Key Insights

The Canadian metal fabrication equipment market is projected for significant expansion, with an estimated Compound Annual Growth Rate (CAGR) of 1.6%. The market size is anticipated to reach 6.5 billion by 2025, following a base year assessment. This growth is propelled by escalating demand for fabricated metal products across key sectors such as construction, automotive, and aerospace. Technological advancements, including automation and robotics, are enhancing productivity and attracting investment. Government initiatives supporting industrial modernization further bolster this trend. A renewed focus on domestic manufacturing and reduced import reliance is also contributing to market momentum. Key industry players like BTD Manufacturing and Colfax are strategically positioned to capitalize on these opportunities.

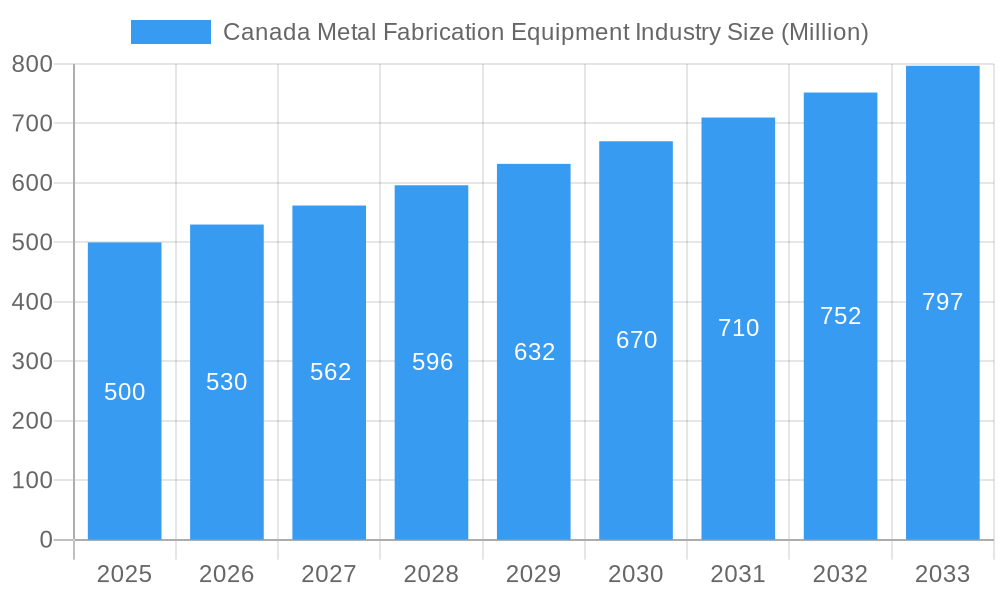

Canada Metal Fabrication Equipment Industry Market Size (In Billion)

Challenges persist, including fluctuating material costs and supply chain volatility. Intense global competition necessitates continuous innovation and strategic adaptation. Despite these headwinds, the market's long-term outlook remains robust, driven by ongoing demand and advancements in technologies like laser cutting, 3D printing, and automated welding. The industry anticipates continued consolidation as larger entities acquire smaller firms to broaden product offerings and market reach. The forecast period from 2025 to 2033 indicates sustained expansion, building upon the foundation of the preceding years, presenting considerable investment potential within this evolving sector.

Canada Metal Fabrication Equipment Industry Company Market Share

Canada Metal Fabrication Equipment Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Canadian metal fabrication equipment industry, covering market size, segmentation, key players, growth drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is essential for industry stakeholders, investors, and businesses seeking to understand this dynamic market.

Canada Metal Fabrication Equipment Industry Market Concentration & Innovation

This section analyzes the competitive landscape, innovation drivers, regulatory influences, and market dynamics within the Canadian metal fabrication equipment industry. The market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. However, several smaller companies contribute to the overall industry. Estimates suggest that the top five players hold approximately xx% of the market share in 2025, while the remaining xx% is distributed amongst numerous smaller participants.

Market Concentration Metrics (2025):

- Top 5 players market share: xx%

- Average market share of top 10 players: xx%

- Number of active players: xx

Innovation Drivers:

- Increasing demand for automation and advanced manufacturing technologies.

- Growing adoption of Industry 4.0 technologies like IoT and AI.

- Focus on improving efficiency and productivity.

- Government initiatives promoting technological advancements.

Regulatory Framework:

- Canadian environmental regulations impacting material usage and waste management.

- Safety standards and compliance requirements for equipment operation.

- Trade regulations and import/export policies.

Product Substitutes & End-User Trends:

- Limited direct substitutes due to the specialized nature of the equipment. However, alternative manufacturing processes, such as 3D printing, pose indirect competition in certain niche segments.

- End-user trends show a shift towards more efficient, precise, and sustainable fabrication equipment.

M&A Activities:

- Recent mergers and acquisitions, such as the February 2022 acquisition of Steelcraft by Arrow Machine and Fabrication Group, and the January 2022 acquisition of Eastern Fabricators by Ag Growth International Inc., reflect the consolidating nature of the market and the strategic importance of expanding capabilities and market reach. Estimated value of M&A deals in 2024: xx Million.

Canada Metal Fabrication Equipment Industry Industry Trends & Insights

The Canadian metal fabrication equipment industry is experiencing robust growth, driven by several key factors. The CAGR from 2025 to 2033 is projected to be xx%, fueled by increasing investments in infrastructure development, expanding industrial sectors (e.g., automotive, construction, energy), and government initiatives promoting domestic manufacturing.

Market Growth Drivers:

- Infrastructure projects, including construction of new buildings, roads, and transportation systems.

- Growth in the automotive, construction, energy, and aerospace sectors.

- Rising demand for customized fabrication services.

- Government policies promoting advanced manufacturing and industrial automation.

- Increasing adoption of sustainable and energy-efficient manufacturing processes.

Technological Disruptions:

- The adoption of automation, robotics, and advanced machining technologies is improving efficiency and productivity in metal fabrication processes.

- The integration of digital technologies, such as IoT and AI, is driving data-driven decision-making and optimized manufacturing operations.

Competitive Dynamics:

- Intense competition exists among established players and new entrants, particularly in technologically advanced segments.

- Market penetration strategies include product innovation, technological advancements, competitive pricing, and strategic alliances.

Dominant Markets & Segments in Canada Metal Fabrication Equipment Industry

Ontario dominates the Canadian metal fabrication equipment market, driven by its strong manufacturing base, concentration of industrial activities, and advanced manufacturing ecosystem. Quebec and British Columbia also hold significant market shares.

Key Drivers of Ontario's Dominance:

- High concentration of automotive, aerospace, and manufacturing industries.

- Well-developed infrastructure and logistics networks.

- Government initiatives supporting industrial development and innovation.

- Skilled workforce and strong technical expertise.

Detailed Dominance Analysis: Ontario’s strong industrial base and robust manufacturing sector create a significant demand for metal fabrication equipment. The province's established supply chain and infrastructure facilitate efficient distribution and support operations. Furthermore, government initiatives promoting innovation and technology adoption in the manufacturing sector contribute to the market's growth within Ontario. The other provinces, while holding significant market shares, lack the same level of industrial concentration and supporting infrastructure, resulting in Ontario's dominant position.

Canada Metal Fabrication Equipment Industry Product Developments

Recent product innovations focus on advanced automation, improved precision, and enhanced efficiency. This includes the integration of robotics, CNC machining centers, laser cutting systems, and automated welding equipment. The market is witnessing a growing adoption of digital twin technology for simulating and optimizing fabrication processes. Furthermore, there's a significant emphasis on developing environmentally friendly equipment with reduced energy consumption and improved waste management capabilities. These technological advancements are enhancing productivity, lowering operational costs, and improving product quality, driving strong market fit and competitive advantage for manufacturers.

Report Scope & Segmentation Analysis

This report segments the Canadian metal fabrication equipment market by equipment type (e.g., press brakes, laser cutters, welding machines, CNC machining centers), end-user industry (e.g., automotive, construction, aerospace, energy), and region (e.g., Ontario, Quebec, British Columbia). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. Growth projections vary by segment, with automation-related equipment expected to experience the highest growth rates, while other segments see steady growth. Competitive dynamics depend heavily on technology leadership and market specialization.

Key Drivers of Canada Metal Fabrication Equipment Industry Growth

Several factors are driving growth in the Canadian metal fabrication equipment market:

- Technological advancements: Automation, robotics, and advanced machining technologies enhance efficiency and productivity.

- Economic growth: Expansion in key sectors like construction and automotive fuels demand.

- Government support: Initiatives promoting advanced manufacturing and industrial innovation. For example, various provincial and federal programs provide incentives for adopting new technologies and investing in the manufacturing sector.

- Infrastructure development: Major infrastructure projects necessitate significant metal fabrication.

Challenges in the Canada Metal Fabrication Equipment Industry Sector

The industry faces several challenges:

- Supply chain disruptions: Global supply chain volatility impacts the availability of components and raw materials. This has led to xx% increase in production costs in 2024.

- High labor costs: Skilled labor shortages can increase operational expenses and limit production capacity.

- Stringent environmental regulations: Compliance with environmental regulations adds to operational costs. For example, the cost of compliance with new emission standards has increased by xx% in the last two years.

Emerging Opportunities in Canada Metal Fabrication Equipment Industry

Emerging opportunities include:

- Growth of the renewable energy sector: Demand for metal fabrication equipment in renewable energy projects is expanding.

- Adoption of additive manufacturing: 3D printing and other additive manufacturing techniques are creating new possibilities.

- Demand for customized solutions: Increasing demand for customized fabrication equipment tailored to specific needs of end-users.

Leading Players in the Canada Metal Fabrication Equipment Industry Market

- BTD Manufacturing

- Colfax

- Komaspec

- Matcor Matsu Group Inc

- Sandvik Mining and Construction Canada Inc

- STANDARD IRON & WIRE WORKS INC

- TRUMPF Canada Inc

- Atlas Copco

- AMADA Canada

- DMG MORI Canada

- List Not Exhaustive

Key Developments in Canada Metal Fabrication Equipment Industry Industry

- February 2022: Arrow Machine and Fabrication Group acquired Steelcraft, expanding its customer base and manufacturing footprint. This significantly increased their market share in the Ontario region.

- January 2022: Ag Growth International Inc. (AGI) acquired Eastern Fabricators, expanding its presence in the food processing equipment market. This acquisition strengthened AGI's position in the stainless-steel fabrication segment.

Strategic Outlook for Canada Metal Fabrication Equipment Industry Market

The Canadian metal fabrication equipment market is poised for continued growth, driven by technological advancements, infrastructure development, and expanding industrial sectors. The focus on automation, digitalization, and sustainability will shape future market dynamics. Companies focusing on innovation, strategic partnerships, and efficient supply chain management will be best positioned to capitalize on the emerging opportunities and overcome challenges in this dynamic market. The market's potential for continued growth is high, particularly in the automation segment, with the potential for even higher growth if supply chain stability is restored and skilled labor shortages are addressed.

Canada Metal Fabrication Equipment Industry Segmentation

-

1. Service Type

- 1.1. Machining and Cutting

- 1.2. Forming

- 1.3. Welding

- 1.4. Other Service Type

-

2. Product Type

- 2.1. Automatic

- 2.2. Semi-automatic

- 2.3. Manual

-

3. End User Industry

- 3.1. Manufacturing

- 3.2. Power and Utilities

- 3.3. Construction

- 3.4. Oil and Gas

- 3.5. Other End-user Industries

Canada Metal Fabrication Equipment Industry Segmentation By Geography

- 1. Canada

Canada Metal Fabrication Equipment Industry Regional Market Share

Geographic Coverage of Canada Metal Fabrication Equipment Industry

Canada Metal Fabrication Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Construction Industry Offers Immense Demand for the Metal Fabrication Equipment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Machining and Cutting

- 5.1.2. Forming

- 5.1.3. Welding

- 5.1.4. Other Service Type

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Automatic

- 5.2.2. Semi-automatic

- 5.2.3. Manual

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. Manufacturing

- 5.3.2. Power and Utilities

- 5.3.3. Construction

- 5.3.4. Oil and Gas

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BTD Manufacturing

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Colfax

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Komaspec

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Matcor Matsu Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sandvik Mining and Construction Canada Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 STANDARD IRON & WIRE WORKS INC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TRUMPF Canada Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Atlas Copco

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AMADA Canada

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DMG MORI Canada**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BTD Manufacturing

List of Figures

- Figure 1: Canada Metal Fabrication Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Metal Fabrication Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 4: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 6: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 8: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Metal Fabrication Equipment Industry?

The projected CAGR is approximately 1.6%.

2. Which companies are prominent players in the Canada Metal Fabrication Equipment Industry?

Key companies in the market include BTD Manufacturing, Colfax, Komaspec, Matcor Matsu Group Inc, Sandvik Mining and Construction Canada Inc, STANDARD IRON & WIRE WORKS INC, TRUMPF Canada Inc, Atlas Copco, AMADA Canada, DMG MORI Canada**List Not Exhaustive.

3. What are the main segments of the Canada Metal Fabrication Equipment Industry?

The market segments include Service Type, Product Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Construction Industry Offers Immense Demand for the Metal Fabrication Equipment.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2022: Arrow Machine and Fabrication Group of Guelph, Ontario, announced the acquisition of Steelcraft, a Kitchener, Ontario, steel design, engineering, and fabrication firm. This acquisition expands Arrow's global customer base and manufacturing footprint. It also further promotes the company's strategy of partnering with leading operator-run machining and fabrication organizations to leverage their collective capabilities, solve customer problems, and develop deeper supply chain interactions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Metal Fabrication Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Metal Fabrication Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Metal Fabrication Equipment Industry?

To stay informed about further developments, trends, and reports in the Canada Metal Fabrication Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence