Key Insights

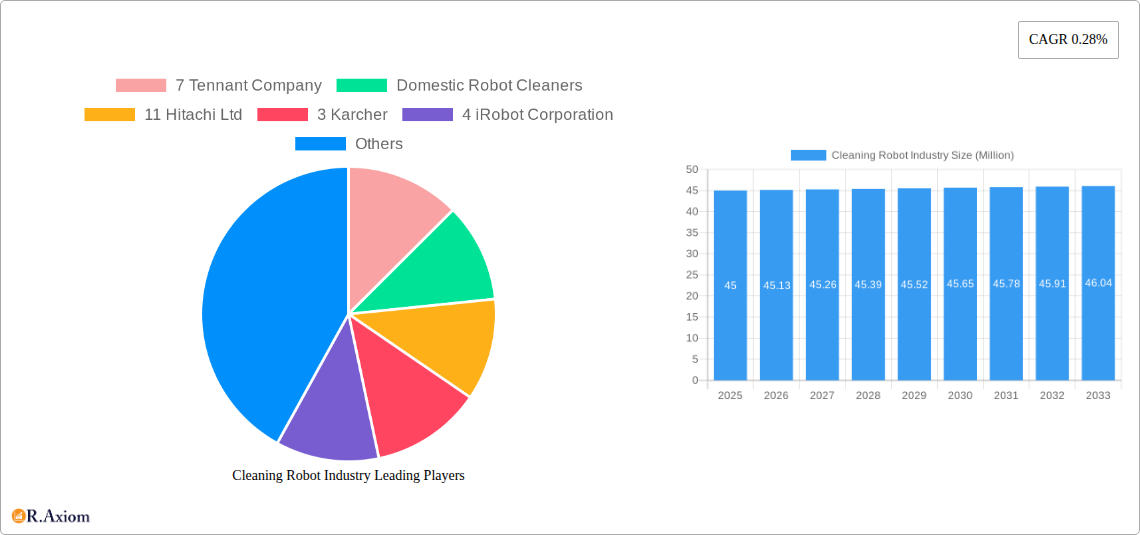

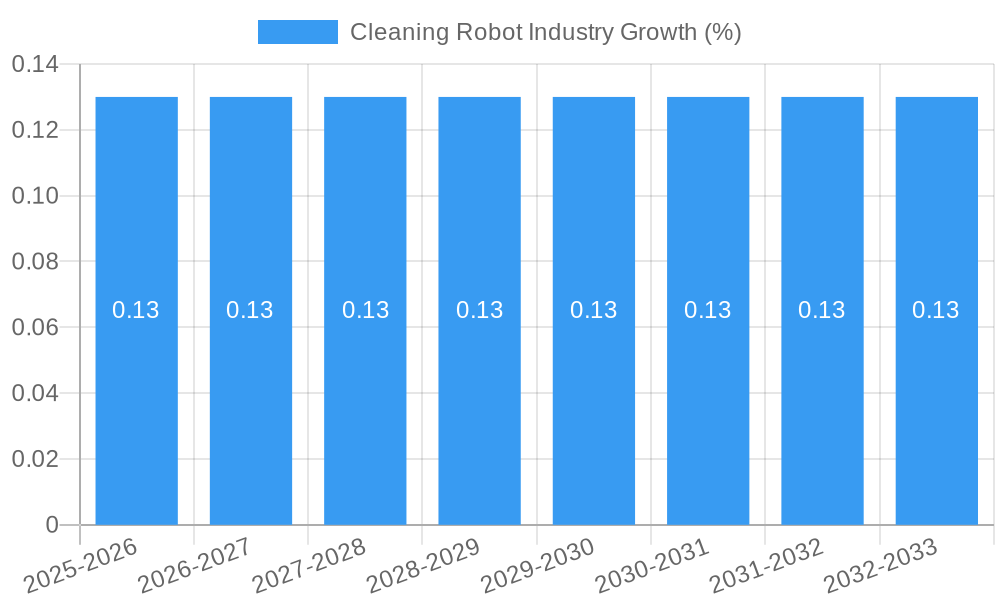

The global cleaning robot market, valued at $45 million in 2025, is projected to experience modest growth, with a Compound Annual Growth Rate (CAGR) of 0.28% from 2025 to 2033. This relatively low CAGR suggests a market currently facing challenges in achieving significant expansion. Several factors contribute to this moderate growth. While technological advancements continue to improve robot capabilities, such as enhanced navigation and cleaning efficacy, high initial purchase costs remain a significant barrier to entry for many consumers. Furthermore, concerns regarding data privacy and the potential displacement of human labor in professional cleaning sectors create hesitancy. The market is segmented into domestic/household robots and professional cleaning robots, with household robots currently dominating due to increasing consumer demand for convenience and time-saving solutions in home maintenance. The professional cleaning sector, while showing potential for future expansion, lags behind due to higher initial investment costs and the need for robust integration into existing cleaning workflows. Key players like iRobot, Ecovacs Robotics, and Roborock Technology are driving innovation and market competition, but the overall growth is constrained by factors mentioned above. Future growth will hinge on addressing these restraints through affordability improvements, enhanced functionalities (like AI-powered cleaning optimization and multi-surface compatibility), and increased consumer awareness regarding the long-term benefits and cost-effectiveness of cleaning robots.

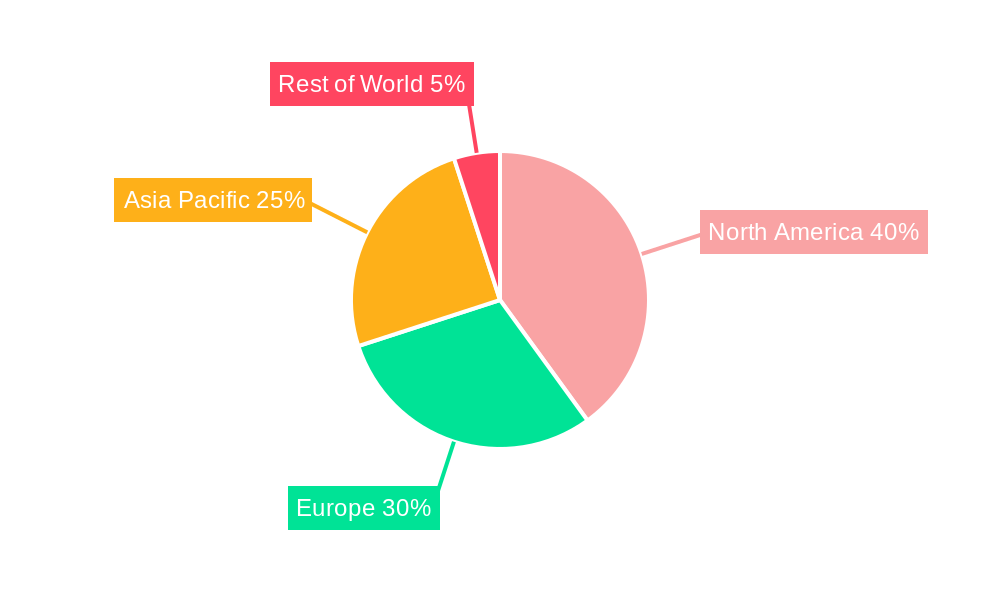

The market's geographic distribution likely shows a concentration in developed regions such as North America and Europe, given higher disposable incomes and greater technological adoption rates. However, rapidly developing economies in the Asia-Pacific region offer significant growth potential in the coming years, particularly as consumer spending power increases and awareness of cleaning robot technology grows. Strategic partnerships between manufacturers and distributors, coupled with aggressive marketing campaigns emphasizing the benefits and convenience of automated cleaning solutions, will play a crucial role in accelerating market penetration and driving higher growth figures in the future. Successful players will leverage advancements in artificial intelligence (AI) and machine learning (ML) to refine robot functionalities, enhancing their cleaning efficiency and user experience, leading to a more compelling value proposition for both domestic and professional cleaning applications.

Cleaning Robot Industry Market Concentration & Innovation

This comprehensive report analyzes the cleaning robot industry, encompassing the period from 2019 to 2033. It delves into market concentration, identifying key players and their respective market shares. The report examines innovation drivers, such as advancements in AI, sensor technology, and battery life, shaping the competitive landscape. Regulatory frameworks impacting the industry, along with the emergence of product substitutes and evolving end-user trends, are meticulously explored. Furthermore, the report details significant mergers and acquisitions (M&A) activities, including deal values and their impact on market consolidation. The analysis covers major players like iRobot, Tennant Company, and Ecovacs Robotics, assessing their strategic positioning and market influence. Market share data for 2024 reveals a fragmented landscape with the top 5 players holding approximately xx% of the market. Significant M&A activity, such as the Amazon-iRobot merger valued at $1.7 Billion, highlights industry consolidation and the influx of significant capital.

- Market Share: Top 5 players hold approximately xx% of the market (2024 data).

- M&A Activity: Amazon's acquisition of iRobot (August 2022) signals significant industry consolidation. Total M&A value for the period 2019-2024 is estimated at $xx Billion.

- Innovation Drivers: Advancements in AI, LiDAR, and battery technology drive product differentiation and market expansion.

- Regulatory Landscape: Analysis of relevant safety and environmental regulations impacting the industry's growth trajectory.

Cleaning Robot Industry Industry Trends & Insights

This section provides an in-depth analysis of the cleaning robot industry's growth drivers, technological advancements, consumer behavior shifts, and competitive dynamics. The report presents detailed market sizing and forecasts for the period 2019-2033, including a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033). Market penetration of cleaning robots in both domestic and professional segments is analyzed, highlighting regional variations. Specific trends such as the increasing adoption of smart home technologies, rising consumer disposable incomes, and growing awareness of hygiene are explored. The shift towards autonomous and AI-powered cleaning robots is analyzed, along with the impact on the competitive landscape. The report also explores the growing demand for specialized cleaning robots for various applications, such as healthcare facilities and industrial settings. The competitive landscape is dissected, examining pricing strategies, marketing campaigns, and innovation efforts of leading players.

Dominant Markets & Segments in Cleaning Robot Industry

This report pinpoints the leading geographic regions and application segments within the cleaning robot market. North America is projected to maintain its dominance in 2025, driven by high consumer spending, technological advancements, and the early adoption of smart home technology. Asia-Pacific is also a key region, showing strong growth potential due to rapid urbanization and industrialization. The dominance of the Domestic/Household Robots segment is analyzed, considering its high market share compared to the professional cleaning segment.

- Key Drivers for North America: High disposable income, early adoption of technology, strong consumer preference for convenience.

- Key Drivers for Asia-Pacific: Rapid urbanization, rising middle class, industrial automation needs.

- Domestic/Household Robots Dominance: Driven by increasing consumer demand for convenient and time-saving home cleaning solutions.

- Professional Robots Growth: Fueled by labor shortages, increased efficiency demands in commercial and industrial settings.

The analysis explores factors contributing to the dominance, including economic factors, infrastructure development, and government policies supporting automation and smart home technology adoption. Detailed market size and growth projections are provided for each dominant segment and region.

Cleaning Robot Industry Product Developments

The cleaning robot industry is characterized by continuous product innovation, with manufacturers focusing on improving cleaning efficiency, autonomy, and smart features. Recent advancements include enhanced navigation systems, object recognition capabilities, improved suction power, and self-emptying dustbins. The development of specialized cleaning robots for various surfaces and environments, along with the integration of smart home ecosystems, are significant trends. These innovations address consumers' demand for more efficient, convenient, and adaptable cleaning solutions, driving market growth and competitiveness.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the cleaning robot market, dividing it by application:

Domestic/Household Robots: This segment encompasses robot vacuum cleaners, mops, and other cleaning robots designed for residential use. This segment is projected to maintain a xx% market share in 2025, with xx Million units sold and a growth projection of xx% from 2025-2033. Competitive dynamics are driven by features, pricing, and brand recognition.

Other Cleaning: Professional Robots: This segment covers industrial and commercial cleaning robots used in diverse settings like warehouses, hospitals, and airports. This segment is forecast to grow at a CAGR of xx% during the forecast period, driven by increasing demand for automation in professional cleaning applications. The competitive landscape is more concentrated, with a focus on durability, efficiency, and specialized cleaning functionalities.

Key Drivers of Cleaning Robot Industry Growth

The cleaning robot industry is experiencing robust growth driven by several key factors:

Technological advancements: Continuous innovations in AI, sensor technology, and battery technology enhance cleaning performance, autonomy, and user experience.

Rising disposable incomes: Increasing affordability of cleaning robots boosts consumer adoption, particularly in developed economies.

Labor shortages: The demand for professional cleaning services is outpacing labor supply, creating an opportunity for automation with cleaning robots.

Growing awareness of hygiene: Concerns about hygiene and sanitation are accelerating the demand for automated cleaning solutions in both residential and commercial settings.

Challenges in the Cleaning Robot Industry Sector

Despite its significant growth, the cleaning robot industry faces some notable challenges:

High initial investment costs: The relatively high purchase price of cleaning robots can hinder widespread adoption, particularly in price-sensitive markets.

Technological limitations: Challenges remain in achieving seamless navigation, effective cleaning of diverse surfaces, and handling unexpected obstacles.

Supply chain disruptions: Global supply chain issues and component shortages may affect the production and availability of cleaning robots.

Emerging Opportunities in Cleaning Robot Industry

The cleaning robot market presents numerous exciting opportunities:

Expansion into new applications: The application of cleaning robots is expanding beyond residential settings, with growth potential in healthcare, logistics, and agriculture.

Integration with smart home ecosystems: Connecting cleaning robots to smart home platforms enhances user experience and creates new revenue streams.

Development of specialized robots: The demand for robots capable of handling specific cleaning tasks, such as window cleaning or gutter cleaning, is increasing.

Leading Players in the Cleaning Robot Industry Market

- iRobot Corporation

- 7 Tennant Company

- 11 Hitachi Ltd

- 3 Karcher

- 12 Samsung Electronics Co Ltd

- 5 Minuteman International

- 5 Cecotec Innovaciones SL

- 10 Haier Group Corporation

- 2 Roborock Technology Co Ltd

- 9 ICE Cobotics

- 9 Panasonic Corporation

- 3 LG Electronics Inc

- AzioBot BV

- Professional Robot Cleaners

- 13 Xiaomi Group

- 6 Avidbots Corp

- 8 Neato Robotics Inc

- 2 Nilfisk A/S

- 6 Softbank Robotics

- 8 Diversey Holdings

- 7 SharkNinja Operating LLC

- 7 Electrolux AB

- Ecovacs Robotics Co Ltd

Key Developments in Cleaning Robot Industry Industry

August 2022: Amazon acquires iRobot for $1.7 Billion, signaling significant industry consolidation and increased investment in the sector.

September 2021: Peppermint, a Pune-based startup, launches an industrial floor-cleaning robot incorporating scrubbing, chemicals, and UV light, demonstrating innovation in professional cleaning solutions.

January 2022: ILIFE launches the EASINE W100, a cordless wet/dry vacuum cleaner with self-cleaning functionality, reflecting advancements in domestic cleaning robot capabilities.

Strategic Outlook for Cleaning Robot Industry Market

August 2022: Amazon acquires iRobot for $1.7 Billion, signaling significant industry consolidation and increased investment in the sector.

September 2021: Peppermint, a Pune-based startup, launches an industrial floor-cleaning robot incorporating scrubbing, chemicals, and UV light, demonstrating innovation in professional cleaning solutions.

January 2022: ILIFE launches the EASINE W100, a cordless wet/dry vacuum cleaner with self-cleaning functionality, reflecting advancements in domestic cleaning robot capabilities.

Strategic Outlook for Cleaning Robot Industry Market

The cleaning robot industry is poised for substantial growth in the coming years, driven by sustained technological advancements, increasing consumer demand for convenient cleaning solutions, and the expanding adoption of automation across various sectors. Emerging markets and applications offer significant opportunities for growth, particularly in the professional cleaning segment. Continuous innovation in areas like AI, navigation systems, and specialized cleaning functionalities will shape the competitive landscape and fuel market expansion. The industry is expected to witness further consolidation through mergers and acquisitions, leading to the emergence of larger, more integrated players.

Cleaning Robot Industry Segmentation

-

1. Application

-

1.1. Domestic/Household Robots

- 1.1.1. Vacuum Floor Cleaner

- 1.1.2. Pool Cleaning

- 1.1.3. Other Cleaning

-

1.2. Professional Robots

- 1.2.1. Floor Cleaning

- 1.2.2. Tank, Tube, and Pipe Cleaning

- 1.2.3. Other Applications

-

1.1. Domestic/Household Robots

Cleaning Robot Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. South America

Cleaning Robot Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Incentive to Maintain High Hygiene Standards in Professional Environments; High Demand from Professional Services in Healthcare

- 3.3. Market Restrains

- 3.3.1. Increasing Vulnerability Related To Cyber-attacks and Frauds

- 3.4. Market Trends

- 3.4.1. Use of Pool Cleaning Robot in Commercial and Domestic Sectors Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cleaning Robot Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Domestic/Household Robots

- 5.1.1.1. Vacuum Floor Cleaner

- 5.1.1.2. Pool Cleaning

- 5.1.1.3. Other Cleaning

- 5.1.2. Professional Robots

- 5.1.2.1. Floor Cleaning

- 5.1.2.2. Tank, Tube, and Pipe Cleaning

- 5.1.2.3. Other Applications

- 5.1.1. Domestic/Household Robots

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cleaning Robot Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Domestic/Household Robots

- 6.1.1.1. Vacuum Floor Cleaner

- 6.1.1.2. Pool Cleaning

- 6.1.1.3. Other Cleaning

- 6.1.2. Professional Robots

- 6.1.2.1. Floor Cleaning

- 6.1.2.2. Tank, Tube, and Pipe Cleaning

- 6.1.2.3. Other Applications

- 6.1.1. Domestic/Household Robots

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Cleaning Robot Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Domestic/Household Robots

- 7.1.1.1. Vacuum Floor Cleaner

- 7.1.1.2. Pool Cleaning

- 7.1.1.3. Other Cleaning

- 7.1.2. Professional Robots

- 7.1.2.1. Floor Cleaning

- 7.1.2.2. Tank, Tube, and Pipe Cleaning

- 7.1.2.3. Other Applications

- 7.1.1. Domestic/Household Robots

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Cleaning Robot Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Domestic/Household Robots

- 8.1.1.1. Vacuum Floor Cleaner

- 8.1.1.2. Pool Cleaning

- 8.1.1.3. Other Cleaning

- 8.1.2. Professional Robots

- 8.1.2.1. Floor Cleaning

- 8.1.2.2. Tank, Tube, and Pipe Cleaning

- 8.1.2.3. Other Applications

- 8.1.1. Domestic/Household Robots

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East and Africa Cleaning Robot Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Domestic/Household Robots

- 9.1.1.1. Vacuum Floor Cleaner

- 9.1.1.2. Pool Cleaning

- 9.1.1.3. Other Cleaning

- 9.1.2. Professional Robots

- 9.1.2.1. Floor Cleaning

- 9.1.2.2. Tank, Tube, and Pipe Cleaning

- 9.1.2.3. Other Applications

- 9.1.1. Domestic/Household Robots

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. South America Cleaning Robot Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Domestic/Household Robots

- 10.1.1.1. Vacuum Floor Cleaner

- 10.1.1.2. Pool Cleaning

- 10.1.1.3. Other Cleaning

- 10.1.2. Professional Robots

- 10.1.2.1. Floor Cleaning

- 10.1.2.2. Tank, Tube, and Pipe Cleaning

- 10.1.2.3. Other Applications

- 10.1.1. Domestic/Household Robots

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Americas Cleaning Robot Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Cleaning Robot Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Cleaning Robot Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 7 Tennant Company

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Domestic Robot Cleaners

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 11 Hitachi Ltd

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 3 Karcher

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 4 iRobot Corporation

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 12 Samsung Electronics Co Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 5 Minuteman International

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 5 Cecotec Innovaciones SL

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 10 Haier Group Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 2 Roborock Technology Co Ltd

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 9 ICE Cobotics

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 9 Panasonic Corporation

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 3 LG Electronics Inc

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 1 AzioBot BV

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 Professional Robot Cleaners

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.16 13 Xiaomi Group

- 14.2.16.1. Overview

- 14.2.16.2. Products

- 14.2.16.3. SWOT Analysis

- 14.2.16.4. Recent Developments

- 14.2.16.5. Financials (Based on Availability)

- 14.2.17 4 Avidbots Corp

- 14.2.17.1. Overview

- 14.2.17.2. Products

- 14.2.17.3. SWOT Analysis

- 14.2.17.4. Recent Developments

- 14.2.17.5. Financials (Based on Availability)

- 14.2.18 6 Neato Robotics Inc

- 14.2.18.1. Overview

- 14.2.18.2. Products

- 14.2.18.3. SWOT Analysis

- 14.2.18.4. Recent Developments

- 14.2.18.5. Financials (Based on Availability)

- 14.2.19 8 Nilfisk A/S

- 14.2.19.1. Overview

- 14.2.19.2. Products

- 14.2.19.3. SWOT Analysis

- 14.2.19.4. Recent Developments

- 14.2.19.5. Financials (Based on Availability)

- 14.2.20 2 Softbank Robotics

- 14.2.20.1. Overview

- 14.2.20.2. Products

- 14.2.20.3. SWOT Analysis

- 14.2.20.4. Recent Developments

- 14.2.20.5. Financials (Based on Availability)

- 14.2.21 6 Diversey Holdings

- 14.2.21.1. Overview

- 14.2.21.2. Products

- 14.2.21.3. SWOT Analysis

- 14.2.21.4. Recent Developments

- 14.2.21.5. Financials (Based on Availability)

- 14.2.22 8 SharkNinja Operating LLC

- 14.2.22.1. Overview

- 14.2.22.2. Products

- 14.2.22.3. SWOT Analysis

- 14.2.22.4. Recent Developments

- 14.2.22.5. Financials (Based on Availability)

- 14.2.23 7 Electrolux AB

- 14.2.23.1. Overview

- 14.2.23.2. Products

- 14.2.23.3. SWOT Analysis

- 14.2.23.4. Recent Developments

- 14.2.23.5. Financials (Based on Availability)

- 14.2.24 1 Ecovacs Robotics Co Ltd

- 14.2.24.1. Overview

- 14.2.24.2. Products

- 14.2.24.3. SWOT Analysis

- 14.2.24.4. Recent Developments

- 14.2.24.5. Financials (Based on Availability)

- 14.2.1 7 Tennant Company

List of Figures

- Figure 1: Global Cleaning Robot Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Cleaning Robot Industry Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: Americas Cleaning Robot Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: Americas Cleaning Robot Industry Volume (K Unit), by Country 2024 & 2032

- Figure 5: Americas Cleaning Robot Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Americas Cleaning Robot Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Cleaning Robot Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Cleaning Robot Industry Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Cleaning Robot Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Cleaning Robot Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Cleaning Robot Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Cleaning Robot Industry Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific Cleaning Robot Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Cleaning Robot Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: North America Cleaning Robot Industry Revenue (Million), by Application 2024 & 2032

- Figure 16: North America Cleaning Robot Industry Volume (K Unit), by Application 2024 & 2032

- Figure 17: North America Cleaning Robot Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Cleaning Robot Industry Volume Share (%), by Application 2024 & 2032

- Figure 19: North America Cleaning Robot Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: North America Cleaning Robot Industry Volume (K Unit), by Country 2024 & 2032

- Figure 21: North America Cleaning Robot Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: North America Cleaning Robot Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: Europe Cleaning Robot Industry Revenue (Million), by Application 2024 & 2032

- Figure 24: Europe Cleaning Robot Industry Volume (K Unit), by Application 2024 & 2032

- Figure 25: Europe Cleaning Robot Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Cleaning Robot Industry Volume Share (%), by Application 2024 & 2032

- Figure 27: Europe Cleaning Robot Industry Revenue (Million), by Country 2024 & 2032

- Figure 28: Europe Cleaning Robot Industry Volume (K Unit), by Country 2024 & 2032

- Figure 29: Europe Cleaning Robot Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Europe Cleaning Robot Industry Volume Share (%), by Country 2024 & 2032

- Figure 31: Asia Pacific Cleaning Robot Industry Revenue (Million), by Application 2024 & 2032

- Figure 32: Asia Pacific Cleaning Robot Industry Volume (K Unit), by Application 2024 & 2032

- Figure 33: Asia Pacific Cleaning Robot Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Pacific Cleaning Robot Industry Volume Share (%), by Application 2024 & 2032

- Figure 35: Asia Pacific Cleaning Robot Industry Revenue (Million), by Country 2024 & 2032

- Figure 36: Asia Pacific Cleaning Robot Industry Volume (K Unit), by Country 2024 & 2032

- Figure 37: Asia Pacific Cleaning Robot Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific Cleaning Robot Industry Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East and Africa Cleaning Robot Industry Revenue (Million), by Application 2024 & 2032

- Figure 40: Middle East and Africa Cleaning Robot Industry Volume (K Unit), by Application 2024 & 2032

- Figure 41: Middle East and Africa Cleaning Robot Industry Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East and Africa Cleaning Robot Industry Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East and Africa Cleaning Robot Industry Revenue (Million), by Country 2024 & 2032

- Figure 44: Middle East and Africa Cleaning Robot Industry Volume (K Unit), by Country 2024 & 2032

- Figure 45: Middle East and Africa Cleaning Robot Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East and Africa Cleaning Robot Industry Volume Share (%), by Country 2024 & 2032

- Figure 47: South America Cleaning Robot Industry Revenue (Million), by Application 2024 & 2032

- Figure 48: South America Cleaning Robot Industry Volume (K Unit), by Application 2024 & 2032

- Figure 49: South America Cleaning Robot Industry Revenue Share (%), by Application 2024 & 2032

- Figure 50: South America Cleaning Robot Industry Volume Share (%), by Application 2024 & 2032

- Figure 51: South America Cleaning Robot Industry Revenue (Million), by Country 2024 & 2032

- Figure 52: South America Cleaning Robot Industry Volume (K Unit), by Country 2024 & 2032

- Figure 53: South America Cleaning Robot Industry Revenue Share (%), by Country 2024 & 2032

- Figure 54: South America Cleaning Robot Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cleaning Robot Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cleaning Robot Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Cleaning Robot Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Cleaning Robot Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 5: Global Cleaning Robot Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Cleaning Robot Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Global Cleaning Robot Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Cleaning Robot Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Cleaning Robot Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Cleaning Robot Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Global Cleaning Robot Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Cleaning Robot Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Cleaning Robot Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Cleaning Robot Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Global Cleaning Robot Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Cleaning Robot Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Cleaning Robot Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Cleaning Robot Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Global Cleaning Robot Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Cleaning Robot Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 21: Global Cleaning Robot Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Cleaning Robot Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: Global Cleaning Robot Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Cleaning Robot Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 25: Global Cleaning Robot Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Cleaning Robot Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: Global Cleaning Robot Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Cleaning Robot Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 29: Global Cleaning Robot Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Cleaning Robot Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: Global Cleaning Robot Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Global Cleaning Robot Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 33: Global Cleaning Robot Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Cleaning Robot Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Global Cleaning Robot Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Cleaning Robot Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 37: Global Cleaning Robot Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Cleaning Robot Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cleaning Robot Industry?

The projected CAGR is approximately 0.28%.

2. Which companies are prominent players in the Cleaning Robot Industry?

Key companies in the market include 7 Tennant Company, Domestic Robot Cleaners, 11 Hitachi Ltd, 3 Karcher, 4 iRobot Corporation, 12 Samsung Electronics Co Ltd, 5 Minuteman International, 5 Cecotec Innovaciones SL, 10 Haier Group Corporation, 2 Roborock Technology Co Ltd, 9 ICE Cobotics, 9 Panasonic Corporation, 3 LG Electronics Inc, 1 AzioBot BV, Professional Robot Cleaners, 13 Xiaomi Group, 4 Avidbots Corp, 6 Neato Robotics Inc, 8 Nilfisk A/S, 2 Softbank Robotics, 6 Diversey Holdings, 8 SharkNinja Operating LLC, 7 Electrolux AB, 1 Ecovacs Robotics Co Ltd.

3. What are the main segments of the Cleaning Robot Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Incentive to Maintain High Hygiene Standards in Professional Environments; High Demand from Professional Services in Healthcare.

6. What are the notable trends driving market growth?

Use of Pool Cleaning Robot in Commercial and Domestic Sectors Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

Increasing Vulnerability Related To Cyber-attacks and Frauds.

8. Can you provide examples of recent developments in the market?

August 2022 - Amazon and iRobot announced to enter into a definitive merger agreement under which Amazon will acquire iRobot. iRobot has a history of making customers' lives easier with innovative cleaning products for the home. iRobot has continued to innovate with every product generation, solving hard problems to help give customers valuable time back in their day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cleaning Robot Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cleaning Robot Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cleaning Robot Industry?

To stay informed about further developments, trends, and reports in the Cleaning Robot Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence