Key Insights

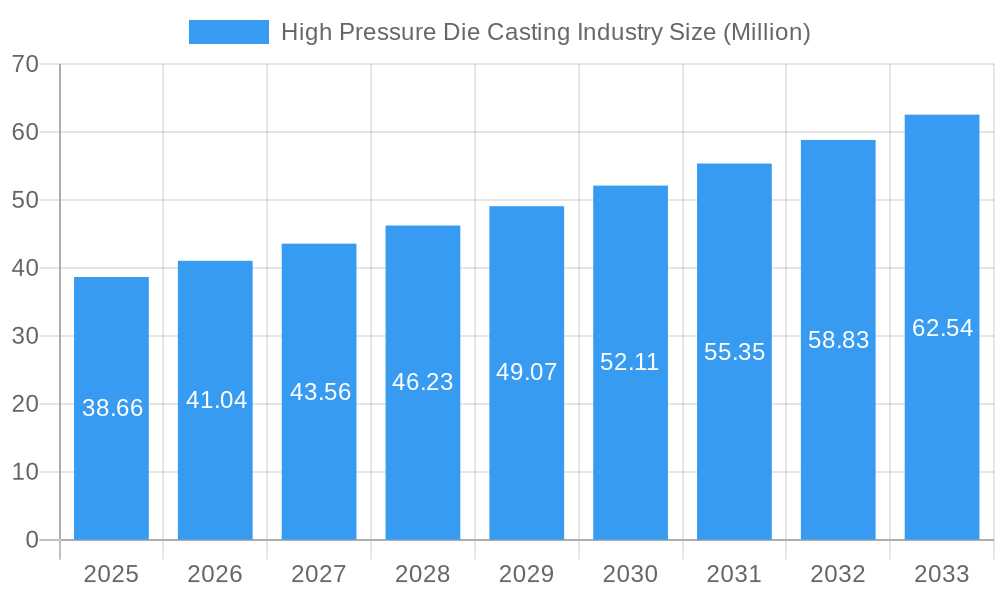

The global High Pressure Die Casting market is projected to witness robust expansion, driven by escalating demand from key end-use industries. With a current market size of approximately $38.66 billion in 2025, the industry is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.16% through the forecast period ending in 2033. This sustained expansion is largely attributed to the increasing adoption of lightweight yet durable components, particularly in the automotive sector, where advancements in electric vehicles (EVs) and stringent fuel efficiency regulations necessitate sophisticated metal casting solutions. The electrical and electronics sector also presents a substantial growth avenue, fueled by the miniaturization and complex designs of consumer electronics and telecommunications equipment. Industrial applications, ranging from machinery to aerospace, further contribute to this upward trajectory, underscoring the versatility and critical role of high-pressure die-cast components.

High Pressure Die Casting Industry Market Size (In Million)

The market dynamics are shaped by a combination of influential drivers and emerging trends. Advanced alloys, particularly aluminum and magnesium, are increasingly favored for their superior strength-to-weight ratios, driving innovation in raw material development and casting techniques. The adoption of sophisticated production processes like Vacuum High-pressure Die Casting and Squeeze High-pressure Die Casting is enhancing precision, reducing porosity, and improving the overall quality of cast parts. Geographically, the Asia Pacific region, led by China and India, is emerging as a dominant force, propelled by its burgeoning manufacturing base and significant investments in automotive and electronics production. North America and Europe also represent mature yet dynamic markets, with a strong emphasis on technological innovation and the production of high-value components. While the market benefits from strong demand, potential restraints such as fluctuating raw material prices and the need for substantial initial capital investment in advanced machinery warrant strategic consideration for stakeholders.

High Pressure Die Casting Industry Company Market Share

This in-depth report provides a detailed examination of the global High Pressure Die Casting (HPDC) industry, offering critical insights and actionable intelligence for stakeholders. Spanning the Historical Period (2019–2024), Base Year (2025), Estimated Year (2025), and a robust Forecast Period (2025–2033), this study delves into market dynamics, growth drivers, challenges, and future opportunities. With an estimated market value projected to reach hundreds of millions of USD by 2033, the HPDC sector is a critical component of manufacturing, driven by advancements in materials, automation, and the ever-evolving demands of key end-use industries. This report leverages high-traffic keywords such as "die casting," "aluminum die casting," "zinc die casting," "magnesium die casting," "automotive die casting," "EV components," "industrial die casting," and "manufacturing technology" to enhance search visibility and engagement.

High Pressure Die Casting Industry Market Concentration & Innovation

The High Pressure Die Casting industry exhibits a moderate level of market concentration, characterized by the presence of both large, established global players and a significant number of regional specialists. Innovation is a key differentiator, driven by the relentless pursuit of lighter, stronger, and more complex components, particularly for the burgeoning electric vehicle (EV) market and advanced electronics. Regulatory frameworks, especially those pertaining to environmental sustainability and material usage, are increasingly influencing production processes and material choices. Product substitutes, while present in some applications, often struggle to match the cost-effectiveness and performance characteristics of HPDC components. End-user trends are heavily influenced by the automotive sector's shift towards EVs, demanding lightweighting solutions and intricate part designs. Mergers and acquisitions (M&A) continue to shape the landscape, with strategic investments aimed at expanding capabilities, geographical reach, and technological expertise. Major M&A deals in recent years have involved valuations in the tens to hundreds of millions of USD, reflecting the industry's consolidation and growth ambitions.

- Market Share Dynamics: Key players like Dynacast and Nemak SAB De CV hold significant market shares, particularly in the automotive segment, with individual company revenues often exceeding one billion USD.

- Innovation Drivers: Advancements in automation, robotic integration, simulation software, and novel alloy development are crucial for competitive advantage.

- Regulatory Impact: Stricter emissions standards and recycling mandates are pushing for the use of more sustainable materials and energy-efficient processes.

- M&A Activity: Acquisitions are focused on acquiring specialized technologies, expanding production capacity, and securing access to new markets.

High Pressure Die Casting Industry Industry Trends & Insights

The High Pressure Die Casting industry is poised for significant expansion, driven by a confluence of technological advancements, evolving consumer preferences, and robust growth in its primary application sectors. The projected Compound Annual Growth Rate (CAGR) for the HPDC market is estimated to be in the range of 5% to 7% over the forecast period. A primary growth catalyst is the accelerating transition towards electric mobility. The demand for lightweight, complex, and high-performance components for EV powertrains, battery enclosures, and chassis systems is creating unprecedented opportunities for HPDC manufacturers. The increasing integration of automation and Industry 4.0 principles within die casting facilities is enhancing efficiency, precision, and cost-effectiveness. Furthermore, the growing adoption of smart manufacturing technologies, including AI and IoT, is enabling predictive maintenance, real-time process optimization, and improved quality control. Consumer preferences for more sustainable and energy-efficient products are also indirectly fueling the demand for HPDC, as lighter vehicles generally consume less energy. The competitive dynamics are intensifying, with companies differentiating themselves through specialized expertise, advanced material capabilities, and superior customer service. Market penetration in emerging economies is steadily increasing as manufacturing capabilities and infrastructure develop. The utilization of vacuum high-pressure die casting and squeeze high-pressure die casting technologies is becoming more prevalent due to their ability to produce parts with enhanced mechanical properties and reduced porosity, essential for critical applications. The overall market size is estimated to exceed fifty billion USD by 2033.

Dominant Markets & Segments in High Pressure Die Casting Industry

The High Pressure Die Casting industry is characterized by distinct dominant markets and segments, with specific raw materials, applications, and production processes driving the majority of market activity and future growth. Aluminum remains the most dominant raw material, accounting for an estimated 70% of the total HPDC market volume, due to its favorable strength-to-weight ratio, recyclability, and cost-effectiveness. The Automotive application segment is the undisputed leader, representing over 50% of the global HPDC market. Within the automotive sector, the burgeoning demand for electric vehicles (EVs) is a significant growth driver, creating substantial opportunities for the production of intricate structural components, battery housings, and motor parts. The Industrial Applications segment also holds substantial importance, encompassing a wide range of machinery, power tools, and automation equipment components.

- Dominant Raw Material:

- Aluminum: Its widespread use in automotive, aerospace, and consumer electronics, coupled with its excellent recyclability, makes it the leading raw material. Market share in this sub-segment is estimated to be over seventy percent.

- Dominant Application:

- Automotive: This segment is the largest consumer of HPDC parts, with significant growth driven by lightweighting initiatives and the EV revolution. Its market share is approximately fifty percent.

- EV Components: Battery enclosures, motor housings, thermal management systems, and structural parts are driving substantial demand.

- Automotive: This segment is the largest consumer of HPDC parts, with significant growth driven by lightweighting initiatives and the EV revolution. Its market share is approximately fifty percent.

- Dominant Production Process:

- Vacuum High-pressure Die Casting: This advanced process is gaining traction for high-performance applications requiring enhanced mechanical properties and reduced porosity, particularly in aerospace and critical automotive components. Its adoption is steadily increasing, estimated to capture over thirty percent of the high-value segments.

High Pressure Die Casting Industry Product Developments

Product development in the High Pressure Die Casting industry is sharply focused on creating lighter, stronger, and more sustainable components. Innovations are centered on advanced aluminum and magnesium alloys that offer superior performance and reduced environmental impact. The design of complex, integrated parts is a key trend, aiming to reduce assembly time and overall product weight. Competitive advantages are increasingly derived from a company's ability to deliver highly precise, defect-free castings for demanding applications like electric vehicle battery enclosures and advanced aerospace structures. Technological advancements in simulation software and rapid prototyping are accelerating the development cycles for new HPDC products.

Report Scope & Segmentation Analysis

This report segments the High Pressure Die Casting market across several key dimensions to provide a granular understanding of market dynamics. The primary segmentation includes Raw Material Type (Aluminum, Zinc, Magnesium), Application (Automotive, Electrical and Electronics, Industrial Applications, Other Applications), and Production Process (Vacuum High-pressure Die Casting, Squeeze High-pressure Die Casting). The Aluminum segment is projected to grow at a CAGR of 6%, driven by automotive demand. The Automotive application segment, expected to reach thirty-five billion USD by 2033, will continue to dominate. Vacuum High-pressure Die Casting, currently representing twenty-five percent of the market, is anticipated to exhibit the highest growth rate due to its suitability for high-performance components.

- Raw Material Type:

- Aluminum: Dominant with significant growth projected due to its versatility.

- Zinc: Strong in decorative and smaller component applications, with steady growth.

- Magnesium: Growing demand for lightweighting in niche automotive and consumer electronics sectors.

- Application:

- Automotive: Leading segment with substantial EV-driven growth.

- Electrical and Electronics: Consistent demand for housings and components.

- Industrial Applications: Broad use in machinery and equipment.

- Other Applications: Includes aerospace, medical, and consumer goods.

- Production Process:

- Vacuum High-pressure Die Casting: High growth due to enhanced properties.

- Squeeze High-pressure Die Casting: Specialized applications with steady demand.

Key Drivers of High Pressure Die Casting Industry Growth

The High Pressure Die Casting industry is propelled by several significant growth drivers. The relentless pursuit of lightweighting in the automotive sector, particularly with the proliferation of electric vehicles, is a paramount driver. Advancements in material science, leading to the development of stronger and more durable alloys, also contribute significantly. The increasing adoption of automation and Industry 4.0 technologies within manufacturing facilities enhances production efficiency and precision, making HPDC more competitive. Furthermore, the expanding applications of HPDC in the electrical and electronics, and industrial sectors, driven by demand for complex and reliable components, are also fueling growth. Favorable government policies and incentives promoting manufacturing and innovation, particularly in emerging economies, further bolster the industry's expansion.

Challenges in the High Pressure Die Casting Industry Sector

Despite its strong growth trajectory, the High Pressure Die Casting industry faces several challenges. Fluctuations in raw material prices, particularly for aluminum, can impact profitability and pricing strategies. Intense global competition and price pressures from manufacturers in lower-cost regions pose a significant challenge. Evolving environmental regulations and the increasing demand for sustainable manufacturing practices require continuous investment in eco-friendly technologies and processes. Skilled labor shortages in specialized manufacturing roles, including die casting technicians and engineers, can hinder operational efficiency and innovation. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can lead to production delays and increased costs.

Emerging Opportunities in High Pressure Die Casting Industry

The High Pressure Die Casting industry is brimming with emerging opportunities. The continued exponential growth of the electric vehicle market presents a massive opportunity for the production of battery enclosures, motor components, and lightweight chassis parts. Advancements in additive manufacturing (3D printing) are creating opportunities for hybrid manufacturing approaches, combining HPDC with 3D printed components for highly complex designs. The increasing demand for smart devices and advanced electronics, requiring intricate and precise metal components, opens new avenues for growth. Furthermore, the development of new high-performance alloys with enhanced properties, such as increased strength at elevated temperatures, will unlock applications in new industries, including aerospace and renewable energy.

Leading Players in the High Pressure Die Casting Industry Market

- Dynacast (Form Technologies Inc)

- Nemak SAB De CV

- Endurance Group

- Koch Enterprises Inc (Gibbs Die Casting Group)

- Sundaram - Clayton Ltd

- Georg Fischer AG

- Ryobi Die Casting Inc

- Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG)

- Officine Meccaniche Rezzatesi SpA

- Rockman Industries

- Engtek Group

- Shiloh Industries Ltd

Key Developments in High Pressure Die Casting Industry Industry

- November 2022: Pace Industries, a leading die-casting company in the United States, announced the closure of its two Muskegon die-casting plants. The company manufactures aluminum die castings, zinc die castings, mechanical assemblies, and injected molded plastics for the automotive industry, impacting regional supply chains.

- September 2022: Rheinmetall AG (Rheinmetall) received a new EUR 20 million (USD 236 million) order for its advanced air-divert valve, the Turbo Bypass Valve (TBV) Gen 6, establishing itself as an industry heavyweight and the source of several recent orders for the Group subsidiary. Production will take place at Pierburg's Neuss, Germany, plant, highlighting continued investment in high-value automotive components.

- May 2022: A division of Georg Fischer, GF Casting Solutions, announced that it will utilize its expertise to enhance the creation of electric vehicle (EV) products and services. The company aims to support customers' transition to electric drive engines and e-mobility by leveraging artificial intelligence (AI) to offer high-quality products that are environmentally friendly, signifying a strong commitment to the EV market and technological integration.

Strategic Outlook for High Pressure Die Casting Industry Market

The strategic outlook for the High Pressure Die Casting industry is exceptionally positive, driven by sustained demand from key sectors and continuous technological evolution. The acceleration of electric vehicle adoption will remain a primary growth catalyst, necessitating innovative and lightweight HPDC solutions. Companies that invest in advanced automation, sustainable manufacturing practices, and the development of novel alloys will be best positioned for success. Strategic partnerships and collaborations will be crucial for navigating complex supply chains and expanding market reach. The industry's ability to adapt to evolving regulatory landscapes and embrace digitalization will be key to unlocking future market potential and solidifying its role as a critical enabler of modern manufacturing.

High Pressure Die Casting Industry Segmentation

-

1. Raw Material Type

- 1.1. Aluminum

- 1.2. Zinc

- 1.3. Magnesium

-

2. Application

- 2.1. Automotive

- 2.2. Electrical and Electronics

- 2.3. Industrial Applications

- 2.4. Other Applications

-

3. Production Process

- 3.1. Vacuum High-pressure Die Casting

- 3.2. Squeeze High-pressure Die Casting

High Pressure Die Casting Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

High Pressure Die Casting Industry Regional Market Share

Geographic Coverage of High Pressure Die Casting Industry

High Pressure Die Casting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Use of Aluminum in Die Casting Equipment to Increase Market Demand

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Automotive Segment Expected to Gain Prominence During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Pressure Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 5.1.1. Aluminum

- 5.1.2. Zinc

- 5.1.3. Magnesium

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Electrical and Electronics

- 5.2.3. Industrial Applications

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Production Process

- 5.3.1. Vacuum High-pressure Die Casting

- 5.3.2. Squeeze High-pressure Die Casting

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 6. North America High Pressure Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 6.1.1. Aluminum

- 6.1.2. Zinc

- 6.1.3. Magnesium

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive

- 6.2.2. Electrical and Electronics

- 6.2.3. Industrial Applications

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Production Process

- 6.3.1. Vacuum High-pressure Die Casting

- 6.3.2. Squeeze High-pressure Die Casting

- 6.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 7. Europe High Pressure Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 7.1.1. Aluminum

- 7.1.2. Zinc

- 7.1.3. Magnesium

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive

- 7.2.2. Electrical and Electronics

- 7.2.3. Industrial Applications

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Production Process

- 7.3.1. Vacuum High-pressure Die Casting

- 7.3.2. Squeeze High-pressure Die Casting

- 7.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 8. Asia Pacific High Pressure Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 8.1.1. Aluminum

- 8.1.2. Zinc

- 8.1.3. Magnesium

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive

- 8.2.2. Electrical and Electronics

- 8.2.3. Industrial Applications

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Production Process

- 8.3.1. Vacuum High-pressure Die Casting

- 8.3.2. Squeeze High-pressure Die Casting

- 8.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 9. Rest of the World High Pressure Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 9.1.1. Aluminum

- 9.1.2. Zinc

- 9.1.3. Magnesium

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Automotive

- 9.2.2. Electrical and Electronics

- 9.2.3. Industrial Applications

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Production Process

- 9.3.1. Vacuum High-pressure Die Casting

- 9.3.2. Squeeze High-pressure Die Casting

- 9.1. Market Analysis, Insights and Forecast - by Raw Material Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Dynacast (Form Technologies Inc )

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nemak SAB De CV

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Endurance Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Koch Enterprises Inc (Gibbs Die Casting Group)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Sundaram - Clayton Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Georg Fischer AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Ryobi Die Casting Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Officine Meccaniche Rezzatesi SpA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rockman Industries

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Engtek Group

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Shiloh Industries Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Dynacast (Form Technologies Inc )

List of Figures

- Figure 1: Global High Pressure Die Casting Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America High Pressure Die Casting Industry Revenue (Million), by Raw Material Type 2025 & 2033

- Figure 3: North America High Pressure Die Casting Industry Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 4: North America High Pressure Die Casting Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America High Pressure Die Casting Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America High Pressure Die Casting Industry Revenue (Million), by Production Process 2025 & 2033

- Figure 7: North America High Pressure Die Casting Industry Revenue Share (%), by Production Process 2025 & 2033

- Figure 8: North America High Pressure Die Casting Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America High Pressure Die Casting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe High Pressure Die Casting Industry Revenue (Million), by Raw Material Type 2025 & 2033

- Figure 11: Europe High Pressure Die Casting Industry Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 12: Europe High Pressure Die Casting Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe High Pressure Die Casting Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe High Pressure Die Casting Industry Revenue (Million), by Production Process 2025 & 2033

- Figure 15: Europe High Pressure Die Casting Industry Revenue Share (%), by Production Process 2025 & 2033

- Figure 16: Europe High Pressure Die Casting Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe High Pressure Die Casting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific High Pressure Die Casting Industry Revenue (Million), by Raw Material Type 2025 & 2033

- Figure 19: Asia Pacific High Pressure Die Casting Industry Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 20: Asia Pacific High Pressure Die Casting Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific High Pressure Die Casting Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific High Pressure Die Casting Industry Revenue (Million), by Production Process 2025 & 2033

- Figure 23: Asia Pacific High Pressure Die Casting Industry Revenue Share (%), by Production Process 2025 & 2033

- Figure 24: Asia Pacific High Pressure Die Casting Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific High Pressure Die Casting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World High Pressure Die Casting Industry Revenue (Million), by Raw Material Type 2025 & 2033

- Figure 27: Rest of the World High Pressure Die Casting Industry Revenue Share (%), by Raw Material Type 2025 & 2033

- Figure 28: Rest of the World High Pressure Die Casting Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Rest of the World High Pressure Die Casting Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Rest of the World High Pressure Die Casting Industry Revenue (Million), by Production Process 2025 & 2033

- Figure 31: Rest of the World High Pressure Die Casting Industry Revenue Share (%), by Production Process 2025 & 2033

- Figure 32: Rest of the World High Pressure Die Casting Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World High Pressure Die Casting Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Pressure Die Casting Industry Revenue Million Forecast, by Raw Material Type 2020 & 2033

- Table 2: Global High Pressure Die Casting Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global High Pressure Die Casting Industry Revenue Million Forecast, by Production Process 2020 & 2033

- Table 4: Global High Pressure Die Casting Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global High Pressure Die Casting Industry Revenue Million Forecast, by Raw Material Type 2020 & 2033

- Table 6: Global High Pressure Die Casting Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global High Pressure Die Casting Industry Revenue Million Forecast, by Production Process 2020 & 2033

- Table 8: Global High Pressure Die Casting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global High Pressure Die Casting Industry Revenue Million Forecast, by Raw Material Type 2020 & 2033

- Table 13: Global High Pressure Die Casting Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global High Pressure Die Casting Industry Revenue Million Forecast, by Production Process 2020 & 2033

- Table 15: Global High Pressure Die Casting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global High Pressure Die Casting Industry Revenue Million Forecast, by Raw Material Type 2020 & 2033

- Table 22: Global High Pressure Die Casting Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global High Pressure Die Casting Industry Revenue Million Forecast, by Production Process 2020 & 2033

- Table 24: Global High Pressure Die Casting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: India High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: China High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global High Pressure Die Casting Industry Revenue Million Forecast, by Raw Material Type 2020 & 2033

- Table 31: Global High Pressure Die Casting Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global High Pressure Die Casting Industry Revenue Million Forecast, by Production Process 2020 & 2033

- Table 33: Global High Pressure Die Casting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa High Pressure Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Pressure Die Casting Industry?

The projected CAGR is approximately 6.16%.

2. Which companies are prominent players in the High Pressure Die Casting Industry?

Key companies in the market include Dynacast (Form Technologies Inc ), Nemak SAB De CV, Endurance Group, Koch Enterprises Inc (Gibbs Die Casting Group), Sundaram - Clayton Ltd, Georg Fischer AG, Ryobi Die Casting Inc, Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG), Officine Meccaniche Rezzatesi SpA, Rockman Industries, Engtek Group, Shiloh Industries Ltd.

3. What are the main segments of the High Pressure Die Casting Industry?

The market segments include Raw Material Type, Application, Production Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Use of Aluminum in Die Casting Equipment to Increase Market Demand.

6. What are the notable trends driving market growth?

Automotive Segment Expected to Gain Prominence During the Forecast Period.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

November 2022: Pace Industries, one of the leading die-casting companies in the United States, announced the closure of its two Muskegon die-casting plants. The company manufactures aluminum die castings, zinc die castings, mechanical assemblies, and injected molded plastics for the automotive industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Pressure Die Casting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Pressure Die Casting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Pressure Die Casting Industry?

To stay informed about further developments, trends, and reports in the High Pressure Die Casting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence