Key Insights

The Middle East Online Car Rental Market is projected for substantial growth, with an estimated market size of $3.85 billion by 2024, exhibiting a CAGR of 8.5% through the forecast period. This expansion is driven by increasing tourism in the UAE and Saudi Arabia, alongside the growing preference for digital booking platforms across various vehicle segments. The convenience of online portals and mobile applications appeals to both leisure and business travelers, shifting demand from traditional booking methods. The market will see continued growth fueled by demand for both economy and luxury rentals, with self-driven options expected to lead, though chauffeur services will remain relevant for premium experiences.

Middle East Online Car Rental Market Market Size (In Billion)

Key trends shaping the Middle East Online Car Rental Market include widespread smartphone and internet penetration, enhancing digital access. Investments in digital infrastructure and a robust e-commerce ecosystem further support this growth. The market is also experiencing an uptick in demand for specialized rentals, including business travel solutions and long-term leases. Technological advancements like AI-powered booking and personalized recommendations are improving customer experience. While price competition and the need for fleet modernization pose challenges, the digitally-savvy population, coupled with government initiatives promoting tourism and economic diversification, ensures sustained and significant market expansion.

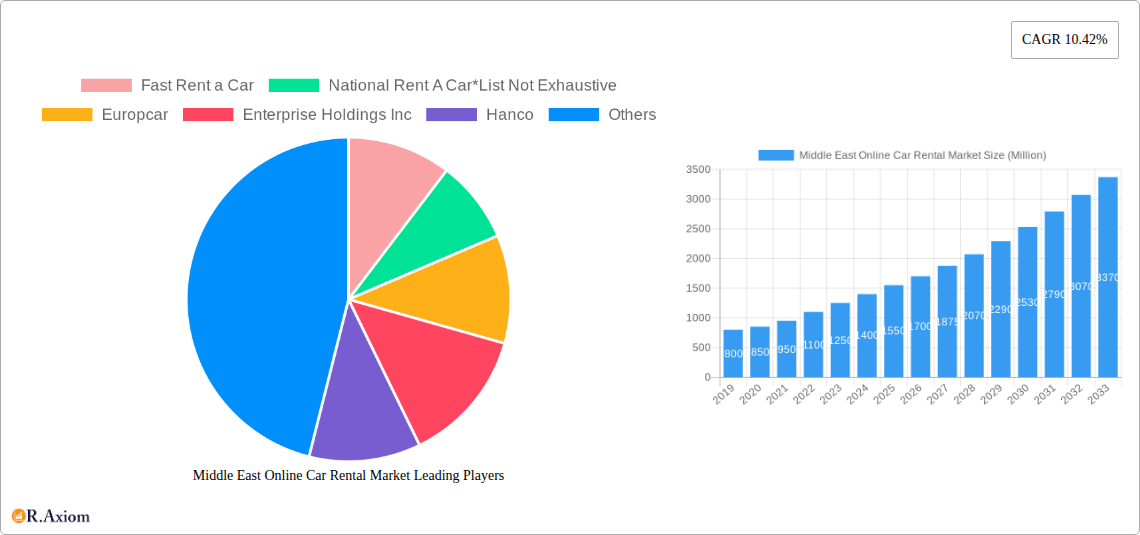

Middle East Online Car Rental Market Company Market Share

Middle East Online Car Rental Market Market Concentration & Innovation

The Middle East online car rental market exhibits a moderate to high concentration, with a few dominant players like Enterprise Holdings Inc., Avis Budget Group Inc., and Hertz Corp. capturing significant market share. Innovation is a key differentiator, driven by technological advancements in booking platforms, fleet management software, and customer experience enhancements. Regulatory frameworks, while evolving, aim to standardize operations and ensure consumer protection. Potential product substitutes include ride-sharing services and public transportation, though their penetration varies across the region. End-user trends are shifting towards digital-first experiences, emphasizing convenience and personalization. Mergers and acquisitions (M&A) are becoming more prevalent as companies seek to expand their geographical reach and service offerings. For instance, an undisclosed M&A deal valued at approximately $50 Million in 2023 aimed to bolster digital capabilities. The market share of key players is estimated as follows: Enterprise Holdings Inc. at 15%, Avis Budget Group Inc. at 12%, and Hertz Corp. at 10%, with other players holding the remaining share.

Middle East Online Car Rental Market Industry Trends & Insights

The Middle East online car rental market is experiencing robust growth, fueled by a burgeoning tourism sector, increasing disposable incomes, and a significant push towards digital transformation across the region. The CAGR for the forecast period 2025–2033 is projected to be a healthy 12.5%, indicating a dynamic and expanding market. Technological disruptions, such as the integration of AI-powered chatbots for customer service and the adoption of contactless rental processes, are reshaping consumer preferences towards seamless and efficient experiences. The surge in leisure and tourism travel post-pandemic, particularly in destinations like Dubai, Abu Dhabi, and Riyadh, is a primary growth driver. Furthermore, the increasing adoption of mobile applications for car rentals has led to a substantial increase in market penetration, reaching an estimated 70% of the total car rental market in major urban centers by 2025.

The competitive dynamics are intensifying, with established global players vying for market dominance alongside agile local startups. This competition is driving innovation in pricing strategies, vehicle variety, and value-added services. The increasing demand for flexible rental options, including short-term rentals for daily utility and long-term leases for corporate clients, is another significant trend. The development of advanced fleet management systems, enabling real-time tracking, predictive maintenance, and optimized utilization, is crucial for operational efficiency and profitability.

The market's growth is also intrinsically linked to the expansion of the travel and hospitality sectors. As Middle Eastern countries continue to invest heavily in tourism infrastructure and host major international events, the demand for convenient and reliable transportation solutions like online car rentals is expected to escalate. The focus on sustainability is also emerging as a trend, with a growing interest in electric and hybrid vehicle rentals, although adoption rates are still in their nascent stages compared to traditional fuel vehicles.

Dominant Markets & Segments in Middle East Online Car Rental Market

The Middle East online car rental market is characterized by several dominant markets and segments, each contributing significantly to its overall growth trajectory.

Dominant Regions and Countries:

- United Arab Emirates (UAE): Consistently leads the market due to its robust tourism infrastructure, prominent global business hub status, and high adoption of digital services. Dubai, in particular, is a major driver of demand, attracting millions of tourists and business travelers annually.

- Saudi Arabia: Rapidly emerging as a dominant market driven by economic diversification initiatives, large-scale infrastructure projects (like NEOM), and a growing domestic tourism sector. Government support for digitalization and increased foreign investment further propels its growth.

- Qatar: Significant growth observed, especially around major events and its expanding tourism offerings. The country's focus on developing world-class infrastructure and its strategic location make it an attractive market.

Dominant Booking Types:

- Online Booking: This segment holds the dominant share, estimated at 85% of the total bookings by 2025.

- Key Drivers: Convenience, real-time price comparison, user-friendly interfaces of websites and mobile apps, and exclusive online discounts.

- Dominance Analysis: The widespread availability of high-speed internet and smartphones across the Middle East facilitates online booking. Platforms offering seamless booking processes, secure payment gateways, and instant confirmation are preferred by a majority of consumers.

Dominant Applications:

- Leisure/Tourism: This segment accounts for the largest share of the market, driven by the region's appeal as a global tourist destination.

- Key Drivers: Influx of international tourists for cultural experiences, family vacations, and business events. The need for flexible and convenient transportation to explore diverse attractions.

- Dominance Analysis: The growth of the tourism sector, coupled with the increasing popularity of self-drive tours to explore natural landscapes and cities, solidifies this segment's dominance.

Dominant Vehicle Types:

- Economy Cars: This segment captures a substantial market share due to its affordability and practicality for daily use and short trips.

- Key Drivers: Cost-effectiveness, fuel efficiency, and suitability for navigating urban environments. Appeal to budget-conscious travelers and local residents needing daily transportation.

- Dominance Analysis: The demand for accessible and economical transportation solutions ensures the consistent popularity of economy cars across various customer demographics.

Dominant End-User Types:

- Self-Driven: This segment is overwhelmingly dominant, reflecting a growing preference for independence and flexibility in travel.

- Key Drivers: Desire for personal freedom and the ability to set one's own itinerary. Increasing comfort and familiarity with driving in regional markets.

- Dominance Analysis: The rise of digital platforms that simplify the self-drive rental process, coupled with a younger demographic that values autonomy, fuels the dominance of self-driven rentals.

Middle East Online Car Rental Market Product Developments

Product developments in the Middle East online car rental market are heavily focused on enhancing user experience and operational efficiency. Innovations include AI-powered recommendation engines for personalized vehicle suggestions, integrated navigation systems with real-time traffic updates, and advanced mobile applications offering end-to-end rental management from booking to return. The integration of contactless pick-up and drop-off solutions, facilitated by mobile keys and digital check-in processes, is a significant trend, catering to the demand for safety and convenience. Furthermore, companies are investing in telematics to provide data-driven insights for fleet optimization and predictive maintenance, giving them a competitive edge.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Middle East Online Car Rental Market, covering the period from 2019 to 2033, with a base year of 2025. The segmentation analysis delves into key aspects of the market to provide granular insights.

- Booking Type: The report analyzes the market split between Online booking and Offline booking. Online booking is projected to maintain its dominance, driven by digital adoption.

- Application: The segmentation based on application categorizes the market into Leisure/Tourism and Daily utility. The Leisure/Tourism segment is expected to be the larger contributor due to the region's growing tourism industry.

- Vehicle Type: The market is examined across Economy cars and Luxury cars, with economy cars anticipated to hold a larger share due to affordability, while luxury cars cater to a premium segment.

- End-User Type: The report differentiates between Self-driven and Chauffeur services. The Self-driven segment is expected to exhibit stronger growth due to increasing consumer preference for independence.

Key Drivers of Middle East Online Car Rental Market Growth

The Middle East online car rental market is propelled by several key drivers. A robust and expanding tourism sector, fueled by significant government investments in infrastructure and promotional activities, is a primary catalyst. The increasing adoption of digital technologies and the proliferation of smartphones across the region have significantly boosted online booking platforms. Furthermore, the growing expatriate population and business travel necessitate convenient and flexible transportation solutions. Economic diversification initiatives in countries like Saudi Arabia are also contributing to increased business activity and, consequently, rental demand. The competitive landscape, with players offering attractive pricing and diversified fleets, further stimulates market growth.

Challenges in the Middle East Online Car Rental Market Sector

Despite its promising growth, the Middle East online car rental market faces several challenges. Intense price competition among numerous players can lead to pressure on profit margins. Navigating diverse and sometimes complex regulatory frameworks across different countries within the region can pose operational hurdles. Ensuring consistent service quality and customer satisfaction across a wide geographical area, especially with fluctuating demand, remains a challenge. Infrastructure limitations in certain emerging areas, coupled with the need for skilled personnel for fleet management and customer service, also present obstacles. Supply chain disruptions affecting vehicle availability and maintenance can further impact operations.

Emerging Opportunities in Middle East Online Car Rental Market

Emerging opportunities in the Middle East online car rental market are ripe for exploitation. The increasing focus on sustainable tourism presents a significant opportunity for companies offering electric and hybrid vehicle rentals. Expansion into untapped markets within the region, particularly in developing economies with growing middle classes, offers substantial growth potential. The integration of advanced technologies like IoT for smart fleet management and AI for personalized customer experiences can provide a competitive edge. Furthermore, the burgeoning demand for specialized rental services, such as car subscriptions and mobility-as-a-service (MaaS) platforms, represents a lucrative avenue for innovation and market penetration.

Leading Players in the Middle East Online Car Rental Market Market

- Fast Rent a Car

- National Rent A Car

- Europcar

- Enterprise Holdings Inc.

- Hanco

- Theeb Rent A Car

- Hertz Corp.

- Sixt SE

- Avis Budget Group Inc.

Key Developments in Middle East Online Car Rental Market Industry

- November 2022: Zofeur launched its first business-to-business on-demand driver service in Dubai, positioning itself as the world's first platform for on-demand, pay-per-minute chauffeur services, enabling seamless integration for automotive service providers.

- November 2022: DFM's partner and exclusive distributor in Qatar delivered Dongfeng passenger vehicles in volume to a luxury car rental company, intended to serve guests worldwide during the soccer extravaganza in Doha.

- July 2022: Theeb Rent-A-Car opened its second location in Hail City, Saudi Arabia, as part of its expansion plans to cover all cities, regions, and provinces in the country, aiming to enhance services for individuals, businesses, and government agencies.

- March 2022: Selfdrive, a car rental technology platform, announced the opening of offices in Qatar and Bahrain, following its expansion into Oman, with ambitions to capture 50-65% of the digital rental market share in these new markets through its wide product offerings and customer experience.

Strategic Outlook for Middle East Online Car Rental Market Market

The strategic outlook for the Middle East online car rental market is exceptionally positive, driven by a confluence of factors poised to accelerate growth and innovation. Continued investment in tourism and infrastructure across key nations will undoubtedly fuel demand for rental services. The ongoing digital transformation narrative in the region empowers online platforms, making them the preferred channel for bookings. Companies that strategically invest in fleet modernization, particularly towards greener alternatives, and leverage advanced technology for seamless customer journeys will gain a significant competitive advantage. Exploring new service models like car subscriptions and embracing mobility-as-a-service concepts will be crucial for long-term success and market leadership in this dynamic sector.

Middle East Online Car Rental Market Segmentation

-

1. Booking type

- 1.1. Online booking

- 1.2. Offline booking

-

2. Application

- 2.1. Leisure/Tourism

- 2.2. Daily utility

-

3. Vehicle Type

- 3.1. Economy cars

- 3.2. Luxury cars

-

4. End-User Type

- 4.1. Self-driven

- 4.2. Chauffeur

Middle East Online Car Rental Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Online Car Rental Market Regional Market Share

Geographic Coverage of Middle East Online Car Rental Market

Middle East Online Car Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Inbound Tourism to Fuel Market Growth

- 3.3. Market Restrains

- 3.3.1. Strict Government Regulations and Policies Toward Car Rental Service Deter Market Growth

- 3.4. Market Trends

- 3.4.1. Online Rental Booking Continues to Witness Major Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Online Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking type

- 5.1.1. Online booking

- 5.1.2. Offline booking

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Leisure/Tourism

- 5.2.2. Daily utility

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Economy cars

- 5.3.2. Luxury cars

- 5.4. Market Analysis, Insights and Forecast - by End-User Type

- 5.4.1. Self-driven

- 5.4.2. Chauffeur

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Booking type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Fast Rent a Car

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 National Rent A Car*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Europcar

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Enterprise Holdings Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hanco

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Theeb Rent A Car

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hertz Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sixt SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Avis Budget Group Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Fast Rent a Car

List of Figures

- Figure 1: Middle East Online Car Rental Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East Online Car Rental Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Online Car Rental Market Revenue billion Forecast, by Booking type 2020 & 2033

- Table 2: Middle East Online Car Rental Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Middle East Online Car Rental Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Middle East Online Car Rental Market Revenue billion Forecast, by End-User Type 2020 & 2033

- Table 5: Middle East Online Car Rental Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Middle East Online Car Rental Market Revenue billion Forecast, by Booking type 2020 & 2033

- Table 7: Middle East Online Car Rental Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Middle East Online Car Rental Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 9: Middle East Online Car Rental Market Revenue billion Forecast, by End-User Type 2020 & 2033

- Table 10: Middle East Online Car Rental Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Saudi Arabia Middle East Online Car Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: United Arab Emirates Middle East Online Car Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Israel Middle East Online Car Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Qatar Middle East Online Car Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Kuwait Middle East Online Car Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Oman Middle East Online Car Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Bahrain Middle East Online Car Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Jordan Middle East Online Car Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Lebanon Middle East Online Car Rental Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Online Car Rental Market?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Middle East Online Car Rental Market?

Key companies in the market include Fast Rent a Car, National Rent A Car*List Not Exhaustive, Europcar, Enterprise Holdings Inc, Hanco, Theeb Rent A Car, Hertz Corp, Sixt SE, Avis Budget Group Inc.

3. What are the main segments of the Middle East Online Car Rental Market?

The market segments include Booking type, Application, Vehicle Type, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.85 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Inbound Tourism to Fuel Market Growth.

6. What are the notable trends driving market growth?

Online Rental Booking Continues to Witness Major Demand.

7. Are there any restraints impacting market growth?

Strict Government Regulations and Policies Toward Car Rental Service Deter Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Zofeur launched its first business-to-business on-demand driver service in Dubai. Zofeur is the world's first platform for on-demand, pay-per-minute chauffeur services. With Zofeur's B2B tool, automotive service providers can seamlessly integrate their systems with Zofeur to book pay-per-use on-demand drivers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Online Car Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Online Car Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Online Car Rental Market?

To stay informed about further developments, trends, and reports in the Middle East Online Car Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence