Key Insights

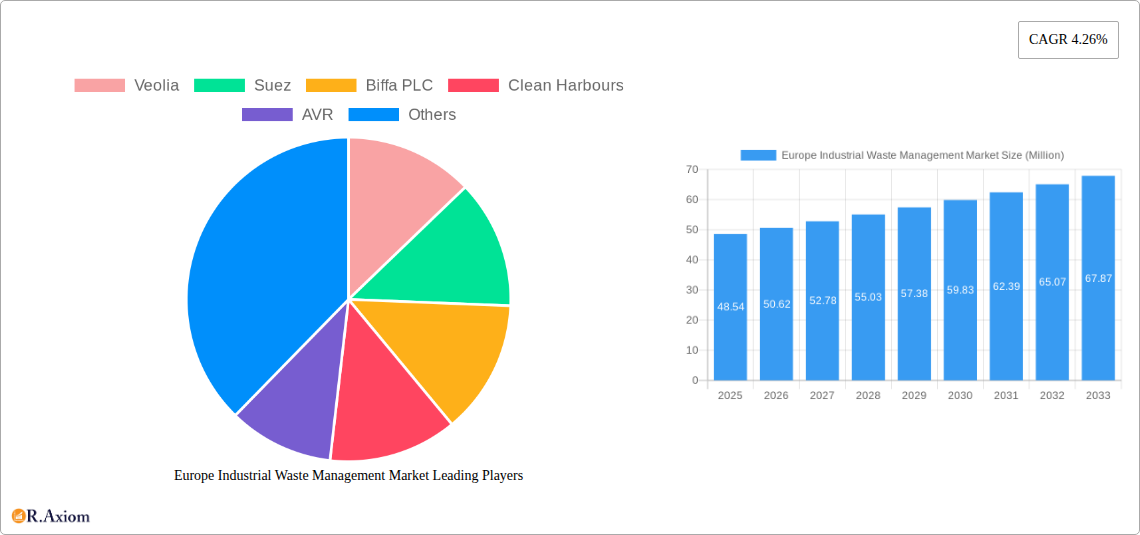

The Europe Industrial Waste Management Market is poised for significant growth, projected to reach an estimated market size of approximately $48.54 million by 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 4.26%, indicating a healthy and sustained upward trajectory. A primary catalyst for this growth is the increasing volume of industrial activities across key European nations, leading to a commensurate rise in waste generation. The growing emphasis on environmental regulations and sustainable practices by governments and corporations alike is a crucial driver, compelling businesses to adopt more responsible waste disposal and management solutions. Furthermore, advancements in waste treatment technologies, particularly in recycling and incineration, are contributing to the market's positive outlook, offering more efficient and environmentally sound alternatives to traditional landfilling. The market is witnessing a notable shift towards circular economy principles, where waste is viewed as a resource, further fueling innovation and investment in advanced waste management infrastructure and services.

Europe Industrial Waste Management Market Market Size (In Million)

The market is segmented across various waste types, with Construction and Demolition waste likely representing a substantial portion due to ongoing infrastructure development and urban renewal projects across Europe. Manufacturing waste and Oil and Gas waste also constitute significant segments, reflecting the industrial landscape of the region. In terms of services, Recycling is expected to dominate, driven by stringent recycling mandates and the economic incentives associated with material recovery. Landfill, while still a part of the waste management strategy, is likely to see a gradual decline in its share as regulatory pressures and technological advancements favor other disposal methods. Incineration, particularly with energy recovery capabilities, is also anticipated to gain traction. Leading players such as Veolia, Suez, and Remondis are at the forefront of innovation and service delivery, actively shaping the market through strategic investments and the development of comprehensive waste management solutions. The European region, with countries like the United Kingdom, Germany, and France leading the charge, is a key hub for these activities, benefiting from proactive environmental policies and a strong industrial base.

Europe Industrial Waste Management Market Company Market Share

Here is the SEO-optimized, detailed report description for the Europe Industrial Waste Management Market, incorporating high-traffic keywords and structured as requested:

This in-depth report provides a definitive analysis of the Europe Industrial Waste Management Market, offering critical insights for stakeholders navigating this dynamic sector. Covering the period from 2019 to 2033, with a base year of 2025, the study delves into market size, growth drivers, segmentation, competitive landscape, and future projections. It is an indispensable resource for waste management companies, industrial manufacturers, regulatory bodies, investors, and environmental consultants seeking to understand and capitalize on the evolving industrial waste solutions and circular economy trends across Europe.

Europe Industrial Waste Management Market Market Concentration & Innovation

The Europe Industrial Waste Management Market exhibits a moderately concentrated landscape, with key players like Veolia, Suez, and Remondis holding significant market shares, estimated to be in the range of 15-20% each in the recycling segment. Innovation is a paramount driver, fueled by stringent European Union environmental regulations and the increasing adoption of sustainable waste management practices. Key innovation areas include advanced waste-to-energy technologies, sophisticated industrial waste recycling processes, and the development of digital waste management platforms for enhanced tracking and efficiency. Regulatory frameworks, such as the EU Circular Economy Action Plan and national waste directives, are instrumental in shaping market dynamics and promoting the adoption of eco-friendly solutions. The prevalence of robust waste sorting and treatment facilities further underscores the market's commitment to innovation. Product substitutes, while present in rudimentary forms, are increasingly being overshadowed by integrated waste management solutions that offer superior environmental and economic benefits. End-user trends are strongly leaning towards resource recovery and minimizing landfill dependency, driving demand for industrial waste valorization. Mergers and acquisitions (M&A) remain a significant strategy for market consolidation and expansion. Notable M&A activities in recent years have involved deals exceeding €500 Million, aimed at acquiring specialized technologies or expanding service portfolios.

Europe Industrial Waste Management Market Industry Trends & Insights

The Europe Industrial Waste Management Market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period. This expansion is primarily driven by an escalating emphasis on sustainable waste management, the circular economy, and stricter environmental legislation across European nations. Industrial sectors are increasingly adopting advanced waste treatment and disposal methods to comply with regulations and enhance their corporate social responsibility profiles. Technological advancements are at the forefront, with significant investments in advanced recycling technologies, including chemical recycling for plastics and the valorization of complex industrial by-products. The adoption of smart waste management systems, leveraging IoT and AI, is optimizing collection routes, improving sorting efficiency, and providing real-time data analytics for better decision-making. Consumer preferences, particularly within business-to-business (B2B) contexts, are shifting towards service providers who offer comprehensive, environmentally sound, and cost-effective waste management solutions. This includes a growing demand for hazardous waste management services and specialized solutions for specific industrial streams like oil and gas waste. Competitive dynamics are intensifying, with established players investing heavily in R&D and expanding their service offerings to include consulting and waste reduction strategies. New entrants are often focused on niche technologies or regional markets, seeking to disrupt the status quo with innovative approaches. Market penetration for advanced recycling and waste-to-energy solutions is steadily increasing, reflecting a broader societal and industrial shift away from traditional landfilling. The economic impact of waste is also becoming a focal point, with businesses recognizing the financial benefits of efficient resource recovery and waste minimization.

Dominant Markets & Segments in Europe Industrial Waste Management Market

The Construction and Demolition (C&D) waste segment is a dominant force within the Europe Industrial Waste Management Market, significantly contributing to its overall value, estimated to reach €XX Billion by 2025. This dominance is propelled by substantial infrastructure development, urban regeneration projects, and stringent regulations mandating the recycling and reuse of C&D materials. For instance, countries like Germany and the UK, with their active construction sectors and robust waste policies, are key contributors.

- Drivers for C&D Waste Dominance:

- Urbanization and Infrastructure Investment: Ongoing projects in major European cities and across the continent necessitate large-scale demolition and construction, generating substantial C&D waste.

- Regulatory Mandates: Strict EU and national policies enforce high recycling rates for construction and demolition debris, pushing for innovative waste recycling solutions and the use of recycled materials in new projects.

- Circular Economy Initiatives: The push towards a circular economy in construction promotes the reuse and recycling of materials, reducing the demand for virgin resources and creating a market for processed C&D waste.

- Technological Advancements: Development of efficient waste sorting technologies and crushing equipment for C&D waste facilitates higher recovery rates.

The Manufacturing Waste segment also represents a substantial portion of the market, driven by the diverse output of the continent's industrial base. This includes scrap metal, plastic waste, chemical waste, and paper and cardboard waste. The increasing focus on industrial sustainability and resource efficiency within manufacturing operations is leading to a greater demand for specialized industrial waste management services.

The Service segment of Recycling holds a commanding position due to the overwhelming regulatory push and economic incentives favoring material recovery. Leading nations are investing heavily in expanding their recycling infrastructure, including advanced sorting facilities and material reprocessing plants. The Incineration segment, particularly with energy recovery capabilities (Waste-to-Energy), is also a significant contributor, offering a solution for non-recyclable waste streams while generating valuable energy. While Landfill remains a part of the waste management strategy, its role is progressively diminishing due to environmental concerns and stricter regulations. The Other Services segment, encompassing waste consulting, logistics, and hazardous waste management, is experiencing steady growth as industries seek integrated and specialized solutions.

Europe Industrial Waste Management Market Product Developments

Recent product developments in the Europe Industrial Waste Management Market focus on enhancing efficiency, sustainability, and resource recovery. Innovations include advanced sorting technologies that utilize AI and machine learning for higher purity of recovered materials, as well as novel chemical recycling processes capable of breaking down complex plastic waste into its molecular components for remanufacturing. The development of specialized treatment solutions for hazardous industrial waste, such as acid neutralization systems and heavy metal containment technologies, offers significant competitive advantages by addressing niche but critical market needs.

Report Scope & Segmentation Analysis

The Europe Industrial Waste Management Market is meticulously segmented to provide comprehensive insights. The Type segmentation includes Construction and Demolition Waste, Manufacturing Waste, Oil and Gas Waste, and Other Waste streams, each with unique management requirements and growth trajectories. The Service segmentation encompasses Recycling, Landfill, Incineration, and Other Services. Each segment is analyzed for its market size, growth projections, and competitive dynamics. For instance, the Recycling segment is expected to witness a significant market share of approximately 40% by 2025, driven by strong regulatory support and increasing corporate sustainability goals.

Key Drivers of Europe Industrial Waste Management Market Growth

The growth of the Europe Industrial Waste Management Market is propelled by several key drivers. Stringent environmental regulations and policies enacted by the European Union and individual member states, such as the EU Circular Economy Action Plan, are compelling industries to adopt advanced waste management solutions. The increasing global awareness of climate change and the need for sustainable practices is fostering a demand for resource recovery and waste minimization. Technological advancements in waste treatment and recycling technologies, coupled with substantial investments in waste-to-energy (WTE) plants, are further accelerating market expansion. The economic imperative of resource efficiency and the potential for revenue generation from recovered materials also play a crucial role.

Challenges in the Europe Industrial Waste Management Market Sector

Despite its growth, the Europe Industrial Waste Management Market faces several challenges. The complexity and varying interpretations of regulatory frameworks across different European countries can create compliance hurdles for international companies. The high capital investment required for establishing state-of-the-art waste treatment facilities and implementing advanced recycling technologies poses a significant barrier to entry for smaller players. Fluctuations in commodity prices for recycled materials can impact the economic viability of recycling operations. Furthermore, public perception and the NIMBY (Not In My Backyard) syndrome can sometimes impede the development of new waste management infrastructure. Ensuring a consistent and high-quality supply of industrial waste feedstock for recycling processes also remains a logistical challenge.

Emerging Opportunities in Europe Industrial Waste Management Market

Emerging opportunities in the Europe Industrial Waste Management Market are centered around the burgeoning circular economy. The development of advanced chemical recycling processes for difficult-to-recycle plastics, such as mixed plastics and contaminated materials, presents a significant growth avenue. The increasing demand for sustainable packaging solutions and the rise of the bioeconomy are creating new markets for organic waste valorization and the production of bioplastics and biofuels. The digitalization of waste management, through the use of IoT, AI, and blockchain technology for enhanced tracking, transparency, and optimization of the waste supply chain, offers substantial opportunities for innovation and efficiency gains. Furthermore, the growing focus on hazardous waste management and the safe disposal of specialized industrial by-products presents lucrative niche markets.

Leading Players in the Europe Industrial Waste Management Market Market

- Veolia

- Suez

- Biffa PLC

- Clean Harbours

- AVR

- Cleanaway Germnay

- Remondis

- Urbaser

- Prezero International

- ALBA Group

List Not Exhaustive 7 3 Other Companie

Key Developments in Europe Industrial Waste Management Market Industry

- October 2023: Veolia opened the doors of more than 100 sites operated by the group in France. The sites include drinking water production plants, wastewater treatment plants, waste sorting centers, or energy recovery units, enabling the general public to go behind the scenes of ecological transformation. A unique opportunity to discover the group's innovative solutions and expertise in its core businesses of water, energy, and waste management.

- September 2023: In order to secure the supply of End-of-life mattress foams, Evonik entered into an agreement with Remondis Group, one of the world's most prominent recyclers. As Evonik develops its chemical recycling process to the next level, this cooperation would be beneficial for it. In the production of new mattresses, it is possible to recover core components of polyurethane foam and use them as premium-quality block-building materials with Evonik's innovative material and hydrolysis technology. The recycling process is currently being tested at a pilot plant in Hanau and will be tested at a larger demonstration plant in the future.

Strategic Outlook for Europe Industrial Waste Management Market Market

The strategic outlook for the Europe Industrial Waste Management Market is exceptionally positive, driven by an unwavering commitment to sustainability and the principles of the circular economy. Future growth will be catalyzed by increased investment in advanced waste-to-energy technologies, sophisticated industrial waste recycling processes, and the adoption of smart waste management systems. The ongoing evolution of environmental legislation will continue to shape market dynamics, encouraging innovation and driving demand for comprehensive waste management solutions. Opportunities for resource recovery and the valorization of industrial by-products are expanding, creating new revenue streams for companies that embrace these trends. The market is poised for continued expansion and transformation as Europe strives to achieve its ambitious environmental goals.

Europe Industrial Waste Management Market Segmentation

-

1. Type

- 1.1. Construction and Demolition

- 1.2. Manufacturing Waste

- 1.3. Oil and Gas Waste

- 1.4. Other Wa

-

2. Service

- 2.1. Recycling

- 2.2. Landfill

- 2.3. Incineration

- 2.4. Other Services

Europe Industrial Waste Management Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Industrial Waste Management Market Regional Market Share

Geographic Coverage of Europe Industrial Waste Management Market

Europe Industrial Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Industrial Waste Generation; Growing Environmental Awareness; Investing in Advanced Recycling Technologies

- 3.3. Market Restrains

- 3.3.1. Increasing Industrial Waste Generation; Growing Environmental Awareness; Investing in Advanced Recycling Technologies

- 3.4. Market Trends

- 3.4.1. Germany Leads the Highest Contribution in the Waste Generation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Construction and Demolition

- 5.1.2. Manufacturing Waste

- 5.1.3. Oil and Gas Waste

- 5.1.4. Other Wa

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Recycling

- 5.2.2. Landfill

- 5.2.3. Incineration

- 5.2.4. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Veolia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Suez

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biffa PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Clean Harbours

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AVR

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cleanaway Germnay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Remondis

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Urbaser

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Prezero International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ALBA Group**List Not Exhaustive 7 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Veolia

List of Figures

- Figure 1: Europe Industrial Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Industrial Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Industrial Waste Management Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Europe Industrial Waste Management Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: Europe Industrial Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Industrial Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Europe Industrial Waste Management Market Revenue Million Forecast, by Service 2020 & 2033

- Table 10: Europe Industrial Waste Management Market Volume Billion Forecast, by Service 2020 & 2033

- Table 11: Europe Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Industrial Waste Management Market?

The projected CAGR is approximately 4.26%.

2. Which companies are prominent players in the Europe Industrial Waste Management Market?

Key companies in the market include Veolia, Suez, Biffa PLC, Clean Harbours, AVR, Cleanaway Germnay, Remondis, Urbaser, Prezero International, ALBA Group**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Europe Industrial Waste Management Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Industrial Waste Generation; Growing Environmental Awareness; Investing in Advanced Recycling Technologies.

6. What are the notable trends driving market growth?

Germany Leads the Highest Contribution in the Waste Generation.

7. Are there any restraints impacting market growth?

Increasing Industrial Waste Generation; Growing Environmental Awareness; Investing in Advanced Recycling Technologies.

8. Can you provide examples of recent developments in the market?

October 2023: Veolia opened the doors of more than 100 sites operated by the group in France. The sites include drinking water production plants, wastewater treatment plants, waste sorting centers, or energy recovery units, enabling the general public to go behind the scenes of ecological transformation. A unique opportunity to discover the group's innovative solutions and expertise in its core businesses of water, energy, and waste management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Industrial Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Industrial Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Industrial Waste Management Market?

To stay informed about further developments, trends, and reports in the Europe Industrial Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence