Key Insights

The North American automotive interiors market is projected for substantial growth, anticipated to reach $176.44 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 2.2%. This expansion is fueled by rising demand for advanced infotainment, smart technology integration, and enhanced passenger comfort and personalization. Shifting consumer preferences towards premium interior features are driving innovation in digital displays, ambient lighting, and advanced seating. The commercial vehicle sector also contributes through fleet modernization and the need for ergonomic driver environments. Key players are investing in R&D for lightweight materials, sustainable design, and connected car technologies.

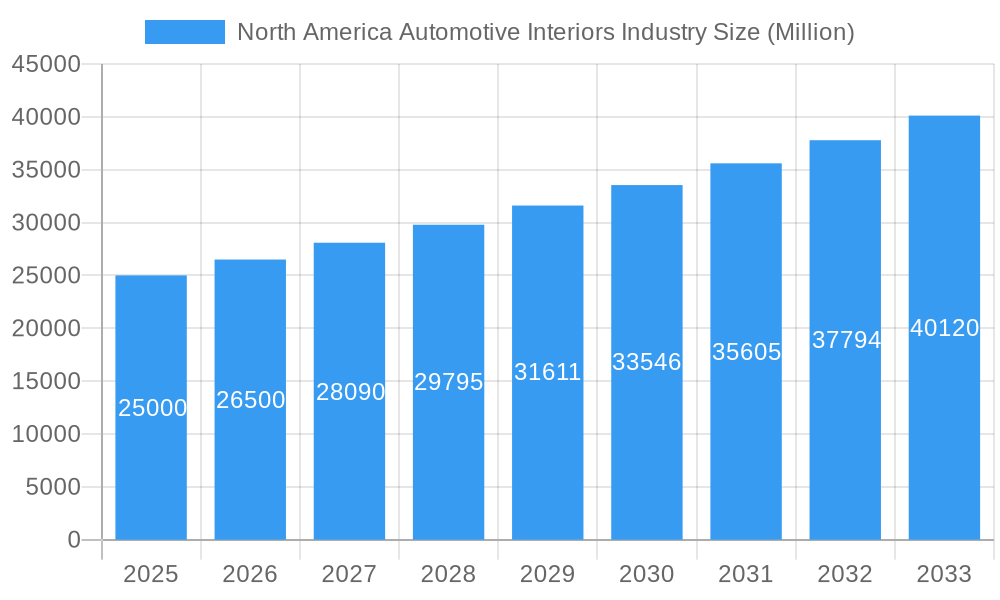

North America Automotive Interiors Industry Market Size (In Billion)

Market dynamics are influenced by electrification and autonomous driving, requiring redesigned interior architectures and new functionalities. Electric vehicles (EVs) enable more spacious interiors, while autonomous driving opens new in-cabin experiences. Challenges include supply chain disruptions, raw material price volatility, and high implementation costs for advanced technologies. Stringent environmental regulations and demand for sustainable materials necessitate eco-friendly practices, potentially increasing short-term production costs. Nevertheless, the ongoing trend towards sophisticated, connected, and comfortable automotive interiors, alongside technological advancements, indicates a dynamic future for the North American automotive interiors industry.

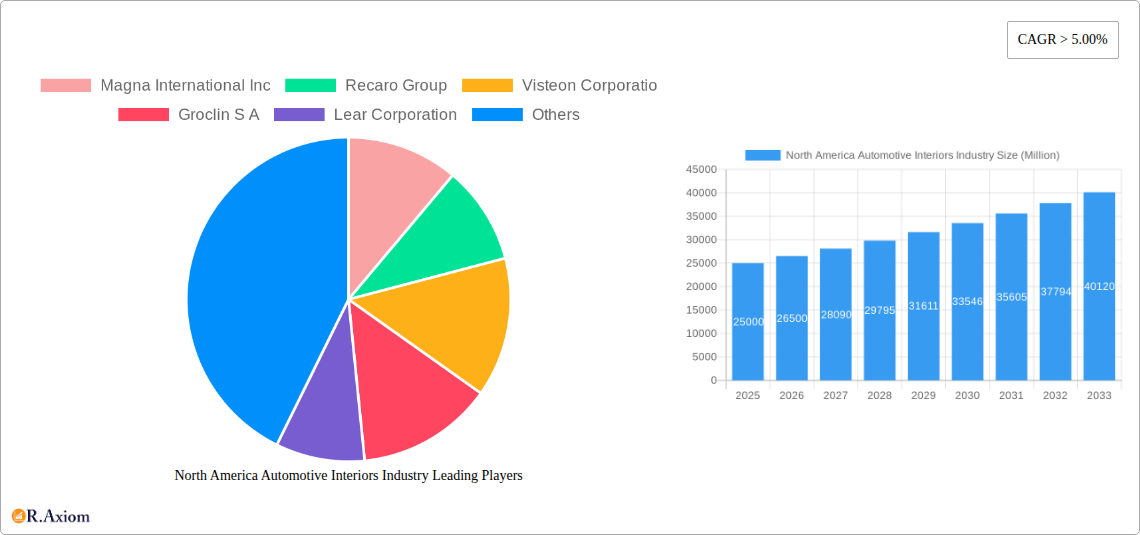

North America Automotive Interiors Industry Company Market Share

North America Automotive Interiors Industry Market Concentration & Innovation

The North America automotive interiors market exhibits a moderate to high level of concentration, with a few key players like Magna International Inc., Lear Corporation, and Faurecia dominating significant market share. The estimated market share for these leading entities ranges from 15% to 25% each as of the base year 2025. Innovation is a critical differentiator, driven by the relentless pursuit of enhanced passenger comfort, safety, and advanced technological integration. Key innovation drivers include the growing demand for sustainable materials, lightweighting solutions, and sophisticated infotainment systems. Regulatory frameworks, such as evolving safety standards and emissions regulations impacting vehicle design, also play a crucial role in shaping interior innovation. The threat of product substitutes, while present in the form of aftermarket upgrades, remains relatively low for integrated OEM interior components. End-user trends are leaning towards personalized cabin experiences, increased connectivity, and premium material finishes, especially within the passenger car segment. Mergers and acquisitions (M&A) activity is a notable feature of the industry, with a projected M&A deal value of over $1,500 million in the forecast period (2025-2033). These activities aim to consolidate market presence, acquire new technologies, and expand product portfolios, further influencing market concentration.

North America Automotive Interiors Industry Industry Trends & Insights

The North America automotive interiors industry is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and economic factors. The overall market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025-2033). A significant trend shaping the industry is the electrification of vehicles. This shift necessitates new interior designs and functionalities, including optimized battery integration, thermal management solutions, and enhanced noise, vibration, and harshness (NVH) control to compensate for the absence of traditional engine noise. The market penetration of advanced driver-assistance systems (ADAS) is also on the rise, leading to increased demand for integrated displays, haptic feedback mechanisms, and intuitive user interfaces within the instrument panels and infotainment systems.

Consumer demand for personalized and connected cabin experiences is a powerful growth driver. This translates to a focus on premium materials, ambient lighting, advanced audio systems, and seamless integration of personal devices. The rise of shared mobility services and autonomous driving technologies also influences interior design, with a greater emphasis on modularity, reconfigurability, and passenger well-being. The industry is also witnessing a strong push towards sustainability. Automakers and suppliers are actively exploring the use of recycled plastics, bio-based materials, and vegan leather alternatives to meet growing environmental consciousness among consumers and regulatory pressures. This focus on eco-friendly interiors presents a significant opportunity for innovation and market differentiation.

Technological disruptions are primarily centered around smart materials, advanced displays, and in-cabin sensing technologies. For instance, the integration of flexible OLED displays, augmented reality (AR) heads-up displays (HUDs), and biometric sensors for driver monitoring and personalization are becoming increasingly prevalent. The competitive dynamics are characterized by intense R&D investments, strategic partnerships between OEMs and Tier 1 suppliers, and a growing presence of technology companies entering the automotive space. The industry is adapting to evolving supply chain landscapes, with a renewed focus on resilience and regionalization to mitigate potential disruptions. The shift towards software-defined vehicles is also impacting interior components, demanding greater connectivity and over-the-air update capabilities for infotainment and control systems.

Dominant Markets & Segments in North America Automotive Interiors Industry

The North America automotive interiors industry is characterized by the dominance of Passenger Cars within the Vehicle Type segment, accounting for an estimated 75% of the market share in 2025. This dominance is propelled by strong consumer demand for personal mobility, technological advancements catering to comfort and entertainment, and a wider array of vehicle models and configurations available in this segment. Economic policies supporting the automotive sector, coupled with robust consumer spending power, contribute significantly to this trend. Infrastructure development and the availability of sophisticated manufacturing capabilities further bolster the dominance of passenger cars.

Within the Component Type segment, the Infotainment System is a leading contributor, estimated to hold a market share of over 30% in 2025. The increasing integration of advanced connectivity features, large touchscreens, voice control, and personalized user experiences are key drivers for this segment. The demand for seamless integration of navigation, entertainment, and communication functionalities fuels its growth. The Instrument Panels also represent a significant segment, driven by the need for advanced digital displays, integrated safety features, and ergonomic designs. The ongoing evolution towards digital cockpits and the integration of ADAS functionalities directly impact the demand and complexity of instrument panels.

The Commercial Vehicles segment, while smaller than passenger cars, is experiencing steady growth, particularly in logistics and delivery services. The demand for durable, functional, and ergonomically designed interiors to enhance driver productivity and safety is a key driver. Economic policies related to trade and logistics, as well as the growth of e-commerce, directly influence the demand for commercial vehicles and their interior components.

Interior Lighting is another growing segment, with consumers increasingly seeking customizable ambient lighting solutions to enhance cabin ambiance and passenger experience. Technological advancements in LED and OLED lighting offer greater flexibility and energy efficiency. The "Others" category, encompassing components like seats, headliners, and floor mats, also contributes substantially to the market, with a continuous focus on comfort, durability, and sustainable materials. The dominance within these segments is further reinforced by the presence of major automotive hubs and a well-established supply chain infrastructure across North America.

North America Automotive Interiors Industry Product Developments

Product innovations in the North America automotive interiors industry are predominantly focused on enhancing user experience, safety, and sustainability. Key advancements include the development of highly integrated and customizable infotainment systems featuring larger, higher-resolution displays and advanced AI-powered voice assistants. Instrument panels are evolving into sophisticated digital cockpits with augmented reality capabilities and intuitive gesture controls. Interior lighting is moving beyond basic illumination to dynamic ambient lighting systems that can adapt to driving conditions or passenger preferences. Furthermore, there is a significant push towards sustainable and recycled materials for various interior components, offering both environmental benefits and unique aesthetic qualities. These developments provide competitive advantages by meeting the growing demand for premium, tech-enabled, and eco-conscious cabin environments.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North America automotive interiors industry, segmenting the market across key parameters.

Vehicle Type: The report analyzes the Passenger Cars segment, which is expected to maintain its dominant position due to high consumer demand and technological integration. The Commercial Vehicles segment is also examined, highlighting its growth driven by logistics and fleet management needs.

Component Type: The report delves into the Infotainment System segment, a critical area of innovation driven by connectivity and user experience. The Instrument Panels segment is analyzed for its evolution towards digital cockpits and ADAS integration. Interior Lighting is explored for its role in cabin ambiance and personalization. The Others segment encompasses various interior components such as seating, upholstery, and trim. Growth projections and market sizes are provided for each of these segments, alongside insights into their respective competitive dynamics.

Key Drivers of North America Automotive Interiors Industry Growth

The North America automotive interiors industry's growth is propelled by several key factors. Technological advancements, particularly in infotainment systems and connectivity, are a primary driver, enhancing passenger experience and vehicle functionality. The increasing adoption of electric vehicles (EVs) necessitates new interior designs, creating a demand for specialized components. Growing consumer preference for premium features, comfort, and personalization further fuels market expansion. Supportive government regulations promoting vehicle safety and emissions standards also indirectly influence interior design and material choices. The robust economic conditions in North America, coupled with rising disposable incomes, contribute to increased demand for new vehicles equipped with advanced interior features.

Challenges in the North America Automotive Interiors Industry Sector

Despite robust growth prospects, the North America automotive interiors industry faces several challenges. Supply chain disruptions, including raw material shortages and logistical bottlenecks, continue to pose a significant threat, impacting production timelines and costs. The increasing complexity of integrated electronic systems and software requires significant R&D investment, presenting a high technological barrier. Fluctuating raw material prices, especially for plastics and rare earth metals, can impact profitability. Intense competitive pressure among established players and emerging technology companies necessitates continuous innovation and cost optimization. Furthermore, stringent regulatory hurdles related to safety, emissions, and material content require constant adaptation and compliance.

Emerging Opportunities in North America Automotive Interiors Industry

Emerging opportunities in the North America automotive interiors industry are multifaceted. The accelerating transition to electric vehicles (EVs) presents a prime opportunity for innovative interior solutions, including lightweighting, thermal management, and novel passenger comfort features. The growing demand for sustainable and eco-friendly materials offers significant potential for companies developing and utilizing recycled and bio-based interior components. The rise of autonomous driving will reshape interior cabin design, creating opportunities for modularity, entertainment-focused spaces, and enhanced passenger well-being solutions. Furthermore, the increasing integration of artificial intelligence (AI) and connectivity opens avenues for personalized user experiences, in-cabin sensing, and advanced human-machine interfaces.

Leading Players in the North America Automotive Interiors Industry Market

- Magna International Inc.

- Recaro Group

- Visteon Corporation

- Groclin S A

- Lear Corporation

- Faurecia

- Adient PLC

- Pioneer Corporation

- Grammer AG

- Panasonic Corporation

Key Developments in North America Automotive Interiors Industry Industry

- 2023: Magna International Inc. announces significant investment in advanced seating technologies, focusing on lightweighting and enhanced comfort features.

- 2023: Faurecia unveils its latest generation of sustainable interior materials, incorporating recycled plastics and natural fibers.

- 2024: Visteon Corporation showcases its next-generation digital cockpit solutions with integrated AI capabilities at CES.

- 2024: Lear Corporation expands its global R&D capabilities in North America, focusing on EV interior solutions and advanced materials.

- 2024: Adient PLC announces strategic partnerships to develop innovative seating solutions for autonomous and shared mobility vehicles.

- 2024: Panasonic Corporation introduces advanced in-cabin audio and visual systems optimized for immersive passenger experiences.

- 2025: Grammer AG highlights its commitment to sustainable manufacturing processes and the development of bio-based interior components.

- 2025: Recaro Group continues to focus on high-performance and ergonomic seating solutions, expanding its offerings for performance-oriented vehicles.

- 2025: Pioneer Corporation announces advancements in automotive display technologies, emphasizing enhanced visual clarity and interactivity.

- 2025: Groclin S A strengthens its position in automotive textiles with a focus on durable and aesthetically pleasing sustainable fabric solutions.

Strategic Outlook for North America Automotive Interiors Industry Market

The strategic outlook for the North America automotive interiors industry is overwhelmingly positive, driven by sustained innovation and evolving consumer demands. The continuous integration of advanced technologies, particularly in infotainment, connectivity, and ADAS, will remain a core growth catalyst. The accelerating shift towards electric vehicles provides a fertile ground for new interior architectures and functionalities. Furthermore, the growing emphasis on sustainability will drive the adoption of eco-friendly materials and manufacturing processes. Strategic partnerships, M&A activities, and substantial R&D investments are expected to shape the competitive landscape, leading to market consolidation and the emergence of new leaders. The industry is well-positioned to capitalize on the growing demand for personalized, connected, and comfortable in-cabin experiences, ensuring robust future market potential.

North America Automotive Interiors Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Component Type

- 2.1. Infotainment System

- 2.2. Instrument Panels

- 2.3. Interior Lighting

- 2.4. Others

North America Automotive Interiors Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

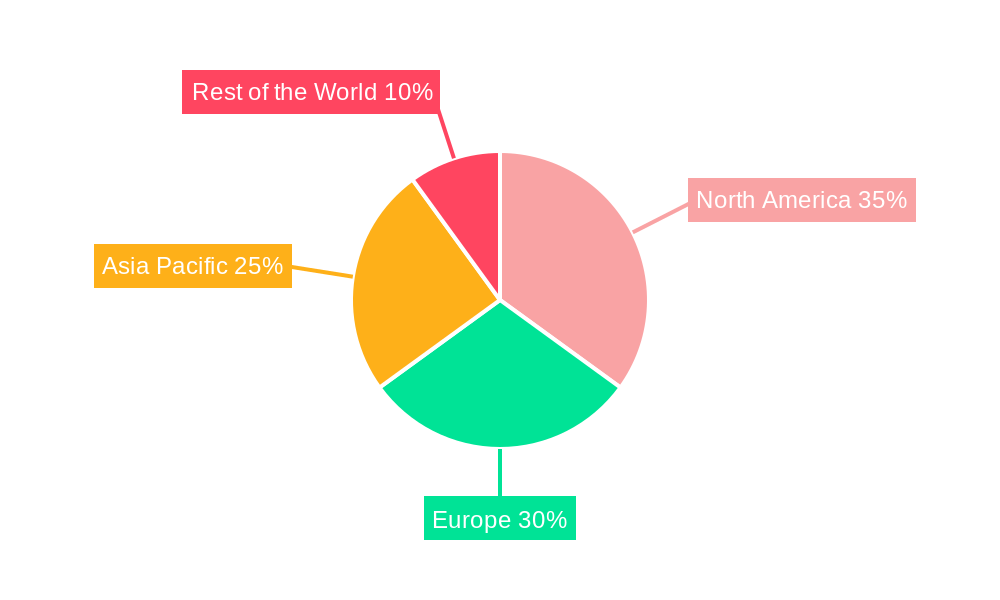

North America Automotive Interiors Industry Regional Market Share

Geographic Coverage of North America Automotive Interiors Industry

North America Automotive Interiors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. Electric Vehicles will Fuel the Growth of Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Interiors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Infotainment System

- 5.2.2. Instrument Panels

- 5.2.3. Interior Lighting

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Magna International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Recaro Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Visteon Corporatio

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Groclin S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lear Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Faurecia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Adient PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pioneer Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Grammer AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Magna International Inc

List of Figures

- Figure 1: North America Automotive Interiors Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Automotive Interiors Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Automotive Interiors Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: North America Automotive Interiors Industry Revenue billion Forecast, by Component Type 2020 & 2033

- Table 3: North America Automotive Interiors Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Automotive Interiors Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: North America Automotive Interiors Industry Revenue billion Forecast, by Component Type 2020 & 2033

- Table 6: North America Automotive Interiors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Automotive Interiors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Automotive Interiors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Automotive Interiors Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Interiors Industry?

The projected CAGR is approximately 2.2%.

2. Which companies are prominent players in the North America Automotive Interiors Industry?

Key companies in the market include Magna International Inc, Recaro Group, Visteon Corporatio, Groclin S A, Lear Corporation, Faurecia, Adient PLC, Pioneer Corporation, Grammer AG, Panasonic Corporation.

3. What are the main segments of the North America Automotive Interiors Industry?

The market segments include Vehicle Type, Component Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 176.44 billion as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Electric Vehicles will Fuel the Growth of Market..

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Interiors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Interiors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Interiors Industry?

To stay informed about further developments, trends, and reports in the North America Automotive Interiors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence