Key Insights

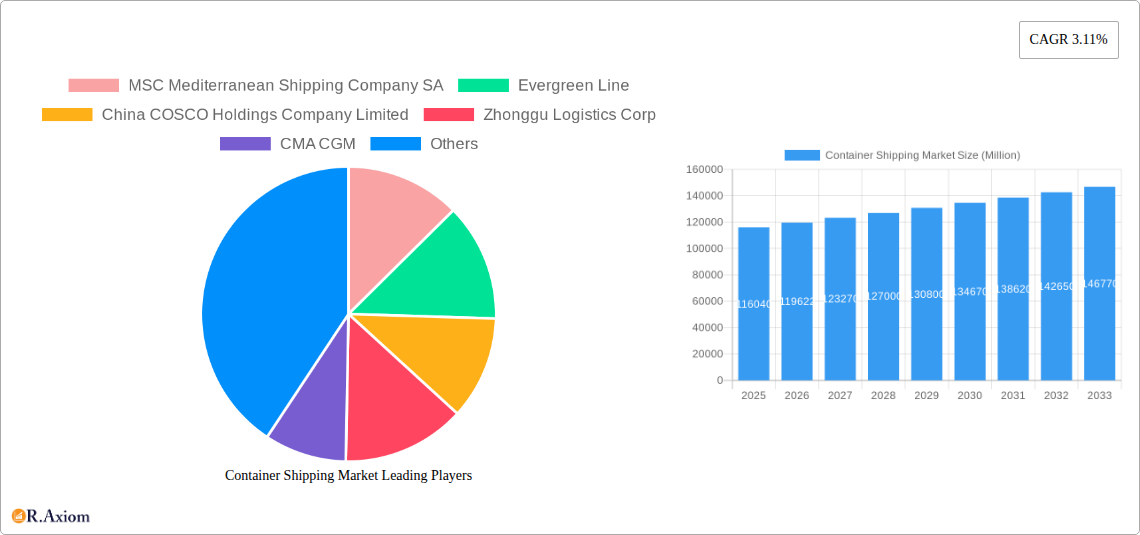

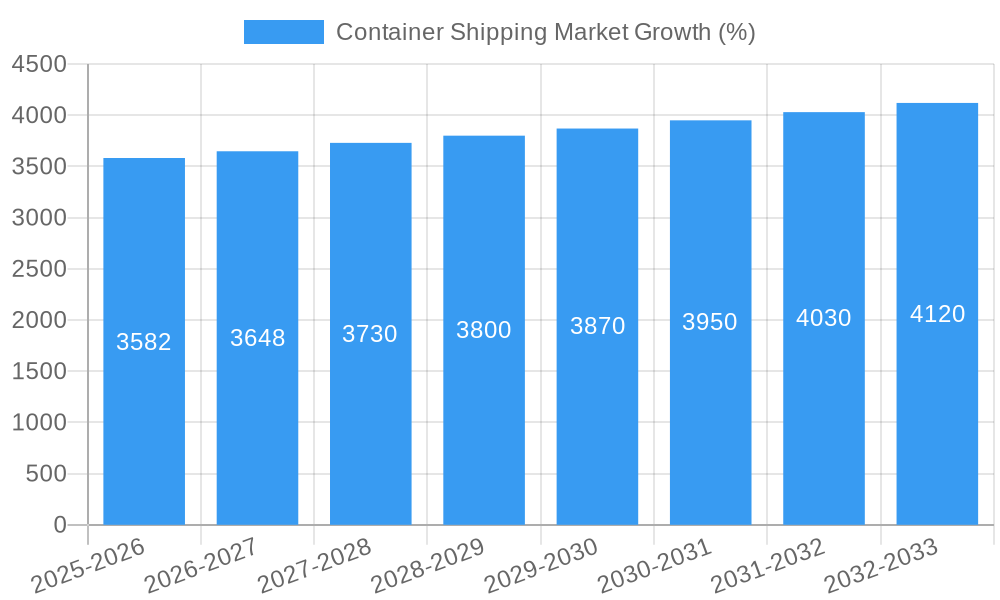

The global container shipping market, valued at $116.04 billion in 2025, is projected to experience steady growth, driven by the increasing globalization of trade and the expansion of e-commerce. A Compound Annual Growth Rate (CAGR) of 3.11% from 2025 to 2033 indicates a consistent, albeit moderate, expansion. Key growth drivers include rising global demand for goods, particularly in developing economies, necessitating efficient and cost-effective shipping solutions. The market is segmented by container size (small, large, high cube) and type (general cargo, reefer), reflecting the diverse needs of shippers. While the industry faces challenges such as fluctuating fuel prices, port congestion, and geopolitical instability, technological advancements in vessel automation, improved logistics, and the adoption of sustainable practices are expected to mitigate these restraints and support market expansion. Major players like Maersk, MSC, CMA CGM, and Evergreen dominate the market, leveraging their vast fleets and global network infrastructure. Regional growth will likely be influenced by economic development and infrastructure improvements, with Asia-Pacific expected to remain a key market due to its significant manufacturing and export activities. The competitive landscape is intense, with companies continually striving for efficiency improvements and strategic partnerships to maintain market share.

The forecast period from 2025-2033 anticipates a gradual increase in market value, influenced by the ongoing expansion of global trade and e-commerce. While economic fluctuations and geopolitical events could introduce short-term volatility, the long-term outlook remains positive. The increasing demand for faster and more reliable shipping services is likely to drive investment in new technologies and infrastructure upgrades. The adoption of digitalization throughout the supply chain will further enhance efficiency and transparency, promoting sustainable growth within the industry. While the market is highly concentrated among major players, there's scope for smaller niche players to thrive by focusing on specific segments or regions. Continued focus on environmental sustainability through initiatives like decarbonization strategies will also shape the market's future trajectory.

Container Shipping Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global container shipping market, covering historical trends (2019-2024), the current market landscape (2025), and future projections (2025-2033). It delves into market segmentation, key players, growth drivers, challenges, and emerging opportunities, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The report incorporates extensive data analysis and forecasts, using millions (Million) as the unit for all values.

Container Shipping Market Market Concentration & Innovation

The container shipping market exhibits a high degree of concentration, with a few major players dominating the global landscape. The top ten players, including MSC Mediterranean Shipping Company SA, Evergreen Line, China COSCO Holdings Company Limited, Zhonggu Logistics Corp, CMA CGM, ONE (Ocean Network Express), Zim, Wan Hai Lines, SITC, and Antong Holdings (QASC), along with approximately 63 other companies, control a significant portion of the market share. Precise market share figures vary based on the year and specific segment, but the top five companies consistently account for over xx% of the total volume. Market concentration is further impacted by mergers and acquisitions (M&A) activities, with recent deals significantly altering the competitive dynamics. For example, AP Moller-Maersk's acquisition of Martin Bencher Group in January 2023 reflects the ongoing consolidation trend, adding to its project logistics capabilities. The total value of M&A deals in the container shipping sector from 2019 to 2024 reached approximately xx Million.

Innovation is driven by the need for enhanced efficiency, sustainability, and technological advancement. Key innovations include:

- Improved Container Technologies: Development of high-cube containers, specialized containers for refrigerated cargo (reefer containers), and smart containers equipped with sensors for real-time tracking and condition monitoring.

- Digitalization and Automation: Implementing digital platforms for freight management, port operations, and supply chain visibility. Automation of processes like cargo handling and scheduling.

- Sustainable Practices: Focus on reducing carbon emissions through the adoption of alternative fuels, optimization of routes and vessel speed, and the implementation of energy-efficient technologies.

Regulatory frameworks, such as international maritime regulations and port regulations, also significantly shape the industry, influencing operational costs and safety standards. Substitute products are limited, with the container shipping sector largely dominating the global movement of goods, although alternative transportation modes like rail and road may play a more significant role for short-haul transportation. End-user trends, particularly the growing demand for e-commerce and faster delivery times, are pushing the industry to adopt more agile and efficient practices.

Container Shipping Market Industry Trends & Insights

The container shipping market experienced significant volatility in recent years. The COVID-19 pandemic initially disrupted supply chains, leading to increased freight rates and port congestion. However, the market has shown signs of recovery, driven by factors such as global trade growth, particularly in Asia, the rising demand for consumer goods, and increasing investment in port infrastructure. The market is projected to grow at a CAGR (Compound Annual Growth Rate) of xx% during the forecast period (2025-2033), reaching a total market size of xx Million by 2033.

Technological advancements, such as the integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies, are revolutionizing the industry, enabling greater efficiency and real-time tracking. Consumer preferences for faster delivery times and personalized experiences are demanding a more flexible and responsive supply chain. Competitive dynamics are increasingly shaped by consolidation through M&A activities, alliances, and the continuous race for innovation and cost optimization. Market penetration of new technologies is gradually increasing, with a focus on digitalization and automation leading the way. The growing adoption of sustainable shipping practices in response to environmental concerns also presents both a challenge and an opportunity for market players.

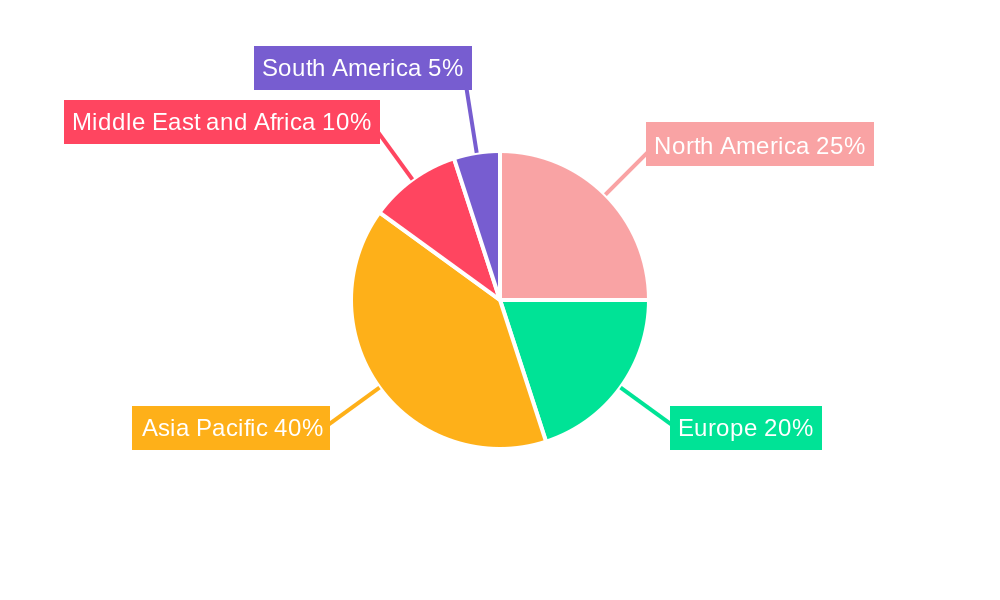

Dominant Markets & Segments in Container Shipping Market

Asia dominates the global container shipping market, with significant activity in countries like China, Singapore, and other key hubs along major shipping lanes. This dominance is driven by several factors:

- Robust Manufacturing Base: Asia houses a vast number of manufacturing and export-oriented businesses, creating substantial demand for container shipping services.

- Extensive Port Infrastructure: The region boasts many large, well-equipped ports capable of handling high volumes of containerized cargo.

- Favorable Economic Policies: Government policies supporting trade and investment foster growth in the shipping sector.

Within the market segmentation:

- By Size: Large containers currently hold the largest market share due to their greater cargo capacity and cost-efficiency for bulk shipments. However, smaller containers cater to specialized needs and niche markets. High-cube containers, offering increased vertical space, are also gaining popularity for certain types of goods.

- By Type: General container shipping remains the dominant segment, but reefer container shipping is experiencing significant growth driven by the increasing demand for perishable goods and temperature-sensitive products.

Container Shipping Market Product Developments

Recent product innovations focus on enhancing container efficiency, sustainability, and security. This includes the development of smart containers incorporating IoT sensors for real-time monitoring and tracking, improving supply chain visibility. Furthermore, there's a growing emphasis on eco-friendly container designs and materials, to reduce the environmental impact of the industry. These innovations provide a competitive advantage by improving efficiency, enhancing customer service, and aligning with the growing demand for sustainable practices.

Report Scope & Segmentation Analysis

This report segments the container shipping market based on container size (small, large, high-cube) and container type (general cargo, reefer).

By Size: Each size category exhibits varying growth projections and competitive landscapes. Large containers dominate, driven by economies of scale, while smaller containers cater to specific niche markets and specialized cargo. High-cube containers show promising growth due to their increased cargo capacity.

By Type: General container shipping currently dominates, representing a large majority of the market. Reefer container shipping demonstrates significant growth potential due to the increasing demand for temperature-sensitive products globally.

Key Drivers of Container Shipping Market Growth

Several factors are driving the growth of the container shipping market:

- Globalization and Increased Trade: The ongoing globalization of economies fuels the need for efficient and reliable cargo transportation.

- E-commerce Boom: The surge in online shopping significantly boosts demand for fast and efficient delivery services, impacting container shipping volumes.

- Technological Advancements: Digitalization, automation, and the development of smart containers improve efficiency and provide better tracking and management.

Challenges in the Container Shipping Market Sector

The container shipping market faces several challenges:

- Geopolitical Instability: Global events and trade conflicts can disrupt supply chains and impact freight rates.

- Port Congestion and Delays: Overcrowded ports lead to delays and increase costs, affecting the entire supply chain.

- Fuel Price Volatility: Fluctuations in fuel prices significantly affect operating costs for shipping companies.

Emerging Opportunities in Container Shipping Market

The container shipping market presents several emerging opportunities:

- Sustainable Shipping Practices: Growing environmental concerns are pushing the industry to adopt greener technologies and reduce carbon emissions.

- Digitalization and Automation: Further advancements in these areas will significantly enhance efficiency and supply chain visibility.

- Expansion into New Markets: Developing economies offer potential for significant market expansion.

Leading Players in the Container Shipping Market Market

- MSC Mediterranean Shipping Company SA

- Evergreen Line

- China COSCO Holdings Company Limited

- Zhonggu Logistics Corp

- CMA CGM

- ONE (Ocean Network Express)

- Zim

- Wan Hai Lines

- SITC

- Antong Holdings (QASC)

- 63 Other Companies

- AP Moller-Maersk AS

- Hapag-Lloyd

Key Developments in Container Shipping Market Industry

- January 2024: SITC and Xiamen Port Holdings Group sign a framework agreement to boost logistics cooperation.

- May 2023: Mazagon Dock Shipbuilders enters the container manufacturing business after receiving a 2,500-unit order.

- January 2023: AP Moller-Maersk completes its acquisition of Martin Bencher Group, strengthening its project logistics capabilities.

Strategic Outlook for Container Shipping Market Market

The future of the container shipping market looks promising, driven by sustained global trade growth, technological innovation, and the increasing demand for efficient and sustainable logistics solutions. The ongoing digital transformation and adoption of sustainable practices will shape the competitive landscape, offering significant opportunities for companies that can adapt and innovate. Continued investment in port infrastructure and the development of new shipping routes will also support the market's long-term expansion.

Container Shipping Market Segmentation

-

1. Size

- 1.1. Small Containers

- 1.2. Large Containers

- 1.3. High Cube Containers

-

2. Type

- 2.1. General Container Shipping

- 2.2. Reefer Container Shipping

Container Shipping Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. Singapore

- 3.6. Malaysia

- 3.7. Indonesia

- 3.8. Thailand

- 3.9. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Egypt

- 4.2. Qatar

- 4.3. Saudi Arabia

- 4.4. United Arab Emirates

- 4.5. South Africa

- 4.6. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Colombia

- 5.3. Rest of South America

Container Shipping Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. Increasing high cube containers segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Size

- 5.1.1. Small Containers

- 5.1.2. Large Containers

- 5.1.3. High Cube Containers

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. General Container Shipping

- 5.2.2. Reefer Container Shipping

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Size

- 6. North America Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Size

- 6.1.1. Small Containers

- 6.1.2. Large Containers

- 6.1.3. High Cube Containers

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. General Container Shipping

- 6.2.2. Reefer Container Shipping

- 6.1. Market Analysis, Insights and Forecast - by Size

- 7. Europe Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Size

- 7.1.1. Small Containers

- 7.1.2. Large Containers

- 7.1.3. High Cube Containers

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. General Container Shipping

- 7.2.2. Reefer Container Shipping

- 7.1. Market Analysis, Insights and Forecast - by Size

- 8. Asia Pacific Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Size

- 8.1.1. Small Containers

- 8.1.2. Large Containers

- 8.1.3. High Cube Containers

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. General Container Shipping

- 8.2.2. Reefer Container Shipping

- 8.1. Market Analysis, Insights and Forecast - by Size

- 9. Middle East and Africa Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Size

- 9.1.1. Small Containers

- 9.1.2. Large Containers

- 9.1.3. High Cube Containers

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. General Container Shipping

- 9.2.2. Reefer Container Shipping

- 9.1. Market Analysis, Insights and Forecast - by Size

- 10. South America Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Size

- 10.1.1. Small Containers

- 10.1.2. Large Containers

- 10.1.3. High Cube Containers

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. General Container Shipping

- 10.2.2. Reefer Container Shipping

- 10.1. Market Analysis, Insights and Forecast - by Size

- 11. North America Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 France

- 12.1.3 United Kingdom

- 12.1.4 Italy

- 12.1.5 Rest of Europe

- 13. Asia Pacific Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 Australia

- 13.1.4 India

- 13.1.5 Singapore

- 13.1.6 Malaysia

- 13.1.7 Indonesia

- 13.1.8 Thailand

- 13.1.9 Rest of Asia Pacific

- 14. Middle East and Africa Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Egypt

- 14.1.2 Qatar

- 14.1.3 Saudi Arabia

- 14.1.4 United Arab Emirates

- 14.1.5 South Africa

- 14.1.6 Rest of Middle East and Africa

- 15. South America Container Shipping Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Colombia

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 MSC Mediterranean Shipping Company SA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Evergreen Line

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 China COSCO Holdings Company Limited

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Zhonggu Logistics Corp

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 CMA CGM

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 ONE (Ocean Network Express)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Zim

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Wan Hai Lines

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 SITC

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Antong Holdings (QASC)**List Not Exhaustive 6 3 Other Companie

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 AP Moller-Maersk AS

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Hapag-Lloyd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 MSC Mediterranean Shipping Company SA

List of Figures

- Figure 1: Global Container Shipping Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 13: North America Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 14: North America Container Shipping Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Container Shipping Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 19: Europe Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 20: Europe Container Shipping Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Container Shipping Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 25: Asia Pacific Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 26: Asia Pacific Container Shipping Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Container Shipping Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 31: Middle East and Africa Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 32: Middle East and Africa Container Shipping Market Revenue (Million), by Type 2024 & 2032

- Figure 33: Middle East and Africa Container Shipping Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: Middle East and Africa Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Container Shipping Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Container Shipping Market Revenue (Million), by Size 2024 & 2032

- Figure 37: South America Container Shipping Market Revenue Share (%), by Size 2024 & 2032

- Figure 38: South America Container Shipping Market Revenue (Million), by Type 2024 & 2032

- Figure 39: South America Container Shipping Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: South America Container Shipping Market Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Container Shipping Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Container Shipping Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 3: Global Container Shipping Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Container Shipping Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Australia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Singapore Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Malaysia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Indonesia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Thailand Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia Pacific Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Egypt Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Qatar Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Saudi Arabia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United Arab Emirates Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East and Africa Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Colombia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of South America Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 38: Global Container Shipping Market Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United States Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Canada Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Mexico Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of North America Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 45: Global Container Shipping Market Revenue Million Forecast, by Type 2019 & 2032

- Table 46: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: Germany Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: United Kingdom Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Italy Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Europe Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 53: Global Container Shipping Market Revenue Million Forecast, by Type 2019 & 2032

- Table 54: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: China Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Australia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: India Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Singapore Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Malaysia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Indonesia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Thailand Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Rest of Asia Pacific Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Global Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 65: Global Container Shipping Market Revenue Million Forecast, by Type 2019 & 2032

- Table 66: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 67: Egypt Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Qatar Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Saudi Arabia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: United Arab Emirates Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: South Africa Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of Middle East and Africa Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Global Container Shipping Market Revenue Million Forecast, by Size 2019 & 2032

- Table 74: Global Container Shipping Market Revenue Million Forecast, by Type 2019 & 2032

- Table 75: Global Container Shipping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 76: Brazil Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Colombia Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Rest of South America Container Shipping Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Container Shipping Market?

The projected CAGR is approximately 3.11%.

2. Which companies are prominent players in the Container Shipping Market?

Key companies in the market include MSC Mediterranean Shipping Company SA, Evergreen Line, China COSCO Holdings Company Limited, Zhonggu Logistics Corp, CMA CGM, ONE (Ocean Network Express), Zim, Wan Hai Lines, SITC, Antong Holdings (QASC)**List Not Exhaustive 6 3 Other Companie, AP Moller-Maersk AS, Hapag-Lloyd.

3. What are the main segments of the Container Shipping Market?

The market segments include Size, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 116.04 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

Increasing high cube containers segment.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

January 2024: SITC signed a framework agreement with Xiamen Port Holdings Group on January 2024, aiming to boost logistics jointly. Headquartered in Hong Kong, SITC is an intra-Asia shipping logistics company. The new agreement will see the two parties focus their cooperation on route network layout, international transit, complete logistics service chain, cross-border e-commerce, hinterland cargo source expansion, port intelligence, and digital transformation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Container Shipping Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Container Shipping Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Container Shipping Market?

To stay informed about further developments, trends, and reports in the Container Shipping Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence