Key Insights

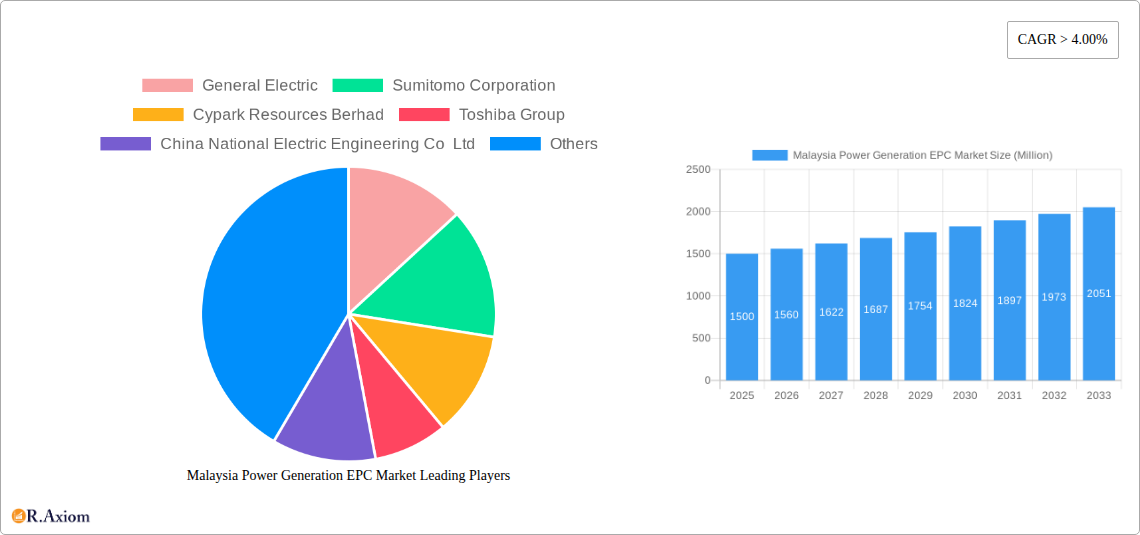

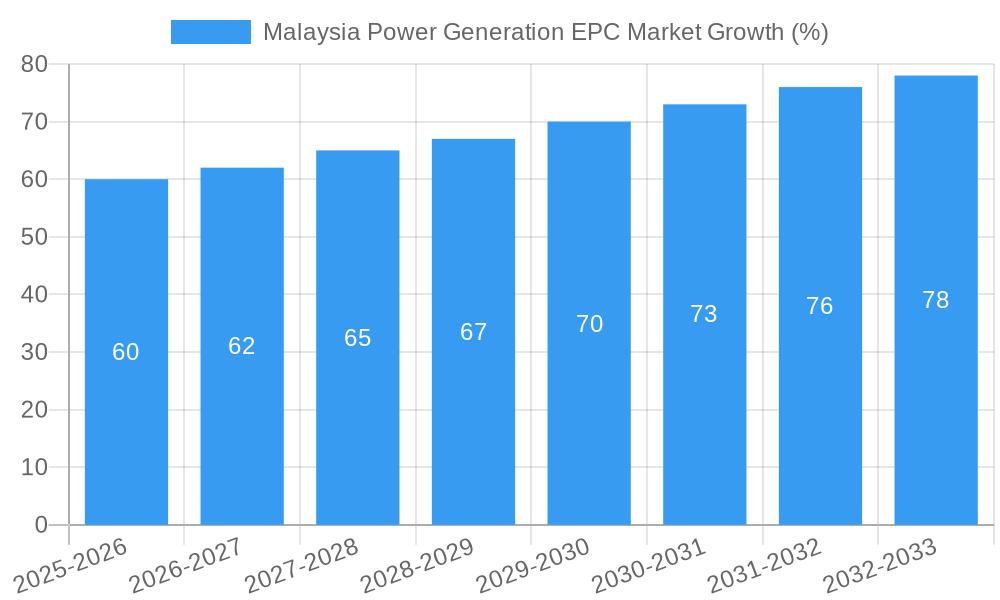

The Malaysia Power Generation Engineering, Procurement, and Construction (EPC) market is experiencing robust growth, driven by increasing energy demand and a government push for renewable energy sources. With a current market size exceeding $XX million (the exact figure is omitted as it's not provided and estimations without clear basis are avoided), a Compound Annual Growth Rate (CAGR) of over 4% is projected through 2033. This growth is fueled by several key factors. Firstly, the expansion of renewable energy projects, particularly solar and wind, is a significant driver. Government initiatives promoting sustainable energy sources are incentivizing investments in these sectors. Secondly, the rising industrialization and urbanization within Malaysia necessitates an increase in power generation capacity, stimulating demand for EPC services across all project sizes, from small-scale to large-scale endeavors. This creates ample opportunities for EPC contractors specializing in diverse power generation technologies, including hydro, coal, and natural gas alongside renewables. Finally, the presence of established international and local EPC companies such as General Electric, Sumitomo Corporation, and Cypark Resources Berhad indicates a competitive yet rapidly evolving market landscape, encouraging innovation and efficiency improvements.

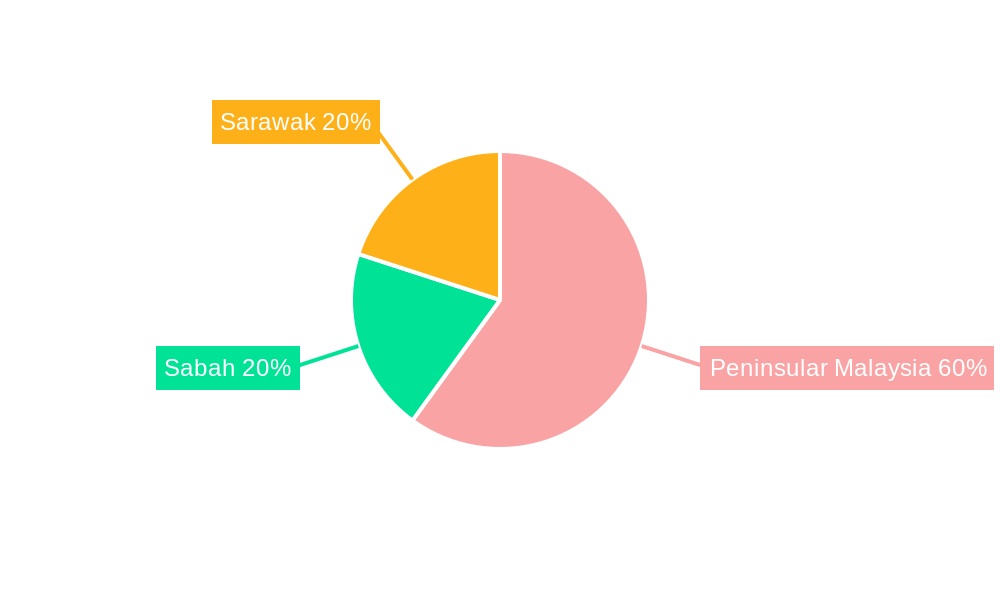

However, the market faces certain restraints. These include potential regulatory hurdles, fluctuations in global commodity prices (particularly for fossil fuels), and the inherent complexities associated with large-scale infrastructure projects. Nevertheless, the long-term outlook remains positive, given the sustained growth in energy demand and the commitment to diversifying Malaysia's energy mix. Segmentation analysis shows strong demand across different end-users, including utilities, independent power producers (IPPs), and industrial sectors. The Asia-Pacific region, particularly countries like China, Japan, and India, serves as a benchmark for Malaysia’s development trajectory in this sector, offering valuable insights into future trends and challenges. Focusing on specific regional breakdowns within Malaysia, combined with a detailed analysis of individual project pipelines, would provide more granular market insights.

This in-depth report provides a comprehensive analysis of the Malaysia Power Generation Engineering, Procurement, and Construction (EPC) market, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. This report leverages rigorous research methodologies to deliver actionable intelligence on market dynamics, growth drivers, challenges, and emerging opportunities. It meticulously segments the market by power generation type (Solar, Wind, Hydro, Coal, Natural Gas), end-user (Utilities, IPPs, Industrial), and project size (Small, Medium, Large Scale).

Malaysia Power Generation EPC Market Market Concentration & Innovation

This section analyzes the competitive landscape, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The Malaysian power generation EPC market exhibits a moderately concentrated structure, with key players holding significant market share. However, the increasing adoption of renewable energy sources fosters a more dynamic and competitive environment. Innovation is driven by the need for cost-effective and efficient power generation solutions, spurred by government incentives and technological advancements. Stringent environmental regulations favor renewable energy technologies, pushing companies to adopt sustainable practices. Substitutes include alternative energy sources and energy efficiency improvements. End-user trends demonstrate a shift towards renewable energy and decentralized generation models. The M&A landscape reveals strategic consolidation among EPC companies, with deal values reaching xx Million in recent years. Specific metrics like precise market share and M&A deal values are presented within the full report.

- Market Concentration: Moderately concentrated, with top players holding xx% market share (2024).

- Innovation Drivers: Government incentives, technological advancements, and environmental regulations.

- M&A Activity: xx number of deals completed between 2019-2024, with a total value of approximately xx Million.

- Key Players' Strategies: Focus on diversification, technological upgrades, and strategic partnerships.

Malaysia Power Generation EPC Market Industry Trends & Insights

The Malaysian power generation EPC market exhibits robust growth, driven by increasing energy demand, government support for renewable energy, and infrastructure development initiatives. The market has witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as the improved efficiency of solar panels and wind turbines, contribute to this growth. Consumer preferences are shifting towards cleaner and more sustainable energy sources. The competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants focusing on renewable energy. Market penetration of renewable energy sources continues to increase, with solar and wind energy leading the growth.

Dominant Markets & Segments in Malaysia Power Generation EPC Market

The Malaysian power generation EPC market is dominated by the Solar segment in terms of project volume and value. The growth is driven by substantial government support via initiatives such as the Large-Scale Solar (LSS) program. The Utilities sector represents the largest end-user segment, owing to the substantial investment in upgrading grid infrastructure and expanding power generation capacity. The Large-Scale projects segment holds the majority of market share due to significant investments in large-scale renewable energy projects. Key drivers across segments include:

- Solar: Government incentives (e.g., LSS program), decreasing solar panel costs, and increasing awareness of renewable energy.

- Utilities: Expansion of grid infrastructure, increasing electricity demand, and government mandates for renewable energy integration.

- Large-Scale Projects: Significant investments in large-scale renewable energy plants and infrastructure development.

Malaysia Power Generation EPC Market Product Developments

Recent product innovations focus on enhancing the efficiency, reliability, and cost-effectiveness of power generation technologies. This includes advancements in solar panel technology, improvements in wind turbine design, and the integration of smart grids and energy storage solutions. These innovations offer competitive advantages by reducing operational costs, increasing energy output, and enhancing grid stability. Technological trends highlight the shift towards modular designs, digitalization, and data analytics for optimized performance and maintenance.

Report Scope & Segmentation Analysis

This report segments the Malaysia power generation EPC market based on generation type (Solar, Wind, Hydro, Coal, Natural Gas), end-user (Utilities, IPPs, Industrial), and project size (Small, Medium, Large Scale). Each segment’s analysis includes market size, growth projections, and competitive dynamics. The solar segment is expected to experience the highest growth rate, driven by government initiatives. The utility sector dominates in terms of project value. Large-scale projects show substantial growth potential due to large investments in renewable energy projects.

Key Drivers of Malaysia Power Generation EPC Market Growth

The Malaysian power generation EPC market’s growth is primarily driven by increasing energy demand fueled by economic expansion, government support for renewable energy through feed-in tariffs and various incentive programs, and the country's commitment to reducing its carbon footprint. Furthermore, infrastructure development and investments in upgrading the national grid are key catalysts.

Challenges in the Malaysia Power Generation EPC Market Sector

Challenges include securing project financing, navigating complex regulatory approvals, potential land acquisition issues for large-scale projects, managing supply chain disruptions, and facing intense competition from both domestic and international EPC contractors. These factors can lead to project delays and cost overruns, impacting overall market growth.

Emerging Opportunities in Malaysia Power Generation EPC Market

Emerging opportunities include the increasing adoption of hybrid renewable energy systems, the growth of energy storage technologies (e.g., battery storage), and the expansion of smart grid infrastructure. The market presents potential for companies specializing in decentralized power generation solutions and those offering integrated EPC services for renewable energy projects.

Leading Players in the Malaysia Power Generation EPC Market Market

- General Electric

- Sumitomo Corporation

- Cypark Resources Berhad

- Toshiba Group

- China National Electric Engineering Co Ltd

- AFRY AB

- Scatec ASA

- Kpower Berhad

- Solarvest Holdings

- Sunway Construction Group Bhd

Key Developments in Malaysia Power Generation EPC Market Industry

- October 2021: Solarvest Holdings Bhd secured a USD 11.2 Million EPC contract for a 50 MW AC solar farm in Bukit Selambau, Kedah, scheduled for commercial operation in 2023.

- August 2021: Solarvest Holdings won a MYR 66 Million EPC contract for a 17.76 MW solar project in Mukim Bota, Perak.

Strategic Outlook for Malaysia Power Generation EPC Market Market

The Malaysia power generation EPC market is poised for sustained growth, driven by the government's commitment to renewable energy, increasing energy demand, and infrastructure development. The focus on renewable energy sources presents significant opportunities for EPC companies specializing in solar, wind, and hybrid projects. Strategic partnerships and technological advancements will be key factors in determining market success.

Malaysia Power Generation EPC Market Segmentation

- 1. Thermal

- 2. Hydroelectric

- 3. Renewables

Malaysia Power Generation EPC Market Segmentation By Geography

- 1. Malaysia

Malaysia Power Generation EPC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Renewable Energy Sector Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Thermal

- 5.2. Market Analysis, Insights and Forecast - by Hydroelectric

- 5.3. Market Analysis, Insights and Forecast - by Renewables

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Thermal

- 6. China Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 8. India Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 General Electric

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Sumitomo Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Cypark Resources Berhad

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Toshiba Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 China National Electric Engineering Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 AFRY AB

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Scatec ASA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kpower Berhad

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Solarvest Holdings

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Sunway Construction Group Bhd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 General Electric

List of Figures

- Figure 1: Malaysia Power Generation EPC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Power Generation EPC Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Power Generation EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Power Generation EPC Market Revenue Million Forecast, by Thermal 2019 & 2032

- Table 3: Malaysia Power Generation EPC Market Revenue Million Forecast, by Hydroelectric 2019 & 2032

- Table 4: Malaysia Power Generation EPC Market Revenue Million Forecast, by Renewables 2019 & 2032

- Table 5: Malaysia Power Generation EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Malaysia Power Generation EPC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Malaysia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Malaysia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Malaysia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Malaysia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Malaysia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Malaysia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Malaysia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Malaysia Power Generation EPC Market Revenue Million Forecast, by Thermal 2019 & 2032

- Table 15: Malaysia Power Generation EPC Market Revenue Million Forecast, by Hydroelectric 2019 & 2032

- Table 16: Malaysia Power Generation EPC Market Revenue Million Forecast, by Renewables 2019 & 2032

- Table 17: Malaysia Power Generation EPC Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Power Generation EPC Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Malaysia Power Generation EPC Market?

Key companies in the market include General Electric, Sumitomo Corporation, Cypark Resources Berhad, Toshiba Group, China National Electric Engineering Co Ltd, AFRY AB, Scatec ASA, Kpower Berhad, Solarvest Holdings, Sunway Construction Group Bhd.

3. What are the main segments of the Malaysia Power Generation EPC Market?

The market segments include Thermal, Hydroelectric, Renewables.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives.

6. What are the notable trends driving market growth?

Renewable Energy Sector Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In October 2021, Solarvest Holdings Bhd won an EPC contract worth USD 11.2 million under round four of a large-scale solar program. The solar farm is set to have 50 MW of AC capacity and will be located in the town of Bukit Selambau, Kedah, Malaysia. The solar farm is scheduled to reach commercial operations by 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Power Generation EPC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Power Generation EPC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Power Generation EPC Market?

To stay informed about further developments, trends, and reports in the Malaysia Power Generation EPC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence