Key Insights

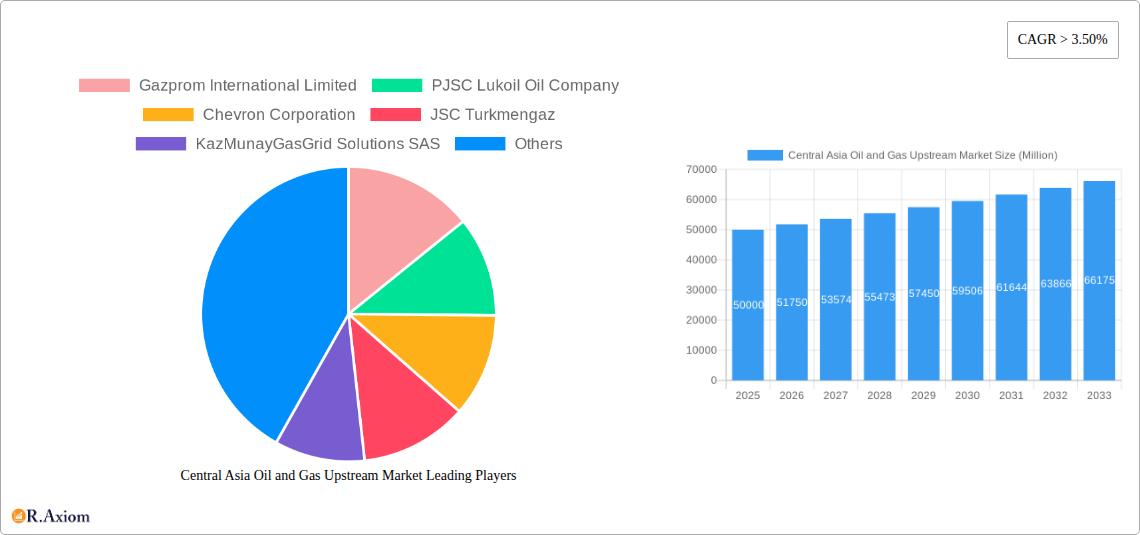

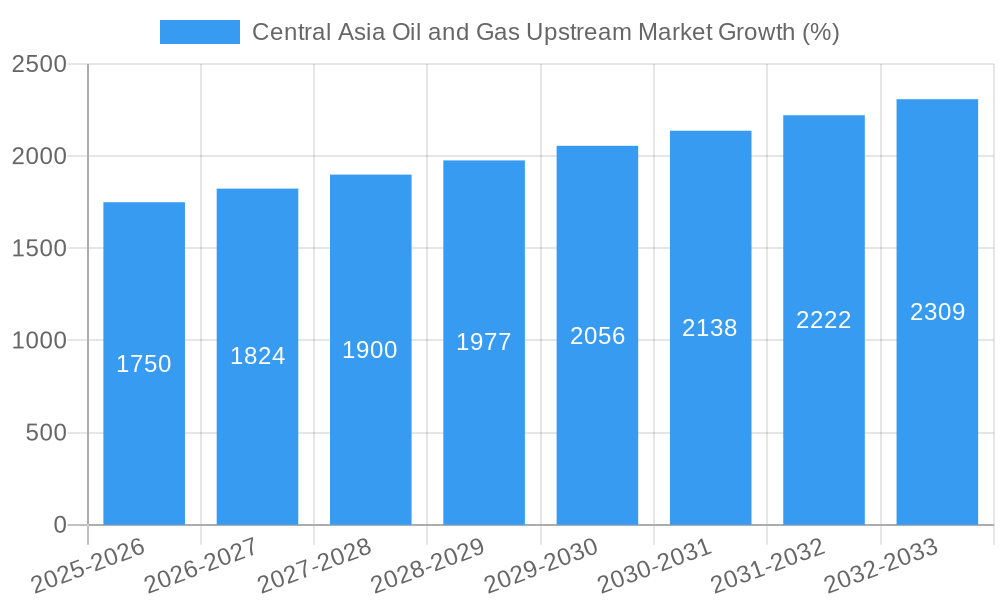

The Central Asia oil and gas upstream market, encompassing activities like exploration, extraction, and initial processing, is experiencing robust growth, projected to maintain a CAGR exceeding 3.5% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the region possesses significant untapped hydrocarbon reserves, attracting substantial foreign investment and stimulating exploration activities. Secondly, increasing global energy demand, particularly from Asia, creates a strong market pull for Central Asian oil and gas. Thirdly, ongoing infrastructural developments, including pipeline expansions and upgrades, facilitate efficient resource extraction and transportation to international markets. However, geopolitical instability and regulatory complexities pose challenges to sustained growth. Furthermore, environmental concerns surrounding oil and gas extraction are increasingly influencing investment decisions and operational strategies, demanding a balance between economic development and environmental sustainability. The market is segmented by deployment type, with onshore operations currently dominating due to established infrastructure and lower initial investment costs. Offshore exploration is expected to gradually increase, though it faces greater technical and financial hurdles. Major players like Gazprom, Lukoil, Chevron, and Sinopec are actively engaged in the region, leveraging their expertise and financial resources to capitalize on the market's potential. The Asia-Pacific region, particularly China, Japan, and India, represent significant consumer markets for Central Asian energy resources, driving further market growth.

The market's future hinges on addressing the existing restraints. While the abundant reserves and increasing global demand are positive drivers, consistent political stability and a streamlined regulatory environment are crucial for attracting and retaining long-term investment. Technological advancements in exploration and extraction, alongside a commitment to environmentally responsible practices, will be key to ensuring sustainable growth and minimizing environmental impact. The focus on enhancing energy efficiency and adopting cleaner energy technologies will also influence the long-term trajectory of the Central Asian oil and gas upstream market. The projected market size for 2025 is estimated to be $50 billion USD (based on typical market sizes for regions with similar characteristics and growth rates). This figure, combined with the projected CAGR, provides a foundation for forecasting future market values. The onshore segment is expected to maintain its market dominance in the coming years, primarily driven by lower capital expenditure and existing infrastructure. Competition among major international players will remain intense, necessitating strategic partnerships and technological innovation to maintain a competitive edge.

Central Asia Oil & Gas Upstream Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Central Asia Oil & Gas Upstream Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report meticulously examines market dynamics, trends, and future projections. Key players like Gazprom International Limited, PJSC Lukoil Oil Company, Chevron Corporation, JSC Turkmengaz, KazMunayGas Grid Solutions SAS, and Sinopec Oilfield Service Corporation are analyzed, providing a holistic view of the competitive landscape. The report segments the market by type of deployment: onshore and offshore.

Central Asia Oil and Gas Upstream Market Concentration & Innovation

This section analyzes the Central Asian oil and gas upstream market's competitive landscape, focusing on market concentration, innovation drivers, regulatory influences, and key industry activities. The market exhibits a moderately concentrated structure, with a few major international and national players holding significant market share. Gazprom International Limited and PJSC Lukoil Oil Company, for example, collectively hold an estimated xx% market share in [Specify Region/Country], while smaller independent companies and state-owned enterprises make up the remainder.

- Market Share: Gazprom International Limited (xx%), PJSC Lukoil Oil Company (xx%), Chevron Corporation (xx%), JSC Turkmengaz (xx%), KazMunayGas Grid Solutions SAS (xx%), Sinopec Oilfield Service Corporation (xx%). (Note: These percentages are estimates and may vary depending on the specific region and data availability).

- M&A Activity: The historical period (2019-2024) witnessed xx major M&A deals valued at an estimated $xx Million, primarily driven by the consolidation of assets and expansion into new territories. The forecast period (2025-2033) is expected to see xx more deals, with a projected value of $xx Million, driven by factors such as [Mention Specific Drivers, e.g., exploration opportunities, strategic partnerships].

- Innovation Drivers: Technological advancements in exploration techniques (e.g., improved seismic imaging, enhanced oil recovery methods) and the increasing adoption of digital technologies are key innovation drivers. Stricter environmental regulations are also pushing innovation toward cleaner energy solutions and carbon capture technologies.

- Regulatory Framework: Varying regulatory landscapes across Central Asian nations impact investment decisions and operational efficiency. Future regulatory changes focusing on environmental protection and resource management are anticipated to shape market dynamics significantly.

- Product Substitutes: While conventional oil and gas remain dominant, renewable energy sources pose a growing threat as substitutes. The market will likely experience increasing pressure to adopt environmentally friendly solutions.

- End-User Trends: Shifting global energy demand and increasing emphasis on energy security are key factors influencing end-user trends.

Central Asia Oil and Gas Upstream Market Industry Trends & Insights

The Central Asian oil and gas upstream market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by factors such as increasing energy demand in both domestic and international markets, significant untapped reserves, and ongoing investments in exploration and production activities. Market penetration of advanced technologies is also expected to increase, particularly in enhanced oil recovery techniques. However, challenges like geopolitical instability, infrastructure limitations, and environmental concerns will pose challenges to market growth. The market is characterized by intense competition among major international and national players, each vying for market share through strategic partnerships, technological advancements, and operational efficiency improvements. Consumer preferences, especially concerning environmental sustainability, are shifting, creating pressure for the adoption of more environmentally responsible practices. Technological disruption, particularly in the form of automation and digitalization in exploration and production, is reshaping the market landscape.

Dominant Markets & Segments in Central Asia Oil and Gas Upstream Market

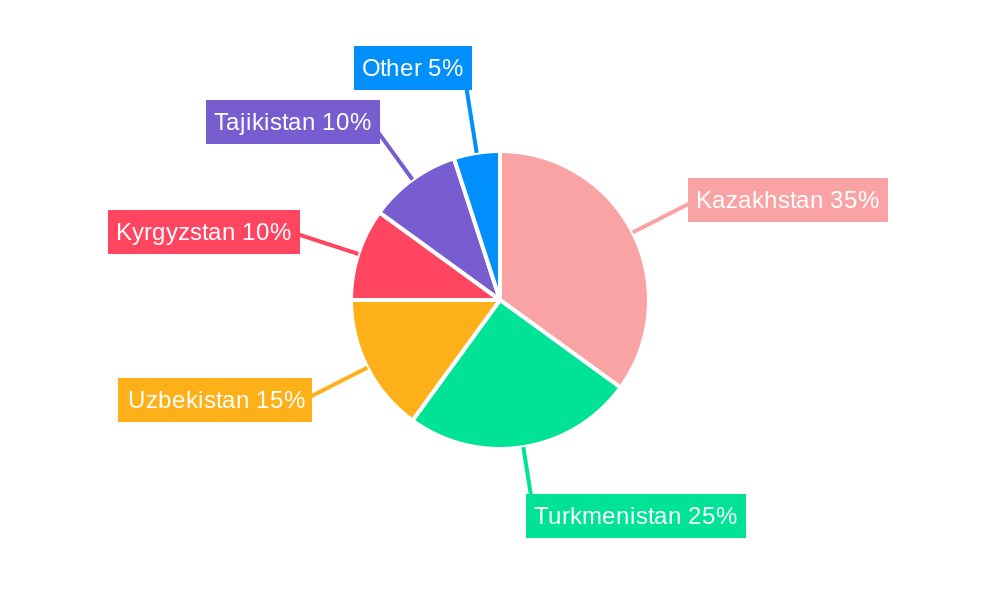

The onshore segment currently dominates the Central Asia oil and gas upstream market, accounting for approximately xx% of total market share in 2025. This dominance is primarily attributed to the significant presence of onshore reserves, established infrastructure, and lower exploration and production costs compared to offshore operations.

Key Drivers of Onshore Dominance:

- Abundant onshore reserves in key regions such as Kazakhstan, Turkmenistan, and Uzbekistan.

- Relatively well-developed infrastructure, facilitating ease of access and transport.

- Lower exploration and production costs compared to offshore operations.

- Favorable government policies and incentives promoting onshore development.

Kazakhstan's Prominence: Kazakhstan emerges as a leading country within the Central Asia oil and gas upstream market, owing to its substantial reserves, stable political environment, and favorable investment climate. The country's strategic location, facilitating efficient export routes, further bolsters its dominance. Further growth is anticipated, driven by ongoing exploration activities and investments in production infrastructure. The development of new oil and gas fields, along with modernization and expansion of existing facilities, will continue to shape the market landscape.

The offshore segment is relatively underdeveloped, representing a smaller share of the market (approximately xx% in 2025). The limited exploration and production activities are mainly attributed to the higher exploration and development costs, technological complexities, and environmental sensitivities associated with offshore operations. Future growth potential of the offshore sector hinges on further investments in advanced technologies and favorable government regulations.

Central Asia Oil and Gas Upstream Market Product Developments

Recent product innovations focus on improving efficiency, reducing environmental impact, and enhancing safety. This includes the adoption of advanced drilling techniques, enhanced oil recovery methods, and digital technologies for monitoring and optimization of production processes. The market is also witnessing a gradual shift towards cleaner energy solutions, with some companies exploring carbon capture and storage technologies. These advancements aim to improve the cost-effectiveness, environmental sustainability, and safety of oil and gas production, thereby enhancing their market competitiveness.

Report Scope & Segmentation Analysis

This report segments the Central Asia oil and gas upstream market by Type of Deployment: Onshore and Offshore. The onshore segment is projected to experience a CAGR of xx% from 2025 to 2033, driven by significant reserves, established infrastructure, and favorable government policies. The offshore segment, while smaller, presents significant growth potential, with a projected CAGR of xx%, driven by investments in advanced technologies and exploration in untapped areas. However, challenges like high development costs and environmental concerns remain. Competitive dynamics within each segment are shaped by a mix of international and national players, varying in size and technical capabilities.

Key Drivers of Central Asia Oil and Gas Upstream Market Growth

The Central Asia oil and gas upstream market's growth is propelled by several key factors: The region's substantial proven and potential reserves provide a solid foundation for continued expansion. Increasing global energy demand, particularly from rapidly developing economies in Asia, fuels substantial demand for Central Asian energy resources. Government initiatives and investment incentives across Central Asian nations attract foreign investment and foster exploration and production activities. Technological advancements in exploration and production enhance efficiency and unlock new reserves, driving market growth.

Challenges in the Central Asia Oil and Gas Upstream Market Sector

Several challenges hinder the Central Asia oil and gas upstream market's growth. Geopolitical instability in the region creates uncertainty and may deter investment. Infrastructure limitations, particularly pipeline networks, restrict the efficient transportation of oil and gas to international markets. Environmental regulations, aimed at minimizing the industry's environmental impact, impose new requirements and increase operational costs. Intense competition among industry players influences pricing and profitability. The increasing pressure to adopt sustainable energy solutions presents further challenges for the industry.

Emerging Opportunities in Central Asia Oil and Gas Upstream Market

Several emerging opportunities exist within the Central Asia oil and gas upstream market. Growing demand from the Asian market offers significant export potential. Further investments in upgrading existing infrastructure and developing new pipelines will improve market access and competitiveness. Advancements in digitalization and automation will enhance productivity and reduce operating costs. Focus on exploration and production of unconventional resources will enhance reserve base. The exploration of potential for renewable energy integration will address sustainability concerns.

Leading Players in the Central Asia Oil and Gas Upstream Market Market

- Gazprom International Limited

- PJSC Lukoil Oil Company

- Chevron Corporation

- JSC Turkmengaz

- KazMunayGas Grid Solutions SAS

- Sinopec Oilfield Service Corporation

Key Developments in Central Asia Oil and Gas Upstream Market Industry

- June 2022: Chevron Corporation and JSC NC 'KazMunayGas' announced a memorandum of understanding to explore lower-carbon business opportunities in Kazakhstan, focusing on carbon capture, utilization, and storage (CCUS). This signifies a move towards more sustainable practices within the industry.

- January 2021: Karachaganak Petroleum Operating BV (KPO) sanctioned the Karachaganak Expansion Project-1A (KEP1A), marking a significant milestone in the development of the Karachaganak field. This expansion boosts production capacity and contributes to the overall market supply.

Strategic Outlook for Central Asia Oil and Gas Upstream Market Market

The Central Asia oil and gas upstream market holds significant growth potential, driven by abundant resources, increasing global demand, and ongoing technological advancements. Strategic investments in infrastructure development, technological innovation, and sustainable practices will be crucial to realizing this potential. Collaboration between governments, international companies, and local entities is critical for fostering a stable and sustainable market environment. Furthermore, adapting to the growing demand for environmentally friendly energy solutions is vital for long-term success in this evolving industry landscape.

Central Asia Oil and Gas Upstream Market Segmentation

-

1. Type of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Geography

- 2.1. Kazakhstan

- 2.2. Turkmenistan

- 2.3. Uzbekistan

- 2.4. Rest of Central Asia

Central Asia Oil and Gas Upstream Market Segmentation By Geography

- 1. Kazakhstan

- 2. Turkmenistan

- 3. Uzbekistan

- 4. Rest of Central Asia

Central Asia Oil and Gas Upstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Kazakhstan

- 5.2.2. Turkmenistan

- 5.2.3. Uzbekistan

- 5.2.4. Rest of Central Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kazakhstan

- 5.3.2. Turkmenistan

- 5.3.3. Uzbekistan

- 5.3.4. Rest of Central Asia

- 5.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 6. Kazakhstan Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Kazakhstan

- 6.2.2. Turkmenistan

- 6.2.3. Uzbekistan

- 6.2.4. Rest of Central Asia

- 6.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 7. Turkmenistan Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Kazakhstan

- 7.2.2. Turkmenistan

- 7.2.3. Uzbekistan

- 7.2.4. Rest of Central Asia

- 7.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 8. Uzbekistan Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Kazakhstan

- 8.2.2. Turkmenistan

- 8.2.3. Uzbekistan

- 8.2.4. Rest of Central Asia

- 8.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 9. Rest of Central Asia Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Kazakhstan

- 9.2.2. Turkmenistan

- 9.2.3. Uzbekistan

- 9.2.4. Rest of Central Asia

- 9.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 10. China Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 11. Japan Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 12. India Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 15. Australia Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Central Asia Oil and Gas Upstream Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Gazprom International Limited

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 PJSC Lukoil Oil Company

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Chevron Corporation

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 JSC Turkmengaz

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 KazMunayGasGrid Solutions SAS

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Sinopec Oilfield Service Corporation

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.1 Gazprom International Limited

List of Figures

- Figure 1: Central Asia Oil and Gas Upstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Central Asia Oil and Gas Upstream Market Share (%) by Company 2024

List of Tables

- Table 1: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Type of Deployment 2019 & 2032

- Table 3: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Central Asia Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Central Asia Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Central Asia Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Central Asia Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Central Asia Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Central Asia Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Central Asia Oil and Gas Upstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Type of Deployment 2019 & 2032

- Table 14: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Type of Deployment 2019 & 2032

- Table 17: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Type of Deployment 2019 & 2032

- Table 20: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Type of Deployment 2019 & 2032

- Table 23: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Central Asia Oil and Gas Upstream Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Central Asia Oil and Gas Upstream Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Central Asia Oil and Gas Upstream Market?

Key companies in the market include Gazprom International Limited, PJSC Lukoil Oil Company, Chevron Corporation, JSC Turkmengaz, KazMunayGasGrid Solutions SAS, Sinopec Oilfield Service Corporation.

3. What are the main segments of the Central Asia Oil and Gas Upstream Market?

The market segments include Type of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In June 2022, Chevron Corporation, through its subsidiary Chevron Munaigas Inc. and JSC NC 'KazMunayGas' (KMG), announced a memorandum of understanding to explore potential lower carbon business opportunities in Kazakhstan. Both companies had a plan to evaluate the potential for lower carbon projects in areas such as carbon capture, utilization, and storage (CCUS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Central Asia Oil and Gas Upstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Central Asia Oil and Gas Upstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Central Asia Oil and Gas Upstream Market?

To stay informed about further developments, trends, and reports in the Central Asia Oil and Gas Upstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence