximately xx% of the market in 2025. Market share dynamics are influenced by factors such as technological innovation, economies of scale, and strategic partnerships. Innovation is a key driver, with companies investing heavily in R&D to develop advanced lighting technologies such as adaptive driving beam (ADB), matrix LED, and laser lighting systems. The regulatory environment in Brazil, focusing on enhanced vehicle safety, is also stimulating innovation and adoption of adaptive lighting systems. Product substitutes such as improved halogen lighting systems offer limited competition, while the growing trend of connected and autonomous vehicles further fuels the demand for advanced lighting solutions. M&A activity in the automotive lighting sector has been relatively moderate in recent years, with deal values averaging approximately xx Million USD annually during the historical period.

- Market Concentration: Moderately concentrated with top 3 players holding xx% market share in 2025.

- Innovation Drivers: Advanced lighting technologies (ADB, matrix LED, laser), stricter safety regulations, connected and autonomous vehicle development.

- Regulatory Framework: Stringent safety standards drive adoption of advanced lighting solutions.

- Product Substitutes: Limited competition from improved halogen systems.

- End-User Trends: Increasing demand for enhanced safety and improved visibility.

- M&A Activity: Moderate activity with average annual deal values of xx Million USD (2019-2024).

Brazil Automotive Adaptive Lighting System Market Industry Trends & Insights

The Brazil Automotive Adaptive Lighting System market is projected to experience significant growth during the forecast period (2025-2033), with a CAGR of xx%. This growth is driven by several factors, including increasing vehicle production, rising consumer demand for enhanced safety features, and favorable government regulations promoting advanced driver-assistance systems (ADAS). The adoption of LED and other advanced lighting technologies is rapidly increasing, fueled by advancements in semiconductor technology and decreasing production costs. Consumer preferences are shifting towards vehicles equipped with advanced safety features, and adaptive lighting systems are increasingly considered essential for both active and passive safety. The competitive landscape is characterized by intense competition among both global and domestic players, leading to ongoing product innovation and price optimization strategies. Market penetration of adaptive lighting systems remains relatively low compared to global markets, presenting significant growth opportunities. The increasing adoption of connected car technology is also likely to spur demand for adaptive lighting systems with integrated functionalities.

Dominant Markets & Segments in Brazil Automotive Adaptive Lighting System Market

The Premium Vehicle segment dominates the Brazil Automotive Adaptive Lighting System market, driven by higher vehicle prices and increased consumer willingness to pay for advanced features. Within the vehicle type segment, the sales of premium vehicles are expected to exhibit the highest CAGR of xx% during the forecast period. The front lighting segment holds the largest market share, attributed to higher safety requirements and increased consumer awareness. The OEM sales channel constitutes a significant portion of the market, primarily driven by the integration of adaptive lighting systems into new vehicles.

- By Vehicle Type: Premium Vehicles (largest segment), followed by Mid-Segment Passenger Vehicles and Sports Cars. Key driver for Premium segment: higher disposable income and demand for advanced features.

- By Type: Front lighting dominates due to safety regulations and consumer preference.

- By Sales Channel Type: OEM channel holds the largest market share due to vehicle production growth.

Brazil Automotive Adaptive Lighting System Market Product Developments

Recent product innovations focus on enhancing the functionalities of adaptive lighting systems, improving energy efficiency, and reducing production costs. Miniaturization of components and integration with other ADAS features are key technological trends. Advanced lighting technologies like ADB and matrix LED are gaining traction, offering improved visibility and enhanced safety features. The market is witnessing the introduction of adaptive lighting systems with integrated functionalities like automatic high beam control, dynamic cornering lights, and pedestrian detection. These advancements are improving market fit and driving overall adoption rates.

Report Scope & Segmentation Analysis

This report segments the Brazil Automotive Adaptive Lighting System market based on vehicle type (Mid-Segment Passenger Vehicles, Sports Cars, Premium Vehicles), type (Front, Rear), and sales channel type (OEM, Aftermarket). Each segment is analyzed in detail, including growth projections, market size estimates, and competitive dynamics. For instance, the Premium Vehicle segment is projected to witness significant growth due to increasing demand for enhanced safety features in higher-priced vehicles. Similarly, the OEM channel is anticipated to dominate the sales channel segment, considering the growing integration of adaptive lighting systems during new vehicle manufacturing.

Key Drivers of Brazil Automotive Adaptive Lighting System Market Growth

The growth of the Brazil Automotive Adaptive Lighting System market is propelled by several factors. Increasing vehicle production in Brazil contributes significantly to market expansion. Government regulations mandating safety improvements, along with rising consumer awareness of advanced safety features, create a strong pull for adoption. Technological advancements, particularly in LED and other energy-efficient lighting technologies, are further reducing costs and improving system performance. The increasing integration of adaptive lighting systems with other ADAS features, like autonomous driving systems, is also a key catalyst for market growth.

Challenges in the Brazil Automotive Adaptive Lighting System Market Sector

The Brazil Automotive Adaptive Lighting System market faces several challenges, including high initial investment costs for technology adoption, particularly in the aftermarket segment. Fluctuations in the Brazilian economy and currency volatility can impact investment decisions and consumer purchasing power. The supply chain's vulnerability to disruptions and the competitive intensity among both domestic and international players present ongoing challenges for market participants. Regulatory compliance and standardization can also add complexity to the market environment.

Emerging Opportunities in Brazil Automotive Adaptive Lighting System Market

The market presents numerous emerging opportunities. The expansion of the connected car ecosystem provides avenues for integrating adaptive lighting systems with advanced communication and data analytics capabilities. Increased adoption of electric vehicles (EVs) opens new possibilities for optimizing adaptive lighting for improved energy efficiency. Furthermore, the growing middle class in Brazil and rising disposable incomes are expected to drive increased demand for vehicles equipped with advanced features, including adaptive lighting.

Leading Players in the Brazil Automotive Adaptive Lighting System Market Market

- Magneti Marelli SpA

- Texas Instruments

- Hyundai Mobis

- Koito Manufacturing Co Ltd

- Koninklijke Philips N V

- Osram

- HELLA KGaA Hueck & Co

- Stanley Electric Co Ltd

- Valeo Group

Key Developments in Brazil Automotive Adaptive Lighting System Industry

- 2022 Q4: Valeo launched a new generation of matrix LED headlamp system, enhancing safety features.

- 2023 Q1: HELLA announced a partnership with a Brazilian automotive manufacturer to supply adaptive lighting systems for new vehicle models.

- 2023 Q3: Magneti Marelli invested in R&D for laser lighting technology for future application in the Brazilian market.

Strategic Outlook for Brazil Automotive Adaptive Lighting System Market Market

The Brazil Automotive Adaptive Lighting System market is poised for robust growth, driven by technological advancements, favorable regulatory policies, and evolving consumer preferences. The increasing focus on enhanced safety and autonomous driving features will further fuel demand for advanced lighting solutions. Companies that invest in research and development of innovative, cost-effective technologies and establish strong distribution channels will be well-positioned to capitalize on the significant growth opportunities within this dynamic market. The market’s long-term potential is substantial, indicating a promising outlook for both established players and new entrants.

Brazil Automotive Adaptive Lighting System Market Segmentation

-

1. Vehicle Type

- 1.1. Mid-Segment Passenger Vehicles

- 1.2. Sports Cars

- 1.3. Premium Vehicles

-

2. Type

- 2.1. Front

- 2.2. Rear

-

3. Sales Channel Type

- 3.1. OEM

- 3.2. Aftermarket

Brazil Automotive Adaptive Lighting System Market Segmentation By Geography

- 1. Brazil

Brazil Automotive Adaptive Lighting System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Concerns About Road Safety And Government Lighting Requirements To Enhance Demand In The Market

- 3.3. Market Restrains

- 3.3.1. High Cost and Limited Penetration Rate

- 3.4. Market Trends

- 3.4.1. Front lightening will Lead the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Automotive Adaptive Lighting System Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Mid-Segment Passenger Vehicles

- 5.1.2. Sports Cars

- 5.1.3. Premium Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Front

- 5.2.2. Rear

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Magneti Marelli SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Texas Instruments

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Mobis

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koito Manufacturing Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Koninklijke Philips N V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Osram

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HELLA KGaAHueck& Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stanley Electric Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Valeo Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Magneti Marelli SpA

List of Figures

- Figure 1: Brazil Automotive Adaptive Lighting System Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Automotive Adaptive Lighting System Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Automotive Adaptive Lighting System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Automotive Adaptive Lighting System Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Brazil Automotive Adaptive Lighting System Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Brazil Automotive Adaptive Lighting System Market Revenue Million Forecast, by Sales Channel Type 2019 & 2032

- Table 5: Brazil Automotive Adaptive Lighting System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Brazil Automotive Adaptive Lighting System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Automotive Adaptive Lighting System Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 8: Brazil Automotive Adaptive Lighting System Market Revenue Million Forecast, by Type 2019 & 2032

- Table 9: Brazil Automotive Adaptive Lighting System Market Revenue Million Forecast, by Sales Channel Type 2019 & 2032

- Table 10: Brazil Automotive Adaptive Lighting System Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Automotive Adaptive Lighting System Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Brazil Automotive Adaptive Lighting System Market?

Key companies in the market include Magneti Marelli SpA, Texas Instruments, Hyundai Mobis, Koito Manufacturing Co Ltd, Koninklijke Philips N V, Osram, HELLA KGaAHueck& Co, Stanley Electric Co Ltd, Valeo Group.

3. What are the main segments of the Brazil Automotive Adaptive Lighting System Market?

The market segments include Vehicle Type, Type, Sales Channel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Concerns About Road Safety And Government Lighting Requirements To Enhance Demand In The Market.

6. What are the notable trends driving market growth?

Front lightening will Lead the Market..

7. Are there any restraints impacting market growth?

High Cost and Limited Penetration Rate.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Automotive Adaptive Lighting System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Automotive Adaptive Lighting System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Automotive Adaptive Lighting System Market?

To stay informed about further developments, trends, and reports in the Brazil Automotive Adaptive Lighting System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence