Key Insights

The Canadian condominiums and apartments market is projected to reach $1279.93 billion by 2025, demonstrating a Compound Annual Growth Rate (CAGR) of 4.9% from 2025 to 2033. This growth is propelled by escalating urbanization in key metropolitan areas such as Toronto, Vancouver, and Montreal, alongside sustained demand from a growing population of immigrants and young professionals. Government support for affordable housing and infrastructure development further bolsters market expansion. Key challenges include rising construction expenses, limited prime urban land availability, and potential interest rate volatility affecting affordability. Market segmentation by city highlights significant regional disparities, with Toronto and Vancouver leading due to robust economies and high population density. Tridel, Aquilini Development, and The Daniels Corporation are prominent market leaders, though smaller developers also play a vital role.

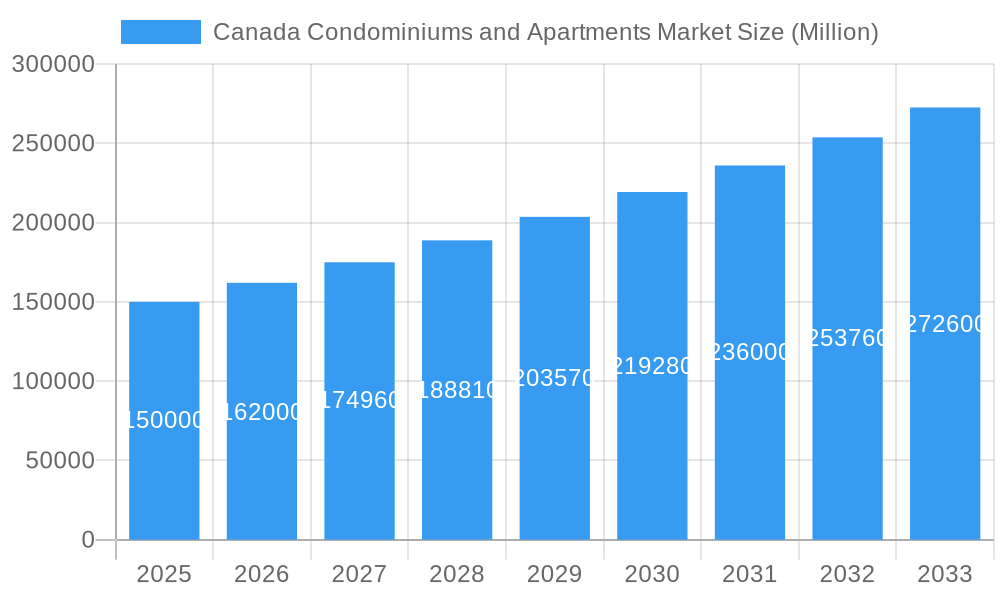

Canada Condominiums and Apartments Market Market Size (In Million)

The forecast for the Canadian condominiums and apartments market through 2033 anticipates continued growth, with potential moderation influenced by economic cycles and regulatory shifts. Regional variations are expected to persist, with Toronto and Vancouver potentially experiencing greater price volatility. Developer competition will likely drive innovation in design, construction, and housing typologies. Sustainable building practices and smart home technologies are anticipated to gain prominence, reflecting evolving consumer demands and environmental considerations. Analysis of the historical period (2019-2024) will provide crucial context for understanding market cycles and their impact on future projections.

Canada Condominiums and Apartments Market Company Market Share

Canada Condominiums and Apartments Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Canadian condominiums and apartments market, covering the period from 2019 to 2033. It examines market dynamics, key players, emerging trends, and future growth prospects, offering invaluable insights for industry stakeholders, investors, and researchers. The report leverages extensive data analysis to provide actionable intelligence and forecasts, with a base year of 2025 and a forecast period spanning 2025-2033.

Canada Condominiums and Apartments Market Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities within the Canadian condominiums and apartments market.

The Canadian condominium and apartment market demonstrates a moderately concentrated structure, with a few large players holding significant market share. For example, companies like Tridel, Bosa Properties, and Brookfield Asset Management command substantial portions of the market in their respective regions. However, numerous smaller regional players and boutique developers maintain a presence, creating a dynamic competitive landscape.

Market Share (Estimated 2024):

- Top 5 players: 40%

- Top 10 players: 60%

- Remaining players: 40%

Innovation Drivers:

- Sustainable building practices: Increasing demand for eco-friendly construction and energy-efficient designs.

- Smart home technologies: Integration of smart devices and automation systems enhancing property value and resident experience.

- Co-living and flexible housing: Rise of co-living spaces and short-term rental options catering to diverse lifestyles.

Regulatory Framework: Provincial and municipal regulations significantly impact development timelines and costs. Building codes, zoning laws, and environmental regulations influence design and construction practices.

M&A Activities: Consolidation is occurring, with larger firms acquiring smaller developers to expand their market reach and portfolio. The total value of M&A deals in the period 2019-2024 is estimated at xx Million. Recent deals, such as The Apartment Fund's USD 50 Million acquisition, underscore this trend.

Product Substitutes: The primary substitutes are rental homes and other forms of housing (e.g., townhouses).

End-User Trends: The demand for condominium and apartment units is driven by population growth, urbanization, and changing lifestyle preferences. Younger generations are increasingly opting for rental accommodation, fueling the apartment sector's growth.

Canada Condominiums and Apartments Market Industry Trends & Insights

The Canadian condominiums and apartments market exhibits robust growth, driven by a confluence of factors including population growth, particularly in major urban centers, increasing urbanization, and a shift in lifestyle preferences towards rental accommodation, especially among younger demographics. The market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024). Market penetration in major cities like Toronto and Vancouver is already high, but substantial growth opportunities remain in secondary markets.

Technological disruptions are transforming the industry. The emergence of PropTech companies offering innovative solutions such as online property management platforms and smart home technologies enhances efficiency and resident satisfaction.

Consumer preferences are shifting toward higher-quality, amenity-rich units located in walkable neighborhoods with convenient access to public transportation and local amenities. This is influencing developers to incorporate sustainable design, smart building features, and community-focused amenities into their projects.

Competitive dynamics are characterized by a mix of large national developers and smaller regional players. Competition is intense in major metropolitan areas, driven by factors including land scarcity and high demand. The industry is witnessing increased consolidation through mergers and acquisitions, with larger firms acquiring smaller companies to expand their market share.

Dominant Markets & Segments in Canada Condominiums and Apartments Market

The Canadian condominium and apartment market is dominated by several key cities, with Toronto, Vancouver, and Montreal representing the largest and most dynamic segments.

Toronto: Toronto's robust economy, strong employment opportunities, and high population density contribute to exceptionally high demand. Key drivers include continuous population influx, significant job growth, and ongoing infrastructural development.

- Key Drivers: Strong economy, high population density, extensive public transportation, and ongoing infrastructure projects.

- Dominance Analysis: Toronto boasts the largest market share due to a higher concentration of high-rise developments and a large pool of potential renters and buyers.

Vancouver: Vancouver's desirable lifestyle, scenic beauty, and proximity to nature attract a large number of residents and investors. However, stringent regulations and high land costs constrain supply.

- Key Drivers: Desirable lifestyle, stunning natural environment, and high demand from both domestic and international buyers.

- Dominance Analysis: Vancouver holds a significant market share, although higher land costs and regulatory hurdles impact development pace.

Montreal: Montreal offers a lower cost of living compared to Toronto and Vancouver, attracting a diverse mix of residents and investors.

- Key Drivers: Relatively lower cost of living, strong cultural scene, and a growing technology sector.

- Dominance Analysis: Montreal exhibits substantial growth potential, but its market share remains below Toronto and Vancouver due to a slower pace of development.

Other Cities: Calgary, Ottawa, and Hamilton show moderate growth, though land availability and economic factors influence their expansion.

- Key Drivers: Growth in specific industries, population increases, and government initiatives promoting affordable housing.

- Dominance Analysis: Secondary markets present opportunities for expansion, particularly for developers focusing on affordable housing solutions.

Canada Condominiums and Apartments Market Product Developments

The Canadian condominium and apartment market witnesses continuous innovation in product design and technology. Developers increasingly incorporate sustainable building materials, energy-efficient technologies, and smart home features to enhance the appeal and value of their properties. These innovations align with growing environmental concerns and changing consumer preferences. Furthermore, there is a notable trend towards flexible housing options, including co-living spaces and short-term rental units, catering to diverse lifestyles and market needs. The integration of smart building technologies offers advantages such as improved energy efficiency, enhanced security, and optimized property management.

Report Scope & Segmentation Analysis

This report segments the Canadian condominiums and apartments market by city: Toronto, Montreal, Vancouver, Ottawa, Calgary, Hamilton, and Other Cities. Each segment is analyzed based on factors like market size, growth projections, and competitive dynamics. Toronto and Vancouver are projected to experience the highest growth rates over the forecast period, with significant investment in new residential developments. Montreal shows steady growth, while secondary cities like Calgary, Ottawa, and Hamilton present a mix of growth potential depending on economic factors and local government policies. The "Other Cities" segment encompasses smaller urban centers and regions exhibiting varying levels of market activity.

Key Drivers of Canada Condominiums and Apartments Market Growth

Several factors drive the growth of the Canadian condominiums and apartments market:

- Population growth and urbanization: Population increase, especially in major urban centers, fuels demand for housing.

- Economic growth and employment: Strong employment opportunities attract people to cities, boosting housing demand.

- Government policies: Government initiatives supporting housing affordability and sustainable development influence market trends.

- Changing lifestyle preferences: A preference for rental accommodation and amenity-rich living fuels demand for apartments and condominiums.

- Technological advancements: Innovations in construction and building technologies improve efficiency and offer enhanced amenities.

Challenges in the Canada Condominiums and Apartments Market Sector

The Canadian condominiums and apartments market faces several challenges:

- High land costs and construction expenses: These factors increase the price of new units, potentially affecting affordability.

- Regulatory hurdles and approval processes: Strict building codes and lengthy approval processes can slow down development.

- Supply chain disruptions: Difficulties in obtaining construction materials and skilled labor can delay projects and increase costs.

- Competition: Intense competition among developers can impact pricing and profitability.

- Interest rate fluctuations: Changes in interest rates significantly influence borrowing costs for both developers and buyers.

Emerging Opportunities in Canada Condominiums and Apartments Market

Several emerging opportunities exist within the Canadian condominiums and apartments market:

- Affordable housing: There is a growing need for affordable housing options in major cities to cater to diverse income levels.

- Sustainable building technologies: The increasing demand for eco-friendly and energy-efficient buildings creates opportunities for developers.

- Smart home integration: The adoption of smart technologies in residential spaces presents growth opportunities.

- Co-living and flexible housing: Innovations such as co-living spaces and flexible lease terms cater to diverse lifestyle preferences.

- Expansion into secondary markets: Development opportunities exist in smaller cities and towns experiencing population growth.

Leading Players in the Canada Condominiums and Apartments Market Market

- Tridel

- Aquilini Development

- The Daniels Corporation

- Living Realty

- Shato Holdings Ltd

- B C Investment Management Corp

- Bosa Properties

- Brookfield Asset Management

- Concert Properties Ltd

- Amacon

- The Minto Group

- Polygon Realty Limited

- Slavens & Associates

- Onni Group

Key Developments in Canada Condominiums and Apartments Market Industry

December 2022: The Equiton Residential Income Fund Trust (The Apartment Fund) acquired a multi-family residential property in Toronto, Ontario, for USD 50 Million. This acquisition highlights the ongoing consolidation within the market, with larger players acquiring existing properties to expand their portfolios. The Ravine Park Apartments (169 units) adds to Toronto's rental inventory near key transit infrastructure.

October 2022: Rentsync and Urbanation partnered to create a comprehensive market data platform for Canadian rental housing. This collaboration will enhance market transparency and provide valuable data-driven insights for industry players. The monthly reports detailing rental trends across various segments will help developers and investors make informed decisions.

Strategic Outlook for Canada Condominiums and Apartments Market Market

The Canadian condominiums and apartments market is poised for continued growth, driven by sustained population increase, economic expansion, and evolving consumer preferences. The focus on sustainable development, smart building technologies, and innovative housing solutions will further shape market dynamics. Opportunities abound in affordable housing, expansion into secondary markets, and the integration of PropTech solutions to optimize operational efficiency and enhance the resident experience. The market will continue to see consolidation, with larger players acquiring smaller firms to gain market share and expand their geographic reach. The increased use of data analytics will aid developers and investors in making more informed decisions about investment allocation and project development.

Canada Condominiums and Apartments Market Segmentation

-

1. City

- 1.1. Toronto

- 1.2. Montreal

- 1.3. Vancouver

- 1.4. Ottawa

- 1.5. Cagalry

- 1.6. Hamilton

- 1.7. Other Cities

Canada Condominiums and Apartments Market Segmentation By Geography

- 1. Canada

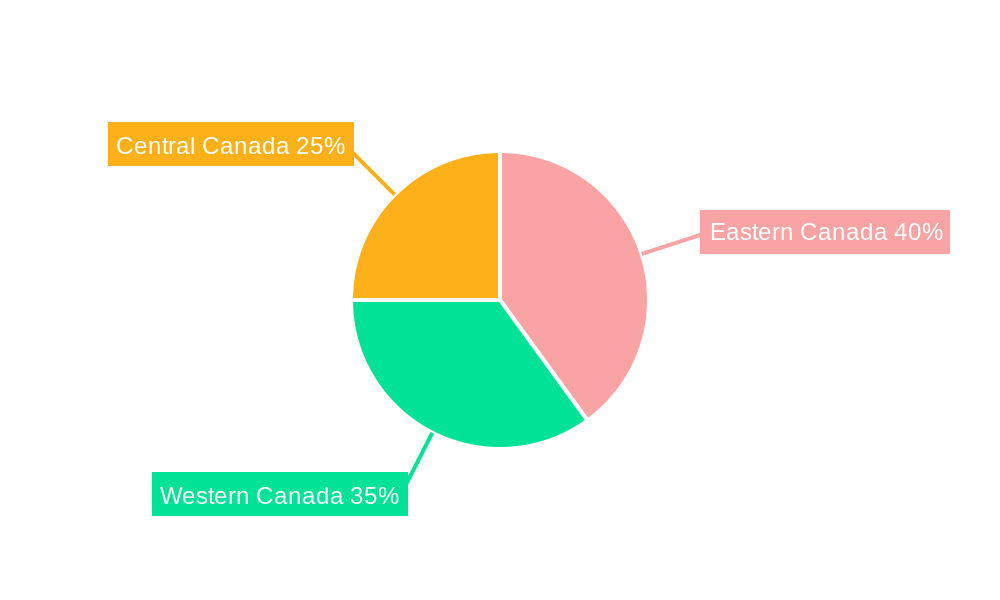

Canada Condominiums and Apartments Market Regional Market Share

Geographic Coverage of Canada Condominiums and Apartments Market

Canada Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Development of sustainable and energy-efficient transportation infrastructure4.; Growth in demand for new road and railway construction projects

- 3.3. Market Restrains

- 3.3.1. 4.; Funding is a major challenge for infrastructure construction and maintenance

- 3.4. Market Trends

- 3.4.1. Increased demand for affordable housing driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by City

- 5.1.1. Toronto

- 5.1.2. Montreal

- 5.1.3. Vancouver

- 5.1.4. Ottawa

- 5.1.5. Cagalry

- 5.1.6. Hamilton

- 5.1.7. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by City

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tridel

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aquilini Development

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Daniels Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Living Realty**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shato Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 B C Investment Management Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bosa Properties

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Brookfield Asset Management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Concert Properties Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amacon

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Minto Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Polygon Realty Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Slavens & Associates

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Onni Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Tridel

List of Figures

- Figure 1: Canada Condominiums and Apartments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Condominiums and Apartments Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Condominiums and Apartments Market Revenue billion Forecast, by City 2020 & 2033

- Table 2: Canada Condominiums and Apartments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Canada Condominiums and Apartments Market Revenue billion Forecast, by City 2020 & 2033

- Table 4: Canada Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Condominiums and Apartments Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Canada Condominiums and Apartments Market?

Key companies in the market include Tridel, Aquilini Development, The Daniels Corporation, Living Realty**List Not Exhaustive, Shato Holdings Ltd, B C Investment Management Corp, Bosa Properties, Brookfield Asset Management, Concert Properties Ltd, Amacon, The Minto Group, Polygon Realty Limited, Slavens & Associates, Onni Group.

3. What are the main segments of the Canada Condominiums and Apartments Market?

The market segments include City.

4. Can you provide details about the market size?

The market size is estimated to be USD 1279.93 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Development of sustainable and energy-efficient transportation infrastructure4.; Growth in demand for new road and railway construction projects.

6. What are the notable trends driving market growth?

Increased demand for affordable housing driving the market.

7. Are there any restraints impacting market growth?

4.; Funding is a major challenge for infrastructure construction and maintenance.

8. Can you provide examples of recent developments in the market?

December 2022: The Equiton Residential Income Fund Trust (The Apartment Fund) acquired a multi-family residential property in Toronto, Ontario. The property was purchased for USD 50 million. The Ravine Park Apartments will include seven stories, 169 units, and 183 combined indoor and outdoor parking spaces. It's close to public transportation, directly across the street from the upcoming Eglinton LRT Ionview Station, within walking distance of the Kennedy Subway and GO stations, and various amenities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Canada Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence