Key Insights

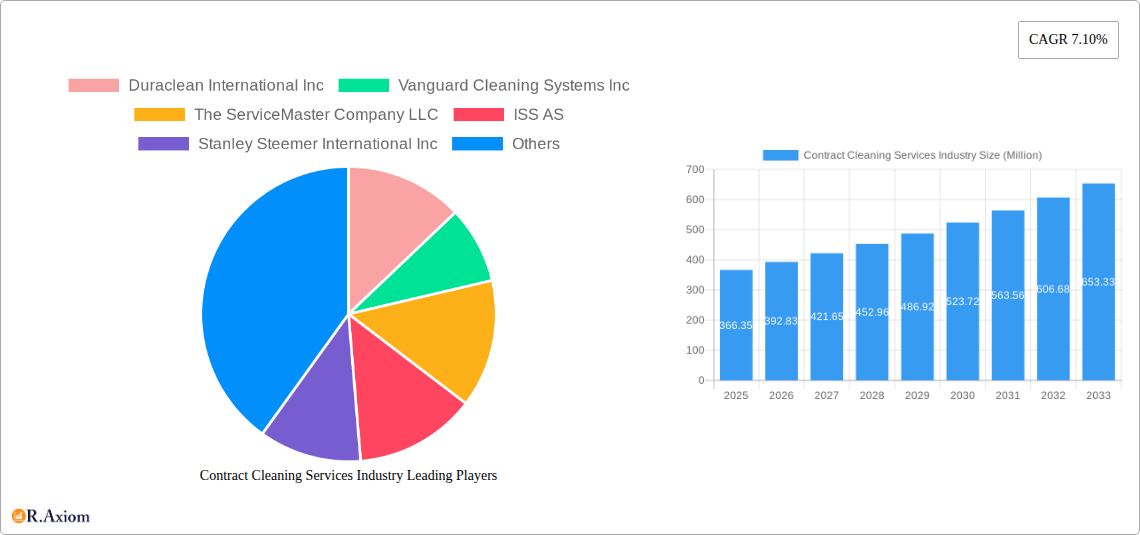

The contract cleaning services industry, valued at $366.35 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 7.10% from 2025 to 2033. This growth is fueled by several key factors. Increasing urbanization and the concentration of businesses in densely populated areas drive demand for professional cleaning services in commercial and industrial settings. The rising awareness of hygiene and sanitation, particularly amplified post-pandemic, has further boosted the sector's appeal. Businesses are increasingly outsourcing cleaning tasks to focus on core competencies, leading to higher adoption of contract cleaning services. Technological advancements, such as the introduction of robotic cleaning equipment and specialized cleaning solutions, are enhancing efficiency and productivity within the industry, driving further growth. The industry is segmented into residential, commercial, and industrial end-users, with commercial likely holding the largest share due to the high concentration of offices, retail spaces, and other businesses requiring regular cleaning. Major players such as Duraclean International, Vanguard Cleaning Systems, ServiceMaster, and ISS are actively shaping the market through expansion, innovation, and acquisition strategies.

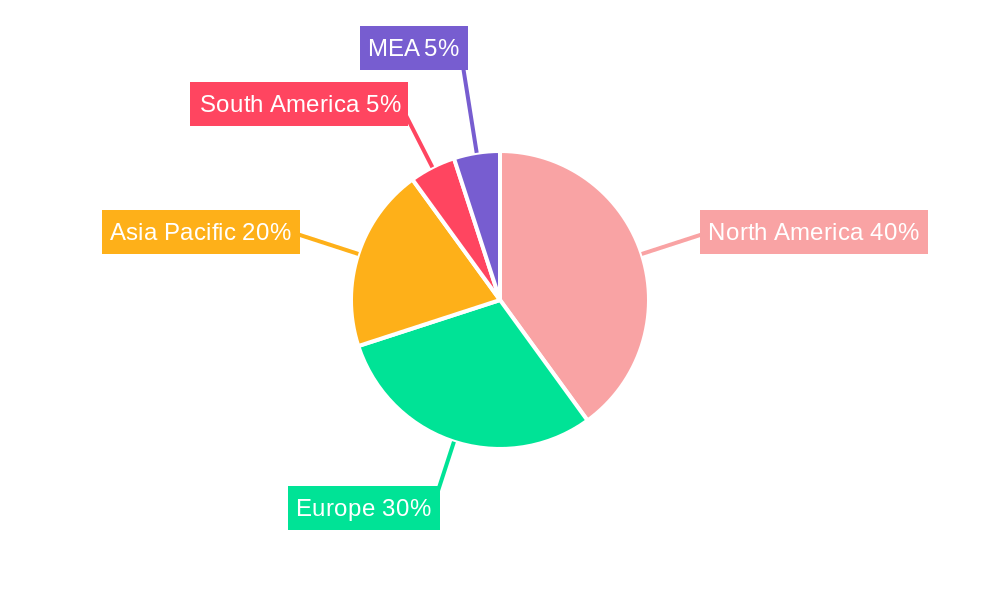

The industry faces certain challenges, however. Fluctuations in the global economy and labor costs can impact profitability and pricing strategies. Competition from smaller, local cleaning businesses can also pressure margins. However, these challenges are likely to be offset by the continued increase in demand driven by long-term trends. The North American market is anticipated to retain a significant market share due to high adoption rates and a developed commercial infrastructure. However, the Asia-Pacific region is poised for significant growth due to rapid economic expansion and urbanization. Overall, the contract cleaning services industry presents a promising investment opportunity for stakeholders, with considerable potential for growth and expansion throughout the forecast period. Continued innovation, strategic acquisitions, and a focus on sustainable cleaning practices are key to success within this dynamic market.

This detailed report provides a comprehensive analysis of the Contract Cleaning Services industry, encompassing market size, growth projections, competitive landscape, and key industry trends from 2019 to 2033. The report leverages extensive primary and secondary research, incorporating data from reputable sources and industry experts. The study period covers 2019-2033, with 2025 serving as both the base and estimated year, and the forecast period extending from 2025-2033. The historical period analyzed is 2019-2024. This report is invaluable for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market. The global market value is projected to reach xx Million by 2033.

Contract Cleaning Services Industry Market Concentration & Innovation

The contract cleaning services market exhibits moderate concentration, with several large players holding significant market share. The top 10 companies, including Duraclean International Inc, Vanguard Cleaning Systems Inc, The ServiceMaster Company LLC, ISS AS, Stanley Steemer International Inc, Pritchard Industries Inc, Sodexo Group, ABM Industries Incorporated, Anago Cleaning Systems Inc, and Jani-King International Inc, collectively account for an estimated xx% of the global market in 2025. However, the market also features a large number of smaller, regional players.

Market Share (Estimated 2025):

- Top 10 Companies: xx%

- Other Players: xx%

Innovation Drivers: Technological advancements, particularly in cleaning equipment and chemicals, are driving innovation. The increasing demand for sustainable and eco-friendly cleaning solutions also fuels the development of new products and services. Regulatory frameworks, focusing on health and safety, are further pushing innovation towards safer and more effective cleaning practices.

M&A Activities: The industry has witnessed several significant mergers and acquisitions (M&A) deals in recent years, valued at an estimated xx Million collectively during the historical period. These transactions aim to expand market reach, enhance service offerings, and achieve economies of scale. For example, a significant acquisition involving two major players may have resulted in a combined entity controlling xx% market share.

Product Substitutes: Limited direct substitutes exist, primarily DIY cleaning methods for smaller residential clients. However, the increasing use of technology-based cleaning solutions, such as robotic cleaners, is emerging as an indirect substitute for traditional manual labor-intensive cleaning processes.

End-User Trends: The increasing adoption of commercial and industrial facilities increases demand for specialized services, further driving market growth.

Contract Cleaning Services Industry Industry Trends & Insights

The contract cleaning services industry is experiencing robust growth, driven by several key factors. The global market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Increased urbanization, expanding commercial and industrial sectors, rising health and hygiene awareness, and heightened demand for specialized cleaning services in sectors like healthcare and hospitality are significant contributors. Technological disruptions, including the introduction of robotic cleaning systems and smart cleaning technologies, are changing the nature of the services provided and enhancing efficiency. Consumer preferences are shifting towards environmentally friendly and sustainable cleaning solutions, creating opportunities for companies offering green cleaning services.

The market penetration of advanced cleaning technologies is increasing rapidly, especially in larger commercial buildings and industrial settings. This trend is partially influenced by increasing regulatory scrutiny of workplace health and safety. The competitive dynamics involve intense competition among large established companies and smaller, more specialized service providers, forcing companies to constantly innovate and improve operational efficiency.

Dominant Markets & Segments in Contract Cleaning Services Industry

The commercial segment dominates the contract cleaning services market, accounting for approximately xx% of the total market value in 2025. This dominance is attributable to the significant demand for cleaning services from businesses of all sizes across diverse sectors, from office buildings to retail establishments and healthcare facilities.

- Key Drivers of Commercial Segment Dominance:

- Rapid growth of commercial real estate.

- Increasing focus on workplace hygiene and safety standards.

- Heightened demand for specialized cleaning services in niche sectors.

- Stringent regulations concerning hygiene and cleanliness in specific commercial settings (hospitals, food processing facilities).

The industrial segment displays considerable growth potential, with notable expansion observed in manufacturing, logistics, and energy sectors. The residential segment, while comparatively smaller, exhibits steady growth fueled by increased disposable incomes and a preference for outsourced cleaning services in certain demographics. Factors influencing the dominance of this segment include robust economic activity, expanding infrastructure, supportive government policies encouraging commercial developments, and a strong focus on maintaining a high standard of hygiene across various industries.

Contract Cleaning Services Industry Product Developments

Recent product innovations have focused on the introduction of eco-friendly cleaning agents, advanced cleaning equipment (e.g., robotic cleaners, automated floor scrubbers), and specialized cleaning solutions for specific industries (e.g., healthcare, food processing). These innovations are driven by the increasing demand for sustainable practices and improvements in efficiency and safety. The adoption of these advancements provides a competitive advantage, allowing companies to offer superior services and meet evolving customer needs.

Report Scope & Segmentation Analysis

This report segments the contract cleaning services market based on end-user: Residential, Commercial, and Industrial.

Residential: This segment includes cleaning services provided to individual homes and apartments. Growth is projected at xx% CAGR, driven by changing lifestyles and increasing disposable incomes. Competition is relatively high due to numerous small to medium-sized businesses.

Commercial: This segment comprises cleaning services for office buildings, retail spaces, and other commercial facilities. This segment is projected to be the largest in value, with a xx% CAGR, fueled by rising concerns over hygiene and workplace safety. Competition is intense among large national and international players.

Industrial: This segment encompasses cleaning services in manufacturing facilities, warehouses, and other industrial settings. This is expected to have a xx% CAGR, driven by the expansion of manufacturing activities and stricter regulatory requirements. Competition is moderate and characterized by specialized service providers.

Key Drivers of Contract Cleaning Services Industry Growth

Several factors contribute to the growth of the contract cleaning services industry: increasing urbanization and the subsequent rise of commercial and residential buildings; stricter health and safety regulations; rising awareness regarding hygiene and sanitation; and technological advancements leading to the development of more efficient and effective cleaning solutions. The expansion of industries like healthcare and hospitality also greatly boosts the demand for specialized cleaning services.

Challenges in the Contract Cleaning Services Industry Sector

The industry faces several challenges, including intense competition, fluctuating labor costs, stringent regulatory requirements, maintaining a consistent supply chain of cleaning materials, and ensuring employee retention. The impact of these factors can be measured through reduced profit margins and difficulty securing contracts in certain competitive markets.

Emerging Opportunities in Contract Cleaning Services Industry

Emerging opportunities lie in the increasing demand for green cleaning solutions, the integration of technology such as AI and robotics into cleaning processes, and the expansion into niche markets like specialized healthcare and pharmaceutical cleaning. Growing concerns over workplace safety will also create new opportunities for specialized cleaning services.

Leading Players in the Contract Cleaning Services Industry Market

- Duraclean International Inc

- Vanguard Cleaning Systems Inc

- The ServiceMaster Company LLC

- ISS AS

- Stanley Steemer International Inc

- Pritchard Industries Inc

- Sodexo Group

- ABM Industries Incorporated

- Anago Cleaning Systems Inc

- Jani-King International Inc

Key Developments in Contract Cleaning Services Industry Industry

October 2022: SBFM secures a five-year contract with PureGym, the UK's largest gym operator, to provide cleaning services across all UK locations. This signifies a significant expansion in the commercial cleaning market.

July 2022: Gausium and Diversey-TASKI form a global partnership to integrate cleaning robotics with advanced cleaning technologies. This collaboration represents a key step towards automation and efficiency improvements within the industry.

Strategic Outlook for Contract Cleaning Services Industry Market

The future of the contract cleaning services market looks promising, fueled by sustained growth in various sectors and the adoption of innovative technologies. The increasing demand for sustainable and technologically advanced cleaning solutions presents substantial growth opportunities for companies that adapt to evolving customer needs and regulatory requirements. Focusing on specialization, technological integration, and sustainability will be vital for achieving long-term success in this dynamic market.

Contract Cleaning Services Industry Segmentation

-

1. End User

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

Contract Cleaning Services Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Contract Cleaning Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Hygienic Consciousness

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Workforce

- 3.4. Market Trends

- 3.4.1. Commercial Cleaning is Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East and Africa Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. North America Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Europe Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Asia Pacific Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1. undefined

- 14. South America Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1. undefined

- 15. North America Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1. undefined

- 16. MEA Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1. undefined

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Duraclean International Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Vanguard Cleaning Systems Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 The ServiceMaster Company LLC

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 ISS AS

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Stanley Steemer International Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Pritchard Industries Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Sodexo Group

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 ABM Industries Incorporated

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Anago Cleaning Systems Inc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Jani-King International Inc

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Duraclean International Inc

List of Figures

- Figure 1: Global Contract Cleaning Services Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Contract Cleaning Services Industry Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: South America Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 17: South America Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: North America Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: North America Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 21: North America Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: North America Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: MEA Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 24: MEA Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 25: MEA Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: MEA Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 27: North America Contract Cleaning Services Industry Revenue (Million), by End User 2024 & 2032

- Figure 28: North America Contract Cleaning Services Industry Volume (K Unit), by End User 2024 & 2032

- Figure 29: North America Contract Cleaning Services Industry Revenue Share (%), by End User 2024 & 2032

- Figure 30: North America Contract Cleaning Services Industry Volume Share (%), by End User 2024 & 2032

- Figure 31: North America Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 32: North America Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 33: North America Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: North America Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 35: Europe Contract Cleaning Services Industry Revenue (Million), by End User 2024 & 2032

- Figure 36: Europe Contract Cleaning Services Industry Volume (K Unit), by End User 2024 & 2032

- Figure 37: Europe Contract Cleaning Services Industry Revenue Share (%), by End User 2024 & 2032

- Figure 38: Europe Contract Cleaning Services Industry Volume Share (%), by End User 2024 & 2032

- Figure 39: Europe Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 40: Europe Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 41: Europe Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Europe Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 43: Asia Pacific Contract Cleaning Services Industry Revenue (Million), by End User 2024 & 2032

- Figure 44: Asia Pacific Contract Cleaning Services Industry Volume (K Unit), by End User 2024 & 2032

- Figure 45: Asia Pacific Contract Cleaning Services Industry Revenue Share (%), by End User 2024 & 2032

- Figure 46: Asia Pacific Contract Cleaning Services Industry Volume Share (%), by End User 2024 & 2032

- Figure 47: Asia Pacific Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 48: Asia Pacific Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 49: Asia Pacific Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 50: Asia Pacific Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 51: Latin America Contract Cleaning Services Industry Revenue (Million), by End User 2024 & 2032

- Figure 52: Latin America Contract Cleaning Services Industry Volume (K Unit), by End User 2024 & 2032

- Figure 53: Latin America Contract Cleaning Services Industry Revenue Share (%), by End User 2024 & 2032

- Figure 54: Latin America Contract Cleaning Services Industry Volume Share (%), by End User 2024 & 2032

- Figure 55: Latin America Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 56: Latin America Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 57: Latin America Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 58: Latin America Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 59: Middle East and Africa Contract Cleaning Services Industry Revenue (Million), by End User 2024 & 2032

- Figure 60: Middle East and Africa Contract Cleaning Services Industry Volume (K Unit), by End User 2024 & 2032

- Figure 61: Middle East and Africa Contract Cleaning Services Industry Revenue Share (%), by End User 2024 & 2032

- Figure 62: Middle East and Africa Contract Cleaning Services Industry Volume Share (%), by End User 2024 & 2032

- Figure 63: Middle East and Africa Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 64: Middle East and Africa Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 65: Middle East and Africa Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 66: Middle East and Africa Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Contract Cleaning Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Contract Cleaning Services Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Contract Cleaning Services Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 5: Global Contract Cleaning Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Global Contract Cleaning Services Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Global Contract Cleaning Services Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 21: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: Global Contract Cleaning Services Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 24: Global Contract Cleaning Services Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 25: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: Global Contract Cleaning Services Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 28: Global Contract Cleaning Services Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 29: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: Global Contract Cleaning Services Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 32: Global Contract Cleaning Services Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 33: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Global Contract Cleaning Services Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 36: Global Contract Cleaning Services Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 37: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contract Cleaning Services Industry?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Contract Cleaning Services Industry?

Key companies in the market include Duraclean International Inc, Vanguard Cleaning Systems Inc, The ServiceMaster Company LLC, ISS AS, Stanley Steemer International Inc, Pritchard Industries Inc, Sodexo Group, ABM Industries Incorporated, Anago Cleaning Systems Inc, Jani-King International Inc.

3. What are the main segments of the Contract Cleaning Services Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 366.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Hygienic Consciousness.

6. What are the notable trends driving market growth?

Commercial Cleaning is Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Lack of Skilled Workforce.

8. Can you provide examples of recent developments in the market?

October 2022 - With a five-year deal, SBFM plans to provide a full range of commercial cleaning services to PureGym, the largest gym operator in the United Kingdom, at all its UK locations. The contract began on September 1, 2022, and SBFM and PureGym have their main offices in Leeds. With 1.7 million members spread across 525 clubs, primarily in the United Kingdom and Europe, PureGym's venues are usually open. The group recently revealed ambitions to increase the number of clubs in its portfolio by a factor of two, intending to have more than 1,000 clubs worldwide by 2030..

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contract Cleaning Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contract Cleaning Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contract Cleaning Services Industry?

To stay informed about further developments, trends, and reports in the Contract Cleaning Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence