Key Insights

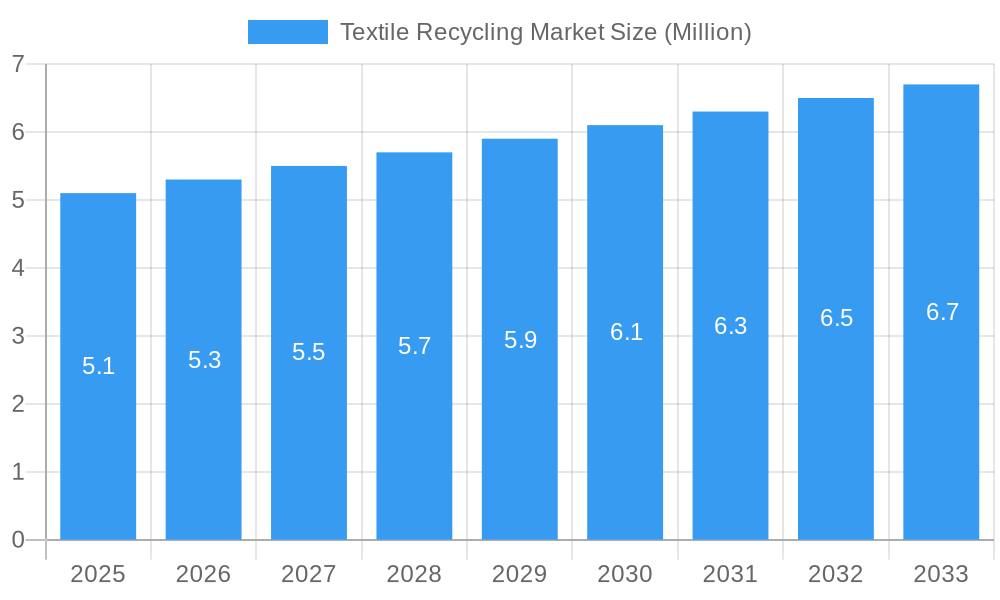

The global textile recycling market is experiencing robust growth, projected to reach a substantial market size of approximately USD 5.10 million by 2025. This expansion is driven by a confluence of powerful factors, including increasing consumer awareness of sustainability, stricter environmental regulations, and a growing demand for eco-friendly fashion and home goods. The market's Compound Annual Growth Rate (CAGR) is estimated at a healthy 3.86%, indicating a steady and sustained upward trajectory. Key drivers fueling this momentum include the urgent need to reduce landfill waste, conserve precious natural resources like water and energy required for virgin fiber production, and the economic incentives associated with creating value from discarded materials. Emerging trends such as the development of advanced chemical recycling technologies, the rise of circular economy models within the fashion industry, and innovative business models focused on textile collection and resale are further solidifying the market's potential. The increasing adoption of recycled materials in apparel, home furnishings, and even automotive interiors underscores the market's expanding reach and application.

Textile Recycling Market Market Size (In Million)

The market is segmented across various materials, with Cotton and Polyester, including Polyester Fiber, emerging as dominant categories due to their widespread use in textiles. Other significant segments include Wool, Nylon and Nylon Fiber, and "Others," reflecting the diverse nature of textile waste. The primary sources of recycled textiles are Apparel Waste and Home Furnishing Waste, which represent the largest streams, followed by Automotive Waste and other miscellaneous sources. The processing landscape is characterized by both Mechanical and Chemical recycling methods, with advancements in chemical recycling offering promising solutions for breaking down complex fiber blends. Geographically, North America and Europe are leading the charge in textile recycling initiatives, driven by progressive environmental policies and strong consumer demand for sustainable products. The Asia Pacific region, with its significant textile manufacturing base and growing population, is poised for substantial growth in this sector as well. Despite the positive outlook, the market faces restraints such as the challenges associated with collecting and sorting diverse textile waste streams, the technical complexities of recycling blended fabrics, and the need for greater consumer participation and industry-wide collaboration to achieve a truly circular textile economy.

Textile Recycling Market Company Market Share

This comprehensive report offers an in-depth analysis of the global Textile Recycling Market, a critical sector poised for significant expansion driven by increasing environmental consciousness, stringent regulations, and innovative technological advancements. Valued at approximately XX Million in 2025, the market is projected to reach XX Million by 2033, exhibiting a robust CAGR of xx% during the forecast period of 2025-2033. Our analysis covers the historical period from 2019 to 2024, providing a solid foundation for understanding current market dynamics and future trajectories.

The report delves into key segments including Cotton, Polyester and Polyester Fiber, Wool, Nylon and Nylon Fiber, and Others for material types; Apparel Waste, Home Furnishing Waste, Automotive Waste, and Others for waste sources; and Mechanical and Chemical recycling processes. We examine dominant markets, emerging opportunities, and the strategic initiatives of leading players, offering actionable insights for stakeholders navigating this dynamic industry.

Textile Recycling Market Market Concentration & Innovation

The Textile Recycling Market is characterized by a moderate to high level of concentration, with several key players driving innovation and investment. Major companies are actively pursuing research and development in advanced recycling technologies, particularly chemical recycling methods, to achieve higher quality outputs and process mixed fiber streams. Regulatory frameworks, such as extended producer responsibility (EPR) schemes and landfill bans on textiles, are increasingly influencing market dynamics, pushing for greater circularity. Product substitutes, while limited in direct replacement for recycled fibers, include virgin materials. However, growing consumer demand for sustainable fashion and ethical production is a significant trend, favoring recycled textiles. Mergers and acquisitions (M&A) are a notable strategy for market expansion and technology acquisition, with recent deal values contributing to market consolidation and the scaling of innovative solutions. For example, investments in pilot projects and the establishment of new recycling facilities are accelerating.

Textile Recycling Market Industry Trends & Insights

The Textile Recycling Market is experiencing a transformative phase, driven by a confluence of factors that are reshaping its landscape. A primary growth driver is the escalating global concern over textile waste, which burdens landfills and contributes to environmental pollution. Governments worldwide are implementing stricter environmental regulations and promoting circular economy principles, incentivizing businesses to adopt sustainable practices. The apparel industry, in particular, is under immense pressure to reduce its environmental footprint, leading to increased demand for recycled fibers and materials. Technological advancements are another pivotal trend, with significant investments flowing into the development of more efficient and cost-effective recycling processes. Chemical recycling technologies, capable of breaking down synthetic and blended fabrics into their constituent monomers or polymers, are gaining traction, promising to unlock the potential of previously unrecyclable textile waste. Mechanical recycling, while a more established method, continues to evolve with improved sorting and processing techniques. Consumer preferences are also shifting dramatically, with a growing segment of conscious consumers actively seeking out products made from recycled materials and supporting brands with strong sustainability credentials. This rising demand is compelling brands to integrate recycled content into their collections, thereby boosting market penetration. The competitive dynamics within the market are intensifying, as established textile manufacturers, waste management companies, and specialized recycling startups vie for market share. Collaboration and strategic partnerships are becoming increasingly common as companies seek to secure raw material supply chains, develop new recycling technologies, and expand their market reach. The concept of "design for recycling" is also emerging as a crucial industry insight, encouraging the creation of garments that are easier to disassemble and recycle at the end of their life cycle. This proactive approach aims to minimize complexities in the recycling process and maximize the recovery of valuable materials, further solidifying the market's growth trajectory. The increasing adoption of digital technologies for supply chain transparency and material tracking is also a noteworthy trend, enabling better management of textile waste streams and facilitating the traceability of recycled content.

Dominant Markets & Segments in Textile Recycling Market

The Textile Recycling Market exhibits distinct dominance across various geographical regions and material segments, driven by specific economic policies, infrastructure development, and consumer behavior.

Dominant Regions & Countries:

- Europe: This region stands out as a leader due to its strong regulatory push towards a circular economy, comprehensive waste management infrastructure, and high consumer awareness regarding sustainability. Countries like Germany, France, and the UK are at the forefront, supported by significant government incentives and private sector investments in recycling technologies. The presence of established fashion brands committed to sustainable sourcing further fuels demand.

- North America: The United States, in particular, is witnessing rapid growth, fueled by increasing consumer demand for recycled apparel and home goods, alongside a growing number of innovative recycling startups. Favorable economic policies and a robust industrial base are contributing factors.

- Asia-Pacific: While historically a significant producer of textile waste, this region is emerging as a key player in recycling due to growing environmental concerns and government initiatives aimed at waste reduction. China and India, with their massive textile industries, are increasingly investing in recycling infrastructure and technologies.

Dominant Material Segments:

- Cotton: As one of the most widely used natural fibers, cotton waste represents a significant portion of textile waste. The established infrastructure for mechanical recycling of cotton makes it a dominant material segment. Innovations in chemical recycling are also expanding its recyclability, especially when blended with synthetics.

- Polyester and Polyester Fiber: The widespread use of polyester in apparel and home furnishings, coupled with advancements in chemical recycling technologies that can efficiently recover polyester monomers, positions this segment for substantial growth. Its durability and versatility make it a prime candidate for closed-loop recycling.

Dominant Source Segments:

- Apparel Waste: This is by far the largest source of textile waste, driven by fast fashion trends and consumer disposability. Initiatives focused on post-consumer textile collection and sorting are directly targeting this segment.

- Home Furnishing Waste: Upholstery, bedding, and curtains constitute a significant, often overlooked, source of textile waste. Growing awareness and specialized collection programs are gradually increasing its contribution to the recycling market.

Dominant Process Segments:

- Mechanical Recycling: This well-established process, involving shredding and re-spinning fibers, currently dominates the market due to its lower cost and scalability for certain materials, particularly cotton and wool.

- Chemical Recycling: Although still in its nascent stages for many applications, chemical recycling is rapidly gaining prominence. Its ability to handle complex blends and produce high-quality, virgin-like materials from materials like polyester and nylon is a significant growth driver and a key area of innovation.

The dominance of these segments is further underscored by ongoing research and development, substantial investment from leading companies, and evolving regulatory landscapes that prioritize resource efficiency and waste reduction.

Textile Recycling Market Product Developments

Product developments in the Textile Recycling Market are rapidly evolving, focusing on enhancing the quality and applicability of recycled fibers. Innovations in chemical recycling are yielding high-quality polyester and nylon fibers that rival virgin materials, enabling their use in premium apparel and performance wear. Mechanical recycling techniques are also improving, allowing for the production of recycled yarns for diverse applications, from industrial textiles to sustainable fashion lines. These advancements provide competitive advantages by reducing reliance on virgin resources, lowering production costs, and meeting the growing demand for eco-friendly products. Emerging applications include the use of recycled textiles in automotive interiors, insulation materials, and even construction components, demonstrating the versatility and expanding market fit of these sustainable alternatives.

Report Scope & Segmentation Analysis

This report meticulously segments the Textile Recycling Market to provide granular insights into its diverse components. The Material segmentation includes Cotton, Polyester and Polyester Fiber, Wool, Nylon and Nylon Fiber, and Others, each with unique recycling challenges and opportunities. The Source segmentation analyzes Apparel Waste, Home Furnishing Waste, Automotive Waste, and Others, highlighting the primary origins of textile waste streams. The Process segmentation focuses on Mechanical and Chemical recycling methods, detailing their respective market shares and growth trajectories. Projections indicate significant growth across all segments, with chemical recycling expected to see the highest CAGR, driven by technological advancements and increasing demand for high-value recycled materials. The competitive landscape within each segment is dynamic, with continuous innovation and strategic partnerships shaping market outcomes.

Key Drivers of Textile Recycling Market Growth

The Textile Recycling Market is propelled by a synergistic interplay of technological, economic, and regulatory factors.

- Technological Advancements: Breakthroughs in chemical recycling, such as advanced depolymerization techniques, are making it possible to recycle complex textile blends and achieve higher quality recycled fibers, thus expanding the scope of recyclability.

- Economic Incentives and Policies: Government initiatives, including subsidies for recycling infrastructure, tax benefits for using recycled materials, and the implementation of Extended Producer Responsibility (EPR) schemes, are creating a more favorable economic environment for textile recyclers.

- Growing Environmental Consciousness: Increasing consumer awareness about the environmental impact of textile waste is driving demand for sustainable fashion and products made from recycled materials, compelling brands to invest in recycling solutions.

- Corporate Sustainability Goals: Many fashion and textile companies have set ambitious sustainability targets, including increased use of recycled content and reduced waste, which directly translates into increased demand for textile recycling services and materials.

Challenges in the Textile Recycling Market Sector

Despite its significant growth potential, the Textile Recycling Market faces several formidable challenges that hinder its widespread adoption and efficiency.

- Complex Fiber Blends: The prevalence of blended fabrics, combining natural and synthetic fibers, poses significant technical hurdles for separation and recycling, often requiring advanced and costly chemical processes.

- Collection and Sorting Infrastructure: Inefficient and fragmented collection systems, coupled with the lack of standardized sorting technologies, lead to contamination and reduced quality of recycled materials, impacting their marketability.

- Cost Competitiveness: The cost of recycled fibers can sometimes be higher than virgin materials, especially for certain processes, making it challenging to compete on price without supportive policies or consumer willingness to pay a premium.

- Scalability of Advanced Technologies: While promising, many advanced chemical recycling technologies are still in their early stages of commercialization and require substantial investment to scale up to meet the vast volume of textile waste generated globally.

- Regulatory Harmonization: Inconsistent or nascent regulatory frameworks across different regions can create complexities for businesses operating internationally and hinder the development of a unified global approach to textile recycling.

Emerging Opportunities in Textile Recycling Market

The Textile Recycling Market is ripe with emerging opportunities, driven by innovation and shifting market demands. The development of novel chemical recycling processes capable of handling a wider range of textile compositions presents a significant avenue for growth. Furthermore, the increasing demand for high-performance recycled fibers in activewear, outdoor gear, and technical textiles offers lucrative new markets. The growing trend towards circular economy models and the implementation of Extended Producer Responsibility (EPR) schemes by governments worldwide are creating a strong impetus for businesses to invest in and adopt textile recycling solutions. Consumer preference for transparent and sustainable supply chains is also opening doors for brands that can demonstrate their commitment through the use of certified recycled materials. Lastly, the untapped potential of post-industrial textile waste, beyond typical apparel and home furnishings, offers a substantial opportunity for developing specialized recycling streams.

Leading Players in the Textile Recycling Market Market

- Worn Again Technologies

- Lenzing Group

- Birla Cellulose

- Pistoni SRL

- Waste Management Inc

- The Woolmark Company

- American Textile Recycling

- Boer Group Recycling Solutions

- I: Collect

- Infinited Fiber Company

- 7 Other Companies

Key Developments in Textile Recycling Market Industry

- December 2023: The Accelerating Circularity Initiative was granted USD 1.5 million worth of funding from the Walmart Foundation, which will be used to scale up the new Building Circular Systems program. The funds will contribute to the development of the early stages of the program, which have so far shown the technical feasibility of textile-to-textile recycling systems.

- March 2023: Kelheim Fibres, a manufacturer of viscose, collaborated with Recycling Atelier Augsburg to produce quality products from recycled materials. The aim of this collaboration is to ensure that the fibers produced by Kelheim Fibres are manufactured from recycled wood, which it claims will further tighten the loop.

Strategic Outlook for Textile Recycling Market Market

The Textile Recycling Market is set for substantial expansion, fueled by a potent combination of escalating environmental regulations, burgeoning consumer demand for sustainable products, and continuous technological innovation. The focus on developing advanced chemical recycling processes will be a critical growth catalyst, enabling the processing of a wider array of textile waste and yielding higher-value recycled materials. Strategic collaborations between textile manufacturers, waste management firms, and technology providers will be instrumental in establishing efficient collection, sorting, and processing infrastructures. Furthermore, the increasing adoption of circular economy principles by brands, driven by their corporate social responsibility commitments, will create significant opportunities for market players. The integration of recycled content into diverse product categories, beyond apparel, such as home furnishings and automotive components, will further diversify revenue streams and broaden market penetration. Investment in research and development to improve the efficiency and cost-effectiveness of recycling processes will remain paramount for securing a competitive edge in this dynamic and evolving market.

Textile Recycling Market Segmentation

-

1. Material

- 1.1. Cotton

- 1.2. Polyester and Polyester Fiber

- 1.3. Wool

- 1.4. Nylon and Nylon Fiber

- 1.5. Others

-

2. Source

- 2.1. Apparel Waste

- 2.2. Home Furnishing Waste

- 2.3. Automotive Waste

- 2.4. Others

-

3. Process

- 3.1. Mechanical

- 3.2. Chemical

Textile Recycling Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Indonesia

- 3.4. Bangladesh

- 3.5. Rest of Asia Pacific

- 4. Middle East and Africa

- 5. South America

Textile Recycling Market Regional Market Share

Geographic Coverage of Textile Recycling Market

Textile Recycling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Environmental Awareness; Regulatory Initiatives and Policies

- 3.3. Market Restrains

- 3.3.1. Growing Environmental Awareness; Regulatory Initiatives and Policies

- 3.4. Market Trends

- 3.4.1. Europe is Set to Revamp Initiatives Focused on Reducing Waste

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Textile Recycling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Cotton

- 5.1.2. Polyester and Polyester Fiber

- 5.1.3. Wool

- 5.1.4. Nylon and Nylon Fiber

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Apparel Waste

- 5.2.2. Home Furnishing Waste

- 5.2.3. Automotive Waste

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Process

- 5.3.1. Mechanical

- 5.3.2. Chemical

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Textile Recycling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Cotton

- 6.1.2. Polyester and Polyester Fiber

- 6.1.3. Wool

- 6.1.4. Nylon and Nylon Fiber

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Source

- 6.2.1. Apparel Waste

- 6.2.2. Home Furnishing Waste

- 6.2.3. Automotive Waste

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Process

- 6.3.1. Mechanical

- 6.3.2. Chemical

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Textile Recycling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Cotton

- 7.1.2. Polyester and Polyester Fiber

- 7.1.3. Wool

- 7.1.4. Nylon and Nylon Fiber

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Source

- 7.2.1. Apparel Waste

- 7.2.2. Home Furnishing Waste

- 7.2.3. Automotive Waste

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Process

- 7.3.1. Mechanical

- 7.3.2. Chemical

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Textile Recycling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Cotton

- 8.1.2. Polyester and Polyester Fiber

- 8.1.3. Wool

- 8.1.4. Nylon and Nylon Fiber

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Source

- 8.2.1. Apparel Waste

- 8.2.2. Home Furnishing Waste

- 8.2.3. Automotive Waste

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Process

- 8.3.1. Mechanical

- 8.3.2. Chemical

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East and Africa Textile Recycling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Cotton

- 9.1.2. Polyester and Polyester Fiber

- 9.1.3. Wool

- 9.1.4. Nylon and Nylon Fiber

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Source

- 9.2.1. Apparel Waste

- 9.2.2. Home Furnishing Waste

- 9.2.3. Automotive Waste

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Process

- 9.3.1. Mechanical

- 9.3.2. Chemical

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. South America Textile Recycling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Cotton

- 10.1.2. Polyester and Polyester Fiber

- 10.1.3. Wool

- 10.1.4. Nylon and Nylon Fiber

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Source

- 10.2.1. Apparel Waste

- 10.2.2. Home Furnishing Waste

- 10.2.3. Automotive Waste

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Process

- 10.3.1. Mechanical

- 10.3.2. Chemical

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Worn Again Technologies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lenzing Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Birla Cellulose

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pistoni SRL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Waste Management Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Woolmark Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 American Textile Recycling

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boer Group Recycling Solutions

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 I

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Worn Again Technologies

List of Figures

- Figure 1: Global Textile Recycling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Textile Recycling Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Textile Recycling Market Revenue (Million), by Material 2025 & 2033

- Figure 4: North America Textile Recycling Market Volume (Billion), by Material 2025 & 2033

- Figure 5: North America Textile Recycling Market Revenue Share (%), by Material 2025 & 2033

- Figure 6: North America Textile Recycling Market Volume Share (%), by Material 2025 & 2033

- Figure 7: North America Textile Recycling Market Revenue (Million), by Source 2025 & 2033

- Figure 8: North America Textile Recycling Market Volume (Billion), by Source 2025 & 2033

- Figure 9: North America Textile Recycling Market Revenue Share (%), by Source 2025 & 2033

- Figure 10: North America Textile Recycling Market Volume Share (%), by Source 2025 & 2033

- Figure 11: North America Textile Recycling Market Revenue (Million), by Process 2025 & 2033

- Figure 12: North America Textile Recycling Market Volume (Billion), by Process 2025 & 2033

- Figure 13: North America Textile Recycling Market Revenue Share (%), by Process 2025 & 2033

- Figure 14: North America Textile Recycling Market Volume Share (%), by Process 2025 & 2033

- Figure 15: North America Textile Recycling Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Textile Recycling Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Textile Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Textile Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Textile Recycling Market Revenue (Million), by Material 2025 & 2033

- Figure 20: Europe Textile Recycling Market Volume (Billion), by Material 2025 & 2033

- Figure 21: Europe Textile Recycling Market Revenue Share (%), by Material 2025 & 2033

- Figure 22: Europe Textile Recycling Market Volume Share (%), by Material 2025 & 2033

- Figure 23: Europe Textile Recycling Market Revenue (Million), by Source 2025 & 2033

- Figure 24: Europe Textile Recycling Market Volume (Billion), by Source 2025 & 2033

- Figure 25: Europe Textile Recycling Market Revenue Share (%), by Source 2025 & 2033

- Figure 26: Europe Textile Recycling Market Volume Share (%), by Source 2025 & 2033

- Figure 27: Europe Textile Recycling Market Revenue (Million), by Process 2025 & 2033

- Figure 28: Europe Textile Recycling Market Volume (Billion), by Process 2025 & 2033

- Figure 29: Europe Textile Recycling Market Revenue Share (%), by Process 2025 & 2033

- Figure 30: Europe Textile Recycling Market Volume Share (%), by Process 2025 & 2033

- Figure 31: Europe Textile Recycling Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Textile Recycling Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Textile Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Textile Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Textile Recycling Market Revenue (Million), by Material 2025 & 2033

- Figure 36: Asia Pacific Textile Recycling Market Volume (Billion), by Material 2025 & 2033

- Figure 37: Asia Pacific Textile Recycling Market Revenue Share (%), by Material 2025 & 2033

- Figure 38: Asia Pacific Textile Recycling Market Volume Share (%), by Material 2025 & 2033

- Figure 39: Asia Pacific Textile Recycling Market Revenue (Million), by Source 2025 & 2033

- Figure 40: Asia Pacific Textile Recycling Market Volume (Billion), by Source 2025 & 2033

- Figure 41: Asia Pacific Textile Recycling Market Revenue Share (%), by Source 2025 & 2033

- Figure 42: Asia Pacific Textile Recycling Market Volume Share (%), by Source 2025 & 2033

- Figure 43: Asia Pacific Textile Recycling Market Revenue (Million), by Process 2025 & 2033

- Figure 44: Asia Pacific Textile Recycling Market Volume (Billion), by Process 2025 & 2033

- Figure 45: Asia Pacific Textile Recycling Market Revenue Share (%), by Process 2025 & 2033

- Figure 46: Asia Pacific Textile Recycling Market Volume Share (%), by Process 2025 & 2033

- Figure 47: Asia Pacific Textile Recycling Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Textile Recycling Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Pacific Textile Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Textile Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Textile Recycling Market Revenue (Million), by Material 2025 & 2033

- Figure 52: Middle East and Africa Textile Recycling Market Volume (Billion), by Material 2025 & 2033

- Figure 53: Middle East and Africa Textile Recycling Market Revenue Share (%), by Material 2025 & 2033

- Figure 54: Middle East and Africa Textile Recycling Market Volume Share (%), by Material 2025 & 2033

- Figure 55: Middle East and Africa Textile Recycling Market Revenue (Million), by Source 2025 & 2033

- Figure 56: Middle East and Africa Textile Recycling Market Volume (Billion), by Source 2025 & 2033

- Figure 57: Middle East and Africa Textile Recycling Market Revenue Share (%), by Source 2025 & 2033

- Figure 58: Middle East and Africa Textile Recycling Market Volume Share (%), by Source 2025 & 2033

- Figure 59: Middle East and Africa Textile Recycling Market Revenue (Million), by Process 2025 & 2033

- Figure 60: Middle East and Africa Textile Recycling Market Volume (Billion), by Process 2025 & 2033

- Figure 61: Middle East and Africa Textile Recycling Market Revenue Share (%), by Process 2025 & 2033

- Figure 62: Middle East and Africa Textile Recycling Market Volume Share (%), by Process 2025 & 2033

- Figure 63: Middle East and Africa Textile Recycling Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Textile Recycling Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Middle East and Africa Textile Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Textile Recycling Market Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Textile Recycling Market Revenue (Million), by Material 2025 & 2033

- Figure 68: South America Textile Recycling Market Volume (Billion), by Material 2025 & 2033

- Figure 69: South America Textile Recycling Market Revenue Share (%), by Material 2025 & 2033

- Figure 70: South America Textile Recycling Market Volume Share (%), by Material 2025 & 2033

- Figure 71: South America Textile Recycling Market Revenue (Million), by Source 2025 & 2033

- Figure 72: South America Textile Recycling Market Volume (Billion), by Source 2025 & 2033

- Figure 73: South America Textile Recycling Market Revenue Share (%), by Source 2025 & 2033

- Figure 74: South America Textile Recycling Market Volume Share (%), by Source 2025 & 2033

- Figure 75: South America Textile Recycling Market Revenue (Million), by Process 2025 & 2033

- Figure 76: South America Textile Recycling Market Volume (Billion), by Process 2025 & 2033

- Figure 77: South America Textile Recycling Market Revenue Share (%), by Process 2025 & 2033

- Figure 78: South America Textile Recycling Market Volume Share (%), by Process 2025 & 2033

- Figure 79: South America Textile Recycling Market Revenue (Million), by Country 2025 & 2033

- Figure 80: South America Textile Recycling Market Volume (Billion), by Country 2025 & 2033

- Figure 81: South America Textile Recycling Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Textile Recycling Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Textile Recycling Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Textile Recycling Market Volume Billion Forecast, by Material 2020 & 2033

- Table 3: Global Textile Recycling Market Revenue Million Forecast, by Source 2020 & 2033

- Table 4: Global Textile Recycling Market Volume Billion Forecast, by Source 2020 & 2033

- Table 5: Global Textile Recycling Market Revenue Million Forecast, by Process 2020 & 2033

- Table 6: Global Textile Recycling Market Volume Billion Forecast, by Process 2020 & 2033

- Table 7: Global Textile Recycling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Textile Recycling Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Textile Recycling Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Global Textile Recycling Market Volume Billion Forecast, by Material 2020 & 2033

- Table 11: Global Textile Recycling Market Revenue Million Forecast, by Source 2020 & 2033

- Table 12: Global Textile Recycling Market Volume Billion Forecast, by Source 2020 & 2033

- Table 13: Global Textile Recycling Market Revenue Million Forecast, by Process 2020 & 2033

- Table 14: Global Textile Recycling Market Volume Billion Forecast, by Process 2020 & 2033

- Table 15: Global Textile Recycling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Textile Recycling Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Global Textile Recycling Market Revenue Million Forecast, by Material 2020 & 2033

- Table 22: Global Textile Recycling Market Volume Billion Forecast, by Material 2020 & 2033

- Table 23: Global Textile Recycling Market Revenue Million Forecast, by Source 2020 & 2033

- Table 24: Global Textile Recycling Market Volume Billion Forecast, by Source 2020 & 2033

- Table 25: Global Textile Recycling Market Revenue Million Forecast, by Process 2020 & 2033

- Table 26: Global Textile Recycling Market Volume Billion Forecast, by Process 2020 & 2033

- Table 27: Global Textile Recycling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Textile Recycling Market Volume Billion Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Germany Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: France Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Italy Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Russia Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Russia Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Global Textile Recycling Market Revenue Million Forecast, by Material 2020 & 2033

- Table 42: Global Textile Recycling Market Volume Billion Forecast, by Material 2020 & 2033

- Table 43: Global Textile Recycling Market Revenue Million Forecast, by Source 2020 & 2033

- Table 44: Global Textile Recycling Market Volume Billion Forecast, by Source 2020 & 2033

- Table 45: Global Textile Recycling Market Revenue Million Forecast, by Process 2020 & 2033

- Table 46: Global Textile Recycling Market Volume Billion Forecast, by Process 2020 & 2033

- Table 47: Global Textile Recycling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Textile Recycling Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: China Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: China Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: India Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: India Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Indonesia Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Indonesia Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Bangladesh Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Bangladesh Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of Asia Pacific Textile Recycling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Textile Recycling Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global Textile Recycling Market Revenue Million Forecast, by Material 2020 & 2033

- Table 60: Global Textile Recycling Market Volume Billion Forecast, by Material 2020 & 2033

- Table 61: Global Textile Recycling Market Revenue Million Forecast, by Source 2020 & 2033

- Table 62: Global Textile Recycling Market Volume Billion Forecast, by Source 2020 & 2033

- Table 63: Global Textile Recycling Market Revenue Million Forecast, by Process 2020 & 2033

- Table 64: Global Textile Recycling Market Volume Billion Forecast, by Process 2020 & 2033

- Table 65: Global Textile Recycling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global Textile Recycling Market Volume Billion Forecast, by Country 2020 & 2033

- Table 67: Global Textile Recycling Market Revenue Million Forecast, by Material 2020 & 2033

- Table 68: Global Textile Recycling Market Volume Billion Forecast, by Material 2020 & 2033

- Table 69: Global Textile Recycling Market Revenue Million Forecast, by Source 2020 & 2033

- Table 70: Global Textile Recycling Market Volume Billion Forecast, by Source 2020 & 2033

- Table 71: Global Textile Recycling Market Revenue Million Forecast, by Process 2020 & 2033

- Table 72: Global Textile Recycling Market Volume Billion Forecast, by Process 2020 & 2033

- Table 73: Global Textile Recycling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 74: Global Textile Recycling Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Textile Recycling Market?

The projected CAGR is approximately 3.86%.

2. Which companies are prominent players in the Textile Recycling Market?

Key companies in the market include Worn Again Technologies, Lenzing Group, Birla Cellulose, Pistoni SRL, Waste Management Inc, The Woolmark Company, American Textile Recycling, Boer Group Recycling Solutions, I: Collect, Infinited Fiber Company**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Textile Recycling Market?

The market segments include Material, Source, Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Environmental Awareness; Regulatory Initiatives and Policies.

6. What are the notable trends driving market growth?

Europe is Set to Revamp Initiatives Focused on Reducing Waste.

7. Are there any restraints impacting market growth?

Growing Environmental Awareness; Regulatory Initiatives and Policies.

8. Can you provide examples of recent developments in the market?

December 2023: The Accelerating Circularity Initiative was granted USD 1.5 million worth of funding from the Walmart Foundation, which will be used to scale up the new Building Circular Systems program. The funds will contribute to the development of the early stages of the program, which have so far shown the technical feasibility of textile-to-textile recycling systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Textile Recycling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Textile Recycling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Textile Recycling Market?

To stay informed about further developments, trends, and reports in the Textile Recycling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence