Key Insights

The European automotive display market is set for significant expansion, projected to achieve a market size of $11.56 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 16.93% through 2033. This robust growth is propelled by the increasing integration of advanced display technologies in vehicles, driven by consumer demand for superior in-car experiences and evolving automotive functionalities. Key growth catalysts include the rising adoption of sophisticated infotainment systems, advanced driver-assistance systems (ADAS), and the widespread trend towards digital cockpits. The automotive sector's premiumization, coupled with stringent safety regulations necessitating clearer and more intuitive information displays, further supports market expansion. Additionally, the surge in electric vehicle (EV) production, often featuring larger and more interactive displays for energy management and navigation, serves as a significant catalyst. The market shows a strong preference for LCD and OLED technologies due to their superior visual clarity, responsiveness, and energy efficiency, critical for both driver information and passenger entertainment.

Europe Automotive Display Industry Market Size (In Billion)

Market segmentation highlights distinct opportunities across various product types and sales channels. Center stack and instrument cluster displays are leading segments, reflecting their essential role in modern vehicle interfaces. The growing demand for augmented reality (AR) integrated heads-up displays (HUDs) is also a notable trend, enhancing driver safety and convenience. Both Original Equipment Manufacturer (OEM) and aftermarket sales channels are expected to contribute to market growth, with OEMs driving initial adoption in new vehicle models and the aftermarket supporting upgrades and retrofits. Geographically, Europe, with its strong automotive manufacturing base and high consumer spending on advanced vehicle features, is a critical market. Key countries including Germany, France, and the United Kingdom are at the forefront of adopting these technologies. However, market restraints include the high cost of advanced display technologies and complex integration challenges within vehicle architectures. Nevertheless, ongoing innovation in display materials, miniaturization, and cost-reduction strategies are expected to mitigate these challenges and sustain the market's upward trajectory.

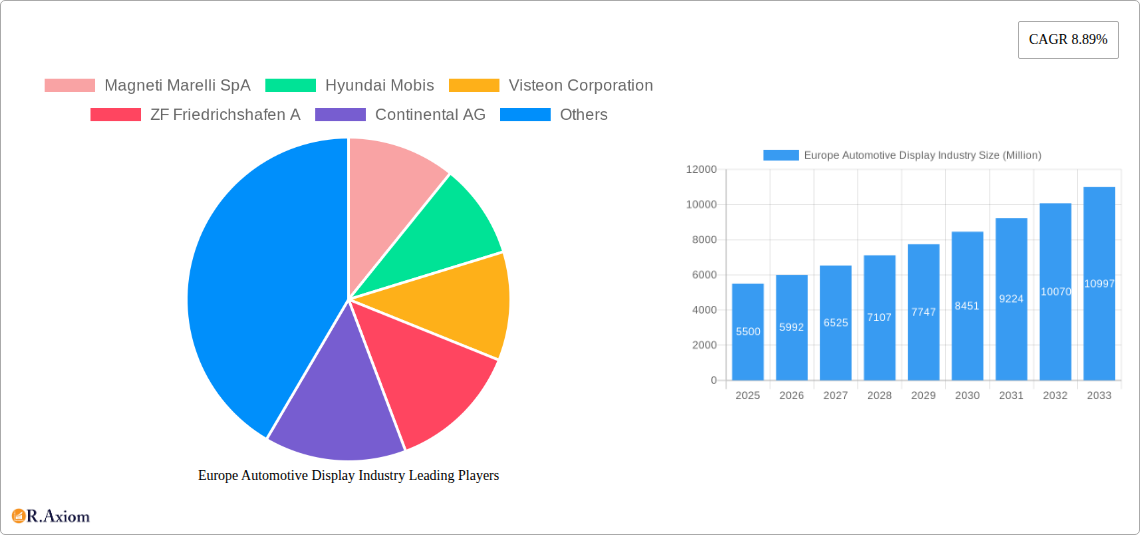

Europe Automotive Display Industry Company Market Share

Europe Automotive Display Industry Market Concentration & Innovation

The Europe automotive display industry is characterized by a moderate to high market concentration, with key players like Continental AG, Robert Bosch GmbH, DENSO Corporation, and LG Electronics holding significant market shares. These giants, alongside specialized firms such as Visteon Corporation, Magneti Marelli SpA, and Hyundai Mobis, drive innovation through substantial R&D investments. The estimated market size for automotive displays in Europe is expected to reach xx million Euros by 2025, with a projected CAGR of xx% throughout the forecast period. Innovation is primarily fueled by the increasing demand for advanced driver-assistance systems (ADAS), enhanced in-car infotainment, and personalized digital cockpits. Regulatory frameworks, particularly stringent EU emissions standards and safety mandates, are indirectly pushing the adoption of sophisticated display technologies that can integrate complex information and driver alerts. Product substitutes, while present in the form of older display technologies, are rapidly being phased out by advancements in LCD and OLED technologies. End-user trends clearly favor larger, higher-resolution displays with intuitive user interfaces and seamless connectivity. Mergers and acquisitions (M&A) activity remains robust, with MTA SpA and JDI Europe GmbH actively seeking strategic partnerships to expand their technological portfolios and market reach. Recent M&A deals in the broader automotive electronics sector, while not always directly display-focused, signal a consolidation trend, with an estimated total deal value of xx million Euros in the past three years.

Europe Automotive Display Industry Industry Trends & Insights

The European automotive display industry is poised for significant growth, driven by a confluence of technological advancements, evolving consumer expectations, and supportive regulatory environments. The overall market value for automotive displays in Europe is projected to grow from an estimated xx million Euros in 2024 to xx million Euros by 2033, exhibiting a compound annual growth rate (CAGR) of xx% over the forecast period. This robust expansion is underpinned by the accelerating adoption of digitalization within vehicles, transforming them into connected, intelligent mobility platforms.

Market Growth Drivers: A primary growth catalyst is the increasing integration of Center Stack Displays and Instrument Cluster Displays in virtually all vehicle segments, from Passenger Cars to Commercial Vehicles. Consumers increasingly expect sophisticated infotainment systems, navigation, and digital instrument clusters that offer a premium and intuitive user experience. The rise of electric vehicles (EVs) and autonomous driving technologies further amplifies this trend, necessitating larger, more immersive displays for critical information dissemination and advanced feature control. The demand for enhanced safety features, such as advanced driver-assistance systems (ADAS) and augmented reality (AR) overlays, is also a significant driver, pushing the adoption of technologies like Heads-up Displays (HUDs).

Technological Disruptions: The shift from traditional LCD technology towards more advanced OLED displays is a major disruptive trend. OLED offers superior contrast ratios, deeper blacks, faster response times, and the flexibility for curved or even transparent displays, enabling more innovative interior design and user interaction possibilities. Mini-LED technology is also emerging as a competitive alternative, offering enhanced brightness and contrast compared to standard LCDs. The integration of touch sensitivity, haptic feedback, and voice control further enriches the user experience, pushing the boundaries of human-machine interface (HMI) design.

Consumer Preferences: European consumers are increasingly prioritizing in-car technology that mirrors their digital lives outside the vehicle. This includes seamless smartphone integration (Apple CarPlay, Android Auto), personalized content streaming, and customizable digital cockpits. The desire for aesthetically pleasing and minimalist interior designs also favors integrated displays that can adapt their appearance and functionality. Furthermore, a growing awareness of safety concerns is driving demand for displays that present critical driving information clearly and unobtrusively, reducing driver distraction.

Competitive Dynamics: The competitive landscape is intense, with established Tier 1 automotive suppliers like Continental AG, Robert Bosch GmbH, DENSO Corporation, LG Electronics, Visteon Corporation, and Magneti Marelli SpA vying for dominance. These companies are investing heavily in R&D to secure patents and develop next-generation display solutions. Emerging players and technology providers are also entering the market, often through collaborations with OEMs. The focus is increasingly on integrated cockpit solutions, where multiple displays and functionalities are seamlessly combined. The OEM sales channel continues to be the primary revenue stream, accounting for an estimated xx% of the market in 2025, while the Aftermarket segment, though smaller, presents growing opportunities for upgrades and replacements. The market penetration of advanced display technologies is projected to reach xx% for OLED and xx% for HUDs by 2033 in new vehicle sales.

Dominant Markets & Segments in Europe Automotive Display Industry

The European automotive display industry exhibits strong dominance in specific regions and segments, driven by economic policies, robust automotive manufacturing bases, and evolving consumer demand.

Dominant Region: Within Europe, Germany stands out as the most dominant market for automotive displays. This is primarily due to its status as the home of several global automotive giants, including Volkswagen Group, BMW Group, and Mercedes-Benz Group. These OEMs are at the forefront of adopting advanced display technologies to differentiate their premium offerings and meet stringent safety and infotainment standards. The robust automotive supply chain in Germany, coupled with significant R&D investments by both OEMs and Tier 1 suppliers, further solidifies its leading position.

Dominant Vehicle Type: Passenger Cars constitute the largest and most dominant segment in terms of automotive display adoption and market value. The continuous push for enhanced in-car experiences, sophisticated infotainment systems, and advanced ADAS features in passenger vehicles drives the demand for a wide array of display technologies. This segment is characterized by rapid innovation cycles and a strong emphasis on user interface design and aesthetic integration.

Dominant Technology Type: While LCD technology currently holds a substantial market share due to its cost-effectiveness and established manufacturing base, OLED is rapidly emerging as a dominant force, particularly in premium and high-end vehicles. The superior visual quality, flexibility, and energy efficiency of OLED displays are making them increasingly attractive for next-generation automotive cockpits. Market analysts predict that OLED's market penetration will significantly increase over the forecast period, challenging LCD's long-standing dominance.

Dominant Product Type: The Center Stack Display is unequivocally the dominant product type within the European automotive display market. This central hub for infotainment, navigation, climate control, and vehicle settings is crucial for the modern driving experience. The increasing screen sizes, higher resolutions, and enhanced touch functionalities of center stack displays are key selling points for consumers. Following closely is the Instrument Cluster Display, which is increasingly transitioning from traditional analog gauges to fully digital and customizable interfaces, offering drivers critical information in a more dynamic and visually appealing manner. Heads-up Displays (HUDs) are also experiencing significant growth, driven by their ability to project essential information directly into the driver's line of sight, enhancing safety and reducing the need to divert attention from the road.

Dominant Sales Type: The OEM (Original Equipment Manufacturer) sales channel is overwhelmingly dominant in the European automotive display industry. This is attributed to the fact that display systems are typically integrated into vehicles during the manufacturing process. OEMs work closely with Tier 1 suppliers to specify and procure these components, ensuring seamless integration and adherence to vehicle design and performance standards. While the Aftermarket segment exists, it primarily caters to older vehicles or specific upgrade opportunities, representing a smaller portion of the overall market value.

Key drivers contributing to the dominance of these segments include:

- Technological Advancement: Continuous innovation in display technologies like OLED and Mini-LED.

- Consumer Demand: Growing preference for connected car features, personalized infotainment, and advanced safety systems.

- Regulatory Mandates: EU regulations emphasizing driver safety and efficient vehicle operation indirectly promote advanced display integration.

- Premiumization Strategy: OEMs leveraging advanced displays as a key differentiator for their premium vehicle models.

- Investment in R&D: Substantial investments by major automotive players and technology providers in developing cutting-edge display solutions.

Europe Automotive Display Industry Product Developments

Product innovation in the Europe automotive display industry is rapidly evolving to meet the demand for immersive and intelligent in-car experiences. Key developments include the increasing integration of larger, higher-resolution OLED and Mini-LED displays that offer superior contrast, wider color gamuts, and faster response times. Curved and flexible display technologies are enabling more ergonomic and aesthetically pleasing dashboard designs, seamlessly integrating into the vehicle's interior architecture. Furthermore, advancements in touch sensitivity, haptic feedback, and voice recognition are enhancing user interaction, creating more intuitive and safer human-machine interfaces. The integration of augmented reality (AR) overlays onto Heads-up Displays (HUDs) is a significant trend, projecting navigation, safety alerts, and other critical information directly onto the windshield, directly in the driver's line of sight. These product developments provide competitive advantages by enhancing safety, improving user experience, and contributing to the overall premiumization of vehicles.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Europe Automotive Display Industry, segmented across several key dimensions. The study period spans from 2019 to 2033, with a base year of 2025 and an estimated year also of 2025, followed by a forecast period from 2025 to 2033. The historical period covered is 2019–2024.

Vehicle Type: The market is segmented into Passenger Cars and Commercial Vehicles. Passenger Cars are expected to dominate due to higher production volumes and a greater emphasis on in-car technology for consumer appeal. Commercial Vehicles, while smaller in volume, present growing opportunities with the integration of advanced displays for fleet management and driver safety.

Technology Type: The analysis includes LCD and OLED technologies. LCD technology, while mature, continues to evolve with Mini-LED advancements. OLED technology is projected for rapid growth, particularly in premium segments, offering superior visual performance and design flexibility.

Product Type: Segmentation covers Center Stack Displays, Instrument Cluster Displays, Heads-up Displays (HUDs), and Other Product Types (e.g., rear-seat entertainment displays, mirror displays). Center Stack Displays currently lead in market share, followed closely by Instrument Cluster Displays. HUDs are experiencing significant growth, driven by safety advancements.

Sales Type: The market is divided into OEM and Aftermarket sales. The OEM segment is the primary driver of revenue, with displays being a critical integrated component of new vehicles. The Aftermarket segment offers opportunities for upgrades and replacements.

Key Drivers of Europe Automotive Display Industry Growth

The Europe automotive display industry's growth is propelled by several interconnected factors. The increasing demand for advanced infotainment systems and seamless connectivity, mirroring consumer expectations from personal electronic devices, is a primary driver. The proliferation of electric vehicles (EVs) and the development of autonomous driving technologies necessitate more sophisticated and informative displays to manage complex vehicle functions and safety features. Stricter automotive safety regulations across Europe, mandating features like advanced driver-assistance systems (ADAS), directly fuel the adoption of integrated displays and HUDs. Furthermore, OEMs are increasingly using advanced display technology as a key differentiator for their premium vehicle segments, driving innovation and market penetration. The ongoing technological advancements in display technologies, such as improved resolution, flexibility, and energy efficiency of OLED and Mini-LED panels, also significantly contribute to market expansion.

Challenges in the Europe Automotive Display Industry Sector

Despite robust growth prospects, the Europe automotive display industry faces several challenges. High development costs and the rapid pace of technological obsolescence require continuous and substantial R&D investment, posing a barrier for smaller players. The complex and fragmented automotive supply chain, particularly with the ongoing global chip shortages, can lead to production delays and increased component costs. Evolving regulatory landscapes, while often driving innovation, can also introduce compliance hurdles and lead to unexpected design modifications. Intense competition among established Tier 1 suppliers and emerging technology providers creates price pressures and demands constant innovation to maintain market share. Furthermore, the integration of complex software and hardware, coupled with cybersecurity concerns, presents significant integration and development challenges.

Emerging Opportunities in Europe Automotive Display Industry

The Europe automotive display industry is ripe with emerging opportunities. The continued expansion of connected car services and in-car entertainment platforms creates demand for larger, more interactive, and personalized displays. The burgeoning market for electric vehicles (EVs) presents a unique opportunity, as their advanced nature often dictates the integration of cutting-edge display technologies for battery management, charging information, and unique interface designs. The increasing adoption of advanced driver-assistance systems (ADAS) and the eventual rise of autonomous driving will drive demand for sophisticated HUDs, multi-display cockpits, and potentially transparent displays that seamlessly integrate information into the driving environment. Furthermore, the development of sustainable and eco-friendly display materials and manufacturing processes aligns with Europe's strong focus on environmental regulations and consumer demand for greener products.

Leading Players in the Europe Automotive Display Industry Market

- Magneti Marelli SpA

- Hyundai Mobis

- Visteon Corporation

- ZF Friedrichshafen AG

- Continental AG

- Robert Bosch GmbH

- MTA SpA

- JDI Europe GmbH

- DENSO Corporation

- LG Electronics

Key Developments in Europe Automotive Display Industry Industry

- 2023: Continental AG announced significant advancements in its transparent OLED display technology, aiming for production in the coming years.

- 2023: Visteon Corporation showcased its latest generation of digital cockpit platforms, integrating multiple displays with advanced AI capabilities.

- 2023: LG Electronics continued to expand its portfolio of automotive OLED panels, focusing on larger sizes and enhanced durability for automotive applications.

- 2024 (Q1): Bosch and Nvidia strengthened their partnership, focusing on AI-powered software for next-generation automotive displays and computing platforms.

- 2024 (Q2): Hyundai Mobis unveiled new flexible display concepts for curved dashboards and advanced HUD systems.

- 2024 (Q3): JDI Europe GmbH announced increased investment in research and development for high-resolution and energy-efficient automotive display solutions.

Strategic Outlook for Europe Automotive Display Industry Market

The strategic outlook for the Europe automotive display industry is exceptionally bright, fueled by the relentless pursuit of digitalization and enhanced user experiences within vehicles. The ongoing shift towards advanced driver-assistance systems (ADAS) and autonomous driving will create significant demand for sophisticated display solutions, including heads-up displays (HUDs) and integrated cockpit systems. The continued evolution of OLED and other next-generation display technologies promises to deliver unprecedented visual fidelity and design flexibility, enabling OEMs to create more immersive and personalized in-car environments. Furthermore, the increasing electrification of the automotive sector provides a fertile ground for innovation, as EVs often lead in adopting cutting-edge technologies. Strategic collaborations between display manufacturers, semiconductor suppliers, and automotive OEMs will be crucial for navigating complex technological challenges and capitalizing on emerging market trends.

Europe Automotive Display Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Technology Type

- 2.1. LCD

- 2.2. OLED

-

3. Product Type

- 3.1. Center Stack Display

- 3.2. Instrument Cluster Display

- 3.3. Heads-up Display

- 3.4. Other Product Types

-

4. Sales Type

- 4.1. OEM

- 4.2. Aftermarket

Europe Automotive Display Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Automotive Display Industry Regional Market Share

Geographic Coverage of Europe Automotive Display Industry

Europe Automotive Display Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Sales of Passenger Cars

- 3.3. Market Restrains

- 3.3.1. Failure in Garage Equipment may Result in Downtime of the Repair Work

- 3.4. Market Trends

- 3.4.1. Autonomous and Electric Vehicles Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Display Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. LCD

- 5.2.2. OLED

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Center Stack Display

- 5.3.2. Instrument Cluster Display

- 5.3.3. Heads-up Display

- 5.3.4. Other Product Types

- 5.4. Market Analysis, Insights and Forecast - by Sales Type

- 5.4.1. OEM

- 5.4.2. Aftermarket

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Magneti Marelli SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hyundai Mobis

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Visteon Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ZF Friedrichshafen A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Continental AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Robert Bosch GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MTA SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 JDI Europe GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DENSO Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Magneti Marelli SpA

List of Figures

- Figure 1: Europe Automotive Display Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Display Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Display Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe Automotive Display Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 3: Europe Automotive Display Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: Europe Automotive Display Industry Revenue billion Forecast, by Sales Type 2020 & 2033

- Table 5: Europe Automotive Display Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Automotive Display Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: Europe Automotive Display Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 8: Europe Automotive Display Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 9: Europe Automotive Display Industry Revenue billion Forecast, by Sales Type 2020 & 2033

- Table 10: Europe Automotive Display Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: France Europe Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Automotive Display Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Display Industry?

The projected CAGR is approximately 16.93%.

2. Which companies are prominent players in the Europe Automotive Display Industry?

Key companies in the market include Magneti Marelli SpA, Hyundai Mobis, Visteon Corporation, ZF Friedrichshafen A, Continental AG, Robert Bosch GmbH, MTA SpA, JDI Europe GmbH, DENSO Corporation, LG Electronics.

3. What are the main segments of the Europe Automotive Display Industry?

The market segments include Vehicle Type, Technology Type, Product Type, Sales Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Sales of Passenger Cars.

6. What are the notable trends driving market growth?

Autonomous and Electric Vehicles Driving the Market.

7. Are there any restraints impacting market growth?

Failure in Garage Equipment may Result in Downtime of the Repair Work.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Display Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Display Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Display Industry?

To stay informed about further developments, trends, and reports in the Europe Automotive Display Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence