Key Insights

The global Automotive Dashboard Market is poised for significant expansion, projected to reach approximately \$55,000 million by 2033, with a robust Compound Annual Growth Rate (CAGR) exceeding 7.00% during the forecast period of 2025-2033. This substantial growth is primarily driven by evolving consumer preferences for enhanced in-car user experiences, increasing adoption of advanced technologies such as sophisticated infotainment systems and digital clusters, and the burgeoning demand for connected and autonomous vehicles. The shift towards sophisticated human-machine interfaces (HMIs) and the integration of AI-powered features are creating new avenues for dashboard innovation. Furthermore, stringent safety regulations and the drive for improved fuel efficiency are compelling automakers to invest in lighter, more ergonomic, and technologically advanced dashboard designs. The market is witnessing a dual trend of technological advancement and a focus on sustainable materials, catering to both performance and environmental consciousness.

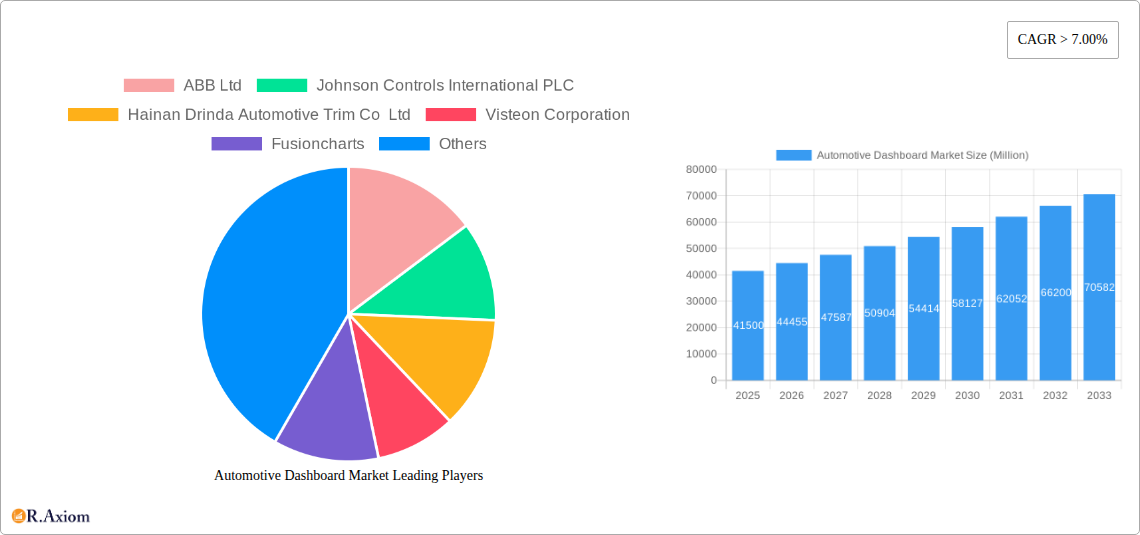

Automotive Dashboard Market Market Size (In Billion)

The market landscape is characterized by intense competition and a dynamic segmentation. In terms of type, LCD Dashboards are expected to dominate, driven by their versatility in displaying information and seamless integration of digital features, while Conventional Dashboards will continue to hold a significant share, especially in emerging markets and specific vehicle segments. Passenger Cars represent the largest vehicle type segment due to higher production volumes and a quicker adoption rate of new technologies, closely followed by Commercial Vehicles which are increasingly incorporating advanced telematics and driver-assistance features. The sales channel is bifurcated between Original Equipment Manufacturers (OEMs), which drive bulk demand for integrated dashboard solutions, and the Aftermarket, which offers customization and upgrade opportunities. Geographically, Asia Pacific, led by China and India, is anticipated to be the fastest-growing region due to its massive automotive production base and rapid technological adoption. North America and Europe will remain significant markets, driven by innovation and consumer demand for premium features.

Automotive Dashboard Market Company Market Share

This in-depth market research report provides a detailed analysis of the global Automotive Dashboard Market, encompassing historical data from 2019 to 2024, a base year of 2025, and comprehensive forecast projections from 2025 to 2033. The report delves into market concentration, innovation, key industry trends, dominant segments, product developments, growth drivers, challenges, emerging opportunities, leading players, and critical industry developments, offering actionable insights for stakeholders seeking to navigate this dynamic sector.

Automotive Dashboard Market Market Concentration & Innovation

The Automotive Dashboard Market exhibits a moderate level of concentration, with key players like Visteon Corporation, Faurecia SE, and Johnson Controls International PLC holding significant market share, estimated to be in the range of 45-55%. Innovation is a primary driver, fueled by the relentless pursuit of advanced human-machine interface (HMI) technologies, digital cockpit integration, and enhanced driver experience. Regulatory frameworks, particularly those focusing on vehicle safety and emissions, indirectly influence dashboard design and feature integration. Product substitutes are limited, primarily revolving around advancements within existing dashboard technologies rather than entirely new categories. End-user trends are increasingly leaning towards personalized, intuitive, and highly customizable digital interfaces, driving demand for advanced LCD dashboards. Mergers and Acquisitions (M&A) activities have been strategic, with deal values ranging from $50 Million to $200 Million, aimed at consolidating market position, acquiring technological expertise, and expanding product portfolios. For instance, a significant M&A transaction in 2023 saw a major Tier 1 supplier acquire a specialized HMI software provider for an estimated $150 Million, enhancing its digital cockpit capabilities.

Automotive Dashboard Market Industry Trends & Insights

The global Automotive Dashboard Market is experiencing robust growth, driven by the escalating demand for sophisticated in-car digital experiences and advanced driver-assistance systems (ADAS). The increasing integration of large, high-resolution displays, customizable interfaces, and voice-activated controls is transforming the traditional dashboard into an intelligent hub. This trend is further propelled by the burgeoning automotive industry, particularly the passenger car segment, which accounts for an estimated 80% of the market. The forecast period (2025–2033) is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately 8-10%, with the market size projected to reach over $30 Billion by 2033. Technological disruptions, including the adoption of augmented reality (AR) displays and advanced visualization techniques, are revolutionizing how drivers interact with their vehicles. Consumer preferences are increasingly focused on seamless connectivity, infotainment, and personalized settings, pushing manufacturers to invest heavily in next-generation dashboard solutions. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on cost-efficiency, with players like Visteon Corporation and Faurecia SE at the forefront. The market penetration of advanced LCD dashboards is rapidly increasing, projected to capture over 70% of the market share by 2033, replacing conventional dashboards in a significant number of vehicles. The transition towards electric vehicles (EVs) also presents a significant opportunity, as EV dashboards often feature more advanced digital interfaces to manage battery status, charging, and energy efficiency.

Dominant Markets & Segments in Automotive Dashboard Market

The Passenger Cars segment is the dominant force within the Automotive Dashboard Market, projected to account for approximately 85% of the global market share by 2033. This dominance is driven by several factors, including higher production volumes, increasing consumer disposable income in key regions, and a greater demand for advanced in-car technologies and premium features. LCD Dashboards are rapidly emerging as the preferred choice, expected to capture over 70% of the market share in the forecast period. This shift is attributed to their superior visual clarity, customization capabilities, and the ability to display complex information such as navigation, ADAS alerts, and real-time vehicle performance data.

Key Drivers of Dominance in Passenger Cars & LCD Dashboards:

- Technological Advancements: Continuous innovation in display technology, processing power, and HMI software enables richer, more interactive user experiences.

- Consumer Preferences: Growing consumer demand for integrated digital experiences, seamless connectivity, and personalized settings directly fuels the adoption of advanced dashboards.

- OEM Investment: Automotive manufacturers are heavily investing in R&D and integrating cutting-edge dashboard technologies to differentiate their vehicles and enhance brand appeal.

- Safety Regulations: Evolving safety standards, particularly concerning driver distraction and the clear display of safety-critical information, favor the versatility of LCD dashboards.

The OEM Sales Channel is expected to continue its dominance, representing an estimated 85-90% of the market share, as dashboards are integral components integrated during vehicle manufacturing. However, the Aftermarket segment is anticipated to witness steady growth, driven by vehicle upgrades and replacement needs. Geographically, Asia-Pacific is projected to remain the largest and fastest-growing regional market, driven by the significant automotive manufacturing hubs in China, Japan, and South Korea, coupled with robust economic growth and increasing vehicle sales. North America and Europe are also significant markets, characterized by a strong consumer preference for advanced automotive technologies and stringent safety regulations.

Automotive Dashboard Market Product Developments

Product developments in the Automotive Dashboard Market are centered on creating more immersive, intuitive, and integrated digital cockpit experiences. Innovations include larger, curved OLED displays, augmented reality head-up displays (AR-HUDs) that project critical information onto the windshield, and advanced haptic feedback systems for touch interfaces. Companies are also focusing on software-driven functionalities, enabling over-the-air (OTA) updates and deep personalization of the user interface. These advancements offer competitive advantages by enhancing driver convenience, safety, and the overall appeal of the vehicle.

Report Scope & Segmentation Analysis

This report meticulously segments the Automotive Dashboard Market across several key dimensions. The Type segmentation includes LCD Dashboard and Conventional Dashboard. The Vehicle Type segmentation covers Passenger Cars and Commercial Vehicles. The Sales Channel segmentation encompasses OEM and Aftermarket. In terms of Type, LCD Dashboards are projected to dominate with a market size of over $25 Billion by 2033, driven by their technological superiority and increasing integration. Conventional dashboards, while still present, are expected to see a decline in market share. For Vehicle Type, Passenger Cars are estimated to hold a market share exceeding $28 Billion by 2033, significantly outweighing Commercial Vehicles due to higher production volumes and a stronger focus on advanced HMI features. The OEM Sales Channel is anticipated to constitute over $27 Billion of the market by 2033, reflecting the integrated nature of dashboard installation in new vehicles.

Key Drivers of Automotive Dashboard Market Growth

Several key drivers are propelling the Automotive Dashboard Market forward. The escalating demand for advanced infotainment systems and seamless connectivity is a primary catalyst, with consumers seeking integrated navigation, multimedia, and communication features. The growing adoption of Advanced Driver-Assistance Systems (ADAS) necessitates sophisticated display technologies to present critical safety information effectively. Furthermore, the continuous innovation in semiconductor technology and display manufacturing is making advanced dashboards more affordable and accessible. Regulatory mandates promoting vehicle safety and driver monitoring also contribute significantly to the market's expansion, encouraging the integration of more intuitive and informative dashboard interfaces. The shift towards electric vehicles (EVs), with their unique operational requirements and often futuristic design philosophies, is also creating new avenues for dashboard innovation.

Challenges in the Automotive Dashboard Market Sector

Despite the positive growth trajectory, the Automotive Dashboard Market faces several challenges. The high cost of advanced display technologies and integrated electronics can be a significant barrier, particularly for entry-level vehicle segments. Ensuring the seamless integration and interoperability of various software and hardware components across different vehicle platforms is technically complex. Cybersecurity threats targeting connected vehicle systems, including dashboard interfaces, pose a growing concern, requiring robust security measures. Moreover, the rapid pace of technological evolution necessitates continuous investment in R&D to remain competitive, which can be a strain on resources for smaller players. Supply chain disruptions, as seen in recent global events, can also impact production and availability of essential components.

Emerging Opportunities in Automotive Dashboard Market

Emerging opportunities within the Automotive Dashboard Market are abundant and multifaceted. The growing trend of in-car personalization and the demand for customizable user interfaces present a significant opportunity for software-driven solutions. The integration of AI-powered virtual assistants and predictive maintenance alerts is another promising area. The expansion of the electric vehicle market is creating a unique demand for digital dashboards that can efficiently display battery status, charging information, and energy consumption data. Furthermore, the development of advanced HMI concepts, such as gesture control and voice commands, is opening new avenues for enhanced user interaction. The increasing focus on sustainable manufacturing and the use of eco-friendly materials in dashboard components also represent a growing opportunity for innovative companies.

Leading Players in the Automotive Dashboard Market Market

- ABB Ltd

- Johnson Controls International PLC

- Hainan Drinda Automotive Trim Co Ltd

- Visteon Corporation

- Fusioncharts

- Dongfeng Electronic

- Huayu Automotive Systems Co Ltd

- Toyoda Gosei Co Ltd

- IA

- Faurecia SE

Key Developments in Automotive Dashboard Market Industry

- 2023 (Q4): Visteon Corporation launched its next-generation cockpit domain controller, enabling advanced digital cluster and infotainment integration for premium vehicles.

- 2023 (Q3): Faurecia SE announced a strategic partnership with a leading software provider to accelerate the development of AI-powered automotive HMI solutions.

- 2023 (Q2): Johnson Controls International PLC expanded its automotive solutions portfolio with the acquisition of a specialized sensor technology company, enhancing its dashboard integration capabilities.

- 2023 (Q1): Huayu Automotive Systems Co Ltd showcased its latest advancements in customizable LCD dashboards designed for emerging electric vehicle platforms.

- 2022 (Q4): Toyoda Gosei Co Ltd introduced a new generation of advanced interior components, including integrated dashboard elements with enhanced tactile feedback.

Strategic Outlook for Automotive Dashboard Market Market

The strategic outlook for the Automotive Dashboard Market remains exceptionally strong. Continued investment in R&D, particularly in areas like AI, AR, and advanced HMI, will be crucial for maintaining a competitive edge. Strategic partnerships and collaborations between technology providers and automotive manufacturers will accelerate innovation and market penetration. The growing demand for connected and autonomous driving features will further drive the adoption of sophisticated digital dashboards. Manufacturers focusing on user experience, personalization, and seamless integration of digital services will be well-positioned for sustained growth. The market is also likely to witness consolidation as larger players seek to acquire specialized expertise and expand their technological offerings to meet evolving consumer expectations and regulatory demands.

Automotive Dashboard Market Segmentation

-

1. Type

- 1.1. LCD Dashboard

- 1.2. Conventional Dashboard

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Sales Channel

- 3.1. OEM

- 3.2. Aftermarket

Automotive Dashboard Market Segmentation By Geography

-

1. North America

- 1.1. United Sates

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

Automotive Dashboard Market Regional Market Share

Geographic Coverage of Automotive Dashboard Market

Automotive Dashboard Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ease of Steering

- 3.3. Market Restrains

- 3.3.1. Cost and Price Sensitivity

- 3.4. Market Trends

- 3.4.1. Technological Developments Creating Demand for LCD Dashboards

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Dashboard Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. LCD Dashboard

- 5.1.2. Conventional Dashboard

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive Dashboard Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. LCD Dashboard

- 6.1.2. Conventional Dashboard

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. OEM

- 6.3.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automotive Dashboard Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. LCD Dashboard

- 7.1.2. Conventional Dashboard

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. OEM

- 7.3.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Automotive Dashboard Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. LCD Dashboard

- 8.1.2. Conventional Dashboard

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel

- 8.3.1. OEM

- 8.3.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Automotive Dashboard Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. LCD Dashboard

- 9.1.2. Conventional Dashboard

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel

- 9.3.1. OEM

- 9.3.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Automotive Dashboard Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. LCD Dashboard

- 10.1.2. Conventional Dashboard

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Cars

- 10.2.2. Commercial Vehicles

- 10.3. Market Analysis, Insights and Forecast - by Sales Channel

- 10.3.1. OEM

- 10.3.2. Aftermarket

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United Arab Emirates Automotive Dashboard Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. LCD Dashboard

- 11.1.2. Conventional Dashboard

- 11.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 11.2.1. Passenger Cars

- 11.2.2. Commercial Vehicles

- 11.3. Market Analysis, Insights and Forecast - by Sales Channel

- 11.3.1. OEM

- 11.3.2. Aftermarket

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 ABB Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Johnson Controls International PLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Hainan Drinda Automotive Trim Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Visteon Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Fusioncharts

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Dongfeng Electronic

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Huayu Automotive Systems Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Toyoda Gosei Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 IA

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Faurecia SE

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 ABB Ltd

List of Figures

- Figure 1: Global Automotive Dashboard Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive Dashboard Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Automotive Dashboard Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Automotive Dashboard Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive Dashboard Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive Dashboard Market Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 7: North America Automotive Dashboard Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 8: North America Automotive Dashboard Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Automotive Dashboard Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Dashboard Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe Automotive Dashboard Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Automotive Dashboard Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 13: Europe Automotive Dashboard Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Automotive Dashboard Market Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 15: Europe Automotive Dashboard Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 16: Europe Automotive Dashboard Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Automotive Dashboard Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Dashboard Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Dashboard Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Dashboard Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Dashboard Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Dashboard Market Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 23: Asia Pacific Automotive Dashboard Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 24: Asia Pacific Automotive Dashboard Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Dashboard Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Automotive Dashboard Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: South America Automotive Dashboard Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Automotive Dashboard Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 29: South America Automotive Dashboard Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: South America Automotive Dashboard Market Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 31: South America Automotive Dashboard Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 32: South America Automotive Dashboard Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: South America Automotive Dashboard Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Automotive Dashboard Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: Middle East Automotive Dashboard Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East Automotive Dashboard Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 37: Middle East Automotive Dashboard Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 38: Middle East Automotive Dashboard Market Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 39: Middle East Automotive Dashboard Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 40: Middle East Automotive Dashboard Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East Automotive Dashboard Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: United Arab Emirates Automotive Dashboard Market Revenue (undefined), by Type 2025 & 2033

- Figure 43: United Arab Emirates Automotive Dashboard Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: United Arab Emirates Automotive Dashboard Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 45: United Arab Emirates Automotive Dashboard Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 46: United Arab Emirates Automotive Dashboard Market Revenue (undefined), by Sales Channel 2025 & 2033

- Figure 47: United Arab Emirates Automotive Dashboard Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 48: United Arab Emirates Automotive Dashboard Market Revenue (undefined), by Country 2025 & 2033

- Figure 49: United Arab Emirates Automotive Dashboard Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Dashboard Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Automotive Dashboard Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Dashboard Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 4: Global Automotive Dashboard Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Dashboard Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Automotive Dashboard Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Automotive Dashboard Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 8: Global Automotive Dashboard Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United Sates Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Dashboard Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Automotive Dashboard Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global Automotive Dashboard Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 15: Global Automotive Dashboard Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Russia Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Dashboard Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global Automotive Dashboard Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Automotive Dashboard Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 24: Global Automotive Dashboard Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: India Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: China Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Automotive Dashboard Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global Automotive Dashboard Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 31: Global Automotive Dashboard Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 32: Global Automotive Dashboard Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 33: Brazil Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Argentina Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Global Automotive Dashboard Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 37: Global Automotive Dashboard Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 38: Global Automotive Dashboard Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 39: Global Automotive Dashboard Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Global Automotive Dashboard Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 41: Global Automotive Dashboard Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 42: Global Automotive Dashboard Market Revenue undefined Forecast, by Sales Channel 2020 & 2033

- Table 43: Global Automotive Dashboard Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 44: Saudi Arabia Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of Middle East Automotive Dashboard Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Dashboard Market?

The projected CAGR is approximately 11.1%.

2. Which companies are prominent players in the Automotive Dashboard Market?

Key companies in the market include ABB Ltd, Johnson Controls International PLC, Hainan Drinda Automotive Trim Co Ltd, Visteon Corporation, Fusioncharts, Dongfeng Electronic, Huayu Automotive Systems Co Ltd, Toyoda Gosei Co Ltd, IA, Faurecia SE.

3. What are the main segments of the Automotive Dashboard Market?

The market segments include Type, Vehicle Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Ease of Steering.

6. What are the notable trends driving market growth?

Technological Developments Creating Demand for LCD Dashboards.

7. Are there any restraints impacting market growth?

Cost and Price Sensitivity.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Dashboard Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Dashboard Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Dashboard Market?

To stay informed about further developments, trends, and reports in the Automotive Dashboard Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence