Key Insights

The APAC Automotive Actuator Market is set for substantial growth, projected to reach $36.74 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 12.35% through 2033. This expansion is driven by escalating demand for advanced safety systems, improved driving comfort, and the rapid adoption of electric vehicles (EVs) across the Asia-Pacific region. Key growth factors include the increasing implementation of sophisticated driver-assistance systems (ADAS), autonomous driving technologies, and the development of smart automotive interiors, where actuators are vital for functions such as throttle control, seat adjustment, and closure systems. Stringent emission regulations and the drive for fuel efficiency are also compelling manufacturers to integrate advanced, electronically controlled actuators, thereby stimulating market demand. The Passenger Cars segment is anticipated to lead the market due to high production volumes and growing consumer preference for technologically advanced vehicles.

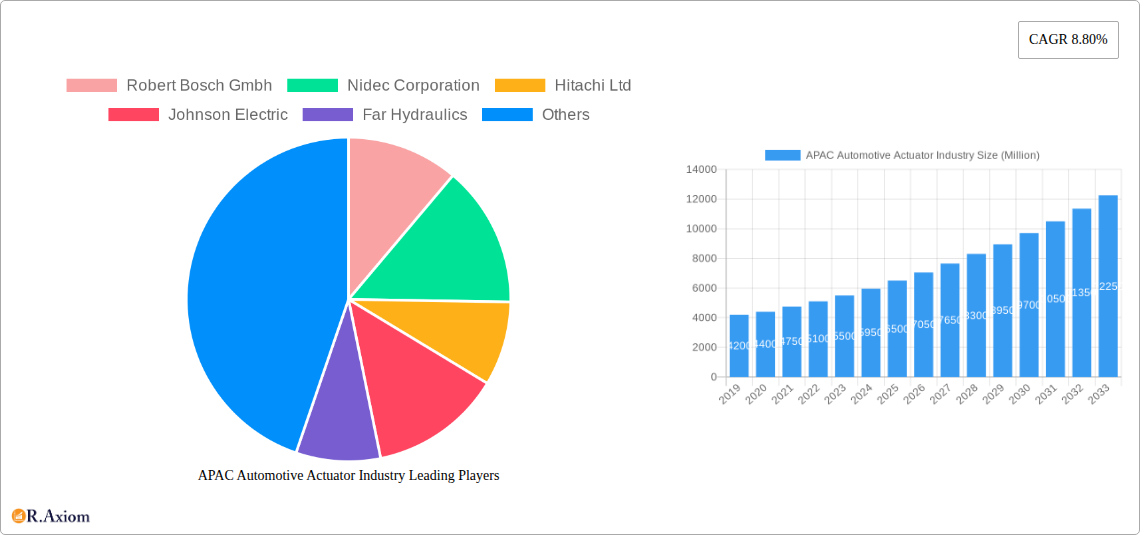

APAC Automotive Actuator Industry Market Size (In Billion)

The market features a diverse range of actuator types, with Electric actuators gaining significant momentum owing to their precision, efficiency, and compatibility with modern automotive designs, particularly in EVs. While Hydraulic and Pneumatic actuators remain relevant, their market share is adapting to the rise of electric alternatives. China and India are at the forefront of market expansion, supported by large domestic automotive production capabilities, favorable government policies for EV adoption, and a growing middle class with increasing purchasing power. Leading companies, including Robert Bosch GmbH, Nidec Corporation, Hitachi Ltd, and Denso Corp, are actively investing in research and development to innovate and meet the evolving needs of the APAC automotive sector. Potential market challenges include the high cost of advanced actuator technologies, supply chain vulnerabilities for critical components, and the requirement for skilled labor to manage complex systems. Nevertheless, continuous innovation and the persistent demand for safer, more comfortable, and sustainable mobility solutions will ensure the continued advancement of the APAC automotive actuator market.

APAC Automotive Actuator Industry Company Market Share

APAC Automotive Actuator Industry Market Concentration & Innovation

The APAC automotive actuator market is characterized by a moderate to high concentration, with key players like Robert Bosch GmbH, Nidec Corporation, Hitachi Ltd., Johnson Electric, Denso Corp, Mitsubishi Electric, and Hella KGaA Hueck & Co. holding significant market share. The electric actuator segment, in particular, is witnessing intense competition driven by the burgeoning electric vehicle (EV) market and increasing demand for advanced driver-assistance systems (ADAS). Innovation in this sector is primarily focused on miniaturization, enhanced efficiency, improved torque density, and the integration of smart functionalities such as self-diagnosis and predictive maintenance. Regulatory frameworks in countries like China and Japan, emphasizing emissions reduction and vehicle safety, are strong innovation drivers, pushing for more sophisticated and reliable actuator solutions. Product substitutes are limited within core actuator functions, but advancements in mechatronics and integrated systems are evolving the overall architecture. End-user trends, particularly the growing preference for luxury features like sophisticated seat adjustment systems and enhanced closure mechanisms in premium passenger cars, are further fueling innovation. Mergers and acquisitions (M&A) activity, while present, has been more strategic, focusing on acquiring niche technologies or expanding geographical reach rather than broad market consolidation. The estimated total M&A deal value in the past five years is approximately $2,500 Million, indicating a mature yet dynamic investment landscape.

APAC Automotive Actuator Industry Industry Trends & Insights

The APAC automotive actuator industry is poised for robust growth, driven by a confluence of technological advancements, evolving consumer preferences, and supportive governmental policies. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.8% from 2025 to 2033, a significant expansion fueled by the accelerating adoption of electric and hybrid vehicles across the region. As the automotive sector transitions towards electrification and autonomous driving, the demand for advanced actuators, particularly electric ones, is skyrocketing. These components are critical for a myriad of functions, from precise throttle control and adaptive braking systems to sophisticated seat adjustments and power closures for doors, trunks, and tailgates. Technological disruptions, including the integration of AI and IoT into actuators for enhanced performance monitoring and predictive maintenance, are redefining industry standards. The penetration of advanced actuator systems in both passenger cars and commercial vehicles is steadily increasing, driven by consumer demand for comfort, convenience, and safety. The competitive dynamics within the APAC region are intense, with established global players fiercely competing with emerging domestic manufacturers. This competition, coupled with the ongoing pursuit of cost efficiencies and performance enhancements, is creating a fertile ground for innovation and market expansion. The industry is also witnessing a growing emphasis on lightweight and energy-efficient actuator designs to contribute to overall vehicle fuel economy and EV range optimization. Furthermore, the increasing complexity of vehicle architectures necessitates smaller, more integrated actuator solutions, pushing the boundaries of engineering and manufacturing. The shift towards smart manufacturing processes and the adoption of Industry 4.0 principles are also playing a crucial role in enhancing production capabilities and product quality.

Dominant Markets & Segments in APAC Automotive Actuator Industry

The APAC automotive actuator industry demonstrates distinct dominance across various segments, with China emerging as the largest and most influential market. This dominance is largely attributable to its status as the world's largest automotive manufacturing hub and a leading adopter of electric vehicles.

Actuator Type Dominance:

- Electric Actuators: This segment is experiencing the most rapid growth and is expected to hold the largest market share.

- Key Drivers: The exponential growth of the electric vehicle (EV) market, stringent emission regulations, and the increasing integration of ADAS features are the primary growth catalysts. China's aggressive EV policies and manufacturing capabilities heavily contribute to this segment's dominance.

- Market Penetration: High and rapidly increasing, especially in new energy vehicles.

- Hydraulic Actuators: While still significant, their share is gradually declining relative to electric actuators.

- Key Drivers: Traditional applications in heavy-duty commercial vehicles and older passenger car models.

- Market Penetration: Moderate, with a declining trend in passenger cars.

- Pneumatic Actuators: Primarily used in specialized industrial and commercial vehicle applications.

- Key Drivers: Niche applications requiring high force and speed, such as in certain braking systems or industrial automation within automotive manufacturing.

- Market Penetration: Low to moderate, restricted to specific use cases.

Application Type Dominance:

- Throttle Actuators: Remain a foundational application, evolving with electronic throttle control (ETC) and drive-by-wire systems.

- Key Drivers: Essential for engine management and fuel efficiency in all vehicle types. The transition to ETC is near-universal in modern vehicles.

- Market Penetration: Near universal in all new vehicles.

- Seat Adjustment Actuators: A rapidly growing segment driven by consumer demand for comfort and luxury features.

- Key Drivers: Increasing premiumization of vehicles and the desire for personalized driving experiences.

- Market Penetration: High in mid-to-high-end passenger cars, growing in mainstream segments.

- Brake Actuators: Crucial for safety systems, with significant advancements in electronic stability control (ESC) and anti-lock braking systems (ABS), and the rise of electric braking.

- Key Drivers: Stringent safety regulations and the development of autonomous braking systems.

- Market Penetration: High, with an increasing shift towards electro-mechanical and electro-hydraulic systems.

- Closure Actuators: Including power doors, tailgates, and trunk systems, driven by convenience and luxury.

- Key Drivers: Growing consumer expectation for convenience features in passenger vehicles.

- Market Penetration: High in premium segments, steadily increasing in mid-range vehicles.

Vehicle Type Dominance:

- Passenger Cars: This segment constitutes the largest market for automotive actuators.

- Key Drivers: High production volumes, increasing technological integration for comfort and safety, and the rapid adoption of EVs. China, Japan, South Korea, and India are key markets.

- Market Penetration: Dominant across all actuator types and applications.

- Commercial Vehicles: Significant demand, particularly for heavy-duty trucks and buses, where hydraulic and pneumatic actuators still hold considerable sway for certain applications.

- Key Drivers: Applications in braking, steering, and suspension systems requiring robust performance.

- Market Penetration: Significant, with specific actuator types dominating particular functions.

APAC Automotive Actuator Industry Product Developments

Product development in the APAC automotive actuator industry is characterized by a strong emphasis on electrification, miniaturization, and smart integration. Key innovations include the development of highly efficient brushless DC (BLDC) electric motors for lighter and more powerful actuators, advanced sensor technologies for precise feedback control, and integrated electronic control units (ECUs) for enhanced functionality. Companies are also focusing on developing robust, high-torque density actuators for EV powertrains and advanced braking systems. The trend towards drive-by-wire technologies is driving the development of sophisticated throttle, steering, and brake actuators with improved responsiveness and safety redundancies. Furthermore, the integration of AI and machine learning algorithms into actuators for predictive diagnostics and optimized performance is a growing area of focus, offering competitive advantages in reliability and maintenance.

Report Scope & Segmentation Analysis

This comprehensive report offers an in-depth analysis of the APAC Automotive Actuator Industry, meticulously segmented to provide actionable insights. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year, followed by a detailed forecast period from 2025 to 2033, and historical data from 2019-2024. The market is segmented by Actuator Type into Hydraulic, Electric, and Pneumatic actuators, each with distinct growth trajectories and application niches. Application Types covered include Throttle, Seat Adjustment, Brake, Closure, and Others, reflecting the diverse functional requirements in modern vehicles. Furthermore, the analysis is granularly broken down by Vehicle Type: Passenger Cars and Commercial Vehicles, acknowledging their differing technological needs and market dynamics.

- Hydraulic Actuators: This segment, while mature, continues to be relevant in commercial vehicles for heavy-duty applications. Market size is projected to see a modest growth, driven by specific industrial needs.

- Electric Actuators: This is the fastest-growing segment, driven by EV adoption and ADAS proliferation. Significant market size and high growth projections are expected due to technological advancements and increasing demand across all vehicle types.

- Pneumatic Actuators: A niche segment with steady, albeit slower, growth. Its market size is expected to remain smaller, serving specialized applications.

- Throttle Actuators: Essential across all vehicle types, this segment is characterized by high market penetration and steady growth, evolving with electronic control systems.

- Seat Adjustment Actuators: This segment is experiencing robust growth due to the increasing demand for comfort and luxury features in passenger cars.

- Brake Actuators: Critical for safety, this segment is seeing significant evolution with the integration of electronic and advanced braking systems, projecting substantial market growth.

- Closure Actuators: Driven by convenience and premium features, this segment is expected to witness strong growth, particularly in passenger cars.

- Passenger Cars: This segment dominates the overall market due to high production volumes and rapid adoption of advanced technologies, including EVs and ADAS.

- Commercial Vehicles: This segment represents a substantial market, with continued demand for robust actuators, especially in heavy-duty applications.

Key Drivers of APAC Automotive Actuator Industry Growth

The APAC automotive actuator industry's growth is propelled by several interconnected factors. The accelerating global shift towards electric vehicles (EVs) is a primary catalyst, driving demand for specialized electric actuators for powertrains, braking, and thermal management systems. Stringent government regulations aimed at reducing vehicle emissions and enhancing safety standards, particularly in major markets like China and India, necessitate the adoption of advanced actuator technologies like electronic throttle control and sophisticated braking systems. Increasing consumer demand for enhanced comfort, convenience, and safety features in vehicles, such as power seats, automated closures, and advanced driver-assistance systems (ADAS), directly fuels the market for various actuator types. Furthermore, the robust growth of the automotive manufacturing sector across the APAC region, coupled with technological advancements in actuator design leading to improved performance, efficiency, and miniaturization, are significant growth enablers.

Challenges in the APAC Automotive Actuator Industry Sector

Despite the strong growth trajectory, the APAC automotive actuator industry faces several challenges. Intense price competition among numerous manufacturers, especially in the high-volume electric actuator segment, can put pressure on profit margins. Fluctuations in raw material costs, particularly for rare earth magnets and specialized alloys, can impact production expenses. The complexity of supply chains, exacerbated by geopolitical factors and logistical disruptions, can lead to delays and increased costs. Evolving regulatory landscapes, while drivers of innovation, also present challenges in terms of compliance costs and the need for continuous adaptation. Furthermore, the rapid pace of technological change requires substantial ongoing investment in research and development to stay competitive, posing a hurdle for smaller players.

Emerging Opportunities in APAC Automotive Actuator Industry

Emerging opportunities in the APAC automotive actuator industry are abundant and diverse. The continued exponential growth of the electric vehicle market presents a significant opportunity for suppliers of high-performance electric actuators for powertrains, battery thermal management, and advanced braking systems. The increasing integration of autonomous driving and advanced driver-assistance systems (ADAS) creates demand for highly precise and reliable actuators for steering, braking, and sensor actuation. The growing demand for in-cabin comfort and convenience features, such as advanced seat adjustments and sophisticated closure systems, offers substantial market potential in the passenger car segment. Furthermore, the development of smart actuators with integrated sensors and diagnostic capabilities for predictive maintenance and enhanced vehicle performance represents a significant technological frontier. Expansion into emerging automotive markets within Southeast Asia and India also offers considerable growth avenues.

Leading Players in the APAC Automotive Actuator Industry Market

- Robert Bosch GmbH

- Nidec Corporation

- Hitachi Ltd.

- Johnson Electric

- Far Hydraulics

- Denso Corp

- CTS Corporation

- Hella KGaA Hueck & Co

- Magneti Marelli

- Mitsubishi Electric

Key Developments in APAC Automotive Actuator Industry Industry

- 2023/08: Nidec Corporation announces expansion of its electric motor production capacity in Vietnam to meet growing EV demand.

- 2023/05: Robert Bosch GmbH introduces a new generation of highly efficient electric brake actuators for passenger cars.

- 2023/02: Hitachi Ltd. collaborates with a major Chinese automaker to develop advanced actuator systems for new energy vehicles.

- 2022/11: Johnson Electric launches a new series of compact and powerful actuators for automotive interior applications.

- 2022/09: Denso Corp invests in a startup specializing in novel actuator control technologies for autonomous driving.

- 2022/06: Mitsubishi Electric unveils a new range of lightweight electric actuators for enhanced EV performance.

- 2021/12: Hella KGaA Hueck & Co. announces a significant increase in production of actuators for ADAS components.

- 2021/07: Magneti Marelli focuses on developing integrated actuator modules for next-generation vehicle architectures.

- 2020/10: Far Hydraulics expands its market reach in Southeast Asia with new distribution partnerships for hydraulic actuators.

- 2020/03: CTS Corporation showcases advanced sensor-integrated actuators for automotive applications.

Strategic Outlook for APAC Automotive Actuator Industry Market

The strategic outlook for the APAC automotive actuator industry is exceptionally positive, driven by the sustained global transition towards electrified and autonomous mobility. Key growth catalysts include the relentless expansion of the electric vehicle market, which directly translates into higher demand for sophisticated electric actuators. The increasing adoption of advanced driver-assistance systems (ADAS) and the ongoing pursuit of enhanced vehicle safety and comfort features will continue to fuel innovation and market penetration across all actuator segments. Manufacturers focusing on developing energy-efficient, compact, and intelligent actuator solutions, coupled with robust supply chain management and strategic partnerships, are best positioned for sustained success. The growing emphasis on sustainability and digitalization within the automotive sector will further shape product development and market opportunities, promising significant future growth and technological advancements.

APAC Automotive Actuator Industry Segmentation

-

1. Actuator Type

- 1.1. Hydraulic

- 1.2. Electric

- 1.3. Pneumatic

-

2. Application Type

- 2.1. Throttle

- 2.2. Seat Adjustment

- 2.3. Brake

- 2.4. Closure

- 2.5. Others

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial vehicles

APAC Automotive Actuator Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

APAC Automotive Actuator Industry Regional Market Share

Geographic Coverage of APAC Automotive Actuator Industry

APAC Automotive Actuator Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Safety Features in Vehicles

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with the System

- 3.4. Market Trends

- 3.4.1. Seat Adjustment to Witness Faster Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Automotive Actuator Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Actuator Type

- 5.1.1. Hydraulic

- 5.1.2. Electric

- 5.1.3. Pneumatic

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Throttle

- 5.2.2. Seat Adjustment

- 5.2.3. Brake

- 5.2.4. Closure

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Actuator Type

- 6. China APAC Automotive Actuator Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Actuator Type

- 6.1.1. Hydraulic

- 6.1.2. Electric

- 6.1.3. Pneumatic

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Throttle

- 6.2.2. Seat Adjustment

- 6.2.3. Brake

- 6.2.4. Closure

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial vehicles

- 6.1. Market Analysis, Insights and Forecast - by Actuator Type

- 7. India APAC Automotive Actuator Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Actuator Type

- 7.1.1. Hydraulic

- 7.1.2. Electric

- 7.1.3. Pneumatic

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Throttle

- 7.2.2. Seat Adjustment

- 7.2.3. Brake

- 7.2.4. Closure

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial vehicles

- 7.1. Market Analysis, Insights and Forecast - by Actuator Type

- 8. Japan APAC Automotive Actuator Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Actuator Type

- 8.1.1. Hydraulic

- 8.1.2. Electric

- 8.1.3. Pneumatic

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Throttle

- 8.2.2. Seat Adjustment

- 8.2.3. Brake

- 8.2.4. Closure

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial vehicles

- 8.1. Market Analysis, Insights and Forecast - by Actuator Type

- 9. South Korea APAC Automotive Actuator Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Actuator Type

- 9.1.1. Hydraulic

- 9.1.2. Electric

- 9.1.3. Pneumatic

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Throttle

- 9.2.2. Seat Adjustment

- 9.2.3. Brake

- 9.2.4. Closure

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial vehicles

- 9.1. Market Analysis, Insights and Forecast - by Actuator Type

- 10. Rest of Asia Pacific APAC Automotive Actuator Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Actuator Type

- 10.1.1. Hydraulic

- 10.1.2. Electric

- 10.1.3. Pneumatic

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Throttle

- 10.2.2. Seat Adjustment

- 10.2.3. Brake

- 10.2.4. Closure

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.3.1. Passenger Cars

- 10.3.2. Commercial vehicles

- 10.1. Market Analysis, Insights and Forecast - by Actuator Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Robert Bosch Gmbh

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nidec Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hitachi Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Johnson Electric

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Far Hydraulics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Denso Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CTS Corporatio

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hella KGaA Hueck & Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Magneti Marelli

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitsubishi Electric

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Robert Bosch Gmbh

List of Figures

- Figure 1: APAC Automotive Actuator Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: APAC Automotive Actuator Industry Share (%) by Company 2025

List of Tables

- Table 1: APAC Automotive Actuator Industry Revenue billion Forecast, by Actuator Type 2020 & 2033

- Table 2: APAC Automotive Actuator Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: APAC Automotive Actuator Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: APAC Automotive Actuator Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: APAC Automotive Actuator Industry Revenue billion Forecast, by Actuator Type 2020 & 2033

- Table 6: APAC Automotive Actuator Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 7: APAC Automotive Actuator Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: APAC Automotive Actuator Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: APAC Automotive Actuator Industry Revenue billion Forecast, by Actuator Type 2020 & 2033

- Table 10: APAC Automotive Actuator Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 11: APAC Automotive Actuator Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 12: APAC Automotive Actuator Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: APAC Automotive Actuator Industry Revenue billion Forecast, by Actuator Type 2020 & 2033

- Table 14: APAC Automotive Actuator Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 15: APAC Automotive Actuator Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 16: APAC Automotive Actuator Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: APAC Automotive Actuator Industry Revenue billion Forecast, by Actuator Type 2020 & 2033

- Table 18: APAC Automotive Actuator Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 19: APAC Automotive Actuator Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 20: APAC Automotive Actuator Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: APAC Automotive Actuator Industry Revenue billion Forecast, by Actuator Type 2020 & 2033

- Table 22: APAC Automotive Actuator Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 23: APAC Automotive Actuator Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 24: APAC Automotive Actuator Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Automotive Actuator Industry?

The projected CAGR is approximately 12.35%.

2. Which companies are prominent players in the APAC Automotive Actuator Industry?

Key companies in the market include Robert Bosch Gmbh, Nidec Corporation, Hitachi Ltd, Johnson Electric, Far Hydraulics, Denso Corp, CTS Corporatio, Hella KGaA Hueck & Co, Magneti Marelli, Mitsubishi Electric.

3. What are the main segments of the APAC Automotive Actuator Industry?

The market segments include Actuator Type, Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 36.74 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Safety Features in Vehicles.

6. What are the notable trends driving market growth?

Seat Adjustment to Witness Faster Growth.

7. Are there any restraints impacting market growth?

High Costs Associated with the System.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Automotive Actuator Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Automotive Actuator Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Automotive Actuator Industry?

To stay informed about further developments, trends, and reports in the APAC Automotive Actuator Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence