Key Insights

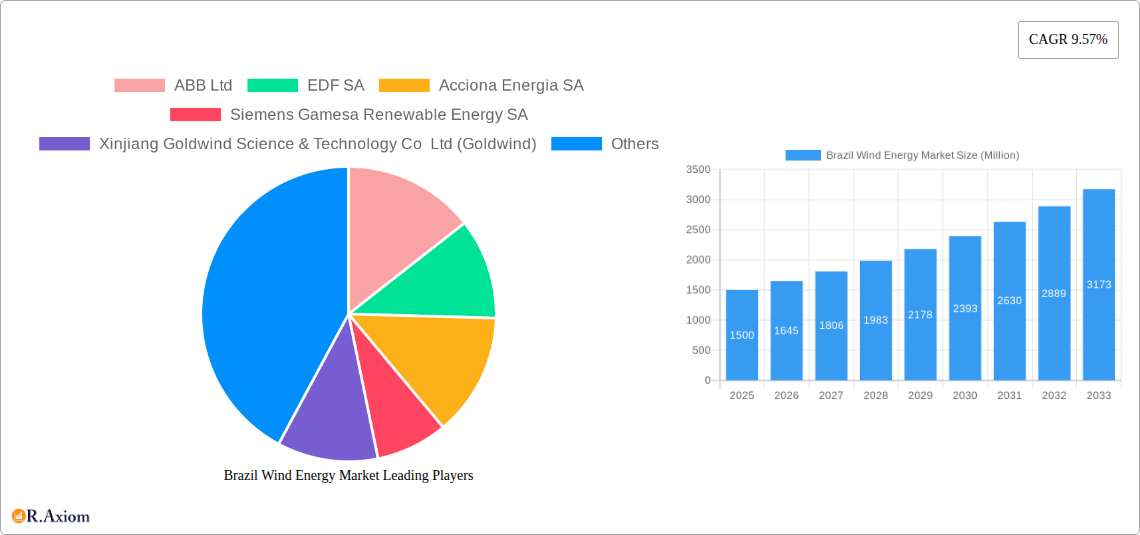

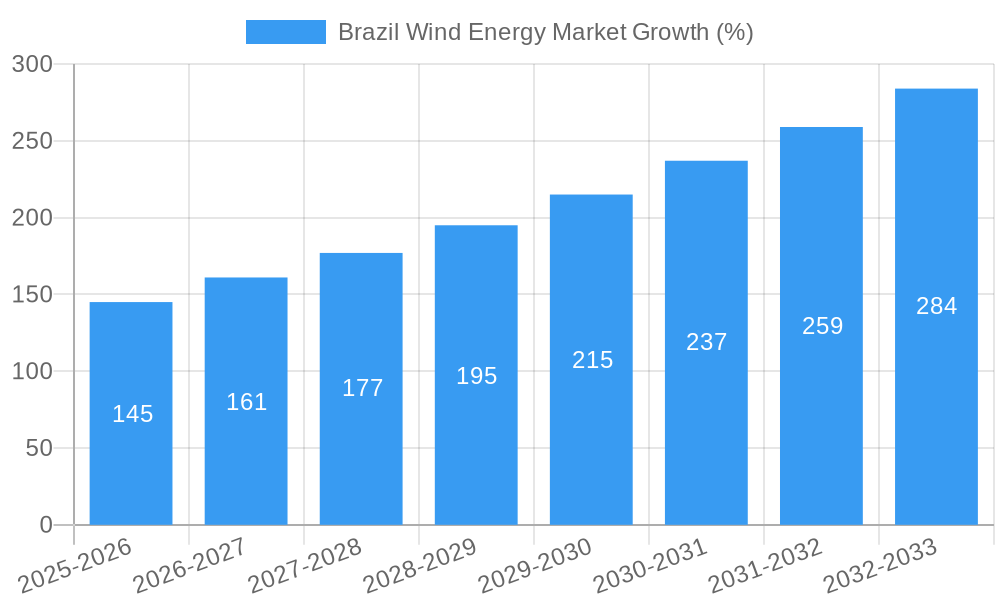

The Brazilian wind energy market presents a compelling investment opportunity, exhibiting robust growth potential fueled by supportive government policies promoting renewable energy sources and a significant untapped wind resource potential. The market, valued at approximately $X million in 2025 (assuming a logical extrapolation based on the provided CAGR of 9.57% and the unspecified 2019-2024 market size), is projected to experience sustained expansion throughout the forecast period (2025-2033). This growth is driven by increasing electricity demand, coupled with Brazil's commitment to diversifying its energy mix and reducing its carbon footprint. Key market segments include onshore wind projects, which currently dominate, and variable-speed turbines offering higher efficiency and energy capture. Larger capacity wind farms are also gaining traction, reflecting economies of scale and technological advancements. Leading players like ABB, EDF, Siemens Gamesa, and Vestas are actively shaping the market landscape through strategic investments and project developments. However, challenges remain, including the need for improved grid infrastructure to accommodate the influx of renewable energy and overcoming regulatory hurdles in certain regions.

The ongoing expansion of wind energy in Brazil is significantly influenced by the country's commitment to environmental sustainability and energy security. The ongoing investment in transmission and distribution networks is vital to address grid integration challenges and ensure reliable electricity delivery. The continuous technological advancements in turbine technology, such as the increasing adoption of variable-speed turbines, further contribute to the overall market growth. Moreover, the government's incentives and supportive policies are expected to continue attracting foreign investment and driving the development of new wind energy projects across different regions within the country. The onshore segment is likely to remain dominant due to its lower initial investment cost and established infrastructure. However, offshore wind energy is likely to witness increasing interest in the coming years as technological hurdles are overcome and favorable offshore wind resources are identified and tapped into. Market competition is intense, with established international players alongside domestic companies vying for market share.

Brazil Wind Energy Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Brazil wind energy market, encompassing historical data (2019-2024), current estimations (2025), and future projections (2025-2033). It offers invaluable insights for industry stakeholders, investors, and policymakers seeking to understand the market's dynamics, growth drivers, challenges, and opportunities. The report leverages rigorous research methodologies and incorporates key performance indicators to provide actionable intelligence.

Brazil Wind Energy Market Concentration & Innovation

The Brazilian wind energy market exhibits a moderately concentrated landscape, with a handful of major players dominating the market share. Key players such as ABB Ltd, EDF SA, Acciona Energia SA, Siemens Gamesa Renewable Energy SA, Xinjiang Goldwind Science & Technology Co Ltd (Goldwind), Vestas Wind Systems AS, Nordex SE, General Electric Company, and Neoenergia SA compete fiercely for market share. Market concentration is influenced by factors such as access to financing, technological capabilities, and project development expertise. While precise market share figures for each company vary year to year and are not publicly available in aggregate, Vestas and Siemens Gamesa consistently rank among the top players, holding a significant portion of the market.

Innovation in the Brazilian wind energy sector is driven by the need to enhance efficiency, reduce costs, and expand into new areas like offshore wind. This is evident in the adoption of larger turbine capacities, advanced blade designs, and improved energy storage solutions. The regulatory framework, while supportive of renewable energy development, still presents certain challenges. Product substitutes, mainly hydroelectric and solar power, exert competitive pressure. End-user trends favor large-scale wind farms supplying electricity to the national grid. Furthermore, Mergers and Acquisitions (M&A) activities are expected to increase to facilitate market consolidation and the expansion into new territories and technologies. The total value of M&A deals in the Brazilian wind energy sector in the past five years is estimated at xx Million, with a notable upward trend observed in recent years.

Brazil Wind Energy Market Industry Trends & Insights

The Brazilian wind energy market is experiencing substantial growth, propelled by several key factors. The country's ambitious renewable energy targets, coupled with government incentives and supportive policies, have significantly stimulated investment in wind power projects. This has resulted in a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to remain robust throughout the forecast period (2025-2033), with a CAGR of xx%. Technological advancements, such as the increasing adoption of larger capacity turbines and improved energy storage solutions, are enhancing the efficiency and cost-effectiveness of wind power generation. Consumer preferences are shifting towards cleaner energy sources, which is further driving market demand. The competitive landscape is characterized by intense competition among both domestic and international players, fostering innovation and driving down prices. Market penetration of wind energy in Brazil's power mix is steadily increasing, projected to reach xx% by 2033.

Dominant Markets & Segments in Brazil Wind Energy Market

- Location of Deployment: Onshore wind projects currently dominate the Brazilian market, owing to lower installation costs and established infrastructure. However, offshore wind is emerging as a significant growth area, with substantial potential yet to be realized. Government initiatives are designed to encourage offshore wind development, as offshore winds possess greater power potential.

- Turbine Type: Variable speed turbines are preferred over fixed-speed turbines due to their higher efficiency and ability to capture more energy from fluctuating winds.

- Rotor Orientation: Horizontal axis turbines (HATs) represent the overwhelmingly dominant technology in Brazil, offering higher energy capture efficiency. Vertical axis turbines (VATs) have limited market presence, despite possessing certain advantages, such as lower noise levels, owing to ongoing technological developments and economic viability.

- Capacity Range: Large capacity wind turbines are becoming increasingly prevalent, driven by economies of scale and reduced installation costs.

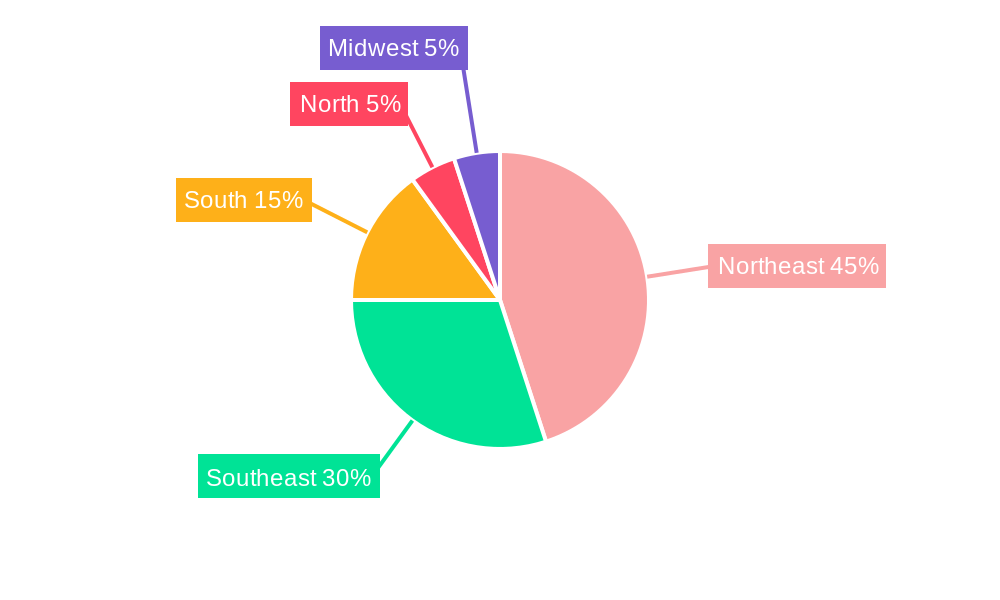

The Northeast region of Brazil is the dominant market for wind energy, benefitting from favorable wind resources and supportive government policies. This dominance is largely underpinned by the region's consistent high-speed winds, abundant available land, and well-established grid infrastructure. Economic policies like tax incentives and streamlined permitting processes have further fuelled the concentration of wind energy projects in this area.

Brazil Wind Energy Market Product Developments

Recent product innovations include the introduction of larger capacity wind turbines with improved blade designs and advanced control systems. These innovations increase energy output, reduce the levelized cost of energy (LCOE), and improve operational efficiency. The market is witnessing a growing integration of energy storage systems to address the intermittency of wind power. The focus is on enhancing the reliability and competitiveness of wind power by addressing the challenges posed by the variability of wind resources. This technological advancement is making wind energy more dependable for both grid integration and local applications.

Report Scope & Segmentation Analysis

This report segments the Brazil wind energy market based on location of deployment (onshore and offshore), turbine type (fixed speed and variable speed), rotor orientation (horizontal axis and vertical axis), and capacity range (small and large). Each segment is analyzed in detail, providing market size, growth projections, and competitive dynamics. For example, the onshore segment is expected to maintain its dominance due to established infrastructure, while the offshore segment is projected to witness exponential growth driven by government initiatives and technological advancements. Similarly, variable speed turbines are expected to gain further market share due to their superior performance, while the large capacity segment will benefit from economies of scale.

Key Drivers of Brazil Wind Energy Market Growth

Several factors contribute to the growth of the Brazilian wind energy market. These include: (1) supportive government policies and incentives promoting renewable energy adoption; (2) the declining cost of wind turbine technology; (3) substantial wind energy resources, particularly in the Northeast region; (4) growing demand for electricity and the need for diversification of the energy mix; (5) increasing environmental awareness among consumers and businesses. The country’s commitment to reducing its carbon footprint through the expansion of renewable energy infrastructure acts as a major catalyst for market growth.

Challenges in the Brazil Wind Energy Market Sector

The Brazilian wind energy market faces several challenges, including: (1) grid infrastructure limitations in certain regions, hindering the integration of newly installed wind capacity; (2) transmission and distribution infrastructure development; (3) land acquisition issues for large-scale wind farms; (4) regulatory uncertainty surrounding permits and licenses; and (5) financing constraints, particularly for offshore wind projects which require significant upfront capital investment. These factors can collectively impact project timelines, costs, and overall market growth. The lack of skilled labor in certain areas might hinder installation and maintenance operations.

Emerging Opportunities in Brazil Wind Energy Market

The Brazilian wind energy market presents significant opportunities, including: (1) the untapped potential of offshore wind resources; (2) the growth of hybrid renewable energy projects combining wind and solar power; (3) increased adoption of energy storage solutions to improve grid stability and reliability; (4) expansion into new regions with high wind potential; (5) the development of innovative financing mechanisms to attract more private investment in the sector.

Leading Players in the Brazil Wind Energy Market Market

- ABB Ltd

- EDF SA

- Acciona Energia SA

- Siemens Gamesa Renewable Energy SA

- Xinjiang Goldwind Science & Technology Co Ltd (Goldwind)

- Vestas Wind Systems AS

- Nordex SE

- General Electric Company

- Neoenergia SA

Key Developments in Brazil Wind Energy Market Industry

- October 2022: Engie and Vestas signed an agreement for an 846 MW Serra de Assurua wind farm in Bahia, Brazil, representing the largest wind project in Latin America upon completion. This signifies a significant investment in the Brazilian wind energy sector and highlights the increasing scale of projects.

- December 2022: Electrobras and Shell announced a cooperation agreement to co-invest in offshore wind power in Brazil. This marks a significant step towards developing Brazil's offshore wind capacity and highlights the growing interest in this sector from major international players.

Strategic Outlook for Brazil Wind Energy Market Market

The Brazilian wind energy market is poised for continued strong growth, driven by supportive government policies, technological advancements, and increasing demand for renewable energy. The development of offshore wind capacity holds significant potential for further expansion. The market is expected to attract substantial investment, particularly in large-scale projects and innovative technologies. The focus on optimizing grid integration and addressing challenges related to infrastructure development will shape future market dynamics.

Brazil Wind Energy Market Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

Brazil Wind Energy Market Segmentation By Geography

- 1. Brazil

Brazil Wind Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Electricity Demand4.; Renewable Capacity Installation Targets Set by the Government

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Adoption of Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Onshore Wind Energy Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Wind Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EDF SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Acciona Energia SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens Gamesa Renewable Energy SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Xinjiang Goldwind Science & Technology Co Ltd (Goldwind)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vestas Wind Systems AS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nordex SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Neoenergia SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Brazil Wind Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Wind Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Wind Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Wind Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Brazil Wind Energy Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 4: Brazil Wind Energy Market Volume gigawatt Forecast, by Location of Deployment 2019 & 2032

- Table 5: Brazil Wind Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Brazil Wind Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 7: Brazil Wind Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Brazil Wind Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 9: Brazil Wind Energy Market Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 10: Brazil Wind Energy Market Volume gigawatt Forecast, by Location of Deployment 2019 & 2032

- Table 11: Brazil Wind Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Wind Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Wind Energy Market?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Brazil Wind Energy Market?

Key companies in the market include ABB Ltd, EDF SA, Acciona Energia SA, Siemens Gamesa Renewable Energy SA, Xinjiang Goldwind Science & Technology Co Ltd (Goldwind), Vestas Wind Systems AS, Nordex SE, General Electric Company, Neoenergia SA.

3. What are the main segments of the Brazil Wind Energy Market?

The market segments include Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Electricity Demand4.; Renewable Capacity Installation Targets Set by the Government.

6. What are the notable trends driving market growth?

Onshore Wind Energy Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Adoption of Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

December 2022: Electrobras, a Brazilian power company, and Shell announced a cooperation agreement as they co-invested in offshore wind power in Brazil. It is a new development for Electrobras in renewable energy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Wind Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Wind Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Wind Energy Market?

To stay informed about further developments, trends, and reports in the Brazil Wind Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence