Key Insights

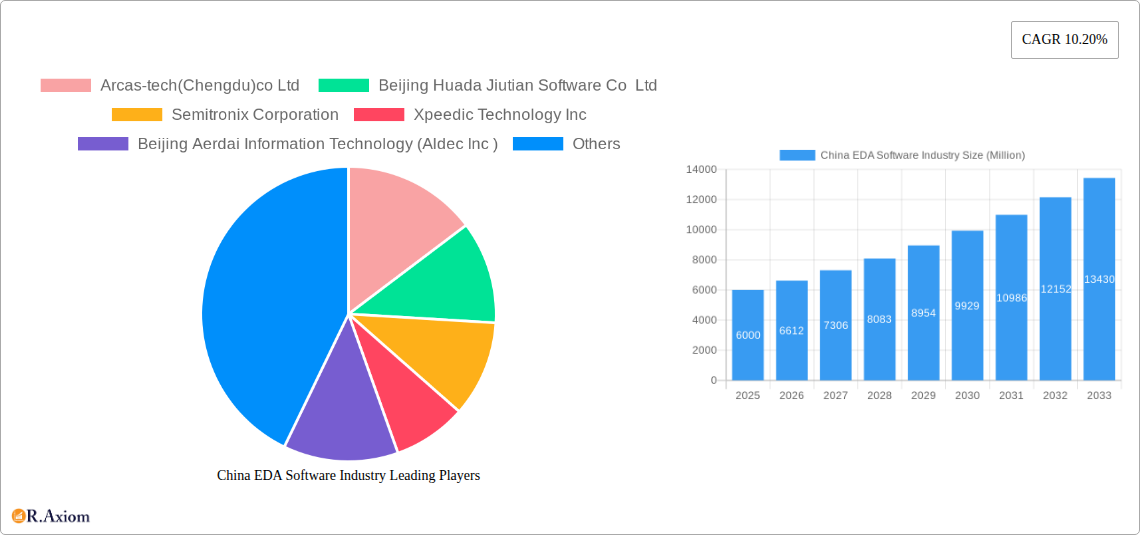

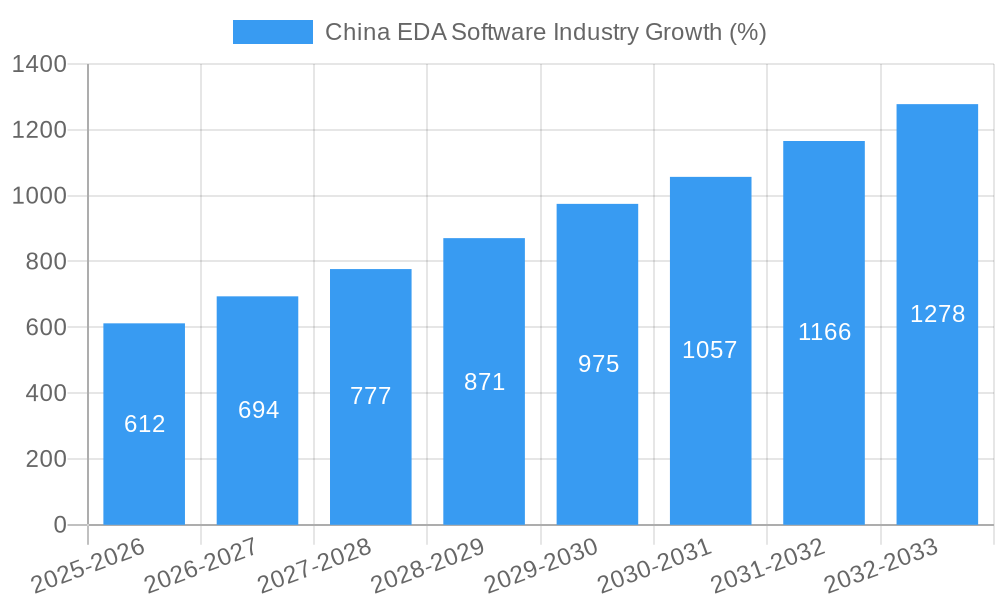

The China EDA (Electronic Design Automation) software market, currently experiencing robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) of 10.2% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the burgeoning domestic semiconductor industry necessitates advanced EDA tools for chip design and verification. The Chinese government's significant investments in technological self-reliance further stimulate demand. Secondly, the increasing complexity of integrated circuits (ICs) and the rise of applications like 5G, AI, and autonomous vehicles demand sophisticated EDA solutions capable of handling intricate designs and simulations. Thirdly, the growing adoption of advanced packaging technologies, such as 3D-ICs and system-in-package (SiP), necessitates specialized EDA tools for efficient design and verification. While the market faces restraints like the dominance of international players and potential technology transfer limitations, the long-term outlook remains positive. The market segmentation reveals strong growth across various applications (communication, consumer electronics, automotive, industrial) and types of EDA software (CAE, IC physical design, PCB/MCM, SIP). This indicates a diversified market with opportunities for both established international companies and emerging domestic players. The market's healthy trajectory is expected to continue driven by consistent government support, technological advancements and increasing domestic demand across various sectors.

The competitive landscape is dynamic, with a mix of established global players like Cadence, Synopsys, and Siemens (Mentor Graphics) competing alongside ambitious domestic companies such as Arcas-tech, Beijing Huada Jiutian, and Xpeedic. This competition fosters innovation and drives price reductions, making EDA tools more accessible to a wider range of designers. The focus is shifting towards cloud-based EDA solutions and collaborative design platforms, enhancing efficiency and scalability. While precise market sizing for 2025 is unavailable, extrapolating from the provided CAGR of 10.2% and assuming a reasonable 2025 market size based on industry reports, a conservative estimate places the market value in the range of $5-7 billion USD. This projection considers the significant investments in the Chinese semiconductor industry and the steady growth in demand for advanced EDA capabilities.

China EDA Software Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China EDA software market, offering valuable insights for industry stakeholders, investors, and businesses seeking to understand this dynamic sector. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period extending to 2033. The total market size is projected to reach xx Million by 2033, showcasing significant growth opportunities.

China EDA Software Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the China EDA software market, examining market concentration, innovation drivers, regulatory frameworks, and key industry dynamics. The market is characterized by a mix of both domestic and international players, with a few dominant companies holding significant market share. For example, Synopsys Inc and Cadence Design Systems Inc collectively hold an estimated xx% of the market share in 2025, while domestic players like Beijing Huada Jiutian Software Co Ltd are striving to increase their presence.

- Market Concentration: The market exhibits moderate concentration, with a few major players dominating certain segments. Smaller, niche players cater to specific applications and needs.

- Innovation Drivers: The push for advanced semiconductor technology, the growth of 5G and AI applications, and government initiatives to promote domestic technology development are key drivers of innovation.

- Regulatory Frameworks: Government regulations and policies aimed at supporting domestic semiconductor industries influence the market dynamics and investment decisions.

- Product Substitutes: Open-source EDA tools and cloud-based solutions are emerging as potential substitutes, although their capabilities often lag behind commercial offerings.

- End-User Trends: The increasing demand for higher performance electronics, miniaturization, and cost reduction drives the adoption of advanced EDA software.

- M&A Activities: The past few years have witnessed several mergers and acquisitions, with deal values averaging xx Million, indicating industry consolidation and strategic partnerships. Examples include the acquisition of xx company by xx for xx Million.

China EDA Software Industry Industry Trends & Insights

The China EDA software market is experiencing robust growth, driven by several factors. The Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033). This growth is fueled by a rising demand for advanced electronics across various applications, technological advancements driving the need for sophisticated design tools, increasing investments in research and development, and supportive government policies aimed at boosting domestic technology capabilities.

Technological disruptions, such as the adoption of artificial intelligence (AI) and machine learning (ML) in EDA tools, are transforming the industry. The market penetration of advanced EDA solutions continues to increase, particularly in high-growth segments such as 5G communication and AI hardware. Competitive dynamics are characterized by both international and domestic players vying for market share through product innovation, strategic partnerships, and acquisitions. Consumer preferences increasingly favor user-friendly, efficient, and cost-effective EDA solutions, spurring innovation in the field.

Dominant Markets & Segments in China EDA Software Industry

The Communication and Consumer Electronics segments are the dominant application areas in the China EDA software market, driven by the high demand for smartphones, IoT devices, and 5G infrastructure. The IC Physical Design and Verification segment holds the largest share among software types, emphasizing the importance of efficient chip design and verification processes in the high-tech manufacturing sector. The market is geographically concentrated in key technology hubs like Shenzhen and Beijing, benefiting from strong infrastructure, skilled workforce, and supportive government policies.

- Key Drivers for Dominant Segments:

- Communication: Growth of 5G, high-speed data networks, and increased adoption of mobile devices.

- Consumer Electronics: Rising demand for smartphones, wearables, and smart home devices.

- Automotive: Adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies.

- IC Physical Design and Verification: Need for efficient design and verification of complex integrated circuits.

- PCB and MCM: Demand for high-density packaging and miniaturization of electronic components.

China EDA Software Industry Product Developments

Recent product innovations have focused on improving design efficiency, verification accuracy, and integration with other design tools. Key advancements include AI-powered design automation, cloud-based EDA platforms, and improved simulation capabilities. These advancements aim to reduce design time and costs while enhancing the quality and performance of electronic products. The market is witnessing a shift toward more specialized EDA tools targeting specific applications and technologies, reflecting the increasing complexity of modern electronics.

Report Scope & Segmentation Analysis

This report segments the China EDA software market by application (Communication, Consumer Electronics, Automotive, Industrial, Other Applications) and by type (Computer-aided Engineering (CAE), IC Physical Design and Verification, Printed Circuit Board and Multi-chip Module (PCB and MCM), Semiconductor Intellectual Property (SIP)). Each segment’s market size, growth projections, and competitive dynamics are analyzed in detail. For instance, the IC Physical Design and Verification segment is expected to witness the fastest growth due to increasing complexity in chip design. Similarly, the Consumer Electronics segment is projected to dominate due to high demand in the consumer market.

Key Drivers of China EDA Software Industry Growth

Several factors are driving the growth of the China EDA software industry. These include:

- Technological advancements: Continuous improvements in semiconductor technology and the rise of AI/ML in EDA tools.

- Government support: Policies promoting domestic technology development and investment in semiconductor manufacturing.

- Economic growth: Expanding electronics industry and increasing demand for high-tech products.

Challenges in the China EDA Software Industry Sector

The China EDA software industry faces several challenges:

- Competition from established international players: Dominant international players pose a significant competitive challenge for domestic firms.

- Technological dependence: Reliance on foreign technology for advanced EDA tools presents a potential bottleneck.

- Talent acquisition: Attracting and retaining skilled professionals in the field remains a challenge.

Emerging Opportunities in China EDA Software Industry

Emerging opportunities for growth include:

- Expansion into new markets: Development of specialized EDA tools for emerging technologies like AI and quantum computing.

- Adoption of cloud-based EDA platforms: Increased adoption of cloud-based solutions for design collaboration and accessibility.

- Growth of domestic EDA companies: Potential for domestic companies to capture market share through innovation and government support.

Leading Players in the China EDA Software Industry Market

- Arcas-tech(Chengdu)co Ltd

- Beijing Huada Jiutian Software Co Ltd

- Semitronix Corporation

- Xpeedic Technology Inc

- Beijing Aerdai Information Technology (Aldec Inc)

- Zuken Ltd

- Altium Limited

- Shanghai Lomicro Information Technology Co Ltd (Agnisys Inc)

- Mentor Graphic Corporation (Siemens PLM Software)

- Synopsys Inc

- Cadence Design Systems Inc

- Platform Design Automation Inc

Key Developments in China EDA Software Industry Industry

- 2022 Q4: Synopsys Inc. launched a new EDA tool for advanced node design.

- 2023 Q1: Cadence Design Systems Inc. partnered with a leading Chinese semiconductor manufacturer.

- 2023 Q3: Beijing Huada Jiutian Software Co Ltd secured significant funding for R&D. (Further key developments can be added here as they become available)

Strategic Outlook for China EDA Software Industry Market

The China EDA software market is poised for continued growth, driven by ongoing technological advancements, supportive government policies, and expanding demand for advanced electronics. Strategic opportunities lie in fostering innovation, developing specialized solutions, and building strategic partnerships. The focus on developing domestic capabilities will be crucial in reducing reliance on foreign technology and shaping the future of the industry.

China EDA Software Industry Segmentation

-

1. Type

- 1.1. Computer-aided Engineering (CAE)

- 1.2. IC Physical Design and Verification

- 1.3. Printed

- 1.4. Semiconductor Intellectual Property (SIP)

-

2. Application

- 2.1. Communication

- 2.2. Consumer Electronics

- 2.3. Automotive

- 2.4. Industrial

- 2.5. Other Applications

China EDA Software Industry Segmentation By Geography

- 1. China

China EDA Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Increasing Government Support for EDA Tool Development; Growing Prevalence of PCB Design

- 3.2.2 System Design and PL/FPGA Design

- 3.3. Market Restrains

- 3.3.1. ; Lack of Comprehensiveness of Chinese Digital Design Tools

- 3.4. Market Trends

- 3.4.1. Automotive Sector is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China EDA Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Computer-aided Engineering (CAE)

- 5.1.2. IC Physical Design and Verification

- 5.1.3. Printed

- 5.1.4. Semiconductor Intellectual Property (SIP)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Communication

- 5.2.2. Consumer Electronics

- 5.2.3. Automotive

- 5.2.4. Industrial

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Arcas-tech(Chengdu)co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Beijing Huada Jiutian Software Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Semitronix Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xpeedic Technology Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Beijing Aerdai Information Technology (Aldec Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zuken Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Altium Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai Lomicro Information Technology Co Ltd (Agnisys Inc )

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mentor Graphic Corporation (Siemens PLM Software)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Synopsys Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cadence Design Systems Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Platform Design Automation Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Arcas-tech(Chengdu)co Ltd

List of Figures

- Figure 1: China EDA Software Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China EDA Software Industry Share (%) by Company 2024

List of Tables

- Table 1: China EDA Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China EDA Software Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: China EDA Software Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: China EDA Software Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: China EDA Software Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: China EDA Software Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: China EDA Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China EDA Software Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: China EDA Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China EDA Software Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: China EDA Software Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: China EDA Software Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 13: China EDA Software Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: China EDA Software Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 15: China EDA Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China EDA Software Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China EDA Software Industry?

The projected CAGR is approximately 10.20%.

2. Which companies are prominent players in the China EDA Software Industry?

Key companies in the market include Arcas-tech(Chengdu)co Ltd , Beijing Huada Jiutian Software Co Ltd, Semitronix Corporation, Xpeedic Technology Inc, Beijing Aerdai Information Technology (Aldec Inc ), Zuken Ltd, Altium Limited, Shanghai Lomicro Information Technology Co Ltd (Agnisys Inc ), Mentor Graphic Corporation (Siemens PLM Software), Synopsys Inc, Cadence Design Systems Inc, Platform Design Automation Inc.

3. What are the main segments of the China EDA Software Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Government Support for EDA Tool Development; Growing Prevalence of PCB Design. System Design and PL/FPGA Design.

6. What are the notable trends driving market growth?

Automotive Sector is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Lack of Comprehensiveness of Chinese Digital Design Tools.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China EDA Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China EDA Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China EDA Software Industry?

To stay informed about further developments, trends, and reports in the China EDA Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence