Key Insights

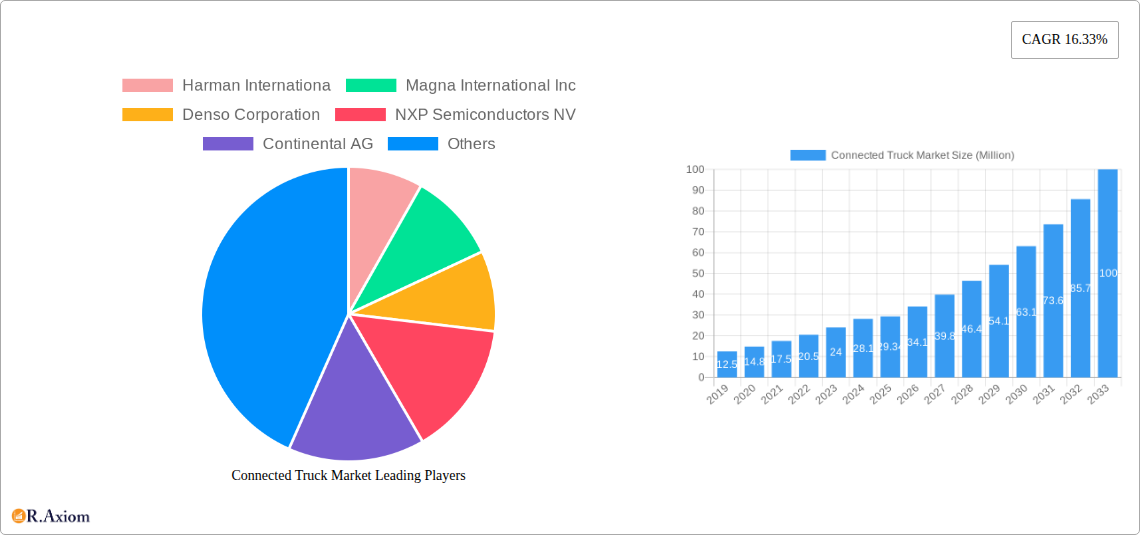

The Connected Truck Market is poised for significant expansion, projected to reach $29.34 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 16.33% anticipated to persist through 2033. This robust growth is primarily fueled by the increasing adoption of advanced safety features, the burgeoning demand for enhanced fleet efficiency through telematics, and the imperative to comply with evolving regulatory mandates for vehicle safety and emissions. Key drivers include the widespread implementation of Blind Spot Warning (BSW), Forward Collision Warning (FCW), and Lane Departure Warning (LDW) systems, all of which contribute to reducing accidents and operational costs. The market's segmentation reveals a strong emphasis on both Light and Heavy Commercial Vehicles, reflecting the broad applicability of connected technologies across the logistics sector. Furthermore, the evolution from Dedicated Short-range Communication (DSRC) to more advanced Long Range communication, particularly through Telematics Control Units (TCUs), signifies a shift towards comprehensive, data-driven fleet management.

Connected Truck Market Market Size (In Million)

The technological landscape is characterized by the increasing integration of Vehicle-to-Vehicle (V2V), Vehicle-to-Cloud (V2C), and Vehicle-to-Infrastructure (V2I) communication. This interconnectedness allows for real-time data exchange, enabling predictive maintenance, optimized routing, and improved driver behavior monitoring, thereby driving operational efficiencies and sustainability. Key players like Continental AG, Robert Bosch GmbH, and Denso Corporation are at the forefront of innovation, investing heavily in R&D to develop sophisticated connected solutions. While the market presents a lucrative opportunity, potential restraints such as cybersecurity concerns, high initial implementation costs, and the need for standardized communication protocols may present challenges. However, the overwhelming benefits in terms of safety, efficiency, and regulatory compliance are expected to outweigh these hurdles, solidifying the upward trajectory of the connected truck market.

Connected Truck Market Company Market Share

Here's the SEO-optimized, detailed report description for the Connected Truck Market, incorporating high-traffic keywords and adhering to your specified structure and content requirements:

Connected Truck Market Market Concentration & Innovation

The global connected truck market exhibits a dynamic blend of concentrated leadership and robust innovation, driven by an intensifying focus on fleet efficiency, safety, and sustainability. Key players like Harman International, Magna International Inc., Denso Corporation, NXP Semiconductors NV, Continental AG, Mercedes-Benz Group AG, Robert Bosch GmbH, Aptiv Global Operations Limited, Sierra Wireless, AB Volvo, and ZF Friedrichshafen AG are continuously investing in research and development to enhance telematics, advanced driver-assistance systems (ADAS), and vehicle-to-everything (V2X) communication technologies. Regulatory frameworks, such as mandates for vehicle safety features and emissions standards, are significant innovation drivers, pushing for the adoption of advanced connectivity solutions. While direct product substitutes for core connected truck functionalities are limited, integrated software platforms and data analytics services are emerging as competitive differentiators. End-user trends are strongly leaning towards operational cost reduction, improved logistics, and enhanced driver safety, fueling demand for sophisticated connected truck solutions. Mergers and acquisitions (M&A) activity remains a key strategy for market consolidation and technology integration, with notable M&A deal values contributing to market restructuring. The market share distribution reveals a competitive landscape where innovation and strategic partnerships are crucial for sustained growth.

Connected Truck Market Industry Trends & Insights

The connected truck market is experiencing unprecedented growth, propelled by a confluence of technological advancements, evolving industry demands, and a strategic shift towards data-driven logistics and enhanced road safety. This comprehensive market analysis delves into the core trends shaping the industry from 2019 to 2033, with a specific focus on the base year of 2025 and a detailed forecast period from 2025 to 2033. The historical period of 2019-2024 provides crucial context for understanding the market's trajectory.

Market Growth Drivers: A primary catalyst is the escalating need for optimized fleet management, driven by the pursuit of reduced operational costs and improved fuel efficiency. The integration of advanced telematics systems allows for real-time monitoring of vehicle performance, driver behavior, and asset utilization, leading to significant cost savings. Furthermore, the burgeoning e-commerce sector and the resulting surge in freight volumes necessitate more efficient and reliable logistics solutions, directly boosting demand for connected trucks. The increasing regulatory pressure concerning driver safety and environmental impact also plays a pivotal role. Governments worldwide are implementing stricter regulations for vehicle safety features and emissions, compelling manufacturers and fleet operators to adopt connected technologies that offer enhanced safety functionalities like Blind Spot Warning (BSW), Forward Collision Warning (FCW), and Lane Departure Warning (LDW), along with advanced Emergency Brake Assist (EBA).

Technological Disruptions: The rapid evolution of communication technologies, including the expansion of 5G networks, is a significant disruptor, enabling higher bandwidth and lower latency for real-time data exchange. This facilitates more sophisticated Vehicle-to-Vehicle (V2V), Vehicle-to-Cloud (V2C), and Vehicle-to-Infrastructure (V2I) communications, paving the way for autonomous driving capabilities and intelligent traffic management systems. Innovations in artificial intelligence (AI) and machine learning (ML) are transforming data analytics, enabling predictive maintenance, route optimization, and personalized driver coaching. The development of robust cybersecurity solutions is also paramount, ensuring the integrity and security of the vast amounts of data generated by connected trucks.

Consumer Preferences: Fleet managers and trucking companies are increasingly prioritizing solutions that offer a tangible return on investment (ROI), focusing on operational efficiency, reduced downtime, and enhanced driver well-being. The demand for integrated platforms that provide a holistic view of fleet operations, from diagnostics and maintenance scheduling to driver performance and route planning, is on the rise. There's also a growing preference for sustainable transportation solutions, which indirectly fuels the adoption of connected trucks that can optimize energy consumption and facilitate the integration of electric and alternative fuel vehicles.

Competitive Dynamics: The connected truck market is characterized by intense competition among established automotive manufacturers, technology providers, and specialized telematics companies. Strategic collaborations, partnerships, and acquisitions are prevalent as companies seek to expand their technology portfolios and market reach. Companies are differentiating themselves through advanced software capabilities, user-friendly interfaces, comprehensive data analytics, and robust support services. The market penetration of connected truck solutions is steadily increasing, indicating a broad adoption trend across various fleet sizes and operational segments. The projected Compound Annual Growth Rate (CAGR) for the connected truck market is robust, reflecting the sustained demand for these advanced technological solutions.

Dominant Markets & Segments in Connected Truck Market

The global connected truck market is characterized by a multifaceted landscape of dominant regions, countries, and specific segments, each contributing to the overall growth and shaping the industry's future trajectory. Understanding these dominant forces is crucial for strategic planning and investment within this rapidly evolving sector. The market is segmented based on Vehicle Type, including Light Commercial Vehicles and Heavy Commercial Vehicles; Range, encompassing Dedicated Short-range Communication (DSRC) (with sub-applications like Blind Spot Warning (BSW), Forward Collision Warning (FCW), Lane Departure Warning (LDW), Emergency Brake Assist (EBA), and Other Short Ranges) and Long Range (Telematics Control Unit); and Communication Type, featuring Vehicle-to-Vehicle (V2V), Vehicle-to-Cloud (V2C), and Vehicle-to-Infrastructure (V2I).

Dominant Regions and Countries: North America, particularly the United States and Canada, currently leads the connected truck market. This dominance is underpinned by several key factors:

- Economic Policies: Favorable government policies and initiatives promoting fleet modernization and efficiency, alongside substantial investments in logistics and infrastructure, create a fertile ground for connected truck adoption.

- Infrastructure: The well-developed road network and advanced digital infrastructure provide a robust foundation for V2X communication and data transmission.

- Technological Adoption: A high propensity for adopting cutting-edge technologies in the commercial trucking sector, driven by the pursuit of operational cost reductions and competitive advantage.

- Regulatory Environment: Stringent safety regulations and a proactive approach to implementing advanced driver-assistance systems (ADAS) mandated by regulatory bodies accelerate the integration of connected safety features.

Europe is another significant market, driven by strong environmental regulations, a mature automotive industry, and a growing emphasis on sustainable logistics. Countries like Germany, France, and the UK are at the forefront of connected truck deployment, fueled by advancements in V2X technology and the push towards smart city initiatives. The Asia-Pacific region is emerging as a rapidly growing market, propelled by increasing investments in infrastructure, the expansion of the logistics sector due to e-commerce growth, and the rising adoption of digital technologies in emerging economies like China and India.

Dominant Segments:

Vehicle Type:

- Heavy Commercial Vehicles (HCVs): This segment holds a significant market share due to the substantial operational costs associated with long-haul trucking and the immediate benefits derived from telematics for route optimization, fuel management, and driver performance monitoring. The larger scale of operations in HCV fleets translates to a higher return on investment for connected technologies.

- Light Commercial Vehicles (LCVs): While smaller in individual vehicle value, the sheer volume of LCVs in last-mile delivery and urban logistics is creating a substantial and growing market for connected solutions focused on efficiency and real-time tracking.

Range:

- Long Range (Telematics Control Unit - TCU): TCUs are foundational to the connected truck ecosystem, enabling comprehensive data collection and transmission for fleet management, diagnostics, and remote services. Their widespread adoption across various truck types makes this segment a dominant force.

- Dedicated Short-range Communication (DSRC): Within DSRC, safety-critical applications such as Forward Collision Warning (FCW) and Lane Departure Warning (LDW) are experiencing strong growth. The increasing emphasis on preventing accidents and improving road safety directly fuels the demand for these features. Blind Spot Warning (BSW) and Emergency Brake Assist (EBA) are also crucial safety components witnessing significant adoption. The development and deployment of V2X infrastructure are key enablers for the full potential of DSRC applications.

Communication Type:

- Vehicle-to-Cloud (V2C): V2C communication is the most prevalent currently, as it enables remote diagnostics, over-the-air updates, fleet management, and the transmission of operational data to cloud-based platforms for analysis and optimization. This form of connectivity is essential for nearly all connected truck applications.

- Vehicle-to-Vehicle (V2V): V2V communication is gaining traction, particularly for enhancing cooperative safety systems like platooning and collision avoidance. As regulatory support and technological maturity increase, V2V is poised for significant growth.

- Vehicle-to-Infrastructure (V2I): V2I communication, which allows trucks to interact with traffic signals, road signs, and other infrastructure elements, is crucial for intelligent transportation systems (ITS) and traffic flow management. Its growth is closely tied to the development of smart city initiatives and dedicated V2I infrastructure deployment.

The interplay between these segments and dominant regions creates a complex but opportunity-rich market. Continued investment in infrastructure, technological innovation, and supportive regulatory frameworks will be critical for sustained growth across all segments of the connected truck market.

Connected Truck Market Product Developments

The connected truck market is witnessing a surge in product innovations focused on enhancing fleet efficiency, safety, and sustainability. Companies are developing advanced telematics units that offer near real-time data on vehicle health, fuel consumption, and driver behavior. Innovations in Vehicle-to-Infrastructure (V2I) and Vehicle-to-Vehicle (V2X) communication are enabling features like cooperative adaptive cruise control and platooning, significantly improving fuel efficiency and road safety. Over-the-air (OTA) software updates are becoming standard, allowing for continuous improvement of vehicle systems without physical intervention. The integration of AI and machine learning is powering predictive maintenance, reducing downtime and operational costs for fleets. These advancements provide a competitive edge by offering actionable insights and automated management capabilities to truck operators.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global connected truck market, segmented across key verticals to offer granular insights. The Vehicle Type segmentation includes Light Commercial Vehicles and Heavy Commercial Vehicles, each with unique adoption patterns and technological requirements. The Range segmentation delves into Dedicated Short-range Communication (DSRC), examining applications such as Blind Spot Warning (BSW), Forward Collision Warning (FCW), Lane Departure Warning (LDW), and Emergency Brake Assist (EBA), alongside Other Short Ranges. It also covers Long Range (Telematics Control Unit) functionalities. The Communication Type segmentation analyzes Vehicle-to-Vehicle (V2V), Vehicle-to-Cloud (V2C), and Vehicle-to-Infrastructure (V2I). Projected growth rates for each segment are detailed, alongside current market sizes and an assessment of competitive dynamics.

Key Drivers of Connected Truck Market Growth

Several pivotal factors are propelling the expansion of the connected truck market. The relentless pursuit of operational efficiency and cost reduction by fleet operators is a primary driver, with telematics and data analytics offering significant fuel savings and optimized route planning. Increasing regulatory mandates for enhanced vehicle safety, such as the implementation of advanced driver-assistance systems (ADAS), are compelling the adoption of connected technologies. The burgeoning e-commerce sector and the resultant surge in freight volumes necessitate more sophisticated logistics and real-time tracking capabilities. Furthermore, advancements in communication technologies, including the rollout of 5G networks, enable more robust and real-time data exchange, facilitating advanced V2X communications and the development of autonomous driving features. The growing awareness and demand for sustainable transportation solutions also indirectly encourage the adoption of connected trucks that can optimize energy usage.

Challenges in the Connected Truck Market Sector

Despite its robust growth, the connected truck market faces several significant challenges. The high initial investment cost for sophisticated connectivity hardware and software can be a barrier for smaller fleet operators. Ensuring robust cybersecurity for connected trucks is paramount, as vulnerabilities could lead to data breaches or disruption of operations, necessitating continuous investment in security solutions. The fragmentation of industry standards and protocols can hinder interoperability between different systems and manufacturers, complicating integration efforts. Furthermore, the availability of skilled personnel to manage and interpret the vast amounts of data generated by connected trucks remains a challenge for many organizations. The complex regulatory landscape across different regions for data privacy and V2X deployment can also create hurdles for widespread adoption.

Emerging Opportunities in Connected Truck Market

The connected truck market presents a wealth of emerging opportunities. The advancement and widespread adoption of autonomous trucking technologies, heavily reliant on sophisticated connectivity, represent a significant future growth area. The expansion of Vehicle-to-Infrastructure (V2I) communication offers opportunities for integrating trucks into smart city ecosystems, optimizing traffic flow and reducing congestion. The increasing demand for real-time, actionable insights from fleet data is driving innovation in advanced analytics platforms and AI-powered decision-making tools. The growing emphasis on sustainability and electrification in the transportation sector creates opportunities for connected trucks to optimize charging logistics for electric trucks and monitor battery performance. Furthermore, the development of new business models around data monetization and value-added services for fleet operators presents lucrative avenues for growth.

Leading Players in the Connected Truck Market Market

- Harman International

- Magna International Inc.

- Denso Corporation

- NXP Semiconductors NV

- Continental AG

- Mercedes-Benz Group AG

- Robert Bosch GmbH

- Aptiv Global Operations Limited

- Sierra Wireless

- AB Volvo

- ZF Friedrichshafen AG

Key Developments in Connected Truck Market Industry

- Oct 2023: Volvo Trucks North America announced a new comprehensive fleet management portal, Volvo Connect, to access Volvo Trucks’ digital services, providing fleets with near real-time data on the health and performance of trucks in operation. The new portal offers analytics and reports that deliver fleets a range of truck data, including fuel consumption, idle time, vehicle speed, seat belt information, and location information.

- Jun 2023: Swedish electric self-driving truck company Einride partnered with Scandinavia's leading postal service, PostNord, to reduce CO2 emissions in Norway by 2,100 tonnes over the coming three years. Six trucks were deployed in the Oslo region in June 2022, but the goal is to reach 35 electric-connected trucks by June 2024.

Strategic Outlook for Connected Truck Market Market

The strategic outlook for the connected truck market is exceptionally positive, fueled by a clear demand for enhanced efficiency, safety, and sustainability in the logistics sector. Key growth catalysts include the continued integration of advanced telematics and V2X communication technologies, enabling greater vehicle autonomy and intelligent transportation systems. The increasing adoption of cloud-based platforms for comprehensive fleet management and data analytics will further drive market expansion. Strategic partnerships between technology providers, automotive manufacturers, and fleet operators are expected to accelerate innovation and market penetration. The growing emphasis on reducing carbon footprints and complying with stringent environmental regulations will also steer the market towards connected solutions that optimize fuel consumption and facilitate the integration of electric and alternative fuel vehicles, promising sustained growth and significant future potential.

Connected Truck Market Segmentation

-

1. Vehicle Type

- 1.1. Light Commercial Vehicles

- 1.2. Heavy Commercial Vehicles

-

2. Range

-

2.1. Dedicated Short-range Communication (DSRC)

- 2.1.1. Blind Spot Warning (BSW)

- 2.1.2. Forward Collision Warning (FCW)

- 2.1.3. Lane Departure Warning (LDW)

- 2.1.4. Emergency Brake Assist (EBA)

- 2.1.5. Other Short Ranges

- 2.2. Long Range (Telematics Control Unit)

-

2.1. Dedicated Short-range Communication (DSRC)

-

3. Communication Type

- 3.1. Vehicle-to-Vehicle (V2V)

- 3.2. Vehicle-to-Cloud (V2C)

- 3.3. Vehicle-to-Infrastructure (V2I)

Connected Truck Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Connected Truck Market Regional Market Share

Geographic Coverage of Connected Truck Market

Connected Truck Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Norms Mandating the Integration of Connected Technologies in Commercial Vehicles are Driving the Growth; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Lack of IT Enabled Infrastructure in Emerging Economies Restricts the Connected Truck Market Growth; Cyber Security Threats Remain a Concern for the Market

- 3.4. Market Trends

- 3.4.1. Increasing Use of Telematics in the Commercial Vehicle Market to Drive the Connected Truck Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Connected Truck Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Light Commercial Vehicles

- 5.1.2. Heavy Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Range

- 5.2.1. Dedicated Short-range Communication (DSRC)

- 5.2.1.1. Blind Spot Warning (BSW)

- 5.2.1.2. Forward Collision Warning (FCW)

- 5.2.1.3. Lane Departure Warning (LDW)

- 5.2.1.4. Emergency Brake Assist (EBA)

- 5.2.1.5. Other Short Ranges

- 5.2.2. Long Range (Telematics Control Unit)

- 5.2.1. Dedicated Short-range Communication (DSRC)

- 5.3. Market Analysis, Insights and Forecast - by Communication Type

- 5.3.1. Vehicle-to-Vehicle (V2V)

- 5.3.2. Vehicle-to-Cloud (V2C)

- 5.3.3. Vehicle-to-Infrastructure (V2I)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Connected Truck Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Light Commercial Vehicles

- 6.1.2. Heavy Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Range

- 6.2.1. Dedicated Short-range Communication (DSRC)

- 6.2.1.1. Blind Spot Warning (BSW)

- 6.2.1.2. Forward Collision Warning (FCW)

- 6.2.1.3. Lane Departure Warning (LDW)

- 6.2.1.4. Emergency Brake Assist (EBA)

- 6.2.1.5. Other Short Ranges

- 6.2.2. Long Range (Telematics Control Unit)

- 6.2.1. Dedicated Short-range Communication (DSRC)

- 6.3. Market Analysis, Insights and Forecast - by Communication Type

- 6.3.1. Vehicle-to-Vehicle (V2V)

- 6.3.2. Vehicle-to-Cloud (V2C)

- 6.3.3. Vehicle-to-Infrastructure (V2I)

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Connected Truck Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Light Commercial Vehicles

- 7.1.2. Heavy Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Range

- 7.2.1. Dedicated Short-range Communication (DSRC)

- 7.2.1.1. Blind Spot Warning (BSW)

- 7.2.1.2. Forward Collision Warning (FCW)

- 7.2.1.3. Lane Departure Warning (LDW)

- 7.2.1.4. Emergency Brake Assist (EBA)

- 7.2.1.5. Other Short Ranges

- 7.2.2. Long Range (Telematics Control Unit)

- 7.2.1. Dedicated Short-range Communication (DSRC)

- 7.3. Market Analysis, Insights and Forecast - by Communication Type

- 7.3.1. Vehicle-to-Vehicle (V2V)

- 7.3.2. Vehicle-to-Cloud (V2C)

- 7.3.3. Vehicle-to-Infrastructure (V2I)

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Connected Truck Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Light Commercial Vehicles

- 8.1.2. Heavy Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Range

- 8.2.1. Dedicated Short-range Communication (DSRC)

- 8.2.1.1. Blind Spot Warning (BSW)

- 8.2.1.2. Forward Collision Warning (FCW)

- 8.2.1.3. Lane Departure Warning (LDW)

- 8.2.1.4. Emergency Brake Assist (EBA)

- 8.2.1.5. Other Short Ranges

- 8.2.2. Long Range (Telematics Control Unit)

- 8.2.1. Dedicated Short-range Communication (DSRC)

- 8.3. Market Analysis, Insights and Forecast - by Communication Type

- 8.3.1. Vehicle-to-Vehicle (V2V)

- 8.3.2. Vehicle-to-Cloud (V2C)

- 8.3.3. Vehicle-to-Infrastructure (V2I)

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Connected Truck Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Light Commercial Vehicles

- 9.1.2. Heavy Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Range

- 9.2.1. Dedicated Short-range Communication (DSRC)

- 9.2.1.1. Blind Spot Warning (BSW)

- 9.2.1.2. Forward Collision Warning (FCW)

- 9.2.1.3. Lane Departure Warning (LDW)

- 9.2.1.4. Emergency Brake Assist (EBA)

- 9.2.1.5. Other Short Ranges

- 9.2.2. Long Range (Telematics Control Unit)

- 9.2.1. Dedicated Short-range Communication (DSRC)

- 9.3. Market Analysis, Insights and Forecast - by Communication Type

- 9.3.1. Vehicle-to-Vehicle (V2V)

- 9.3.2. Vehicle-to-Cloud (V2C)

- 9.3.3. Vehicle-to-Infrastructure (V2I)

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Harman Internationa

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Magna International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Denso Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 NXP Semiconductors NV

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Continental AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mercedes-Benz Group AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Robert Bosch GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Aptiv Global Operations Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sierra Wireless

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AB Volvo

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 ZF Friedrichshafen AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Harman Internationa

List of Figures

- Figure 1: Global Connected Truck Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Connected Truck Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Connected Truck Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Connected Truck Market Revenue (Million), by Range 2025 & 2033

- Figure 5: North America Connected Truck Market Revenue Share (%), by Range 2025 & 2033

- Figure 6: North America Connected Truck Market Revenue (Million), by Communication Type 2025 & 2033

- Figure 7: North America Connected Truck Market Revenue Share (%), by Communication Type 2025 & 2033

- Figure 8: North America Connected Truck Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Connected Truck Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Connected Truck Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Connected Truck Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Connected Truck Market Revenue (Million), by Range 2025 & 2033

- Figure 13: Europe Connected Truck Market Revenue Share (%), by Range 2025 & 2033

- Figure 14: Europe Connected Truck Market Revenue (Million), by Communication Type 2025 & 2033

- Figure 15: Europe Connected Truck Market Revenue Share (%), by Communication Type 2025 & 2033

- Figure 16: Europe Connected Truck Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Connected Truck Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Connected Truck Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Connected Truck Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Connected Truck Market Revenue (Million), by Range 2025 & 2033

- Figure 21: Asia Pacific Connected Truck Market Revenue Share (%), by Range 2025 & 2033

- Figure 22: Asia Pacific Connected Truck Market Revenue (Million), by Communication Type 2025 & 2033

- Figure 23: Asia Pacific Connected Truck Market Revenue Share (%), by Communication Type 2025 & 2033

- Figure 24: Asia Pacific Connected Truck Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Connected Truck Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Connected Truck Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Rest of the World Connected Truck Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Rest of the World Connected Truck Market Revenue (Million), by Range 2025 & 2033

- Figure 29: Rest of the World Connected Truck Market Revenue Share (%), by Range 2025 & 2033

- Figure 30: Rest of the World Connected Truck Market Revenue (Million), by Communication Type 2025 & 2033

- Figure 31: Rest of the World Connected Truck Market Revenue Share (%), by Communication Type 2025 & 2033

- Figure 32: Rest of the World Connected Truck Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Connected Truck Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Connected Truck Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Connected Truck Market Revenue Million Forecast, by Range 2020 & 2033

- Table 3: Global Connected Truck Market Revenue Million Forecast, by Communication Type 2020 & 2033

- Table 4: Global Connected Truck Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Connected Truck Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Connected Truck Market Revenue Million Forecast, by Range 2020 & 2033

- Table 7: Global Connected Truck Market Revenue Million Forecast, by Communication Type 2020 & 2033

- Table 8: Global Connected Truck Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Connected Truck Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Connected Truck Market Revenue Million Forecast, by Range 2020 & 2033

- Table 14: Global Connected Truck Market Revenue Million Forecast, by Communication Type 2020 & 2033

- Table 15: Global Connected Truck Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Connected Truck Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Connected Truck Market Revenue Million Forecast, by Range 2020 & 2033

- Table 24: Global Connected Truck Market Revenue Million Forecast, by Communication Type 2020 & 2033

- Table 25: Global Connected Truck Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Connected Truck Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Connected Truck Market Revenue Million Forecast, by Range 2020 & 2033

- Table 33: Global Connected Truck Market Revenue Million Forecast, by Communication Type 2020 & 2033

- Table 34: Global Connected Truck Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: South America Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Middle East and Africa Connected Truck Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Connected Truck Market?

The projected CAGR is approximately 16.33%.

2. Which companies are prominent players in the Connected Truck Market?

Key companies in the market include Harman Internationa, Magna International Inc, Denso Corporation, NXP Semiconductors NV, Continental AG, Mercedes-Benz Group AG, Robert Bosch GmbH, Aptiv Global Operations Limited, Sierra Wireless, AB Volvo, ZF Friedrichshafen AG.

3. What are the main segments of the Connected Truck Market?

The market segments include Vehicle Type, Range, Communication Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Norms Mandating the Integration of Connected Technologies in Commercial Vehicles are Driving the Growth; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Use of Telematics in the Commercial Vehicle Market to Drive the Connected Truck Market.

7. Are there any restraints impacting market growth?

Lack of IT Enabled Infrastructure in Emerging Economies Restricts the Connected Truck Market Growth; Cyber Security Threats Remain a Concern for the Market.

8. Can you provide examples of recent developments in the market?

Oct 2023: Volvo Trucks North America announced a new comprehensive fleet management portal, Volvo Connect, to access Volvo Trucks’ digital services, providing fleets with near real-time data on the health and performance of trucks in operation. The new portal offers analytics and reports that deliver fleets a range of truck data, including fuel consumption, idle time, vehicle speed, seat belt information, and location information.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Connected Truck Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Connected Truck Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Connected Truck Market?

To stay informed about further developments, trends, and reports in the Connected Truck Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence