Key Insights

The Europe Automotive Relay Market is set for substantial expansion, with a projected market size of $5.77 billion by 2025, experiencing a Compound Annual Growth Rate (CAGR) of 16.84% through 2033. This growth is propelled by the increasing sophistication of automotive electrical systems, driven by the widespread adoption of Advanced Driver-Assistance Systems (ADAS), advanced infotainment, and electrification technologies. Key market drivers include the rising demand for enhanced vehicle safety and the continuous integration of sophisticated Electronic Control Units (ECUs) in passenger and commercial vehicles. The transition to electric vehicles (EVs) and hybrid electric vehicles (HEVs) further fuels demand for advanced relays in battery management, power distribution, and charging systems. Stringent automotive safety regulations across European nations also encourage the adoption of cutting-edge relay solutions.

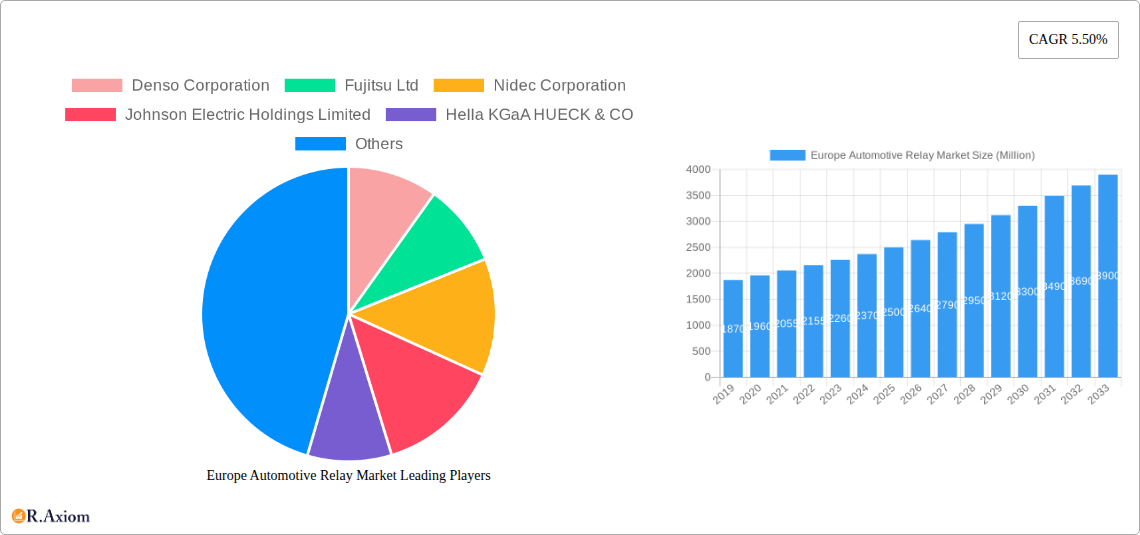

Europe Automotive Relay Market Market Size (In Billion)

Market segmentation highlights significant trends. The "PCB Relay" segment is anticipated to grow steadily due to its compact design and suitability for integrated electronic architectures. Conversely, the "Plug-in Relay" segment will retain a substantial market share, particularly in commercial vehicles and applications prioritizing ease of maintenance. Within applications, "Engine Management Modules" and "Motors & Pumps" remain crucial. The "Locking System" segment is emerging as a key growth area, supported by advanced keyless entry and security features. The increasing adoption of electric powertrains is also driving demand for specialized relays in "Other Applications," including power distribution units and battery management systems. Leading European markets such as the United Kingdom, Germany, France, and Italy are expected to spearhead growth, benefiting from robust automotive manufacturing sectors and early technology adoption. Emerging European markets also demonstrate promising growth, indicating a dynamic market landscape.

Europe Automotive Relay Market Company Market Share

This report provides an in-depth, SEO-optimized analysis of the Europe Automotive Relay Market, covering market size, growth trends, and future forecasts.

Europe Automotive Relay Market Market Concentration & Innovation

The Europe automotive relay market exhibits a moderate concentration, with a few dominant players like Denso Corporation, Robert Bosch GmbH, and TE Connectivity holding significant market share. Innovation is a key differentiator, driven by the increasing demand for advanced automotive features, electrification, and stricter emission standards. Companies are investing heavily in research and development to introduce smaller, more efficient, and higher-performing relays. Key innovation drivers include miniaturization for space-constrained electronic control units (ECUs), enhanced switching capabilities for higher current loads in electric vehicles (EVs), and improved reliability to meet stringent automotive safety standards. Regulatory frameworks, such as EURO 7 emissions standards and evolving safety directives, are compelling manufacturers to adopt cutting-edge relay technologies. Product substitutes, while present in some basic applications, are largely outpaced by the specialized requirements of modern automotive systems. End-user trends lean towards vehicles with sophisticated electronic systems, demanding robust and intelligent relay solutions. Merger and acquisition (M&A) activities are limited but strategic, focusing on acquiring niche technologies or expanding market reach. For instance, a hypothetical M&A in 2023 involving a specialized relay manufacturer and a Tier 1 supplier could be valued in the tens of millions of Euros, aiming to bolster integrated solutions. The market share of the top three players is estimated to be around 45%, with ongoing efforts to capture further ground through technological advancements and strategic partnerships.

Europe Automotive Relay Market Industry Trends & Insights

The Europe automotive relay market is poised for significant expansion, projected to grow at a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This growth is underpinned by a confluence of transformative industry trends and evolving consumer preferences. The relentless push towards vehicle electrification is a paramount growth driver, necessitating a sophisticated array of high-current automotive relays for battery management systems, charging infrastructure, and electric powertrain components. As the average number of relays per vehicle continues to climb, driven by the integration of advanced driver-assistance systems (ADAS), infotainment, and comfort features, the demand for both PCB relays and plug-in relays is escalating. Technological disruptions, including advancements in solid-state relays (SSRs) and micro-electromechanical systems (MEMS) relays, are slowly gaining traction, offering potential advantages in terms of speed, reliability, and miniaturization, although traditional electromechanical relays remain dominant due to cost-effectiveness and established performance. Consumer preferences are increasingly aligned with vehicles that offer enhanced safety, connectivity, and personalized driving experiences, all of which rely heavily on a complex network of electronic controls managed by automotive relays. The competitive landscape is characterized by intense rivalry among established players and emerging innovators, leading to continuous product development and price competition. Market penetration of advanced relay technologies is still in its nascent stages, presenting significant opportunities for early adopters. The increasing average selling price (ASP) of automotive relays, driven by higher specifications and added functionalities for EVs and autonomous driving, is also contributing to market value growth. The market penetration for advanced relay solutions is expected to reach 30% by 2033.

Dominant Markets & Segments in Europe Automotive Relay Market

The European automotive relay market is largely dominated by Passenger Cars, which represent the largest segment by vehicle type. This dominance is fueled by the sheer volume of passenger vehicle production and sales across key European automotive hubs like Germany, France, the UK, and Spain. The increasing sophistication of features in mainstream passenger vehicles, including advanced lighting systems, climate control, infotainment, and ADAS, necessitates a high density of automotive relays.

Within the Application segment, Motors & Pumps and Locking Systems are leading segments.

- Motors & Pumps: The proliferation of electric windows, sunroofs, power seats, windshield wipers, fuel pumps, and coolant pumps in virtually all vehicle segments drives substantial demand for relays controlling these motor and pump functions. The increasing adoption of electric powertrains further amplifies the demand for relays used in electric pumps for battery cooling and other auxiliary functions. The market share for Motors & Pumps applications is estimated at 28%.

- Locking Systems: The evolution of vehicle security, including central locking systems, keyless entry, and advanced anti-theft mechanisms, relies heavily on reliable and durable automotive relays. As vehicles become more sophisticated, so do their locking systems, requiring specialized relays for their operation.

Regarding Type, PCB Relays hold a significant market share due to their inherent advantages of direct mounting onto printed circuit boards, enabling compact and cost-effective integration within ECUs. Their widespread use in engine management modules, body control modules, and lighting systems solidifies their leading position. However, Plug-in Relays remain crucial for applications requiring easy replacement or maintenance, such as in fuse boxes and certain high-power switching applications. The market share for PCB Relays is estimated at 55%.

Key drivers for the dominance of these segments include:

- Economic Policies: Favorable automotive manufacturing policies and incentives in leading European nations encourage production and innovation, directly impacting relay demand.

- Infrastructure: A well-developed automotive manufacturing ecosystem and robust supply chains across Europe facilitate the integration of automotive relays into vehicle production lines.

- Consumer Demand: A strong consumer appetite for feature-rich and technologically advanced vehicles directly translates into increased demand for the relay components that enable these features.

- Regulatory Compliance: Evolving safety and emissions regulations necessitate more complex electronic systems, thereby increasing the reliance on automotive relays.

Europe Automotive Relay Market Product Developments

Product innovations in the Europe automotive relay market are centered on enhancing performance, reducing size, and increasing energy efficiency to meet the evolving demands of modern vehicles. Companies are actively developing relays with higher current handling capabilities for electric vehicle powertrains and battery management systems, alongside miniaturized solutions that allow for greater integration within increasingly complex ECUs. For instance, the Fujitsu Ltd introduction of the FTR-G3 relay in April 2023, the smallest 30A relay in its class, exemplifies this trend towards miniaturization and high power density, making it ideal for power windows, power seats, and door locks. Similarly, OMRON GmbH's February 2023 launch of the G8NB automotive PCB relay, available with single or twin contact poles, showcases a focus on versatile and reliable solutions for various applications. These developments are crucial for vehicle manufacturers seeking to optimize space, reduce weight, and improve overall vehicle efficiency and functionality.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Europe automotive relay market, encompassing a comprehensive segmentation. The market is bifurcated by Type, including PCB Relay and Plug-in Relay. Application segmentation covers Locking System, Engine Management Module, Motors & Pumps, and Other Applications. Furthermore, the analysis extends to Vehicle Type, differentiating between Passenger Cars and Commercial Vehicle. Growth projections for each segment indicate a steady upward trajectory, driven by advancements in automotive technology and the increasing electrification of vehicles. The market size for PCB Relays is projected to reach xx Million Euros by 2033, while Plug-in Relays are expected to grow to xx Million Euros. The Locking System application segment is estimated to be valued at xx Million Euros in 2033, with Motors & Pumps reaching xx Million Euros. Passenger Cars will continue to be the dominant vehicle type, contributing xx Million Euros to the market by 2033, while Commercial Vehicles will see a steady growth to xx Million Euros.

Key Drivers of Europe Automotive Relay Market Growth

Several key factors are propelling the growth of the Europe automotive relay market. The accelerating transition towards electric vehicles (EVs) is a primary driver, requiring a greater number and higher specification of relays for battery management, charging, and power distribution. The increasing integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies, replete with complex electronic control units (ECUs), also necessitates more sophisticated and reliable relays. Furthermore, evolving automotive safety standards and stringent emissions regulations, such as those mandating improved fuel efficiency and reduced environmental impact, are pushing vehicle manufacturers to adopt advanced electronic solutions, thereby boosting relay demand. The trend towards vehicle connectivity and in-car infotainment systems also contributes significantly to this growth.

Challenges in the Europe Automotive Relay Market Sector

Despite robust growth prospects, the Europe automotive relay market faces several challenges. Increasing price pressure from OEMs and intense competition among manufacturers can squeeze profit margins, particularly for standard relay types. The complexity of global supply chains, exacerbated by geopolitical uncertainties and raw material price volatility, poses a significant risk to consistent production and delivery schedules. Moreover, the emergence of alternative technologies, such as solid-state relays, while still nascent, presents a long-term challenge to traditional electromechanical relays in certain high-performance applications. Stringent quality and reliability standards required by the automotive industry necessitate substantial investment in R&D and manufacturing processes, adding to operational costs. Regulatory shifts and the evolving nature of automotive safety and emissions mandates can also create hurdles for manufacturers needing to adapt their product portfolios swiftly.

Emerging Opportunities in Europe Automotive Relay Market

The Europe automotive relay market is ripe with emerging opportunities. The rapid expansion of the electric vehicle (EV) charging infrastructure presents a significant avenue for growth, requiring specialized relays for charging stations and onboard charging systems. The continued development and adoption of ADAS and autonomous driving features are creating demand for highly reliable and advanced relays capable of handling complex control functions. Opportunities also lie in developing smart relays with integrated diagnostic capabilities and IoT connectivity, offering enhanced system monitoring and predictive maintenance for vehicle fleets. Furthermore, the increasing demand for comfort and convenience features in vehicles, such as advanced lighting and climate control systems, continues to drive the need for a diverse range of automotive relays. The pursuit of lightweight and compact vehicle designs also fuels innovation in miniaturized relay solutions.

Leading Players in the Europe Automotive Relay Market Market

- Denso Corporation

- Fujitsu Ltd

- Nidec Corporation

- Johnson Electric Holdings Limited

- Hella KGaA HUECK & CO

- TE Connectivity

- Omron Corporation

- Robert Bosch GmbH

- LS e-Mobility Solutions

- Panasonic Corporation

- MTA S p A

Key Developments in Europe Automotive Relay Market Industry

- April 2023: Fujitsu Ltd introduced the FTR-G3 relay, the smallest 30A relay in its class, measuring just 6.6 x 13.7 x 14.0mm and weighing approximately 4.0gr. The FTR-G3 relay is an excellent choice for power windows, power seats, tilt steering, door locks, windshield wipers, and sunroof control applications.

- February 2023: OMRON GmbH introduced the G8NB automotive PCB relay. The G8NB relay can be purchased with single (G8NB-1) or twin contact poles (G8NB-2).

Strategic Outlook for Europe Automotive Relay Market Market

The strategic outlook for the Europe automotive relay market is overwhelmingly positive, driven by the ongoing transformation of the automotive industry. The sustained growth in electric vehicle adoption, coupled with the increasing complexity of vehicle electronics for ADAS and connectivity features, will continue to be the primary growth catalysts. Manufacturers that can innovate with high-performance, miniaturized, and energy-efficient relay solutions, particularly for EV powertrains and advanced control systems, are well-positioned for success. Strategic partnerships between relay manufacturers and automotive OEMs or Tier 1 suppliers will be crucial for navigating market dynamics and securing long-term contracts. The ongoing trend towards vehicle electrification and enhanced onboard electronics ensures a consistent demand for reliable and advanced automotive relay solutions throughout the forecast period, making this a dynamic and promising market sector.

Europe Automotive Relay Market Segmentation

-

1. Type

- 1.1. PCB Relay

- 1.2. Plug-in Relay

-

2. Application

- 2.1. Locking System

- 2.2. Engine Management Module

- 2.3. Motors & Pumps

- 2.4. Other Applications

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicle

Europe Automotive Relay Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

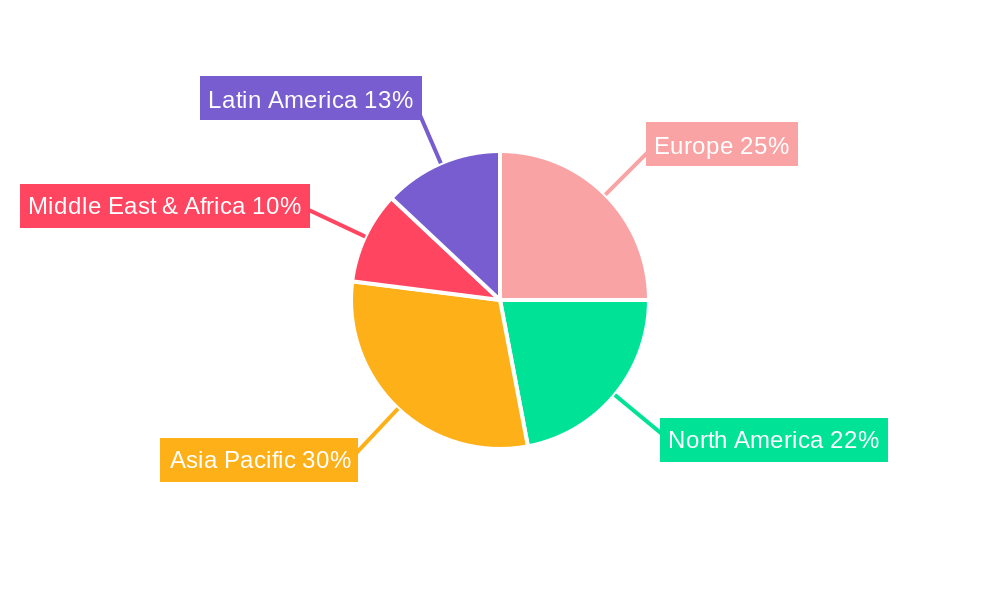

Europe Automotive Relay Market Regional Market Share

Geographic Coverage of Europe Automotive Relay Market

Europe Automotive Relay Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Electric Passenger and Commerical Vehicle Sales

- 3.3. Market Restrains

- 3.3.1. Integration of Vinyl Flooring Deters the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Electronic Vehicles and Advancement of Technology Demand Driving Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Relay Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. PCB Relay

- 5.1.2. Plug-in Relay

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Locking System

- 5.2.2. Engine Management Module

- 5.2.3. Motors & Pumps

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fujitsu Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nidec Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Johnson Electric Holdings Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hella KGaA HUECK & CO

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TE Connectivity

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Omron Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Robert Bosch GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LS e-Mobility Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 MTA S p A

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: Europe Automotive Relay Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Relay Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Relay Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Automotive Relay Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Europe Automotive Relay Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Europe Automotive Relay Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Automotive Relay Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Automotive Relay Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Europe Automotive Relay Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Europe Automotive Relay Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Automotive Relay Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Automotive Relay Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Automotive Relay Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Automotive Relay Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Automotive Relay Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Automotive Relay Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Automotive Relay Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Automotive Relay Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Automotive Relay Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Automotive Relay Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Automotive Relay Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Relay Market?

The projected CAGR is approximately 16.84%.

2. Which companies are prominent players in the Europe Automotive Relay Market?

Key companies in the market include Denso Corporation, Fujitsu Ltd, Nidec Corporation, Johnson Electric Holdings Limited, Hella KGaA HUECK & CO, TE Connectivity, Omron Corporation, Robert Bosch GmbH, LS e-Mobility Solutions, Panasonic Corporation, MTA S p A.

3. What are the main segments of the Europe Automotive Relay Market?

The market segments include Type, Application, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.77 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Electric Passenger and Commerical Vehicle Sales.

6. What are the notable trends driving market growth?

Electronic Vehicles and Advancement of Technology Demand Driving Growth.

7. Are there any restraints impacting market growth?

Integration of Vinyl Flooring Deters the Growth of the Market.

8. Can you provide examples of recent developments in the market?

April 2023: Fujitsu Ltd introduced the FTR-G3 relay, the smallest 30A relay in its class, measuring just 6.6 x 13.7 x 14.0mm and weighing approximately 4.0gr. The FTR-G3 relay is an excellent choice for power windows, power seats, tilt steering, door locks, windshield wipers, and sunroof control applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Relay Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Relay Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Relay Market?

To stay informed about further developments, trends, and reports in the Europe Automotive Relay Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence