Key Insights

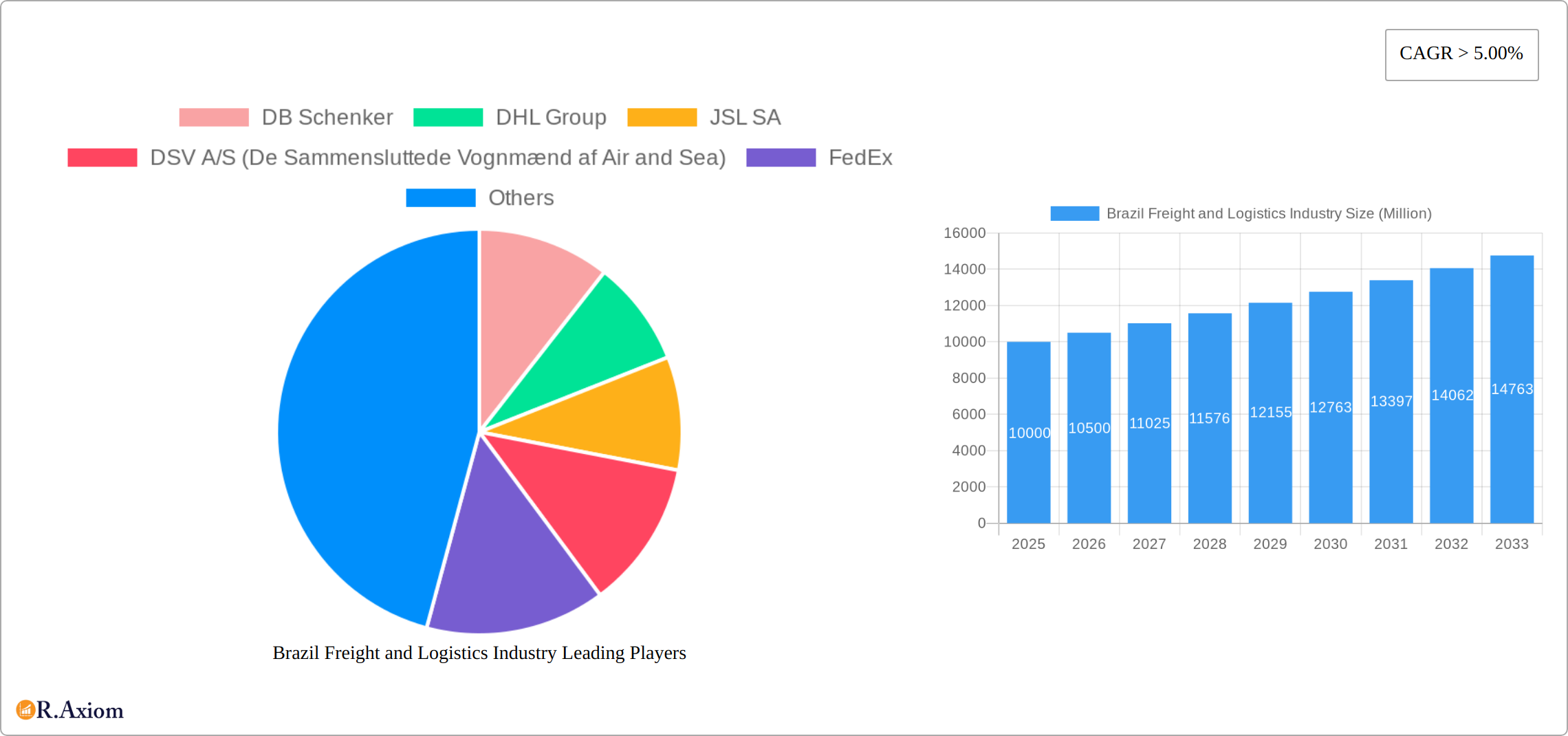

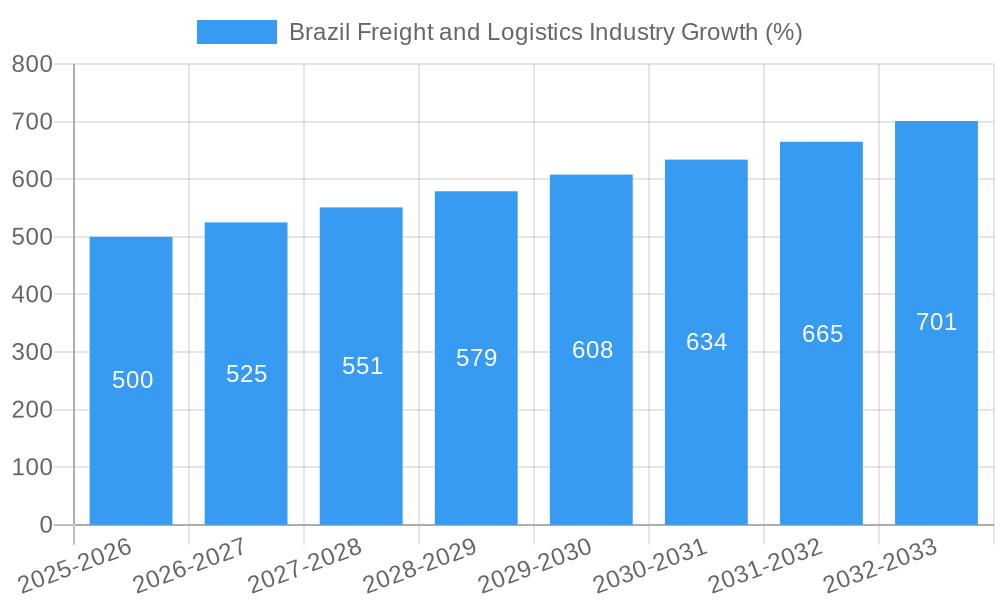

The Brazilian freight and logistics market, valued at approximately $XX million in 2025, exhibits robust growth potential, exceeding a 5% CAGR through 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector necessitates efficient delivery networks, driving demand for courier, express, and parcel (CEP) services, especially temperature-controlled options for perishable goods. Simultaneously, growth in sectors like agriculture, construction, and manufacturing fuels demand for broader freight solutions. Brazil's vast geographical expanse and diverse industrial landscape necessitate a robust logistics infrastructure to support these sectors' expansion. While challenges such as infrastructure limitations and regulatory hurdles remain, ongoing investments in infrastructure modernization and streamlining logistics processes are expected to mitigate these restraints. The market is segmented by end-user industry (Agriculture, Fishing & Forestry; Construction; Manufacturing; Oil & Gas; Mining & Quarrying; Wholesale & Retail Trade; Others) and logistics function (CEP, Temperature Controlled, Other Services), offering diverse opportunities for players like DB Schenker, DHL, JSL, DSV, FedEx, and others.

The competitive landscape is marked by a blend of established multinational corporations and local players. International firms leverage their extensive networks and advanced technologies, while domestic companies benefit from local market expertise and tailored solutions. The temperature-controlled segment, driven by the increasing demand for food and pharmaceutical products, is anticipated to witness significant growth. The market's future success is intrinsically linked to continuous improvement in infrastructure, technological advancements (such as real-time tracking and improved route optimization), and government policies aimed at streamlining regulations and fostering a more efficient logistics ecosystem. The presence of major players indicates a mature and competitive market with significant potential for further expansion and innovation in the coming years. This growth trajectory is poised to create significant opportunities for both established players and new entrants, particularly those offering specialized services and technologically advanced solutions.

Brazil Freight and Logistics Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Brazilian freight and logistics industry, encompassing market size, segmentation, key players, growth drivers, challenges, and future opportunities. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for businesses, investors, and stakeholders seeking a deep understanding of this dynamic market.

Brazil Freight and Logistics Industry Market Concentration & Innovation

The Brazilian freight and logistics industry exhibits a moderately concentrated market structure, with several major players dominating specific segments. Key players like DHL Group, DB Schenker, and JSL SA hold significant market share, though the market also features a multitude of smaller, specialized firms. Market share data for 2024 indicates DHL Group holds approximately xx%, DB Schenker xx%, and JSL SA xx%, with the remaining share distributed amongst numerous regional and niche players.

Innovation in the sector is driven by several factors:

- Technological advancements: The adoption of digital technologies, such as blockchain, IoT, and AI, is streamlining operations, enhancing efficiency, and improving visibility across the supply chain.

- Regulatory changes: Government initiatives aimed at improving infrastructure and reducing bureaucracy are fostering innovation and competition.

- Sustainability concerns: Growing environmental awareness is pushing companies to adopt more sustainable practices, leading to innovations in green logistics solutions.

- E-commerce boom: The rapid expansion of e-commerce is creating demand for faster, more efficient delivery services, driving innovation in last-mile logistics.

Mergers and acquisitions (M&A) activity has been relatively active, with several significant deals in recent years. While precise deal values are not consistently publicly available, transactions involving major players have typically exceeded USD xx Million, reflecting consolidation trends and the pursuit of scale and diversification.

Brazil Freight and Logistics Industry Industry Trends & Insights

The Brazilian freight and logistics market is experiencing robust growth, driven by several key factors. The rising e-commerce sector is fueling demand for efficient delivery services, contributing significantly to the industry’s expansion. Technological advancements, such as the adoption of advanced tracking systems and automated warehouses, are enhancing operational efficiency and reducing costs. Furthermore, infrastructure investments by the government are improving connectivity and reducing transportation times, boosting overall market growth.

The market is witnessing a shift towards more specialized services, including temperature-controlled transportation and specialized handling of high-value goods. Consumer preference for faster and more reliable delivery is driving the adoption of innovative logistics solutions. Competitive dynamics are marked by intense rivalry among major players, with a focus on price competitiveness, service quality, and technological innovation. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, with market penetration expected to reach xx% by 2033.

Dominant Markets & Segments in Brazil Freight and Logistics Industry

The Brazilian freight and logistics market demonstrates significant diversity across various end-user industries and logistics functions.

Dominant End-User Industries:

- Manufacturing: This sector constitutes a substantial portion of the freight and logistics demand, driven by the need for efficient movement of raw materials, intermediate goods, and finished products. Key drivers include robust industrial production and export activities.

- Wholesale and Retail Trade: The expansion of e-commerce and organized retail has significantly increased demand for efficient last-mile delivery services, bolstering the growth of this segment. Strong consumer spending and rising urbanization are major contributors.

- Oil and Gas: This industry requires specialized logistics solutions for transporting heavy and hazardous materials, leading to high demand for specialized carriers and handling services. Government investments in the energy sector further fuel market growth.

Dominant Logistics Functions:

- Courier, Express, and Parcel (CEP): The surge in e-commerce has fueled significant growth in this segment. Increased consumer demand for fast and reliable delivery is driving technological advancements and service innovation.

- Temperature Controlled: The healthcare and food & beverage industries’ growing demands for reliable temperature-controlled transportation are driving significant growth in this niche. Stringent regulatory requirements and specialized infrastructure are key factors.

Brazil Freight and Logistics Industry Product Developments

Recent product innovations in the Brazilian freight and logistics industry are primarily focused on enhancing efficiency, sustainability, and visibility across the supply chain. Companies are investing heavily in technological advancements like advanced tracking systems, AI-powered route optimization, and blockchain-based solutions for increased transparency. These innovations address market demands for enhanced efficiency, cost reduction, and improved supply chain resilience. The market fit for these developments is strong, given the pressing need for optimization in a rapidly expanding market.

Report Scope & Segmentation Analysis

This report segments the Brazilian freight and logistics market across several dimensions:

End-User Industry: Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; Others. Each segment exhibits unique growth trajectories and competitive dynamics, reflecting the specific demands of each industry. Market sizes and growth projections vary significantly across these segments, with manufacturing and wholesale/retail trade showing the most significant growth potential.

Logistics Function: Courier, Express, and Parcel (CEP); Temperature Controlled; Other Services. The CEP segment displays the highest growth rate due to e-commerce expansion. Temperature-controlled logistics is a high-growth niche driven by healthcare and food & beverage industry needs. Other services comprise a diverse array of specialized offerings. Competitive dynamics differ across these functions.

Key Drivers of Brazil Freight and Logistics Industry Growth

The Brazilian freight and logistics industry’s growth is fueled by several interconnected factors: the booming e-commerce sector’s demand for efficient delivery; substantial investments in infrastructure development improving connectivity and reducing transportation times; technological advancements enhancing operational efficiency; and increasing government initiatives supporting logistics sector growth and reducing bureaucratic hurdles. These factors create a positive feedback loop, driving sustained market expansion.

Challenges in the Brazil Freight and Logistics Industry Sector

The Brazilian freight and logistics industry faces several challenges. Infrastructure limitations, particularly in certain regions, constrain efficiency and increase costs. Bureaucratic hurdles and regulatory complexities pose significant operational challenges. Intense competition among players requires constant innovation and efficiency improvements. Furthermore, fluctuations in fuel prices and economic instability can impact profitability. These challenges necessitate strategic adjustments and innovative solutions for sustained success.

Emerging Opportunities in Brazil Freight and Logistics Industry

Emerging opportunities abound in the Brazilian freight and logistics market. The growth of e-commerce presents significant potential for last-mile delivery optimization. Investment in sustainable logistics solutions and technology adoption offers significant competitive advantage. Expansion into underserved regional markets presents attractive growth possibilities. Moreover, the increasing focus on supply chain resilience and risk management creates demand for specialized services and solutions.

Leading Players in the Brazil Freight and Logistics Industry Market

- DB Schenker

- DHL Group

- JSL SA

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- FedEx

- DC Logistics Brasil

- Kuehne + Nagel

- Braspress Transportes Urgentes

- AMTrans Logistics

- TBL - Transportes Bertolini Ltda

- Tegma Gestao Logistica S

- Gafor SA

Key Developments in Brazil Freight and Logistics Industry Industry

- February 2024: DHL Supply Chain and Adidas inaugurated a state-of-the-art distribution center in Brazil, incorporating innovative technologies and sustainable practices. This signifies a significant investment in advanced logistics infrastructure, enhancing efficiency and setting a benchmark for industry standards.

- January 2024: Polar, a DHL Group subsidiary, expanded its fleet with multi-temperature trucks, catering to the specialized needs of the healthcare logistics market. This demonstrates a strategic move to address a growing niche and highlights the increasing demand for specialized temperature-controlled transportation.

- January 2024: Kuehne + Nagel launched its Book & Claim insetting solution for electric vehicles, improving its decarbonization solutions. This reflects the industry's growing focus on sustainability and commitment to reducing its environmental footprint.

Strategic Outlook for Brazil Freight and Logistics Industry Market

The Brazilian freight and logistics market exhibits robust growth potential driven by ongoing e-commerce expansion, infrastructure development, and technological advancements. Companies that strategically embrace technological innovation, focus on sustainability, and adapt to the evolving needs of diverse end-user industries are poised for significant success. The market's future prospects are positive, with continued expansion expected across various segments.

Brazil Freight and Logistics Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Brazil Freight and Logistics Industry Segmentation By Geography

- 1. Brazil

Brazil Freight and Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase demand of Petrochemical is driving the market4.; Increase in Investments is driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Operations

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JSL SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DC Logistics Brasil

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Braspress Transportes Urgentes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AMTrans Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TBL - Transportes Bertolini Ltda

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tegma Gestao Logistica S

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Gafor SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Brazil Freight and Logistics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Freight and Logistics Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Freight and Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Freight and Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Brazil Freight and Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Brazil Freight and Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazil Freight and Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Freight and Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 7: Brazil Freight and Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 8: Brazil Freight and Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Freight and Logistics Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Brazil Freight and Logistics Industry?

Key companies in the market include DB Schenker, DHL Group, JSL SA, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), FedEx, DC Logistics Brasil, Kuehne + Nagel, Braspress Transportes Urgentes, AMTrans Logistics, TBL - Transportes Bertolini Ltda, Tegma Gestao Logistica S, Gafor SA.

3. What are the main segments of the Brazil Freight and Logistics Industry?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase demand of Petrochemical is driving the market4.; Increase in Investments is driving the market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; High Cost of Operations.

8. Can you provide examples of recent developments in the market?

February 2024: DHL Supply Chain and ADIDAS, inaugurated one of the most modern Distribution Centers (DCs) in Brazil. With an investment of more than USD 14M (R$ 70 million), the facilities were built from scratch especially for this project and add innovative technologies and sustainable practices. The new CD, with nearly 40,000 m², will be adidas' main logistics operations center in Brazil, serving the three areas (e-commerce, retail and own stores) in a synergistic way in a more agile, efficient and technological logistics design.January 2024: Polar, a DHL Group company specialized in the transportation of medicines, vaccines and other medical and hospital supplies, has included in its fleet currently composed of more than 350 vehicles, 5 multi-temperature trucks, in an investment of more than R$ 5 million. The new vehicle profile makes it possible to deliver products that require different temperature ranges, something that is still uncommon in the health logistics market in Brazil.January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Freight and Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Freight and Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Freight and Logistics Industry?

To stay informed about further developments, trends, and reports in the Brazil Freight and Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence