Key Insights

The global Dental Equipment Market is poised for steady expansion, projected to reach $17.2 billion in 2025 with a Compound Annual Growth Rate (CAGR) of 1.7% through 2033. This consistent growth is underpinned by an aging global population that increasingly prioritizes oral health, coupled with advancements in dental technology driving demand for sophisticated diagnostic and treatment solutions. The market is segmented across General and Diagnostics Equipment, Dental Consumables, and Other Dental Devices, with General and Diagnostics Equipment holding a significant share due to the integration of innovative technologies like dental lasers and advanced radiology equipment. Dental consumables, particularly biomaterials and implants, are also experiencing robust demand, reflecting a growing trend towards restorative and cosmetic dental procedures. The increasing awareness of oral hygiene and the accessibility of advanced dental treatments across various end-user segments, including hospitals and specialized clinics, further fuel market progression.

Dental Equipment Industry Market Size (In Billion)

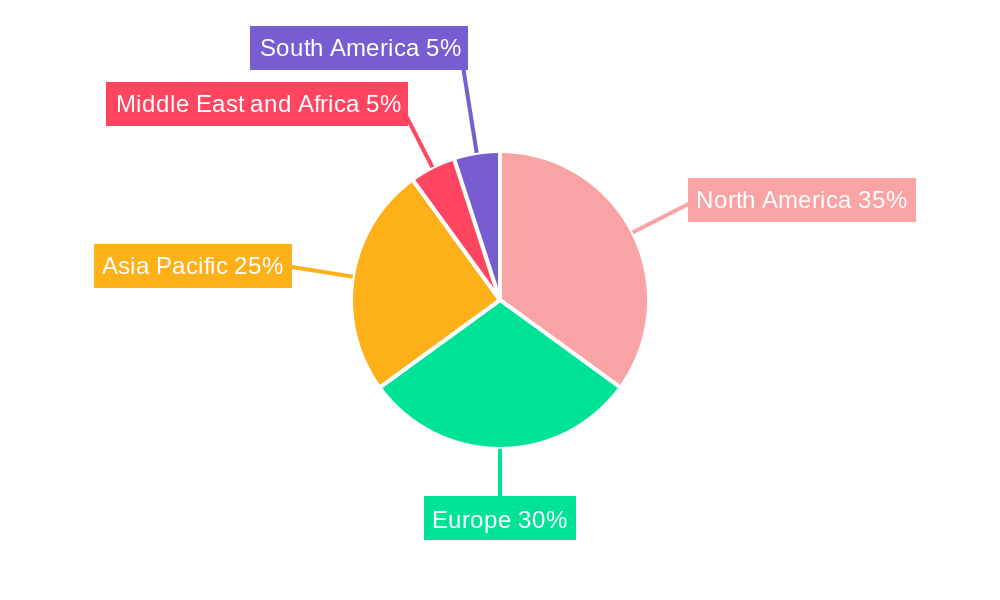

Key drivers propelling the Dental Equipment Market include the rising prevalence of dental caries, periodontal diseases, and the growing demand for aesthetic dental solutions. Technological innovations, such as the development of digital dentistry solutions, CAD/CAM systems, and minimally invasive treatment options, are also significant growth catalysts. While the market benefits from these positive trends, certain restraints, such as the high cost of advanced dental equipment and the limited reimbursement policies in some regions, could temper growth. Geographically, North America and Europe currently lead the market due to high disposable incomes, advanced healthcare infrastructure, and a strong emphasis on preventive dental care. However, the Asia Pacific region presents a substantial growth opportunity, driven by increasing healthcare expenditure, a burgeoning middle class, and rising awareness about oral health. Major industry players are actively engaged in research and development to introduce novel products and expand their market presence through strategic collaborations and acquisitions, ensuring the continued evolution of the dental care landscape.

Dental Equipment Industry Company Market Share

Dental Equipment Industry Market Concentration & Innovation

The global Dental Equipment market is characterized by a moderately concentrated landscape, with key players like Envista Holdings Corporation (Nobel Biocare Services AG), Henry Schein Inc., Dentsply Sirona, and 3M dominating significant market share. In the historical period (2019-2024), market concentration has been influenced by strategic mergers and acquisitions. For instance, significant M&A deals totaling over $5 billion have reshaped the competitive environment, leading to the consolidation of smaller entities and the expansion of established giants. Innovation is the primary driver of growth, fueled by advancements in digital dentistry, artificial intelligence for diagnostics, and minimally invasive treatment technologies like advanced dental lasers. The regulatory framework, governed by bodies such as the FDA and EMA, ensures product safety and efficacy but also presents hurdles for new entrants. Product substitutes are emerging, particularly in the realm of direct-to-consumer dental care solutions, posing a challenge to traditional practice models. End-user trends are shifting towards greater demand for esthetic dentistry and preventive care, driving innovation in areas like cosmetic dentistry equipment and oral hygiene technologies.

Dental Equipment Industry Industry Trends & Insights

The global Dental Equipment market is poised for substantial growth, projected to reach an estimated value of over $30 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This robust expansion is propelled by several key trends. Increasing global awareness regarding oral hygiene and the rising incidence of dental caries and periodontal diseases are significant market growth drivers. As populations age, the demand for restorative and cosmetic dental procedures, including implants and prosthetics, escalates, further fueling market penetration. Technological disruptions are at the forefront of this industry, with the widespread adoption of digital dentistry solutions. Intraoral scanners, 3D printing for dental prosthetics, and AI-powered diagnostic tools are revolutionizing dental practices, enhancing precision, efficiency, and patient experience. The integration of these technologies streamlines workflows and reduces treatment times, making dental care more accessible and appealing. Consumer preferences are increasingly leaning towards less invasive and more esthetic treatment options. This has led to a surge in demand for advanced dental lasers for soft and hard tissue procedures, as well as sophisticated orthodontic solutions that offer greater comfort and shorter treatment durations. The competitive dynamics within the market are intense, with companies continuously investing in research and development to launch innovative products and expand their global footprint. Strategic alliances and collaborations, such as the one between Oral-B and Straumann, are becoming crucial for companies to leverage synergistic strengths, particularly in areas like preventive care and quality science education for dental professionals, aiming for better long-term patient outcomes. The growing emphasis on preventive dentistry, driven by both professional recommendations and patient awareness, is creating new avenues for growth in diagnostic equipment and specialized consumables. The increasing disposable income in emerging economies, coupled with a growing middle class that prioritizes healthcare, is also a significant contributor to the market's upward trajectory. The shift towards personalized medicine in dentistry, where treatments are tailored to individual patient needs and genetic predispositions, is another emerging trend shaping product development and market strategies.

Dominant Markets & Segments in Dental Equipment Industry

North America currently holds the dominant position in the global Dental Equipment market, driven by high healthcare expenditure, advanced technological adoption, and a strong emphasis on preventive dental care. Within North America, the United States accounts for a substantial portion of market share, benefiting from a well-established healthcare infrastructure, a high concentration of dental professionals, and robust reimbursement policies for dental procedures.

The General and Diagnostics Equipment segment is a significant contributor to market revenue, valued at an estimated over $10 billion in 2025. Within this segment, Radiology Equipment is a key growth area, with Intra-oral Radiology Equipment projected to witness particularly strong demand due to its indispensability in routine diagnostics and treatment planning. The increasing affordability and improved imaging capabilities of intra-oral X-ray systems and digital sensors are key drivers. Furthermore, the segment of Dental Chair and Equipment remains fundamental, with advancements focusing on ergonomic design, patient comfort, and integrated technology for enhanced procedural efficiency.

The Dental Consumables segment, estimated to be worth over $8 billion in 2025, is another powerhouse in the market. Dental Implants are a major revenue generator, fueled by an aging global population and the growing demand for tooth replacement solutions. The market for dental implants is characterized by continuous innovation in materials science, leading to improved biocompatibility and osseointegration. Dental Biomaterials, including bone grafting materials and dental cements, also represent a substantial segment, driven by the increasing volume of reconstructive and cosmetic dental procedures.

In terms of Treatment segments, Orthodontic treatment is witnessing significant growth, with the rising popularity of clear aligners and other esthetic orthodontic solutions. The market for orthodontic equipment and consumables is expanding rapidly, driven by both adolescent and adult patient demand for improved smile aesthetics and functional bite correction. Prosthodontic treatments, encompassing crowns, bridges, and dentures, also represent a substantial segment, closely linked to the demand for dental implants and restorative dental care.

The End User analysis reveals Clinics as the dominant end-user segment, accounting for over 70% of the market share. Dental clinics, ranging from small private practices to large multi-specialty dental centers, are the primary purchasers of dental equipment and consumables. The increasing number of dental professionals establishing their own practices and the growing trend of dental practice consolidation contribute to the dominance of this segment.

Key drivers for the dominance of these markets and segments include:

- Economic Policies: Favorable government policies supporting healthcare infrastructure development and research and development initiatives.

- Technological Advancements: Continuous innovation in digital dentistry, AI, and materials science driving demand for sophisticated equipment and consumables.

- Consumer Awareness and Preferences: Growing patient demand for esthetic, minimally invasive, and preventive dental care.

- Demographic Trends: Aging populations, increasing prevalence of chronic diseases, and rising disposable incomes.

Dental Equipment Industry Product Developments

Product development in the Dental Equipment industry is heavily focused on enhancing precision, patient comfort, and procedural efficiency through technological integration. Innovations such as portable and intuitive intraoral scanners like Ivoclar's VivaScan exemplify the trend towards digital workflows and ease of integration into daily practice. Advancements in dental lasers are offering more precise soft and hard tissue treatments with faster healing times. In radiology, the development of higher resolution sensors and AI-powered diagnostic software is improving diagnostic accuracy and reducing radiation exposure. The competitive advantage lies in devices that streamline workflows, reduce treatment chair time, and deliver superior patient outcomes, catering to the growing demand for esthetic and minimally invasive dentistry.

Report Scope & Segmentation Analysis

This report meticulously analyzes the global Dental Equipment market across several key segments. The General and Diagnostics Equipment segment encompasses Dental Lasers (including Soft Tissue Lasers and Hard Tissue Lasers), Radiology Equipment (Extra-oral Radiology Equipment and Intra-oral Radiology Equipment), Dental Chairs and Equipment, and Other General and Diagnostic Equipment. The Dental Consumables segment includes Dental Biomaterials, Dental Implants, Crowns and Bridges, and Other Dental Consumables. The report also segments the market by Other Dental Devices and by Treatment modalities such as Orthodontic, Endodontic, Periodontic, and Prosthodontic. Finally, the End User segmentation covers Hospitals, Clinics, and Other End Users. Each segment is projected to exhibit distinct growth trajectories, driven by specific technological advancements, patient demands, and market dynamics within their respective niches. Clinics are expected to remain the dominant end-user segment due to their high volume of dental procedures.

Key Drivers of Dental Equipment Industry Growth

The Dental Equipment industry's growth is propelled by several intertwined factors. Technologically, the pervasive adoption of digital dentistry, including intraoral scanners, 3D printing, and AI-powered diagnostics, is revolutionizing treatment planning and execution. Economically, increasing disposable incomes globally, particularly in emerging economies, and rising dental insurance coverage are boosting patient spending on dental procedures. Regulatory frameworks, while stringent, are also evolving to encourage innovation in safe and effective dental technologies. Furthermore, the growing awareness among the global population regarding the importance of oral health for overall well-being is a significant driver, leading to increased demand for both preventive and restorative dental care.

Challenges in the Dental Equipment Industry Sector

Despite robust growth, the Dental Equipment sector faces several challenges. Stringent regulatory hurdles and the lengthy approval processes for new medical devices can impede market entry for innovative products. Supply chain disruptions, exacerbated by geopolitical events and raw material shortages, can impact production timelines and costs. High upfront investment costs for advanced digital dental equipment can be a barrier for smaller dental practices, particularly in resource-constrained regions. Moreover, intense competition among established players and the emergence of new market entrants necessitate continuous innovation and competitive pricing strategies. The threat of counterfeit products also poses a risk to market integrity and patient safety.

Emerging Opportunities in Dental Equipment Industry

Emerging opportunities in the Dental Equipment industry are abundant, driven by evolving consumer preferences and technological frontiers. The growing demand for personalized and esthetic dental treatments presents a significant opportunity for advanced cosmetic dentistry equipment and biocompatible restorative materials. The increasing focus on preventive dentistry and early disease detection is fueling the market for advanced diagnostic tools and oral health monitoring devices. Furthermore, the expansion of telehealth and teledentistry platforms creates opportunities for remote consultation tools and digital communication solutions. Emerging markets in Asia Pacific and Latin America, with their rapidly growing middle classes and increasing healthcare expenditure, represent untapped potential for market penetration. The development of sustainable and eco-friendly dental products is also an emerging trend that can attract environmentally conscious consumers and practices.

Leading Players in the Dental Equipment Industry Market

- Envista Holdings Corporation

- Henry Schein Inc.

- A-Dec Inc.

- Midmark Corp

- Biolase Inc.

- Aseptico Inc.

- 3M

- Dentsply Sirona

- Bien-Air Medical Technologies

- Ivoclar Vivadent AG

- GC Corporation

Key Developments in Dental Equipment Industry Industry

- June 2022: Ivoclar launched the VivaScan, a portable and simple intraoral scanning solution. The device's standalone design facilitates easy integration into regular practice activities, delivering impressive scanning results and promoting a more effective workflow.

- June 2022: Oral-B and Straumann announced a new global alliance aimed at increasing the importance of prevention in periodontal and peri-implant health. This alliance will establish new standards in quality science education for dental professionals and support better long-term patient outcomes.

Strategic Outlook for Dental Equipment Industry Market

The strategic outlook for the Dental Equipment Industry market is highly positive, characterized by sustained innovation and expanding global reach. Growth catalysts include the continued integration of digital technologies, such as AI and advanced imaging, into everyday dental practice, enhancing precision and patient care. The increasing emphasis on preventive and esthetic dentistry will drive demand for specialized equipment and consumables. Furthermore, the growing healthcare infrastructure and rising disposable incomes in emerging markets present significant untapped potential. Strategic partnerships and a focus on value-based solutions will be crucial for companies to navigate the competitive landscape and capitalize on future market opportunities, ensuring long-term profitability and industry leadership.

Dental Equipment Industry Segmentation

-

1. Product

-

1.1. General and Diagnostics Equipment

-

1.1.1. Dental Laser

- 1.1.1.1. Soft Tissue Lasers

- 1.1.1.2. Hard Tissue Lasers

-

1.1.2. Radiology Equipment

- 1.1.2.1. Extra-oral Radiology Equipment

- 1.1.2.2. Intra-oral Radiology Equipment

- 1.1.3. Dental Chair and Equipment

- 1.1.4. Other General and Diagnostic Equipment

-

1.1.1. Dental Laser

-

1.2. Dental Consumables

- 1.2.1. Dental Biomaterials

- 1.2.2. Dental Implants

- 1.2.3. Crowns and Bridges

- 1.2.4. Other Dental Consumables

- 1.3. Other Dental Devices

-

1.1. General and Diagnostics Equipment

-

2. Treatment

- 2.1. Orthodontic

- 2.2. Endodontic

- 2.3. Peridontic

- 2.4. Prosthodontic

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End Users

Dental Equipment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Dental Equipment Industry Regional Market Share

Geographic Coverage of Dental Equipment Industry

Dental Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Aging Population Coupled with Increasing Incidence of Dental Diseases; Increasing Demand for Cosmetic Dentistry; Innovation in Dental Products

- 3.3. Market Restrains

- 3.3.1. Increasing Cost of Surgeries and Lack of Proper Reimbursement of Dental Care

- 3.4. Market Trends

- 3.4.1. The Prosthodontic Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. General and Diagnostics Equipment

- 5.1.1.1. Dental Laser

- 5.1.1.1.1. Soft Tissue Lasers

- 5.1.1.1.2. Hard Tissue Lasers

- 5.1.1.2. Radiology Equipment

- 5.1.1.2.1. Extra-oral Radiology Equipment

- 5.1.1.2.2. Intra-oral Radiology Equipment

- 5.1.1.3. Dental Chair and Equipment

- 5.1.1.4. Other General and Diagnostic Equipment

- 5.1.1.1. Dental Laser

- 5.1.2. Dental Consumables

- 5.1.2.1. Dental Biomaterials

- 5.1.2.2. Dental Implants

- 5.1.2.3. Crowns and Bridges

- 5.1.2.4. Other Dental Consumables

- 5.1.3. Other Dental Devices

- 5.1.1. General and Diagnostics Equipment

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontic

- 5.2.2. Endodontic

- 5.2.3. Peridontic

- 5.2.4. Prosthodontic

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Dental Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. General and Diagnostics Equipment

- 6.1.1.1. Dental Laser

- 6.1.1.1.1. Soft Tissue Lasers

- 6.1.1.1.2. Hard Tissue Lasers

- 6.1.1.2. Radiology Equipment

- 6.1.1.2.1. Extra-oral Radiology Equipment

- 6.1.1.2.2. Intra-oral Radiology Equipment

- 6.1.1.3. Dental Chair and Equipment

- 6.1.1.4. Other General and Diagnostic Equipment

- 6.1.1.1. Dental Laser

- 6.1.2. Dental Consumables

- 6.1.2.1. Dental Biomaterials

- 6.1.2.2. Dental Implants

- 6.1.2.3. Crowns and Bridges

- 6.1.2.4. Other Dental Consumables

- 6.1.3. Other Dental Devices

- 6.1.1. General and Diagnostics Equipment

- 6.2. Market Analysis, Insights and Forecast - by Treatment

- 6.2.1. Orthodontic

- 6.2.2. Endodontic

- 6.2.3. Peridontic

- 6.2.4. Prosthodontic

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Clinics

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Dental Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. General and Diagnostics Equipment

- 7.1.1.1. Dental Laser

- 7.1.1.1.1. Soft Tissue Lasers

- 7.1.1.1.2. Hard Tissue Lasers

- 7.1.1.2. Radiology Equipment

- 7.1.1.2.1. Extra-oral Radiology Equipment

- 7.1.1.2.2. Intra-oral Radiology Equipment

- 7.1.1.3. Dental Chair and Equipment

- 7.1.1.4. Other General and Diagnostic Equipment

- 7.1.1.1. Dental Laser

- 7.1.2. Dental Consumables

- 7.1.2.1. Dental Biomaterials

- 7.1.2.2. Dental Implants

- 7.1.2.3. Crowns and Bridges

- 7.1.2.4. Other Dental Consumables

- 7.1.3. Other Dental Devices

- 7.1.1. General and Diagnostics Equipment

- 7.2. Market Analysis, Insights and Forecast - by Treatment

- 7.2.1. Orthodontic

- 7.2.2. Endodontic

- 7.2.3. Peridontic

- 7.2.4. Prosthodontic

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Clinics

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Dental Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. General and Diagnostics Equipment

- 8.1.1.1. Dental Laser

- 8.1.1.1.1. Soft Tissue Lasers

- 8.1.1.1.2. Hard Tissue Lasers

- 8.1.1.2. Radiology Equipment

- 8.1.1.2.1. Extra-oral Radiology Equipment

- 8.1.1.2.2. Intra-oral Radiology Equipment

- 8.1.1.3. Dental Chair and Equipment

- 8.1.1.4. Other General and Diagnostic Equipment

- 8.1.1.1. Dental Laser

- 8.1.2. Dental Consumables

- 8.1.2.1. Dental Biomaterials

- 8.1.2.2. Dental Implants

- 8.1.2.3. Crowns and Bridges

- 8.1.2.4. Other Dental Consumables

- 8.1.3. Other Dental Devices

- 8.1.1. General and Diagnostics Equipment

- 8.2. Market Analysis, Insights and Forecast - by Treatment

- 8.2.1. Orthodontic

- 8.2.2. Endodontic

- 8.2.3. Peridontic

- 8.2.4. Prosthodontic

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Clinics

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Dental Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. General and Diagnostics Equipment

- 9.1.1.1. Dental Laser

- 9.1.1.1.1. Soft Tissue Lasers

- 9.1.1.1.2. Hard Tissue Lasers

- 9.1.1.2. Radiology Equipment

- 9.1.1.2.1. Extra-oral Radiology Equipment

- 9.1.1.2.2. Intra-oral Radiology Equipment

- 9.1.1.3. Dental Chair and Equipment

- 9.1.1.4. Other General and Diagnostic Equipment

- 9.1.1.1. Dental Laser

- 9.1.2. Dental Consumables

- 9.1.2.1. Dental Biomaterials

- 9.1.2.2. Dental Implants

- 9.1.2.3. Crowns and Bridges

- 9.1.2.4. Other Dental Consumables

- 9.1.3. Other Dental Devices

- 9.1.1. General and Diagnostics Equipment

- 9.2. Market Analysis, Insights and Forecast - by Treatment

- 9.2.1. Orthodontic

- 9.2.2. Endodontic

- 9.2.3. Peridontic

- 9.2.4. Prosthodontic

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Clinics

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Dental Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. General and Diagnostics Equipment

- 10.1.1.1. Dental Laser

- 10.1.1.1.1. Soft Tissue Lasers

- 10.1.1.1.2. Hard Tissue Lasers

- 10.1.1.2. Radiology Equipment

- 10.1.1.2.1. Extra-oral Radiology Equipment

- 10.1.1.2.2. Intra-oral Radiology Equipment

- 10.1.1.3. Dental Chair and Equipment

- 10.1.1.4. Other General and Diagnostic Equipment

- 10.1.1.1. Dental Laser

- 10.1.2. Dental Consumables

- 10.1.2.1. Dental Biomaterials

- 10.1.2.2. Dental Implants

- 10.1.2.3. Crowns and Bridges

- 10.1.2.4. Other Dental Consumables

- 10.1.3. Other Dental Devices

- 10.1.1. General and Diagnostics Equipment

- 10.2. Market Analysis, Insights and Forecast - by Treatment

- 10.2.1. Orthodontic

- 10.2.2. Endodontic

- 10.2.3. Peridontic

- 10.2.4. Prosthodontic

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Clinics

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Envista Holdings Corporation (Nobel Biocare Services AG)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Henry Schein Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 A-Dec Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Midmark Corp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Biolase Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aseptico Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 3M

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dentsply Sirona

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bien-Air Medical Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ivoclar Vivadent AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GC Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Envista Holdings Corporation (Nobel Biocare Services AG)

List of Figures

- Figure 1: Global Dental Equipment Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Dental Equipment Industry Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Dental Equipment Industry Revenue (undefined), by Product 2025 & 2033

- Figure 4: North America Dental Equipment Industry Volume (K Units), by Product 2025 & 2033

- Figure 5: North America Dental Equipment Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Dental Equipment Industry Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Dental Equipment Industry Revenue (undefined), by Treatment 2025 & 2033

- Figure 8: North America Dental Equipment Industry Volume (K Units), by Treatment 2025 & 2033

- Figure 9: North America Dental Equipment Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 10: North America Dental Equipment Industry Volume Share (%), by Treatment 2025 & 2033

- Figure 11: North America Dental Equipment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 12: North America Dental Equipment Industry Volume (K Units), by End User 2025 & 2033

- Figure 13: North America Dental Equipment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Dental Equipment Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Dental Equipment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Dental Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 17: North America Dental Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Dental Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Dental Equipment Industry Revenue (undefined), by Product 2025 & 2033

- Figure 20: Europe Dental Equipment Industry Volume (K Units), by Product 2025 & 2033

- Figure 21: Europe Dental Equipment Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Europe Dental Equipment Industry Volume Share (%), by Product 2025 & 2033

- Figure 23: Europe Dental Equipment Industry Revenue (undefined), by Treatment 2025 & 2033

- Figure 24: Europe Dental Equipment Industry Volume (K Units), by Treatment 2025 & 2033

- Figure 25: Europe Dental Equipment Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 26: Europe Dental Equipment Industry Volume Share (%), by Treatment 2025 & 2033

- Figure 27: Europe Dental Equipment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 28: Europe Dental Equipment Industry Volume (K Units), by End User 2025 & 2033

- Figure 29: Europe Dental Equipment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Dental Equipment Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Dental Equipment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: Europe Dental Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 33: Europe Dental Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Dental Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Dental Equipment Industry Revenue (undefined), by Product 2025 & 2033

- Figure 36: Asia Pacific Dental Equipment Industry Volume (K Units), by Product 2025 & 2033

- Figure 37: Asia Pacific Dental Equipment Industry Revenue Share (%), by Product 2025 & 2033

- Figure 38: Asia Pacific Dental Equipment Industry Volume Share (%), by Product 2025 & 2033

- Figure 39: Asia Pacific Dental Equipment Industry Revenue (undefined), by Treatment 2025 & 2033

- Figure 40: Asia Pacific Dental Equipment Industry Volume (K Units), by Treatment 2025 & 2033

- Figure 41: Asia Pacific Dental Equipment Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 42: Asia Pacific Dental Equipment Industry Volume Share (%), by Treatment 2025 & 2033

- Figure 43: Asia Pacific Dental Equipment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 44: Asia Pacific Dental Equipment Industry Volume (K Units), by End User 2025 & 2033

- Figure 45: Asia Pacific Dental Equipment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Dental Equipment Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Dental Equipment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Asia Pacific Dental Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 49: Asia Pacific Dental Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Dental Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Dental Equipment Industry Revenue (undefined), by Product 2025 & 2033

- Figure 52: Middle East and Africa Dental Equipment Industry Volume (K Units), by Product 2025 & 2033

- Figure 53: Middle East and Africa Dental Equipment Industry Revenue Share (%), by Product 2025 & 2033

- Figure 54: Middle East and Africa Dental Equipment Industry Volume Share (%), by Product 2025 & 2033

- Figure 55: Middle East and Africa Dental Equipment Industry Revenue (undefined), by Treatment 2025 & 2033

- Figure 56: Middle East and Africa Dental Equipment Industry Volume (K Units), by Treatment 2025 & 2033

- Figure 57: Middle East and Africa Dental Equipment Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 58: Middle East and Africa Dental Equipment Industry Volume Share (%), by Treatment 2025 & 2033

- Figure 59: Middle East and Africa Dental Equipment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 60: Middle East and Africa Dental Equipment Industry Volume (K Units), by End User 2025 & 2033

- Figure 61: Middle East and Africa Dental Equipment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East and Africa Dental Equipment Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East and Africa Dental Equipment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 64: Middle East and Africa Dental Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 65: Middle East and Africa Dental Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Dental Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Dental Equipment Industry Revenue (undefined), by Product 2025 & 2033

- Figure 68: South America Dental Equipment Industry Volume (K Units), by Product 2025 & 2033

- Figure 69: South America Dental Equipment Industry Revenue Share (%), by Product 2025 & 2033

- Figure 70: South America Dental Equipment Industry Volume Share (%), by Product 2025 & 2033

- Figure 71: South America Dental Equipment Industry Revenue (undefined), by Treatment 2025 & 2033

- Figure 72: South America Dental Equipment Industry Volume (K Units), by Treatment 2025 & 2033

- Figure 73: South America Dental Equipment Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 74: South America Dental Equipment Industry Volume Share (%), by Treatment 2025 & 2033

- Figure 75: South America Dental Equipment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 76: South America Dental Equipment Industry Volume (K Units), by End User 2025 & 2033

- Figure 77: South America Dental Equipment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 78: South America Dental Equipment Industry Volume Share (%), by End User 2025 & 2033

- Figure 79: South America Dental Equipment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 80: South America Dental Equipment Industry Volume (K Units), by Country 2025 & 2033

- Figure 81: South America Dental Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Dental Equipment Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Dental Equipment Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Dental Equipment Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 3: Global Dental Equipment Industry Revenue undefined Forecast, by Treatment 2020 & 2033

- Table 4: Global Dental Equipment Industry Volume K Units Forecast, by Treatment 2020 & 2033

- Table 5: Global Dental Equipment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Dental Equipment Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 7: Global Dental Equipment Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Dental Equipment Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Global Dental Equipment Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 10: Global Dental Equipment Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 11: Global Dental Equipment Industry Revenue undefined Forecast, by Treatment 2020 & 2033

- Table 12: Global Dental Equipment Industry Volume K Units Forecast, by Treatment 2020 & 2033

- Table 13: Global Dental Equipment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 14: Global Dental Equipment Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 15: Global Dental Equipment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Dental Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: United States Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United States Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Canada Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Mexico Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Mexico Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 23: Global Dental Equipment Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 24: Global Dental Equipment Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 25: Global Dental Equipment Industry Revenue undefined Forecast, by Treatment 2020 & 2033

- Table 26: Global Dental Equipment Industry Volume K Units Forecast, by Treatment 2020 & 2033

- Table 27: Global Dental Equipment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 28: Global Dental Equipment Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 29: Global Dental Equipment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Dental Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Germany Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: France Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: France Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Italy Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Italy Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Spain Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Spain Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Global Dental Equipment Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 44: Global Dental Equipment Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 45: Global Dental Equipment Industry Revenue undefined Forecast, by Treatment 2020 & 2033

- Table 46: Global Dental Equipment Industry Volume K Units Forecast, by Treatment 2020 & 2033

- Table 47: Global Dental Equipment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 48: Global Dental Equipment Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 49: Global Dental Equipment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: Global Dental Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 51: China Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: China Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Japan Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Japan Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: India Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: India Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: Australia Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Australia Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 59: South Korea Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: South Korea Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Global Dental Equipment Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 64: Global Dental Equipment Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 65: Global Dental Equipment Industry Revenue undefined Forecast, by Treatment 2020 & 2033

- Table 66: Global Dental Equipment Industry Volume K Units Forecast, by Treatment 2020 & 2033

- Table 67: Global Dental Equipment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 68: Global Dental Equipment Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 69: Global Dental Equipment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 70: Global Dental Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 71: GCC Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: GCC Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: South Africa Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: South Africa Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 77: Global Dental Equipment Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 78: Global Dental Equipment Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 79: Global Dental Equipment Industry Revenue undefined Forecast, by Treatment 2020 & 2033

- Table 80: Global Dental Equipment Industry Volume K Units Forecast, by Treatment 2020 & 2033

- Table 81: Global Dental Equipment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 82: Global Dental Equipment Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 83: Global Dental Equipment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 84: Global Dental Equipment Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 85: Brazil Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: Brazil Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 87: Argentina Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: Argentina Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Dental Equipment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Dental Equipment Industry Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Equipment Industry?

The projected CAGR is approximately 1.7%.

2. Which companies are prominent players in the Dental Equipment Industry?

Key companies in the market include Envista Holdings Corporation (Nobel Biocare Services AG), Henry Schein Inc, A-Dec Inc, Midmark Corp , Biolase Inc, Aseptico Inc, 3M, Dentsply Sirona, Bien-Air Medical Technologies, Ivoclar Vivadent AG, GC Corporation.

3. What are the main segments of the Dental Equipment Industry?

The market segments include Product, Treatment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Aging Population Coupled with Increasing Incidence of Dental Diseases; Increasing Demand for Cosmetic Dentistry; Innovation in Dental Products.

6. What are the notable trends driving market growth?

The Prosthodontic Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Cost of Surgeries and Lack of Proper Reimbursement of Dental Care.

8. Can you provide examples of recent developments in the market?

In June 2022, Ivoclar launched a new VivaScan for dentists. It is a portable and simple intraoral scanning solution. The device's standalone design makes it simple to include in regular practice activities, where it produces impressive scanning results and facilitates a more effective workflow.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Equipment Industry?

To stay informed about further developments, trends, and reports in the Dental Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence